Building custom rollups with dynamic fee markets is rapidly becoming the go-to strategy for DeFi app-chains aiming to deliver high throughput and cost efficiency. As Ethereum hovers at $3,930.52, the pressure on Layer 1 networks continues to drive innovation in scalable rollup architectures and specialized fee models. Developers are no longer limited to one-size-fits-all chains; instead, they can design application-specific blockchains that adapt to unique demand curves, user behaviors, and economic incentives.

Why Custom Rollups Are the Backbone of Next-Gen DeFi

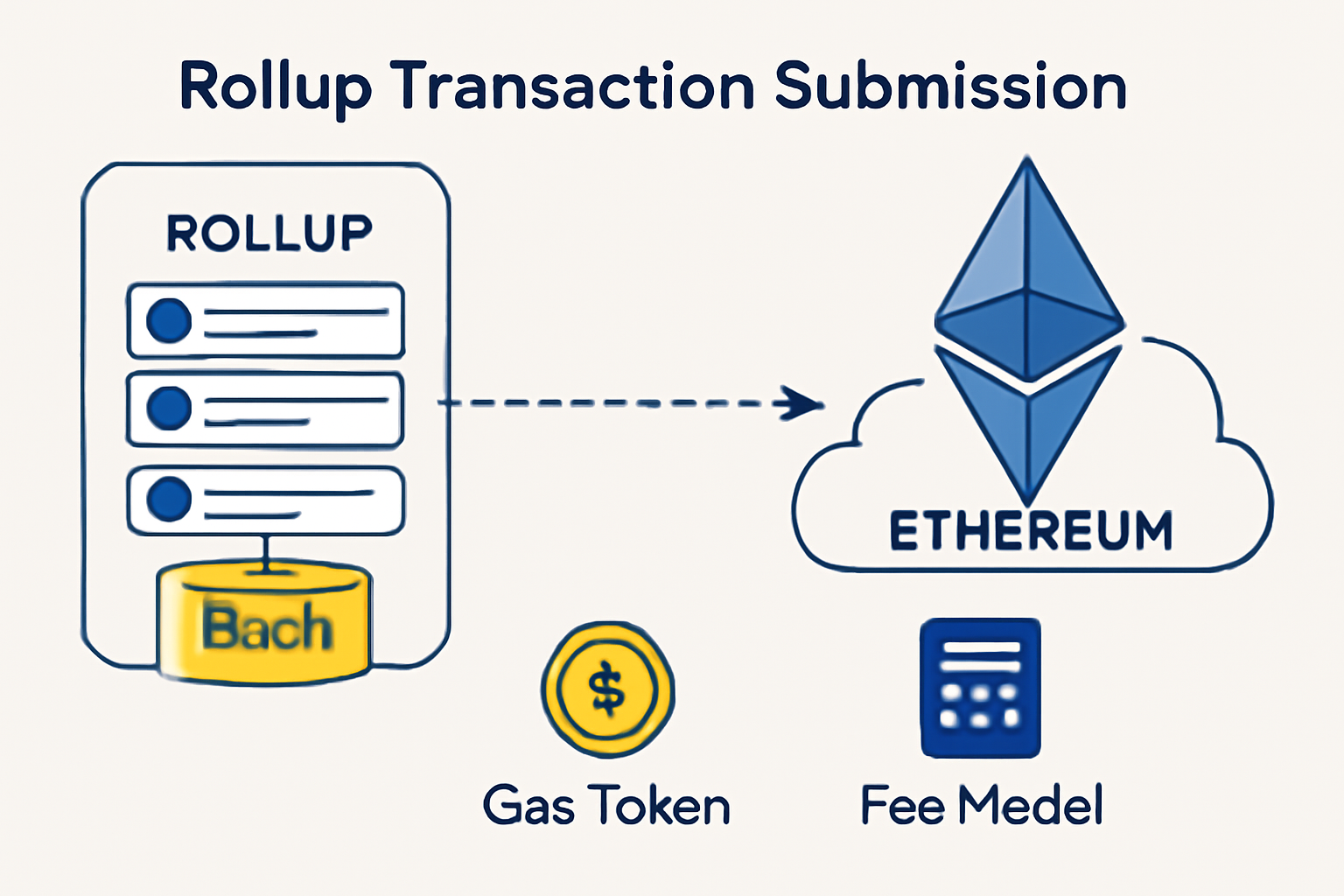

Rollups have evolved from a niche scaling solution to the backbone of decentralized finance infrastructure. By batching transactions off-chain and settling proofs to Ethereum, rollups dramatically reduce congestion and transaction fees. The real breakthrough, however, lies in custom rollups: these are tailored L2s where developers can select native gas tokens, define resource allocation, and implement fee markets that fit their application’s needs. This flexibility is transforming how DeFi protocols approach user experience and cost optimization.

