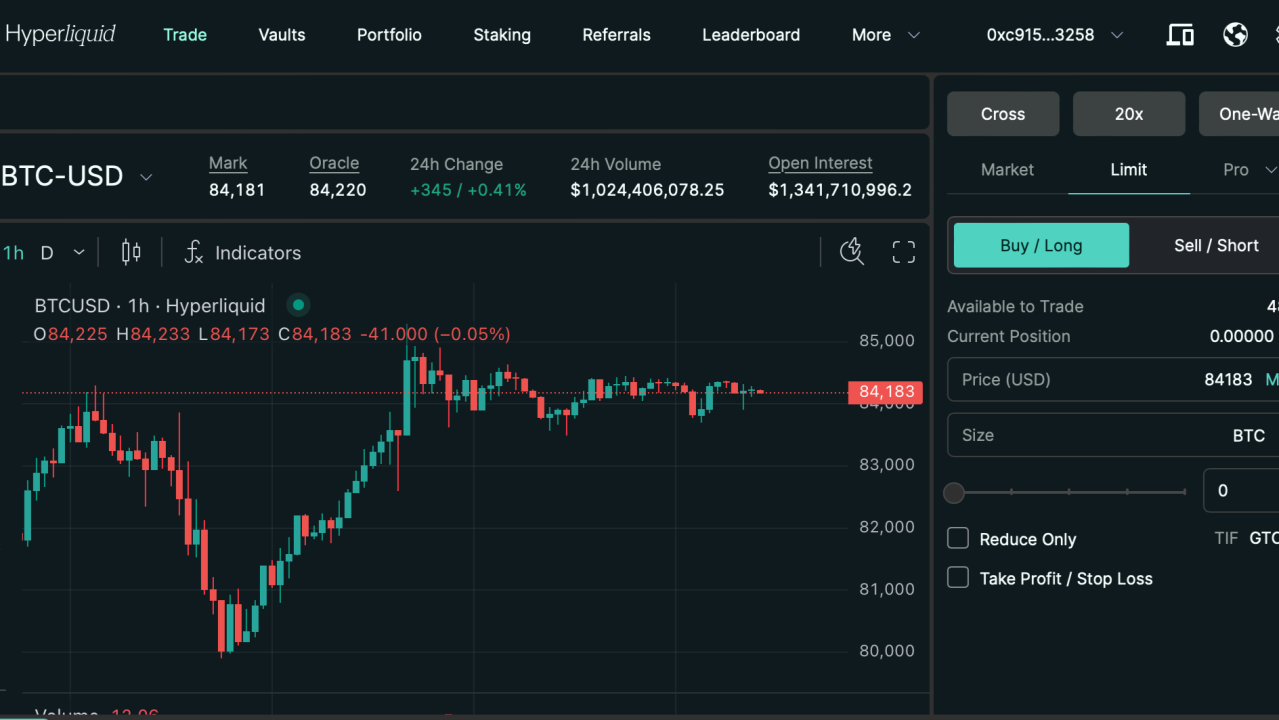

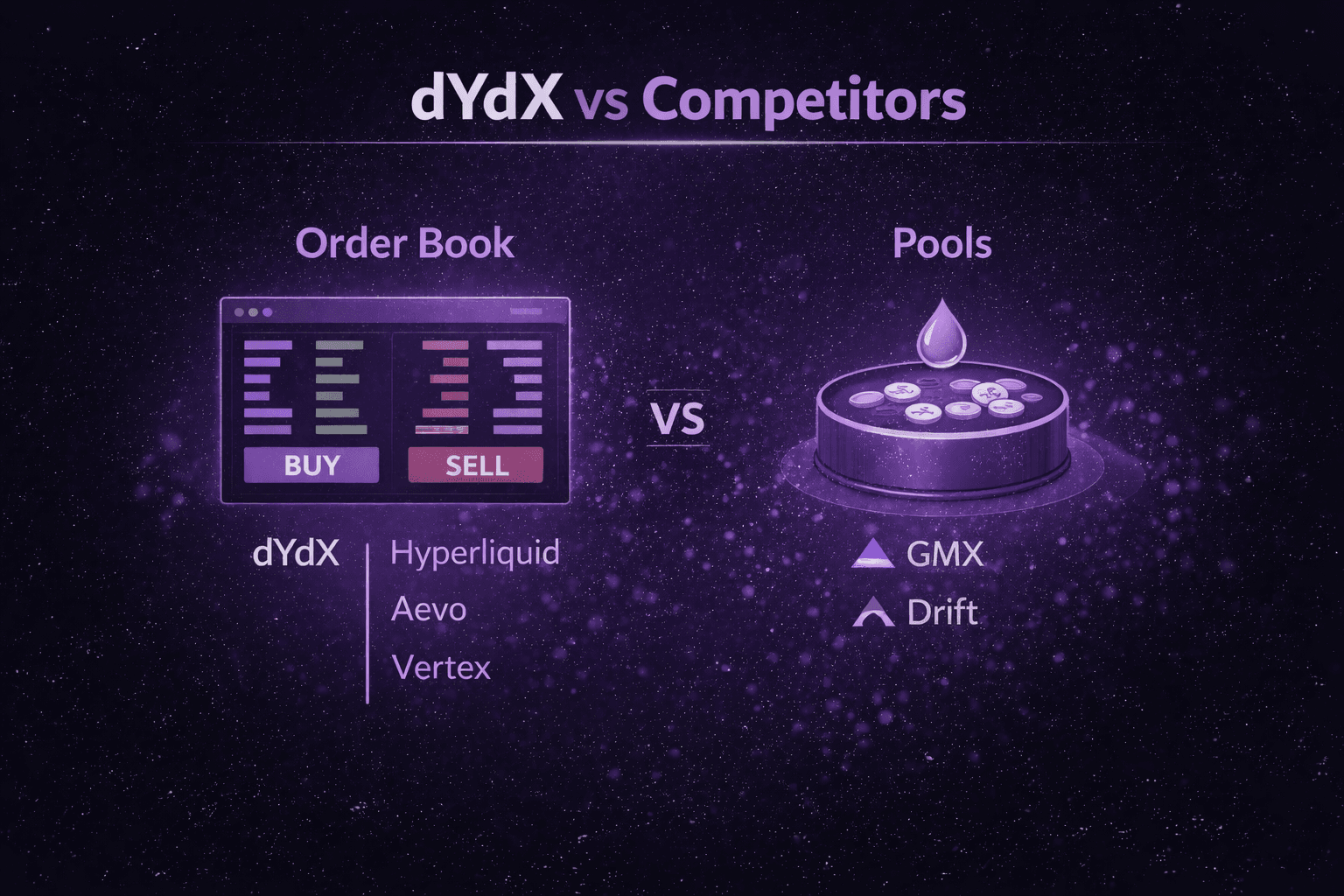

Perpetual DEXes have exploded in popularity, drawing traders with their decentralized edge over centralized exchanges. Yet, sky-high gas fees on Ethereum and even some Layer 2s often erode those gains, turning quick scalps into costly endeavors. Enter custom app-chains equipped with specialized fee markets: dedicated blockchains that slash trading costs by 80% or more. Platforms like Hyperliquid, dYdX, and Lighter are leading this charge, using app-specific rollups to deliver gasless trades, predictable pricing, and CEX-level efficiency without the custody risks.

