Imagine a blockchain that can scale up in real time, handle millions of transactions per second, and then gracefully wind down when demand drops – all without fragmenting the ecosystem or sacrificing composability. Welcome to the world of ephemeral rollups on Solana, where temporary app-chains are unlocking elastic scalability for the next generation of decentralized applications.

Solana’s relentless push for performance has already made it a darling among high-frequency traders and game developers. But with Solana currently trading at $228.14, the network faces an ever-present challenge: how do you serve both massive spikes in demand and maintain seamless user experience without bloating fees or fragmenting state?

What Are Ephemeral Rollups, Really?

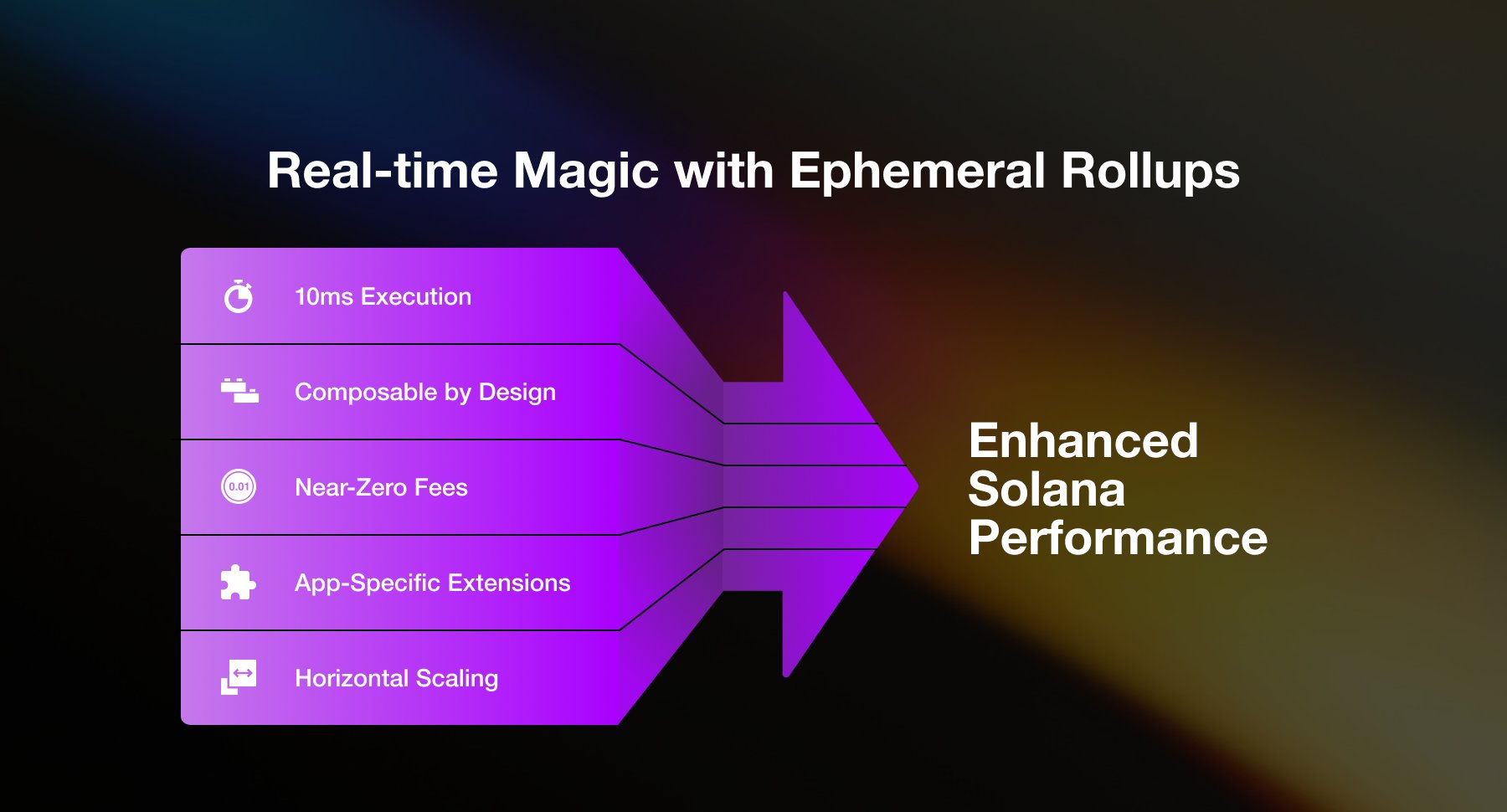

Unlike traditional rollups that persist as semi-permanent sidechains or L2s, ephemeral rollups are built to be temporary. Developed by MagicBlock, these custom execution environments spin up on demand, process high volumes of transactions with blazing speed (think and lt;50 ms end-to-end latency), then dissolve – committing their final state back to Solana’s main chain.

The magic happens when you temporarily delegate control over specific program-owned accounts to a high-performance SVM validator. This validator runs outside Solana’s usual consensus and gossip layers, so it can process orders of magnitude more transactions per second. During this session:

- The delegated accounts are locked on the main chain (readable but not writable)

- All writes happen inside the ephemeral rollup

- Once done, state changes are committed atomically back to Solana

This model delivers a burst of raw computational power exactly when needed – perfect for use cases like real-time games, prediction markets, or DeFi platforms where milliseconds matter.

