Gas fees are the heartbeat of blockchain operations, yet their unpredictability has long been a pain point for both developers and users. On legacy networks like Ethereum, fees can spike unexpectedly due to network congestion or surges in demand, leaving users frustrated and dApps struggling to onboard new participants. In fact, recent studies reveal that up to 70% of first-time users abandon decentralized apps at onboarding, unexpected transaction fees are frequently cited as the main culprit. This volatility doesn’t just slow adoption; it fundamentally undermines trust in the decentralized ecosystem.

Why Predictable Gas Fees Matter for App-Chains

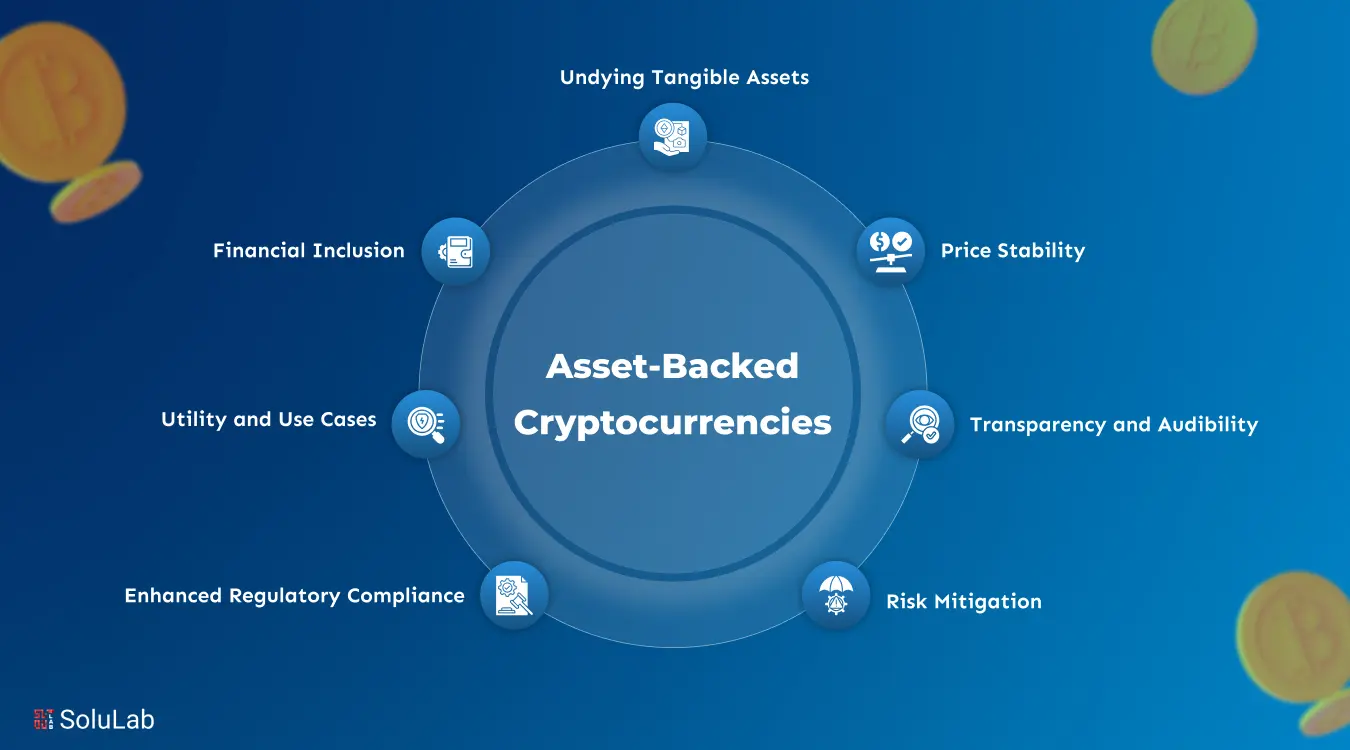

App-chains, custom blockchains tailored for specific applications, are flipping the script on gas fee design. Instead of relying on generalized fee markets exposed to wild swings, app-chains can implement stable fee user experiences by leveraging specialized economics and technology stacks. This predictability isn’t just a nice-to-have; it’s rapidly becoming a competitive necessity as mainstream users demand clarity and reliability from blockchain-powered products.

The move toward predictable gas fees in app-chains is more than a technical upgrade, it’s an economic and psychological shift. When users know exactly what they’ll pay (or if they’ll pay at all), they’re far more likely to experiment with new dApps, make repeat transactions, or even migrate from traditional platforms. Developers also gain the ability to budget precisely, allocate resources efficiently, and forecast growth without the specter of surprise cost spikes.

Key Benefits of Predictable Gas Fees in App-Chains

-

Enhanced User Onboarding: Predictable gas fees remove surprise costs, reducing abandonment rates by up to 70% for first-time dApp users. This smoother onboarding experience helps attract and retain new users.

-

Simplified Budgeting for Developers: Models like SKALE’s subscription-based fees allow developers to deploy app-chains for a flat monthly rate, making cost planning straightforward and eliminating variable gas expenses.

-

Stable Payment Options: Platforms such as MStableChain enable users to pay transaction fees with multiple stablecoins, ensuring consistent and transparent costs regardless of network activity.

-

Gasless Transactions via Account Abstraction: The adoption of ERC-4337 allows apps and wallets to sponsor user transactions, leading to over 103 million gas-free operations in 2024 and making dApps more accessible to all.

-

Increased User Trust and Satisfaction: Stable and transparent fee structures foster confidence among users, encouraging deeper engagement with decentralized applications and reducing hesitation due to fee volatility.

-

Better Financial Planning for Enterprises: Predictable fees enable businesses and developers to allocate resources efficiently, supporting long-term growth and sustainability in the blockchain ecosystem.

Innovative Fee Models: From Multi-Stablecoins to Subscriptions

The latest generation of app-chains is experimenting with bold new models that directly address gas fee unpredictability:

- Multi-native stablecoins: Platforms like MStableChain allow transaction fees to be paid in multiple stablecoins, ensuring that costs remain steady regardless of crypto market volatility. This flexibility empowers users with choice and shields them from sudden price swings (arxiv.org).

- Subscription-based networks: SKALE’s innovative approach lets developers deploy dedicated chains for a flat monthly fee. The result? End-users enjoy zero gas costs while developers gain predictable budgeting (skale.space).

- Sponsorships and account abstraction: Thanks to standards like ERC-4337, wallets or apps can sponsor user transactions, removing the gas barrier entirely for end-users. This has already led to over 103 million gas-free user operations recorded in 2024 alone (panewslab.com).

User Experience Impacts: Lowering Barriers and Building Trust

The real power of predictable gas fees lies in their impact on user experience, a factor often underestimated by protocol engineers but critical for mainstream adoption. When transaction costs are transparent or even invisible (as in gasless models), onboarding friction plummets and retention soars. Users no longer need to second-guess whether interacting with a smart contract will result in an unexpected drain on their wallet.

This shift is already evident across several leading ecosystems. Subscription-based chains have seen developer interest surge due to simplified cost structures, while multi-stablecoin payment options have been credited with improving cross-border usability for DeFi applications. As these innovations mature, expect them to set new industry standards for what it means to build accessible, scalable decentralized platforms.