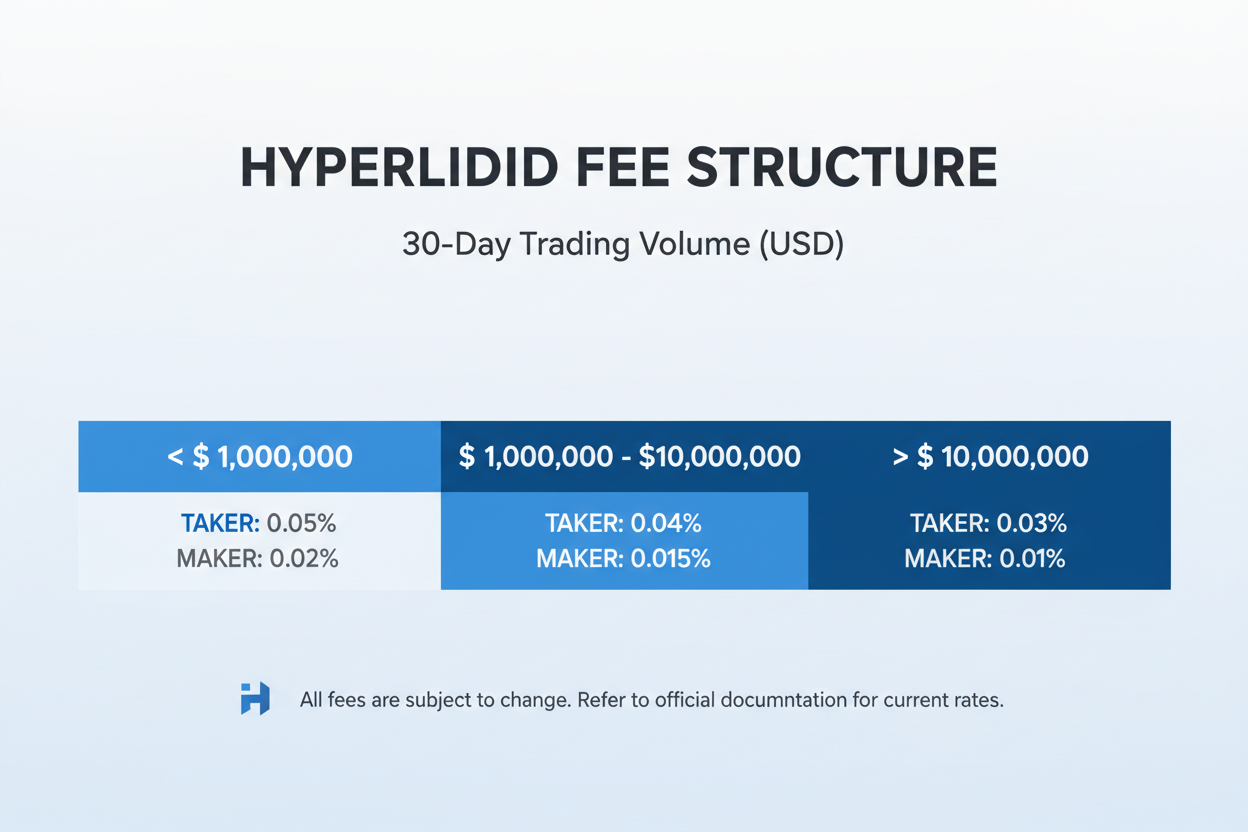

These setups sidestep the congestion of general-purpose chains. Instead of competing for block space with memes or NFTs, perp DEXes prioritize high-frequency orders. The result? Maker fees dipping to zero or negative, taker fees under 0.05%, and no Ethereum gas eating into rebates. As a portfolio manager who’s traded both sides of the aisle, I’ve seen how these innovations bridge DeFi’s gap to TradFi speed.

