Dynamic fee markets are rapidly becoming the backbone of custom app-chains, enabling developers to fine-tune user experience and maximize throughput in ways that generic blockchains cannot match. As the “Everyone Gets a Chain” economy gains momentum, the ability to deploy application-specific chains with specialized fee mechanisms is reshaping what’s possible for decentralized apps, DeFi protocols, and onchain social platforms.

Dynamic Fee Markets: The Engine Behind App-Chain Optimization

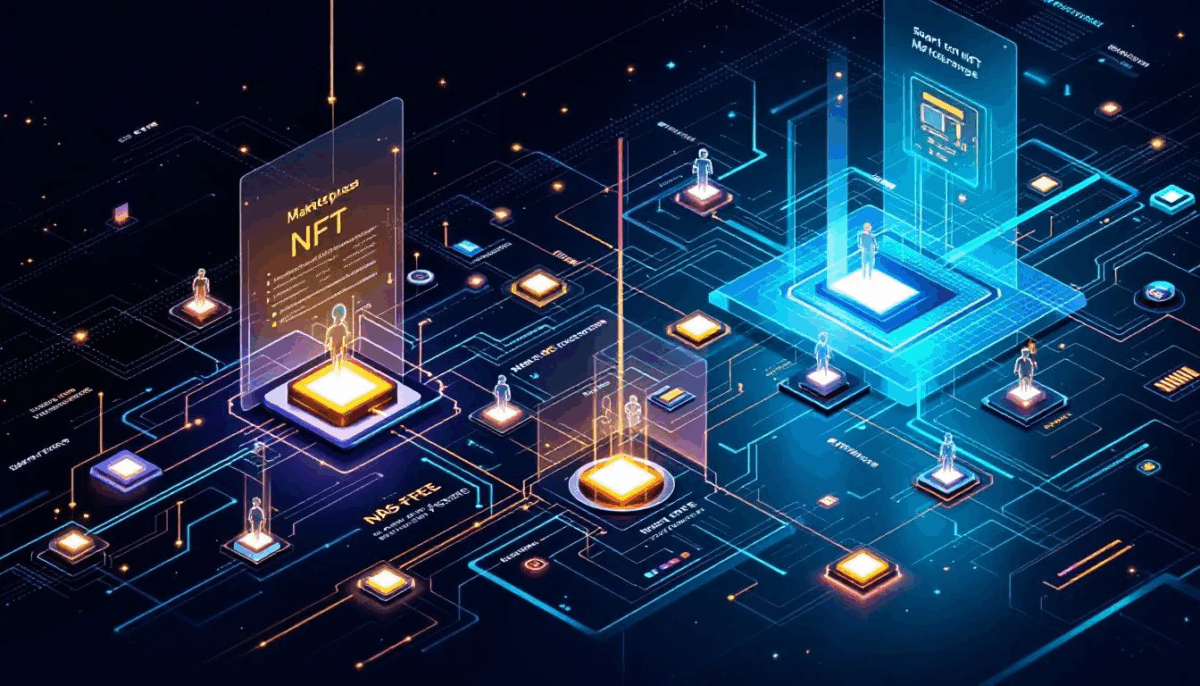

The classic one-size-fits-all gas model of legacy Layer 1s is giving way to nuanced, application-driven pricing. With dynamic fee markets, transaction costs adjust automatically based on real-time network demand, resource consumption, and even user segmentation. This means an NFT marketplace can prioritize low-latency minting during drops, while a DeFi protocol can dynamically scale fees for high-frequency trading.

Consider Solana’s recent adoption of multi-dimensional fee markets: by pricing execution, storage, and bandwidth separately, Solana has dramatically increased network capacity and reduced volatility in fees. This granular approach allows each app-chain to allocate resources efficiently and maintain high throughput even during periods of intense activity. For technical deep-dives into these mechanisms, see our guide on how dynamic fee markets power scalable custom app-chains.

User Experience Reimagined Through Fee Customization

User experience (UX) is no longer shackled to unpredictable or opaque gas prices. By leveraging dynamic pricing models like EIP-1559 or implementing custom gas tokens (e. g. , allowing ERC-20 tokens for fees), app-chains can offer everything from subsidized onboarding for new users to tiered pricing for power users. This flexibility translates into faster confirmations, reduced failed transactions, and ultimately higher user retention.

