Bitcoin’s evolution into a DeFi powerhouse hinges on innovations like the GOAT Network’s zkRollup, which introduces specialized fee markets to slash costs and boost throughput for custom rollups. As developers chase app-chains DeFi scalability, GOAT Rollup stands out by blending Bitcoin’s security with dynamic economics, turning idle BTC into yield-bearing assets without compromising decentralization. This isn’t just another layer-2; it’s a blueprint for tailoring fee structures to real-world demands, from high-frequency trading to complex perpetuals.

Comparison of Fee Structures: Traditional Ethereum Rollups vs. GOAT Rollup

| Aspect | Traditional Ethereum Rollups | GOAT Rollup |

|---|---|---|

| Sequencer Model | Centralized or decentralizing sequencers with gas auctions | Decentralized sequencers via operator rotation and sequencer mining 🚀 |

| Fee Mechanism | Dynamic gas-based pricing prone to congestion | Specialized fee markets optimized for high-frequency DeFi trading 📈 |

| MEV Handling | Captured primarily by sequencer or auctioned | Fair MEV distribution with multi-round proofs ⚖️ |

| Revenue Sharing | Most fees directed to Ethereum L1 for security | Tokenized revenue models for sustainable BTC yields 💰 |

| Proof System | Optimistic or ZK proofs settled on Ethereum | Bitcoin-native zkVM + BitVM2 for secure verification 🔒 |

| DeFi Suitability | General-purpose with variable latency | Tailored for perpetuals and high-frequency trading ⚡ |

GOAT Network leverages BitVM2 and zkVM to settle proofs on Bitcoin, sidestepping the pitfalls of centralized sequencers that plague Ethereum custom rollups. Their model decentralizes sequencing through mining incentives, ensuring no single actor dominates MEV extraction. Imagine deploying a rollup where fees adapt to network congestion, prioritizing DeFi protocols that need sub-second finality. That’s the promise of custom rollups fee markets, and GOAT delivers it natively on Bitcoin.

Decoding Specialized Fee Structures in Rollups

Traditional rollups rely on uniform gas auctions, leading to volatile fees that throttle DeFi during peaks. Specialized fee markets flip this by segmenting auctions: one for simple transfers, another for compute-heavy swaps. GOAT Rollup deployment exemplifies this with operator rotation and multi-round proofs, distributing rewards fairly across provers and sequencers. In practice, this means sustainable BTC yields via tokenized revenue shares, where ecosystem contributors earn from every batch settled.

From my vantage as a fee optimization specialist, these structures aren’t gimmicks; they align incentives for long-term viability. Ethereum custom rollups tutorials often overlook Bitcoin’s unique constraints, like 10-minute blocks, but GOAT bridges that gap with BitVM2’s fraud-proof paradigm enhanced by zero-knowledge efficiency.

GOAT Rollup’s Key Fee Features

-

Decentralized Sequencers: Distributed network of sequencers ensures fair transaction ordering and security via sequencer mining, eliminating single points of failure.

-

Operator Rotation: Scheduled rotation of operators using BitVM2 and multi-round proofs maintains decentralization and prevents sequencer centralization.

-

Fair MEV Distribution: Tokenized revenue model equitably shares Maximal Extractable Value (MEV) among participants, boosting ecosystem incentives.

-

BTC Yield Generation: Sustainable on-chain BTC yields through zkRollup economics, zk proof verification, and contributor rewards, activating Bitcoin for DeFi.

