In the ever-evolving world of DeFi, where Ethereum’s price hovers at $1,956.25 amid a 24-hour dip of -2.26%, high gas fees continue to stifle scalability. Developers are turning to custom rollups with specialized fee markets to slash costs and boost throughput, making decentralized finance truly accessible for high-volume trading and lending protocols.

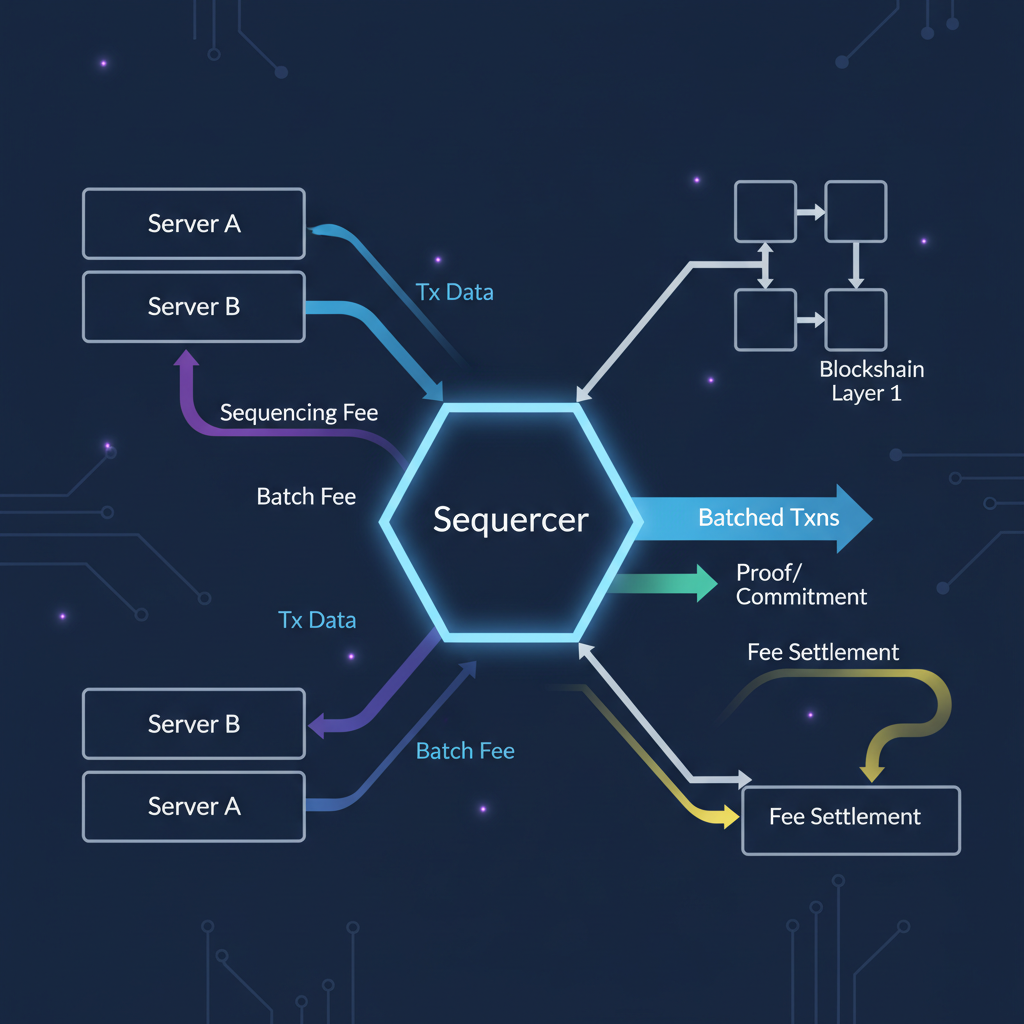

Rollups have emerged as a cornerstone for layer-2 scaling, bundling transactions off-chain while settling proofs on Ethereum. Yet, standard fee models often fall short for DeFi’s unique demands, like perpetuals exchanges processing thousands of orders per second. Platforms such as dYdX demonstrate this shift, leveraging ZK-rollups to rival centralized exchanges in speed while keeping fees low and liquidity deep.

