Building high-throughput decentralized applications (DApps) that can handle surging user demand and fluctuating network activity requires more than just a fast blockchain. Developers are increasingly turning to custom rollups and dynamic fee markets to deliver application-specific blockchains that scale efficiently while optimizing transaction costs. In 2025, the landscape for deploying these solutions is rapidly evolving, with Rollups-as-a-Service (RaaS) platforms and modular frameworks lowering the barriers for ambitious teams.

Why Custom Rollups Are the Backbone of Scalable DApps

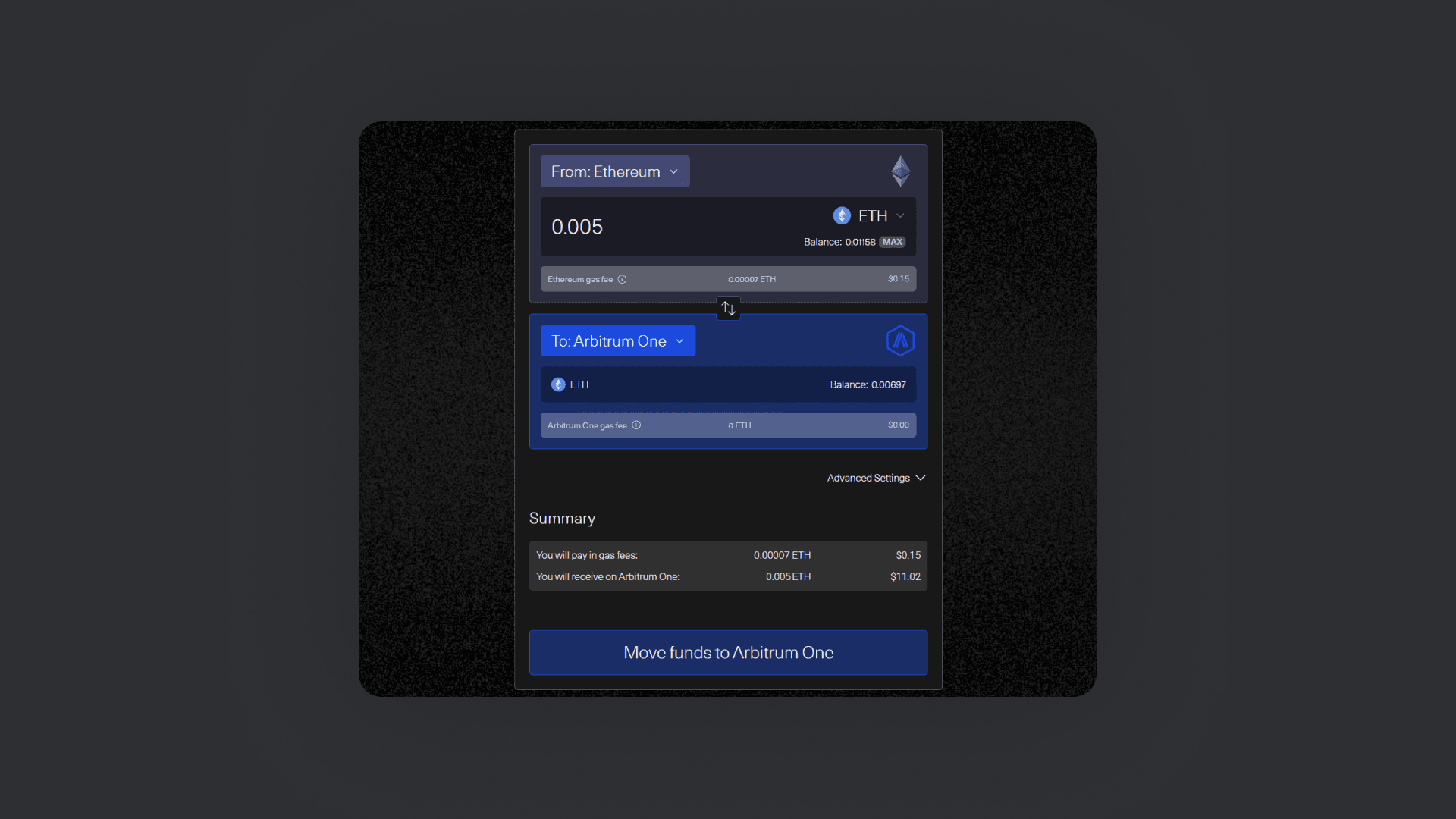

Rollups process transactions off-chain, batching them before finalizing on a base layer like Ethereum. This approach slashes congestion and fees, making it ideal for DApps in DeFi, gaming, and NFTs that demand high throughput. But one-size-fits-all rollups rarely meet the nuanced needs of advanced projects. Enter custom app-chains: purpose-built rollups with tailored architectures and fee mechanisms.

