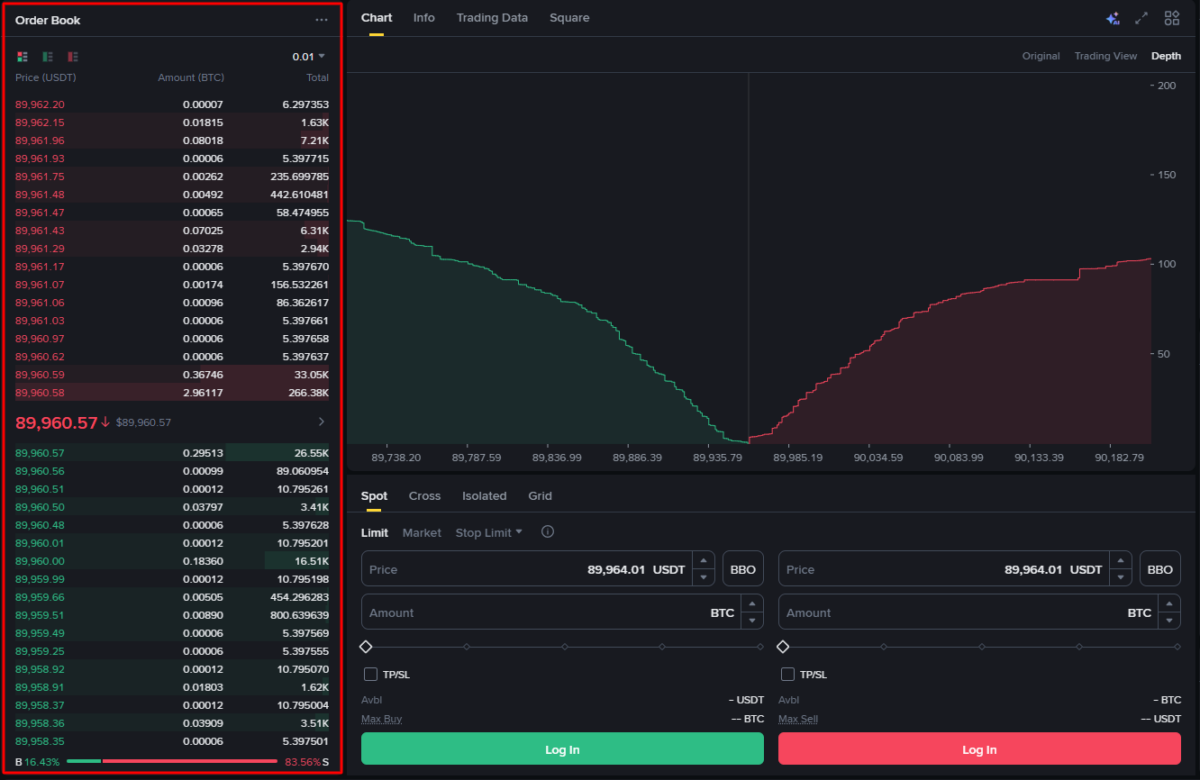

In the evolving landscape of decentralized finance, custom app-chains like Hotstuff Perps stand out by prioritizing specialized fee markets that drive liquidity and efficiency. Tiered maker rebates emerge as a powerful tool, rewarding market makers with escalating incentives based on volume. This structure not only deepens order books but also aligns economic incentives with long-term platform growth, drawing lessons from Hotstuff L1’s performant on-chain order book.

