In the evolution of blockchain infrastructure, dynamic fee markets have emerged as a cornerstone for optimizing resource allocation and user experience in custom app-chains and rollups. Drawing inspiration from dynamic pricing in traditional industries like ride-sharing and cloud computing, these systems empower application-specific blockchains to adapt transaction costs to real-time demand. The result is greater scalability, enhanced network responsiveness, and more predictable economics for both users and developers.

Why Dynamic Fee Markets Matter for Custom App-Chains

Generic blockchains often struggle with unpredictable congestion and volatile transaction fees. For example, during NFT drops or DeFi liquidations on Ethereum mainnet, fees can spike dramatically, excluding many users from participating. Custom app-chains address this by implementing specialized fee markets tailored to their unique workloads and user bases. By dynamically adjusting fees based on network conditions, these chains prevent spam, prioritize critical transactions, and maintain high throughput even under stress.

This adaptive approach is not theoretical. It mirrors the surge pricing models used by Uber or real-time auctions for cloud resources on AWS – but applied at the protocol level to blockchain infrastructure. Below are three impactful design patterns currently driving innovation in the space.

EIP-1559-Inspired Fee Markets for Rollups

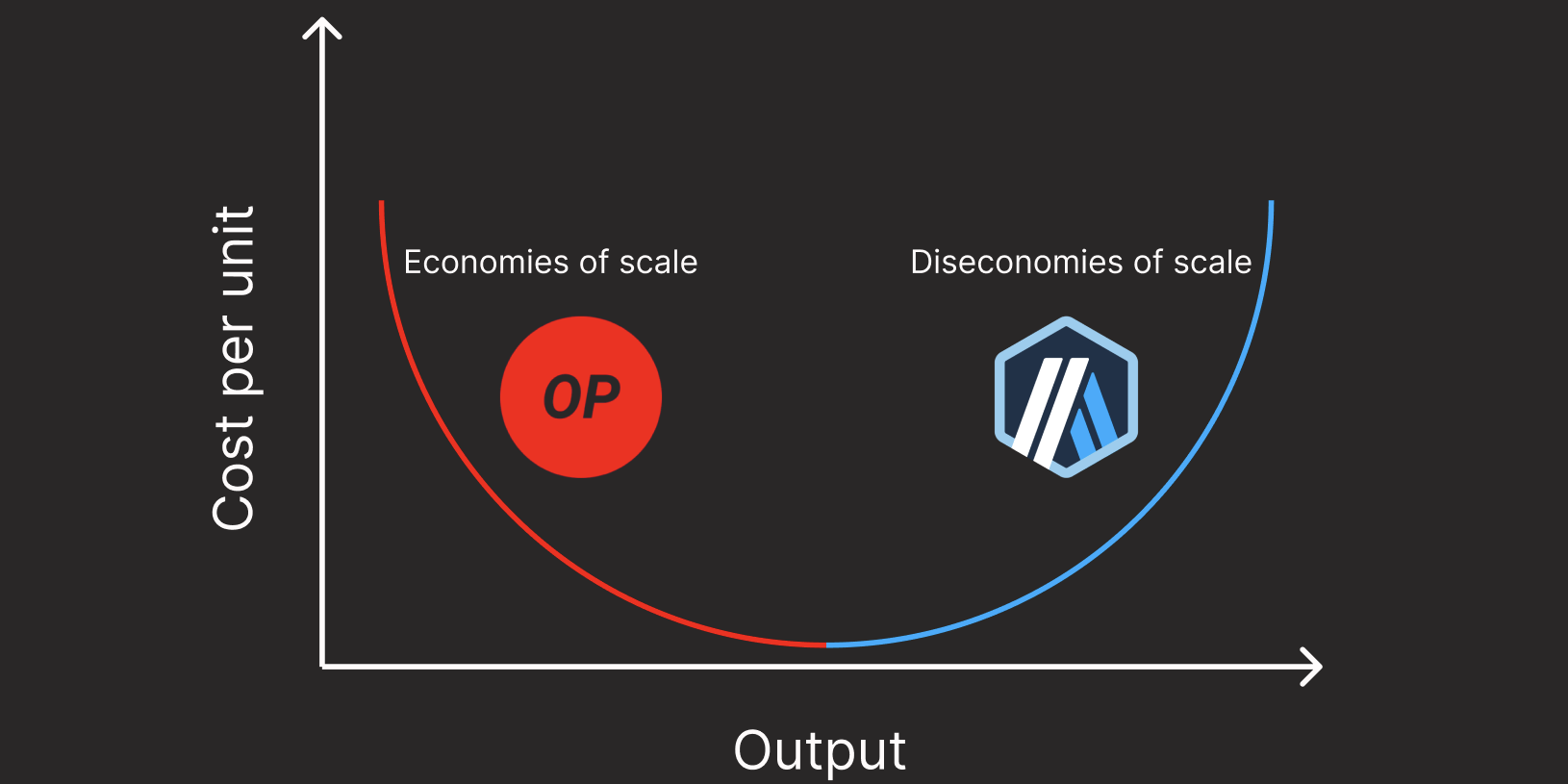

The introduction of EIP-1559 on Ethereum was a watershed moment for blockchain fee mechanics. Several leading Layer 2 rollups – including Optimism and Arbitrum – have now adopted EIP-1559-style dynamic fee markets within their own architectures. Here’s how it works:

- A base transaction fee is algorithmically adjusted based on recent block utilization.