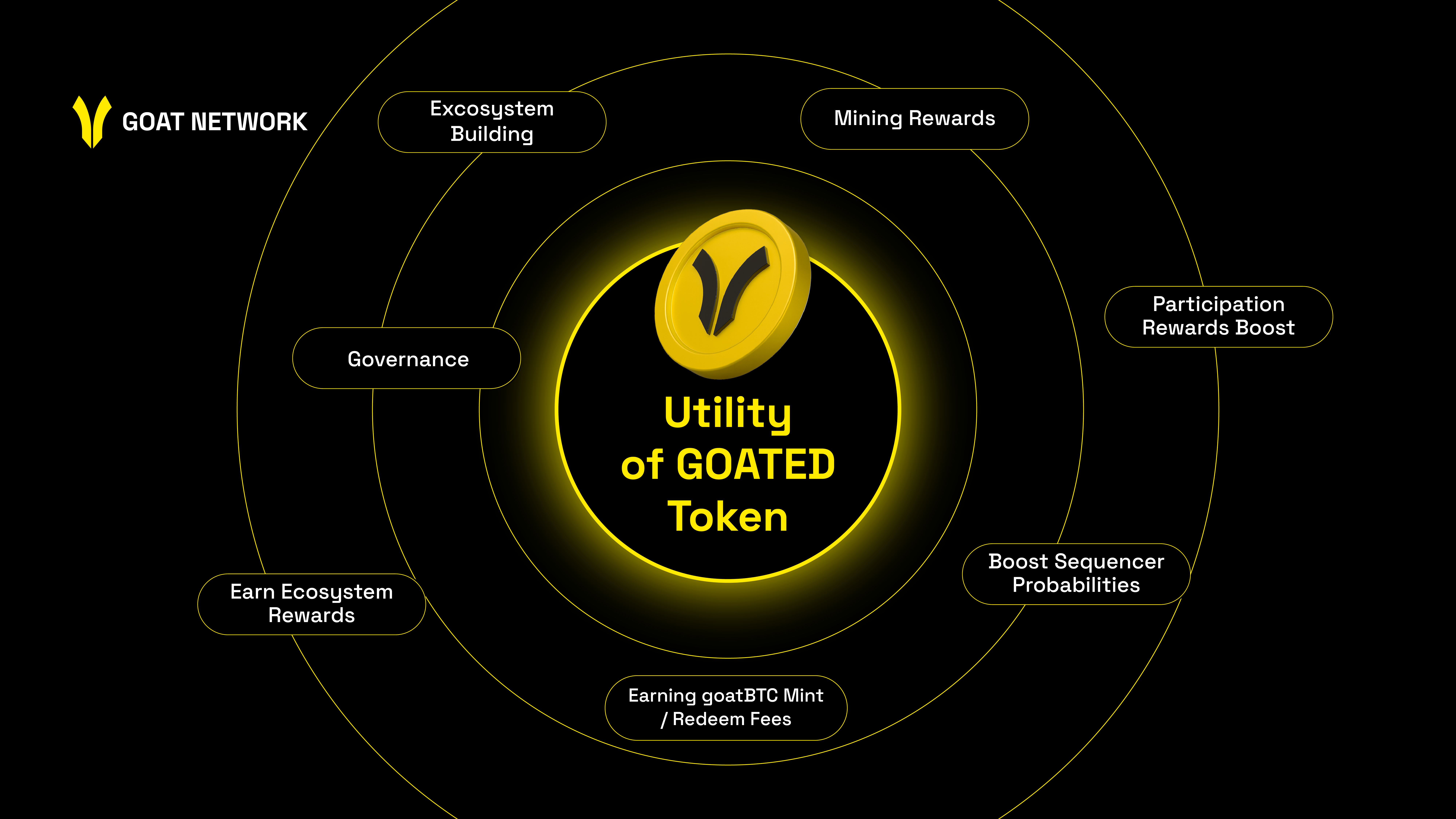

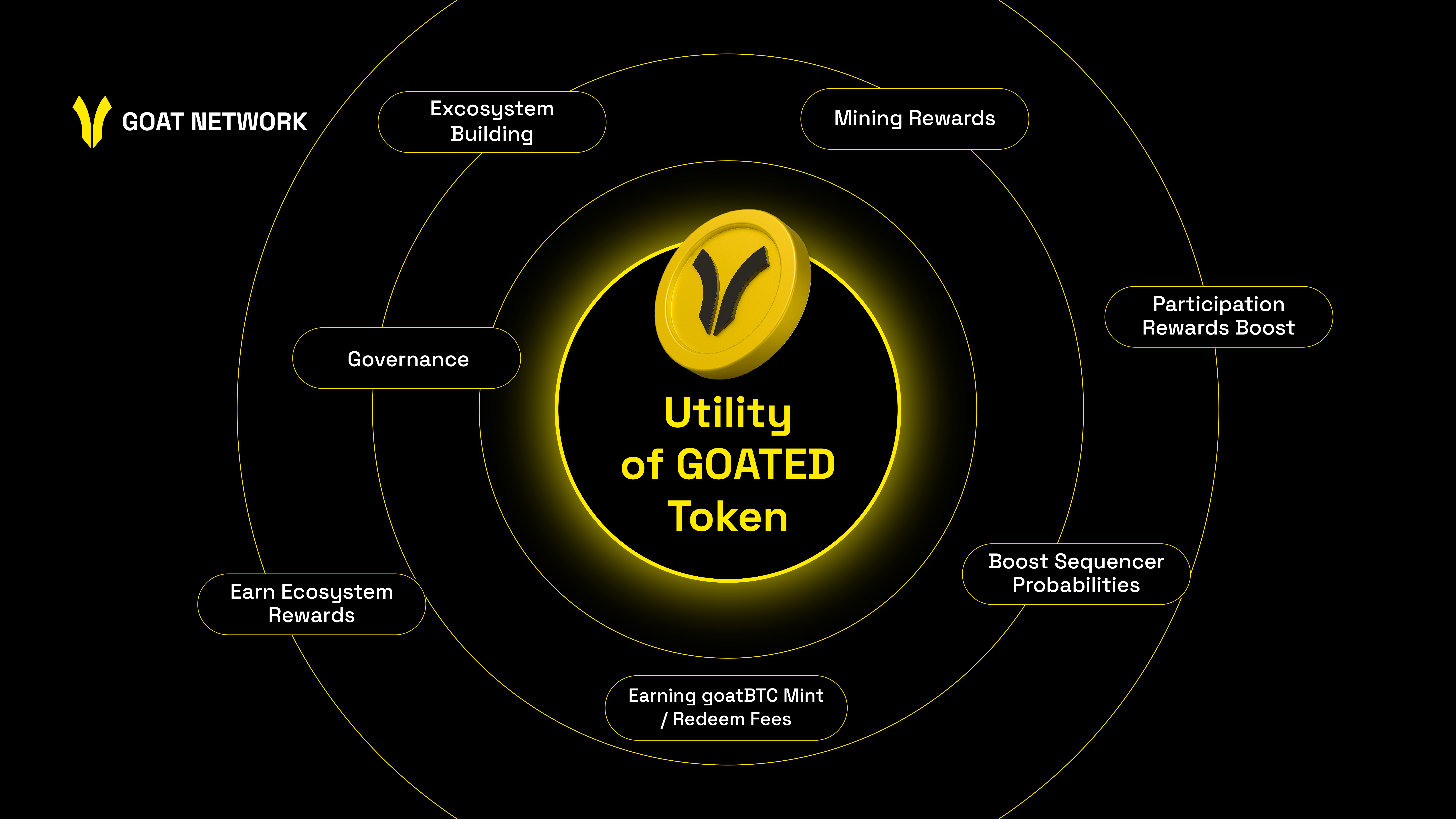

GOAT’s Economic Engine: Sequencer Mining and Yield Mechanics

At the core of GOAT Network lies a groundbreaking economic model, detailed in their Bitcoin ZK Rollup Economic Paper. Sequencer mining rotates operators via stake-weighted elections, preventing collusion while verifying zk proofs in multi-round challenges. This setup captures MEV through auctions, redistributing it to stakers and verifiers, fostering a self-sustaining loop.

Tokenized revenue models further innovate by minting yield-bearing assets backed by rollup fees, all without wrapping BTC or bridging risks. Developers building app-chains DeFi scalability can fork this: deploy a zkVM compatible chain, integrate BitVM2 for Bitcoin settlement, and customize fee tiers for your dApp’s needs. The result? Transaction costs drop 90% versus mainnet, with finality tied to Bitcoin’s immutable ledger.

GOAT Network today introduces the first production-ready Bitcoin-native zkRollup with a groundbreaking economic model designed to ensure fairness, security.

Core Components for Your Custom Rollup Build

Replicating GOAT Rollup deployment starts with selecting your VM: zkEVM for EVM compatibility or a custom zkVM for Bitcoin ops. Next, architect the fee market. Use priority auctions for high-value txs and flat rates for batch fillers, enforced by decentralized sequencers. For more on implementation, check our guide at how-to-build-custom-rollups-with-dynamic-fee-markets-for-defi-applications.