The market has seen a surge in infrastructure providers offering RaaS solutions, allowing teams to launch their own rollup with minimal operational overhead. According to BlockJournal.io, platforms like Lumoz and AltLayer are streamlining everything from node management to upgrades, letting developers focus on what matters most: application logic and user experience.

Understanding Dynamic Fee Markets for Application-Specific Blockchains

A static fee structure often leads to either underutilized capacity or frustrating bottlenecks during peak times. Dynamic fee markets, inspired by Ethereum’s EIP-1559 model, solve this by letting fees adjust automatically based on network demand. This ensures resources are allocated efficiently and users can pay extra for priority inclusion when it matters most.

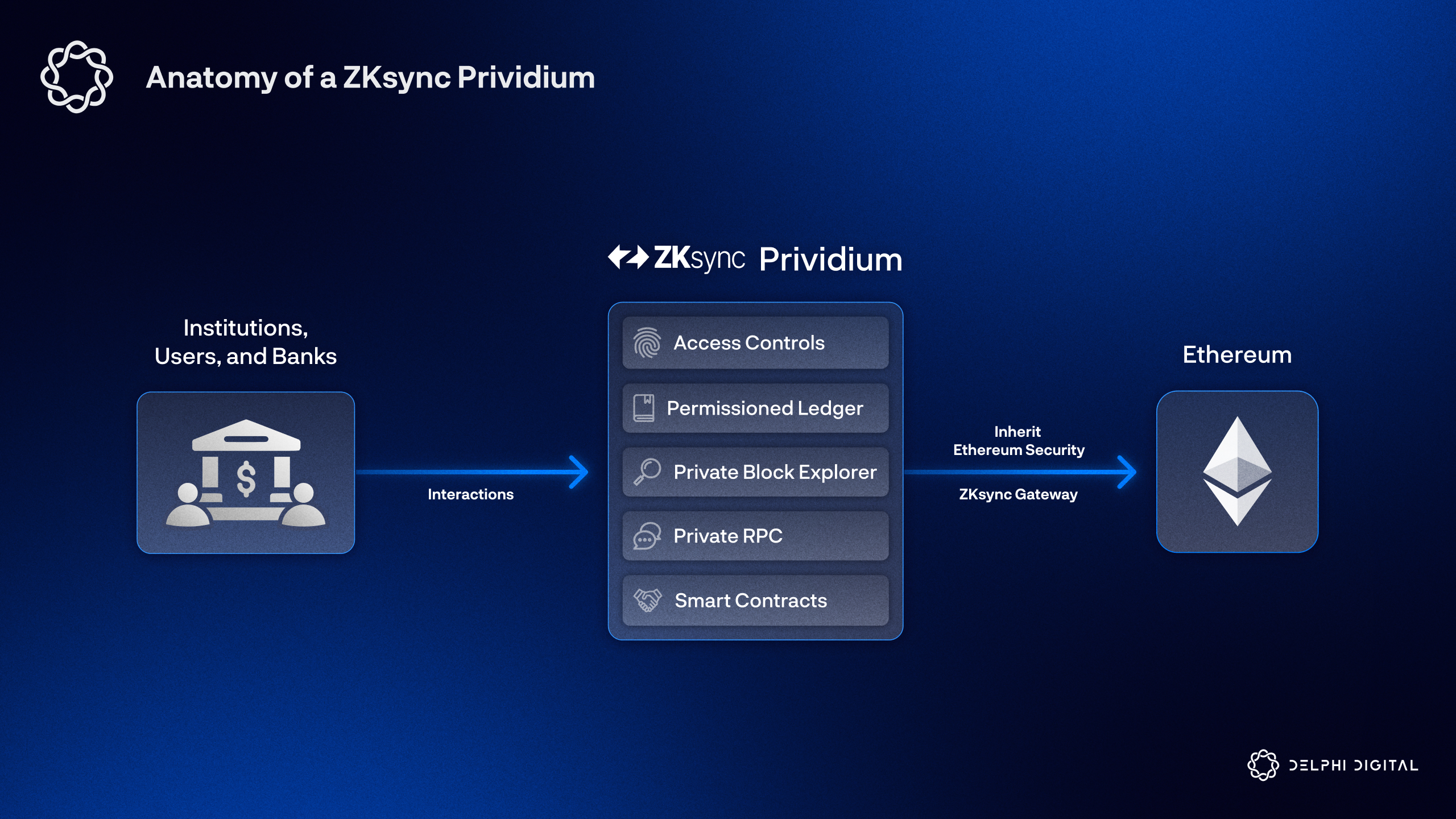

The OP Stack is a prime example: its EIP-1559-powered base fees fluctuate with network activity while permitting optional priority tips. Platforms like Arbitrum Orbit go further by enabling developers to craft entirely bespoke fee algorithms, think tiered pricing or usage-based discounts, directly into their custom rollup logic (BlockEden.xyz). Meanwhile, zkSync’s ZK Stack offers privacy-preserving ZK Rollups with flexible fee models suitable for sensitive use cases.

Key Benefits of Dynamic Fee Markets for High-Throughput DApps

-

Efficient Resource Allocation: Dynamic fee markets, such as those enabled by EIP-1559 on the OP Stack, automatically adjust base fees based on network demand. This ensures that block space is allocated to users who value it most, preventing congestion and optimizing throughput for high-traffic DApps.

-

Lower and Predictable Transaction Costs: By adjusting fees in real-time according to network activity, dynamic fee markets help maintain lower and more predictable costs for users. Platforms like zkSync’s ZK Stack and Arbitrum Orbit allow developers to fine-tune fee models, reducing volatility and improving user experience.

-

Enhanced Scalability: Dynamic fee mechanisms support higher transaction throughput by efficiently managing network load. Solutions like Immutable X and dYdX leverage rollups with dynamic fees to process thousands of transactions per second, making them ideal for high-volume DApps.

-

Customizable Fee Structures: Developers can tailor dynamic fee models—such as tiered pricing or user-activity-based adjustments—using frameworks like Arbitrum Orbit and OP Stack. This flexibility allows DApps to align fee incentives with specific use cases and user needs.

-