Unlocking Liquidity Through Tiered Incentives

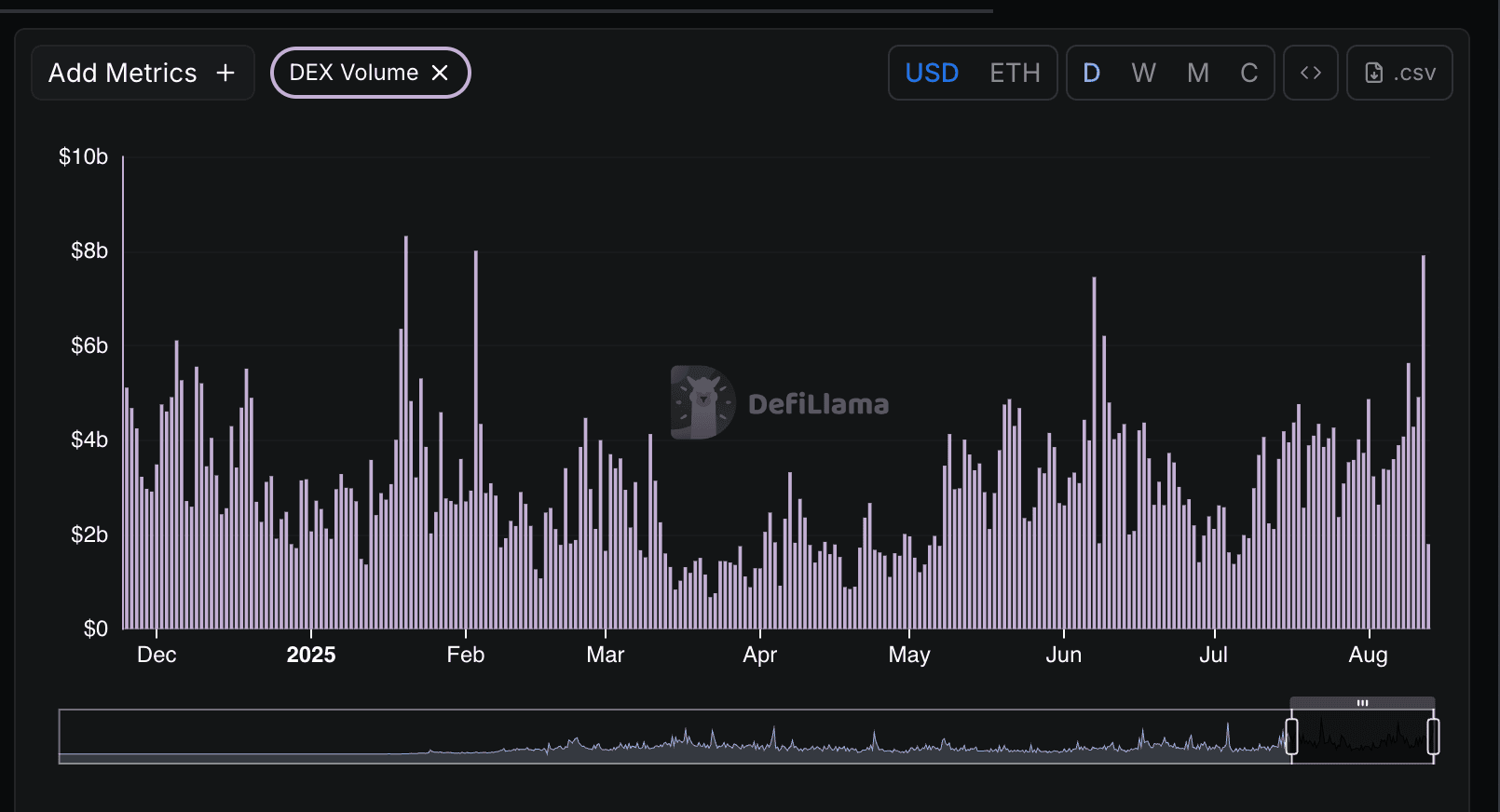

Custom rollups fee markets thrive when liquidity providers feel genuinely rewarded. Traditional flat fees often fail to attract serious market makers, leading to thin books and volatile spreads. Tiered maker rebates in app-chains flip this script, offering negative fees or cashbacks that scale with commitment. Platforms like Hotstuff Perps can leverage this to foster a vibrant perp trading ecosystem, where high-volume makers subsidize their operations through rebates funded by taker fees.

Consider the mechanics: rebates kick in as makers hit volume thresholds, say over 14 or 30 days. This gamifies liquidity provision, encouraging consistent quoting across volatile markets. In my view, it’s a smart evolution from CEX models, adapted for blockchain’s transparency. Hotstuff’s programmable routing layer amplifies this, routing trades optimally while rebates keep makers engaged.

Real-World Benchmarks Shaping Hotstuff Perps Fees

Several protocols have pioneered tiered systems, providing blueprints for specialized blockchain rebates. Drift Protocol sets a baseline with -0.25 basis points for non-BTC/ETH perps, boosted by staking up to 40%. Deepcoin credits 0.02% rebates in real-time for USDT pairs, enhancing immediacy. Extended scales from 0.0025% at 0.5% market share to 0.02% at 5%, tying rewards to dominance.

