As blockchain ecosystems mature, the race to build dynamic fee market appchains is heating up. Developers and investors alike are seeking ways to optimize transaction costs, improve network efficiency, and unlock new economic models. At the heart of this evolution lies artificial intelligence – not as a buzzword, but as a real-time engine powering adaptive, specialized fee structures that respond intelligently to demand and supply within custom app-chains.

AI Fee Optimization: The New Standard for App-Chains

The traditional static fee model is ill-suited for today’s high-velocity blockchain networks. Sudden surges in user activity can trigger congestion and unpredictable spikes in costs, undermining both user experience and network profitability. Enter AI fee optimization for blockchain: leveraging machine learning to analyze real-time data streams, these systems proactively calibrate transaction fees based on network load, resource availability, and even predictive demand modeling.

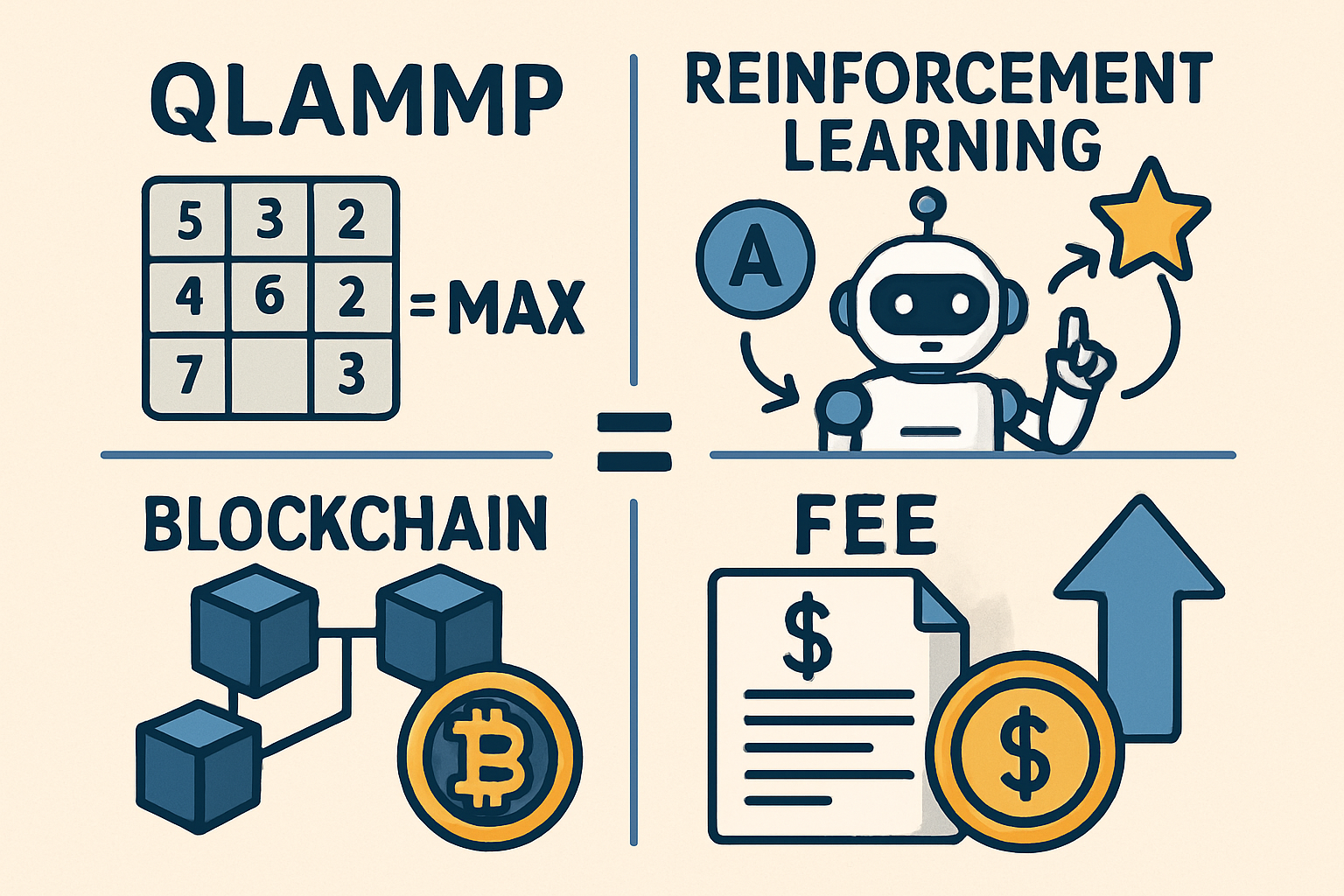

A standout example is the Q-Learning Agent for Market Making Protocols (QLAMMP), which uses reinforcement learning to dynamically adjust fees in liquidity pools – maximizing returns while maintaining healthy trading volumes (arxiv.org). This approach isn’t limited to DeFi; multidimensional AI-driven pricing models are being explored for everything from bandwidth allocation to storage, as highlighted in recent research on dynamic non-fungible resource markets (arxiv.org).

Pushing the Boundaries: Sub-Cent Stable Fees and Custom Logic

One of the most promising outcomes of AI-powered dynamic markets is the emergence of sub-cent stable fees. By continuously monitoring market conditions and leveraging predictive analytics, app-chains can offer transaction costs that remain both low and predictable – a critical feature for mainstream adoption across payments, gaming, or supply chain applications.

This isn’t just theory. In DeFi circles, adaptive algorithms now adjust swap fees in real time to mitigate impermanent loss for liquidity providers (arxiv.org). Meanwhile, platforms like ZA Miner are using AI-driven logic to auto-tune cloud mining contracts based on live market volatility – ensuring users enjoy consistent passive income regardless of broader price swings (globenewswire.com).

Ethereum’s Dynamic Fee Proposals: A Macro Perspective at $4,494.89 ETH

