In the bustling world of blockchain, where every transaction vies for a slice of limited blockspace, congestion has long been the silent killer of user experience. General-purpose chains like Ethereum pack diverse applications into shared infrastructure, sparking fierce competition that drives up fees and slows everything down. Enter custom rollups and app-chains: purpose-built blockchains that promise sovereignty over resources. But even here, without dedicated fee markets, spikes in one app’s demand can ripple across the network. By implementing isolated fee structures, developers can shield their app-chains from these storms, ensuring smooth scalability tailored to unique needs.

Think about prediction markets or DeFi protocols during hype cycles. On a monolithic chain, a viral event floods the mempool, jacking up gas fees for everyone. Syndicate. io nails this pain point, highlighting how their programmable rollups let single apps scale independently, ditching the shared fee chaos.

Breaking Free from the Noisy Neighbor Trap

Traditional networks operate on a single, global fee market where apps battle for priority. This setup works fine in low-demand times but crumbles under pressure, as seen in Ethereum’s past surges. Custom rollups flip the script by batching transactions off-chain and settling on a base layer, slashing baseline costs. Yet, to truly prevent custom rollups congestion prevention, you need app-chains fee isolation. Separate markets for resources like state writes, data availability, or bandwidth mean one app’s frenzy doesn’t hike costs elsewhere.

Solana’s push toward multi-dimensional fees offers a glimpse: by pricing compute, votes, and storage distinctly, they’ve boosted throughput without blanket price hikes. In app-chains, this evolves further, letting devs craft specialized fee structures rollups that match their app’s rhythm, be it high-frequency trading or sporadic NFT drops.

Unlocking Predictable Costs and Peak Performance

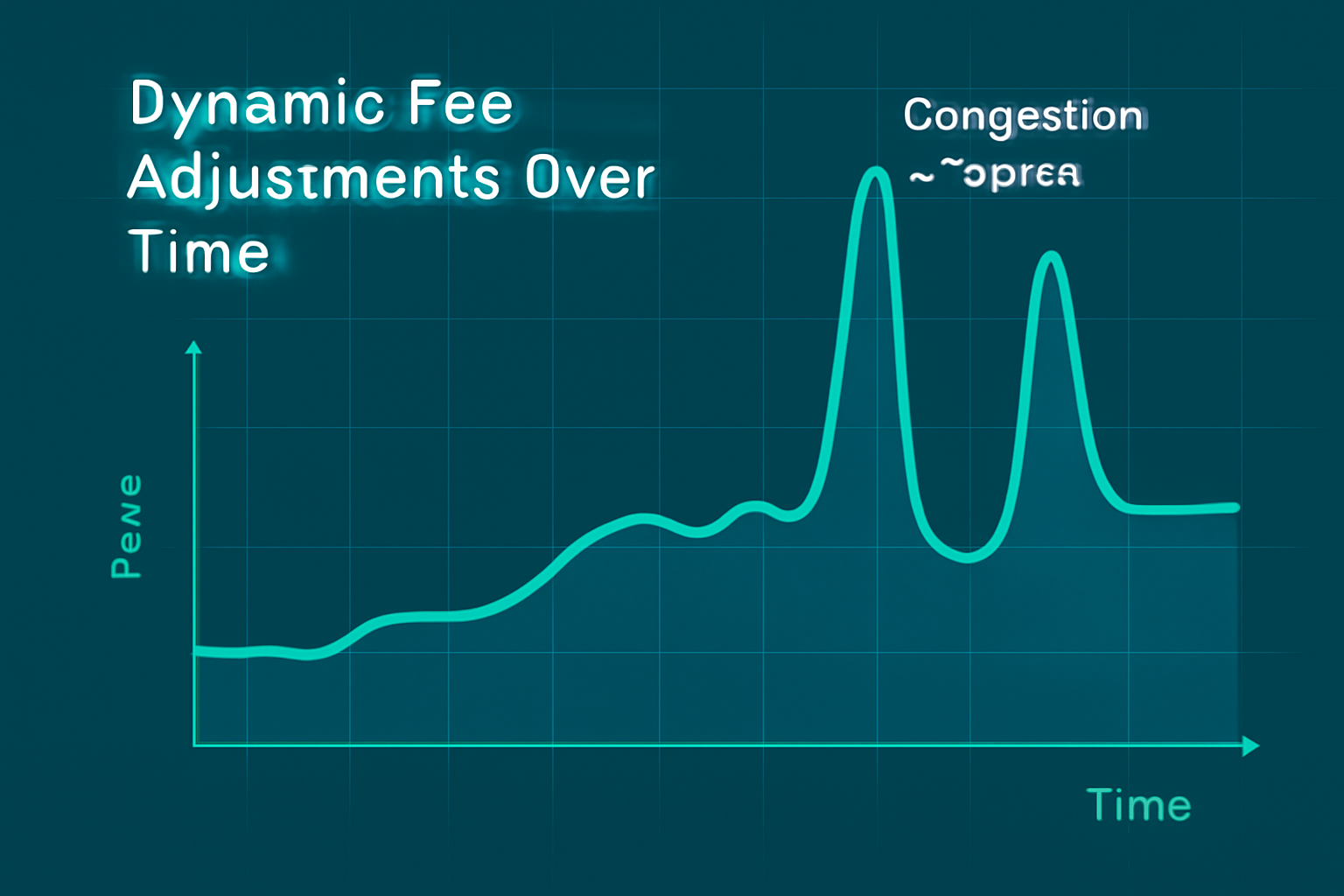

Dedicated fee markets aren’t just technical tweaks; they’re economic game-changers for blockchain app-chains scalability 2025. First off, predictability reigns. Dynamic adjustments based on real-time usage keep fees fair, avoiding the lottery-like bids of unified markets. Users plan better, devs forecast revenue streams more accurately.

