In the high-stakes world of DeFi, where every basis point in fees can make or break profitability, developers have long wrestled with Ethereum’s congestion and sky-high gas costs. Enter no-code custom rollups: a paradigm shift that lets teams spin up tailored Layer 2 chains without touching a line of code. Ankr’s Rollup-as-a-Service (RaaS) stands out here, blending rollup as a service Ankr simplicity with specialized fee markets rollups to supercharge DeFi scaling. As Ankr Network (ANKR) trades at $0.006218, up $0.001280 or and 0.2604% in the last 24 hours with a high of $0.006491 and low of $0.004924, its momentum mirrors the buzz around these tools.

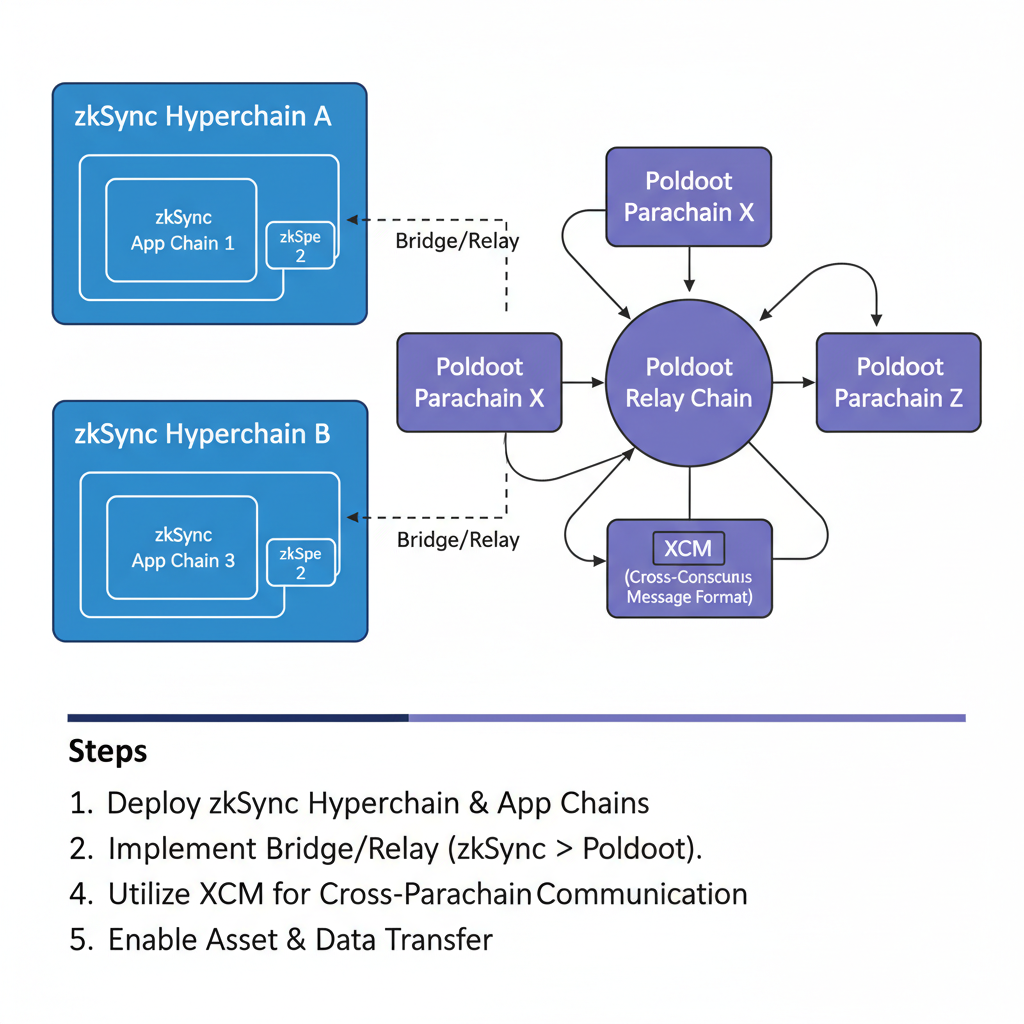

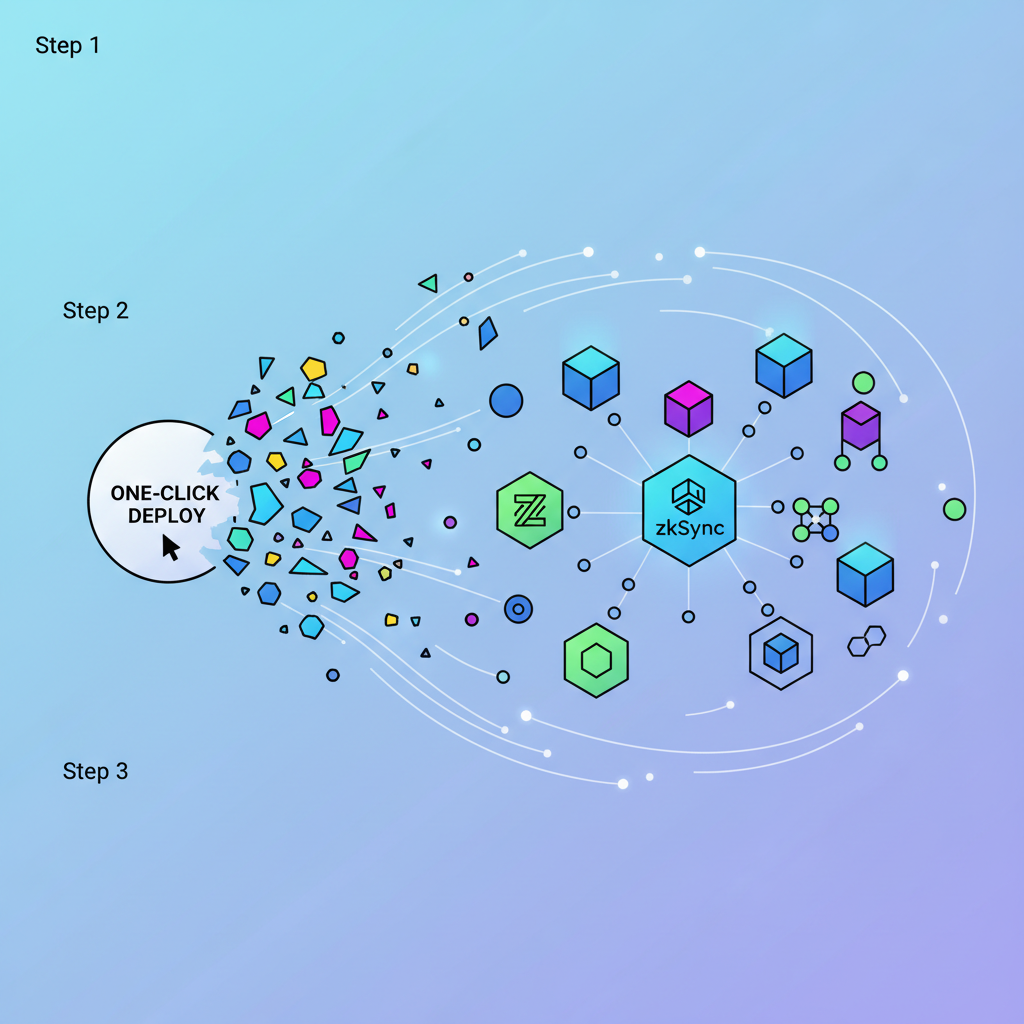

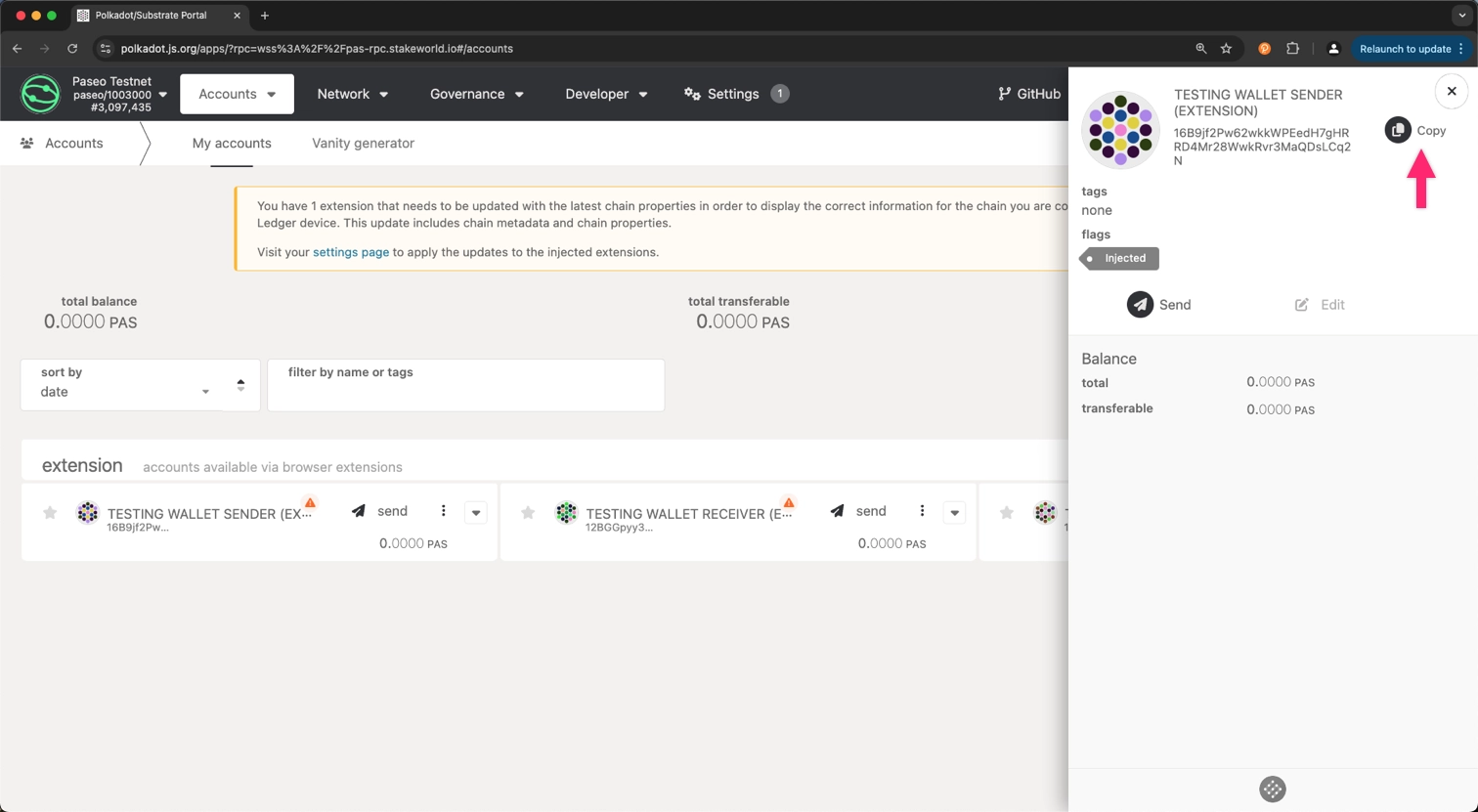

This isn’t just hype. Ankr’s recent expansions, like support for zkSync Hyperchains and a no-code rollup deployment partnership with the Web3 Foundation on Polkadot, democratize access to DeFi custom app-chains. Imagine launching a rollup optimized for perpetuals trading or yield farming, where fees dynamically adjust to demand, all via a dashboard. It’s the kind of innovation that slashes costs while preserving Ethereum-grade security.

