In 2025, programmable on-chain sequencers are rewriting the playbook for custom app-chains. Gone are the days when transaction ordering and network economics were dictated by opaque, centralized actors. Instead, developers now wield fine-grained control over how transactions are sequenced, fees are structured, and governance is enforced, ushering in a new era of blockchain scalability and flexibility.

Programmable Sequencers: The Engine of App-Chain Innovation

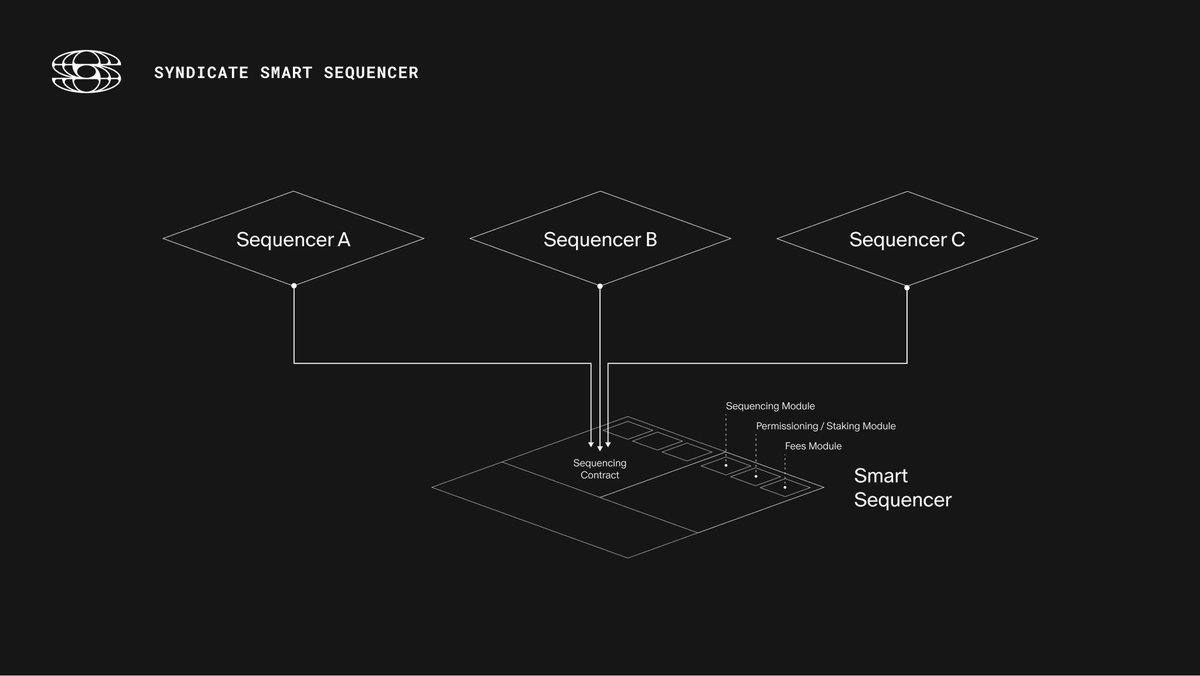

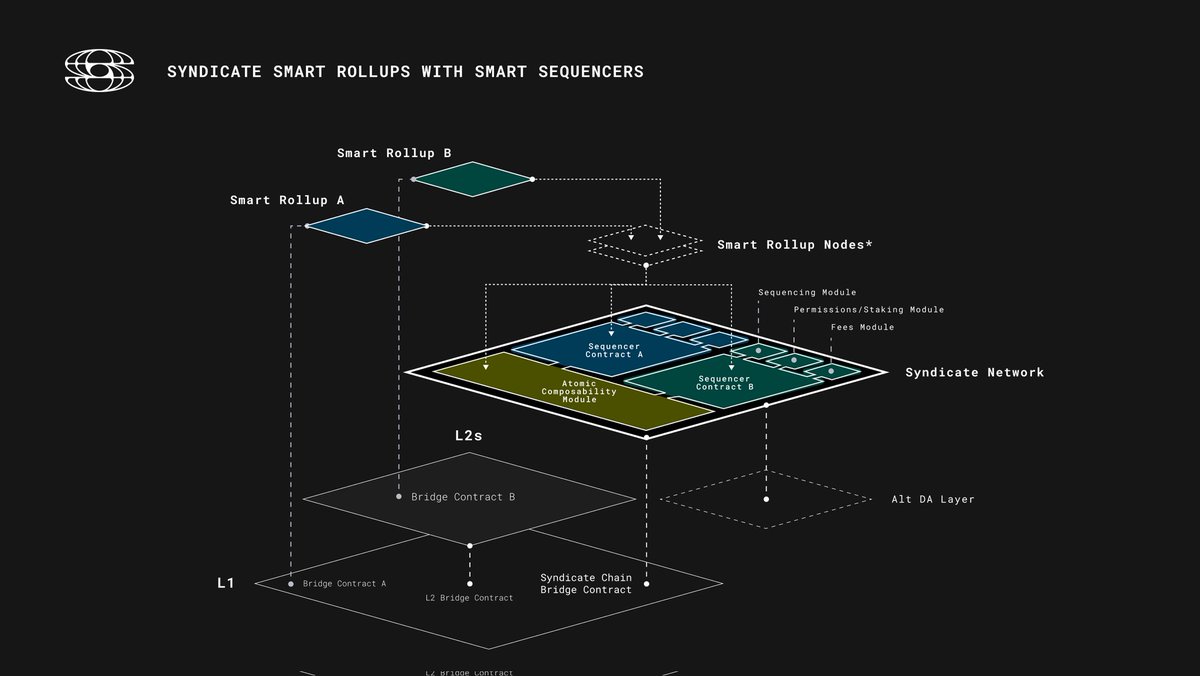

The heart of this transformation is the programmable on-chain sequencer, a smart contract-powered module that determines which transactions make it into each block and in what order. Platforms like Syndicate (SYND) have set the standard here, letting communities encode transaction inclusion policies, permissioning logic, and even fee market mechanisms directly into their chains’ DNA. This isn’t just technical progress, it’s a power shift from protocol operators to builders and users.

Consider this: with programmable sequencing, an NFT marketplace can enforce anti-front-running rules at the protocol level. A DeFi app-chain can implement dynamic congestion pricing or auction-based fee markets tailored to its liquidity profile. Supply chain networks can guarantee deterministic transaction flows for compliance or auditability. The result? Specialized fee markets and on-chain economies designed for real-world needs, not one-size-fits-all compromises.