Performance jumps too. Isolating demand nips the “noisy neighbor” issue in the bud, where one app’s traffic bogs down others. Ephemeral rollups on Solana exemplify this: they spin up for demand spikes, handle loads, then dissolve, all without stressing the main chain. AppChain’s payments rollup on Arbitrum Nitro hit a mind-blowing $0.0000017 average tx cost, proving dedicated setups deliver dirt-cheap, reliable ops.

Comparison of General-Purpose Chains vs. App-Chains with Dedicated Fee Markets

| Aspect | Shared Chains | Dedicated App-Chains |

|---|---|---|

| Fees | Unpredictable and high due to global fee market competition among all apps | Predictable with dynamic, app-specific adjustments (e.g., maker-taker models) |

| Congestion Handling | Suffers from ‘noisy neighbor’ problem; all apps compete for blockspace leading to delays | Isolated fee markets prevent cross-app interference and optimize resource allocation |

| Customization | Limited to chain-wide parameters; one-size-fits-all | Highly flexible; tailored multidimensional fees for bandwidth, computation, storage, etc. |

| Tx Cost Example | Volatile and often high during peaks (shared blockspace) | As low as $0.0000017 (e.g., AppChain’s dedicated payments rollup on Arbitrum Nitro) |

Customization shines brightest. Devs can roll out maker-taker models to reward liquidity providers or congestion-based tiers to throttle peaks gently. It’s opinionated design: why settle for EIP-1559’s blunt auctions when you can fine-tune for your app’s soul? This flexibility powers Syndicate’s metabased L3s, blending decentralization with value capture.

Crafting Your Fee Market Blueprint

Ready to build? Start by dissecting resources. Price bandwidth separately from computation; storage gets its own bucket. This granular approach, as detailed in guides on custom fee markets, lets you sidestep bottlenecks.

Next, wire in dynamic logic. Smart contracts monitor utilization, tweaking base fees or caps on the fly. For incentives, rebates for makers or priority queues for staked users align economics with behavior. I’ve seen teams iterate here, testing sims to balance throughput and revenue without overcomplicating the sequencer.

These simulations are crucial; one wrong calibration, and you risk idle capacity or endless backlogs that frustrate users. Layer in safeguards like fee caps or minimums to protect against edge cases, drawing from proven patterns in isolated fee markets.

Navigating Pitfalls in Fee Market Design

Implementation isn’t all smooth sails. Dynamic fees demand reliable oracles for usage data, or you invite manipulation risks. Sequencer centralization looms too, especially in early rollup stages where a single point controls ordering. My take: opt for decentralized sequencers from the start, like Syndicate’s atomically composable ones, to future-proof against MEV extraction. And don’t overlook user education; transparent fee breakdowns build loyalty in an ecosystem rife with black-box pricing.

Resource silos shine here. Separate compute from storage fees, and suddenly high-write DeFi doesn’t punish read-heavy games. Solana’s multi-dimensional model proves it, ramping bandwidth without compute spikes. For app-chains, this means prediction markets can subsidize oracle updates via dedicated pots, keeping scores cheap while data feeds stay funded.

Ephemeral rollups add elasticity. Picture a viral event: your appchain spins up a temporary chain, absorbs the flood at minimal cost, then merges back seamlessly. No permanent bloat, just elastic scale. zk. Link’s L3 traction underscores this, aggregating liquidity across chains while slashing DA fees below L2 levels.

Real-World Wins and Forward Momentum

AppChain’s Arbitrum Nitro rollup isn’t hype; that $0.0000017 tx cost handles global payments like cash, isolating fees to crush volatility. Syndicate’s prediction market appchain tackles sector limits head-on, with programmable sequencers enabling maker-taker dynamics that reward sharp traders. Meanwhile, metabased rollups foster community ownership, channeling fees into governance tokens for sustained decentralization.

Compare that to general-purpose chains: Ethereum’s shared mempool still sees MEV bots frontrunning retail during pumps. Dedicated setups flip power to apps, tailoring specialized fee structures rollups for niches. High-throughput gaming? Prioritize low-latency packets. SocialFi? Subsidize posts over heavy trades.

Looking ahead, blockchain app-chains scalability 2025 hinges on these innovations. As L3s proliferate, tools like Caldera’s rollup kits will democratize deployment, letting indie devs launch sovereign chains overnight. The “everyone gets a chain” era, as Dynamic Wallet puts it, customizes speeds and economics per app, ending the blockspace wars.

Teams I’ve advised swear by iterative A/B testing in testnets, blending dynamic auctions with fixed baselines for stability. It’s not set-it-and-forget-it; fee markets evolve with usage patterns. Embrace this, and your appchain won’t just avoid congestion, it becomes a beacon of efficiency in a crowded multi-chain landscape.