Comparison of Tiered Maker Rebates

| Platform | Maker Rebate | Tier Details | Measurement Period | Additional Notes |

|---|---|---|---|---|

| Drift Protocol | -0.25 bps | Staking DRIFT tokens increases rebates by up to 40% | N/A | Base for non-BTC/ETH perpetuals |

| Deepcoin | 0.02% | Flat rebate | N/A | Real-time credit after order execution for USDT perpetuals |

| Extended | 0.0025% – 0.02% | Increasing rebates by 30-day maker market share (0.5% to 5% share) | 30 days | Encourages sustained liquidity provision |

| Polymarket | 100% of taker fees | Daily USDC rebates to liquidity providers | N/A | Rebate pool funded entirely by taker fees |

| Hyperliquid | -0.002% | Volume-based tiers and referral rewards | 14-day rolling volume | Dynamic model directing fees to community HLP pool |

Polymarket funnels all taker fees into daily USDC rebates, a pure pass-through model. Hyperliquid’s dynamic 14-day tiers start at -0.002% maker rebate, feeding into community pools. These examples highlight app-chain liquidity incentives at work: rebates aren’t charity, they’re precision-engineered to minimize slippage and maximize throughput.

Key Advantages of Tiered Maker Rebates

-

Deeper order books: Tiered rebates incentivize market makers to provide more liquidity, as seen in Hyperliquid’s dynamic model with -0.002% maker rebates, leading to robust on-chain order books in custom app-chains like Hotstuff Perps.

-

Reduced spreads: By rewarding high-volume makers, platforms like Drift Protocol (-0.25 basis points rebate) tighten bid-ask spreads, improving trading efficiency on performant L1s such as Hotstuff.

-

Sustained maker retention: Volume-based tiers, like Extended’s rebates scaling to 0.02% for 5% market share, encourage long-term liquidity provision and loyalty among makers.

-

Volume-based scalability: Rebates adjust with 14-day or 30-day volumes (e.g., Deepcoin’s 0.02% real-time rebates), allowing chains like Hotstuff to scale liquidity with growing activity.

-

Community-aligned economics: 100% fee redistribution as in Polymarket’s USDC rebates funds community pools, aligning incentives in app-chains for sustainable growth.

Architecting Rebates for Custom App-Chains

Building tiered maker rebates in Hotstuff Perps begins with defining tiers tied to verifiable on-chain metrics. Use 14-day or 30-day rolling volumes for fairness, tracking maker orders via order book interactions. Smart contracts enforce rebates post-settlement, deducting from a fee pool accrued from takers. Hotstuff’s HotStuff-derived consensus ensures sub-second finality, critical for real-time crediting without disputes.

Opinion: Skip overly complex staking multipliers initially; focus on pure volume tiers to bootstrap liquidity. Integrate with the chain’s native token for optional boosts, mirroring Drift. This setup not only cuts costs for makers but positions Hotstuff Perps as a leader in perp trading efficiency.

Volume tracking demands precision. Leverage Hotstuff’s on-chain order book to log maker contributions transparently, avoiding oracle dependencies that plague other chains. Rebate calculations can run off-chain for speed, settling on-chain via batched claims, minimizing gas while upholding verifiability.

Step-by-Step Blueprint for Hotstuff Perps

Deploying this in a custom app-chain like Hotstuff Perps requires a methodical rollout. Start simple, iterate based on data, and watch liquidity compound.

Once live, dashboards become your best friend. Real-time metrics on tier progression and rebate payouts build trust, pulling in more makers. I’ve seen similar setups on Hyperliquid turn casual quoters into dedicated providers, and Hotstuff Perps, with its MonadBFT-inspired consensus hitting 10,000 TPS, can scale this effortlessly.

Navigating Pitfalls in Specialized Fee Markets

No system is flawless. Gaming risks loom large: wash trading to inflate volumes or tier-poaching by coordinated groups. Counter this with anti-sybil measures, like minimum quote sizes or spread requirements, enforced by the protocol. Hotstuff’s programmable layer shines here, allowing dynamic rules that adapt to market conditions without hard forks.

