High-velocity apps are fundamentally changing the blockchain landscape. From real-time gaming and AI data streaming to decentralized finance (DeFi) protocols handling thousands of transactions per second, these applications demand throughput, low latency, and predictable fees that general-purpose blockchains struggle to provide. As dApp developers look ahead to 2025, the limitations of legacy chains like Ethereum’s mainnet are more apparent than ever. Network congestion, unpredictable gas spikes, and resource competition make it nearly impossible for high-throughput applications to deliver seamless user experiences at scale.

Why General-Purpose Blockchains Fall Short for High-Velocity Apps

Most mainstream dApps initially launched on shared networks such as Ethereum or Solana, drawn by their security and developer ecosystems. However, as user bases grew and transaction volumes surged, these platforms revealed critical bottlenecks:

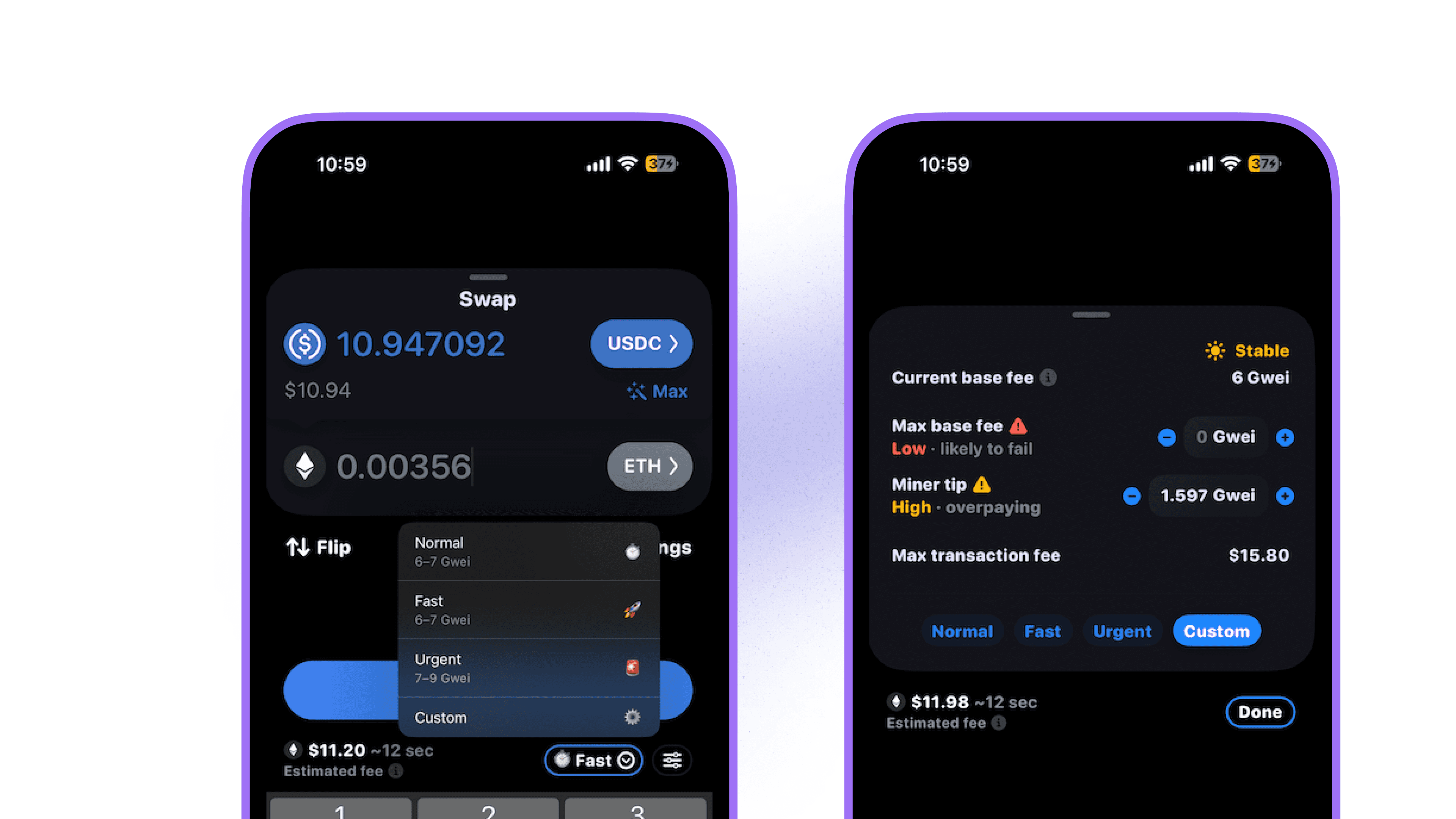

- Unpredictable Fees: Network congestion leads to volatile gas prices, undermining microtransaction-heavy models like gaming or streaming.

- Resource Contention: Competing dApps fight for blockspace, causing latency spikes and failed transactions during periods of high demand.

- Limited Customization: Fee structures are one-size-fits-all, making it impossible to optimize for specific application needs.

This is especially problematic for sectors where milliseconds matter. For example, in on-chain games or decentralized exchanges (DEXs), even slight delays can erode trust and drive users away.