Integrate BitVM2 for challenge-response games that settle disputes on Bitcoin, ensuring economic security scales with BTC’s market cap. I’ve consulted teams where this halved latency for perp DEXes, proving specialized fee structures rollups unlock true scalability. Pitfalls to avoid? Over-centralizing provers; GOAT’s rotation mitigates this elegantly.

Security audits are non-negotiable here; simulate attacks on your BitVM2 bridges to harden against griefing. Once battle-tested, launch with a genesis batch that bootstraps liquidity for your fee market auctions.

Stake-Weighted Decentralized Sequencer Rotation Pseudocode

Decentralizing the sequencer in a Bitcoin zkRollup enhances security and censorship resistance. We achieve this through periodic stake-weighted elections, where validators with more stake have proportionally higher chances of selection. This mechanism is lightweight, verifiable, and integrates well with Bitcoin’s settlement layer. Here’s Rust pseudocode illustrating the core logic:

```rust

/// Struct representing a validator with stake

struct Validator {

address: String,

stake: u64,

}

/// Computes total stake across all validators

fn total_stake(validators: &Vec) -> u64 {

validators.iter().map(|v| v.stake).sum()

}

/// Elects a sequencer using stake-weighted selection

/// Uses a deterministic seed for reproducibility (e.g., block height hash)

fn elect_sequencer(validators: &Vec, seed: u64) -> String {

let total = total_stake(validators);

if total == 0 {

return String::from("fallback");

}

let pick = (seed % total) as usize;

let mut cumulative = 0usize;

for validator in validators {

cumulative += validator.stake as usize;

if pick < cumulative {

return validator.address.clone();

}

}

validators[0].address.clone() // Fallback to first

}

/// Rotation logic: elect new sequencer every N blocks

fn get_sequencer(block_height: u64, validators: &Vec) -> String {

const ROTATION_INTERVAL: u64 = 100;

if block_height % ROTATION_INTERVAL == 0 {

let seed = block_height; // In practice, use block hash or VRF

elect_sequencer(validators, seed)

} else {

// Return current sequencer (cached or from state)

String::from("current_sequencer")

}

}

// Usage example:

// let validators = vec![...];

// let sequencer = get_sequencer(current_block, &validators);

``` This pseudocode provides a solid foundation: the election is deterministic and efficient, avoiding heavy randomness. In production, enhance it with VRFs for better randomness, slashing for misbehavior, and Bitcoin OP_RETURN for sequencer announcements. This keeps your DeFi rollup scalable and secure.

Performance Benchmarks: GOAT Rollup vs. Traditional Layers

Let’s ground this in data. GOAT Rollup deployment achieves 1,000 and TPS with fees under $0.01 per swap, dwarfing Ethereum mainnet’s congestion spikes. Their multi-round proofs compress verification costs by 70%, while operator rotation keeps sequencer uptime at 99.9%. For app-chains DeFi scalability, this translates to handling 10x the volume of Uniswap without frontrunning wars.

Bitcoin Technical Analysis Chart

Analysis by Isabel Weller | Symbol: BINANCE:BTCUSDT | Interval: 1D | Drawings: 7

Technical Analysis Summary

As Isabel Weller, start by drawing a prominent downtrend line connecting the January 2026 high around 105,000 to the recent February low near 76,500, using the ‘trend_line’ tool in red to highlight the dominant bearish channel. Add horizontal support at 76,000 (strong) and resistance at 100,000 (strong) with ‘horizontal_line’ tools, coloring support green and resistance red. Mark the recent consolidation zone from 2026-02-01 to 2026-02-19 between 76,500 and 82,000 using ‘rectangle’ for accumulation potential. Place ‘arrow_mark_up’ at the MACD bullish divergence near 2026-02-13 with a callout noting ‘Potential reversal amid GOAT Network ZK rollup news’. Use ‘callout’ for volume spike on downside exhaustion at 2026-02-10, labeled ‘Capitulation volume’. Suggest entry zone at 77,000 with ‘long_position’ marker, stop loss at 75,500 (‘short_position’ style), and profit target at 95,000. Fib retracement from high to low for 50% level at 90,750. Vertical line at 2026-02-13 for ‘GOAT Network launch news’. Text box summary: ‘Hybrid view: TA bearish short-term, DeFi catalysts bullish medium-term.’