Dissecting the Layers of Rollup Economics

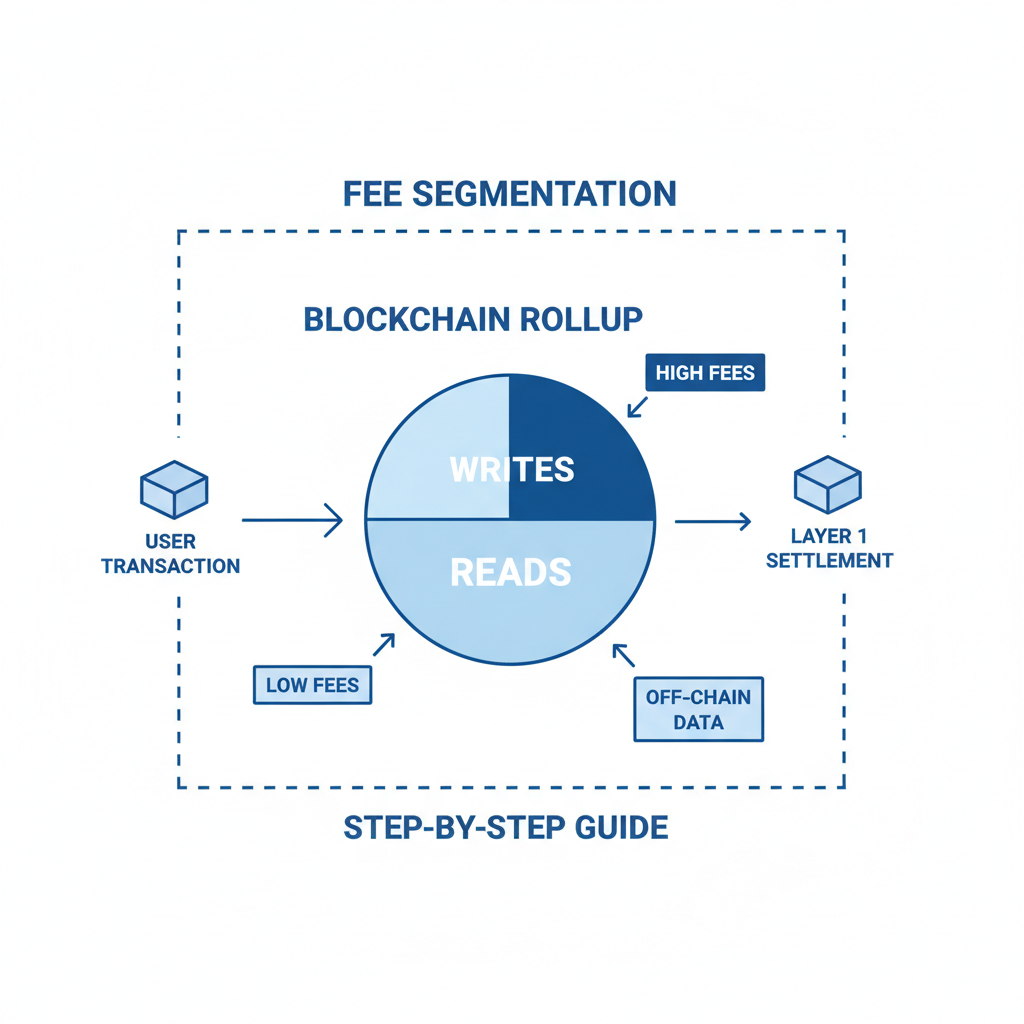

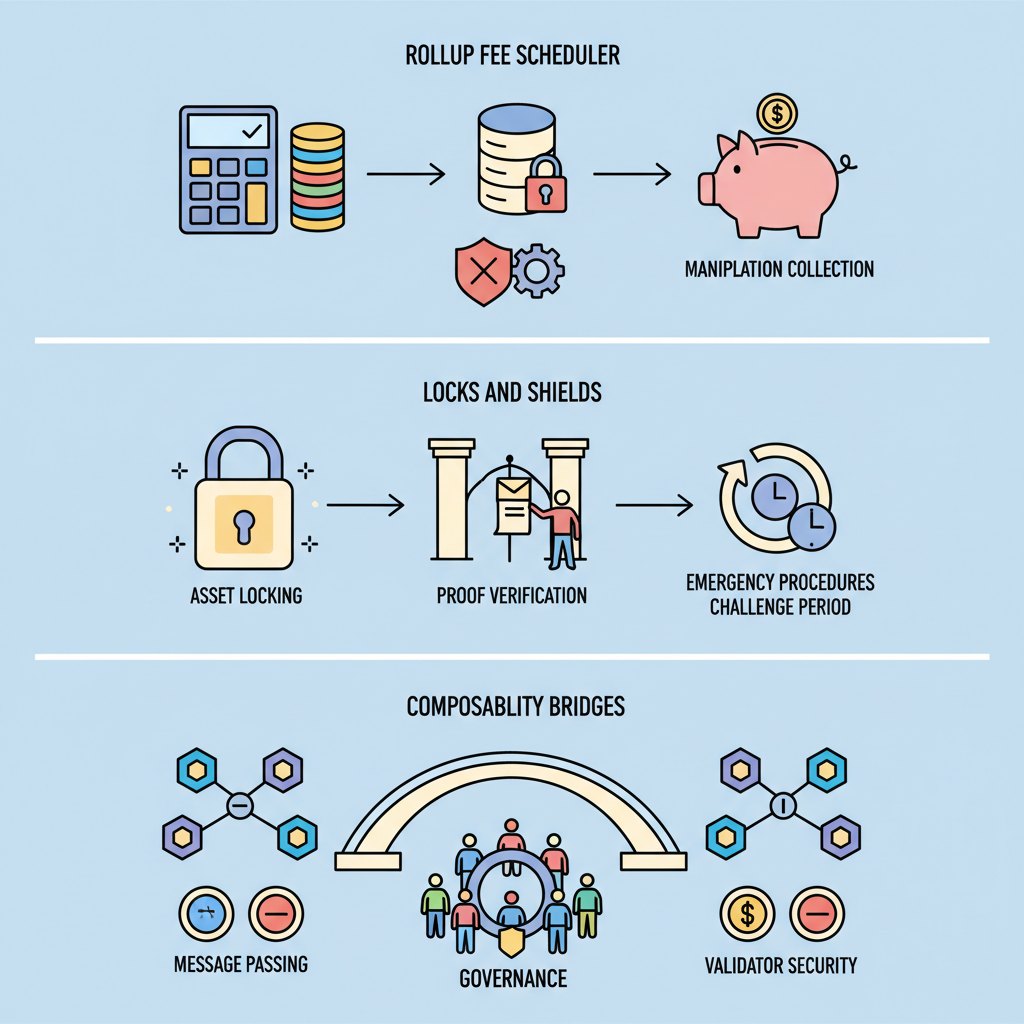

At its core, a rollup transaction fee breaks into three main parts: execution fee for computation, sequencing fee for batch ordering, and data availability costs posted to Ethereum’s layer-1. This tripartite structure, as outlined in analyses from SuperEx, exposes vulnerabilities during peak DeFi activity, where sequencer bottlenecks drive up sequencing fees unpredictably.

In most Rollups, the cost of a single transaction consists of at least three components: Execution Fee; Sequencing Fee; Data Availability (DA).