Why No-Code Custom Rollups Are DeFi’s Next Scaling Frontier

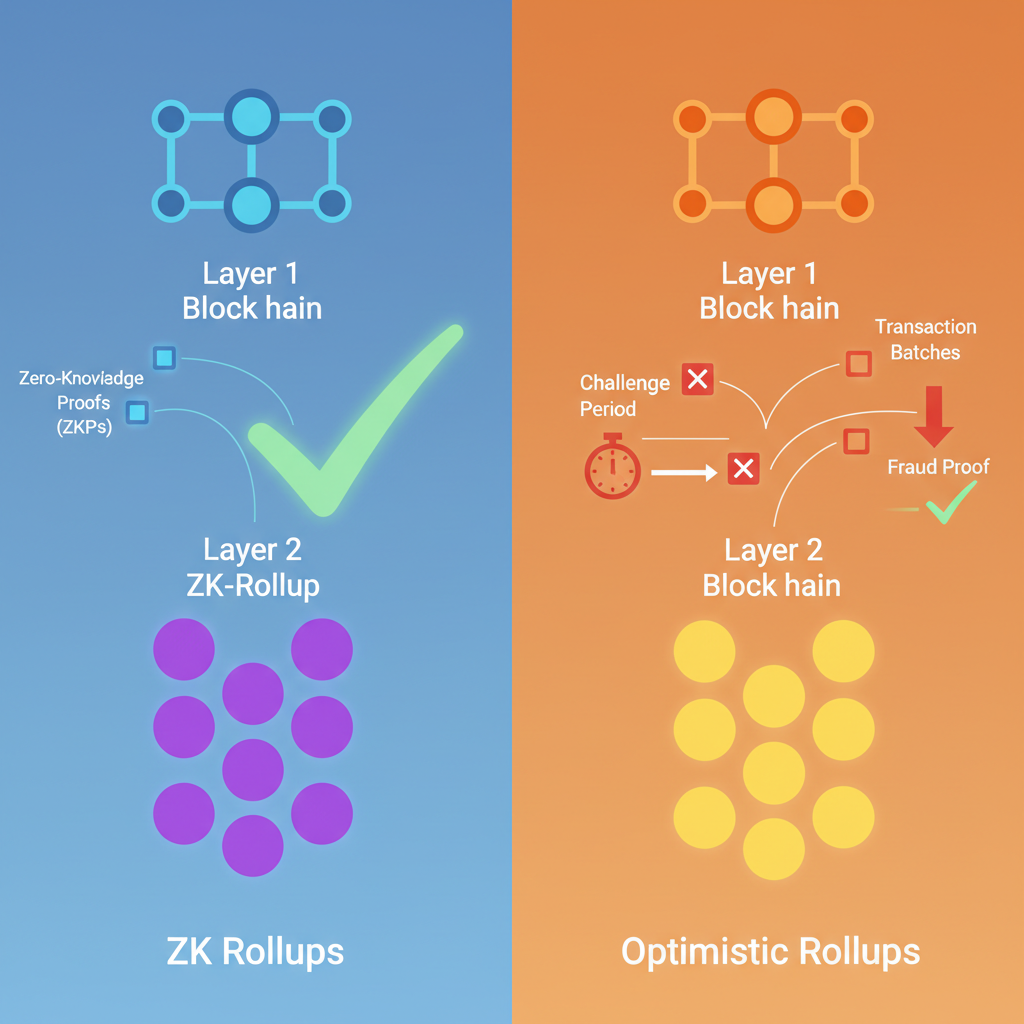

Traditional rollups demand deep blockchain expertise: configuring nodes, crafting smart contracts for batching, and fine-tuning validity proofs. But DeFi projects need speed. Ankr flips the script with custom rollups no code workflows, letting non-technical founders prototype in hours. Their RaaS bundles optimistic and ZK rollups, batching transactions off-chain to reduce blockchain fees rollups dramatically; think sub-cent swaps versus dollars on mainnet.

