Ethereum’s Layer 2 landscape in 2025 is a mosaic of innovation and fragmentation. While rollups have delivered dramatic gains in throughput and cost reduction, the trade-off has been a splintered ecosystem, where liquidity, user experience, and composability are hampered by siloed execution environments. Enter shared sequencers: a new class of infrastructure that is rapidly becoming the connective tissue for cross-chain app-chains and modular blockchain fee markets.

Why Rollup Fragmentation Became the Bottleneck

Rollups, whether optimistic or zk-based, were engineered to offload computation from Ethereum’s mainnet, slashing fees and scaling dApps. But as each rollup evolved independently, two core problems crystallized:

- Liquidity Fragmentation: Assets became trapped on isolated rollups, making cross-chain trading clunky and reducing the depth of any single liquidity pool.

- Composability Breakdown: The dream of Lego-like dApp interoperability faded as protocols couldn’t execute atomic operations across chains without complex bridges.

This was more than a technical inconvenience; it was an existential threat to the vision of permissionless innovation. As noted by projects like Espresso Systems and research from T3RN, developers began to prioritize composability over raw speed, searching for ways to restore seamless interactions between rollups.

The Rise of Shared Sequencers: A Modular Solution

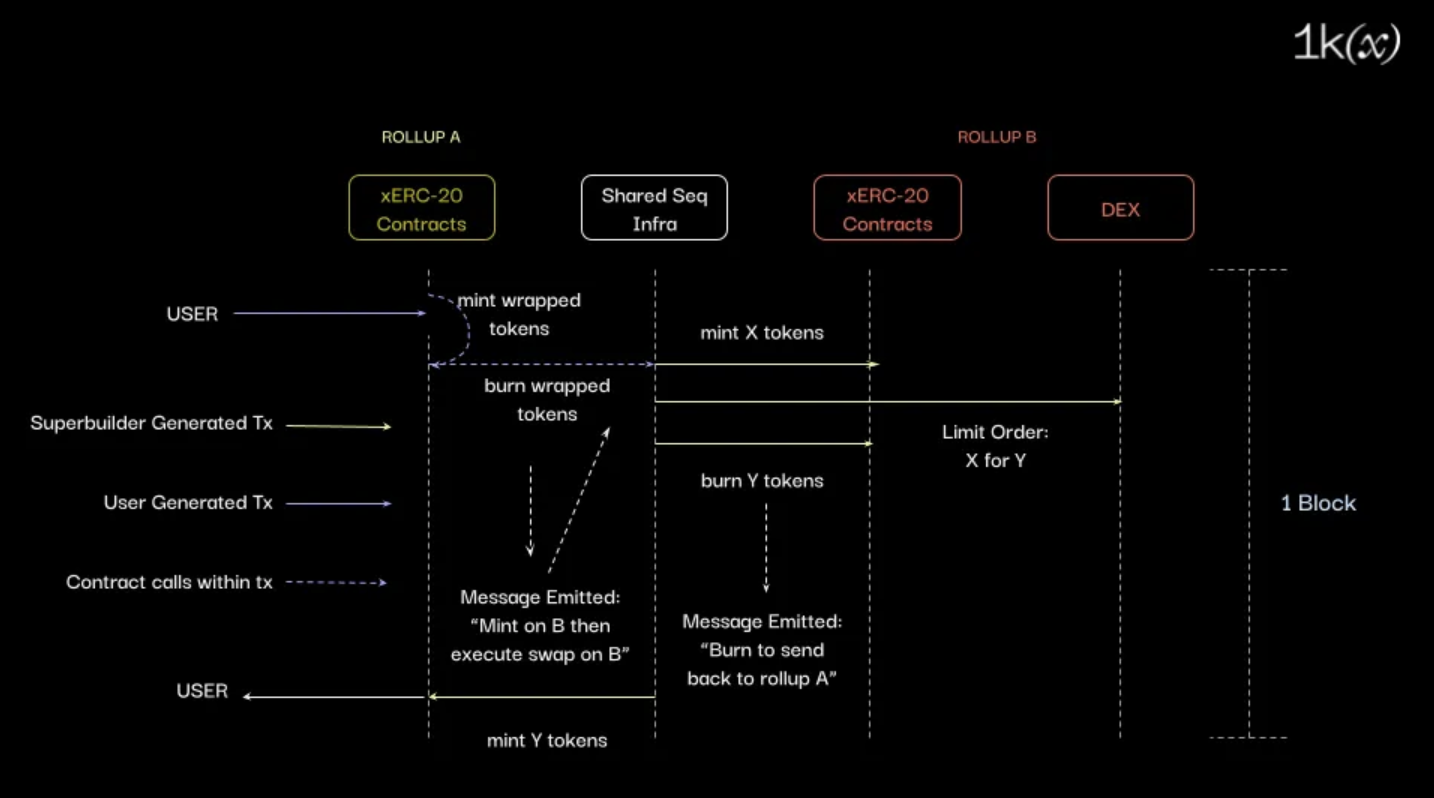

A shared sequencer is a decentralized network that provides transaction ordering services for multiple rollups simultaneously. Instead of each rollup relying on its own isolated sequencer (which can become a centralization risk or liveness bottleneck), shared sequencers offer:

- Synchronous Transaction Ordering: Enabling atomic cross-rollup trades by sequencing transactions across chains in real time.

