Shared sequencers are rapidly emerging as a foundational layer for the next generation of interoperable app-chains and rollups. As blockchain ecosystems mature, the limitations of isolated sequencer models are coming into sharp focus. The need for seamless cross-rollup coordination, unified liquidity, and robust decentralization is driving both technical innovation and architectural debate. In this article, we explore how shared sequencers are shaping the future of modular blockchains, why they matter for developers and users, and the new challenges they introduce to fee markets and network economics.

What Are Shared Sequencers?

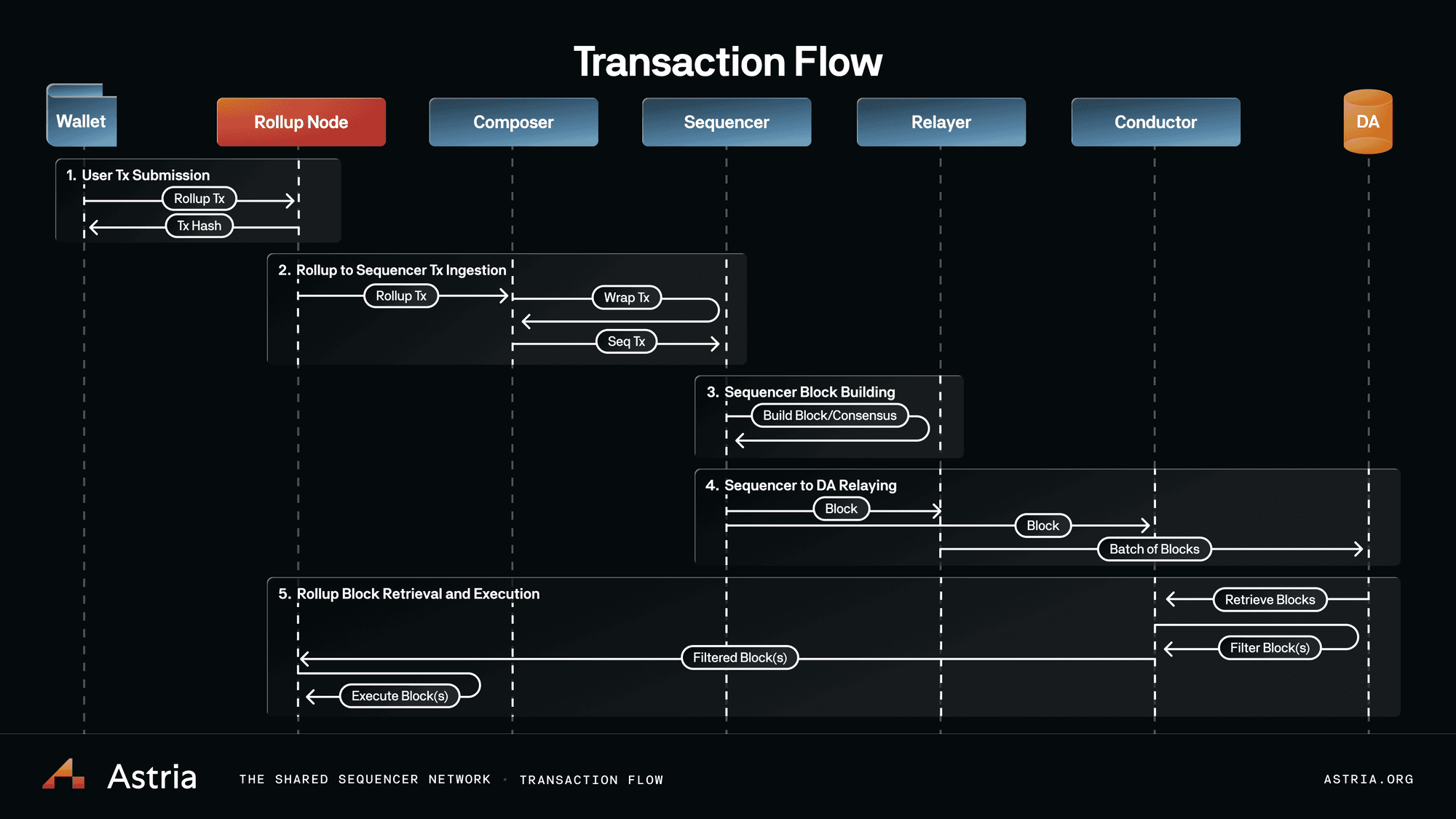

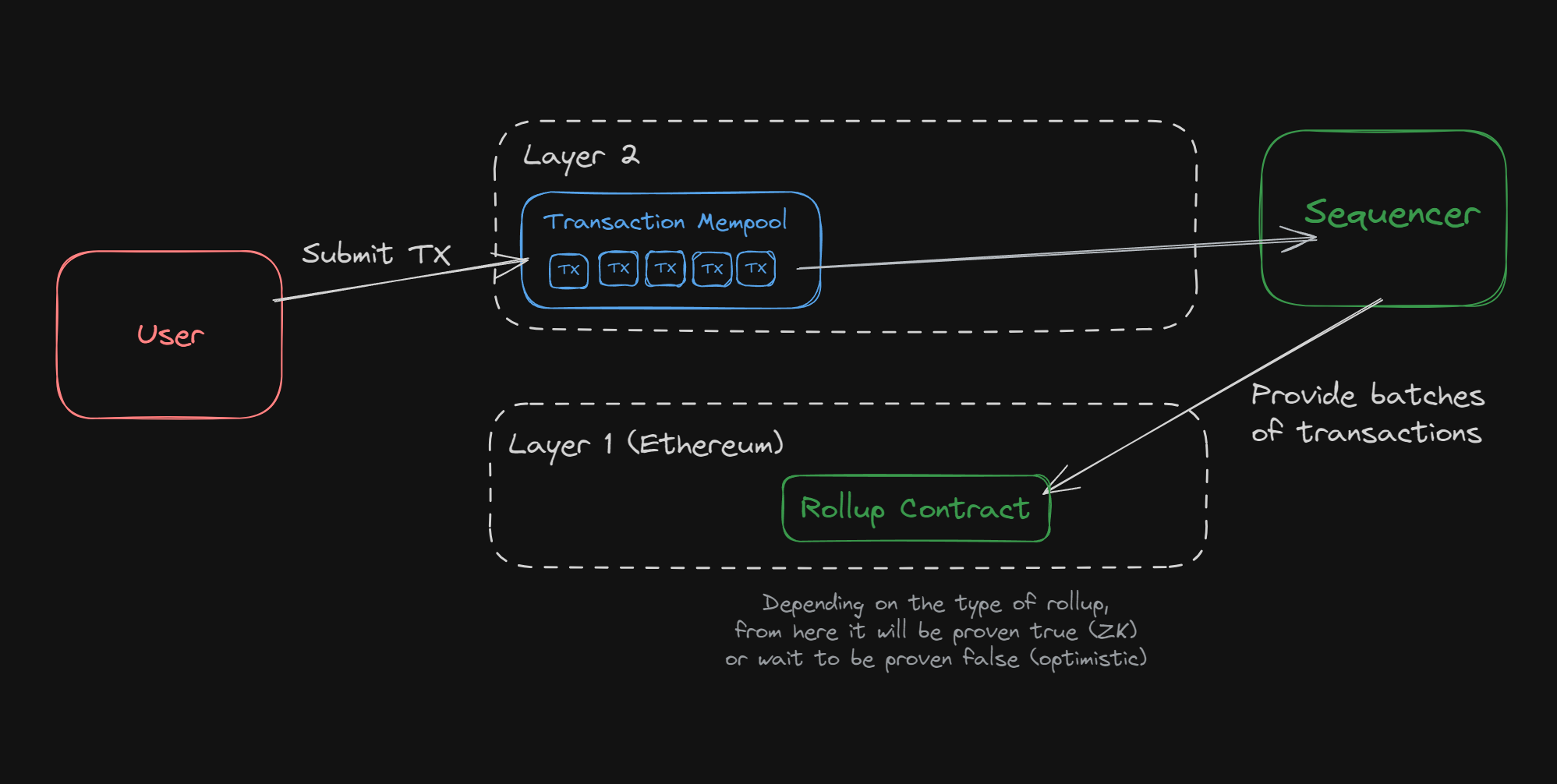

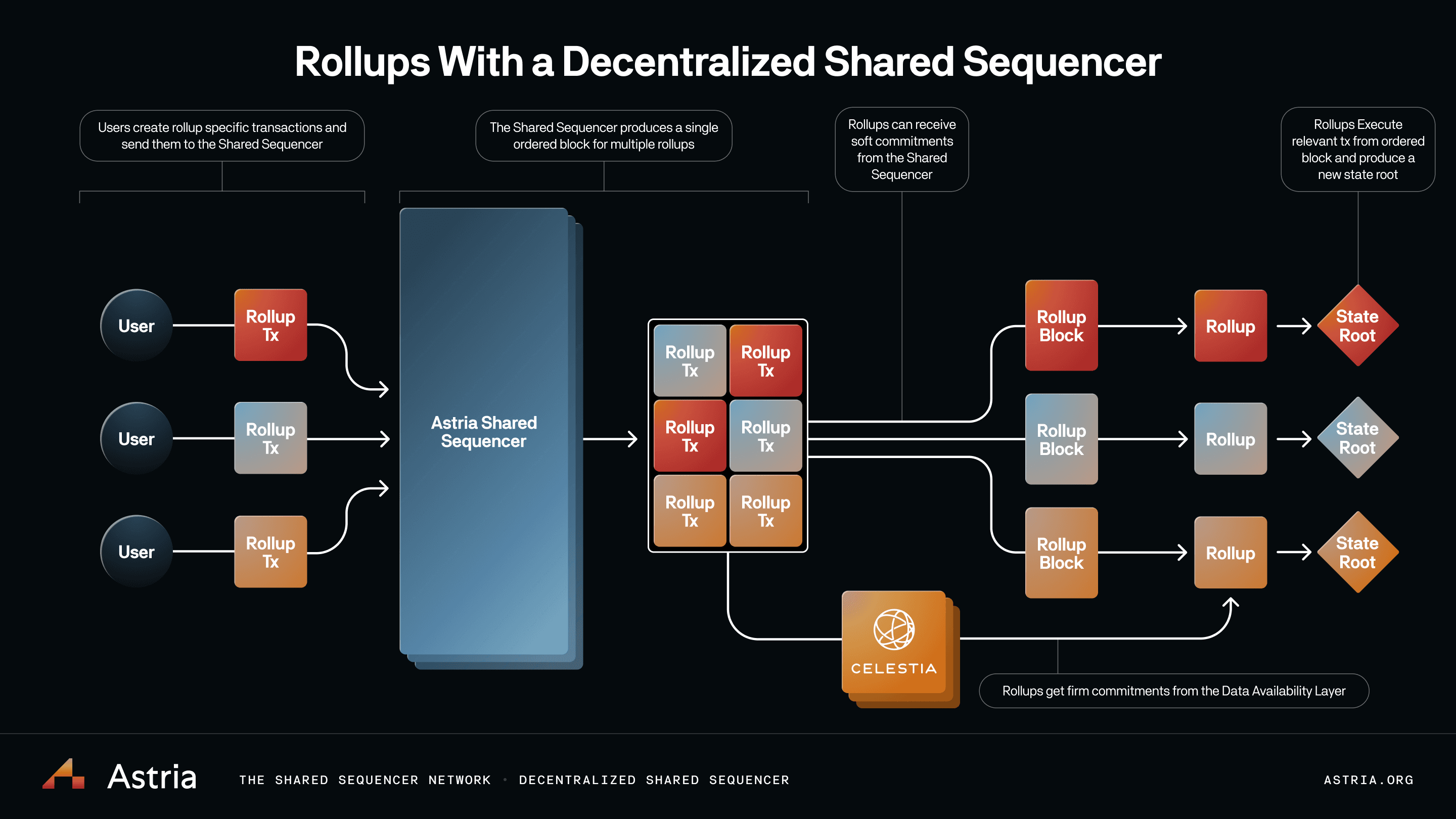

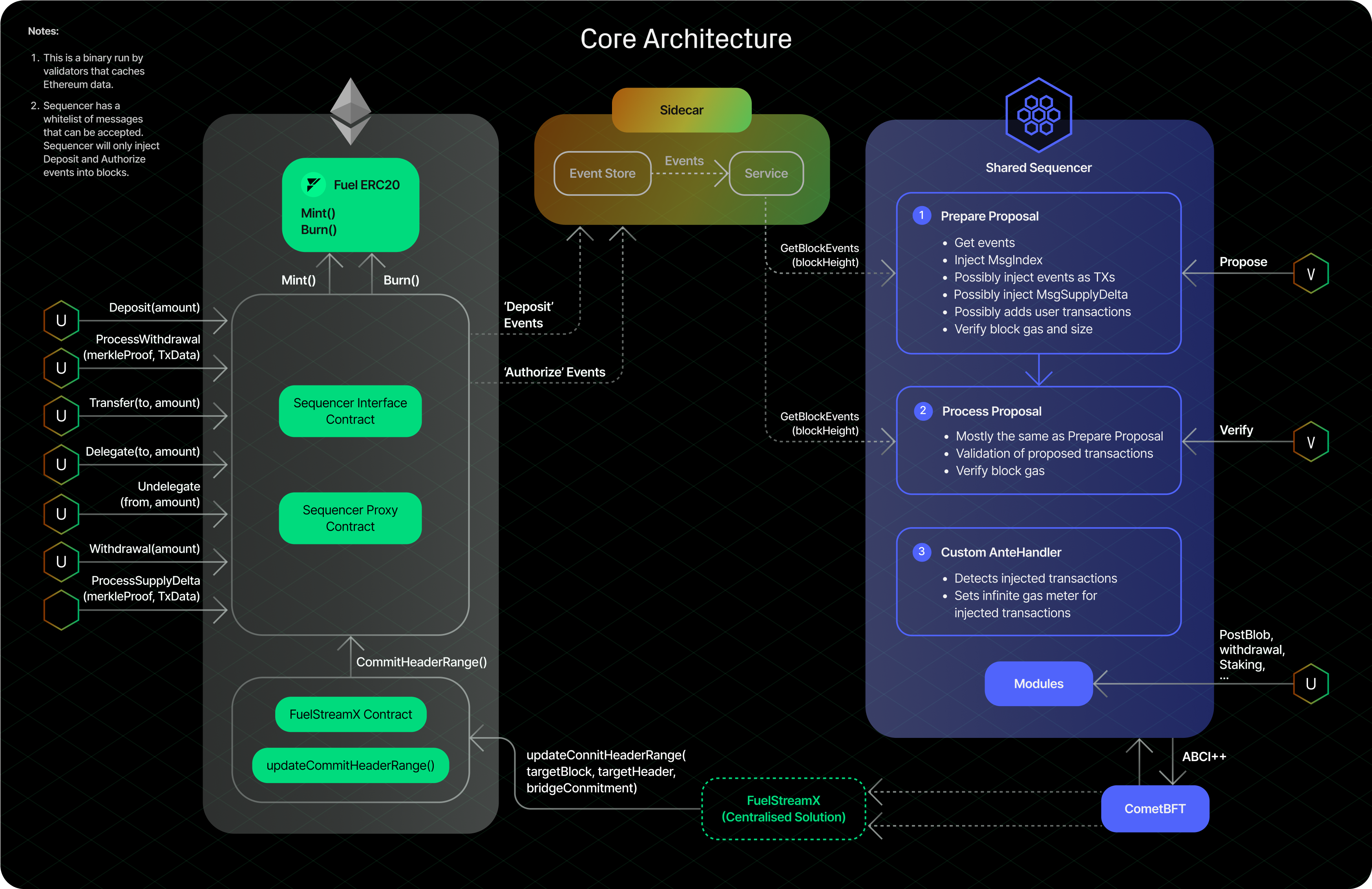

At their core, shared sequencers are decentralized services that accept transactions from multiple domains, such as rollups and custom app-chains, and order them according to a consensus protocol before submitting them to a base layer. Unlike traditional sequencer models, where each rollup maintains its own transaction ordering mechanism (often leading to centralization and fragmentation), shared sequencers act as neutral coordinators. They provide a common ordering layer that is accessible to many chains, reducing single points of failure and improving censorship resistance.