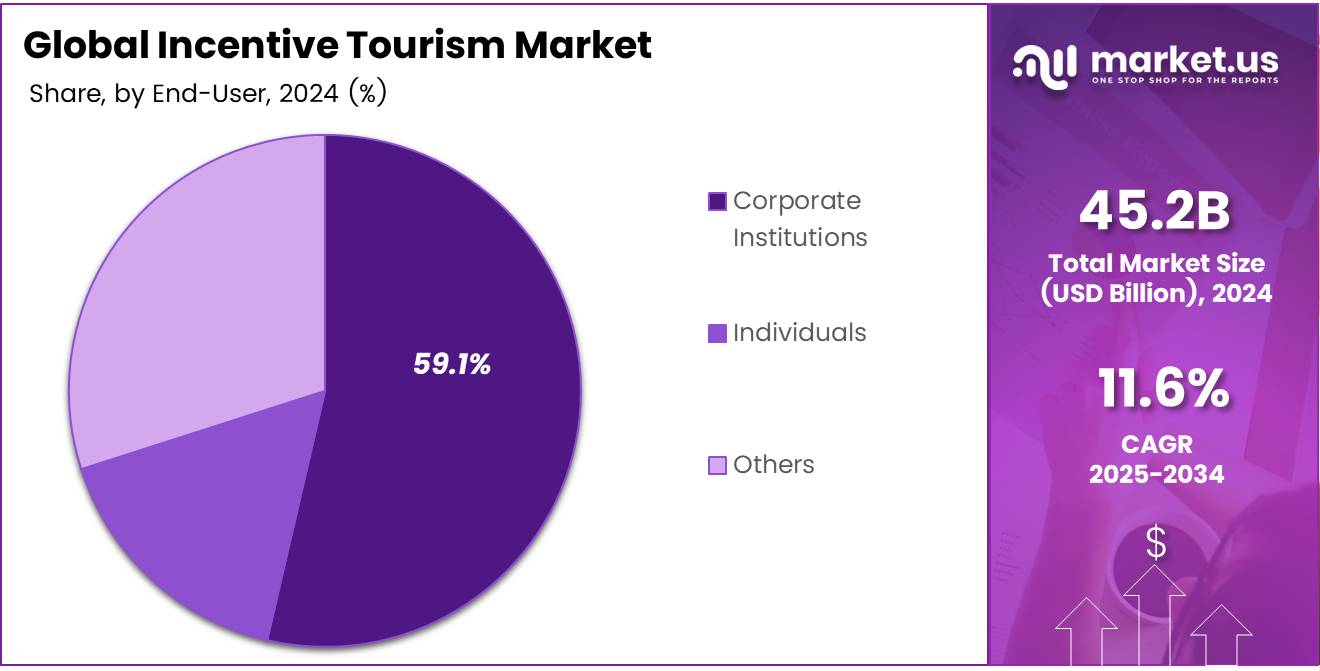

Another hurdle: fee pool sustainability. If takers dry up, rebates falter. Solution? Hybrid funding from native token emissions or treasury allocations during early stages, tapering as volume grows. Polymarket’s 100% pass-through works post-maturity, but bootstrapping needs nuance. In custom rollups fee markets, this balance prevents over-reliance on speculation.

Regulatory shadows also hover over perps, especially with tiered incentives mimicking CEX rebates. Frame it as liquidity rewards, not trading subsidies, and bake in compliance hooks for KYC-optional tiers if needed. Hotstuff Perps can differentiate by emphasizing DeFi purity, sidestepping the pitfalls that snag generalized L1s.

| Challenge | Solution for Hotstuff Perps |

|---|---|

| Wash trading | Min quote sizes and spread checks |

| Pool depletion | Token emissions hybrid |

| Scalability | HotStuff consensus sub-second finality |

| Transparency | On-chain dashboards and audits |

These safeguards turn potential weaknesses into strengths, fortifying app-chain liquidity incentives against real-world stresses.

The Competitive Edge for Hotstuff Perps Fees

Why does this matter now? CLOB wars rage on, with dYdX and Hyperliquid setting the pace via rebates. Hotstuff Perps enters with superior tech: pairing tiered maker rebates with a performant order book and routing layer. Imagine agents from Lyra Tool Discovery automating quotes, juicing volumes across tiers seamlessly.

This isn’t just fees; it’s an ecosystem flywheel. Deeper books slash slippage for retail traders, drawing volume that fattens the rebate pool further. Developers building on Hotstuff gain tools for their own specialized blockchain rebates, from prediction markets to tokenized assets. As the blockchain trilemma bends under custom chains, tiered systems prove scalability doesn’t demand compromises.

Hotstuff Labs’ launch signals a shift. By embedding these mechanics natively, they sideline rollup gas bloat, delivering CEX-grade perps on L1. Makers win with escalating rewards, takers with tight spreads, and the chain with sticky TVL. It’s a blueprint for the next wave of DeFi-native infrastructure.