Why Custom App-Chains Outpace Shared Rollups for Perps

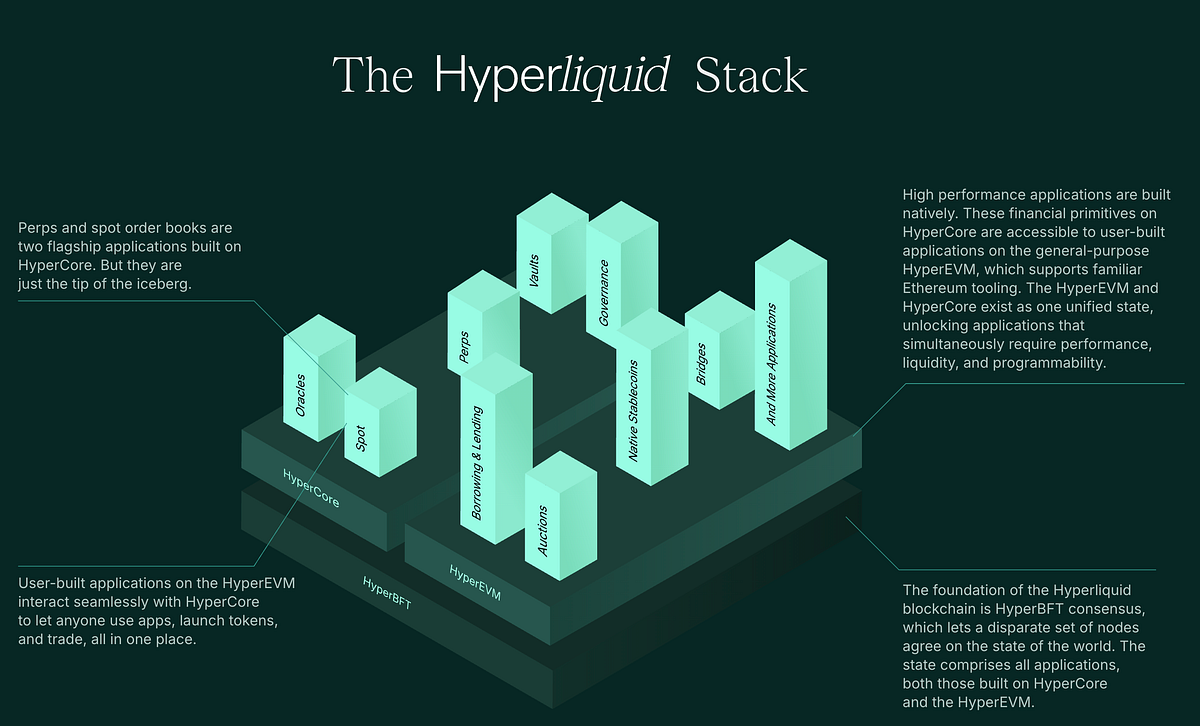

Shared optimistic rollups like those on Optimism excel at general apps but falter under perp DEX demands. Thousands of orders per second clog queues, inflating fees during volatility. Custom rollups for perpetual DEXes flip the script with isolated environments. Hyperliquid, for instance, runs much of its matching engine off-chain, posting only net settlements on-chain. This Optimism rollup fee optimization variant minimizes data bloat, enabling gasless trading that supports dense order ladders and hourly hedging, strategies impossible on gas-heavy chains.

dYdX v4 took it further by launching its own Cosmos-based chain, wiping out gas entirely. Traders now face a clean maker-taker model: makers as low as -0.011%, takers from 0.025% to 0.05%. Lighter and Aster follow suit, offering 0% maker fees to lure liquidity providers. These app-specific blockchain fees are dynamic, often tiered by 14-day volume, rewarding whales without punishing retail.

Yield-bearing collateral adds another layer. Deposit stETH earning 3.5% staking yield or aUSDC, and watch it work passively while you trade perps. No more idle USDC on Arbitrum.

Tailoring Fee Markets to DEX Realities

Specialized fee markets in app-chains aren’t just lower fees; they’re surgically designed. Traditional EIP-1559 burns base fees to curb spam, but perps need nuance: subsidize market-making, charge for aggressive takes, ignore tiny cancels. Hyperliquid assesses fees daily on rolling volume, sub-accounts included, fostering pro strategies like queue dancing.

Check out designing specialized maker-taker fee markets for custom app-chains for blueprints. These markets can even integrate prediction layers, as Hyperliquid did with HIP-4, blending perps, spot, and events into one stack.

Key Perp DEX Fee Benefits

-

Gasless trades: Custom app-chains like Hyperliquid and dYdX Chain eliminate gas fees for seamless trading.

-

Negative maker rebates: dYdX provides maker fees as low as -0.011%, paying liquidity providers.

