As the blockchain landscape matures, developers are increasingly turning to application-specific rollups (AppRollups) to overcome the limitations of generic Layer 1 and Layer 2 protocols. These dedicated rollup environments empower teams to design and implement custom fee markets, optimizing transaction costs, throughput, and user incentives for their unique use cases. In this technical guide, we’ll explore the foundational principles and practical steps for deploying custom fee mechanisms within application-specific rollups, an architecture that is rapidly becoming standard in the modular blockchain era.

Why Custom Fee Markets Matter for App-Chains

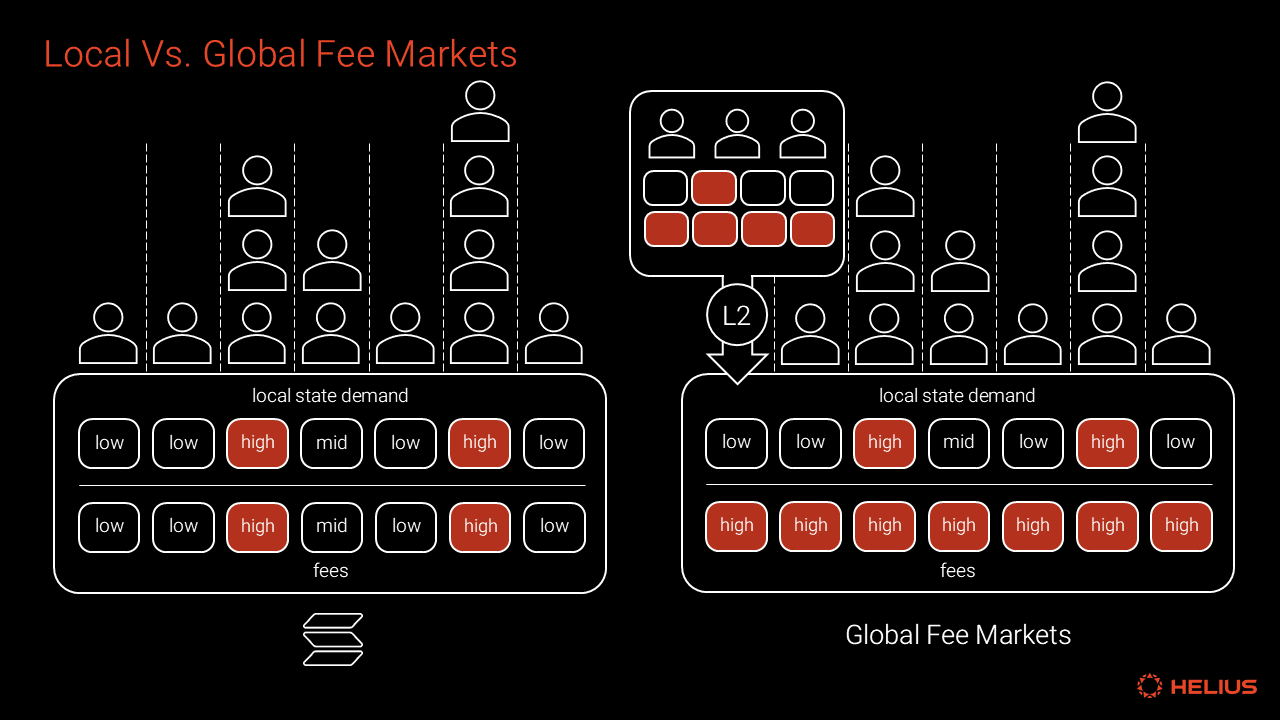

The traditional blockchain model enforces a uniform, one-size-fits-all gas market where users compete for block space using a base asset (e. g. , ETH). While this approach maximizes generality, it introduces inefficiencies for specialized applications, especially those with non-standard transaction profiles or unique economic models. With AppRollups, each chain operates as a sovereign environment, enabling developers to:

- Tailor fee structures to specific user behaviors and transaction types

- Create utility for custom gas tokens, driving organic demand and new incentive models

