In 2025, the landscape of blockchain scalability and customization is rapidly transforming, thanks to the rise of programmable on-chain sequencers. These smart contract-powered modules are empowering developers to build application-specific blockchains (app-chains) that feature highly tailored fee markets and economic models. Unlike traditional blockchains, where fee logic and transaction ordering are often rigid or externally managed, programmable sequencers allow for unprecedented flexibility and transparency, ushering in a new era of decentralized economic sovereignty.

Programmable Sequencers: The Engine Behind Custom Fee Markets

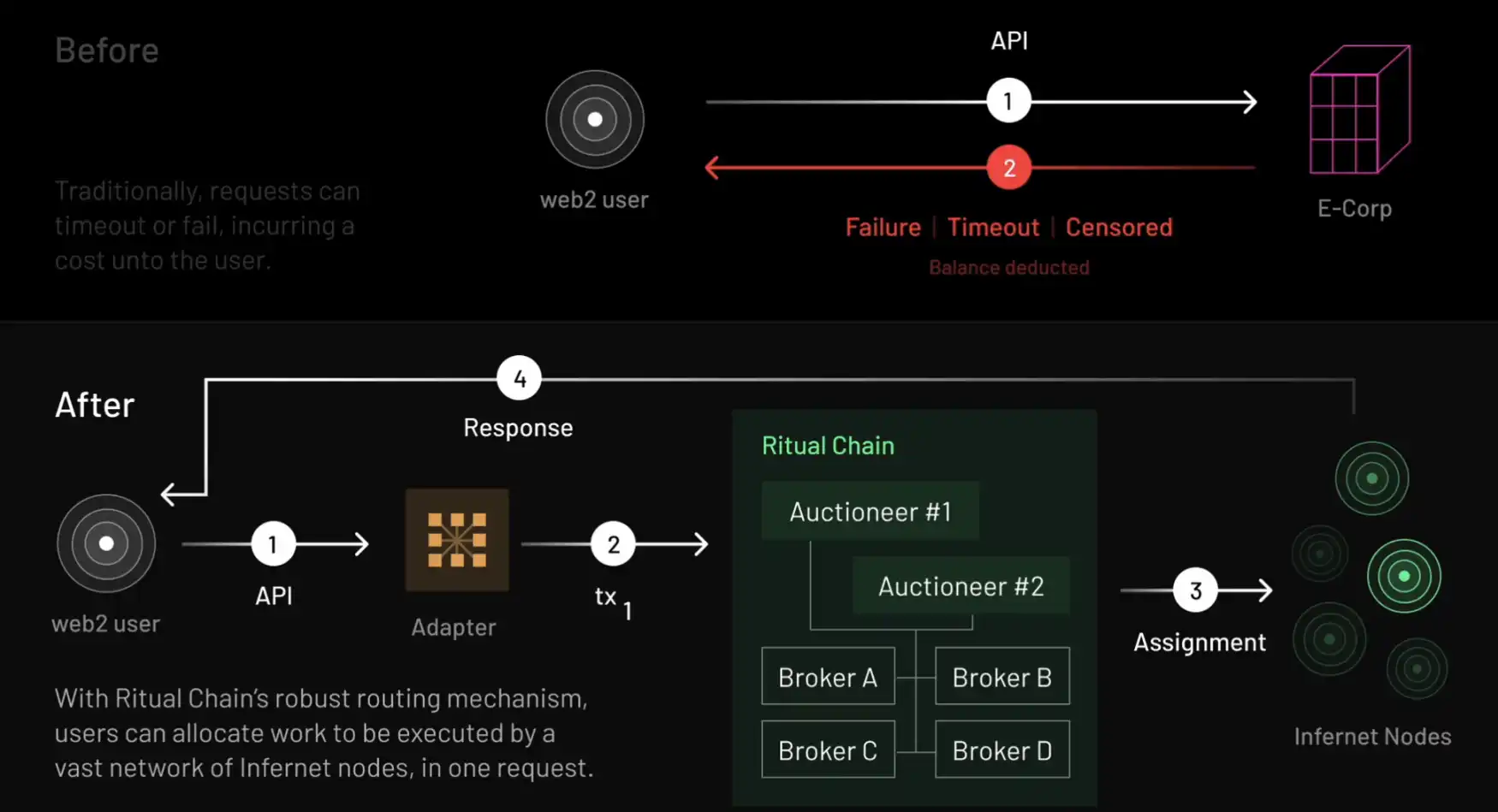

At their core, programmable on-chain sequencers are smart contracts that determine how transactions are ordered, included, and priced within a blockchain network. This is a significant departure from earlier systems that relied on off-chain or centralized sequencing services, models that could stifle innovation and introduce single points of failure. By embedding sequencing logic directly into the blockchain layer, developers can now dictate every nuance of transaction handling: from inclusion rules to dynamic pricing models.