For instance, DeFi platforms now experiment with choosing between public, permissionless rollups for open liquidity and private, application-specific rollups for institutional-grade compliance. Customization extends to gas economics, data availability layers, and even settlement logic. This modularity enables projects to sidestep the limitations of legacy chains and build for their own community’s priorities.

Dynamic Fee Markets: The Engine of Blockchain Fee Optimization

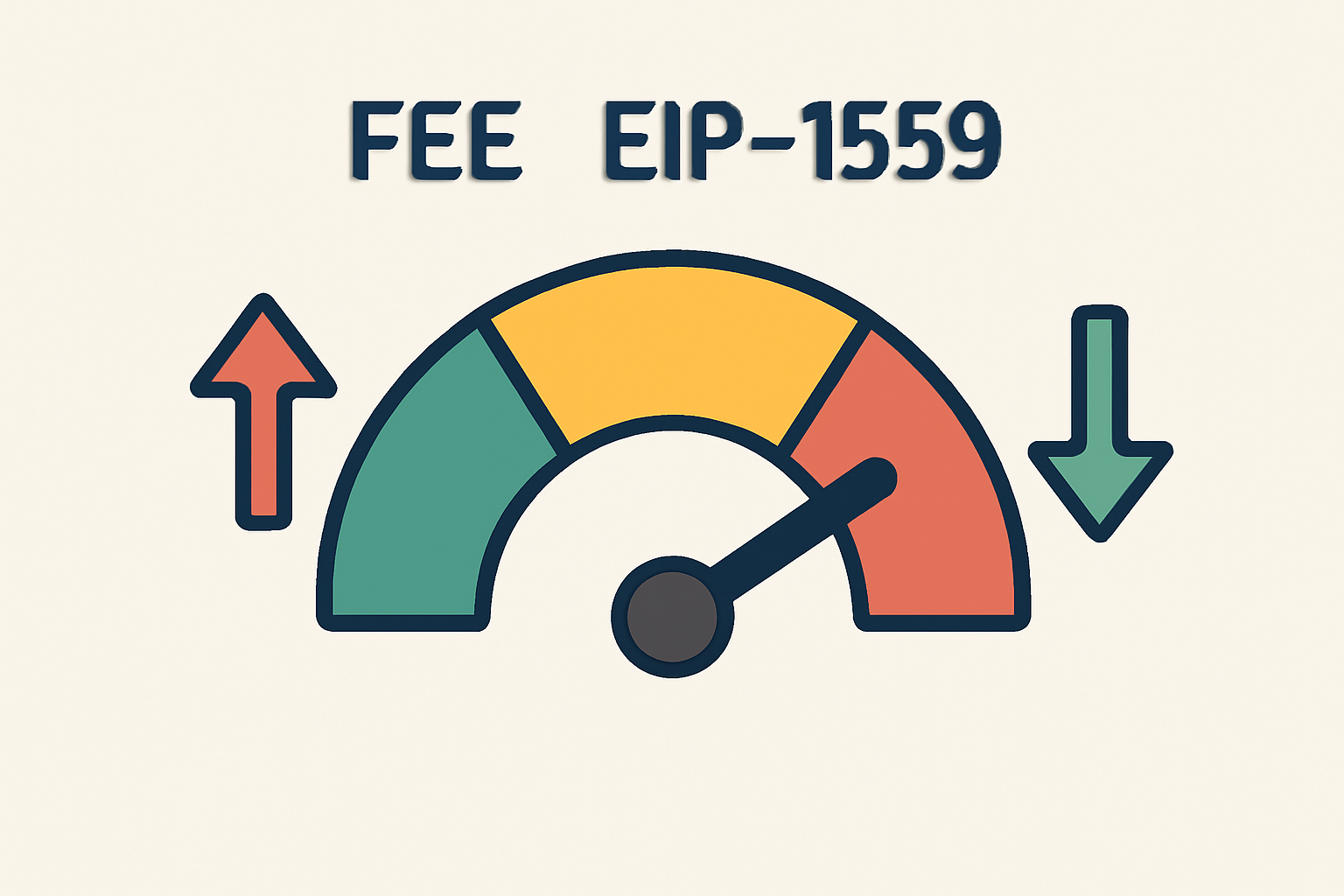

Traditional blockchains like Ethereum use static or semi-dynamic fees, which can spike unpredictably during periods of high demand. Dynamic fee markets, by contrast, introduce real-time pricing mechanisms that adjust based on network activity. The OP Stack framework and similar rollup SDKs have made it easier to implement EIP-1559-style base fees that fluctuate with usage, plus optional priority fees for users who need faster confirmations.

This approach doesn’t just optimize for lower average costs – it also smooths out volatility for both users and operators. By responding to actual demand in each block, dynamic fee markets help prevent congestion and make it easier for developers to predict transaction economics. For DeFi platforms where throughput and predictability are paramount, this is a game changer.