The Ethereum ecosystem continues to be a proving ground for innovative fee market designs. With ETH currently priced at $4,494.89, developers are increasingly focused on aligning incentives between users and protocol stakeholders through smarter application-layer fee models.

A particularly notable proposal suggests a mechanism where app-layer fees decrease proportionally as project funding increases – using a square root function for fairness and sustainability (ainvest.com). This kind of dynamic logic could soon become standard across leading app-chains seeking both robust revenues and user-friendly pricing.

Ethereum (ETH) Price Prediction Table: 2026-2031 (Impact of AI-Driven Dynamic Fee Markets)

Professional ETH price forecasts integrating the effect of AI-powered dynamic fee mechanisms and evolving app-chain use cases.

| Year | Minimum Price | Average Price | Maximum Price | Year-over-Year % Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $4,000 | $5,100 | $6,250 | +13.5% | AI-driven efficiency and app-chain adoption drive steady growth; minor regulatory headwinds possible. |

| 2027 | $4,600 | $5,800 | $7,800 | +13.7% | Broader implementation of AI-based fee markets, DeFi expansion; global regulatory clarity boosts confidence. |

| 2028 | $5,200 | $6,600 | $9,200 | +13.8% | Ethereum cements leadership in AI/blockchain integration; new competitors emerge but ETH retains dominance. |

| 2029 | $5,800 | $7,500 | $11,000 | +13.6% | AI-powered scaling solutions reduce congestion; enterprise adoption accelerates, but macro market volatility persists. |

| 2030 | $6,400 | $8,600 | $13,000 | +14.7% | Greater DeFi/NFT/AI synergy; ETH benefits from cross-chain interoperability and sustainable fee models. |

| 2031 | $7,200 | $9,900 | $15,500 | +15.1% | AI-native app-chains become mainstream; ETH sees strong institutional flows, but faces cyclical corrections. |

Price Prediction Summary

Ethereum is poised for progressive growth between 2026 and 2031, supported by the adoption of AI-driven dynamic fee markets and expanding real-world use cases. Average prices are forecasted to rise at a steady pace, with bullish scenarios reflecting successful adoption and integration of AI technologies, while bearish scenarios account for regulatory and macroeconomic risks. ETH remains a leading smart contract platform, with AI-enhanced efficiency and dynamic fee models likely to attract both users and institutional capital.

