Application-specific blockchains (ASBs) are rapidly becoming the architecture of choice for builders seeking efficiency, scalability, and fine-tuned control over transaction costs. As the industry matures beyond generic smart contract platforms, it’s clear that a one-size-fits-all fee model is fundamentally mismatched to the diverse demands of real-world applications. Enter specialized fee markets: dynamic, multidimensional pricing mechanisms that empower custom app-chains to optimize resource allocation and unlock new use cases across industries.

Why General-Purpose Blockchains Hit a Wall

Classic blockchains like Ethereum rely on a single, fungible unit (gas) to price computational resources. This approach can’t distinguish between bandwidth-heavy data storage, compute-intensive contract execution, or latency-sensitive transactions. The result? Inefficiencies and unpredictable costs for developers and users alike.

The market is recognizing these limitations. As noted by Alice Li from Foresight Ventures: “General-purpose blockchains may not be optimal for specific use cases. ” Increasingly, innovators are opting for application-specific blockchains with tailored fee structures that precisely match their operational requirements.

The Mechanics of Specialized Fee Markets

Specialized fee markets go far beyond flat-rate or monolithic gas models. By introducing dynamic pricing based on actual resource usage, these systems enable chains to:

- Reduce transaction costs by eliminating unnecessary overhead

- Optimize throughput through workload splitting and resource-aware scheduling

- Dynamically reflect network congestion and scarcity in real time

This multidimensional approach ensures that each transaction pays for its true impact on the system, whether it’s storage-heavy NFT minting or high-frequency DeFi swaps.

Real-World Use Cases Unlocked by Custom Fee Structures

Top Real-World Blockchain Applications Enabled by Specialized Fee Markets

-

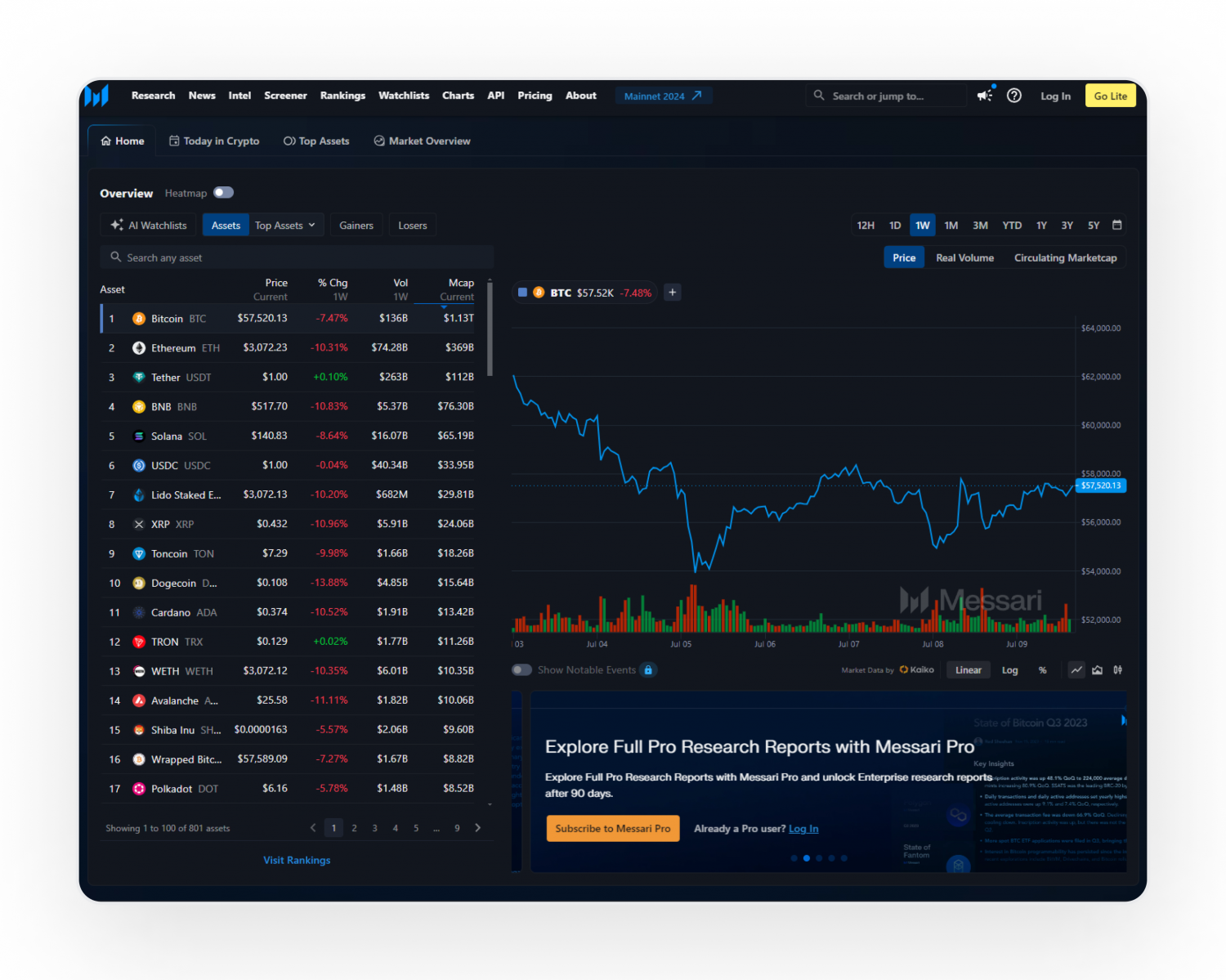

Decentralized Finance (DeFi): Uniswap — Uniswap leverages application-specific blockchains and specialized fee markets to enable efficient, low-cost token swaps and liquidity provision, supporting billions in daily trading volume while minimizing transaction overhead.