The Case for Elastic Blockchain Infrastructure

If you’ve ever tried running a fast-paced game or high-frequency trading bot directly on-chain, you know how quickly network congestion can turn your dream into a laggy nightmare. Traditional horizontal scaling with isolated app-chains fragments liquidity and breaks composability – two things that make blockchains magical in the first place.

Ephemeral rollups sidestep these pitfalls by:

- Maintaining full composability with existing Solana smart contracts

- Allowing developers to customize runtime features (think real-time physics engines or live price feeds)

- Avoiding long-term fragmentation since each rollup is short-lived and merges back into the main chain

This means you get elastic scaling only when you need it – no need to permanently fork off into your own lonely app-chain just to support peak loads.

Security Without Compromise: The Fraud-Proof Layer

You might wonder: if we’re letting validators run wild outside consensus, how do we keep things honest? MagicBlock tackles this with a dynamic fraud-proof system. Developers set a fraud-proof window during which anyone can challenge invalid state transitions. A network of light clients also samples and verifies commitments before finalization.

This approach offers robust security guarantees while preserving the lightning-fast execution that makes ephemeral rollups so compelling. In essence, it’s about getting Web2-level performance without giving up Web3 trust assumptions.

If you’re hungry for more technical deep dives or want to follow upcoming releases as MagicBlock gears up for Phase 1 launch at the end of Q2 2025, check out our dedicated resource page at CustomAppChains. com.

Developers and founders are already buzzing about the implications. By decoupling peak demand from long-term infrastructure, ephemeral rollups let you “burst” compute on Solana only when your app truly needs it. For example, a battle royale game can spin up a lightning-fast execution environment for each match, or a DeFi protocol can process high-frequency arbitrage during volatile market swings, all without clogging the mainnet or pricing out other users.

Top 5 Use Cases for Ephemeral Rollups on Solana

-

On-Chain Gaming: Ephemeral Rollups, pioneered by MagicBlock, enable real-time, low-latency gameplay on Solana. Developers can run custom physics engines and process millions of game actions per second, making experiences like real-time multiplayer games and on-chain leaderboards seamless and fair.

-

High-Frequency DeFi Trading: Platforms like MagicBlock HFT leverage Ephemeral Rollups to achieve execution times as low as 1-3 milliseconds. This rivals centralized exchanges, enabling high-frequency trading, arbitrage, and real-time risk management with full blockchain transparency.

-

Real-Time Social Applications: Ephemeral Rollups empower decentralized social networks and messaging apps to deliver instant interactions and updates. Projects like Dialect can use these rollups to support real-time chat, notifications, and collaborative features without network lag.

-

Prediction Markets: Platforms such as Zeitgeist can utilize Ephemeral Rollups for fast, trustless resolution of prediction markets. This enables instant settlement and live odds updates, crucial for event-driven betting and forecasting.

-

Event-Driven NFT Drops: Ephemeral Rollups allow for high-throughput, fair NFT minting events with minimal latency. Projects like DRiP can handle massive user demand during limited-time drops, ensuring equitable access and preventing network congestion.

It’s not just about raw speed. The ability to customize runtime features means developers can build app-specific logic (like physics engines or custom fee markets) directly into their ephemeral rollup session. This level of flexibility opens the door for entirely new classes of dApps that simply weren’t feasible within the constraints of traditional monolithic chains or even static L2s.

How Ephemeral Rollups Are Reshaping Fee Markets

Fee market design is where things get really interesting. Since ephemeral rollups are spun up as-needed and tailored to specific workloads, developers can implement specialized fee structures, think dynamic pricing during high-traffic events or zero-fee sessions subsidized by in-game economies. This granular control over economics lets projects experiment with business models previously impossible on public blockchains.

For instance, in a real-time trading scenario where every millisecond counts, teams might opt for a flat-rate fee per burst session rather than per-transaction fees, aligning incentives with performance rather than network congestion. Or consider an NFT mint where fees scale down as more users participate simultaneously, rewarding community engagement instead of punishing it.

What’s Next? The Road to Permissionless Elasticity

The phased rollout of MagicBlock’s technology is worth watching closely. In Phase 1 (end of Q2 2025), MagicBlock will operate most nodes but allow third parties to participate, a crucial testbed for stress-testing security and performance at scale. By year-end 2025, the vision is full permissionless participation backed by robust fraud proofs and light client verification, making elastic blockchain infrastructure a public good rather than a walled garden.

With Solana trading at $228.14, these innovations couldn’t be timelier. As more capital and activity flood into Solana’s ecosystem, from on-chain games to algorithmic trading desks, the demand for elastic scaling solutions will only intensify. Ephemeral rollups position Solana not just as a fast chain but as an adaptable one, able to flex with the needs of its most ambitious builders.

If you’re building at the bleeding edge, or just want to see what elastic blockchain infrastructure looks like in practice, now’s the time to pay attention. Ephemeral rollups aren’t just another scaling buzzword; they’re the missing piece that could finally bring Web2-level performance and UX to decentralized systems without sacrificing composability or trustlessness.