In the fast-evolving landscape of DeFi, where protocols handle thousands of transactions per second, general-purpose blockchains often buckle under pressure. High-throughput applications demand more: dedicated infrastructure that scales without compromise. Custom app-chains with dynamic fee markets emerge as the solution, offering DeFi app-chain optimization through tailored blockchains that prioritize performance over shared congestion. This approach, gaining traction in 2026 predictions, empowers protocols to control their destiny, from resource allocation to economic incentives.

Consider the limitations of monolithic Layer 1s or even optimistic rollups. Congested networks spike fees during peaks, frustrating users and stifling growth. Custom app-chains sidestep this by creating sovereign environments. Platforms like SKALE Network exemplify this, allowing developers to spin up app-specific chains with zero gas fees and instant finality. StrayShot, a real-time gaming dApp, leverages such a chain to manage dynamic in-game economies, amassing over 2 million unique active wallets while slashing costs.

Advantages of Dedicated App-Chains for Performance-Critical DeFi

Building custom app-chains unlocks dedicated resources, eliminating the bidding wars that plague Ethereum or Solana during hype cycles. This sovereignty translates to consistent throughput, vital for perpetuals trading or high-frequency lending where latency kills profitability. Developers gain full customization over consensus, governance, and even virtual machines, fostering innovation unbound by L1 constraints.

Zero-gas models, as seen in SKALE, remove friction for end-users, boosting adoption in DeFi where every basis point counts. Instant finality ensures trades settle without the anxious wait for confirmations, mirroring CeFi speed while upholding decentralization. In my analysis, this shift toward specialized blockchain fees positions protocols for sustainable growth, especially as RaaS markets project explosive expansion through 2032.