- Unified Liquidity Pools: Breaking down silos so that capital can flow freely between dApps on different L2s.

- Censorship Resistance and Decentralization: Distributing sequencing power among many actors reduces the risk of manipulation or downtime.

This architecture not only addresses fragmentation but also unlocks new design space for app-chains with specialized fee markets, a critical trend as projects seek to differentiate their economic models in an increasingly modular stack. For a deep dive into how these networks function under the hood, see this analysis at Superchain Thesis.

The Espresso Effect: Real-World Progress in Cross-Chain Composability

No conversation about shared sequencer rollups is complete without mentioning Espresso Systems. Their approach aggregates interoperability clusters with a shared sequencing layer, enabling what they call “fully synchronous composability. ” This means dApps can now perform complex operations, like flash loans or swaps, that interact with contracts on several L2s in one atomic action, all without requiring users to manually bridge assets or wait for slow confirmations.

The impact? Projects plugging into solutions like Espresso benefit from near-instant confirmations and improved capital efficiency as liquidity pools are no longer fragmented by chain boundaries. According to recent research from Superchain Thesis (see here for details), these architectures are already transforming how DeFi protocols think about scalability and user experience in 2025.

Pushing the Boundaries: What Shared Sequencer Networks Enable Next

The integration of shared sequencing isn’t just solving old pain points, it’s opening up entirely new possibilities for custom app-chains:

- Cross-Rollup Atomicity: DeFi protocols can guarantee settlement across L2s without trust assumptions or third-party bridges.

- Diverse Fee Markets: Developers can experiment with novel fee structures tailored to their application’s needs while still benefiting from unified infrastructure.

- User-Centric Experiences: End-users interact with multi-chain dApps as if they’re using a single chain, no more hopping between wallets or paying double gas fees.

But as with any foundational shift, the evolution of shared sequencer rollups brings new design questions to the fore. The most pressing: how do we ensure that these networks remain credibly neutral, performant, and resistant to both economic and technical attacks?

Navigating the Challenges: MEV, Governance, and Latency

One major area of active research is cross-rollup MEV (Miner Extractable Value). By aggregating transaction ordering, shared sequencers can reduce isolated MEV opportunities on individual rollups, but they also create a new surface for cross-chain value extraction. Protocol designers are exploring solutions ranging from cryptographic fairness proofs to auction-based sequencing rights that align incentives across participants. For a nuanced breakdown of these tradeoffs, check out this thought piece at Abstract Watch.

Governance is equally critical. Who gets to run a shared sequencer? How are upgrades coordinated when multiple rollups depend on the same infrastructure? Some projects are experimenting with DAO-based models or staking requirements to balance openness with security.

Latency remains a technical hurdle. Coordinating transaction ordering across many chains can introduce delays, especially if consensus protocols aren’t optimized for speed and liveness. However, real-world deployments in 2025 show that with careful engineering, sub-second finality is achievable even in complex multi-rollup environments.

Where Does This Leave Modular Blockchain Fee Markets?

The emergence of shared sequencer rollups is catalyzing experimentation in modular blockchain fee markets. App-chain builders can now design custom fee mechanisms, think dynamic pricing for high-priority transactions or application-specific subsidies, without sacrificing interoperability or liquidity depth. This flexibility is already attracting DeFi platforms, NFT marketplaces, and gaming projects looking to differentiate their user experience while still tapping into the security and composability of the broader Ethereum ecosystem.

If you’re building an app-chain in 2025, integrating with a shared sequencer isn’t just about solving fragmentation, it’s about unlocking new business models and user journeys that were previously impossible in siloed L2 architectures. For more on how these ecosystems are evolving, see this deep dive at Superchain Thesis.

The Road Ahead: Interoperable App-Chains as the New Standard

The trajectory is clear: by breaking down barriers between rollups and enabling atomic cross-chain operations, shared sequencers are setting the foundation for a new era of cross-chain app-chains. As standards like ERC-7683 gain traction and more projects adopt frameworks like Espresso’s synchronous composability clusters, expect to see:

- Frictionless dApp experiences: Users won’t need to know, or care, what chain they’re interacting with under the hood.

- Diversified economic models: Builders can innovate on fee structures without compromising access to unified liquidity.

- A more resilient ecosystem: Decentralized sequencing reduces single points of failure and censorship risk across modular stacks.

If you’re serious about building scalable rollup architecture in 2025, or just want to future-proof your DeFi protocol, now’s the time to explore what shared sequencing can do for you. The superchain era isn’t coming; it’s already here, and it’s redefining what’s possible for developers who dare to build beyond silos.