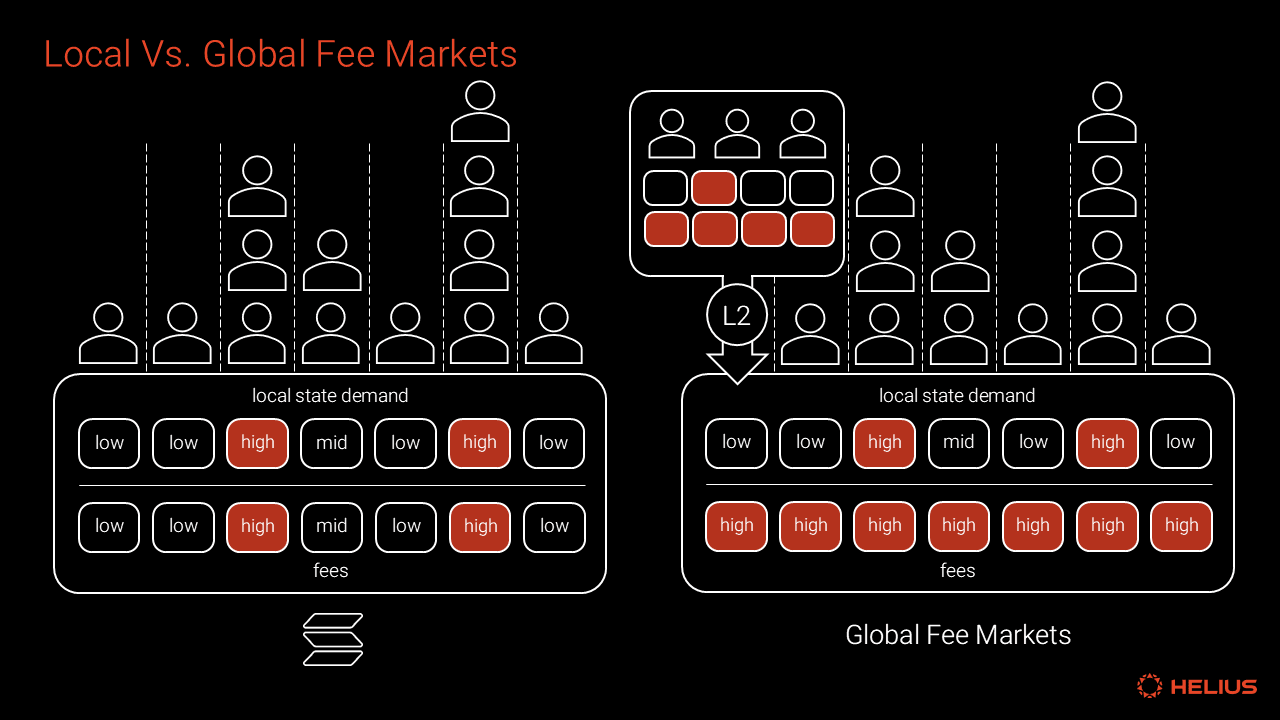

Multidimensional fee markets are rapidly redefining how custom rollups approach scalability, efficiency, and user experience. As blockchains race to reach 1M transactions per second (TPS), the limitations of single-dimensional fee models have become increasingly apparent. In this new paradigm, custom rollups leverage multidimensional fee markets to allocate resources more precisely, minimize congestion, and unlock true application-specific optimization.

Why Multidimensional Fee Markets Matter at 1M TPS

Traditional blockchains typically price all resources, computation, storage, bandwidth, using a single unit of account. This approach creates bottlenecks as it cannot accurately reflect the heterogeneous demand on different resources. As transaction volume surges toward 1M TPS on custom rollups, these inefficiencies multiply. Multidimensional fee markets address this by assigning separate prices to each resource type. This allows for:

- Granular resource allocation: Users pay only for what they consume, ensuring fairer and more efficient usage.

- Reduced congestion: Hotspots in one dimension (e. g. , computation) do not choke the entire network.

- Stable fees: Isolated fee spikes become less likely as supply-demand dynamics are balanced across dimensions.

