Custom app-chains are rewriting the rules of blockchain economics in 2025. At the core of this evolution is the rise of specialized sequencers, which empower application-specific blockchains to design fee markets that are both fair and highly efficient. As programmable sequencing becomes mainstream, developers are gaining granular control over transaction ordering, fee logic, and network incentives, ushering in a new era for on-chain applications.

Why Sequencers Matter for Application-Specific Blockchains

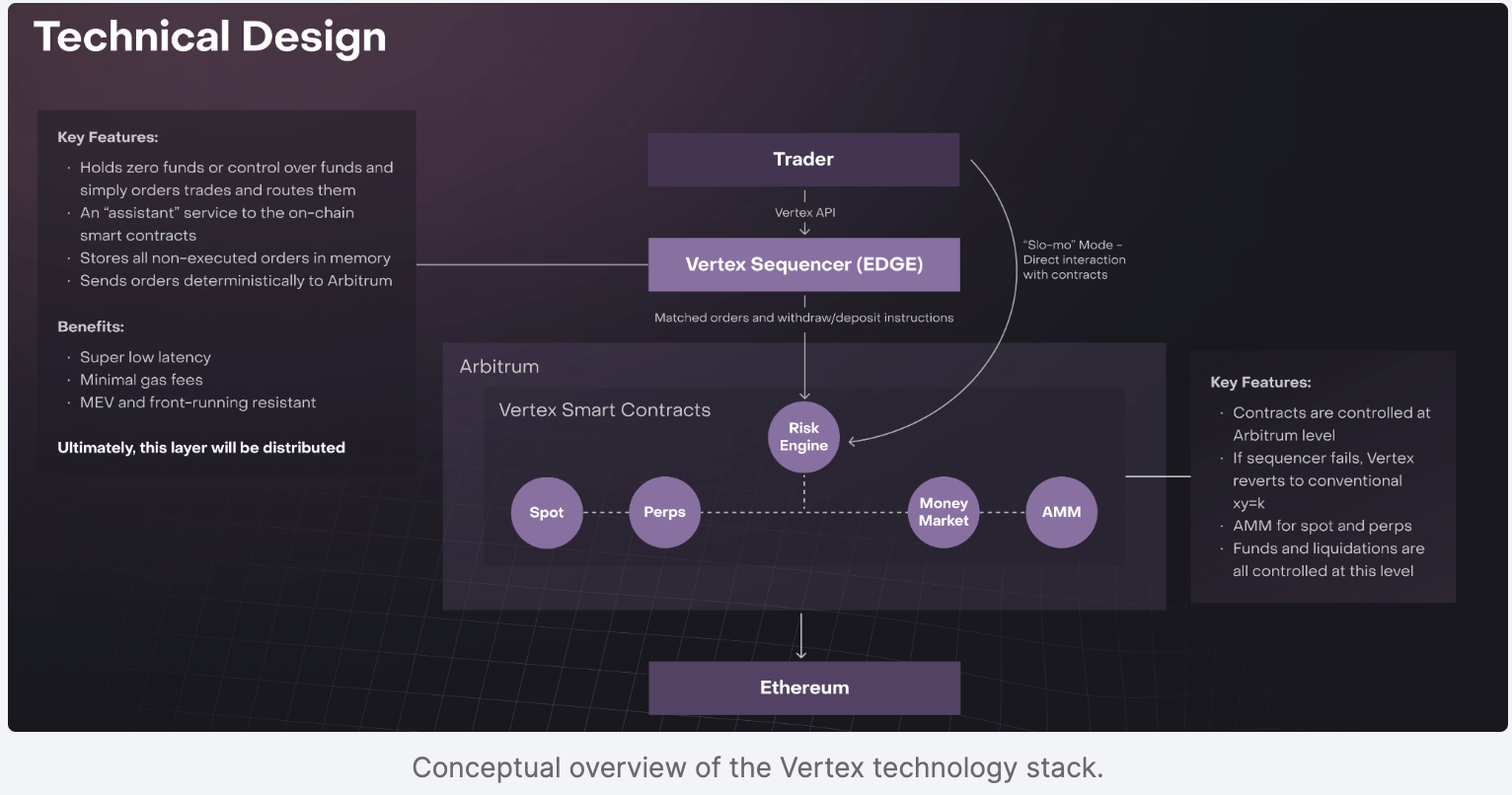

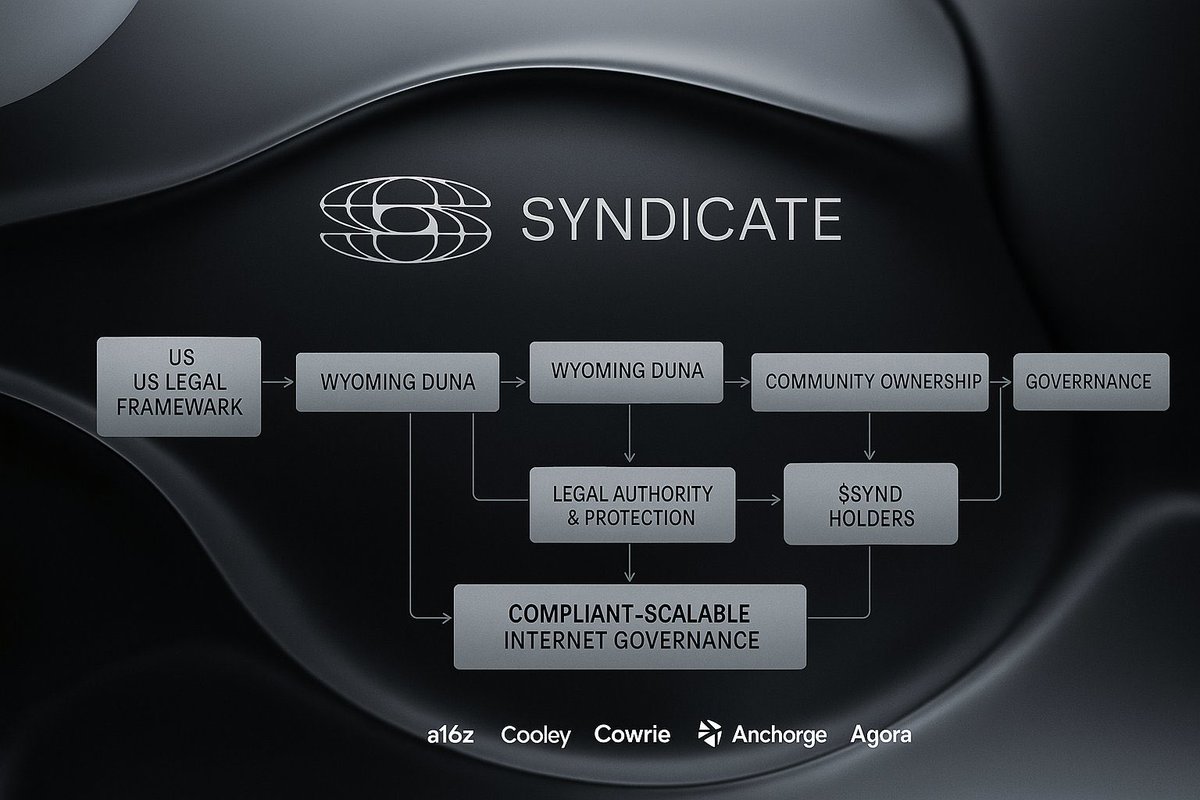

Sequencers are the gatekeepers of blockchain activity. Their job: order incoming transactions before they’re finalized on-chain. In shared networks like Ethereum, this process is largely uniform. But custom app-chains, built with platforms like Syndicate or Chainstack, are breaking away from this one-size-fits-all approach. By deploying programmable on-chain sequencers, these chains can:

- Define their own transaction ordering rules, reducing exposure to MEV (Miner Extractable Value) attacks and ensuring more equitable outcomes for users.

- Create bespoke fee structures tailored to their application’s unique economic model, rather than inheriting the priorities of a generalized chain.

- Embed governance directly into sequencing logic, making policies like allowlists or dynamic subsidies transparent and upgradeable.

This unprecedented flexibility is fueling innovation across DeFi protocols, gaming platforms, and data marketplaces looking to optimize both user experience and value capture.

The Mechanics: How Specialized Sequencers Enable Fairer Fee Markets

The magic lies in programmability. With platforms such as Syndicate’s stack, developers can deploy smart contracts that act as their chain’s sequencer, embedding custom logic for transaction selection, prioritization, and fee distribution. This means:

- Fair Transaction Ordering: By customizing sequencing algorithms, app-chains can mitigate front-running and sandwich attacks that plague traditional networks. This ensures users pay fair fees rather than being squeezed by opportunistic actors.