- If blocks are consistently full, the base fee rises; if blocks are underutilized, it falls.

- This stabilizes transaction costs over time and helps users estimate fees more reliably.

This design pattern is particularly effective in rollups because it smooths out short-term volatility without sacrificing liveness or security. It also aligns incentives between sequencers (block producers) and end-users, reducing the risk of sudden fee spikes that can disrupt dApps built atop these chains.

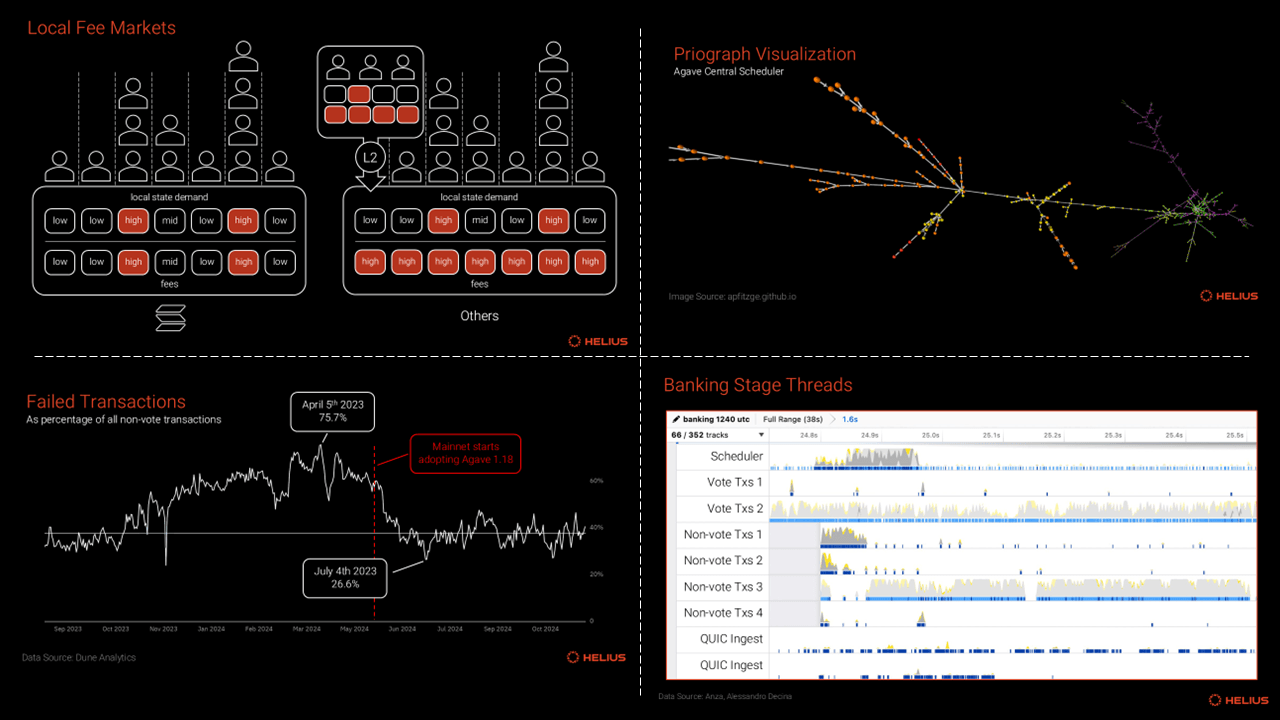

Application-Specific Congestion Pricing: Surge Logic On-Chain

Some custom app-chains take dynamic fees a step further by introducing application-specific congestion pricing mechanisms. Platforms such as dYdX v4 (a decentralized derivatives exchange) and Osmosis (a Cosmos-based DEX) implement congestion-based multipliers that automatically increase transaction costs during periods of high activity.

- Punitive multipliers: When blockspace demand surges (e. g. , during market volatility), a multiplier is applied to all transactions to discourage spam and prioritize core trading flows.

- User prioritization: Critical transactions (like liquidations or large trades) can still access blockspace at higher cost, while non-essential activity gets priced out temporarily.

- User experience: This mirrors Uber’s surge pricing model but ensures that essential DeFi operations remain functional even under extreme load.