Improved User Experience: Dynamic fee markets minimize failed or delayed transactions by prioritizing users who pay appropriate fees. This leads to smoother interactions, as seen on platforms like Zora and Immutable X, where users benefit from rapid confirmations and low-cost operations.

Frameworks and Tools: Launching Your Own Custom Rollup in 2025

The technical barrier to launching a custom app-chain has never been lower thanks to dedicated frameworks and RaaS providers:

- OP Stack: Open-source toolkit supporting EIP-1559 dynamic fees; ideal for rapid prototyping or production-grade deployments.

- Arbitrum Orbit: Allows granular control over execution environment and native support for flexible fee structures, perfect for DeFi apps needing custom economics (BlockEden.xyz).

- ZK Stack: Empowers developers to deploy zero-knowledge rollups with advanced privacy features and tunable transaction pricing.

- Lumoz and AltLayer RaaS: Full-stack platforms handling infrastructure so you can iterate quickly without managing nodes or upgrades (BlockJournal.io).

This modularity means you can mix-and-match components such as data availability layers (e. g. , Celestia), fraud proofs, or consensus engines according to your application’s unique requirements, and budget constraints.

For builders, the real magic happens when you combine these modular frameworks with dynamic fee markets that reflect your DApp’s actual usage patterns. Instead of locking users into rigid prices or exposing them to wild fee swings, you can design a system that flexes in real time, prioritizing urgent transactions, rewarding long-term users, or even subsidizing certain activities to bootstrap growth. This is where custom rollups truly shine: they let you encode your project’s economic DNA directly into the protocol layer.

Implementing and Optimizing Your Rollup Fee Structure

Once you’ve selected a stack and RaaS provider, the next step is architecting your rollup’s fee logic. The EIP-1559 model remains a gold standard for balancing predictability and market responsiveness. By integrating EIP-1559, your base fee automatically adjusts to block demand while allowing optional tips for expedited processing. Explore how emergentmind.com breaks down the nuances of rollup transaction fee mechanisms.

If your DApp has unique requirements, such as microtransactions in gaming or high-value trades in DeFi, you can implement tiered pricing, volume-based discounts, or congestion surcharges. Some teams are experimenting with alternative data availability layers like Celestia (The Rollup) to further optimize costs and throughput.

The flexibility of custom rollups also enables advanced use cases such as:

- Gasless user onboarding: Subsidize initial transactions to reduce friction for new users.