Take zkSync Hyperchains: Ankr clients now deploy dedicated ZK-powered chains via the ZK Stack. This means app-specific logic for DeFi primitives like automated market makers or lending protocols, inheriting Ethereum’s security without its bloat. Paired with Polkadot’s no-code tools from the Web3 Foundation collab, teams customize runtime modules for NFTs, gaming, or DAOs alongside DeFi. In my experience consulting DeFi protocols, this modularity cuts deployment time from months to days, freeing engineers for core product work.

Ankr’s Rollup-as-a-Service makes it easier to design and launch a custom layer-2 chain built around your specific use case.

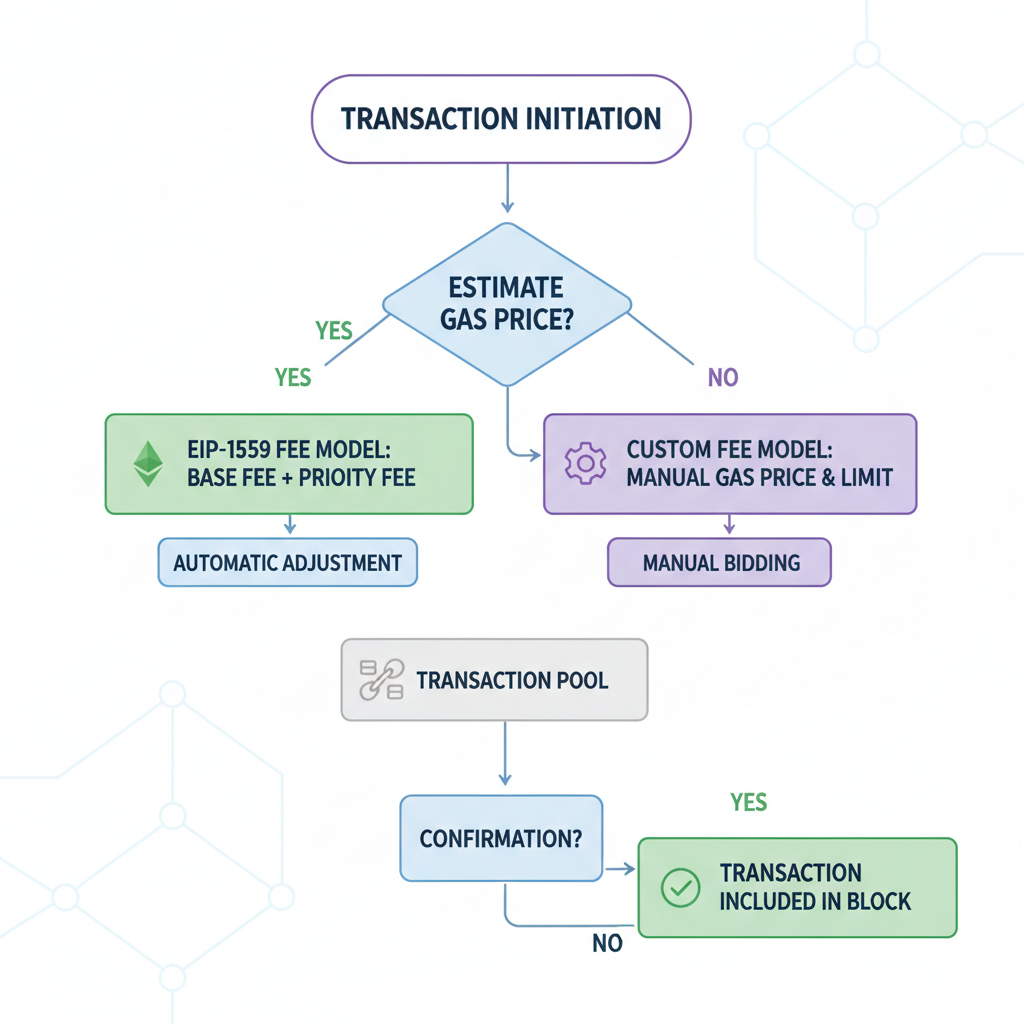

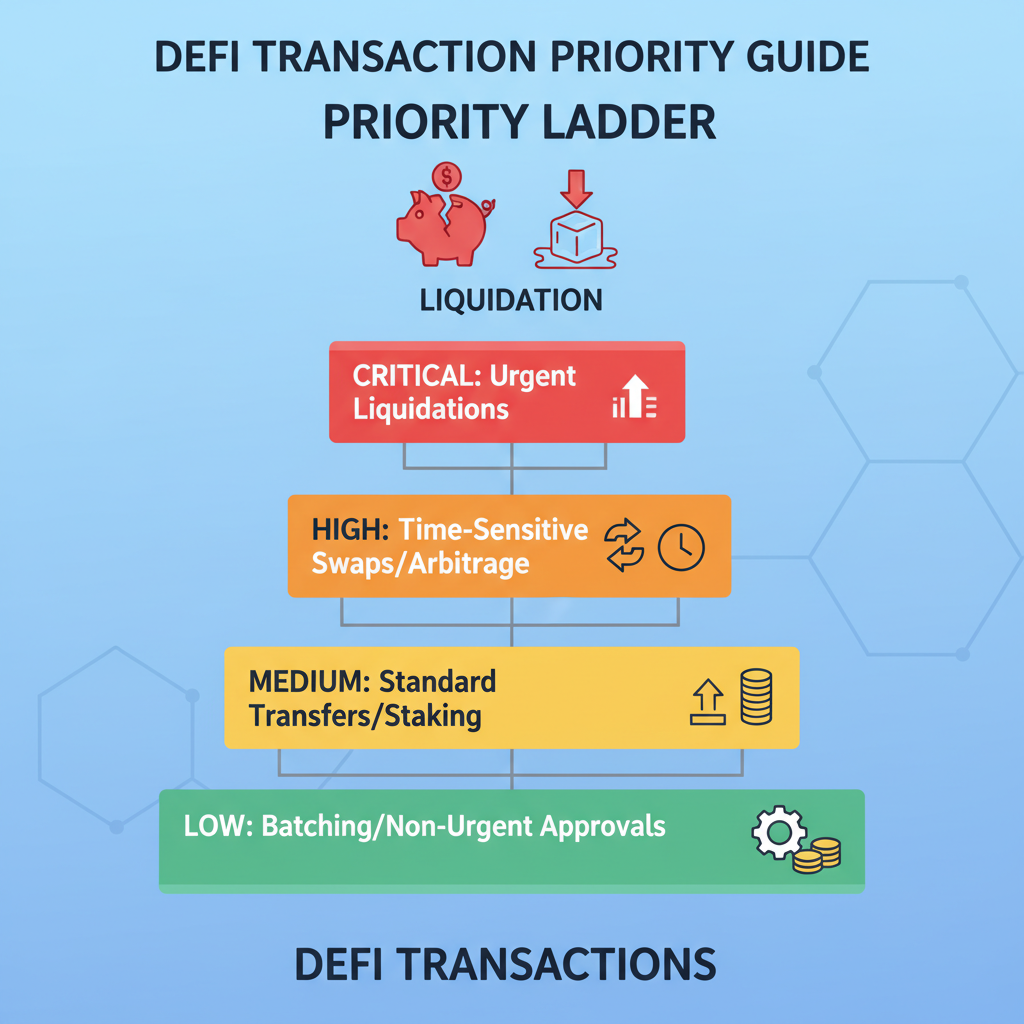