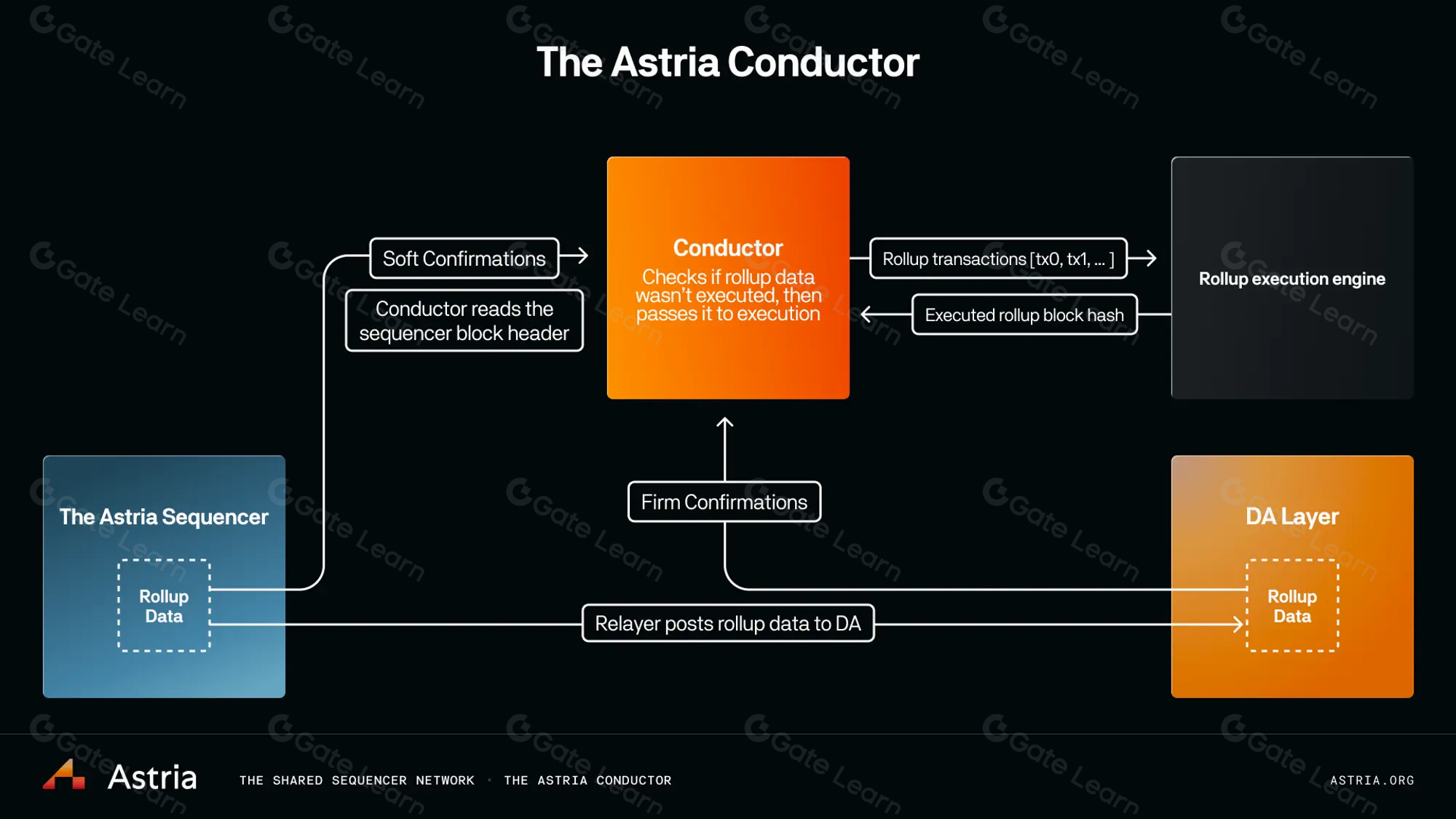

This architecture is already being explored by projects like Astria and Espresso, which aim to create middleware layers that enable multiple rollups to share sequencing infrastructure. The result is a more resilient and interconnected ecosystem, where the risks of sequencer collusion or downtime are significantly reduced. For a deep dive into the technical underpinnings, see how shared sequencers are enabling true interoperability in the superchain era.