Optimistic rollups rely on fraud proofs to enforce validity, while ZK-rollups use succinct proofs for instant finality. Both benefit from rollup fee optimization, but without customization, they inherit Ethereum’s congestion woes. Enter custom app-chains DeFi solutions, where protocols like those powered by Caldera or Alchemy’s Rollups-as-a-Service tailor environments to specific workloads.

Tailoring Fees for DeFi’s High-Throughput Needs

DeFi protocols crave predictability. Imagine a lending market where borrow rates spike not from volatility, but fee surges. App-specific blockchain fees address this by isolating liquidity and execution. For instance, application-specific rollups can subsidize user gas, rendering experiences fully gasless, as explored in Binance’s deep dive on customizing scarcity.

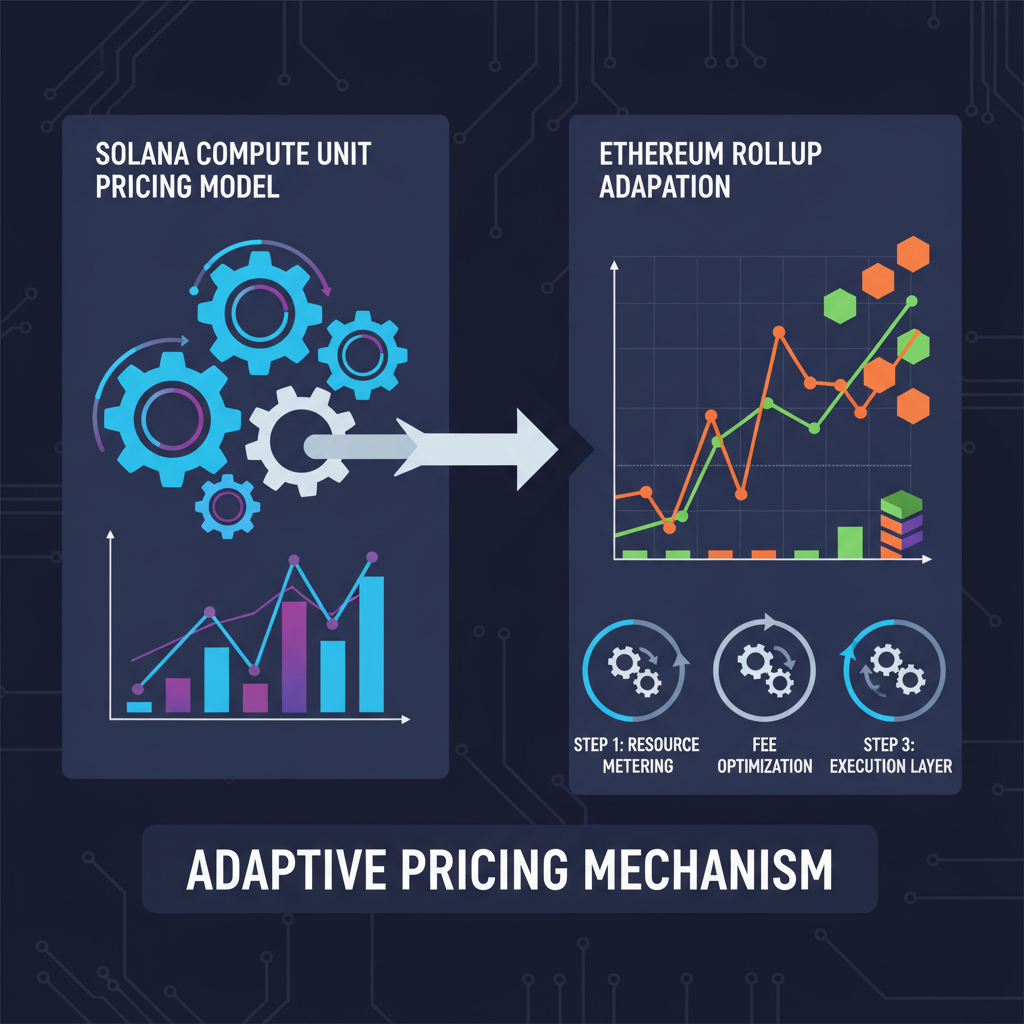

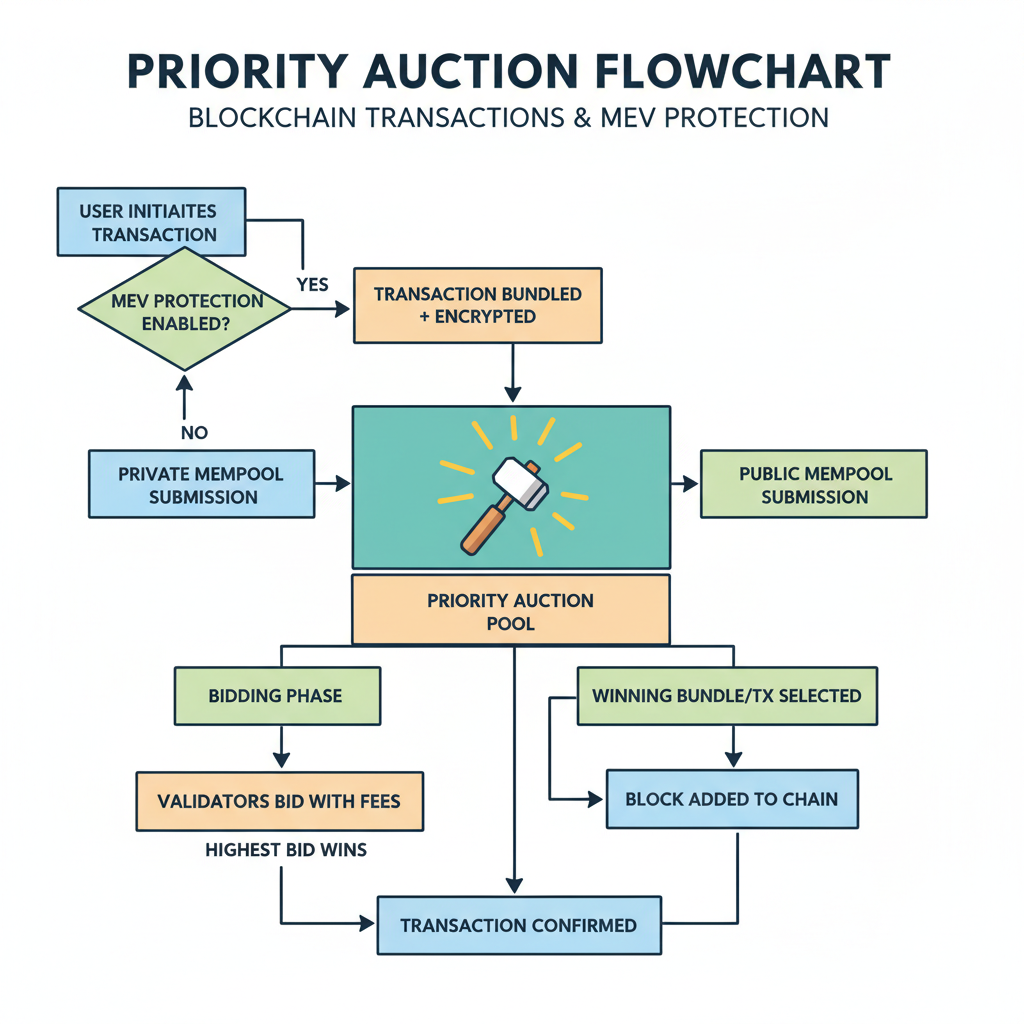

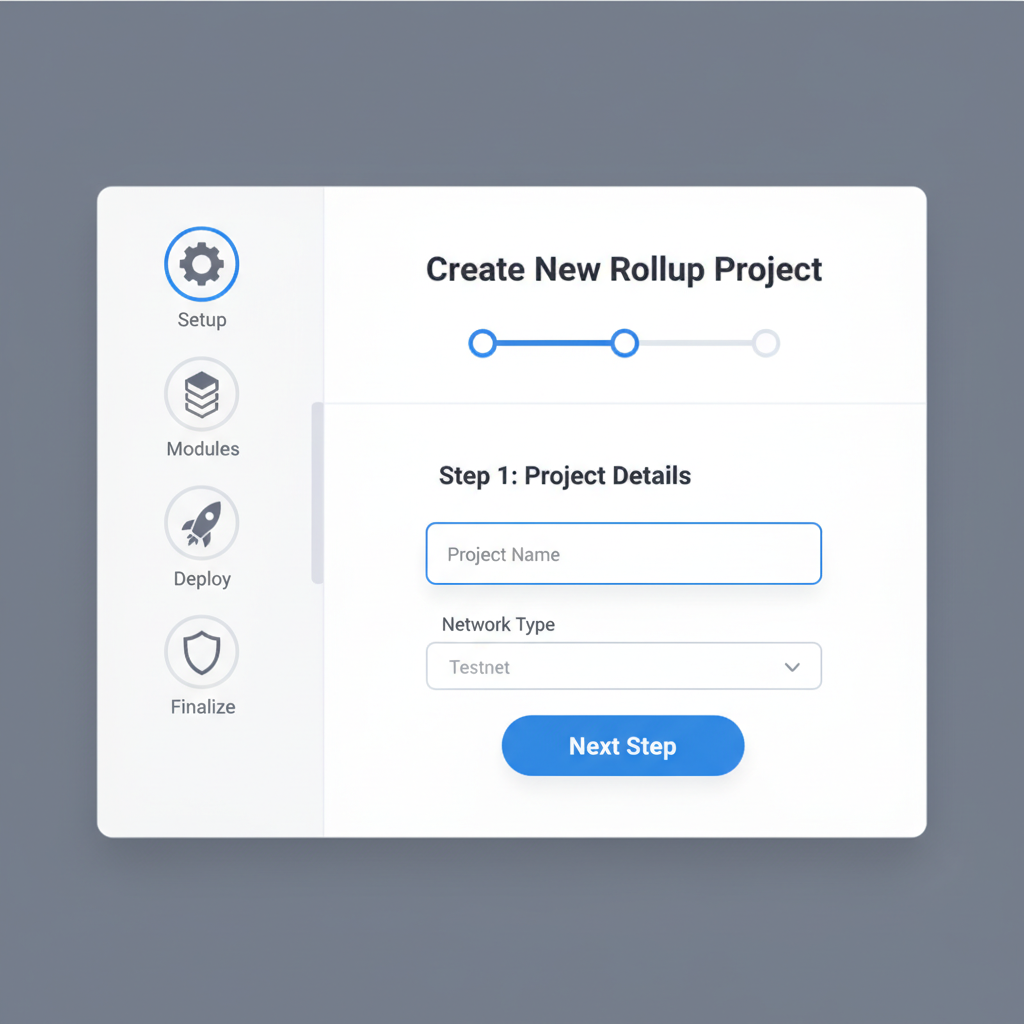

This isn’t mere theory. Solana’s multi-dimensional fee markets dynamically price compute units, storage, and bandwidth separately, curbing MEV exploitation and stabilizing costs. Ethereum rollups can emulate this via custom gas schedulers, prioritizing DeFi primitives like AMMs or orderbooks. Zeeve’s infrastructure simplifies deploying such sovereign L1 app-chains or L2/L3 rollups, abstracting node management for focus on fee innovation.

