In the high-stakes world of decentralized exchanges, on-chain order books promise the transparency and censorship resistance that centralized platforms can’t match. Yet, they’ve long been hobbled by sky-high gas fees, turning what should be fluid trading into a costly grind. Imagine placing 5000 and limit orders with sub-$1 fees total, no batching required. Appchains make this reality, tailoring blockchain economics for onchain CLOB efficiency and unlocking blockchain order book scaling that general-purpose chains dream of.

The Pain Points of Order Books on L1 and Rollups

Layer 1 networks like Ethereum deliver unmatched security, but their gas auctions crush high-volume trading. A single limit order can cost dollars during peaks, making 5000 and orders prohibitive without off-chain trickery. Rollups help by batching, slashing fees multiple times over L1 as Zeeve notes, yet they inherit Ethereum’s volatility. Unpredictable gas disrupts UX, and shared sequencer risks introduce centralization whispers, echoing Reddit gripes about rollups being “marginally lower fees than L1 and not decentralized. “

For DEXs chasing custom rollups low fees, shared L2s fall short on sovereignty. Governance ties upgrades to parent chains, and value accrual leaks to generic tokens. Conduit. xyz data on onchain gaming reveals rollups save over 90% versus shared chains, but order books demand more: deterministic matching, zero slippage, and MEV immunity. Binance pegs L1 settlement for 100 million tx at $25,000 monthly, feasible only for giants. Appchains sidestep this by owning the stack.

