Dynamic fee markets are quietly reshaping the foundation of blockchain scalability. For custom app-chains, they’re not just a technical upgrade – they’re the lever that unlocks efficiency, user experience, and new economic models. The static, one-size-fits-all fee schedules of legacy Layer 1s are fading fast as developers demand fine-grained control over every aspect of their chain’s economics.

Why Dynamic Fee Markets Matter for Custom App-Chains

Application-specific blockchains (app-chains) are built to serve unique use cases – from high-frequency DeFi platforms to immersive gaming ecosystems. Each demands a different approach to resource allocation and cost management. Static fees can’t keep up with volatile demand or the unpredictable spikes that come with real-world usage. Enter dynamic fee markets: systems that adjust transaction costs in real time based on network congestion and resource availability.

This isn’t theory. Dynamic fees are already powering more efficient decentralized exchanges, as highlighted by Nadcab Labs, letting DEXs flexibly adjust trading costs to match market activity. The result? Smoother trading, fewer failed transactions, and happier users.

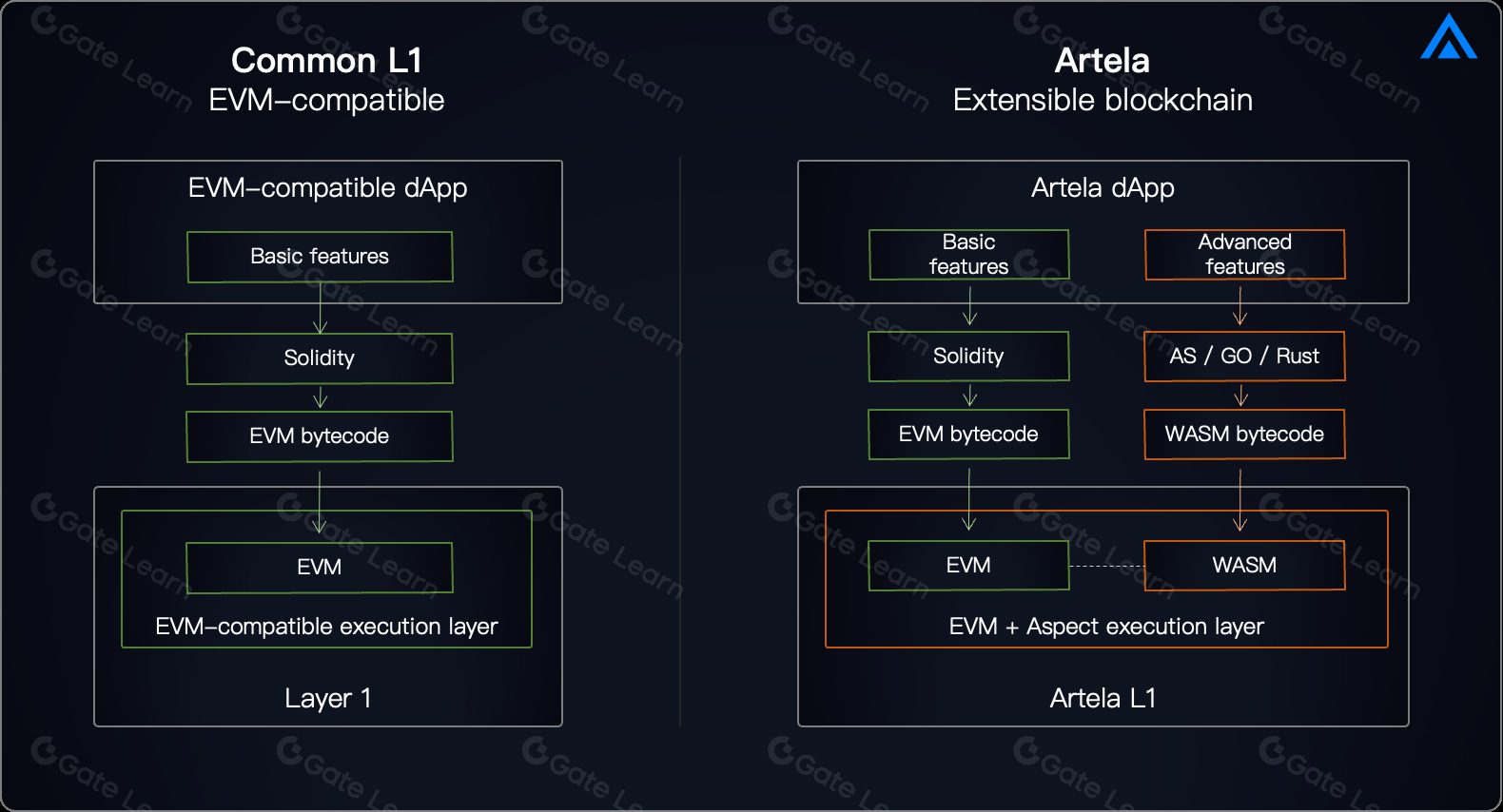

But the impact goes far beyond DEXs. Modular blockchains and the rise of the app-chain era (see Orbis86’s analysis) have made it clear: teams no longer need to accept generic fee structures imposed by shared Layer 1 protocols. With custom rollups and app-chains, you can design specialized fee markets tailored to your dApp’s exact needs – even going fee-less for certain use cases.