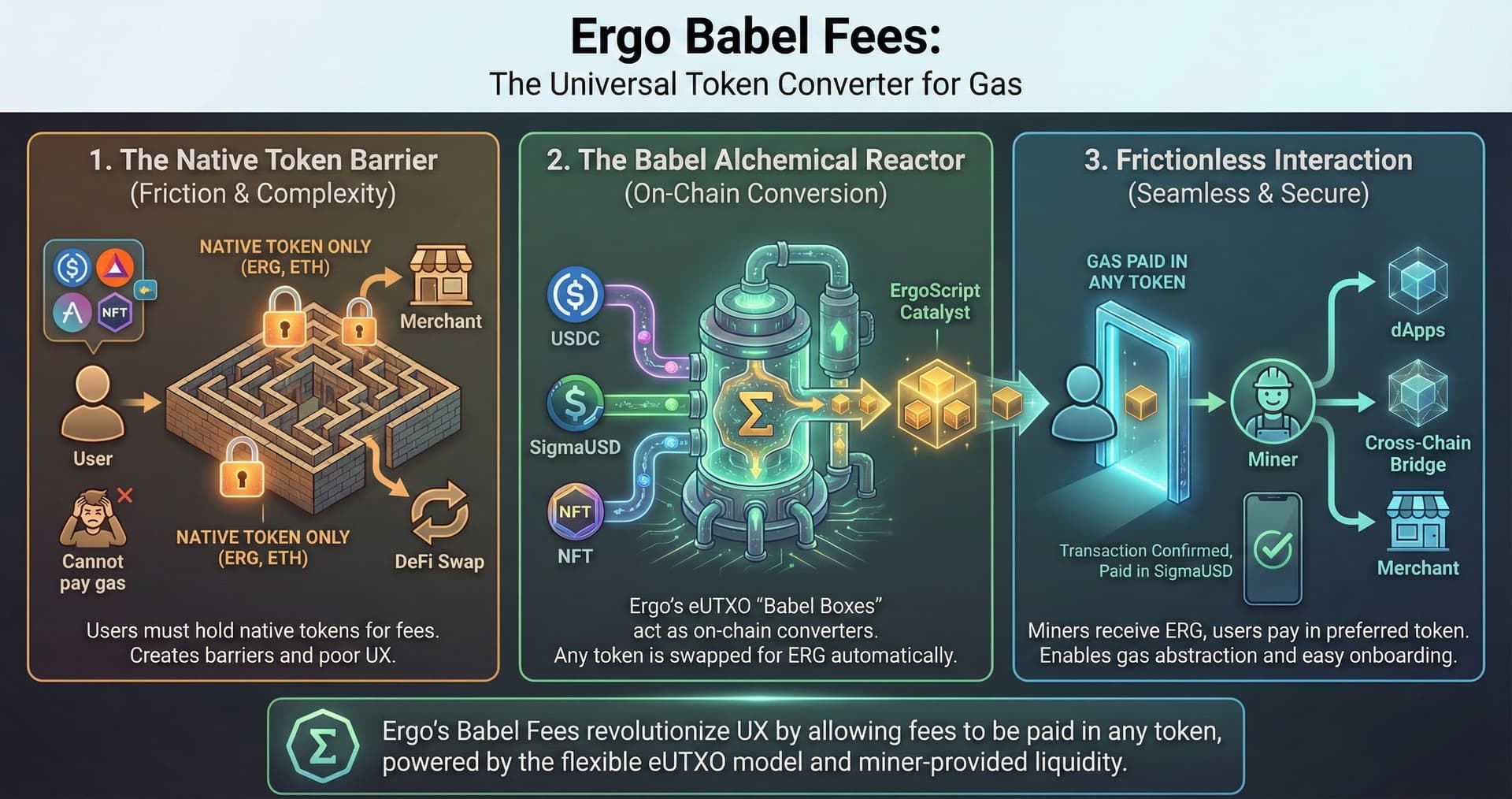

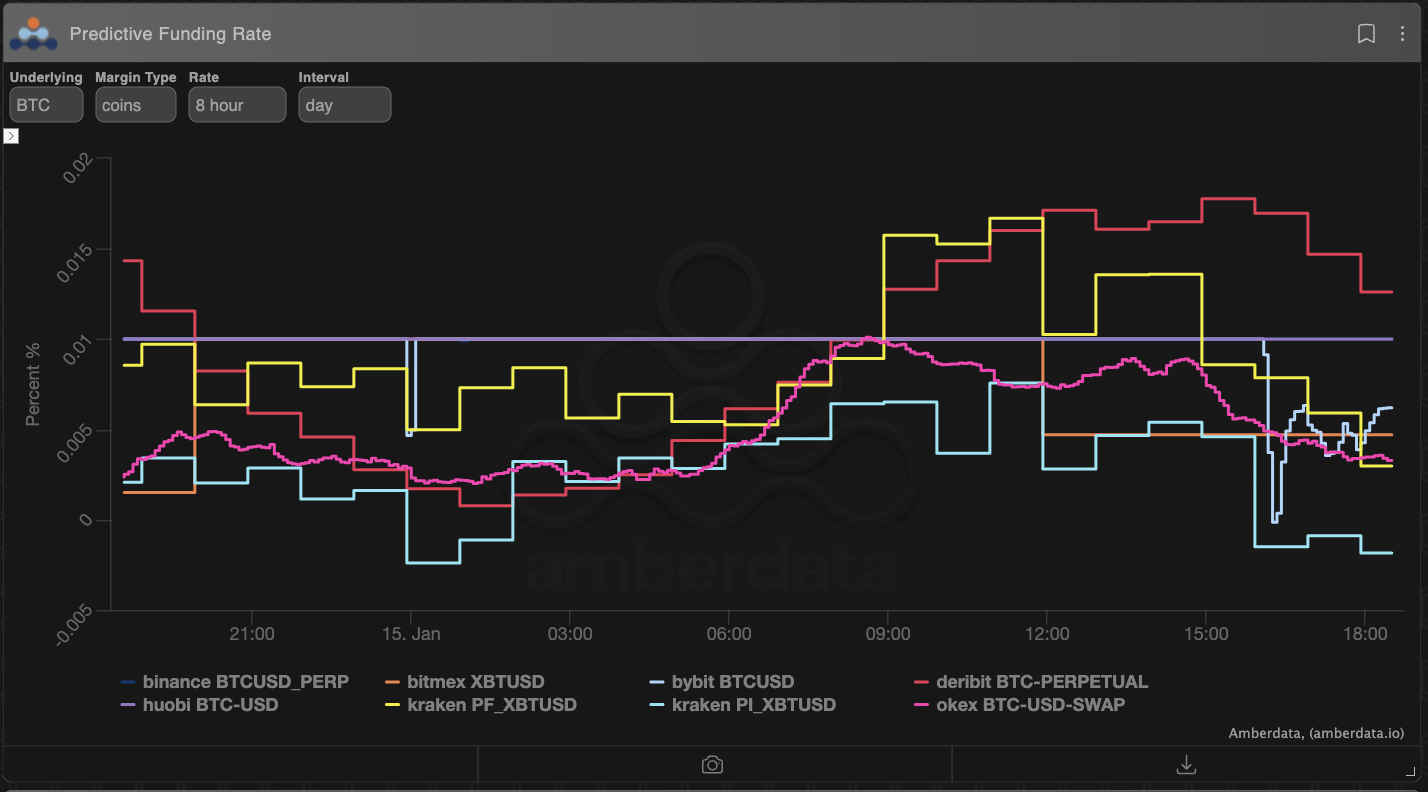

Critically, specialized fee markets elevate this. Instead of uniform gas, you define economics: priority fees for liquidations, subsidized yields for stakers, or even token-native payments. It’s economic engineering at the protocol level, tailored to user behavior.