Decentralization Meets Resilience: Eliminating Single Points of Failure

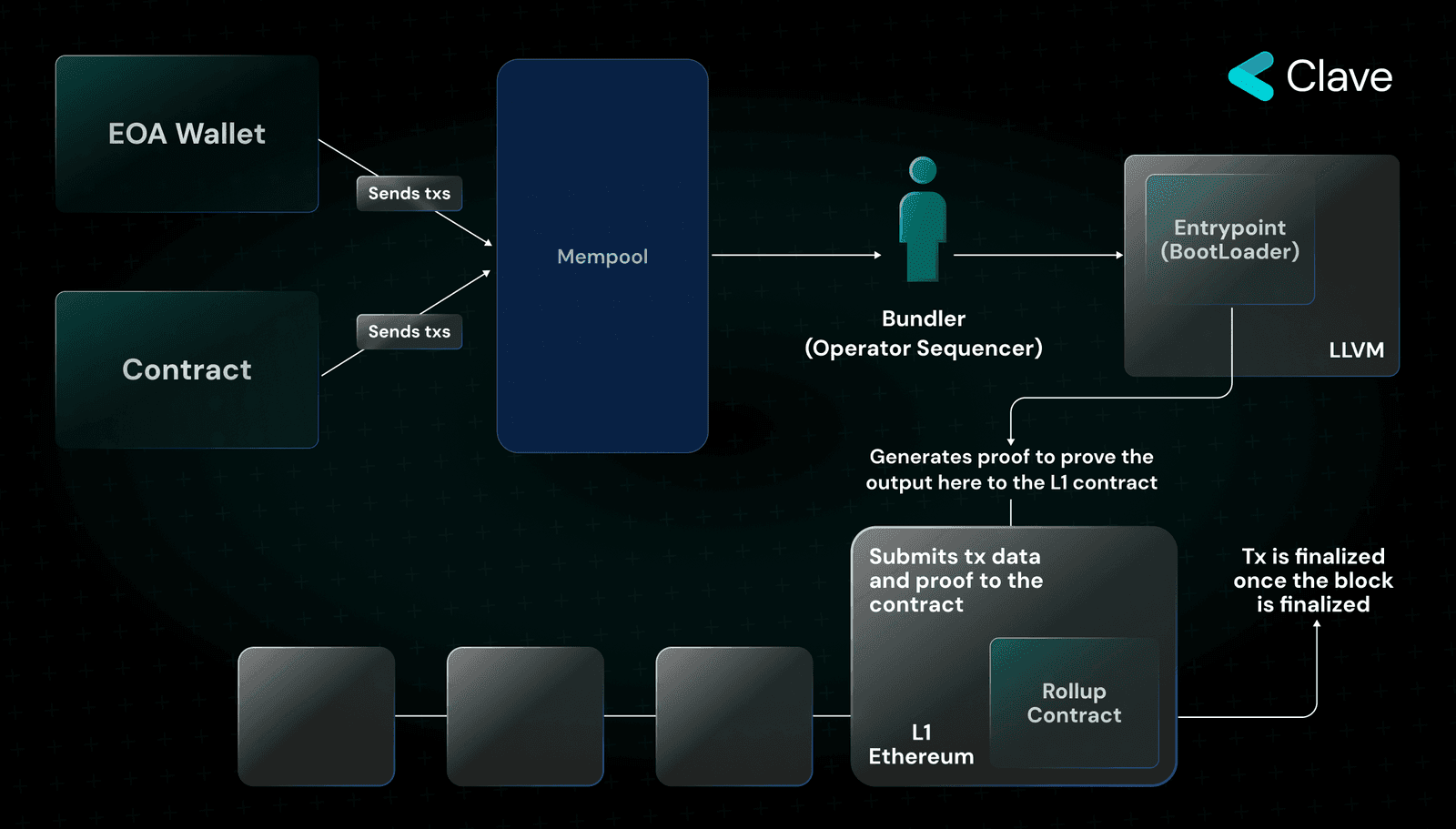

The move to programmable on-chain sequencers doesn’t just unlock customization, it also addresses some of blockchain’s oldest pain points. Centralized sequencing has long been a bottleneck, introducing downtime risks and making censorship all too easy. In contrast, protocols like Tanssi rotate sequencing responsibilities across permissionless node pools. If one node fails or goes rogue, others step in seamlessly, keeping the network live and trustless.

This architecture also boosts security against manipulation tactics like front-running or back-running, issues that plagued earlier rollup models reliant on single sequencer nodes. By decentralizing control and encoding sequencing logic transparently in smart contracts, projects like ZKsync’s ZK Stack are pioneering new defenses while maintaining ultra-low latency for users.

Smart Contract Sequencing: Customization Without Compromise

The real breakthrough is that all this flexibility is delivered without sacrificing performance or composability. Developers can update sequencing logic via governance votes or automated triggers, no hard forks required. Imagine rolling out a new fee model overnight based on community input or integrating cross-chain execution graphs (like those pioneered by Router Protocol) to optimize settlement across diverse blockchains.

This level of agility lets teams iterate rapidly as user needs evolve, whether it’s slashing transaction costs during off-peak hours or onboarding new validators with zero downtime. For in-depth guides on designing these custom fee markets and deploying your own app-specific rollups with programmable sequencers, check out our dedicated resources at CustomAppChains. com.

Programmable sequencers are also a catalyst for cross-chain interoperability, a feature that’s finally moving from theory to production in 2025. By encoding cross-chain execution logic directly into the sequencer layer, app-chains can coordinate atomic swaps, synchronize state across networks, and minimize settlement risk without relying on centralized bridges. Router Protocol’s programmable execution graphs exemplify this trend, enabling seamless trustless communication between previously siloed ecosystems.

Real-World Use Cases of Programmable Sequencers in 2025

-

Syndicate-Powered NFT Marketplaces: Programmable on-chain sequencers on Syndicate enable NFT platforms to set custom transaction ordering, dynamic fee structures, and anti-front-running logic. This empowers creators and collectors with fairer, more transparent trading environments.

-