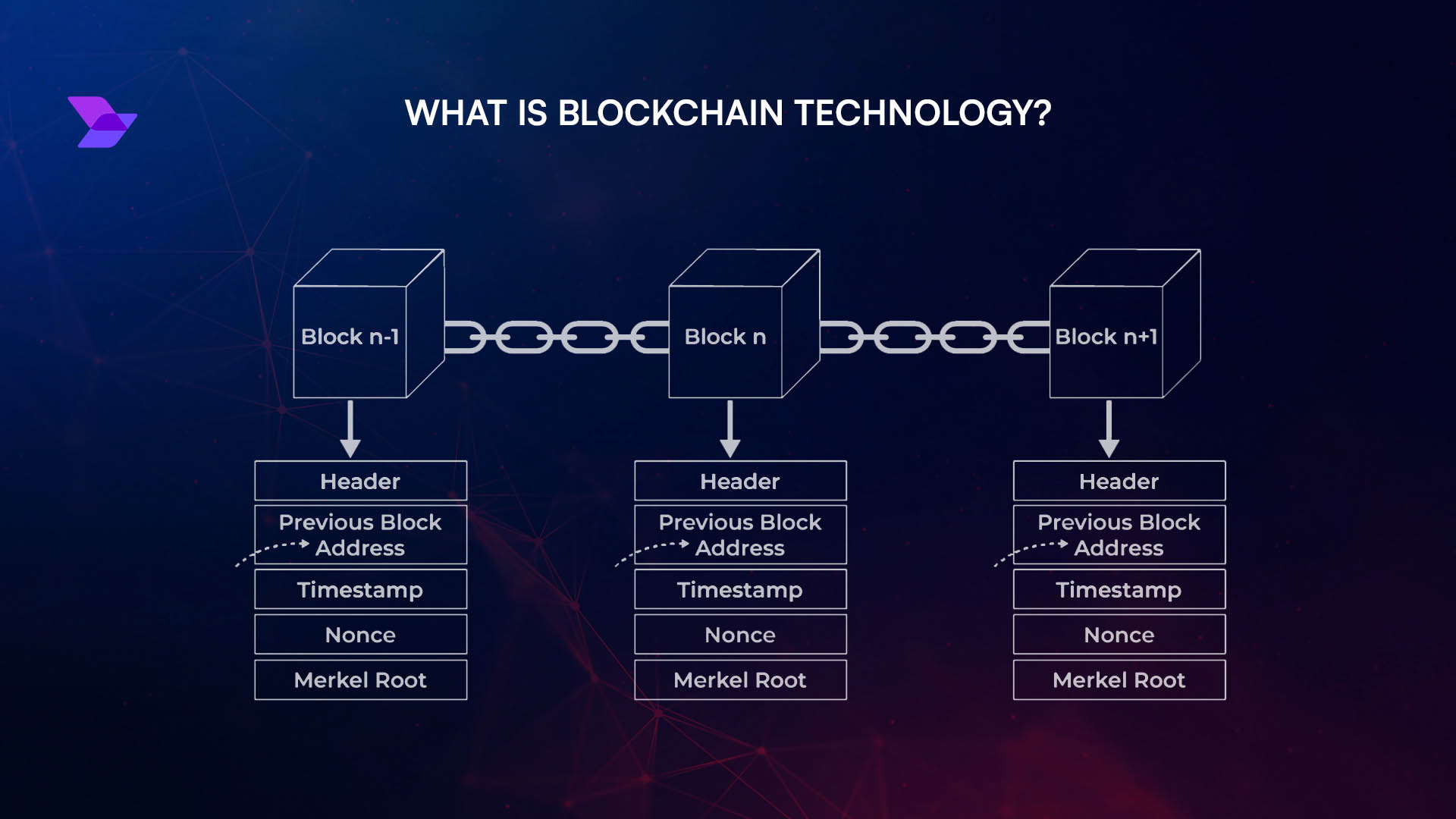

The Mechanics: How Dynamic Fee Markets Work

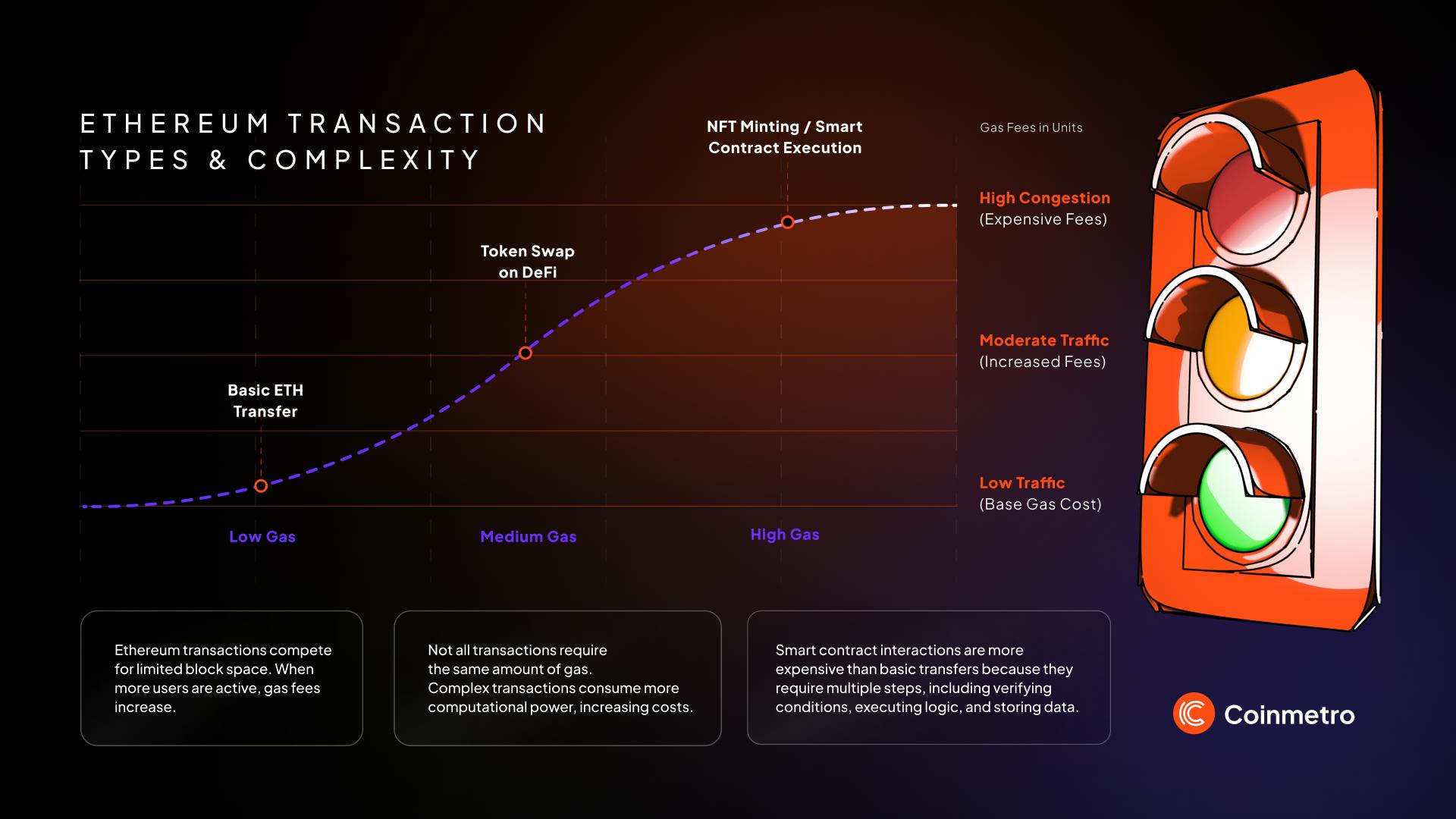

At their core, dynamic fee markets price transactions along multiple resource axes – computation, storage, bandwidth – rather than a single flat rate. This multidimensional approach (explored in detail by Emergent Mind) lets chains reflect true resource consumption and incentivize efficient usage.

Top Benefits of Dynamic Fee Markets for App-Chains

-

Efficient Resource Allocation: Dynamic fee markets automatically adjust transaction costs based on real-time network demand, preventing congestion and ensuring optimal use of blockchain resources.

-

Enhanced User Experience: By maintaining predictable and fair transaction fees—even during peak periods—dynamic fee structures foster trust and encourage greater user engagement on decentralized applications.