Custom App-Chains: The Next Evolution in Blockchain Scalability

Enter custom app-chains: application-specific blockchains designed from the ground up for a single use case. Platforms like Zeeve, SKALE, and EOSIO are enabling projects to deploy dedicated chains with tailored consensus mechanisms, throughput optimizations, and, crucially, specialized fee markets. This approach eliminates the bottlenecks of shared infrastructure by giving each app its own sovereign environment.

Consider SKALE’s model: their app-specific chains offer zero gas fees, instant finality, and full control over network parameters. Real-world examples like StrayShot (an on-chain shooter game) and Exorde (a decentralized web indexing protocol) demonstrate how dedicated chains unlock both performance and cost efficiency. StrayShot’s SKALE chain delivers real-time multiplayer action with zero gas fees, something simply not possible on congested L1s.

The Power of Specialized Fee Markets

The true innovation lies in specialized fee markets for dApps. Unlike generic networks where every transaction competes in a global auction, app-chains allow developers to design fee structures that match their business logic:

Key Advantages of Specialized Fee Markets for High-Velocity Apps

-

Predictable and Transparent Transaction Costs: Specialized fee markets on AppChains enable developers to set fixed or dynamic fees tailored to their application’s needs, ensuring users experience consistent and transparent costs—a crucial factor for high-velocity apps like gaming or AI data pipelines.

-

Enhanced User Adoption Through Lower Fees: By implementing zero or minimal gas fees, as seen with SKALE AppChains, high-velocity applications can significantly reduce barriers to entry and attract a broader user base, especially in sectors reliant on frequent microtransactions.

-

Optimized Performance and Resource Allocation: AppChains with specialized fee markets eliminate competition for network resources, allowing for high throughput and low latency—essential for real-time applications such as multiplayer games or decentralized data processing.

-

Customizable Transaction Prioritization: Developers can design fee structures that prioritize critical transactions, ensuring essential operations are processed instantly and reliably, which is vital for time-sensitive dApps.

-

Improved User Experience and Trust: Predictable fees and seamless performance foster greater user trust and satisfaction, as demonstrated by platforms like StrayShot and Exorde, which leverage AppChains to deliver reliable, gas-free experiences.

This flexibility is critical for user-centric apps. For instance, a gaming chain might subsidize all player actions while charging a small fee only for NFT minting, directly aligning costs with value creation. In DeFi protocols, dynamic fee models can prioritize liquidations or arbitrage trades during periods of volatility, ensuring system stability without penalizing routine users.

Case Study Snapshot: How Exorde Achieves High Throughput Without Fees

Exorde’s dedicated app-chain processes vast amounts of web data with no transaction fees, safeguarding both throughput and privacy. By decoupling from a global fee market and focusing on its unique requirements, Exorde ensures consistent performance even at peak loads (source).

The shift toward custom app-chains isn’t just about technical superiority, it’s about creating economic models that unlock new kinds of user experiences. As we move into 2025, expect specialized fee markets to become a defining feature of the most successful high-velocity apps in the Web3 ecosystem.

For developers, the implications are profound. Instead of optimizing for the lowest common denominator on a congested L1, teams can now architect application-specific rollups and chains tuned to their throughput, latency, and cost requirements. This opens the door to novel business models: real-time gaming economies with zero friction, AI data streams that scale linearly with demand, and DeFi protocols that dynamically adjust fees based on market volatility.

Building With Custom App-Chains: What to Consider in 2025

The landscape for high-velocity apps blockchain solutions is rapidly evolving. Platforms like SKALE and EOSIO are leading the charge by offering plug-and-play infrastructure for launching custom chains (Zeeve). When evaluating options, teams should weigh:

- Developer Experience: How easy is it to deploy and upgrade your app-chain? Are there mature dev tools and support?

- Security Guarantees: Does the platform inherit security from a major L1 or use its own consensus? How are validator incentives aligned?

- Fee Market Flexibility: Can you implement dynamic fees, zero gas models, or prioritize specific transaction types?

- Ecosystem Interoperability: How seamless is bridging assets or data between your app-chain and other networks?

The most competitive dApps in 2025 will be those that treat fee market design as a core part of their product strategy, not an afterthought. By leveraging specialized fee structures, teams can offer users transparent pricing, subsidize critical actions, or even experiment with novel incentive mechanisms like pay-per-use or subscription-based access.

This paradigm shift also benefits end users. No more abandoned transactions due to network congestion. No more surprise fees when activity spikes elsewhere on the chain. Instead, users get predictable performance and cost, crucial for applications where microseconds and pennies matter.

The Future of High-Throughput dApps: Where Specialized Fee Markets Lead Next

The rise of custom app-chains with tailored fee markets signals a new era for Web3 scalability. As high-velocity apps push the boundaries of what’s possible on-chain, from decentralized order books to live esports tournaments, the ability to fine-tune infrastructure becomes a competitive edge rather than a luxury.

This trend isn’t limited to gaming or DeFi either. Sectors like supply chain management, IoT data aggregation, and AI-powered marketplaces will increasingly rely on application-specific rollups to meet their unique demands (source). The winners will be those who embrace both technical innovation and economic creativity, designing not just faster blockchains but smarter ones.

If you’re building in this space, now is the time to experiment with custom fee structures and dedicated infrastructure. The playbook for scaling high-velocity dApps is being written in real time, and the most ambitious teams are already reaping the benefits of sovereignty over their own blockspace.