Ethereum’s Layer 2 landscape is undergoing a radical transformation in 2025. The focus has decisively shifted from raw throughput to cross-chain composability and atomic execution between rollups. With Ethereum (ETH) priced at $2,837.38 as of this writing, the ecosystem’s value proposition is increasingly tied to how seamlessly liquidity and state can move across application-specific rollups and modular app-chains.

Why Shared Sequencers Are the Missing Link for Rollup Interoperability

Historically, each Ethereum rollup operated with its own dedicated sequencer. This siloed approach led to fragmented liquidity, inconsistent transaction ordering, and persistent interoperability headaches. Developers faced trade-offs between speed, decentralization, and user experience, often settling for centralized sequencers that exposed users to censorship risk and single points of failure.

Shared sequencers are emerging as the unifying infrastructure layer that coordinates transaction ordering across multiple rollups. By providing a neutral, decentralized ordering mechanism, shared sequencers enable:

- Synchronous state visibility: Rollups can see each other’s latest state within the same block interval.

- Atomic cross-rollup transactions: Users can execute complex interactions spanning multiple rollups with guaranteed inclusion or revert.

- MEV minimization: Coordinated sequencing reduces opportunities for cross-rollup MEV extraction and mitigates latency arbitrage.

- Censorship resistance: Decentralized sequencing networks eliminate single points of control over transaction inclusion.

This design paradigm is being rapidly adopted by leading projects like Espresso Systems, Astria, Movement Labs’ M1 network, and Rome Protocol. Each brings unique approaches to consensus, execution separation, and interoperability guarantees, but all converge on a shared goal: making Ethereum rollups work together like one seamless chain.