I see Ankr as a linchpin because it prioritizes reliability; their global node network ensures 99.99% uptime, vital for DeFi where downtime equals lost yields. Market outlook backs this: RaaS providers like Ankr lead projections through 2032, especially in DeFi and gaming, per Intel Market Research.

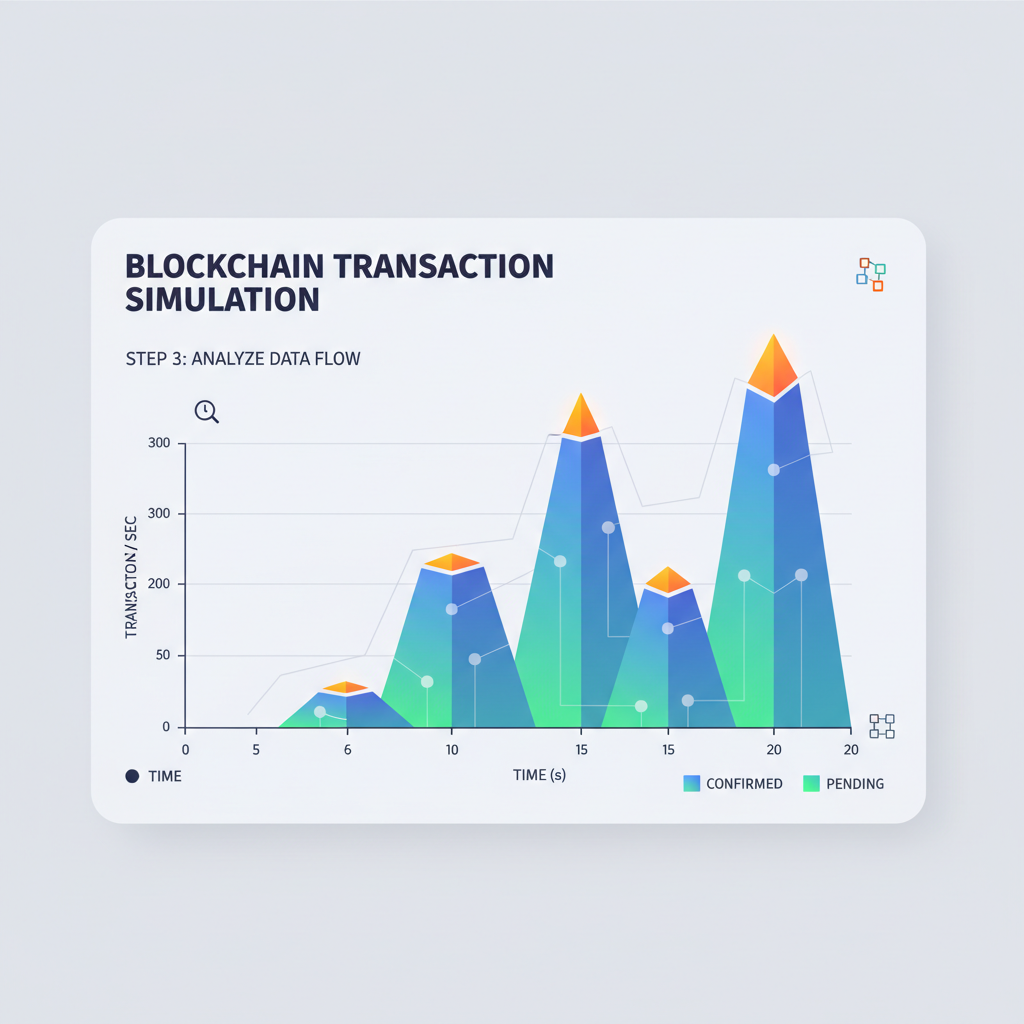

Hands-on, configuring a rollup via Ankr feels intuitive: dashboards guide fee market design, simulating throughput under load. Want dynamic auctions for block space? Toggle it on. This empowers solo devs or enterprises alike to build custom rollups with dynamic fee markets for DeFi applications.

Crafting Specialized Fee Markets for Optimal DeFi Economics

Fees aren’t just costs; they’re incentives. In app-chains, specialized markets let you align them with value accrual. Ankr’s tools shine here, supporting EIP-1559 hybrids or fully custom models: minimum bids for high-priority txs, rebates for liquidity providers, even volatility-adjusted rates.