Dynamic Fee Markets: The Engine of Efficient Resource Allocation

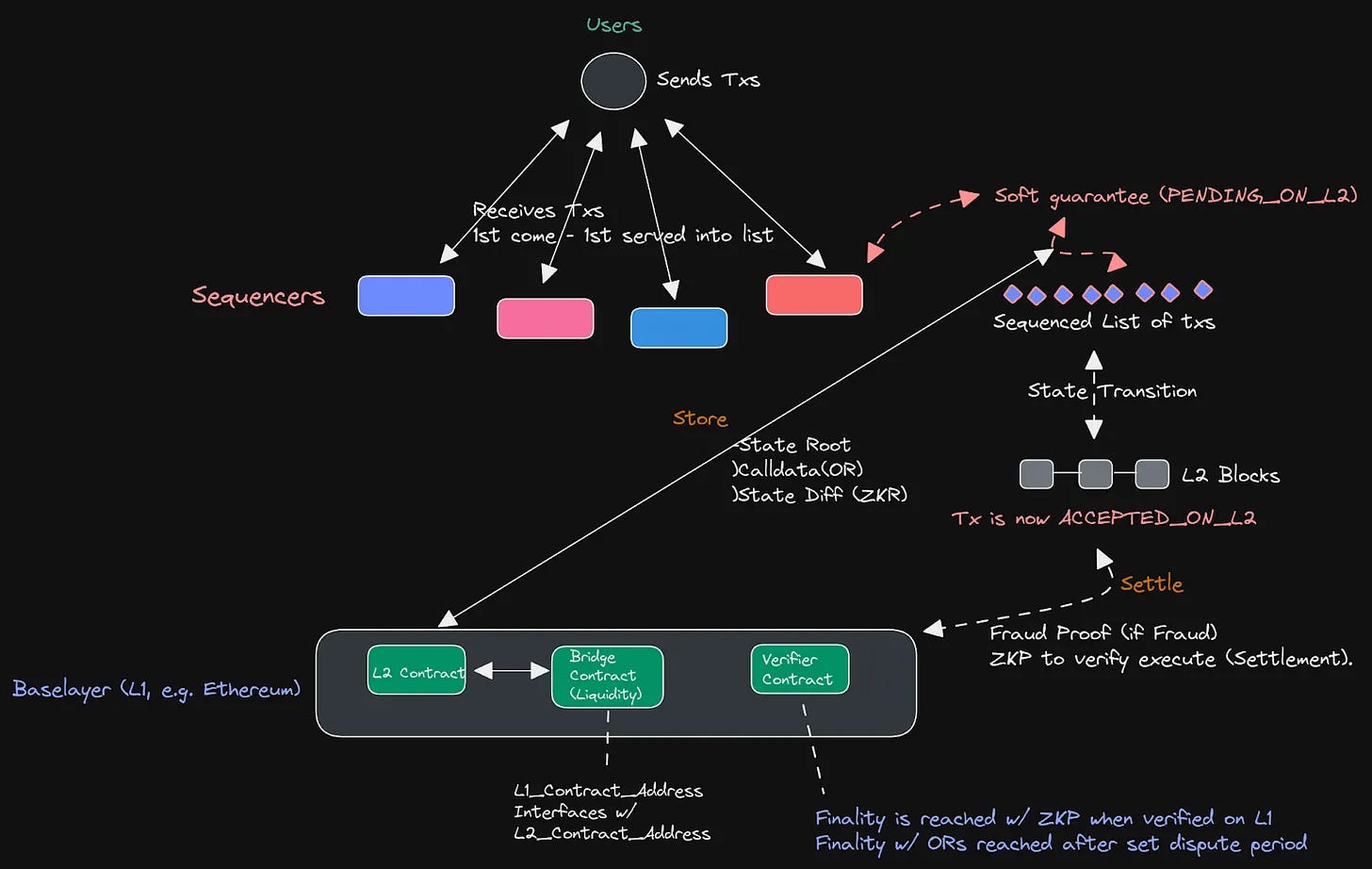

Static fees breed inefficiency; dynamic fee structures rollups adapt in real-time to demand. Ethereum’s EIP-1559 set the precedent with base fees that burn excess and adjust block fullness, creating predictable costs amid volatility. For custom app-chains, this evolves further: fees modulate based on utilization, prioritizing high-value transactions without blanket price hikes.

Read more on how dynamic fee markets power scalable custom app-chains. In high-throughput DeFi, such mechanisms prevent spam, reward sequencers fairly, and maintain low latency. Protocols can fine-tune curves to favor liquidity providers or arbitrageurs, aligning incentives with protocol health.

Emerging Design Patterns Shaping Custom App-Chain Fee Markets

Developers are pioneering patterns that make custom app-chains fee markets truly sophisticated. Local fee markets charge dynamically per account or program, letting hot modules price premium access while idle ones stay cheap. This granular control optimizes for DeFi composability, where a lending pool might subsidize low-risk borrows.

Universal fee abstraction lets users pay in any token, with relayers handling swaps and cross-chain routing. Dynamic swap fees on DEXes within app-chains adjust to volatility, curbing front-running and stabilizing pools. Sequencer auctions, akin to Solana’s Gulf Stream, let bidders vie for inclusion, ensuring MEV flows back to the protocol.