Driving Interoperability and Unified Liquidity

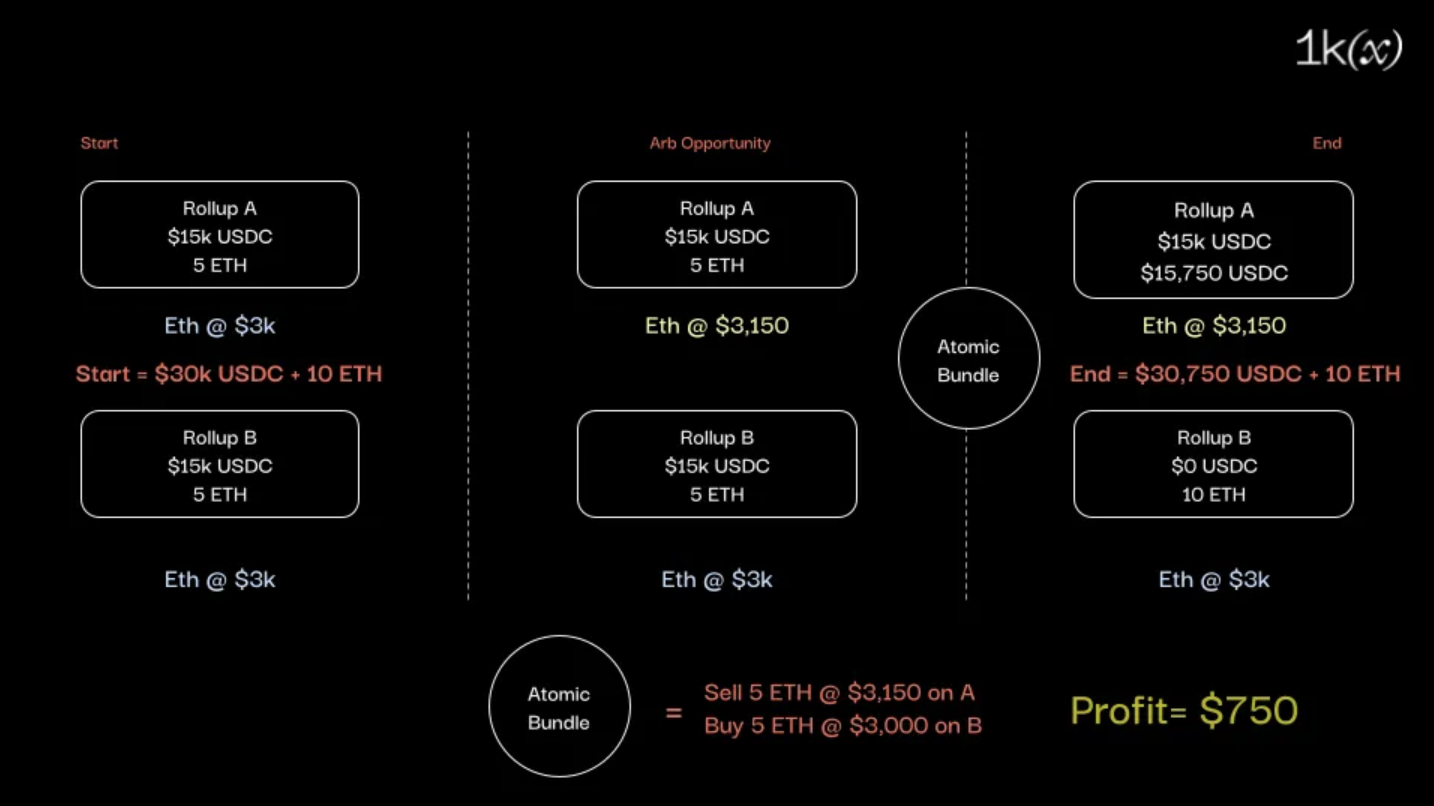

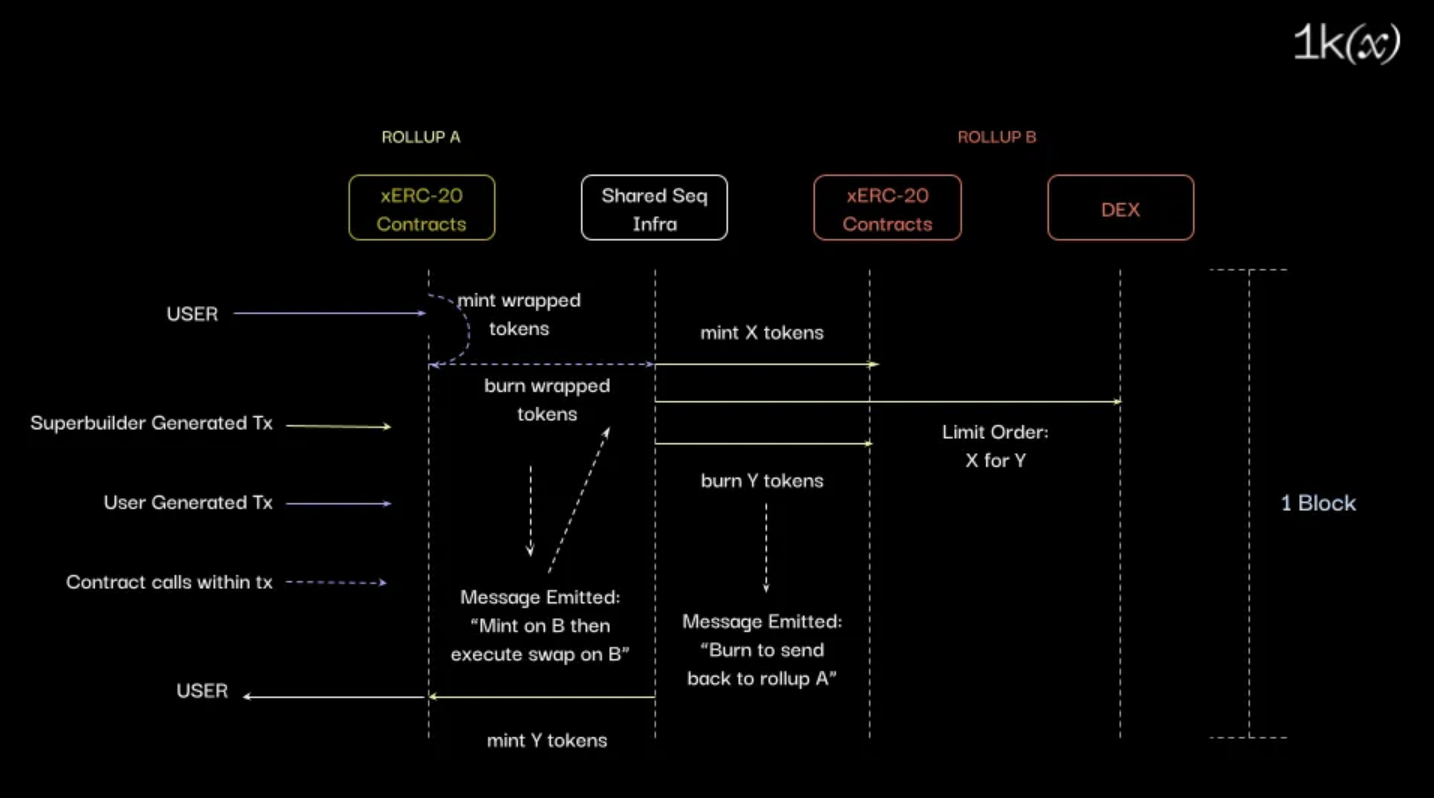

The most transformative impact of shared sequencers lies in their ability to facilitate atomic cross-rollup transactions. By coordinating transaction ordering across multiple rollups, shared sequencers make it possible for interdependent actions to be finalized synchronously, an essential feature for DeFi protocols, NFT marketplaces, and other dApps that require composability across chains. This is a major step beyond the fragmented liquidity and slow bridging processes that have historically hampered the user experience on modular blockchains.

Shared sequencing also paves the way for unified liquidity pools and more efficient capital allocation. When rollups can trust a common ordering service, they can safely interact with each other without waiting for slow finality on the base layer. This unlocks new design space for protocols seeking to operate across multiple app-chains or even different L2 ecosystems. For more on how this is transforming rollup interoperability, read how shared sequencers are changing the superchain’s rollup interoperability.