DeFi Protocols on ZKsync ZK Stack: DeFi apps leveraging ZKsync’s ZK Stack use decentralized sequencers to prevent MEV attacks and ensure low-latency, manipulation-resistant trading. The TimeBoost model specifically enhances security and efficiency for high-frequency DeFi operations.

-

Supply Chain App-Chains with Tanssi: Supply chain networks built on Tanssi utilize programmable sequencers to automate transaction ordering, rotate validation duties, and guarantee uninterrupted data flow across global logistics partners.

-

Cross-Chain Settlement via Router Protocol: Router Protocol’s programmable execution graph coordinates transaction sequencing across multiple blockchains, enabling seamless, trustless NFT and DeFi asset transfers between custom app-chains.

-

Enterprise App-Chains on Chainstack: Businesses deploying custom app-chains through Chainstack leverage programmable sequencers for granular fee management and permissioned transaction flows, optimizing cost and compliance in enterprise supply networks.

For developers, this means building app-chains is no longer an exercise in compromise. Need to implement a unique fee auction? Want to give your DAO the power to adjust gas economics on the fly? Or maybe you require deterministic transaction ordering for compliance? All of this is now possible, without sacrificing throughput or composability.

The knock-on effect is profound: specialized fee markets are emerging everywhere. NFT chains adopt anti-sniping logic at the base layer, DeFi protocols run real-time congestion pricing modules, and enterprise blockchains enforce compliance-driven sequencing, all through modular smart contracts. This composability is why Syndicate (SYND) and similar platforms are seeing rapid adoption among forward-thinking teams looking to differentiate their networks.

The Road Ahead: App-Chain Development in 2025

The new paradigm isn’t just about technical flexibility, it’s about community empowerment. With sequencer logic living on-chain and governance hooks baked in from day one, DAOs can vote on fee models or update sequencing rules in real time. This fluidity accelerates innovation cycles and aligns incentives between builders and users.

Of course, there are still challenges: designing robust governance frameworks for critical protocol upgrades remains non-trivial; ensuring economic security as sequencer sets grow more decentralized demands vigilant monitoring; and optimizing cross-chain settlements at scale is an ongoing arms race. But the direction is clear, programmable on-chain sequencers have made custom app-chains more agile, resilient, and user-aligned than ever before.

If you’re ready to dive deeper into how programmable sequencer contracts enable custom fee markets, and want actionable blueprints for your own application-specific rollup, explore our hands-on guides at CustomAppChains. com.