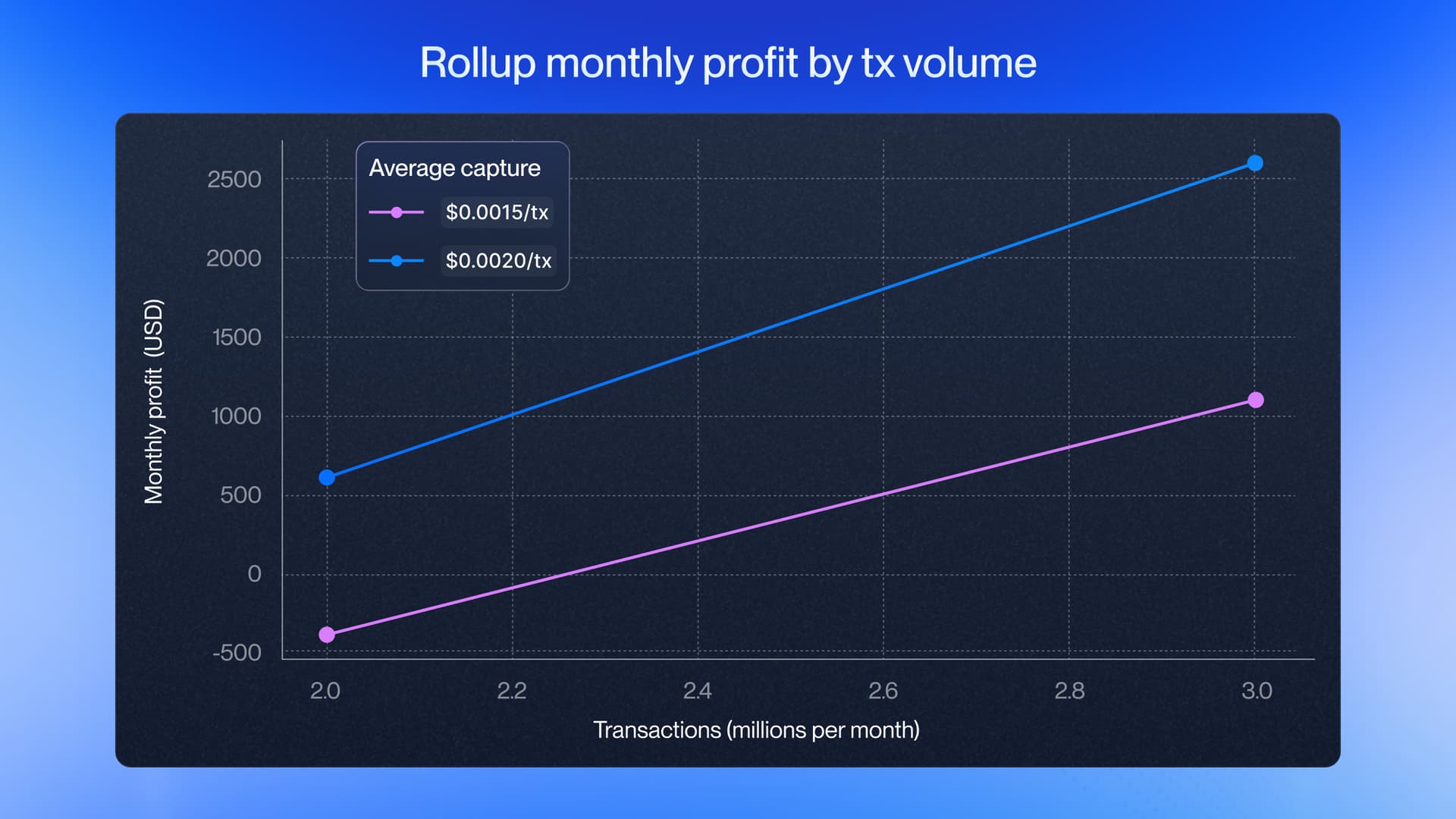

- Capture value directly from protocol usage, supporting sustainable development and innovation

This flexibility is not just theoretical. According to Binance research, over 30% of application-specific rollups now implement custom gas token models or alternative fee structures, a trend accelerating as more teams seek sovereignty over their economics.