Fee Comparison: L1 vs. Rollups vs. Appchains

| Architecture | Fees | Throughput | MEV | Notes |

|---|---|---|---|---|

| L1 | $1+ per order | 🐌 | ❌ | High volatility |

| Rollup | Sub-$0.1 avg | 🚀 | ⚠️ | Batched settlement |

| Appchain | Sub-$1 for 5000+ orders | 🚀🚀 | ✅ | No batching |

Appchains: Sovereign Fee Markets for DEX Precision

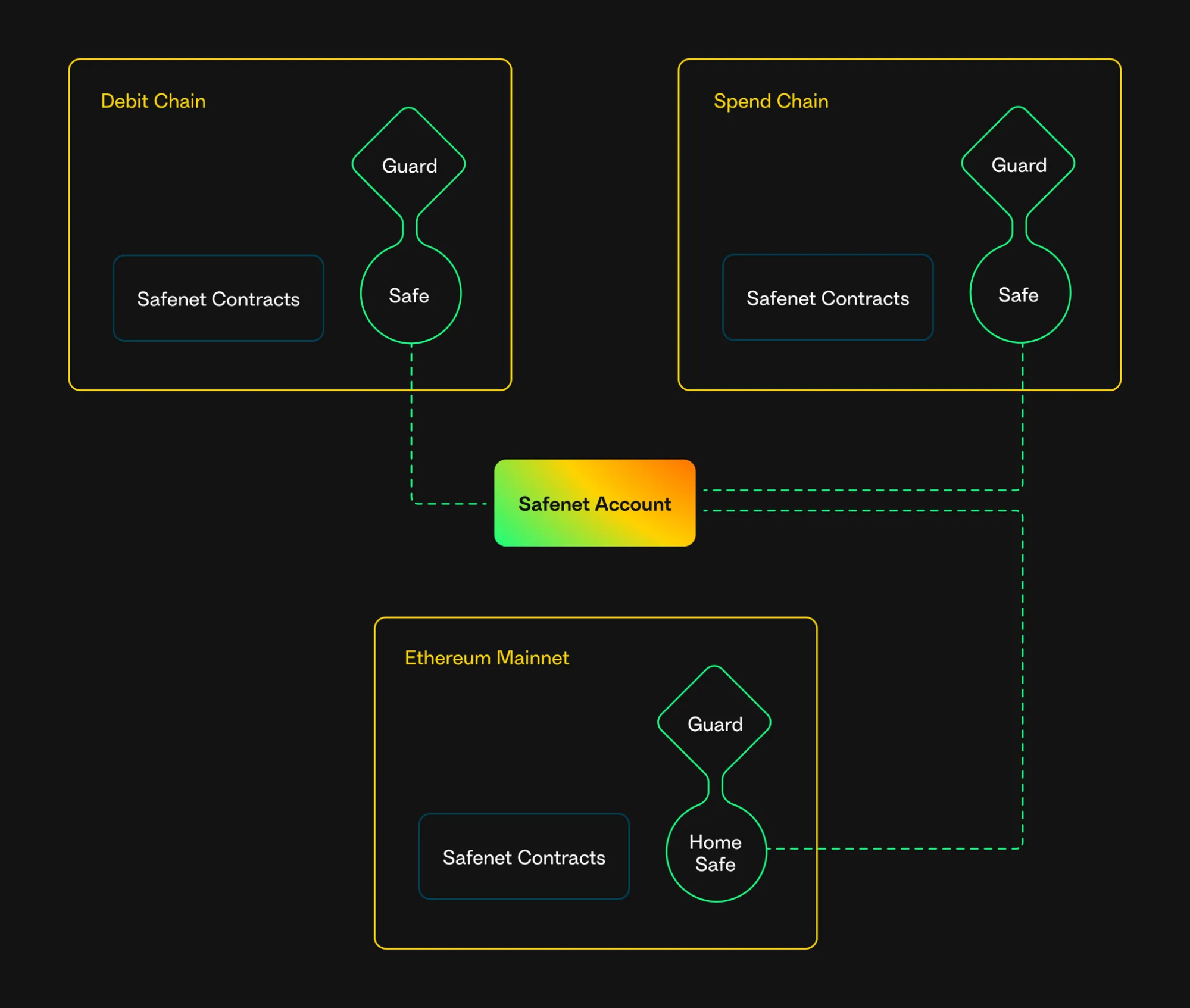

Appchains, or application-specific blockchains, dedicate hardware and consensus to one use case, like a DEX’s central limit order book. GetBlock. io defines them as single-dApp chains, perfect for specialized fee markets DEX. Mint native tokens for gas, tune fees predictably low, and embed matching engines in consensus for Hyperliquid-style determinism.

This vertical integration shines. Instanodes highlights appchains’ token control over utility and fees, unlike L1s. Alchemy’s rollup economics show L3s paying DA fees upward; appchains settle directly or via chosen L1, minimizing leakage. Medium’s builder guide flags rollup pitfalls like volatile fees; appchains fix that with fixed, app-tuned gas. For gas efficient app-chains, custom precompiles batch settlements natively, boosting capital efficiency.

Breakthrough Implementations Pushing Boundaries

ETHGlobal’s showcase nails it: a Superchain order book appchain cuts gas 90%, axes MEV via account abstraction and bundler nodes, enables slippage-free limits. Hyperliquid fuses matching into consensus, rivaling CeFi latency for high-frequency plays. dYdX’s app-chain migration? 100x throughput leap, proving dedicated infra’s edge.

These aren’t hypotheticals. Substack’s PhD DeFi take praises ZK rollups’ low fees and finality for throughput; appchains amplify via full customization. Bleap’s 2026 fee rankings nod to Solana-like lows, but appchains tailor beyond, sans shared-chain congestion.

Builders are already deploying these stacks to deliver onchain CLOB efficiency that feels like CeFi without the trust assumptions. Let’s unpack the mechanics powering sub-$1 fees for thousands of limit orders, no batching hacks needed.

Engineering Ultra-Low Fees: Specialized Gas for Order Ops

At the heart of appchain magic lies a specialized fee market tuned for order book primitives. Instead of Ethereum’s uniform gas for everything from swaps to NFTs, appchains define custom opcodes: one for placing limits, another for cancels, a third for matches. Gas units reflect computational reality – a simple limit order might cost 5,000 gas at $0.0001 per unit, totaling pennies. Scale to 5000 orders? Still under a buck, even solo submissions.