-

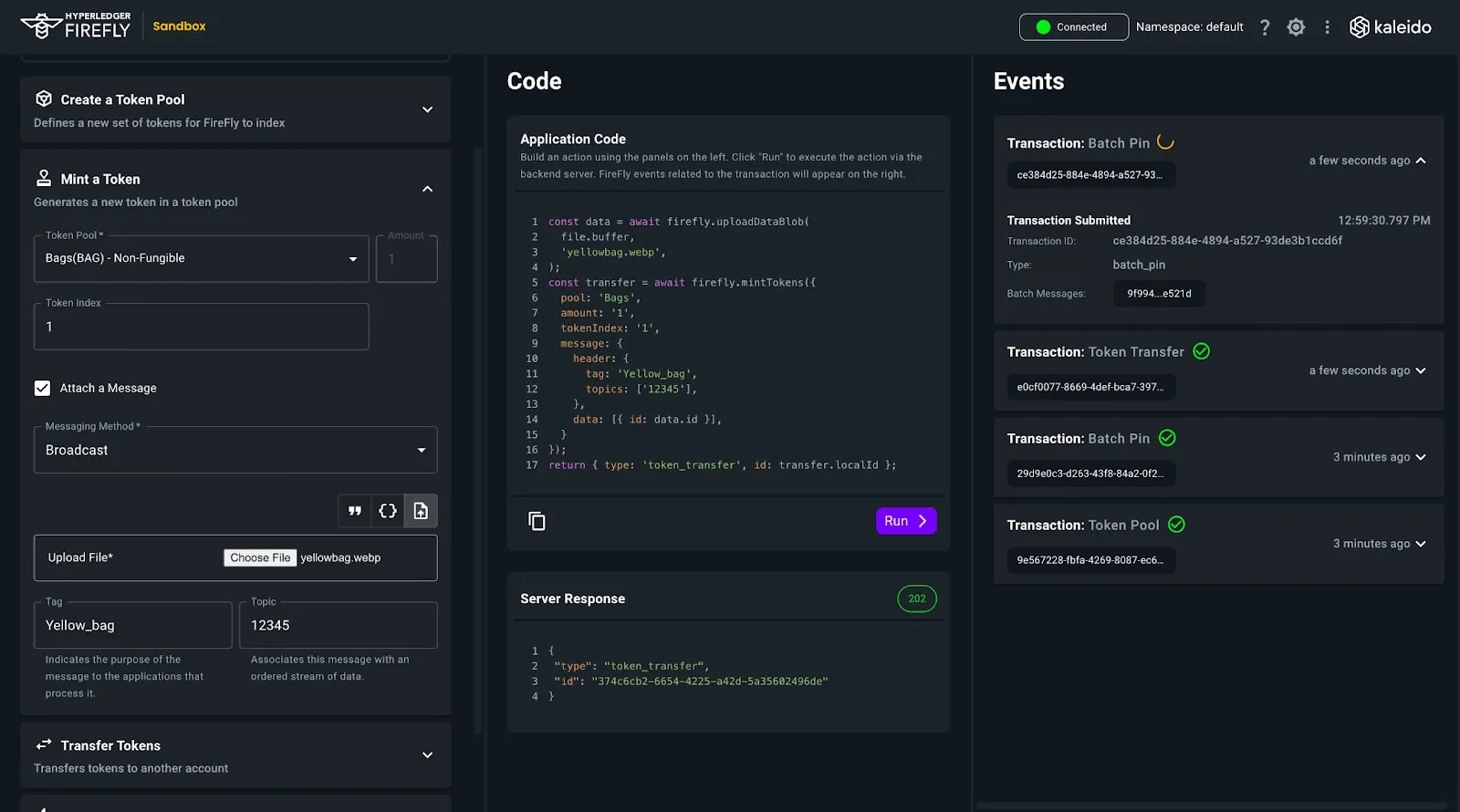

Customizable Fee Structures: Platforms like Base Appchains by Coinbase and Kaleido’s Appchains empower developers to tailor fee mechanisms to the specific needs of their dApps, supporting a wide variety of use cases from DeFi to gaming.

-

Scalability and Performance: Dynamic fee markets enable app-chains to handle higher transaction volumes with lower latency, as seen in solutions like Kaleido’s Appchains, which maximize throughput while ensuring network stability.

-

Fair Revenue Generation: Proposals like Ethereum’s Dynamic Fee Proposal introduce mechanisms that balance revenue for app builders with fairness for users, capping fees and incentivizing broader participation.