-

Supply Chain Tracking: IBM Food Trust — IBM Food Trust utilizes blockchain with specialized fee structures to provide transparent, tamper-proof tracking of food products from farm to table, enhancing safety and efficiency for global supply chains.

-

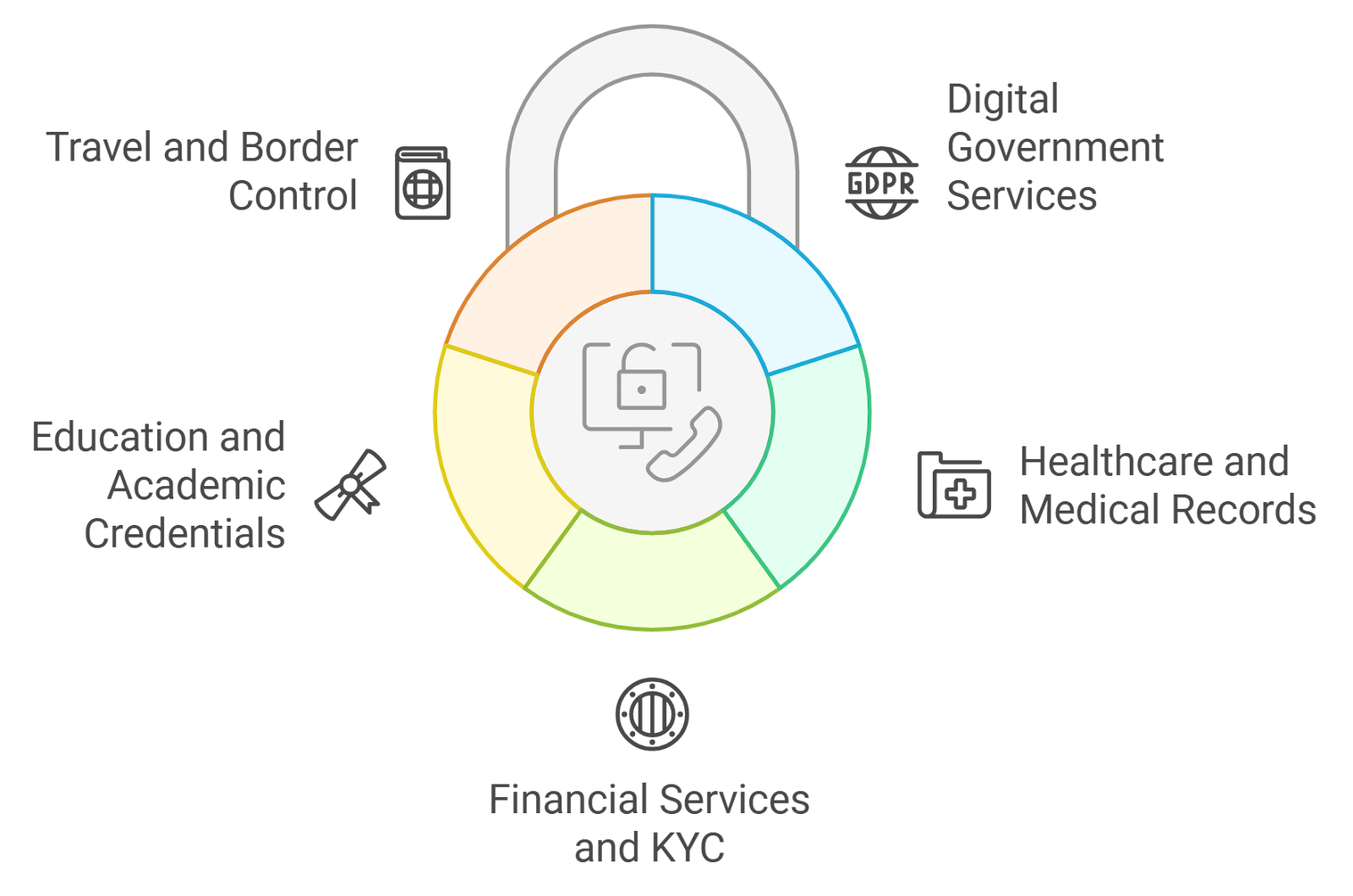

Digital Identity Management: Sovrin Network — Sovrin Network offers decentralized, self-sovereign identity solutions, using application-specific blockchain fees to allow secure, user-controlled credential management and selective data sharing.