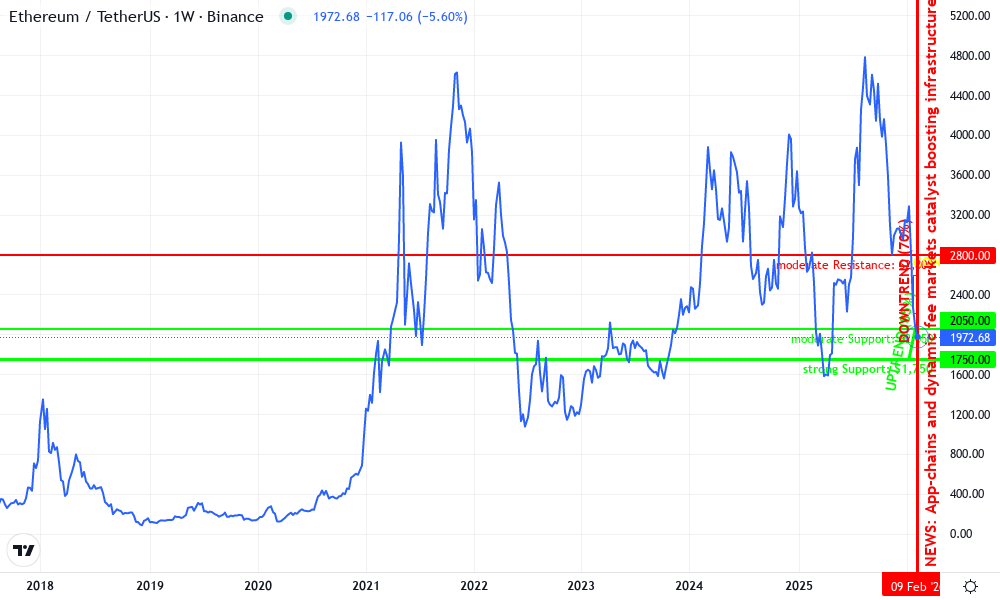

Ethereum Technical Analysis Chart

Analysis by Julia Reid | Symbol: BINANCE:ETHUSDT | Interval: 1W | Drawings: 7

Technical Analysis Summary

As Julia Reid, employ conservative markings emphasizing long-term fundamental strength amid short-term volatility. Initiate with a primary uptrend line (trend_line) connecting the January 2026 low at 1750 USDT (2026-01-15) to the early February swing low at 2050 USDT (2026-02-05), projecting support into late February. Overlay horizontal_lines at key support (1750, strong) and resistance (2800, moderate; 3500, weak historical). Mark a recent consolidation rectangle (rectangle) from 2026-02-01 to 2026-02-12, bounded by 2200-2600 USDT. Add fib_retracement from the 2026-01-15 low to 2026-02-10 high (1750-2800), highlighting 38.2% (2320) and 50% (2275) retracement zones for entries. Place arrow_mark_up at MACD bullish divergence near 2026-02-08, callout on declining volume pattern post-pullback, and vertical_line at 2026-02-12 for recent DeFi app-chain news catalyst. Entry zone: long above 2275 (low risk), stop below 1750, target 2800 then 3500. Use text annotations for fundamental context: ‘App-chains bolster ETH infrastructure; patience prevails.’

Risk Assessment: low

Analysis: Strong fundamentals from 2026 Web3 trends outweigh short-term volatility; conservative structure favors holders

Julia Reid’s Recommendation: Accumulate on dips above 2050, hold core position—patience for sustainable growth

Key Support & Resistance Levels

📈 Support Levels:

-

$1,750 – January capitulation low, volume spike confirmation; strong fundamental floor

strong -

$2,050 – February swing low, prior consolidation base

moderate

📉 Resistance Levels:

-

$2,800 – Recent February high, prior resistance test

moderate -

$3,500 – Psychological and historical extension target

weak

Trading Zones (low risk tolerance)

🎯 Entry Zones:

-

$2,275 – 50% Fib retracement of recent rally, MACD divergence alignment; conservative long entry

low risk -

$2,050 – Trendline support retest, low-risk dip buy if holds

medium risk

🚪 Exit Zones:

-

$2,800 – Initial profit target at recent high

💰 profit target -

$3,500 – Measured move extension

💰 profit target -

$1,750 – Below major support invalidates bullish thesis

🛡️ stop loss

Technical Indicators Analysis

📊 Volume Analysis:

Pattern: declining on pullback

Bearish price action met with shrinking volume, signaling exhaustion and potential reversal

📈 MACD Analysis:

Signal: bullish divergence

MACD line forming higher low while price tests lows, conservative buy signal emerging

Applied TradingView Drawing Utilities

This chart analysis utilizes the following professional drawing tools:

Disclaimer: This technical analysis by Julia Reid is for educational purposes only and should not be considered as financial advice.

Trading involves risk, and you should always do your own research before making investment decisions.

Past performance does not guarantee future results. The analysis reflects the author’s personal methodology and risk tolerance (low).