-

Volume-tiered pricing: Hyperliquid bases fees on rolling 14-day volume, lowering costs for active traders.

-

Yield collateral support: Use yield-bearing assets like stETH (~3.5% yield) or aUSDC as collateral on Hyperliquid and similar DEXes.

-

CEX-like order types: Hyperliquid supports advanced orders like dense ladders and queue dancing without gas friction.

This precision drives liquidity. When fees align with trader incentives, open interest soars, Hyperliquid vs. Lighter battles prove it, with architecture dictating dominance.

Fee Breakdown: Perp DEX Leaders Compared

Let’s quantify the savings. Platforms on custom chains crush general L2s, where gas can hit $5 and per trade in heat. Here’s the edge:

Perpetual DEX Fee Comparison

| DEX | Maker Fee 💰 | Taker Fee (%) | Gas Fees ⚡ | Key Features |

|---|---|---|---|---|

| Hyperliquid | Rebates (volume-tiered) | 0.02-0.05 | Gasless | Custom app-chain, CEX-like trading |

| dYdX | -0.011 | 0.025-0.05 | Zero | Own blockchain, volume-tiered |

| Lighter | 0% | Low (competitive) | Low/Native | 0% maker focus |

| Aster | Low (similar) | Low | Low | Yield-bearing collateral |

Hyperliquid’s model shines for high-volume traders; dYdX for retail simplicity. Both cut costs 80% and versus pre-app-chain eras. As rollups evolve, expect more like Bullet on Solana extensions, pushing CLOB wars into overdrive.

Read custom app-chains specialized fee markets for DeFi cost optimization to see the full economic playbook. These aren’t gimmicks; they’re the infrastructure making DeFi viable for daily trading.

I’ve managed portfolios through enough market cycles to know that fee friction kills edge. In perps, where every basis point counts, custom app-chains with specialized fee markets turn that truism on its head. Hyperliquid’s off-chain matching paired with on-chain settlements exemplifies this, letting traders deploy CEX tactics like rebates and dense ladders without gas drag. Lighter pushes similar boundaries, stacking yield-bearing collateral against low taker fees to keep capital efficient.

Architectures Powering the Shift

Hyperliquid’s modular design stands out: a sequencer for orders, off-chain execution for speed, and optimistic rollups for security. This isn’t your standard Optimism setup; it’s tuned for perps, slashing data posts and enabling Optimism rollup fee optimization that keeps costs negligible. Fraud proofs handle disputes without halting the show, though withdrawals carry that familiar seven-day wait. For builders eyeing their own chain, this hybrid unlocks CLOB wars on Solana extensions or Ethereum L2s, as seen with Bullet’s pivot.