Rollups-as-a-Service: Lowering the Barrier for Application-Specific Blockchains

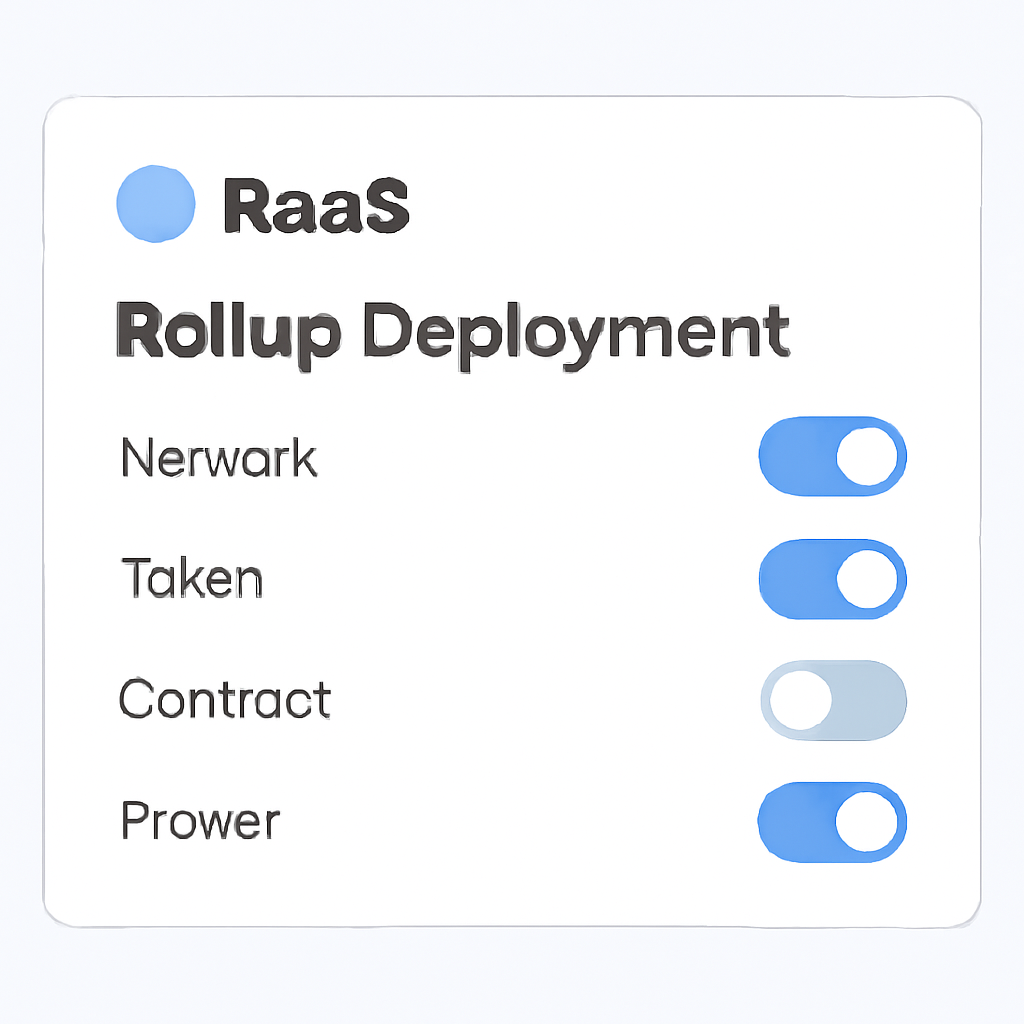

Deploying a custom rollup used to require deep expertise in blockchain infrastructure and months of development time. Today, Rollups-as-a-Service (RaaS) platforms like QuickNode and Alchemy have changed the equation. These providers offer streamlined tooling, high-performance RPC endpoints, and managed services that abstract away much of the complexity.

With RaaS, teams can launch scalable, secure DeFi app-chains with features like custom gas tokens, flexible data availability options, and native support for dynamic fee markets. This means more time spent building innovative protocols – less time wrangling infrastructure headaches. For a deeper dive into how these services power next-gen dApps, check out our technical guide on building custom rollups with dynamic fee markets.

Zero-Knowledge Rollups: Privacy Meets Performance

Another frontier in rollup design is the adoption of zero-knowledge (ZK) proofs for transaction validation. ZK rollups offer not just scalability but also enhanced privacy – a critical feature for many DeFi applications handling sensitive financial data. Projects like dYdX show how ZK rollups can achieve thousands of trades per second while keeping both costs and information leakage minimal.

The convergence of modular toolkits, RaaS offerings, and advanced cryptography is empowering developers to build DeFi platforms that are not just faster or cheaper but fundamentally more adaptable. In the next section, we’ll explore how multidimensional fee markets and resource-specific pricing unlock new levels of efficiency – and why these innovations matter as Ethereum remains firmly above $3,930.52.