Osmosis and Arbitrum showcase these in action, blending low costs with rapid execution. For DeFi protocols eyeing rollup transaction cost reduction, integrating these patterns via RaaS like Zeeve accelerates deployment. The result? Systems that absorb complexity, as Forbes notes in DeFi’s maturation toward tighter coordination.

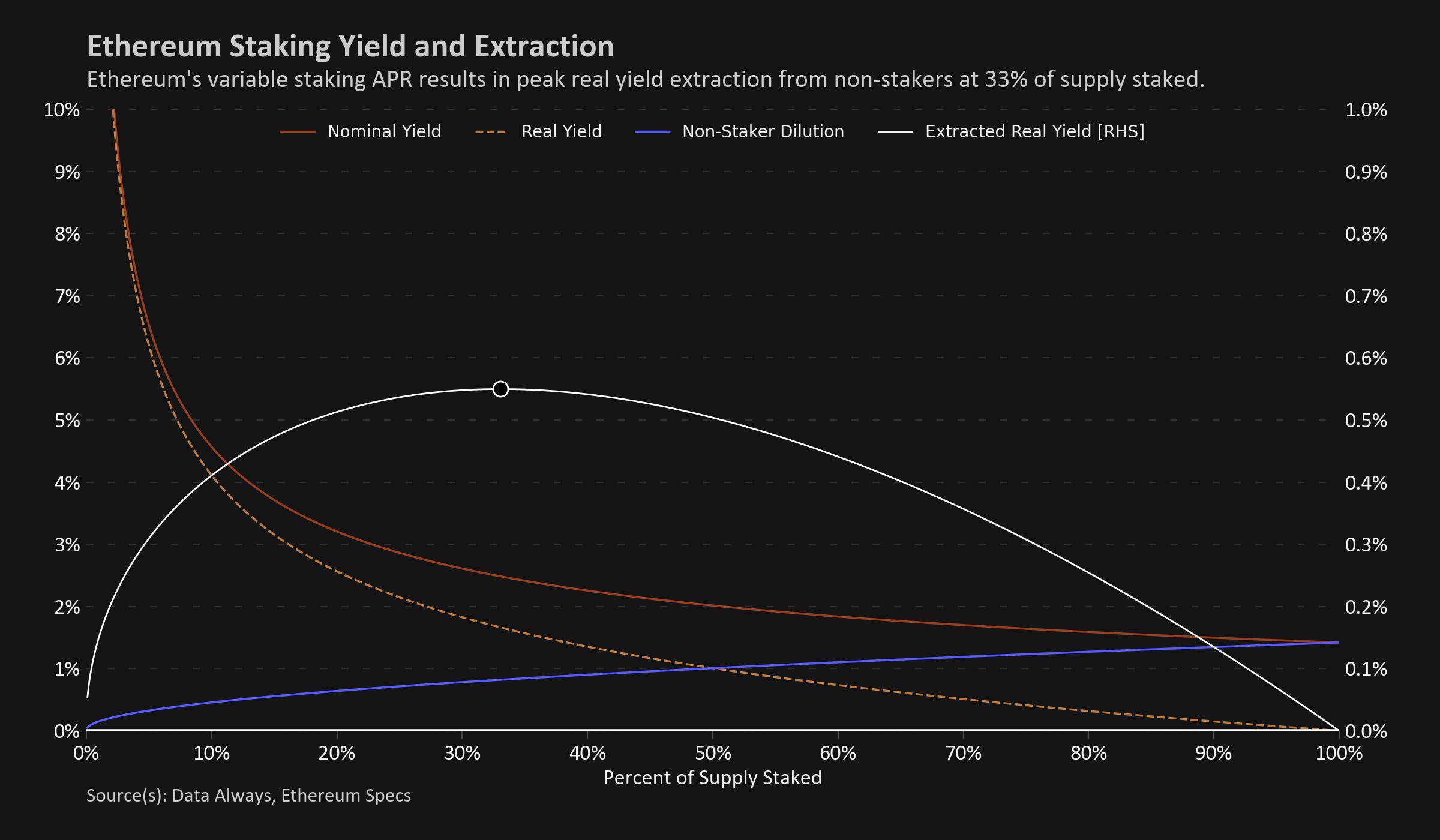

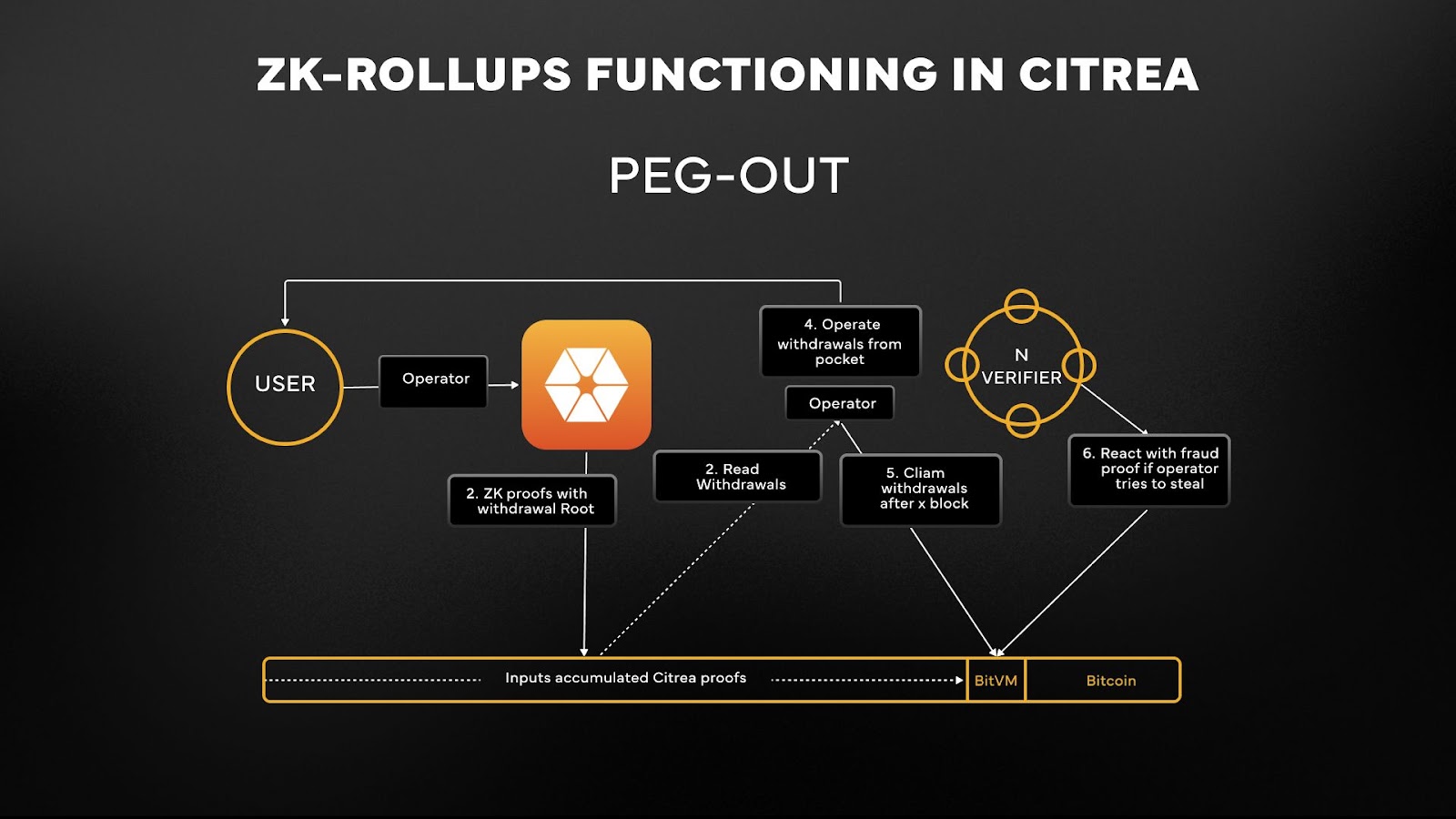

Privacy layers add another dimension; ZK-rollups with dynamic fees enable confidential high-throughput trades, aligning with 2026 trends. Yet, success hinges on economic design: capturing MEV internally sustains validators, fostering long-term viability.