Core Steps in Implementing Custom Fee Markets

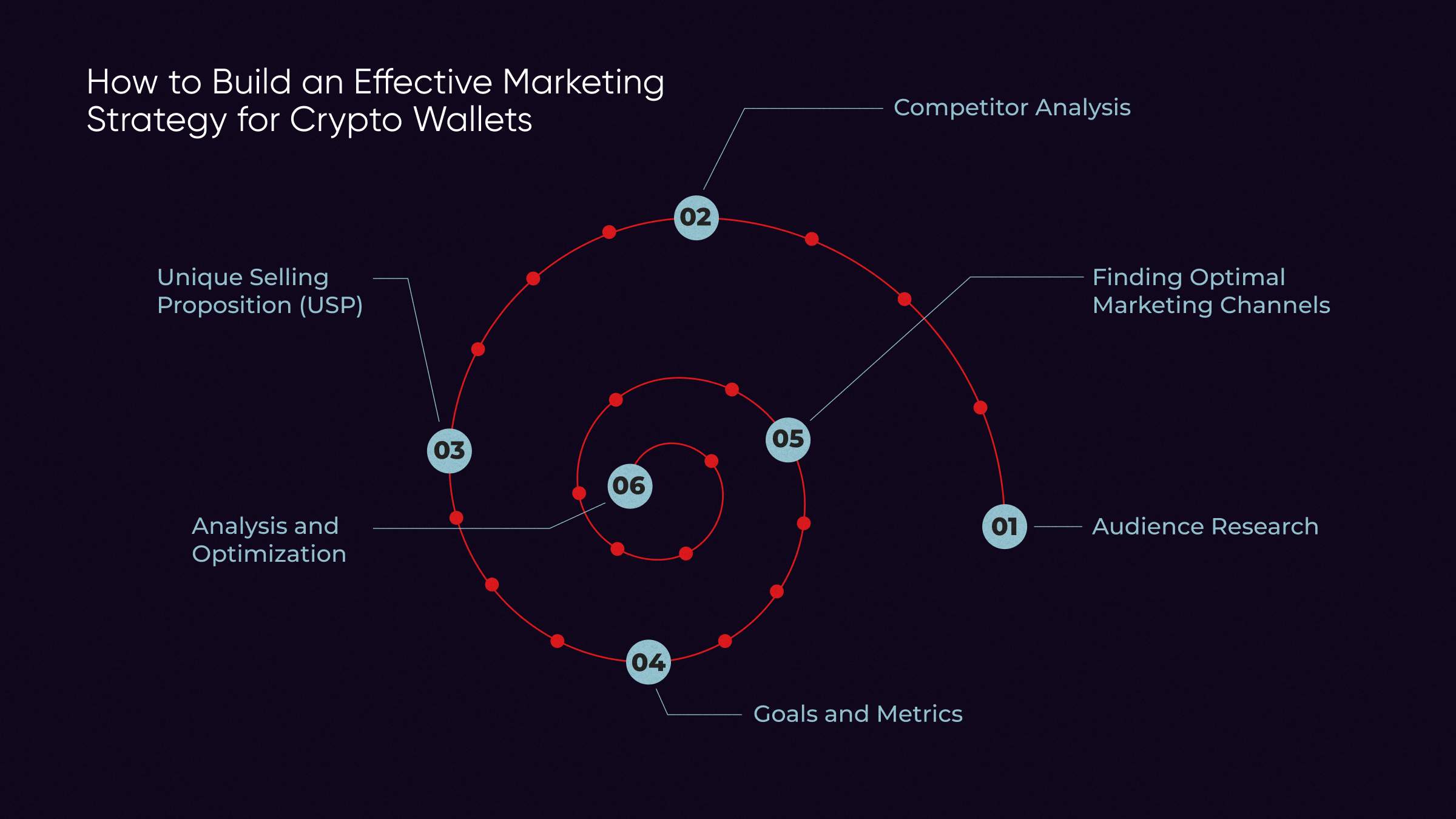

The process of designing and integrating a custom fee market into an AppRollup can be broken down into several critical phases:

Key Phases in Custom Fee Market Implementation

-

Define Fee Parameters: Specify the variables influencing transaction fees, such as transaction complexity, priority levels, and user segments. This foundational step ensures the fee market aligns with application requirements.

-

Develop Fee Calculation Logic: Create transparent and predictable algorithms that compute fees based on the chosen parameters. This logic must be auditable to maintain user trust and network integrity.