-

Healthcare Data Sharing: MedRec — MedRec applies blockchain with tailored fee markets to securely manage and share electronic medical records, improving interoperability and patient privacy across healthcare providers.

The impact of specialized fee markets is tangible across sectors:

- Decentralized Finance (DeFi): ASBs can offer optimized fee structures for swaps and lending protocols. For example, custom rollups designed for DeFi can reduce friction by aligning fees to liquidity pool operations rather than generic computation (source).

- Supply Chain Management: Chains like Openport use tailored resource allocation to connect shippers and carriers directly, lowering costs while ensuring real-time transparency (source).

- Digital Identity: Blockchain-based identity systems leverage custom app-chains with privacy-centric fee models to empower user-owned credentials (source).

- NFT Marketplaces and Gaming: Purpose-built chains like WAX offer ultra-low fees and rapid settlement, crucial for digital collectibles trading at scale.

- Healthcare Data Sharing: Confidential transactions and selective disclosure become feasible when chains can price privacy-preserving computation as a first-class resource.

Pushing Scalability Without Sacrificing Security or Usability

The flexibility of specialized fee markets allows ASBs to address sector-specific regulatory requirements (e. g. , GDPR compliance in healthcare), integrate confidential transactions for sensitive enterprise data flows, and support rapid scaling as user bases grow. Notably, solutions like chainScale demonstrate how functionality-oriented workload splitting can significantly boost throughput while minimizing latency (source). This positions custom app-chains as the backbone infrastructure for next-generation decentralized applications.

Crucially, these advances are not theoretical, they are being implemented in production environments across industries. The ability to granularly price resources like storage, compute, and bandwidth means that application-specific blockchains can serve demanding use cases such as real-world asset tokenization, supply chain provenance, and decentralized identity at a fraction of the cost and with greater reliability than legacy blockchain models.

Economic Design: Aligning Incentives for Sustainable Growth

At the core of every successful custom app-chain is a robust economic model that aligns incentives between validators, developers, and end users. Specialized fee markets allow protocol designers to fine-tune how fees are distributed, rewarding those who provide scarce resources or contribute to network security while discouraging spam and inefficient usage. This flexibility is essential for supporting diverse business models, from pay-per-use data sharing in healthcare to microtransactions in IoT networks.

For instance, consider healthcare data sharing networks where patient privacy is paramount. Custom chains can implement confidential transactions priced according to their computational overhead, ensuring both compliance and economic viability. Similarly, real-world asset tokenization platforms can introduce tiered fee schedules based on asset class or transaction complexity, something that’s nearly impossible on general-purpose chains.

Developer Experience: Lower Barriers, Higher Innovation

The proliferation of open-source frameworks for building custom app-chains has dramatically lowered the barrier to entry for developers. Instead of wrestling with unpredictable gas costs or resource contention on shared networks, teams can deploy blockchains with bespoke fee logic tailored to their application’s needs. This not only accelerates time-to-market but also fosters experimentation in areas such as decentralized identity, confidential data marketplaces, and next-generation NFT infrastructure.

- Predictable Costs: Developers can offer users transparent pricing models, critical for mainstream adoption.

- Resource Isolation: Mission-critical applications avoid congestion caused by unrelated workloads.

- Rapid Iteration: Upgrades and governance can be streamlined without waiting for whole-network consensus changes.

The Road Ahead: Challenges and Opportunities

While specialized fee markets solve many pain points endemic to monolithic blockchains, they introduce new challenges around interoperability and cross-chain liquidity. As the ecosystem matures, expect to see bridges and middleware protocols emerge that facilitate seamless value transfer between custom app-chains, without sacrificing the benefits of tailored economic design.

Key Challenges Facing Specialized Fee Markets

-

Interoperability Hurdles: Application-specific blockchains (ASBs) often operate in isolated environments, making it difficult to seamlessly transfer assets and data across different networks. This fragmentation can impede real-world adoption, as seen in the complexities of bridging assets between platforms like Cosmos and Polkadot.

-

Standardization Gaps: The lack of universally accepted protocols for specialized fee markets leads to inconsistent implementations across ASBs. This complicates integration efforts and slows industry-wide adoption, with projects like Interledger and Hyperledger still working towards more comprehensive standards.

-

Cross-Chain Liquidity Risks: Fragmented liquidity pools across multiple ASBs can result in higher slippage, increased volatility, and reduced capital efficiency. Platforms such as Thorchain and Chainlink CCIP are actively developing solutions, but cross-chain liquidity remains a significant risk factor.

-

Need for Advanced Monitoring Tools: Specialized fee markets require sophisticated analytics and monitoring to ensure network health, detect anomalies, and optimize resource allocation. While tools like Tenderly and Blocknative offer some capabilities, comprehensive, ASB-focused monitoring solutions are still emerging.

The trajectory is clear: application-specific blockchains with dynamic fee structures are rapidly becoming foundational infrastructure across finance, logistics, digital identity management, healthcare data sharing, and beyond. By empowering builders with granular control over resource allocation and cost modeling, specialized fee markets unlock innovation at scale while aligning incentives for sustainable ecosystem growth.