Key Factors Affecting Ethereum Price

- Adoption of AI-powered dynamic fee mechanisms improving network efficiency and user experience.

- Growth of app-chains and specialized DeFi/NFT ecosystems on Ethereum.

- Potential for regulatory clarity or new compliance requirements affecting crypto markets.

- Ongoing competition from alternative smart contract platforms and scaling solutions.

- Macroeconomic factors (e.g., interest rates, global investment flows) impacting crypto asset valuations.

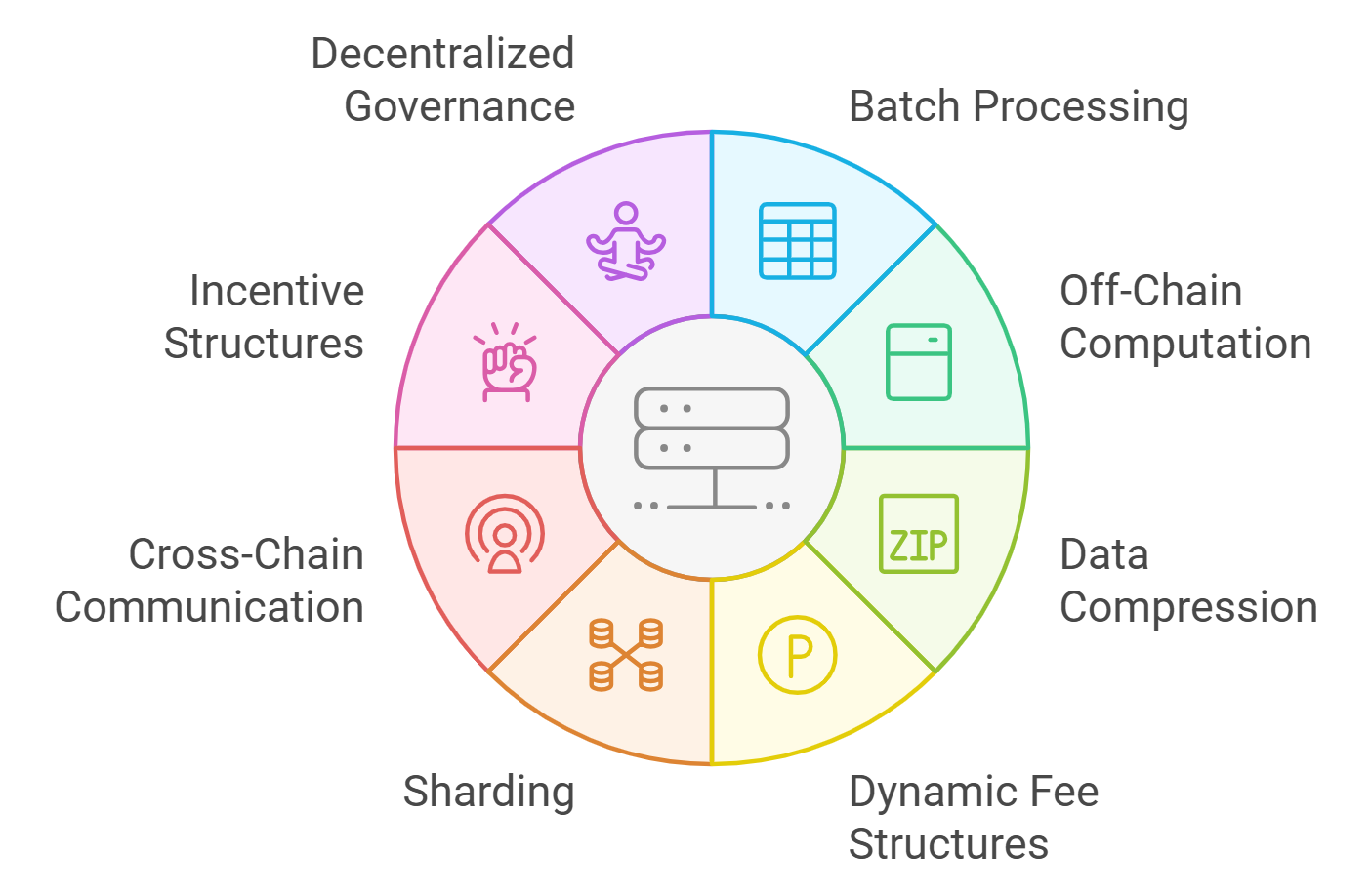

- Advances in Ethereum’s own technology (e.g., sharding, layer-2 rollouts, further protocol upgrades).