-

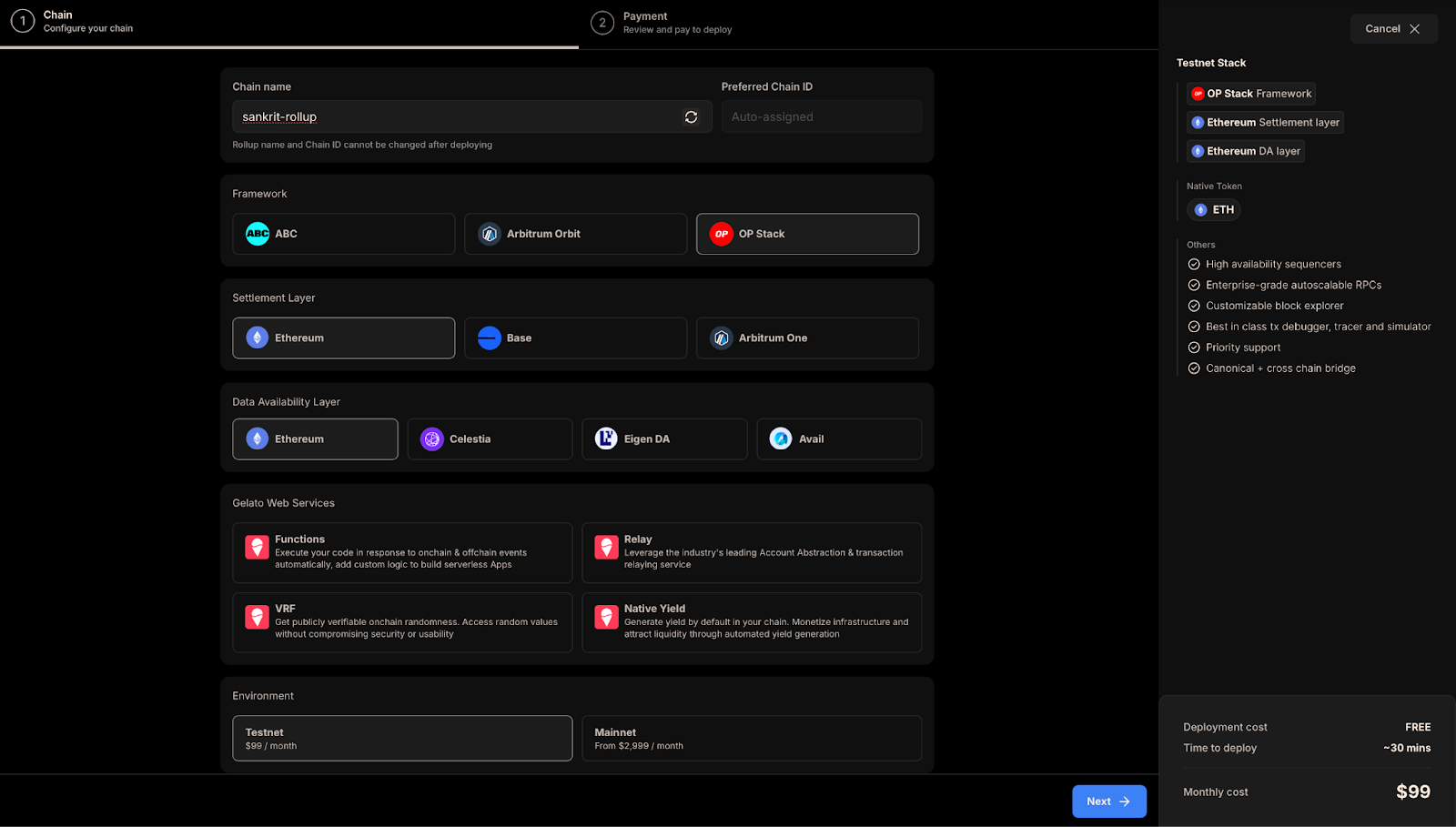

Integrate with Rollup Infrastructure: Seamlessly embed the fee logic into the rollup’s transaction processing pipeline. Utilize platforms like Caldera to streamline integration and management of custom fee structures.

-

Test and Optimize: Conduct rigorous testing to evaluate the impact of the custom fee market on performance and user experience. Use analytics to iteratively refine parameters and logic for optimal outcomes.

-

Leverage RaaS Providers: Utilize Rollups-as-a-Service platforms such as Caldera or Alchemy Rollups to simplify deployment, monitoring, and ongoing management of application-specific rollups with custom fee markets.

- Define Fee Parameters: Start by identifying what will drive fees on your chain. Options include transaction complexity, data size, execution priority, or even external metrics such as oracle prices.

- Develop Transparent Fee Logic: Implement deterministic algorithms for fee calculation. This ensures predictability for users while allowing dynamic adjustments as your app evolves.

- Integrate With Execution Pipeline: Embed your custom logic directly into the rollup’s transaction processing layer. This may involve modifying sequencer software or utilizing Rollups-as-a-Service (RaaS) platforms that support pluggable modules.

- User Experience Considerations: Design front-end interfaces that clearly communicate expected fees and provide feedback on how users can optimize costs.

- Pilot and Iterate: Use testnets to collect data on how your market performs under real-world conditions. Adjust parameters based on observed throughput, latency, and user behavior.

The Role of RaaS Providers in Custom Rollup Deployment

The technical overhead of launching an AppRollup with bespoke fee mechanics can be significant, especially when factoring in security audits and ongoing maintenance. This is where RaaS (Rollups-as-a-Service) providers such as Caldera come into play. Platforms like Caldera’s RaaS suite offer powerful abstractions: out-of-the-box modules for data availability integration, customizable sequencer logic, and admin dashboards that let operators tweak economic parameters without redeploying core infrastructure.