Consider how Arbitrum Orbit chains implement dynamic gas pricing: high-volume apps get ultra-low costs during periods of low congestion but still maintain robust security when usage surges. Developers can even choose their own gas tokens and permissions with solutions like Base Appchains by Coinbase, or tailor every parameter with Kaleido’s rapid deployment stack.

Real-World Innovation: Ethereum’s Dynamic Fee Proposal

The Ethereum community recently floated a compelling proposal for application-layer dynamic fees (from Kevin Owocki and Devansh Mehta). The idea is simple but powerful: as more funding capital flows into a project, the percentage-based fees decrease proportionally, capping at 1% for large pools but offering higher returns for smaller ones. This square root model ensures fairness while maximizing revenue for builders at every scale.

This proposal isn’t just about fairness – it’s about sustainability and growth. By aligning incentives across users and developers, Ethereum is setting a template that custom app-chains can adapt and extend.

Scaling Without Compromise: Customization Meets Efficiency

What makes dynamic fee markets so transformative is their flexibility. Whether you’re building a DeFi protocol that needs predictable costs or a gaming platform that requires microtransactions at scale, you can tune your chain’s economics in real time. Solutions like Kaleido let you customize everything from decentralization models to governance rules and gas fees, ensuring maximum throughput without sacrificing control.

Specialized fee structures are now at the heart of blockchain scalability. By letting developers fine-tune how resources are priced and allocated, dynamic fee markets enable app-chains to adapt instantly to demand shocks, seasonal spikes, and evolving user behavior. This is a paradigm shift: instead of chains getting clogged and users getting priced out, the network flexes and breathes with its community.

Optimizing for Performance and User Experience

For high-throughput dApps, fee optimization isn’t just a nice-to-have, it’s mission-critical. Custom rollups that integrate multidimensional fee models can charge differently for compute-heavy transactions versus simple data storage, as outlined by Emergent Mind. This targeted pricing ensures that even during periods of extreme activity, critical transactions get through while non-essential activity is naturally deprioritized. The result is a smoother, more reliable user experience and a network that can scale without compromise.

Take the example of Arbitrum Orbit’s dynamic pricing. By intelligently modulating gas fees based on current network load, Orbit chains offer both high security and ultra-low costs when it matters most. Developers gain the freedom to choose their own gas tokens and permissions, features that are quickly becoming standard for next-gen application-specific blockchains.

The Competitive Edge: Customization in the App-Chain Era

We’re entering a phase where every serious project can launch its own tailored blockchain. Modular frameworks and platforms like Base Appchains by Coinbase and Kaleido give teams the tools to build, deploy, and iterate on custom rollups with specialized fee markets. This isn’t just about saving on transaction costs; it’s about unlocking entirely new business models and user experiences that weren’t possible under the constraints of monolithic Layer 1s.

Custom App-Chains Leveraging Dynamic Fee Markets

-

Ethereum Dynamic Fee Proposal: Ethereum community members Kevin Owocki and Devansh Mehta introduced a dynamic fee structure at the application layer, using a square root function to balance fairness and revenue for app builders. This model ensures lower fees for smaller funding pools and caps fees at 1% for larger projects, optimizing resource allocation and user experience.

-

Base Appchains by Coinbase: Coinbase’s Developer Platform launched Base Appchains—dedicated Layer 3 solutions with customizable gas tokens and permissions. These app-chains offer high throughput, low costs, and flexible fee markets, providing fast, reliable performance tailored to dApp needs.

-

Kaleido Appchains: Kaleido enables rapid deployment of app-chains with fully customizable fee structures. Developers can fine-tune decentralization, governance, and gas fees, empowering scalable, high-performance dApps with dynamic fee markets.

Dynamic fee markets also foster a more inclusive ecosystem. By allowing for microtransactions and reduced minimum fees during off-peak times, new categories of applications, like decentralized social media or IoT networks, become viable. Developers can even experiment with fee-less models for certain user segments or gamified incentives to keep communities engaged.

What’s Next: The Road to Mass Adoption

The march toward scalable, efficient blockchain infrastructure is accelerating. As more teams adopt dynamic fee mechanisms, expect to see a wave of innovation in how networks monetize, allocate resources, and prioritize transactions. The “everyone gets a chain” economy is no longer a distant vision, it’s quickly becoming the norm.

For builders and blockchain architects, the message is clear: mastering dynamic fee markets is the fastest path to both performance and differentiation in an increasingly crowded space. The future belongs to those who treat their chain’s economics as a living system, one that can be tuned, optimized, and evolved in real time.

Ready to design your own scalable app-chain with a specialized fee market? Dive into the resources at CustomAppChains. com and join a community pushing the boundaries of what’s possible in decentralized infrastructure.