- Custom Fee Structures: Want to subsidize onboarding transactions or introduce loyalty discounts? Programmable sequencers make it possible to implement these policies at the protocol level.

- Bespoke Incentives: Chains can design incentive mechanisms directly within their sequencer contracts, rewarding certain behaviors or penalizing spam, in ways that align with their community’s goals.

This level of customization isn’t just theoretical; it’s already being put into practice by leading projects in the modular blockchain space. For a deeper dive into the technical underpinnings of programmable sequencing, check out our guide on how programmable on-chain sequencers enable custom fee markets for app-chains in 2025.

Navigating Tradeoffs: Challenges Facing Custom Sequencer Design

No innovation comes without tradeoffs. While specialized sequencers unlock powerful new capabilities for application-specific blockchains, they also introduce fresh challenges:

- Liquidity Fragmentation: Splitting activity across many custom chains can dilute liquidity pools compared to larger shared networks.

- Infrastructure Overhead: Running dedicated sequencing infrastructure demands additional technical expertise and resources from development teams.

- Centralization Risks: If not properly decentralized or governed, custom sequencers could become single points of failure, undermining trust in an otherwise decentralized protocol.

The most successful projects are those that strike a balance between bespoke control and robust decentralization, often by leveraging open-source frameworks for auditable governance and upgradable logic within their sequencing contracts. For more insights on designing resilient fee markets with programmable infrastructure, see our article on how programmable sequencer contracts enable custom fee markets on app-chains.

As the landscape matures, we’re seeing custom app-chains move beyond experimentation and into production environments that demand both performance and fairness. The ability to iterate on fee market design at the application level is driving a new generation of decentralized services that can adapt rapidly to user needs and evolving market conditions.

Real-World Use Cases for Programmable Sequencers in 2025

-

Syndicate App-Chain Platform: Enables DeFi projects to create custom fee markets and programmable transaction ordering, reducing MEV risks and aligning incentives with user needs.

-

Chainlink Runtime Environment (CRE): Empowers data marketplaces and DeFi protocols to implement on-chain programmable sequencing for secure, fair transaction processing and dynamic fee models.

-

Immutable zkEVM App-Chains: Used in gaming, these chains leverage specialized sequencers for atomic transaction bundles, ensuring low-latency gameplay and efficient in-game asset trading.

-

Polygon CDK (Chain Development Kit): Allows developers to deploy custom app-chains with programmable sequencers, supporting DeFi, NFT, and gaming apps with flexible fee and block ordering logic.