This service-driven approach dramatically reduces time-to-market while maintaining full sovereignty over your chain’s economics, a critical advantage as app-chains proliferate across DeFi, gaming, social networks, and beyond.

Evolving Utility: The Rise of Custom Gas Tokens

A growing subset of AppRollups are experimenting with native gas tokens rather than defaulting to ETH or other L1 assets. By embedding custom tokens at the heart of their fee markets, these chains create continuous demand loops, aligning user incentives with protocol health. As highlighted by Binance research, this model has already been adopted by more than 30% of new app-rollup deployments in 2025, a figure expected to rise further as teams pursue deeper integration between utility tokens and protocol cash flows.

Custom gas tokens enable more granular economic design. For example, protocols can implement staking requirements, dynamic fee discounts, or loyalty rewards for heavy users. These mechanisms not only drive organic demand for the token but also support sustainable value accrual strategies, an essential consideration as regulatory and compliance frameworks evolve. Projects leveraging custom app-chain fee structures are positioned to capture new revenue streams while maintaining flexibility in how they incentivize participation.

Performance Optimization and Fee Market Dynamics

Implementing a successful custom fee market is not just about lowering costs, it’s about creating a responsive system that optimizes for both network health and user experience. By tuning parameters such as minimum base fees, congestion surcharges, or even introducing auction-based block space allocation, developers can dynamically balance throughput with economic security. This is especially relevant as application-specific rollups begin to handle higher transaction volumes and more complex workflows.

One notable benefit is the ability to experiment rapidly with economic models that would be infeasible on a shared Layer 1. For instance, gaming-focused rollups might subsidize microtransactions to encourage onboarding, while DeFi protocols could introduce tiered pricing based on liquidity contribution or trading volume. The result is a landscape where fee markets are as diverse as the applications themselves, each chain evolving its own optimal equilibrium.

Security, Auditing, and Upgrade Paths

With great flexibility comes increased responsibility: custom fee logic must be robustly tested and audited to prevent exploits or unintended incentives. Security reviews should cover edge cases in transaction ordering, denial-of-service vectors related to fee manipulation, and the integrity of any off-chain components (such as oracle feeds). Leveraging modular architectures provided by RaaS platforms ensures that upgrades, whether to patch vulnerabilities or refine economic parameters, can be performed with minimal disruption.

Teams should also establish clear upgrade paths for their fee market modules. This involves governance mechanisms (on-chain or off-chain), transparent changelogs, and rigorous staging environments for testing before mainnet deployment. The goal is continuous improvement without sacrificing stability, a balance critical for long-term adoption.

Looking Ahead: The Future of App-Chain Fee Structures

The proliferation of application-specific rollups signals a paradigm shift in blockchain scalability and user-centric design. As more projects move away from generic gas markets toward purpose-built economic systems, we will see increasing experimentation with hybrid models, combining fixed fees, dynamic auctions, rebates, and even cross-rollup interoperability incentives.

Key Trends in App-Chain Fee Structures for 2025-2026

-

Custom Gas Tokens for App Chains: Over 30% of application-specific rollups now implement their own gas tokens, creating organic demand and utility for native app tokens and enabling flexible fee policies. (Source: Binance)

-

Rollups-as-a-Service (RaaS) Platforms: Providers like Caldera and Alchemy enable rapid deployment of application-specific rollups with configurable fee markets, lowering technical barriers for custom fee logic. (Source: Caldera)

-

Dynamic Fee Models and Cash Flows for App Tokens: Projects are introducing cash flow models for app tokens, allowing for permissive, flexible, and compliant fee structures that can be tailored to user segments and transaction types. (Source: a16z crypto)

-

Data Availability (DA) Optimization: Application-specific rollups are increasingly integrating DA solutions (e.g., EigenLayer, Celestia) to reduce costs and enable more granular, usage-based fee structures. (Source: Alchemy)

-

Tailored Transaction Prioritization: Custom fee logic allows rollups to prioritize specific transaction types (e.g., DeFi swaps, NFT mints), optimizing throughput and user experience for their core use cases. (Source: TokenMinds)

Ultimately, the ability to customize every layer of the transaction lifecycle, from sequencing logic to end-user pricing, gives developers unprecedented control over both performance and monetization strategies. For those building the next generation of decentralized applications, mastering custom rollup architecture and specialized fee markets is no longer optional; it’s foundational.