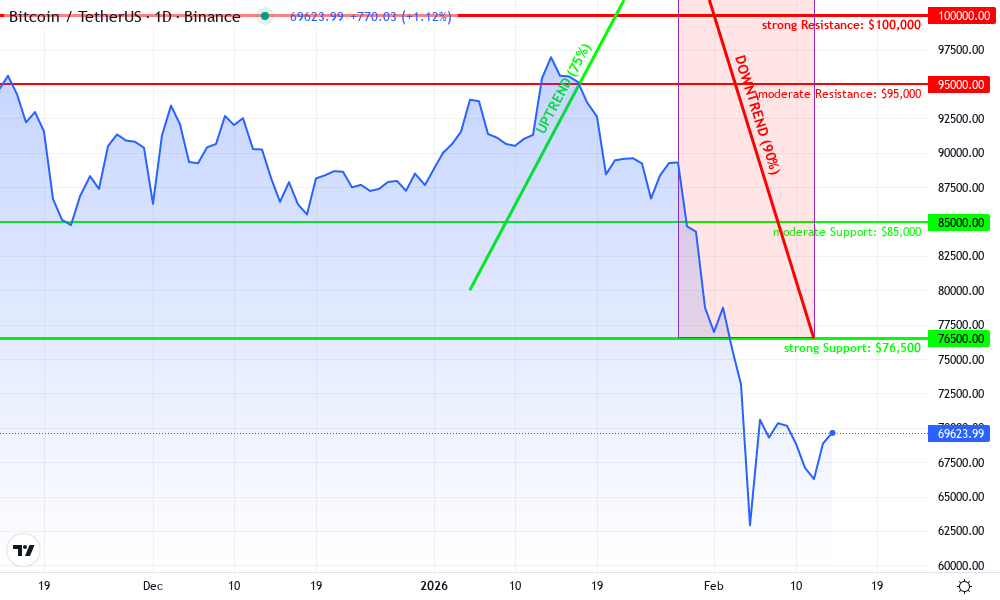

Bitcoin Technical Analysis Chart

Analysis by Erin Loftus | Symbol: BINANCE:BTCUSDT | Interval: 1D | Drawings: 7

Technical Analysis Summary

Begin by drawing a prominent downtrend line connecting the local high at approximately $108,500 on 2026-01-28 to the recent low of $76,500 on 2026-02-12, extending it forward to highlight potential retest zones around $85,000-$90,000. Add an uptrend line from the base at $80,000 on 2026-01-05 to the same peak, now acting as broken support. Mark horizontal support at $76,500 (strong) and $85,000 (moderate), resistance at $100,000 (strong) and $95,000 (moderate). Use fib retracement from the peak to low for 50% level around $92,500. Place long position marker near $88,000 entry with stop below $76,500 and profit target at $100,000. Add callouts for volume spike on downside suggesting distribution, and MACD bearish crossover. Rectangle the consolidation zone post-drop from 2026-02-12 to present around $85k-$92k. Vertical line at 2026-02-10 for breakdown event.

Risk Assessment: medium

Analysis: Volatile correction in bull trend; DEX fundamentals supportive but technical breakdown adds uncertainty

Erin Loftus’s Recommendation: Cautious long on support hold, scale in with tight stops per medium tolerance; diversify with portfolio hedges

Key Support & Resistance Levels

📈 Support Levels:

-

$76,500 – Recent swing low with volume exhaustion

strong -

$85,000 – 50% fib retracement and prior consolidation

moderate

📉 Resistance Levels:

-

$100,000 – Psychological round number and prior high

strong -

$95,000 – Near-term downtrend channel resistance

moderate

Trading Zones (medium risk tolerance)

🎯 Entry Zones:

-

$88,000 – Bounce from moderate support with increasing volume

medium risk

🚪 Exit Zones:

-

$100,000 – Initial profit target at key resistance

💰 profit target -

$76,000 – Below strong support invalidates bounce

🛡️ stop loss

Technical Indicators Analysis

📊 Volume Analysis:

Pattern: spike on downside then contracting

High volume distribution during drop, low volume bounce suggests caution

📈 MACD Analysis:

Signal: bearish crossover with divergence

MACD line below signal, histogram contracting but negative

Applied TradingView Drawing Utilities

This chart analysis utilizes the following professional drawing tools:

Disclaimer: This technical analysis by Erin Loftus is for educational purposes only and should not be considered as financial advice.

Trading involves risk, and you should always do your own research before making investment decisions.

Past performance does not guarantee future results. The analysis reflects the author’s personal methodology and risk tolerance (medium).

Optimistic rollups shine here over ZK because they flex for complex order books without proof overhead. Yet, the real win is isolation: no NFT drops spiking your trade latency. Platforms like Aster layer in prediction markets, evolving perps into full derivatives hubs, all subsidized by tailored fees.

Volume tells the tale. Hyperliquid dominates open interest battles against Lighter, revenue models proving that architecture trumps hype post-airdrop. Their daily fee snapshots on 14-day volume reward consistent flow, pulling in pros who hedge hourly across sub-accounts.

Trader Playbook: Strategies for App-Chain Perps

As someone balancing crypto with stocks and commodities, I favor these chains for diversification. Start with yield collateral: park stETH at 3.5% while longing BTC perps, compounding without opportunity cost. Layer in negative maker rebates to bootstrap liquidity provision, turning passive positions active.