Efficiency Gains and Cost Optimization

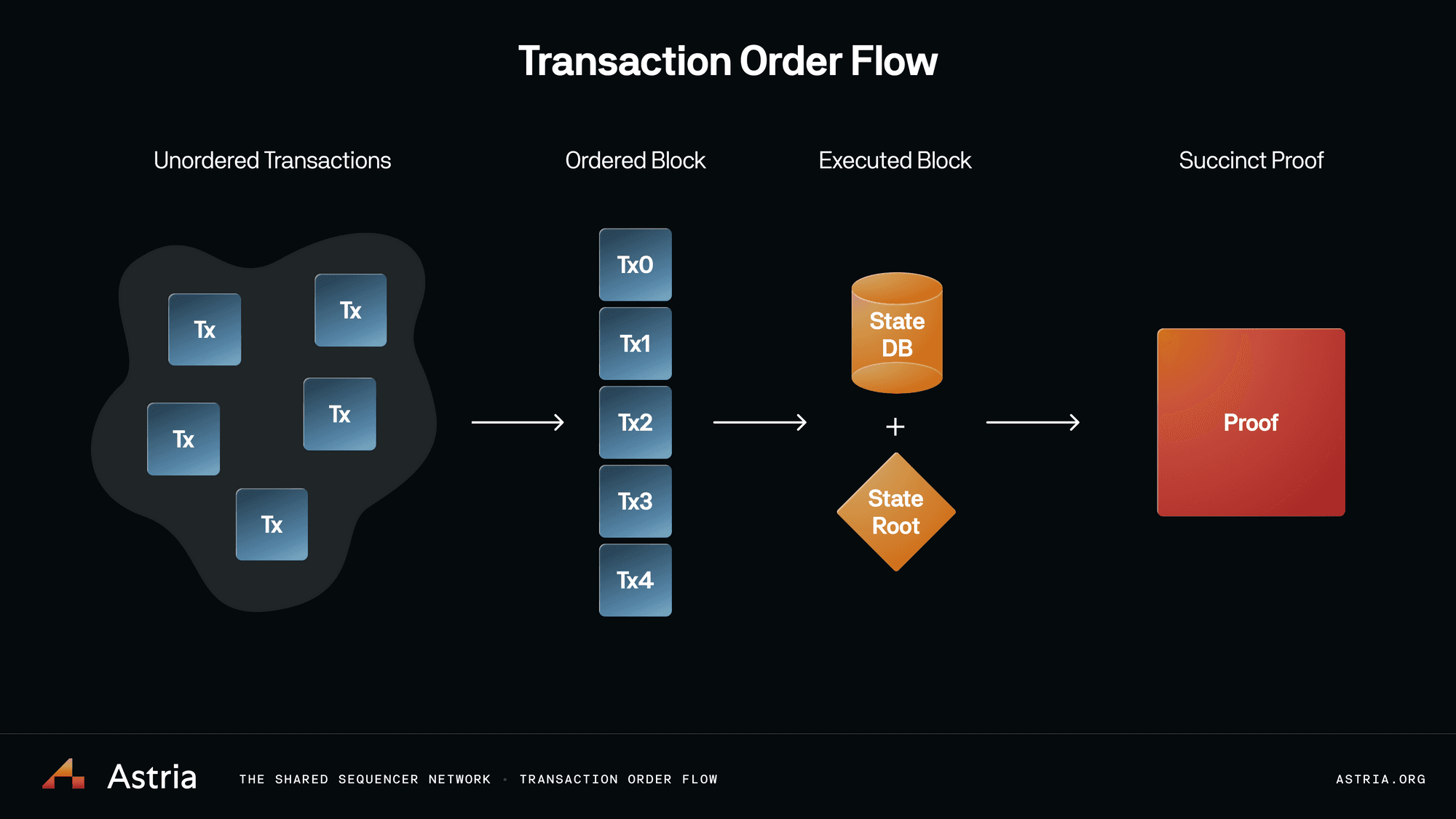

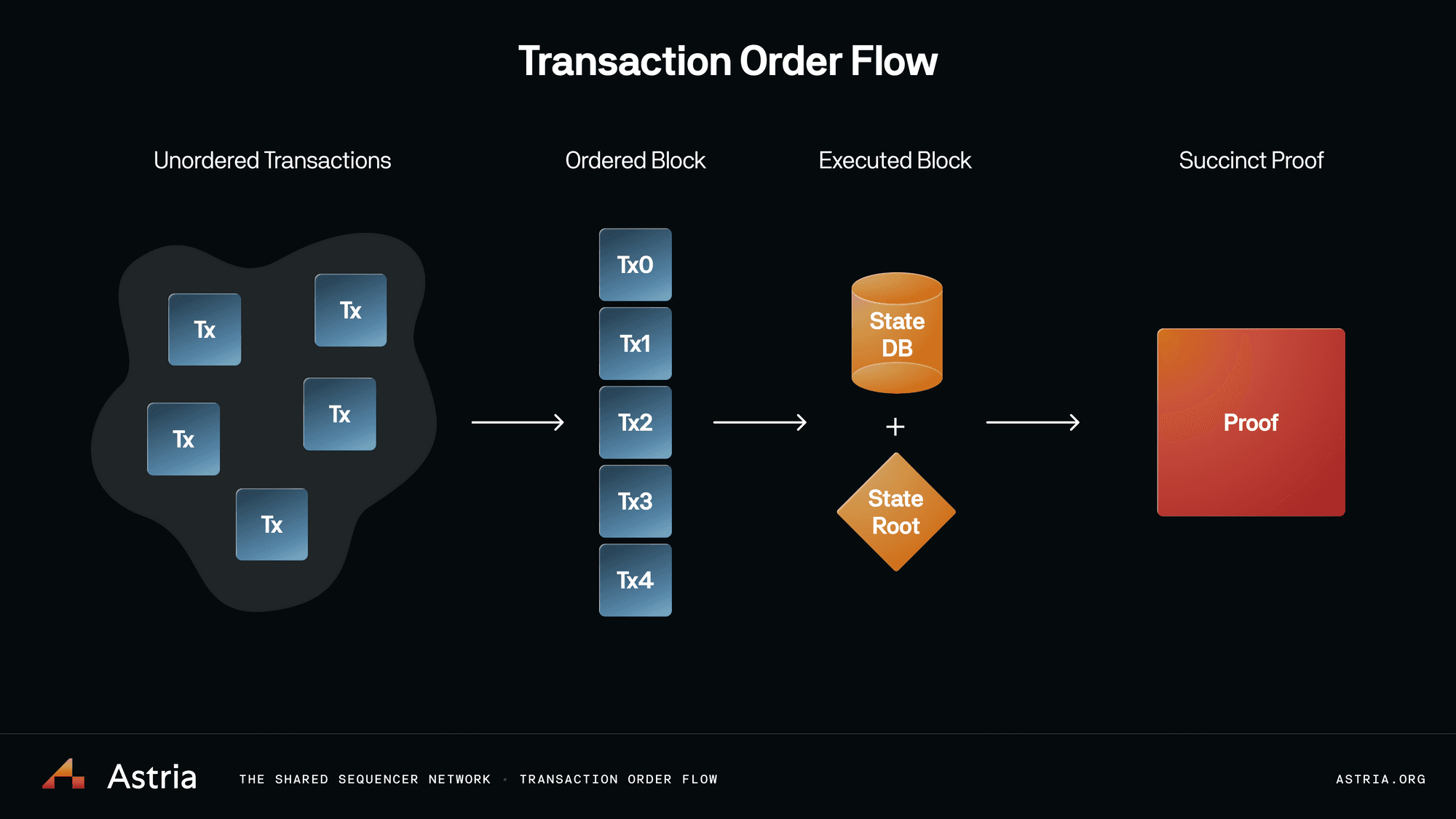

Another major draw of the shared sequencer paradigm is its potential for cost minimization. By batching and compressing transactions from multiple rollups before posting to the base chain, shared sequencers can significantly lower per-transaction fees and reduce network congestion. This is especially important for smaller app-chains that may struggle with high operational costs or sporadic transaction volumes when running independent sequencers.

The consolidation of sequencing also enables more predictable fee markets. Instead of each rollup developing its own fee structure, often resulting in volatile or inefficient pricing, shared sequencer networks can implement sophisticated auction mechanisms or dynamic pricing models that better reflect aggregate demand. This aligns incentives across chains and fosters a healthier, more competitive ecosystem.