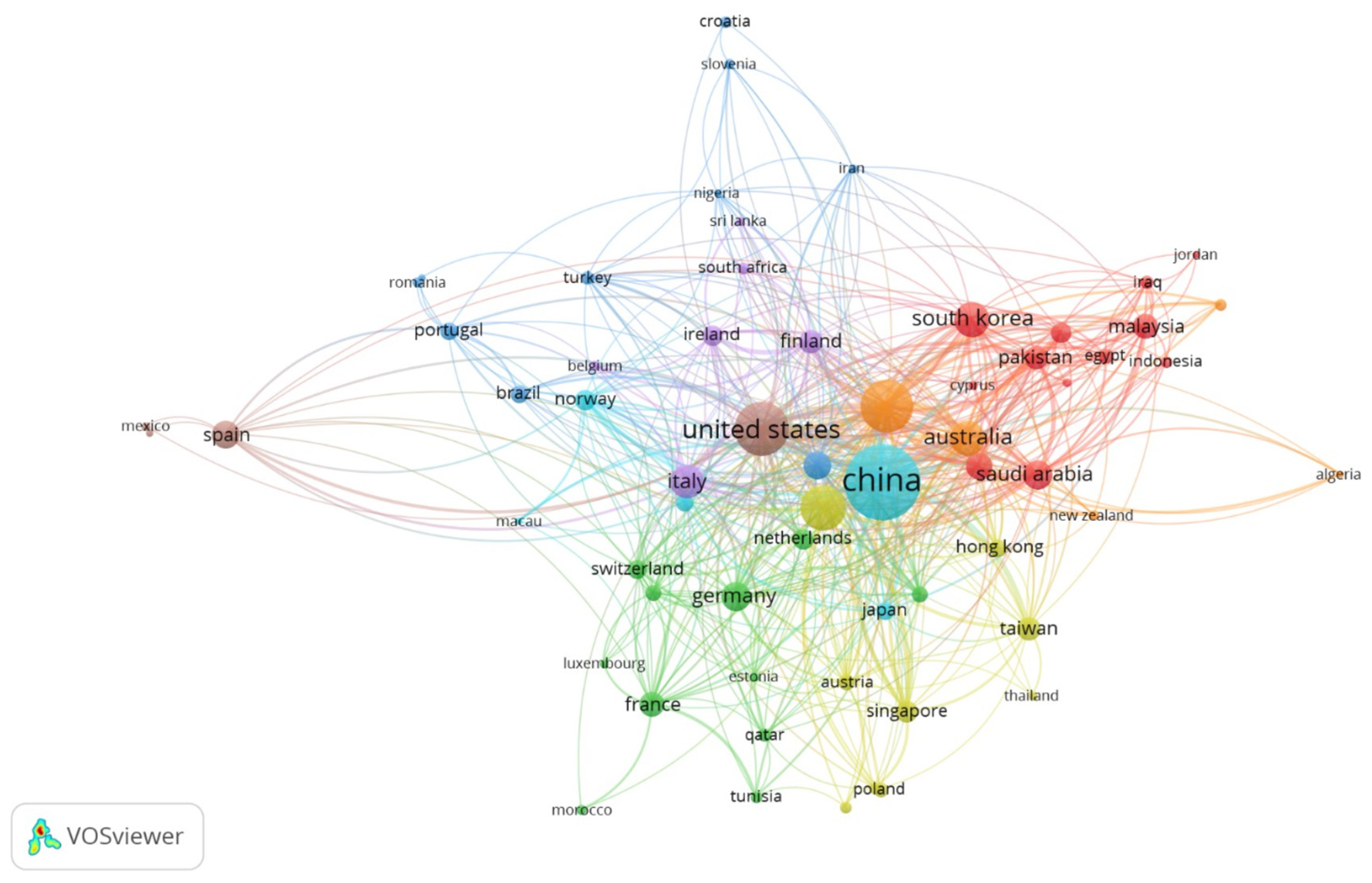

This approach is at the heart of recent breakthroughs by projects like Eclipse Labs and Solana, which are actively implementing multi-dimensional pricing to push throughput boundaries (eclipselabs.io, solanacompass.com).