This programmability means app-chains can establish custom fee markets designed specifically for their use cases. For instance, a DeFi app-chain might implement time-sensitive auction-based fees to maximize throughput during peak trading hours, while a gaming chain could prioritize low-latency microtransactions with flat-rate pricing. The result? Fee structures that are not only more efficient but also more aligned with user expectations and application goals.

Benefits of Specialized Blockchain Fee Models

The ability to design isolated fee markets has far-reaching implications:

- Predictable Costs: By decoupling from global network congestion, each app-chain can ensure its users experience stable transaction fees, even when other chains face spikes in demand.

- User-Centric Incentives: Developers can reward specific behaviors or actions that contribute to network growth or stability. For instance, loyalty discounts for frequent users or bonus rewards for validators who maintain uptime.

- Dynamic Adaptation: Smart contracts can adjust fee parameters in real time based on usage metrics or external data feeds, optimizing both user experience and network sustainability.

This level of customization is especially valuable as blockchain adoption broadens beyond finance into areas like gaming, supply chain management, and social media platforms, all with unique economic requirements.

Syndicate: A Case Study in On-Chain Sequencing Innovation

The Syndicate Network stands out as a pioneering example of this paradigm shift. Anticipated to launch its flagship sequencing token (SYND) on September 17,2025, Syndicate moves the entire sequencing logic into transparent smart contracts, eliminating reliance on centralized operators. With SYND as its native token powering gas fees and staking mechanisms, Syndicate enables developers to deploy fully customizable app-chains with granular control over transaction ordering and economic incentives.

This approach not only enhances network sovereignty but also unlocks new possibilities for atomic composability between chains, a critical feature for complex decentralized applications requiring cross-chain interoperability without compromising security or performance.

The momentum behind programmable on-chain sequencers is clear: they are catalyzing a wave of innovation across the blockchain ecosystem by making specialized fee models accessible to builders everywhere. As these technologies mature throughout 2025 and beyond, expect even more creative applications, and perhaps entirely new categories of decentralized networks, to emerge.

Developers are already experimenting with advanced fee architectures, such as real-time congestion pricing, tiered access for premium users, and even community-governed adjustments to transaction costs. These features are directly enabled by the flexibility of programmable on-chain sequencers, which allow every aspect of network economics to be expressed as code. The result is a blockchain landscape where each app-chain can optimize for its own definition of fairness, efficiency, and growth.

2025: The Year of Decentralized Economic Sovereignty

As more projects adopt programmable sequencers, the broader implications for the crypto space are profound. App-chains are no longer beholden to the limitations or fee volatility of shared infrastructure; instead, they gain decentralized economic sovereignty. This means that governance decisions about transaction inclusion, validator incentives, and even inflation schedules can be made transparently and enforced at the protocol level.

With projects like Syndicate leading the way, the competition among app-chains is shifting from raw throughput to user experience and economic design. Chains that best align their fee markets with user needs will attract liquidity and developer interest. In this environment, composability between chains becomes not just a technical challenge but an economic opportunity: programmable sequencers can be designed to interoperate or even share liquidity pools while maintaining distinct fee policies.

This trend also dovetails with advances in data availability layers and modular blockchain stacks. As rollups and app-chains become more customizable at every layer, from consensus to execution to fees, the barriers to launching purpose-built networks continue to fall. Builders no longer have to compromise between scalability and sovereignty; they can have both.

What’s Next for App-Chain Fee Markets?

The pace of innovation in 2025 suggests we’re only scratching the surface of what’s possible with programmable on-chain sequencers. Expect continued experimentation with:

- Automated Market Makers for Blockspace: Dynamic pricing models that use AMM-style logic to set transaction fees based on supply and demand.

- Governance-Driven Fee Adjustments: DAOs voting on fee parameters or introducing new incentive schemes in response to real-world usage data.

- Pooled Sequencing: Multiple app-chains sharing sequencing infrastructure while maintaining isolated fee markets, a powerful tool for cross-domain interoperability.

The path forward will likely feature deeper integration with off-chain data sources (oracles), more sophisticated validator incentive mechanisms, and greater transparency around how fees are allocated or burned. For developers interested in building or optimizing custom app-chains with specialized fee markets, now is an ideal time to explore this new frontier. For further guidance on designing adaptive fee structures or understanding the technical nuances behind programmable sequencers, check out our detailed guides like How To Design Custom Fee Markets For Application-Specific Blockchains.

The era of monolithic blockchains is fading fast. In its place rises a modular ecosystem where every application can define its own rules, not just for computation or storage but for economics itself. Programmable on-chain sequencers are at the heart of this transformation, giving rise to a future where blockchain networks are as diverse, and as specialized, as the communities they serve.