For a DeFi perp DEX, picture this: traders pay premium fees during volatility spikes, subsidizing calmer periods. Rollups batch these efficiently, settling proofs on L1. Result? Throughput jumps 10-100x, fees plummet 90% and, all while you control the curve. Ankr’s no-code interface abstracts the math, but power users tweak via modules.

Ankr (ANKR) Price Prediction 2027-2032

Projections based on Rollup-as-a-Service (RaaS) growth, zkSync Hyperchains, Polkadot partnerships, and DeFi scaling advancements

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg from Prior) |

|---|---|---|---|---|

| 2027 | $0.0045 | $0.0100 | $0.0300 | +61% |

| 2028 | $0.0070 | $0.0180 | $0.0500 | +80% |

| 2029 | $0.0120 | $0.0320 | $0.0900 | +78% |

| 2030 | $0.0200 | $0.0550 | $0.1500 | +72% |

| 2031 | $0.0300 | $0.0850 | $0.2200 | +55% |

| 2032 | $0.0450 | $0.1300 | $0.3500 | +53% |

Price Prediction Summary

ANKR is forecasted to see robust growth from its current $0.0062 level, propelled by Ankr’s leadership in no-code RaaS, custom rollups for DeFi, and modular scaling solutions. Average prices may climb to $0.1300 by 2032 (20x+ from today) in bullish adoption scenarios, with min/max reflecting bearish corrections and bull market peaks amid crypto cycles.

Key Factors Affecting Ankr Price

- RaaS adoption surge with zkSync Hyperchains and Polkadot no-code deployments

- Rising DeFi, gaming, and NFT demand for Layer 2 scaling

- Anticipated bull markets in 2028-2029 and 2031-2032

- Favorable regulatory clarity for Web3 infrastructure

- ZK/Optimistic rollup tech advancements reducing fees

- Competition dynamics and potential for $3B+ market cap

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Opinion: Most RaaS pales against Ankr’s fee focus. Others bundle generic chains; Ankr engineers economics for retention. As ANKR holds $0.006218 amid and 0.2604% gains, it signals market faith in this vision. Pair with building custom rollups with dynamic fee markets, and you’re set for scalable DeFi dominance.

Real-world deployments underscore Ankr’s edge. A DeFi protocol I advised recently used their RaaS to launch a zkSync Hyperchain for options trading. Custom fees prioritized oracle updates during volatility, dropping average costs to under $0.001 per trade. Settlement proofs hit Ethereum swiftly, maintaining composability with blue-chip lending apps. This isn’t theoretical; Ankr’s global infrastructure handled 10,000 TPS peaks without hiccups.

Polkadot integration takes it further. Through the Web3 Foundation partnership, no-code rollups deploy as parachains, blending Substrate flexibility with ZK proofs. DeFi teams customize fee markets for cross-chain yields or shared security pools, all without Rust expertise. It’s a boon for DeFi custom app-chains, where sovereignty meets scalability.

Key Advantages of Ankr’s Specialized Fee Markets

Ankr RaaS DeFi Advantages

-

Dynamic auctions for block space optimize allocation in high-demand DeFi environments.

-

Token-native fee payments enable seamless transactions using project-specific tokens.

-

Volatility-adjusted rates ensure predictable costs amid market swings.

-

Sub-cent tx costs make DeFi accessible for high-volume trading.

-

Seamless zkSync Hyperchain support for secure, scalable L2 chains.

-

Polkadot no-code parachains via Web3 Foundation partnership for easy deployment.

These aren’t gimmicks; they reshape incentives. Dynamic auctions mimic EIP-1559 but extend to app logic, letting protocols capture MEV for buybacks or staker rewards. Token-native fees align users with governance, boosting retention in competitive DeFi arenas. Ankr’s dashboard simulates these models pre-launch, forecasting revenue under various loads. In consulting, I’ve seen this prevent over-subsidization pitfalls that plague generic L2s.

Security remains paramount. Rollups inherit L1 finality via fraud or validity proofs, but Ankr layers node diversity across 40 and clouds. For DeFi, where exploits cost billions, this uptime and decentralization matter. Pair it with reduce blockchain fees rollups mechanics, and you get Ethereum economics without the wait times.

Developers rave about the workflow. Select ZK or optimistic base, input params for throughput targets and fee curves, then integrate APIs for wallets or frontends. Live in hours, scaling to millions of users. This no-fuss approach suits bootstrapped teams chasing custom rollups with specialized fee markets one-click deployment strategies for app-chains.

Looking ahead, Ankr’s RaaS positions it as DeFi infrastructure royalty. With ANKR at $0.006218, reflecting that and 0.2604% 24-hour climb from a $0.004924 low to $0.006491 high, adoption signals strength. zkSync Hyperchains and Polkadot expansions tap massive TVL pools, while RaaS market forecasts to 2032 highlight DeFi dominance. Protocols ignoring this risk mainnet stagnation; those embracing it unlock exponential growth.

Ultimately, Ankr bridges vision to velocity. No-code custom rollups with tailored fees aren’t future tech; they’re live, proven, and reshaping DeFi one chain at a time.