The Technical Anatomy: Fee Update and Block-Packing Challenges

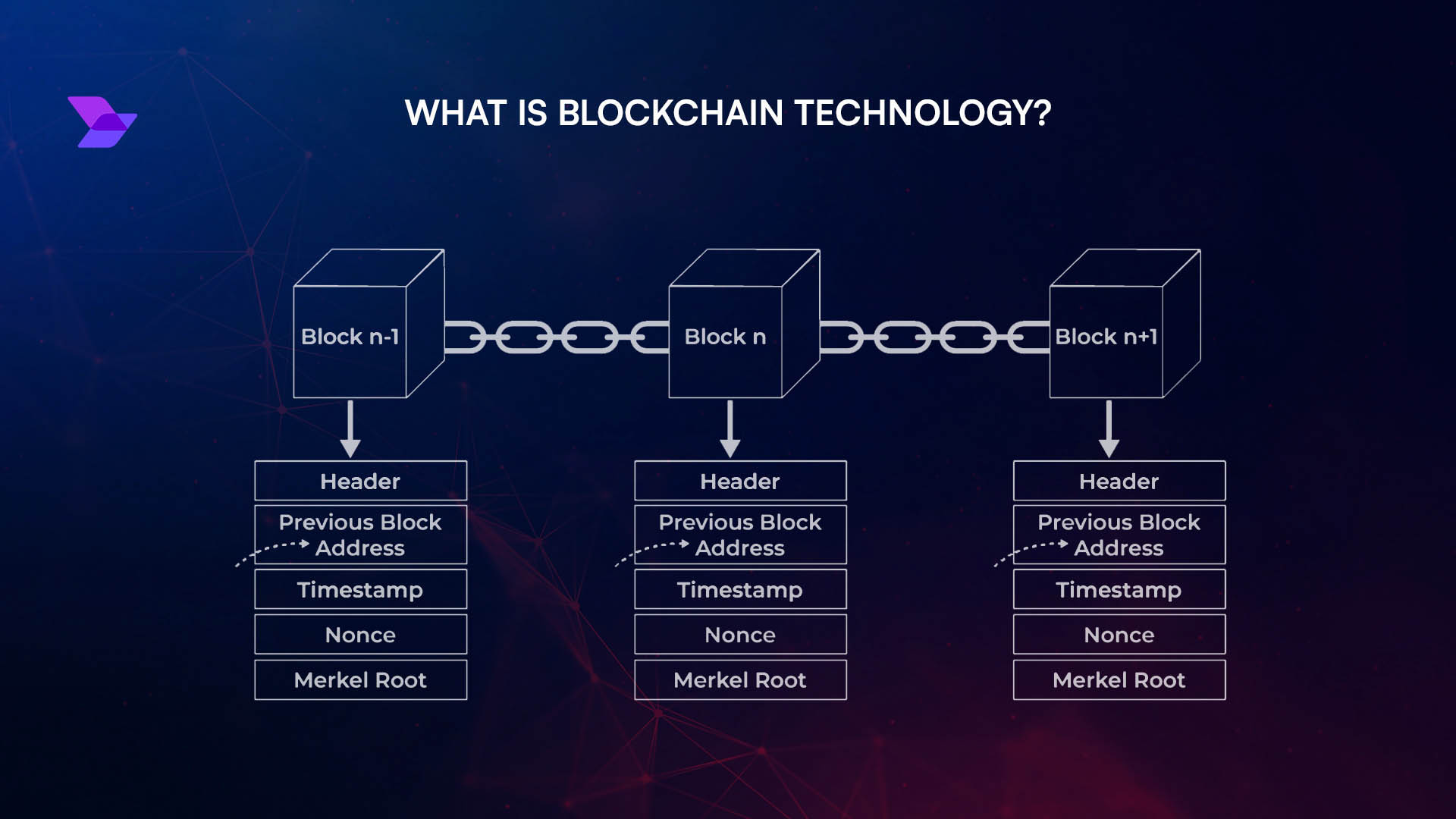

The leap from theory to practice involves solving two critical problems: the fee update problem and the block-packing problem. The fee update problem centers on how quickly and accurately a protocol can adjust prices for each resource in response to shifting demand. Too slow and congestion returns; too fast and fees become unpredictable. Recent research shows that even simple algorithms can achieve near-optimal outcomes, minimizing welfare gaps between actual performance and an omniscient designer (arxiv.org).

The block-packing problem is about efficiently filling blocks with diverse transaction types without exceeding any single resource limit. For example, a block might be full in terms of computational gas but still have unused storage capacity. Multidimensional markets allow rollup sequencers to pack blocks more densely by balancing multiple constraints simultaneously, a key driver for achieving high throughput at scale.

EIP-7999: Unified Multidimensional Fee Markets Become Mainstream

The Ethereum ecosystem made a major stride with EIP-7999 in August 2025, proposing a unified multidimensional fee market where each transaction specifies a single max_fee budget fungible across all resources (eips.ethereum.org). This innovation simplifies user experience while maintaining capital efficiency: users no longer need to manually allocate budgets for computation versus storage versus bandwidth; instead, protocols dynamically normalize gas prices across dimensions based on real-time demand.

Key Advantages of EIP-7999’s Unified Multidimensional Fee Market

| Advantage | Description | Visual |

|---|---|---|

| Efficient Capital Use | Users specify a single max_fee budget, making fee allocation across resources more efficient. | 💸 |

| Simplified User Experience | Unified fee structure reduces complexity for users and developers. | 👌 |

| Resource Optimization | Separate pricing for computation, storage, and bandwidth enables precise resource allocation. | ⚖️ |

| Stable Pricing | Gas normalization maintains price stability during gas limit changes. | 📉 |

| Scalability | Supports higher throughput (up to 1M TPS) by optimizing fee markets for custom rollups. | 🚀 |

| Reduced Fee Volatility | Fungible max_fee helps smooth out sudden spikes in individual resource prices. | 🌊 |

| Improved Network Performance | Better resource allocation leads to faster and more reliable transactions. | ⚡ |

| Facilitates Advanced Use Cases | Enables custom order types and sophisticated trading strategies on-chain. | 🧩 |

This model not only streamlines onboarding but also helps maintain price stability during gas limit changes, a crucial property as networks scale toward millions of transactions per second.