Multidimensional Fee Markets: Granular Control for DeFi Resource Allocation

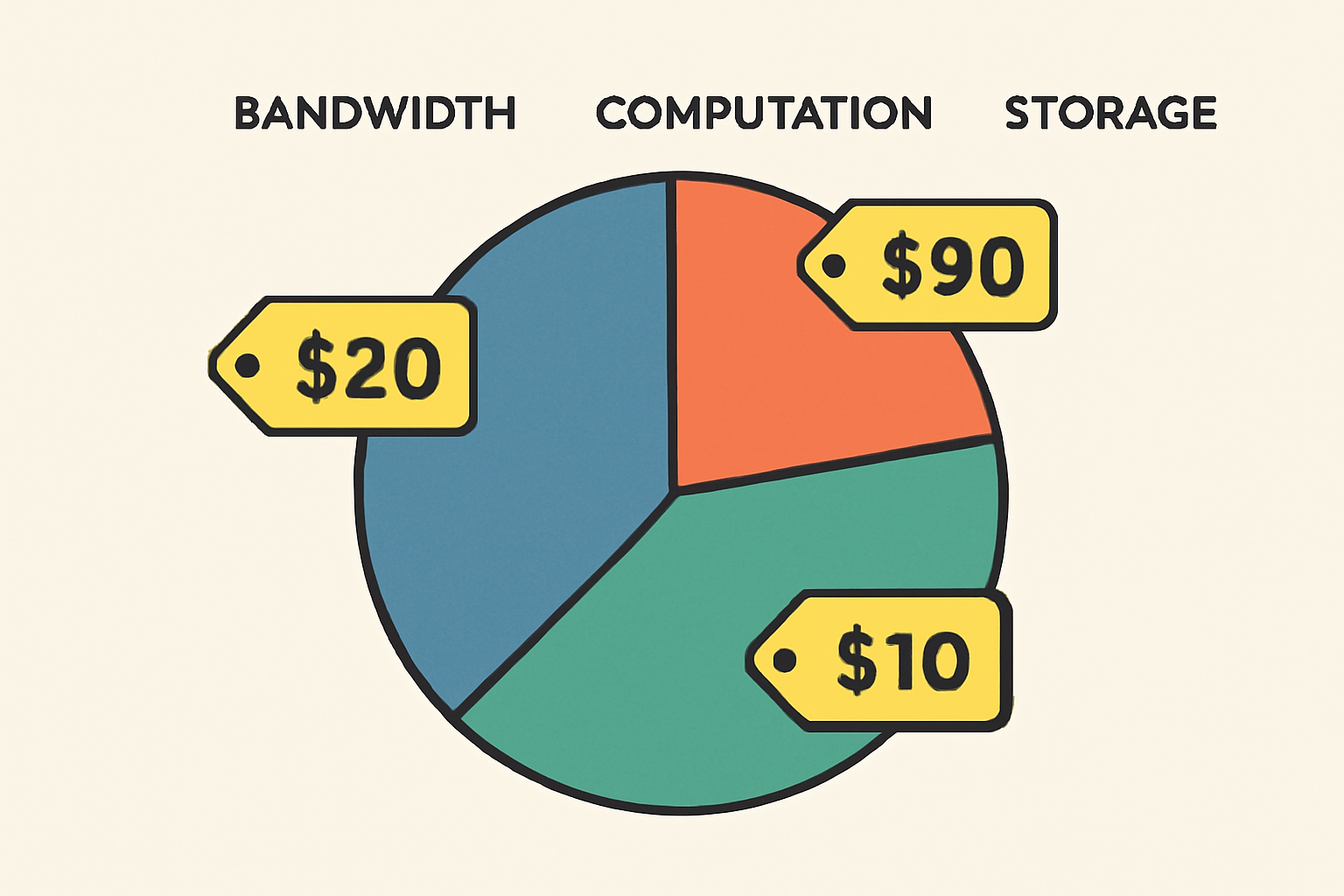

As DeFi protocols grow more sophisticated, so too do their resource needs. Enter multidimensional fee markets: a leap beyond single-token gas models. Instead of charging a flat fee for every transaction, these systems price bandwidth, computation, and storage independently, allowing for nuanced allocation of network resources. For example, a lending protocol with heavy computation but light data storage can optimize costs by paying only for what it consumes. This approach not only unlocks new economic models for DeFi platforms but also incentivizes efficient smart contract design and usage.

Developers can now implement fee structures that flexibly adapt to the actual resources their dApps require. This is especially valuable for protocols with variable workloads, such as automated market makers or on-chain derivatives platforms, which may spike in computational demand during volatile market conditions like the ones seen as Ethereum stays at $3,930.52. For a technical walk-through on designing such custom fee markets, see our guide on custom fee markets for application-specific rollups.

Modular Rollup Toolkits: Building Blocks for Custom DeFi App-Chains

The rise of open-source rollup SDKs and modular toolkits has made it easier than ever to piece together a custom blockchain stack. Toolkits like OP Stack, Polygon CDK, and others offer plug-and-play components for consensus, execution, settlement, and fee logic. Teams can start with a proven framework and layer on specialized features, such as custom fee algorithms, privacy modules, or even cross-chain interoperability, without reinventing the wheel.