- Priority lanes for power users: Let high-volume traders or NFT minters pay extra for guaranteed inclusion during spikes.

- Differentiated pricing by activity type: Offer lower fees for eco-friendly actions or community-driven initiatives.

Real-World Impact: DApps Scaling with Custom Rollups

The benefits aren’t just theoretical. Projects like Immutable X have leveraged ZK Rollups to deliver gas-free NFT trading at scale (Digital Finance News). dYdX has set new benchmarks for decentralized derivatives by combining high throughput with low fees using ZK tech (ZK Today). Even NFT platforms like Zora are deploying OP Stack-based chains to achieve rapid launches and minimal costs (GBA Global). The takeaway? Dynamic fee markets unlock new business models and superior UX across verticals.

Best Practices When Designing Custom App-Chains

- Analyze user flow: Model how different user segments interact with your app-chain to inform your fee structure.

- Pilot dynamic pricing: Start with conservative adjustments before rolling out complex algorithms network-wide.

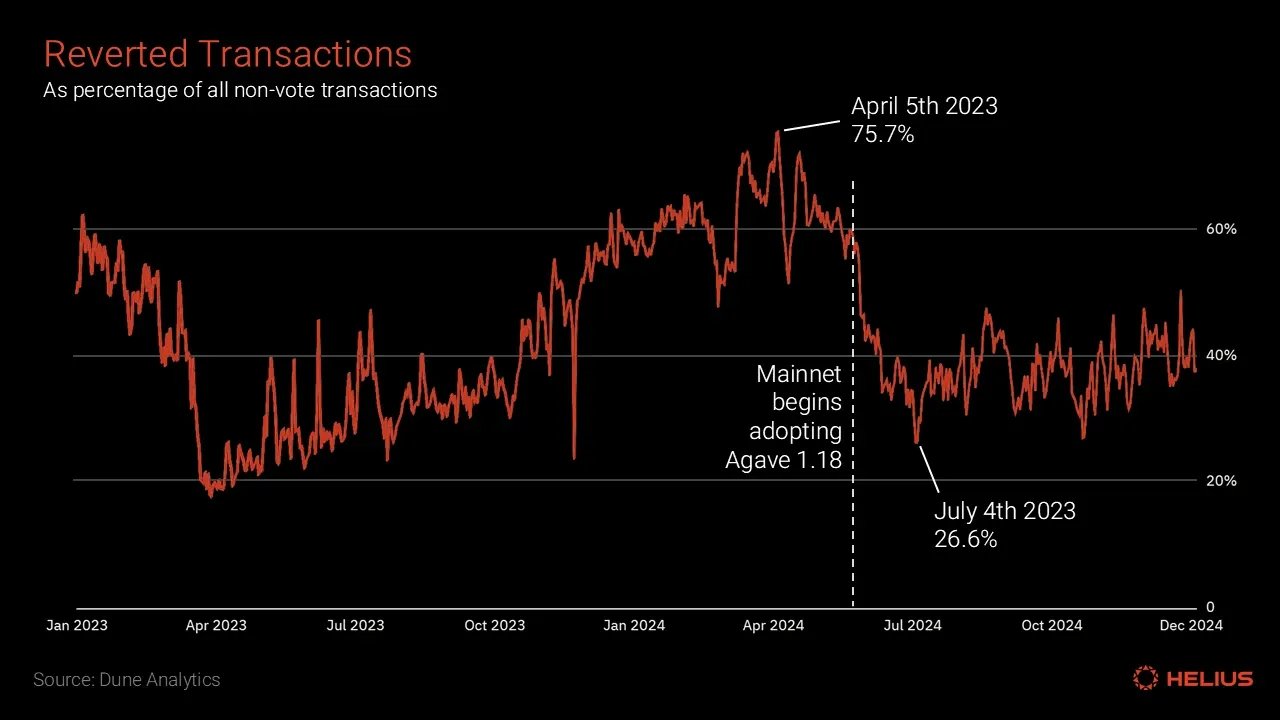

- Monitor network health: Use analytics dashboards to track congestion, failed transactions, and user churn in real time.

- Engage your community: Solicit feedback on fee changes and consider governance mechanisms for future updates.

The era of one-size-fits-all blockchains is over. With custom rollups and dynamic fee markets, developers can finally build application-specific blockchains that deliver both scale and flexibility, without sacrificing cost-efficiency or user experience.