Starknet provides a compelling case study: as network usage increases, its dynamic fee model ensures that transaction finality times drop and costs become more predictable. This isn’t just theory, projects deploying on Starknet have reported up to 40% lower median fees during peak periods compared to static-fee L2s.

Sovereignty and Economic Control for App Builders

The shift toward custom app-chains with specialized fee structures grants projects full sovereignty over their economic models. Unlike shared Layer 1s or monolithic rollups where MEV extraction and sequencer incentives are dictated by the base protocol, dedicated chains can implement unique revenue-sharing models, experiment with MEV mitigation strategies, or even launch zero-fee promotional campaigns.

dYdX’s migration to its own app-chain exemplifies this trend. By controlling its own sequencer logic and dynamic fee market parameters, dYdX can optimize for ultra-low-latency order execution while customizing incentives for liquidity providers, all without being constrained by Ethereum mainnet congestion or competing for blockspace with unrelated applications.

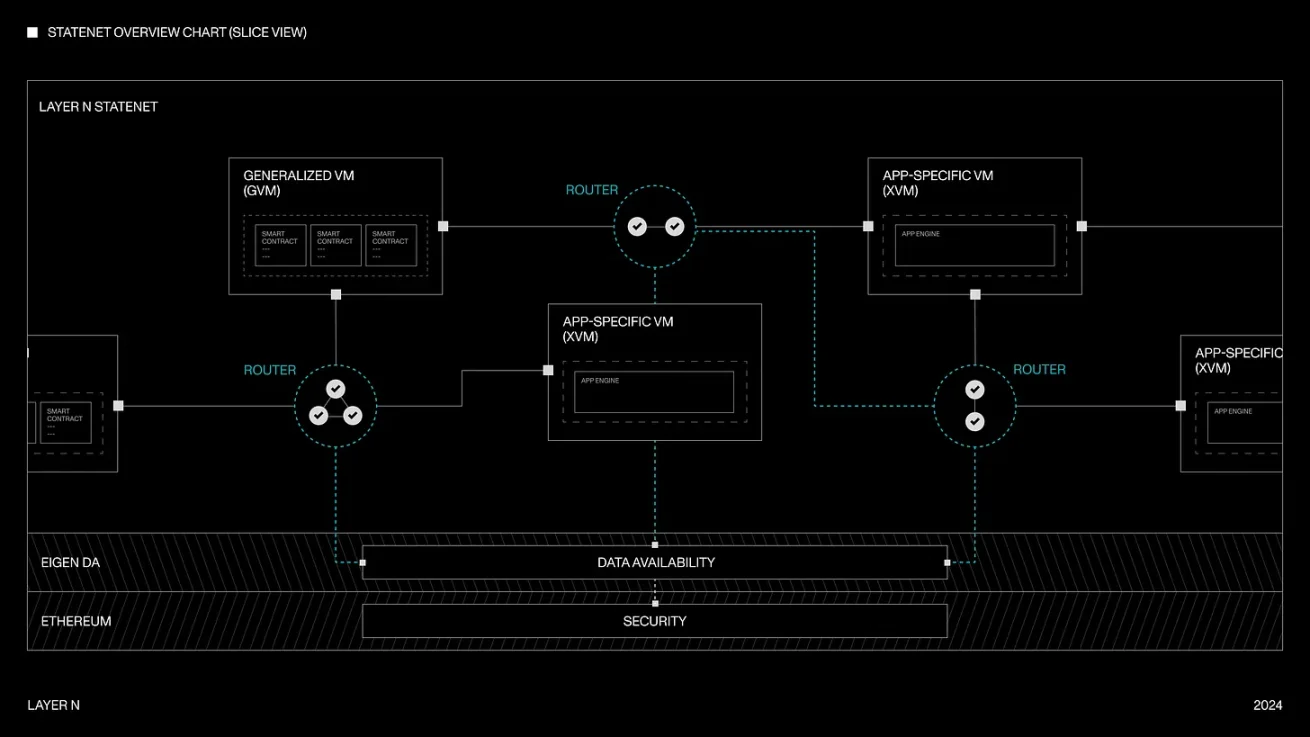

The Modular Blockchain Thesis in Action

This paradigm shift aligns with the broader modular blockchain thesis: decoupling consensus, data availability, and execution layers lets each component specialize for performance. Dynamic fee markets are the connective tissue enabling this specialization, empowering builders to optimize every aspect of their chain’s economics and UX.