This isn’t guesswork. Hyperliquid’s consensus-embedded matching engine processes orders deterministically, sidestepping probabilistic mempools. No MEV auctions mean no fee spikes; fees stay pegged to a native token with predictable issuance. Account abstraction layers in bundlers that aggregate user intents off-chain but settle on-chain atomically, slashing effective costs further. The ETHGlobal Superchain demo quantified it: 90% fee drop via these tweaks, with bundlers handling the grunt work.

Contrast this with rollups. Even optimistic ones rely on calldata posting to L1, where Binance estimates $25k monthly for high-volume chains. Appchains choose settlement – direct to Ethereum for security or Cosmos-style sovereign for speed – optimizing data availability costs. ZK proofs add finality without full computation exposure, as Substack’s DeFi analysis underscores for high-throughput apps.

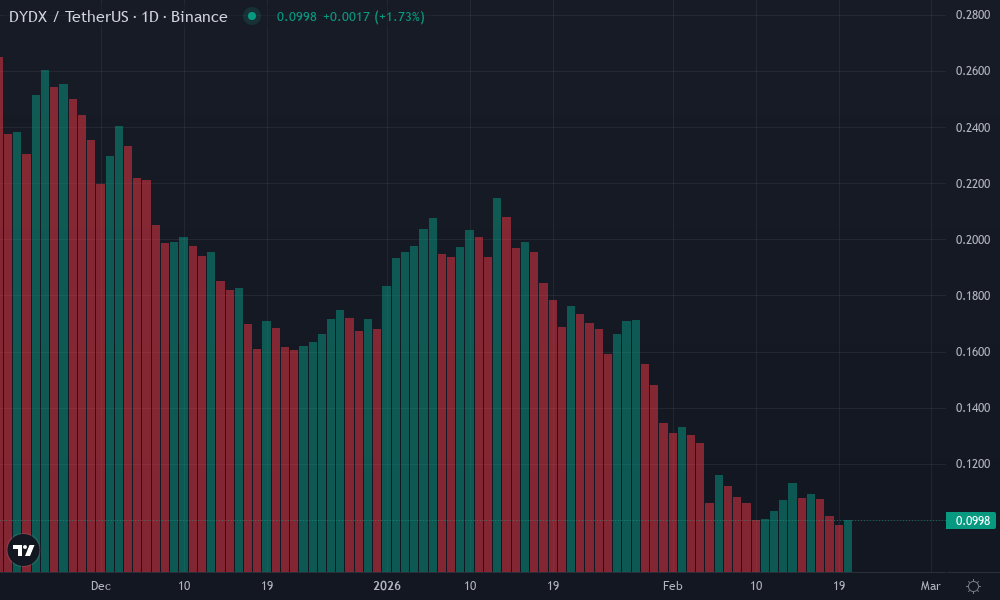

dYdX Technical Analysis Chart

Analysis by Isabel Weller | Symbol: BINANCE:DYDXUSDT | Interval: 1D | Drawings: 6

Technical Analysis Summary

In my balanced hybrid style, start by drawing a primary downtrend line connecting the January 2026 high at 0.58 to the late April 2026 low at 0.42, using ‘trend_line’ for the bearish channel. Add horizontal lines at key support 0.42 and resistance 0.52. Use fib_retracement from the Jan high to March low for potential retracement levels. Rectangle the mid-March to early April consolidation zone. Callouts for volume divergence and MACD bearish crossover. Arrows for potential entry long above 0.45 with stop below 0.42. Text notes tying to dYdX appchain efficiency gains.