The Architecture: How Shared Sequencing Networks Actually Work

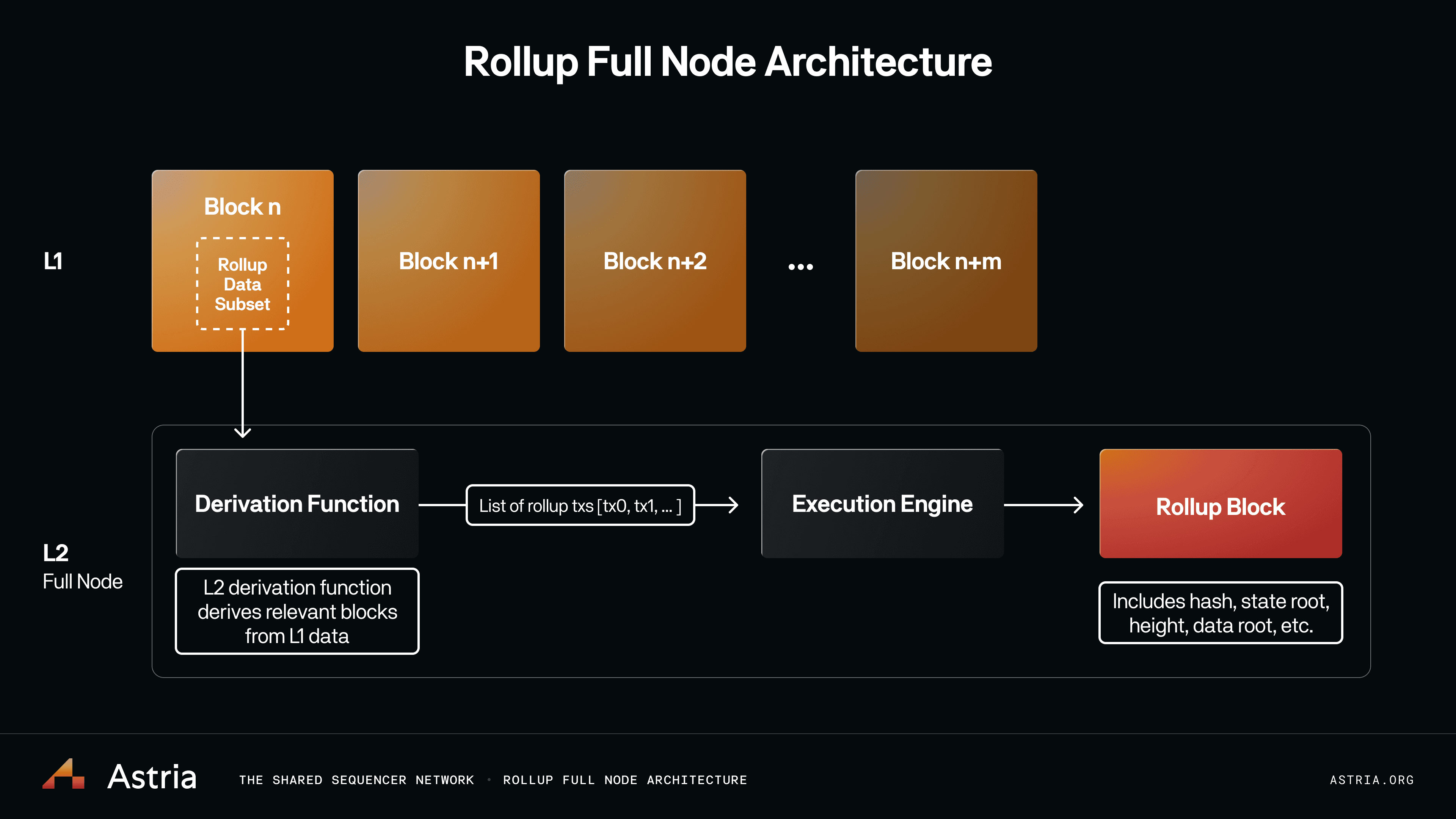

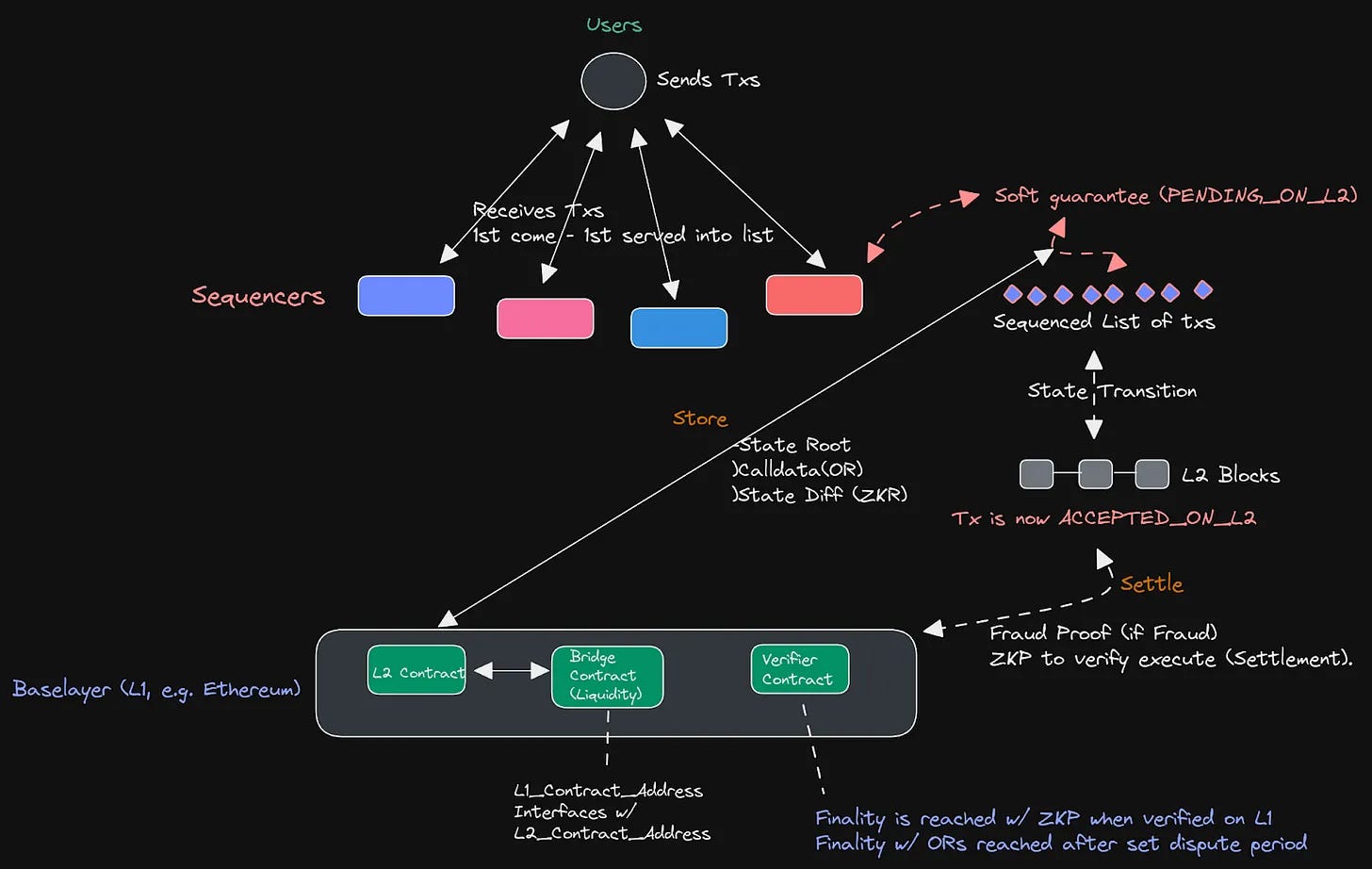

A shared sequencer network sits between the user-facing dApps and the underlying data availability layers (e. g. , Ethereum mainnet or modular DA chains). Here’s how it typically operates:

- User submits transactions to their chosen rollup (e. g. , an app-chain optimized for DeFi or gaming).

- The shared sequencer receives transactions from multiple rollups simultaneously, batching them into a single canonical order.

- This ordered batch is then committed to the data availability layer for settlement; individual rollups later execute their relevant transactions based on this global ordering.