- Institutional adoption and integration of blockchain/AI solutions in mainstream finance and industry.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

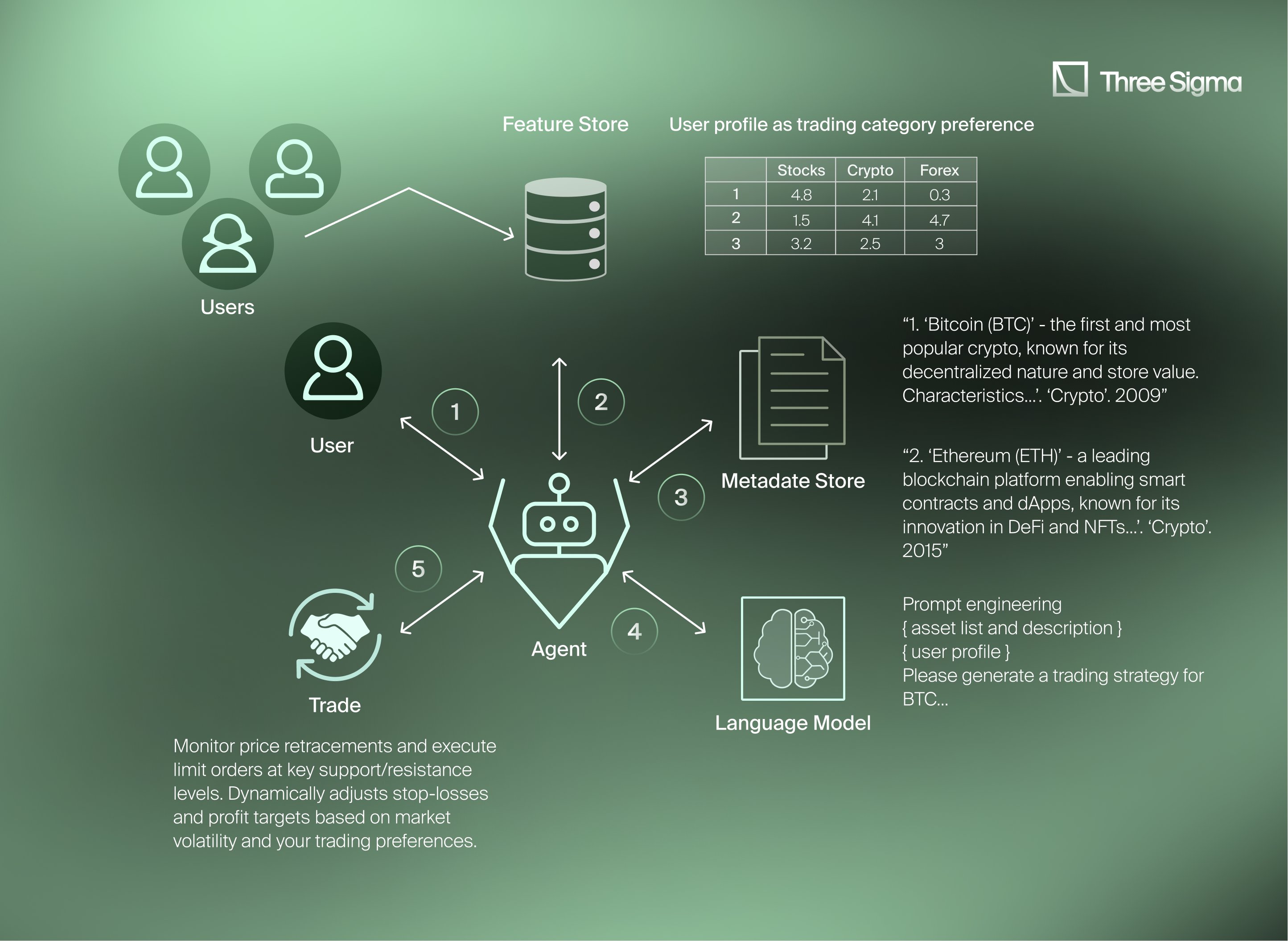

As the macro landscape shifts, the competitive edge for app-chain builders is no longer just throughput or composability, it’s the ability to engineer custom fee structures that can flex in real time. AI-driven systems are now being trained not only to react, but to anticipate: analyzing mempool activity, order book depth, and even off-chain signals like social sentiment to preempt network congestion or flash demand spikes. This level of intelligence enables networks to offer differentiated experiences, think granular micro-fees for IoT transactions or premium bandwidth surcharges during peak hours, while keeping base costs stable for everyday users.

Consider the implications for industries like supply chain management. As highlighted in recent analysis (citron-tec.com), AI-powered blockchains can deliver investor-first strategies by tailoring transaction fees to shipment urgency or compliance requirements in real time. This is a leap from one-size-fits-all pricing toward a world where every transaction is priced according to its context, risk profile, and value contribution.

The Investor Angle: AI Fee Markets as Alpha Drivers

The rise of AI fee optimization blockchain tools isn’t just a boon for developers, it’s changing the game for investors as well. Automated portfolio management apps are harnessing these technologies to lower user fees and maximize yield, as noted by Blockchain Council’s research on smarter investing (Blockchain Council). Over time, this compounding effect can turn sub-cent savings into significant portfolio outperformance, especially when network fees are dynamically suppressed during periods of low volatility.

Key Benefits of AI-Powered Dynamic Fee Markets

-

Optimized Transaction Costs: AI-driven fee mechanisms, such as those proposed for Ethereum’s application layer, adjust fees in real-time based on network demand and project funding levels. This ensures users pay fair, dynamically calculated fees, reducing costs during periods of low congestion.

-

Enhanced Network Efficiency: Solutions like Q-Learning Agent for Market Making Protocols (QLAMMP) use reinforcement learning to set optimal fee rates, balancing network utilization and preventing congestion or underuse.

-