-

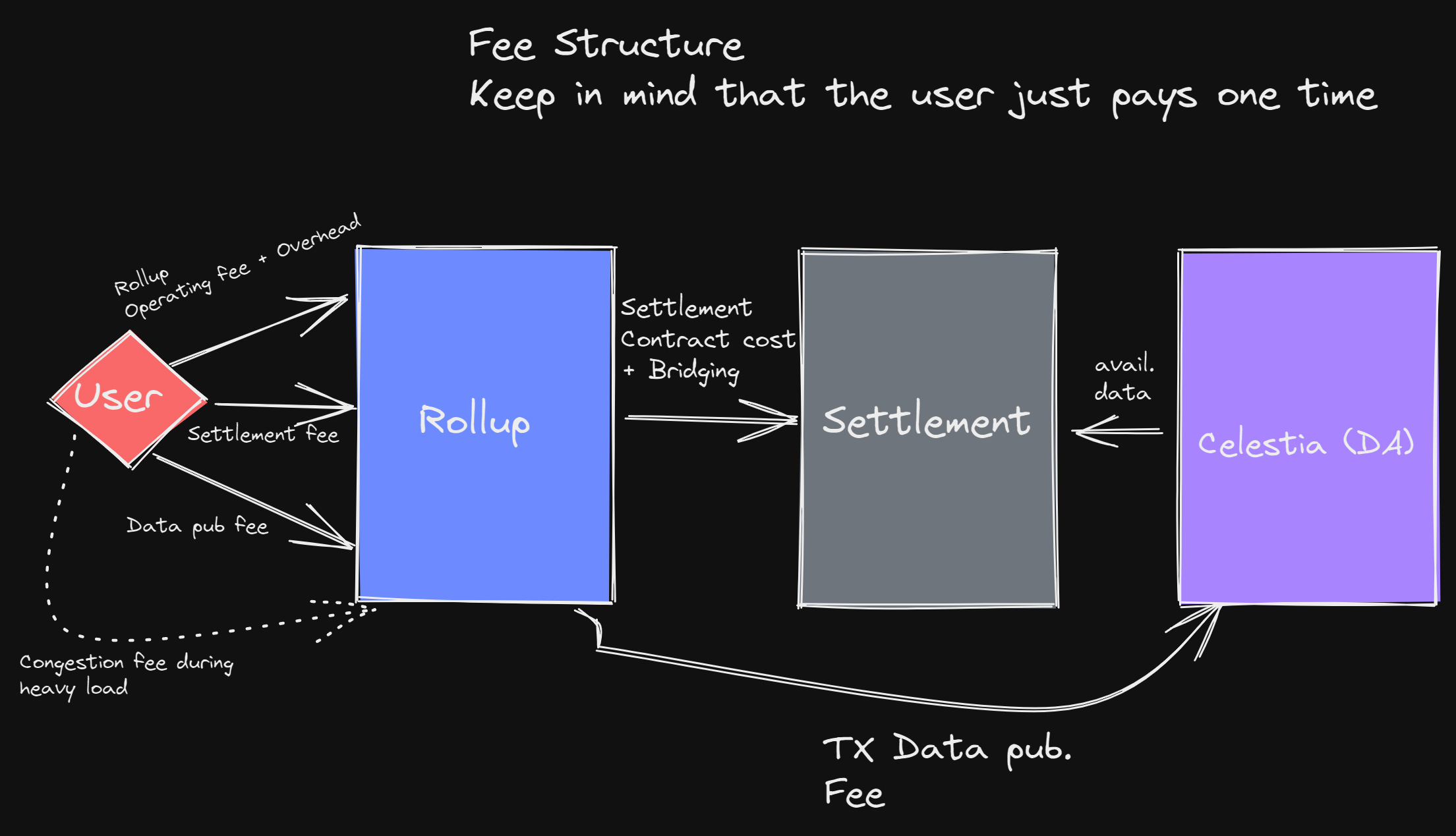

Celestia Modular App-Chains: Data marketplaces build on Celestia use programmable sequencers to optimize data availability, transaction fees, and fair ordering across independent chains.

Emerging Patterns: Modular Fee Markets and Cross-Chain Coordination

One of the most compelling trends for 2025 is the rise of modular fee markets, where app-chains not only tailor their own economics but also coordinate with other chains for liquidity sharing and atomic composability. Programmable sequencers are central to this vision, enabling:

- Dynamic pricing models that adjust fees based on real-time demand, congestion, or even off-chain signals.

- Interoperable incentives, allowing users to earn rewards or discounts across multiple app-chains connected by shared sequencer logic.

- Composability between rollups, so transactions can move seamlessly, and cost-effectively, across ecosystems without being bottlenecked by legacy fee structures.

This shift is especially relevant as protocols like Syndicate and Chainlink’s Runtime Environment facilitate cross-chain applications where custom fee logic follows the user, not just the chain. For technical architects, this means designing with both local optimization and network-wide coordination in mind. To explore practical approaches to dynamic fee markets powering scalable custom app-chains, visit our resource on how dynamic fee markets power scalable custom app-chains.

Best Practices for Developers: Building Fair and Efficient Fee Markets in 2025

If you’re architecting a new app-chain or considering a migration from shared blockspace, here are some guiding principles:

- Prioritize transparency: Make sequencing rules and fee logic auditable by users and third parties.

- Design for upgradeability: Use modular contracts so economic policies can evolve without disrupting core operations.

- Pursue decentralization: Implement multi-party sequencer models or rotating committees to reduce single points of failure.

- Monitor user experience: Continuously test how changes in sequencing impact transaction costs, confirmation times, and overall satisfaction.

The future belongs to chains that treat their fee market as a living protocol layer, one that can be tuned for growth, fairness, or innovation as circumstances dictate. The days of static gas auctions are numbered; what comes next will be more flexible, more transparent, and fundamentally more aligned with community values.