Key Advantages of Shared Sequencers for App-Chains

-

Enhanced Decentralization and Censorship Resistance: Shared sequencers distribute transaction ordering across multiple independent operators, reducing single points of failure and the risk of censorship. Projects like Astria are pioneering decentralized middleware to ensure liveness and fairness across participating rollups.

-

Seamless Cross-Rollup Interoperability: By coordinating transaction ordering, shared sequencers enable atomic cross-rollup transactions, making it possible for app-chains to interact and compose with each other efficiently. This is crucial for DeFi platforms and interoperable dApps operating across multiple rollups.

-

Improved Efficiency and Lower Costs: Aggregating transactions from multiple rollups allows shared sequencers to optimize batch processing, reducing latency and transaction fees. This efficiency benefits smaller app-chains that may not sustain independent sequencers. Variant Fund highlights cost minimization as a core advantage.

-

Greater Network Resilience: Shared sequencers contribute to a more robust and fault-tolerant ecosystem by removing reliance on a single sequencer per app-chain. This distributed approach enhances overall network uptime and security.

-

Foundation for Trustless Interoperability: Shared sequencers lay the groundwork for trustless, permissionless interaction between rollups and app-chains, advancing the blockchain modularity thesis and enabling a more cohesive multi-chain future.

However, these efficiencies come with new challenges. Managing cross-rollup MEV (Maximal Extractable Value), ensuring fair ordering, and preventing latency gaps are active areas of research. Protocols like Espresso are experimenting with decentralized marketplaces for sequencing rights, while others focus on cryptographic guarantees for transaction inclusion. For a closer look at the trade-offs involved, see shared sequencers in rollup ecosystems: solving fragmentation and reducing costs.

As the shared sequencer landscape matures, the interplay between rollup coordination and specialized fee markets is coming into sharper focus. Developers are now empowered to design application-specific chains that leverage shared sequencing to not only optimize costs, but also to access a broader liquidity pool and composability layer. This is particularly relevant for custom app-chains seeking to differentiate themselves through unique economic models or innovative transaction types.

One of the most promising aspects is the ability of shared sequencers to reduce liquidity fragmentation. In the legacy model, each rollup’s isolated sequencer created silos of liquidity, forcing users to rely on slow, risky bridges or cumbersome cross-chain swaps. With shared sequencers, liquidity can flow more freely between domains, enabling atomic swaps, unified order books, and seamless user experiences across rollups. This is a critical step toward a modular blockchain future where the sum is truly greater than its parts. For further reading, see how shared sequencers like Espresso are enabling cross-rollup composability in the OP Superchain.

Emerging Challenges: MEV, Fairness, and Security

Despite these advances, the move to shared sequencing is not without its risks. Cross-rollup MEV extraction remains a thorny issue. When multiple chains share a sequencing layer, opportunities for value extraction multiply, as sophisticated actors can arbitrage across rollups or manipulate transaction ordering for profit. Ensuring that MEV is either minimized or fairly distributed is an ongoing technical and governance challenge.

Fairness in transaction ordering is another area of active development. The risk of certain actors gaining preferential access or front-running transactions must be mitigated through cryptographic proofs, randomized leader selection, or other advanced consensus mechanisms. Additionally, maintaining liveness and resilience in the face of potential DDoS attacks or collusion among sequencer operators requires robust protocol design and constant monitoring.

Major Challenges Facing Shared Sequencer Networks

-

Cross-Rollup MEV (Maximal Extractable Value) Risks: Shared sequencer networks must address the challenge of managing MEV across multiple rollups, as malicious actors could exploit transaction ordering for profit, undermining fairness and trust in the system.

-

Ensuring Fair and Transparent Transaction Ordering: Achieving consensus on transaction order across diverse rollups is complex, with risks of misordering or latency gaps that can impact user experience and cross-chain composability.

-

Maintaining Decentralization and Censorship Resistance: While shared sequencers aim to reduce centralization, ensuring that no single entity or small group gains undue influence remains a significant governance and technical challenge.

-

Scalability and Performance Bottlenecks: As more rollups utilize a shared sequencer, the network must efficiently handle increased transaction volume without introducing bottlenecks or higher latency.

-

Interoperability and Protocol Standardization: Integrating diverse rollups and app-chains with different protocols and requirements requires robust standards and coordination, which is still an evolving area for shared sequencer networks.

Security considerations extend beyond just the sequencer set itself. Since shared sequencers serve as critical infrastructure for many app-chains simultaneously, any compromise could have cascading effects across the ecosystem. This makes decentralization and transparency in sequencer selection paramount for long-term trust.

The Road Ahead: Customization and Ecosystem Growth

The rise of shared sequencers marks a pivotal shift for developers building on modular blockchains. Teams can now focus on application logic and user experience while relying on a robust, decentralized backbone for transaction ordering and interoperability. As more projects adopt this model, expect to see:

- Specialized fee markets tailored to app-specific needs and usage patterns

- Greater experimentation with cross-rollup DeFi protocols and unified NFT marketplaces

- Rapid innovation in sequencing consensus algorithms and MEV mitigation strategies

- Increased integration between L2s, app-chains, and base layers

Ultimately, shared sequencers are poised to become the connective tissue of the next-generation blockchain stack. Their impact on rollup interoperability, custom app-chain design, and network efficiency will only grow as standards solidify and adoption widens. For those building at the frontier of decentralized applications, mastering shared sequencing will be a critical competitive edge.