As modular frameworks and rollup-as-a-service providers mature, the technical and operational barriers to launching a high-performance app-chain continue to fall. Projects can now fine-tune their rollup fee structure in real time, balancing incentives for validators, sequencers, and users without sacrificing security or composability. This flexibility is particularly valuable for applications with unpredictable or bursty demand patterns, such as onchain games, decentralized exchanges, or social protocols that see sudden surges in activity.

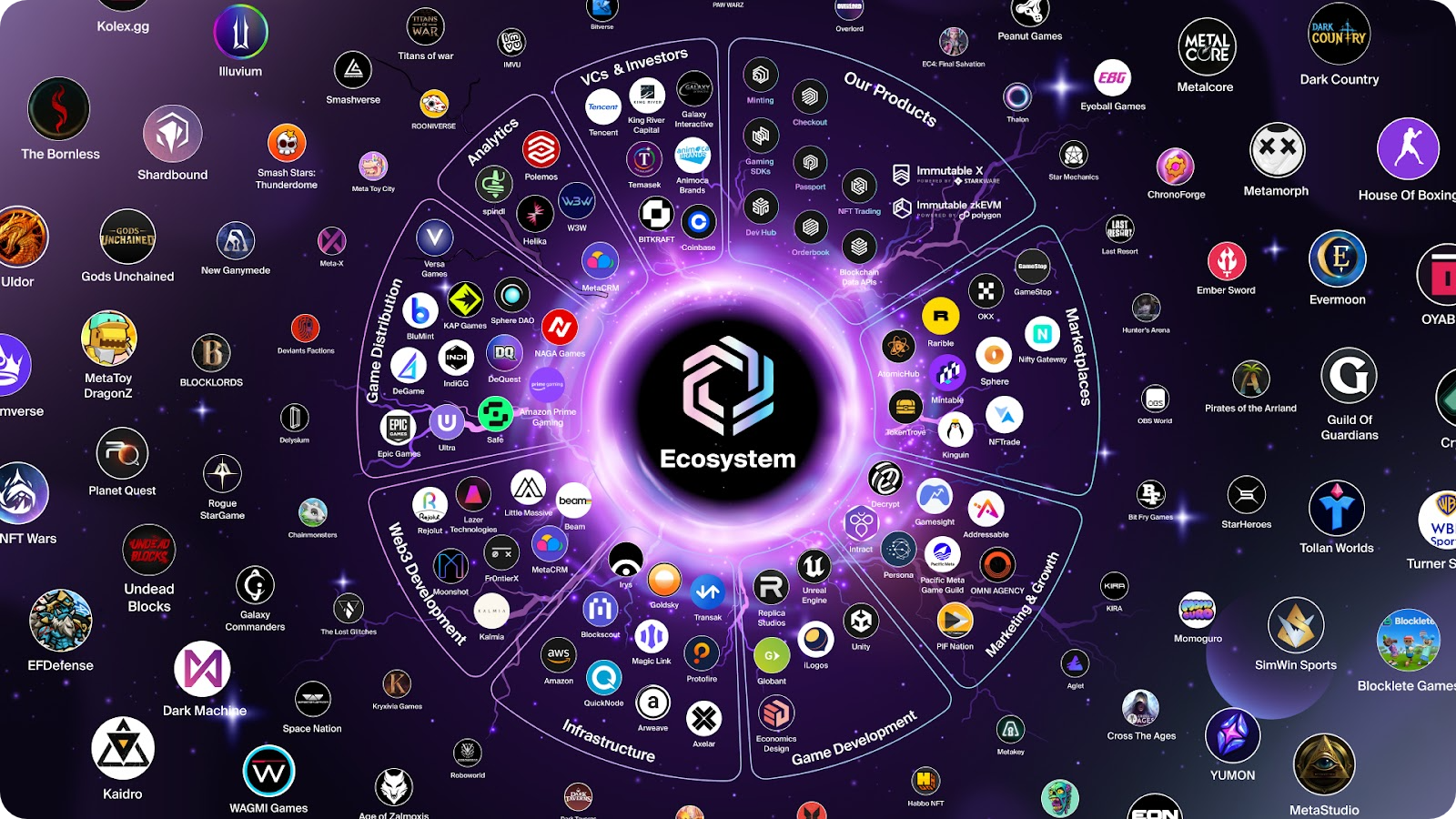

Interoperability further amplifies the impact of dynamic fee markets. App-chains can adjust cross-chain transaction fees dynamically to attract liquidity from other networks or incentivize specific types of bridging activity. For example, an NFT platform might temporarily lower fees for cross-chain mints during a major event, while a DeFi protocol could offer discounted swaps when routing trades through certain liquidity pools. This level of control is simply unattainable on generic Layer 1s with rigid gas models.

Top Use Cases for Dynamic Fee Markets in App-Chains

-

DeFi DEXs (e.g., dYdX, UniswapX): Dynamic fee markets allow decentralized exchanges to optimize transaction costs and throughput by adjusting fees based on real-time network demand. This ensures efficient trade execution, minimizes slippage, and provides users with predictable, low-latency experiences during periods of high activity.

-

NFT Platforms (e.g., OpenSea, Magic Eden): NFT marketplaces leverage dynamic fee structures to reduce transaction costs and congestion during high-demand drops or minting events. This flexibility enables smoother user experiences and fairer access to limited-edition assets.

-

Onchain Gaming (e.g., Immutable X, TreasureDAO): Game-focused app-chains utilize dynamic fee models to subsidize or adjust transaction costs, enabling microtransactions and seamless in-game asset transfers without pricing out users during network spikes.

-

Social Apps (e.g., Farcaster, Lens Protocol): Social protocols benefit from tailored fee markets by offering fee-less or subsidized interactions for new users, enhancing onboarding and engagement while maintaining scalability as the user base grows.

-

Cross-Chain Bridges (e.g., Wormhole, LayerZero): Dynamic fee markets help bridges optimize costs for cross-chain transfers, adjusting fees to reflect network congestion and ensuring efficient, secure interoperability between app-chains and major blockchains.

Challenges in Deploying Dynamic Fee Markets