Implementing these advanced fee mechanisms requires careful architecture, but the payoff in DeFi app-chain optimization is profound. Protocols must decide on sequencer models early: centralized for speed or decentralized for resilience. Hybrid approaches, blending auctions with priority queues, balance both, ensuring specialized blockchain fees reflect true resource costs without alienating retail users.

Step-by-Step Path to Launching Your High-Throughput App-Chain

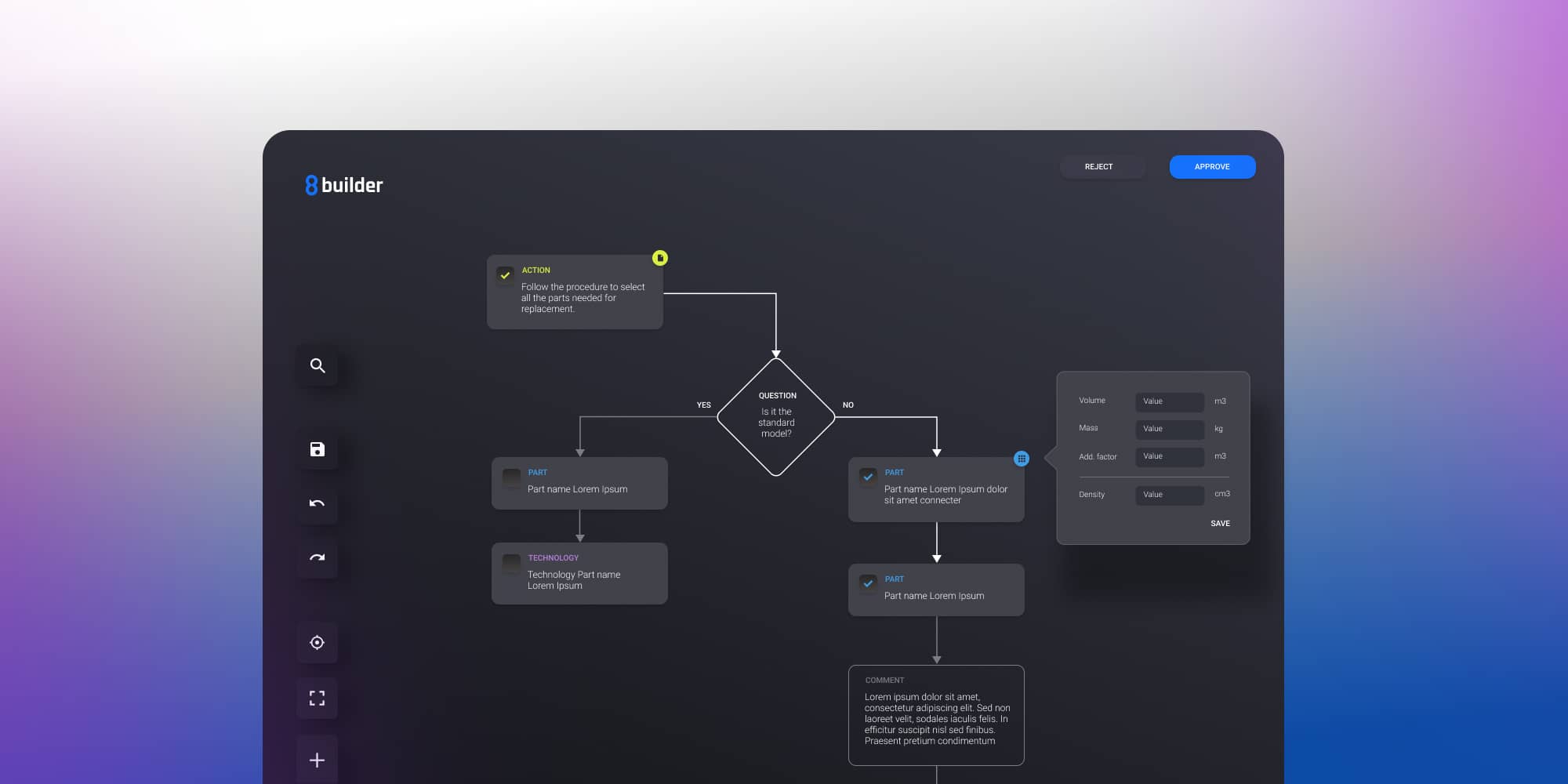

Key Steps for Custom App-Chains

-

1. Choose a RaaS ProviderSelect platforms like SKALE Network or Zeeve for deploying app-specific chains with dedicated resources, zero gas fees, and instant finality.

-

2. Define Dynamic Fee CurvesModel fees after EIP-1559 on Ethereum, enabling automatic base fee adjustments based on network demand for efficient block space allocation.

-

3. Implement Sequencer AuctionsSet up auctions where users bid for transaction inclusion, as seen in designs like Arbitrum or Solana, to handle high demand and low latency.

-

4. Integrate ZK Proofs for PrivacyIncorporate ZK-rollups or zkVMs to enable private transactions at scale, supporting privacy-preserving DeFi applications.

-

5. Test and Deploy with CustomizationCustomize consensus, governance, and MEV handling, then test for high throughput before launching your DeFi protocol.

Start with a Rollups-as-a-Service provider like Zeeve, which streamlines chain deployment for DeFi and payments. Define your fee curve using EIP-1559 inspired logic, where base fees rise with block utilization above 50%. Test under simulated load: inject 10,000 TPS bursts to validate latency stays under 100ms. Integrate MEV capture via local auctions, redistributing proceeds to stakers. This methodical build yields rollup transaction cost reduction of up to 90%, per industry benchmarks.

Customization extends to virtual machines. Tailor EVM forks for DeFi primitives, embedding native oracles to minimize external calls. Governance tokens can vote on fee parameters, creating adaptive markets that evolve with usage patterns. I’ve seen protocols falter here by overcomplicating; simplicity wins, focusing on three levers: base fee elasticity, tip incentives, and spam penalties.