- If a user’s transaction involves multiple rollups (e. g. , swapping assets across two chains), the shared sequencer ensures atomic inclusion, either all legs are included in the same batch or none are.

This architecture enables true synchronous composability, where complex protocols like cross-chain DEXes or multi-rollup lending platforms can operate without trust assumptions about bridges or off-chain relayers. For technical deep dives on implementation patterns and trade-offs, see this detailed guide on atomic cross-rollup trades in OP Stack ecosystems.

Pioneering Projects: Astria, Movement M1 and Rome Protocol Lead the Charge in 2025

The competition among shared sequencing networks is heating up:

- Astria’s Shared Sequencer Network: Astria provides decentralized sequencing with fast finality while allowing individual rollups to retain sovereignty over execution. Its “lazy sequencer” model guarantees atomic inclusion but not execution, highlighting an open challenge for synchronous messaging protocols.

- Movement M1: By decoupling ordering from execution and leveraging Byzantine Fault Tolerance consensus, Movement M1 enables high-throughput atomic composability across diverse execution environments, all without sacrificing decentralization or liveness guarantees.

- Rome Protocol on Solana: Taking a novel approach by deploying its shared sequencer atop Solana’s high-performance blockchain, Rome Protocol addresses liquidity fragmentation among Ethereum L2s while supporting real-time cross-rollup arbitrage strategies.

The impact? Developers can now build custom app-chains with specialized fee markets, optimizing gas economics while benefiting from unified access to global liquidity pools. This marks a fundamental shift away from isolated scaling solutions toward an interoperable mesh of application-specific blockchains on Ethereum’s backbone.

However, the transition to shared sequencer architectures is not without trade-offs. Atomic execution guarantees remain a significant technical hurdle. While most current shared sequencers can ensure atomic inclusion: meaning a cross-rollup transaction is either included everywhere or nowhere, they cannot yet guarantee atomic execution. In practice, this means that while state updates are coordinated, actual execution could still diverge due to differences in rollup logic or lags in block processing. This limitation is especially relevant for use cases like multi-chain liquidations or real-time arbitrage, where even minor inconsistencies can introduce risk and complexity.

Managing cross-rollup MEV (Maximum Extractable Value) is another pressing challenge. As rollups become more interconnected, the surface area for MEV extraction expands, potentially introducing new vectors for latency arbitrage and partial execution attacks. Shared sequencer networks must incorporate robust MEV minimization strategies, such as fair ordering protocols and transparent auction mechanisms, to maintain trust and efficiency across the ecosystem. Projects like Espresso Systems are pioneering these efforts by integrating advanced cryptographic techniques and open participation models into their sequencing layers.

The push toward full decentralization is also ongoing. While shared sequencer networks like Astria and Movement M1 are making strides towards eliminating single points of failure, reaching full censorship resistance at scale remains a moving target. Decentralized validator sets, permissionless participation, and on-chain governance are all critical components of this evolution, but each introduces new vectors for coordination risk and protocol-level attacks that must be addressed through rigorous testing and iterative upgrades.

What This Means for Developers and App-Chain Architects

The rise of shared sequencers fundamentally changes how application-specific chains (app-chains) are designed on Ethereum in 2025. Developers can now:

- Simplify cross-chain UX: Build dApps that abstract away bridging friction, letting users interact with multiple rollups as if they were a single chain.

- Create specialized fee markets: Tailor gas pricing models to unique app-chain economics while still tapping into global liquidity via shared sequencing.

- Design atomic protocols: Implement complex DeFi primitives, like multi-collateral lending or cross-rollup DEXes, that require synchronous state visibility across chains.

- Avoid centralization risks: Leverage decentralized sequencing to reduce exposure to censorship or downtime from centralized operators.

This paradigm shift is already spurring innovation across DeFi, gaming, payments, and beyond. For example, developers are experimenting with new forms of programmable liquidity routing that leverage atomic inclusion guarantees from shared sequencers, unlocking capital efficiency previously impossible with isolated rollup stacks.

Looking Ahead: The Expansion Window for Rollups in 2025,2026

The next year will be pivotal as projects like Espresso Systems expand their footprint across the Ethereum superchain landscape. With ETH holding strong at $2,837.38, the economic incentives for composable app-chains have never been higher. Expect to see an explosion of custom rollups leveraging unified sequencing layers, not just for cost savings but to unlock entirely new application categories relying on seamless interoperability.

If you’re building in this space, or architecting your own custom app-chain, now is the time to dive deep into the mechanics of shared sequencing networks. For further technical breakdowns on how these systems solve fragmentation and unlock new fee market designs, see resources like this analysis on reducing costs through shared sequencing.

The bottom line: Shared sequencers are rapidly becoming the connective tissue that unifies Ethereum’s modular future, enabling not just lower transaction costs but entirely new levels of composability and economic coordination across app-chains. As research continues around atomic execution guarantees and MEV minimization at scale, expect 2025,2026 to mark the true expansion window where interoperable rollups move from theory into production reality.