Designing custom fee markets for application-specific blockchains is one of the most powerful tools available to modern blockchain architects. Unlike monolithic chains, appchains let you sculpt economic incentives and user experiences to fit your application’s unique needs. As blockchain adoption matures, developers are moving beyond one-size-fits-all gas models toward specialized fee structures that reflect real resource consumption, user priorities, and network conditions.

Why Standard Fee Models Fall Short for Appchains

Most general-purpose blockchains rely on a single-dimensional gas system. Every transaction, whether it’s storing data, running computation, or transferring tokens, competes for the same blockspace using a uniform pricing model. This simplicity comes at a cost: it doesn’t account for the diverse resource demands of different applications. For example, a decentralized exchange and an NFT minting platform may have vastly different requirements in terms of storage, computation, and network bandwidth.

The result? Inefficient resource allocation and unpredictable fees during periods of congestion. For appchains aiming to deliver seamless UX or optimize specific business models, this approach is limiting. Instead, specialized fee structures allow you to price resources more accurately and fine-tune incentives across every layer of your stack.

Core Principles for Designing Custom Fee Markets

Key Principles for Custom Fee Markets in Appchains

-

Understand and Measure Resource Utilization: Identify which resources—such as computation, storage, or bandwidth—your application consumes most. This enables accurate fee modeling tailored to your appchain’s unique demands.

-

Adopt Multidimensional Fee Structures: Move beyond single-metric fees by pricing multiple resources separately. This approach, highlighted in recent arXiv research, helps prevent resource monopolization and improves overall network efficiency.

-

Use Dynamic Pricing Mechanisms: Implement fee models that adjust in real time based on network congestion and resource availability. Dynamic pricing ensures fairness and optimal performance as demand fluctuates.

-

Incentivize Efficient Resource Usage: Design your fee structure to reward users who minimize resource consumption and penalize inefficient or abusive behaviors. This can include higher fees during peak usage or for resource-intensive transactions.

-

Ensure Transparency and Predictability: Clearly communicate how fees are calculated and what factors influence them. Transparent fee markets build user trust and help participants make informed decisions.

-

Continuously Review and Adapt Fee Structures: Regularly monitor your network and user behavior, updating fee mechanisms as needed to address evolving requirements and maintain optimal efficiency.

The latest research on multidimensional blockchain fee markets highlights several principles that should guide your design:

- Resource Awareness: Identify the primary resources your chain consumes, computation (CPU), storage (disk), bandwidth (network), and even state growth. Each resource can be priced independently based on its scarcity and importance to your application.

- Dynamic Pricing: Fees should adapt in real time to changing network demand and congestion levels. This helps prevent spam attacks while keeping costs predictable for regular users.

- User Incentives: Well-designed custom fee markets reward efficient behavior (e. g. , batching transactions or submitting during off-peak hours) while penalizing wasteful or malicious usage.

- Transparency and Predictability: Users need clear visibility into how fees are set so they can make informed decisions about when and how to transact.

This shift from static to dynamic, multidimensional pricing is not just theoretical, it’s already being explored in leading-edge projects and academic work (see arXiv). By embracing these principles, appchain builders can unlock new levels of efficiency and user satisfaction.

Tactics for Building Specialized Fee Structures

The next step is translating these principles into practice within your own blockchain economic models. Here are some proven strategies:

- Segment Fees by Resource Type: Assign separate fees for CPU cycles, storage bytes used, bandwidth consumed, etc. , rather than a single catch-all gas metric.

- Auction-Based Congestion Pricing: Use real-time auctions or dynamically adjusting base fees to allocate scarce resources during high demand periods, ensuring that those who value blockspace most pay accordingly.

- User Refunds and Penalties: Implement mechanisms that refund unused resources back to well-behaved senders or penalize those who submit spammy transactions (see Mirror. xyz research). This aligns user incentives with overall network health.

- Simplicity at the Surface: Even with complex backend logic, keep the user-facing experience as simple as possible, offering clear estimates or even fixed-fee options where feasible (Supra’s guide).

This modular approach empowers developers to optimize transaction cost structures precisely around their application’s needs, whether that’s minimizing average transaction costs or maximizing throughput during critical times.

As you implement these specialized fee structures, it’s crucial to monitor how users and validators respond in real-world conditions. Iterative refinement is key: what works well at launch may need adjustment as your appchain grows, user patterns shift, or new attack vectors emerge. Consider deploying analytics dashboards that break down resource consumption by type and track fee market performance over time.

Real-World Examples and Lessons Learned

Some application-specific blockchains have already pioneered multidimensional fee markets. For instance, projects in the DeFi space are segmenting fees based on computation versus storage, while NFT platforms may prioritize bandwidth and state growth costs. By separating these dimensions, they’ve achieved:

- Lower average transaction costs for everyday users through targeted optimizations

- Improved network resilience against denial-of-service attacks by making spam prohibitively expensive across all relevant resources

- Greater predictability for both users and developers, thanks to transparent pricing models tied to actual usage rather than arbitrary gas schedules

If you’re building an appchain with unique throughput or UX requirements, don’t hesitate to experiment with hybrid approaches. For example, you might combine fixed base fees for common transactions with dynamic auctions for high-impact operations. Or leverage off-chain data feeds (oracles) to inform congestion pricing in near real time.

Checklist: Launching Your Custom Fee Market

This hands-on approach ensures you’re not just theorizing but actively tuning your blockchain economic models for optimal performance. Regular audits and community feedback loops will help surface pain points before they become systemic issues.