Risk Assessment: medium

Analysis: Bearish trend intact but oversold with strong DeFi fundamentals from appchain shift; medium tolerance suits waiting for confirmation

Isabel Weller’s Recommendation: Accumulate on dips near 0.44 for medium-term hold, targeting 0.55+ on appchain momentum

Key Support & Resistance Levels

📈 Support Levels:

-

$0.42 – Recent swing low and volume cluster support

strong -

$0.45 – Mid-March bounce level

moderate

📉 Resistance Levels:

-

$0.52 – April high and downtrend channel top

strong -

$0.55 – Fib 50% retracement from Jan high

moderate

Trading Zones (medium risk tolerance)

🎯 Entry Zones:

-

$0.445 – Bounce off strong support 0.42 with volume pickup, appchain narrative support

medium risk

🚪 Exit Zones:

-

$0.52 – Resistance test with profit target

💰 profit target -

$0.415 – Below key support invalidation

🛡️ stop loss

Technical Indicators Analysis

📊 Volume Analysis:

Pattern: Declining volume on downside, potential exhaustion

Red volume bars shrinking suggests weakening sellers, bullish divergence

📈 MACD Analysis:

Signal: Bearish crossover but flattening histogram

MACD line below signal, yet momentum slowing—watch for bullish cross

Applied TradingView Drawing Utilities

This chart analysis utilizes the following professional drawing tools:

Disclaimer: This technical analysis by Isabel Weller is for educational purposes only and should not be considered as financial advice.

Trading involves risk, and you should always do your own research before making investment decisions.

Past performance does not guarantee future results. The analysis reflects the author’s personal methodology and risk tolerance (medium).

Sovereignty extends to tokenomics. Mint a gas token capturing all fees, rebating traders or staking rewards. No more subsidizing unrelated dApps on shared L2s. Instanodes nails why this beats L1s: full control over utility, from fee burns to governance votes tied to trading volume.

Real-World Metrics: Appchains Crushing Benchmarks

dYdX v4 on its Cosmos SDK appchain hit 100x Ethereum throughput post-migration, with fees in the microcents range during peaks. Hyperliquid routinely clears millions in daily volume at latencies under 100ms, fees negligible for pros running HFT bots. These aren’t outliers; they’re blueprints.

Conduit’s gaming data translates directly: dedicated rollups/appchains cut onchain costs 90% and versus shared setups. For DEXs, that means sustainable economics – no more praying for low gas seasons. Reddit’s L2 skeptics have a point on decentralization risks, but appchains bootstrap with permissioned validators, graduating to open sets as permissionlessly as any chain.

Running one? Entry barriers dropped. Tools like OP Stack’s Orbit or Cosmos SDK let teams spin up in weeks, L1 costs contained under $10k monthly for modest volumes. Zeeve’s rollup guide shows batching wins, but appchains leapfrog by ditching it entirely for native efficiency.

Appchains don’t just lower fees; they redefine trading economics, making on-chain order books viable for retail and whales alike.

Picture a DEX where every limit order is as cheap as a spot trade on Binance, but fully non-custodial. High-frequency strategies bloom without CeFi compromises. Gaming guilds run in-game markets; prediction platforms handle micro-bets at scale. Blockchain order book scaling unlocks composability too – frontends plug into appchain APIs, backends settle cross-chain via IBC or bridges.

Challenges linger, sure. Validator coordination demands ops chops, and liquidity fragmentation risks user confusion. Yet, as Alchemy outlines rollup models, appchains capture value upstream: child chains pay homage, but parents dictate terms. The Superchain ecosystem hints at interoperability layers mitigating silos.

For developers eyeing custom rollups low fees, start small: prototype on testnets, measure order throughput, iterate fee schedules. Open-source matching engines from Hyperliquid or dYdX accelerate. The payoff? A DEX that doesn’t flinch at volatility, delivering gas efficient app-chains where fees fuel growth, not friction.

This shift feels inevitable. General-purpose chains commoditize; appchains specialize. As DeFi matures, expect order book DEXs to dominate, powered by these sovereign machines churning sub-$1 miracles daily.