Challenges persist. Cross-chain composability demands bridges with dynamic fees, lest silos form. Universal abstraction protocols mitigate this, swapping fees atomically across chains. Regulatory winds in 2026 favor utility-driven models, per Blockchain App Factory insights, rewarding chains with real economic loops over speculative hype.

Real-World Wins and Economic Edge in 2026 DeFi

StrayShot’s triumph underscores the model: 2 million wallets on a dedicated chain, fees reinvested into gameplay rewards. High-throughput DeFi protocols like perpetuals exchanges report 5x liquidity inflows post-migration, as predictable costs lure institutions. MEV, once a L1 plague, becomes a feature; app-chains auction bundles internally, slashing negative externalities and boosting validator yields.

Opinion: In a maturing DeFi landscape, as DL News observes, fragmented apps coalesce into systems. Custom app-chains with dynamic fee markets forge that unity, absorbing Ethereum’s complexity while delivering CeFi polish. Forward-thinkers integrate AI for predictive fee tuning, preempting congestion via ML-driven sequencer queues. Privacy via ZK-rollups seals the deal, enabling confidential strategies without performance drag.

Market data reinforces this: RaaS surges through 2032, fueled by modular designs. Top L2 tokens emphasize interoperability, but app-chains leap ahead with sovereignty. For developers, the edge lies in iteration; launch lean, measure utilization, tweak fees weekly. Patience here mirrors equity investing: compound small optimizations into dominance.

Read deeper into how to design custom fee markets for application-specific blockchains. Ultimately, these chains redefine scalability, turning DeFi from promise to powerhouse. Protocols embracing custom app-chains fee markets today position for tomorrow’s trillion-dollar flows, where throughput and efficiency dictate winners.