Increased Investor Profitability: Platforms such as ZA Miner employ AI-powered dynamic contracts that automatically adjust mining strategies in response to market volatility, helping investors maintain steady passive income.

-

Improved Market Fairness: AI-powered multidimensional fee markets, as explored in recent research, enable pricing adjustments for resources like bandwidth and storage. This prevents denial-of-service attacks and ensures fair resource allocation for all users.

-

Reduced Risk for DeFi Participants: Adaptive fee algorithms in DeFi protocols dynamically adjust transaction fees based on market volatility, mitigating impermanent loss for liquidity providers and enhancing overall market stability.

For founders launching new protocols or marketplaces, working with top AI token development teams means integrating on-chain triggers and dynamic pricing logic from day one (Medium · Blockchain App Factory). The result? Multiple revenue streams, from transaction fees to premium services, all automatically tuned by machine learning agents that optimize for both growth and sustainability.

What’s Next? Composable Fee Markets and Permissionless Innovation

The future is pointing toward composable dynamic fee markets, where app-chains expose APIs that let dApps or even end-users customize their own pricing logic within protocol-defined safety limits. Imagine a gaming app that lets power users pay extra for instant settlement during tournaments, while casual players enjoy baseline sub-cent stable fees. Or enterprise chains where supply chain partners negotiate bespoke fee schedules based on shipment volume or carbon footprint targets, all orchestrated by interoperable AI agents.

This evolution invites a new era of permissionless innovation: as more open-source frameworks emerge around AI-driven pricing engines, we’ll see rapid experimentation with economic models tailored to every niche, from decentralized prediction markets narrowing bid-ask spreads (Blockchain App Factory) to agent marketplaces layering premium services atop basic transaction flows (IdeaUsher).

The bottom line? Integrating machine learning into specialized rollups and application-specific blockchains isn’t just about reducing costs, it’s about unlocking entirely new business models and user experiences. As ETH holds steady at $4,494.89 and more projects deploy these advanced mechanisms, expect dynamic fee market appchains to become the gold standard for scalable, fair, and future-proof decentralized networks.