Despite the clear benefits, implementing specialized fee mechanisms comes with its own set of challenges. Developers must handle increased complexity in chain governance and infrastructure management. Bootstrapping validator sets and ensuring robust economic security remain non-trivial tasks, especially for early-stage projects without established token economies.

However, new primitives like restaking (e. g. , EigenLayer) and shared security modules are rapidly mitigating these hurdles. By inheriting security from established networks while retaining full control over fee policies and upgrade cycles, app-chains can safely experiment with innovative economic designs.

The Road Ahead: Specialized Fee Markets as Standard Practice

The trajectory is clear: as more teams realize the power of dynamic fee markets, static gas models will become the exception rather than the rule. We’re already seeing blue-chip protocols like dYdX and Starknet set new standards for throughput and user experience via tailored fee structures. The next wave will see even smaller projects leveraging these tools to carve out defensible niches, whether by subsidizing onboarding costs or rewarding specific user behaviors.

If you’re building a high-velocity application or exploring new economic primitives at the frontier of blockchain scalability, mastering custom fee market design is now table stakes. For deeper technical dives, including code samples for implementing EIP-1559-style pricing or ERC-20 gas tokens, see our advanced guides on designing custom fee markets for application-specific rollups and building custom app-chains for DEXs.

Key Takeaways: Why Dynamic Fee Markets Matter Now

- Throughput: Tailored pricing unlocks higher transaction capacity without network-wide congestion.

- User Experience: Predictable costs and faster finality drive retention across all verticals.

- Sovereignty: Full control over economics enables rapid iteration and unique incentive structures.

- Interoperability: Adaptive fees facilitate seamless cross-chain flows and composability.

- Sustainability: Dynamic models optimize resource allocation, minimizing waste while maximizing utility for all stakeholders.

The modular blockchain era rewards those who treat their chain’s economics as a first-class product feature, not just an afterthought. As specialized fee markets move from experimental to essential infrastructure, expect the most successful app-chains to be those that relentlessly iterate on their pricing engines to deliver both performance and delight at scale.