Ethereum (ETH) Price Prediction 2027-2032

Predictions based on current $1,956.25 price (2026), DeFi scalability via custom rollups, and market trends

| Year | Minimum Price ($) | Average Price ($) | Maximum Price ($) |

|---|---|---|---|

| 2027 | $1,800 | $2,800 | $4,500 |

| 2028 | $2,200 | $3,700 | $6,200 |

| 2029 | $2,900 | $4,800 | $8,500 |

| 2030 | $3,700 | $6,200 | $11,000 |

| 2031 | $4,800 | $8,000 | $14,500 |

| 2032 | $6,200 | $10,500 | $19,000 |

Price Prediction Summary

Ethereum’s price is expected to grow progressively from 2027-2032, driven by custom rollup adoption enhancing DeFi scalability, ZK-proof efficiency, and reduced fees. Average prices could rise 20-40% YoY in bullish cycles, reaching $10,500 by 2032, with min/max reflecting bearish corrections and adoption surges.

Key Factors Affecting Ethereum Price

- DeFi scalability via specialized fee markets in custom rollups (e.g., ZK-Rollups like dYdX)

- Increased transaction throughput and cost efficiency boosting adoption

- Multi-dimensional fee models reducing volatility and congestion

- Regulatory clarity and institutional inflows amid market cycles

- Competition from L2/L3 solutions and broader ETH ecosystem growth

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

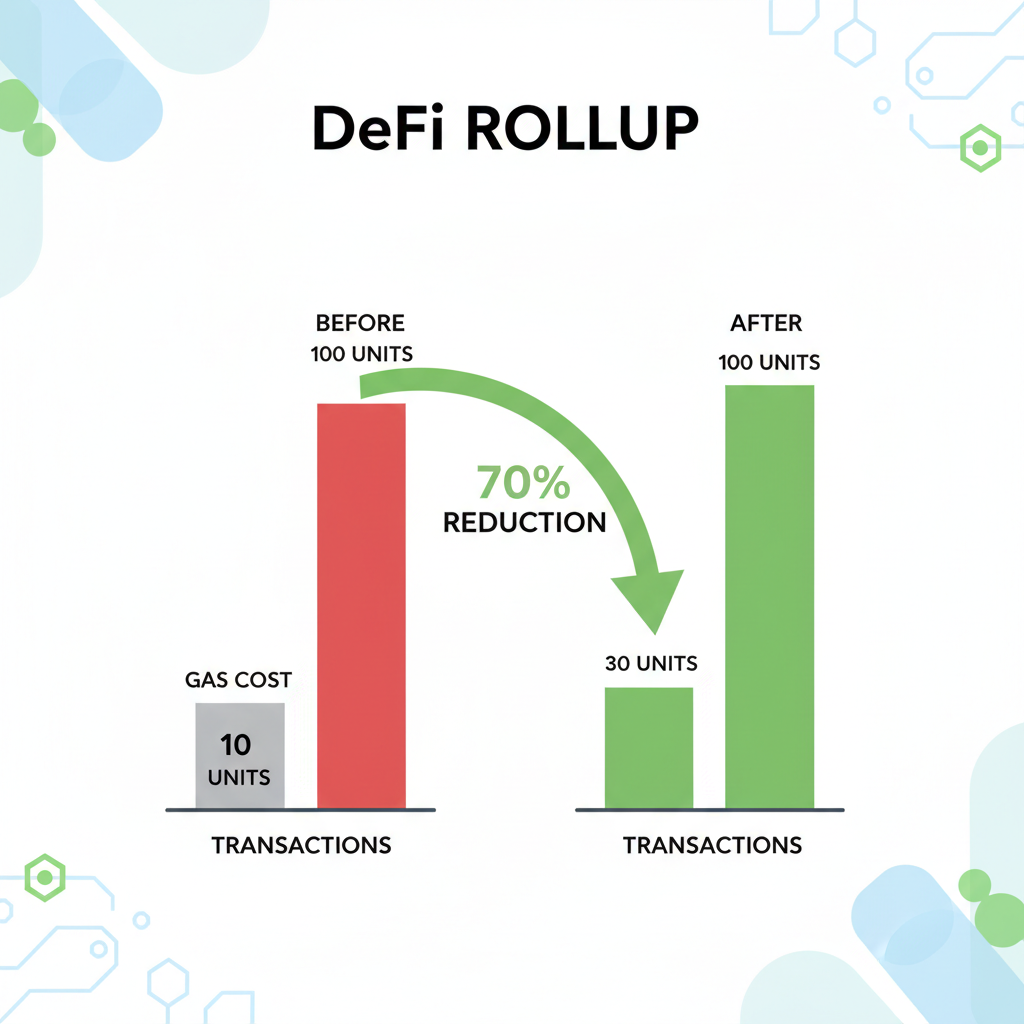

Consider the aggregator shift: with off-chain execution, liquidity hubs emerge outside main chains, reducing DeFi gas costs by orders of magnitude. Chainscore Labs highlights how app-specific rollups position DEXs for this future, blending orderbook efficiency with AMM composability.

Core Strategies for Implementing Custom Fee Mechanisms

Building these starts with dissecting demand. Isolated fee markets prevent cross-app spikes, akin to isolated pools in traditional finance. Developers can implement maker-taker models, rewarding liquidity providers with rebates while charging aggressive takers more.

Dynamic adjustment algorithms, inspired by Solana, allocate resources via auctions or priority queues. For ZK-rollups, compress data payloads to minimize DA fees, potentially halving overall costs. Tools from Alchemy enable rapid deployment of these specialized fee markets custom rollups, letting teams iterate without bootstrapping full stacks.