The result is an elastic fee environment where resource allocation reflects true economic urgency – a powerful tool for maintaining chain stability without compromising decentralization or openness.

Dynamic Fee Markets in Custom App-Chains: 3 Key Examples

-

EIP-1559-Inspired Fee Markets for Rollups: Leading Ethereum Layer 2 rollups such as Optimism and Arbitrum have implemented EIP-1559-style dynamic fee markets. Here, the base transaction fee adjusts algorithmically based on real-time network demand and congestion. This design pattern helps stabilize transaction costs, prevents abrupt fee spikes, and enhances user experience by making fees more predictable within custom app-chains.

-

Application-Specific Congestion Pricing: Custom app-chains like dYdX v4 and Osmosis employ congestion-based fee multipliers that dynamically increase transaction costs during high network activity. This strategy discourages spam, prioritizes critical transactions, and ensures the chain remains responsive for core users—mirroring surge pricing models used in ride-sharing and cloud computing.

-

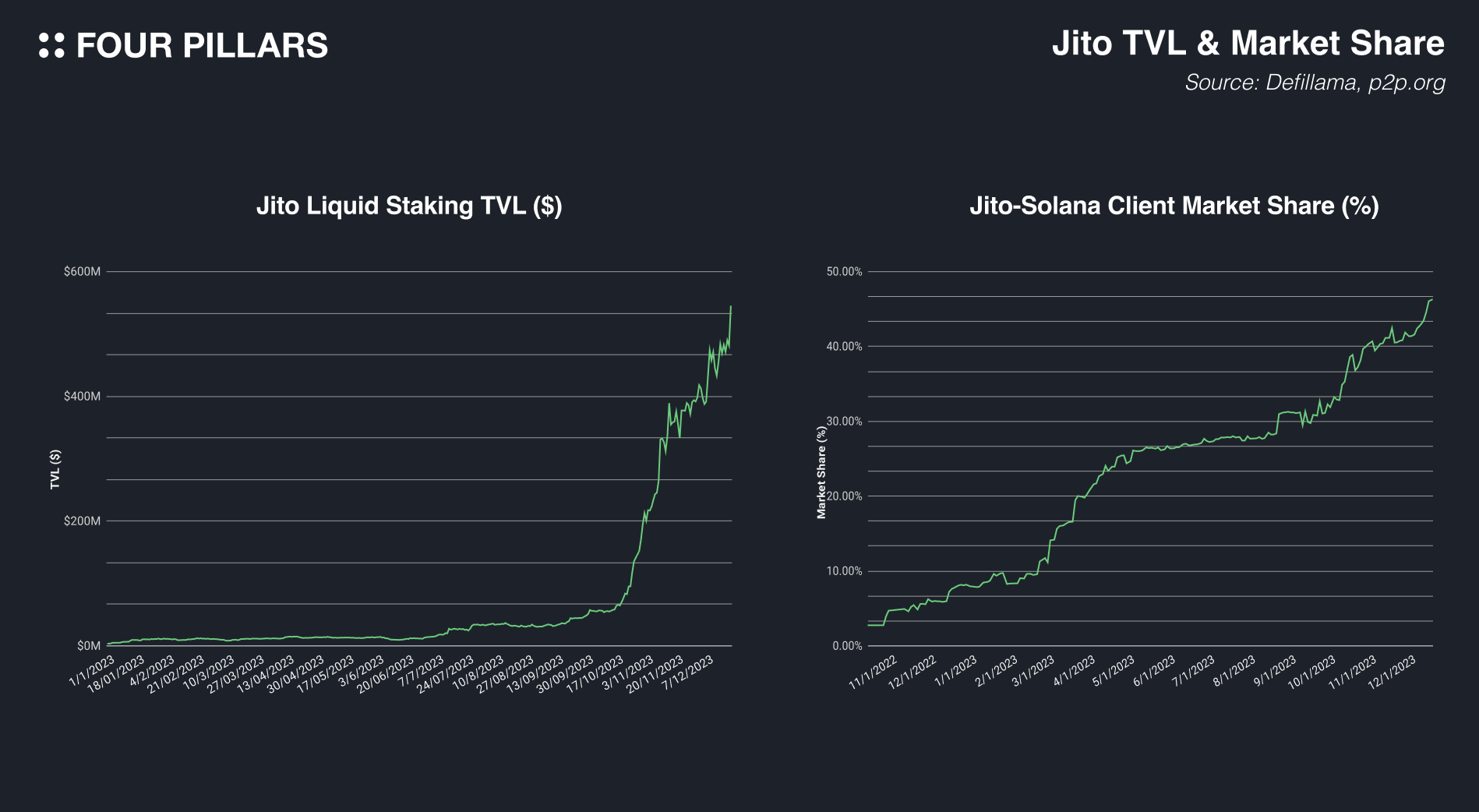

Auction-Based Block Space Allocation: Specialized blockchains such as Celo (via Gas Auction) and Solana (via priority fees) utilize real-time auctions for block space. Users bid for transaction inclusion based on urgency, creating efficient price discovery for limited resources and allowing application-specific chains to optimize throughput and revenue according to actual demand.