Risk Assessment: medium

Analysis: Downtrend intact but oversold with fundamental catalysts; volume suggests reversal potential, but resistance overhead caps upside

Isabel Weller’s Recommendation: Scale into longs at support with tight stops—hybrid play leveraging DeFi innovation for 20-30% upside to resistance

Key Support & Resistance Levels

📈 Support Levels:

-

$76,000 – Strong multi-touch low with volume exhaustion

strong -

$79,500 – Moderate interim support from prior consolidation

moderate

📉 Resistance Levels:

-

$100,000 – Key psychological and prior high resistance

strong -

$90,500 – 50% fib retracement of decline

moderate

Trading Zones (medium risk tolerance)

🎯 Entry Zones:

-

$77,500 – Bounce from strong support with bullish MACD divergence, GOAT news catalyst

medium risk -

$79,000 – Pullback entry in minor uptrend channel

low risk

🚪 Exit Zones:

-

$95,000 – Profit target at 38.2% fib retracement and prior resistance confluence

💰 profit target -

$74,500 – Stop loss below structure break and volume low

🛡️ stop loss

Technical Indicators Analysis

📊 Volume Analysis:

Pattern: exhaustion on downside spikes

Tall red volume bars on declines peaking at 2026-02-10, signaling distribution climax; green volume picking up on recent bounce

📈 MACD Analysis:

Signal: bullish divergence

MACD histogram contracting with price lows higher, line crossing signal above zero line near 2026-02-13

Applied TradingView Drawing Utilities

This chart analysis utilizes the following professional drawing tools:

Disclaimer: This technical analysis by Isabel Weller is for educational purposes only and should not be considered as financial advice.

Trading involves risk, and you should always do your own research before making investment decisions.

Past performance does not guarantee future results. The analysis reflects the author’s personal methodology and risk tolerance (medium).

I’ve stress-tested similar setups in consulting gigs, and the edge comes from fee tiering: low-priority queues for retail trades subsidize premium slots for arbitrage bots. This isn’t theoretical; GOAT’s Bitcoin ZK Rollup Economic Paper quantifies it with simulations showing 15% annual yields for stakers at scale. Ethereum custom rollups tutorials push OP stacks, but Bitcoin’s scarcity makes GOAT’s model more capital-efficient, recycling fees into protocol-owned liquidity.

Developer Toolkits for Specialized Fee Rollups

Building your own starts with open-source stacks like Polygon CDK or Celestia for DA, but infuse GOAT-inspired economics. Fork their zkVM repo, tweak the auction logic for your dApp’s tokenomics, and deploy via building-custom-rollups-with-dynamic-fee-markets-a-developer-s-guide. Pro tip: hybrid auctions blending EIP-1559 burns with MEV shares prevent deflationary death spirals.

Challenges persist, like aligning Bitcoin’s block times with sub-second DeFi needs. GOAT sidesteps this via optimistic batching with zk timeouts, a pattern worth emulating. In my view, the real game-changer is ecosystem flywheels: fees fund grants for rollup-native apps, pulling in builders chasing custom rollups fee markets that reward innovation over speculation.

- Choose zkVM over zkEVM for Bitcoin-native ops, cutting gas by 40%.

- Implement rotation auctions weekly to refresh sequencer pools.

- Tokenize surplus MEV as governance votes, decentralizing upgrades.

- Audit multi-round proofs for liveness faults under high contention.

Scaling DeFi on Bitcoin demands this precision. GOAT Network proves custom rollups can thrive without Ethereum’s baggage, delivering yields that compound BTC’s dominance. As rollup wars heat up, those mastering specialized fee structures rollups will capture the value accrual. Dive into the papers, prototype a sequencer, and watch your app-chain hum with efficient, yield-rich transactions. The infrastructure for tomorrow’s DeFi is here, forged in Bitcoin’s fire.