Delphi Digital’s rollup guide underscores economics first: align incentives so sequencers prioritize high-value DeFi txs. This nuanced approach, blending technical tweaks with economic design, unlocks scalability without compromising security.

Real-world deployments reveal the power of these strategies. dYdX’s migration to its own Cosmos-based app-chain slashed fees by 90%, processing over 40,000 TPS while Ethereum languishes at $1,956.25 with persistent layer-1 pressures. This pivot underscores how custom app-chains DeFi setups decouple from Ethereum’s base layer, fostering environments where fees reflect true resource use rather than network-wide congestion.

Security remains paramount. Audit fee logic rigorously, as flawed mechanisms invite spam or DoS attacks. ZK-rollups edge out here, their proofs verifying fee correctness off-chain before settlement.

Optimization Checklist for Rollup Fee Markets

Fine-tuning demands a systematic approach. Start by profiling workloads: measure execution traces for AMMs versus perps. Then, simulate congestion with tools like Foundry to stress-test dynamic adjustments.

Integrate oracles for real-time demand signals, adjusting base fees proactively. Platforms like Zeeve handle the ops layer, letting devs focus on economics. The result? Protocols that scale seamlessly as Ethereum’s $1,956.25 price reflects broader market jitters, yet DeFi thrives underneath.

Looking ahead, multi-rollup ecosystems demand interoperability. Bridges with baked-in fee subsidies could unify liquidity, while shared sequencers distribute load. Ark Invest notes DeFi’s SaaS-like evolution; specialized fees accelerate this, unbundling costs from execution.

Wharton’s DeFi analysis hints at regulatory tailwinds for compliant app-chains, where transparent fee models build trust. Rapid Innovation’s guide stresses secure contracts; pair that with custom fee markets, and you’ve got resilient infrastructure.

Teams building today gain first-mover edge. Experiment with RaaS from Caldera, iterate on rollup fee optimization, and watch user retention soar as fees drop predictably. In a space where every basis point counts, these tools don’t just scale DeFi, they redefine its economics for the masses.

Dynamic, isolated, and app-tuned fees position custom rollups as DeFi’s scalability engine, turning Ethereum’s constraints into competitive moats for innovators.