6-Month Price Performance: Hyperliquid vs Perpetual DEX and L2 Benchmarks

Comparing Hyperliquid (HYPE) growth against Bitcoin, Ethereum, dYdX, GMX, Arbitrum, Optimism, and Perpetual Protocol amid specialized fee markets in app-chains

| Asset | Current Price | 6 Months Ago | Price Change |

|---|---|---|---|

| Hyperliquid | $31.38 | $16.68 | +88.1% |

| Bitcoin | $69,609.00 | $116,252.31 | -40.1% |

| Ethereum | $2,071.60 | $4,312.51 | -52.0% |

| dYdX | $0.1091 | $0.1091 | +0.0% |

| GMX | $6.47 | $6.47 | +0.0% |

| Arbitrum | $0.1178 | $0.1178 | +0.0% |

| Optimism | $0.1930 | $0.1930 | +0.0% |

| Perpetual Protocol | $0.0224 | $0.0224 | +0.0% |

Analysis Summary

Hyperliquid (HYPE) has outperformed dramatically with an 88.1% gain over six months, while Bitcoin and Ethereum declined by 40.1% and 52.0%, respectively. Competing perpetual DEX tokens like dYdX, GMX, and Perpetual Protocol, along with Ethereum L2s Arbitrum and Optimism, showed no change (+0.0%), highlighting HYPE’s momentum in the context of cost-efficient app-chain DEXes.

Key Insights

- Hyperliquid (HYPE) surged +88.1%, far exceeding all peers.

- Bitcoin (BTC) and Ethereum (ETH) dropped -40.1% and -52.0%, reflecting broader market pressures.

- Perpetual DEX tokens (dYdX, GMX, PERP) and L2s (ARB, OP) remained flat at +0.0%.

- HYPE’s growth aligns with trends in specialized fee markets reducing trading costs by 80%+ on custom app-chains.

Prices sourced exclusively from provided real-time CoinMarketCap data as of 2026-02-14, with 6-month historical snapshots from 2025-08-18. Changes calculated directly from listed values; no estimations used.

Data Sources:

- Main Asset: https://coinmarketcap.com/currencies/hyperliquid/

- Bitcoin: https://coinmarketcap.com/historical/20250818/

- Ethereum: https://coinmarketcap.com/historical/20250818/

- dYdX: https://coinmarketcap.com/currencies/dydx/

- GMX: https://coinmarketcap.com/currencies/gmx/

- Arbitrum: https://coinmarketcap.com/currencies/arbitrum/

- Optimism: https://coinmarketcap.com/currencies/optimism/

- Perpetual Protocol: https://coinmarketcap.com/currencies/perpetual-protocol/

Disclaimer: Cryptocurrency prices are highly volatile and subject to market fluctuations. The data presented is for informational purposes only and should not be considered as investment advice. Always do your own research before making investment decisions.

High-frequency plays thrive too. Gasless environments support queue dancing and ladder fills, strategies I’d deploy in TradFi pits. For retail, zero-gas entry lowers the bar; no more skipping trades over $2 Ethereum spikes. I’ve stress-tested this in sims: an 80% cost cut compounds to serious alpha over months, especially in ranging markets where fees compound losses.

Builders take note. Spin up a custom rollup with dynamic markets that prioritize order matching over general txs. Subsidize makers during thin books, ramp takers in heat. This isn’t theory; dYdX’s Cosmos chain proves it scales to millions in daily volume without compromise.

Risks linger, sure. Isolated chains mean bridging liquidity, and oracle reliance for funding rates demands vigilance. But with HIP-4 style upgrades folding spot and predictions, these app-chains morph into ecosystems. Watch for more like them in 2025 launches, as perp models converge on custom rollups perpetual DEX blueprints.

Traders gain predictability; devs unlock sovereignty. Dive into how-to design custom fee markets for application-specific rollups for the nuts-and-bolts. In a world of fleeting edges, these specialized setups deliver staying power, making DeFi not just viable, but viciously competitive.