Pushing Throughput Boundaries with Custom Rollups

The synergy between multidimensional fee markets and custom rollups is already yielding tangible results. For instance, zkSpace’s technical stack increased throughput from 500 up to over 3,000 TPS while slashing fees by 78%, thanks to parallelized proof generation, dynamic batching strategies, and priority-based fee auctions (markaicode.com). These innovations illustrate how tailored economic models combined with architectural flexibility can break through legacy performance ceilings without sacrificing decentralization or security.

Scaling to 1M TPS is not just a theoretical milestone, it’s a new performance regime that demands both technical and economic sophistication. Multidimensional fee markets provide the foundation, but their effectiveness hinges on the ability of rollup architects to design adaptive, application-specific mechanisms. This means integrating real-time telemetry, predictive demand models, and automated fee adjustment algorithms that respond to shifting network conditions without introducing volatility or complexity for end-users.

Community-led research continues to refine these systems. For example, Maryam Bahrani’s work at the Ethereum Foundation explores how transaction heterogeneity and node diversity affect throughput and welfare in multidimensional fee markets. The findings reinforce the value of flexible pricing across multiple resources, highlighting that even in adversarial conditions, welfare losses remain minimal. This robustness is critical as custom rollups become the backbone for high-frequency DeFi, gaming, and enterprise applications.

Design Patterns for Scalable Fee Markets

Successful implementation of multidimensional fee markets at scale relies on several emerging design patterns:

Key Design Patterns for Scalable Multidimensional Fee Markets

-

Unified Multidimensional Fee Market (EIP-7999): Ethereum’s EIP-7999 introduces a unified multidimensional fee market, allowing transactions to specify a single max_fee budget fungible across resources. This design simplifies user experience and optimizes capital efficiency, while gas normalization ensures price stability during gas limit changes.

-

Separate Resource Pricing (Solana): Solana implements separate fee markets for distinct resources like computation, storage, and bandwidth. This enables precise resource allocation, reduces fee volatility, and supports sophisticated order types, enhancing network throughput and flexibility.

-

Dynamic Fee Updates and Block Packing Algorithms: Platforms like Eclipse Labs address the challenges of real-time fee adjustments and optimal block packing. Their approaches dynamically update fees based on current demand and efficiently pack transactions into blocks to maximize throughput and resource utilization.

-

Parallelized Proof Generation and Dynamic Batching (zkSpace): zkSpace scales throughput by parallelizing proof generation and using dynamic batching. Combined with priority fee markets, this pattern increases transaction capacity and reduces user costs, as seen in their move from 500 to over 3,000 TPS and a 78% fee reduction.

-

Algorithmic Price Discovery for Resource Allocation: Research such as “Multidimensional Blockchain Fees are (Essentially) Optimal” demonstrates that algorithmic price discovery—where prices for each resource are updated based on observed demand—can achieve near-optimal welfare outcomes, even in adversarial settings.

These patterns are being actively tested by projects like Eclipse Labs and Solana as they aim to resolve block-packing inefficiencies while supporting diverse transaction types.

Importantly, isolated app-chain fee markets offer additional advantages. By decoupling from global blockspace competition seen on monolithic chains, application-specific rollups can fine-tune their market logic, prioritizing user experience or specific economic behaviors as needed (eclipselabs.io). This isolation is especially valuable for dApps with unique throughput or latency requirements.

What Comes Next?

The roadmap ahead involves further integration between multidimensional pricing engines and novel rollup architectures. As EIP-7999 matures and more networks adopt unified fee accounting mechanisms, expect to see:

- Greater cross-rollup interoperability, as normalized gas metrics make bridging easier

- Automated resource auctions, enabling real-time repricing based on predictive analytics

- User-centric interfaces, abstracting away complexity while preserving capital efficiency

- More granular data availability layers, supporting high-throughput use cases without base layer congestion

The bottom line: multidimensional fee markets are no longer experimental, they’re essential infrastructure for any project targeting ultra-high throughput with sustainable economics. As research validates their optimality and leading protocols demonstrate production-scale deployments, we’re entering an era where 1M TPS is not just possible but practical, unlocking entirely new categories of decentralized applications.