Auction-Based Block Space Allocation: Real-Time Price Discovery

A third major pattern leverages auction mechanisms for allocating block space itself. Specialized chains like Celo (with its Gas Auction) or Solana (with priority fees) allow users to bid directly for inclusion in upcoming blocks:

- Bidding system: Users submit bids reflecting how much they value immediate transaction inclusion versus waiting longer at a lower cost.

- Efficient price discovery: Block producers select the highest bids until available space is filled, maximizing network revenue while ensuring urgent transactions clear first.

- Differentiated user experience: Power users can pay premiums during peak times; casual users save costs by waiting for less congested periods.

This auction-based approach creates transparent price signals for limited resources – similar to ad auctions in digital marketing – letting application-specific chains optimize both throughput and economic sustainability according to actual demand patterns.

Dynamic fee markets are not only technically sophisticated but also pragmatically essential for the next generation of blockchain infrastructure. Their practical implementation in custom app-chains and rollups is already reshaping how decentralized applications scale, serve users, and manage scarce resources.

Interplay of Patterns: Composability and Customization

These three design patterns, EIP-1559-inspired fee markets, application-specific congestion pricing, and auction-based block space allocation, are not mutually exclusive. In fact, leading projects often combine them to create highly customized fee environments tailored to their own economic models and user bases.

- Rollups may start with EIP-1559-style base fees for predictability but layer on congestion multipliers during periods of extreme demand.

- DeFi exchanges can use auctions for high-value trades while applying baseline dynamic fees to routine transactions.

- Gaming chains might adopt gasless UX for in-game actions but trigger congestion pricing for NFT mints or major events.

This composability means that custom app-chains are no longer constrained by one-size-fits-all economics. Instead, they can iterate rapidly on their fee logic, experimenting with new mechanisms, optimizing for unique workloads, and responding in real time to shifts in user behavior or market conditions.

Strategic Advantages: Beyond Cost Optimization

The strategic benefits of dynamic fee markets extend well beyond simple transaction cost reduction. By aligning network incentives with actual usage patterns, these mechanisms:

- Improve security: Pricing blockspace based on demand makes denial-of-service attacks more expensive and less attractive.

- Enhance fairness: Predictable fees and transparent auctions reduce frontrunning and ensure all users have a fair shot at inclusion.

- Drive innovation: Teams can design specialized economic models, for example, subsidizing onboarding flows or rewarding power users, that would be impossible on generic chains.

The result is a virtuous cycle: better user experience attracts more activity, which in turn provides richer data for further tuning the fee market logic. This feedback loop is critical as web3 applications evolve from niche experiments into mainstream platforms handling millions of daily transactions.

Looking Forward: The Future of Fee Market Engineering

The ongoing evolution of dynamic fee markets will define the competitive landscape for custom app-chains over the next several years. As more projects experiment with multidimensional pricing, off-chain scaling patterns, and cross-chain abstractions, we’ll see even finer-grained control over how resources are allocated, and how value flows through decentralized ecosystems.

The core takeaway: mastering dynamic fee market design is now a prerequisite for any team building serious web3 infrastructure. Whether your goal is minimizing costs for end-users or maximizing throughput during global events, these patterns offer a robust toolkit to engineer application-specific blockchains that are both efficient and resilient under real-world conditions.

3 Proven Dynamic Fee Market Patterns for App-Chains

-

EIP-1559-Inspired Fee Markets for Rollups: Leading Ethereum Layer 2 rollups such as Optimism and Arbitrum have adopted EIP-1559-style dynamic fee markets. Here, the base transaction fee is adjusted algorithmically in real time based on network demand and congestion. This design pattern stabilizes transaction costs, prevents sudden fee spikes, and improves user experience by making fees more predictable within custom app-chains.

-

Application-Specific Congestion Pricing: Custom app-chains like dYdX v4 and Osmosis implement congestion-based fee multipliers that dynamically increase transaction costs during periods of high network activity. This strategy discourages spam, prioritizes critical transactions, and ensures the chain remains responsive for core users—mirroring surge pricing models used by ride-sharing and cloud computing platforms.

-

Auction-Based Block Space Allocation: Specialized blockchains such as Celo (via Gas Auction) and Solana (with priority fees) use real-time auctions for block space. Users bid for transaction inclusion based on urgency, enabling efficient price discovery for limited resources and allowing application-specific chains to optimize throughput and revenue according to actual demand.