This modularity accelerates time-to-market and reduces the risk of critical bugs, while still empowering projects to innovate at the protocol level. For DeFi founders, it means the freedom to experiment with new economic incentives, governance models, and user experiences, without being locked into rigid L1 or L2 architectures.

Best Practices for Launching a DeFi App-Chain with Dynamic Fees

- Start with clear resource profiling: Analyze your protocol’s expected computational, storage, and bandwidth needs to inform your fee market design.

- Leverage RaaS platforms: Use managed rollup infrastructure to reduce operational overhead and focus on application logic.

- Implement robust monitoring: Deploy analytics dashboards to monitor fee market performance, user costs, and network health in real time.

- Pilot with testnets: Validate your dynamic fee algorithms and user experience in a controlled environment before mainnet launch.

- Iterate on feedback: Engage your community to refine fee structures and optimize for both power users and new entrants.

As DeFi continues to evolve, the ability to fine-tune transaction costs, resource allocation, and user incentives will define the next wave of successful protocols. Custom rollups with dynamic, multidimensional fee markets are not just a technical upgrade, they’re a strategic advantage. By embracing these innovations, developers can deliver scalable, cost-effective, and user-centric DeFi app-chains that thrive even as Ethereum holds steady at $3,930.52.

If you’re ready to dive deeper into the technical nuances of custom rollup design, explore our advanced guide on implementing custom fee markets in application-specific rollups.