The Road Ahead: Innovation in Blockchain Economic Models

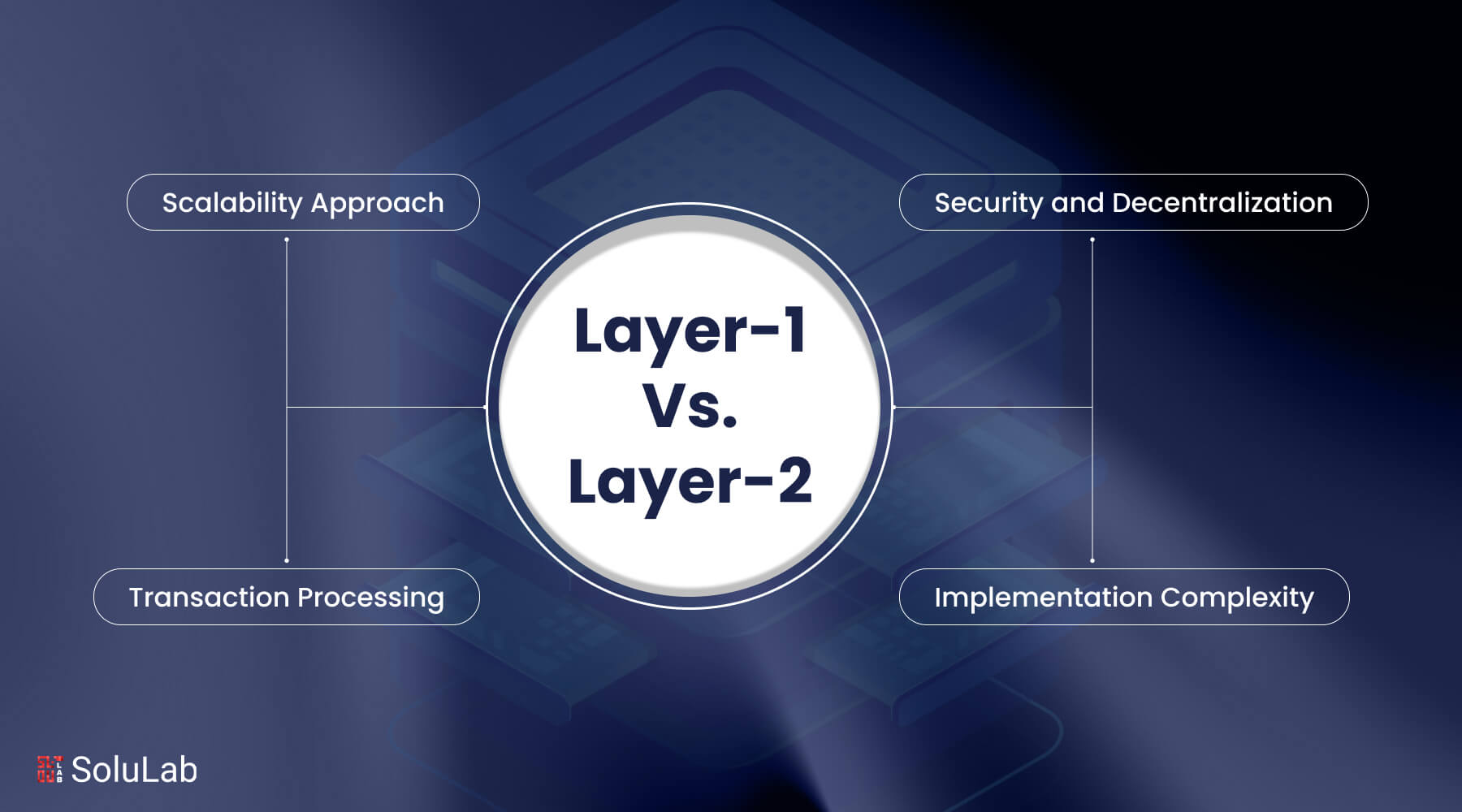

The evolution of custom fee markets is far from over. As cross-chain interoperability expands and layer-2 solutions mature, expect further innovation in how fees are calculated, distributed, and even shared across ecosystems. The flexibility of application-specific blockchains means you can continually refine your approach as new research emerges, without being locked into legacy models.

If you’re looking for deeper technical dives or want to see live examples of multidimensional fee markets in production, check out the latest academic work on multidimensional blockchain fees. For practical guides tailored to dApp development and cost optimization strategies, Supra’s overview offers actionable insights (Supra’s guide).

Common Pitfalls in Custom Fee Market Design

-

Overlooking Multidimensional Resource Usage: Many developers fail to account for the diverse resources (like computation, storage, and bandwidth) their appchain consumes, leading to inefficient or unfair fee structures.

-

Relying on Static Fee Models: Using fixed or inflexible fee structures can result in network congestion or underutilization, as fees may not reflect real-time demand or resource scarcity.

-

Lack of Transparency in Fee Calculation: Opaque or complex fee formulas can confuse users and erode trust, making it difficult for them to predict transaction costs.

-

Ignoring User Incentives and Behavior: Neglecting to align fee mechanisms with user incentives can encourage inefficient resource usage or even enable spam and denial-of-service attacks.

-

Failing to Regularly Review and Adapt Fees: Static or rarely updated fee models may become obsolete as user behavior, network conditions, or technology evolves, reducing effectiveness over time.

-

Underestimating the Complexity of Multidimensional Pricing: Implementing multi-resource pricing without robust modeling can introduce unintended consequences, such as resource monopolization or unfair pricing across transaction types.

The journey toward efficient transaction cost optimization is iterative, but the payoff is massive. With thoughtfully designed specialized fee structures, application-specific blockchains can deliver scalable performance and superior user experiences that generic chains simply can’t match.