Application-specific blockchains (appchains) are transforming the decentralized landscape by allowing developers to fine-tune infrastructure for a single use case. This level of customization is especially potent when it comes to governance and tokenomics design, two pillars that determine not only the technical robustness but also the economic sustainability and community alignment of a project. In this guide, we’ll break down best practices for crafting governance frameworks and token economies that maximize value in custom appchains.

Strategic Alignment: Tokenomics That Drive Project Success

Tokenomics isn’t just about supply schedules or staking rewards. The most effective application-specific blockchain projects build their token economies around clear, measurable objectives. For example, a decentralized social network might structure its native token to reward content creation and curation, rather than simple holding or trading. This ensures that every incentive nudges users toward behaviors that directly benefit the ecosystem.

Key principle: Your token’s utility and distribution should be mapped directly to your project’s core KPIs. This means analyzing what actions create value within your dApp – whether it’s transaction throughput, data contribution, or protocol security – and then designing rewards, penalties, and access rights accordingly.

- Incentivize desired user actions (e. g. , posting quality content)

- Create deflationary or inflationary mechanisms based on activity

- Integrate staking or slashing for protocol security

- Design clear vesting schedules for founders and early investors

For more on aligning economic incentives with project goals, see this recent analysis at ChainMonitor.

Decentralized Governance: Empowering Your Community

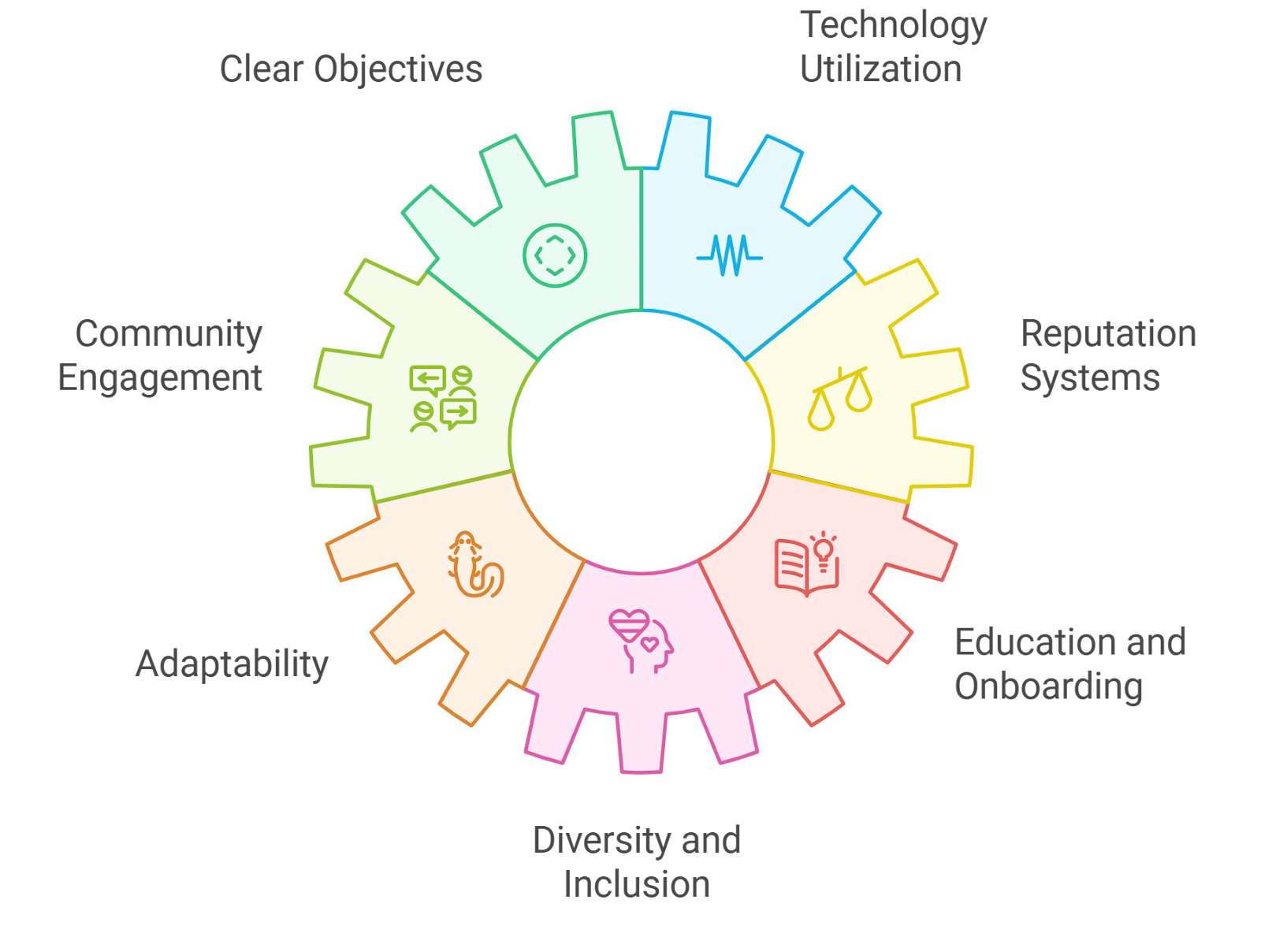

The flexibility of appchains extends to governance models as well. Unlike monolithic L1s with rigid on-chain voting systems, custom governance in appchains can be tailored for maximum transparency, inclusivity, and adaptability. Popular models include:

Notable Appchains with Custom Governance Structures

-

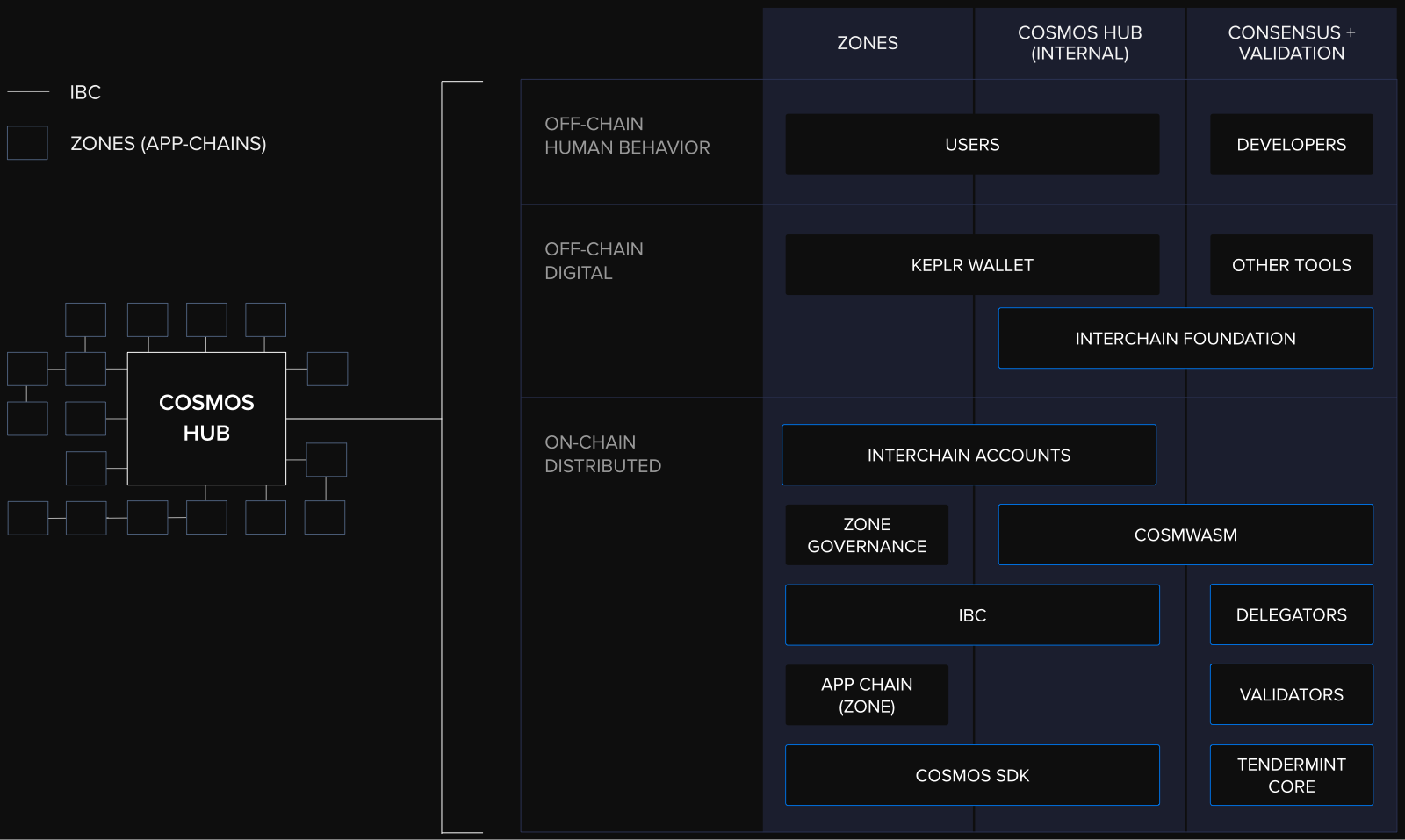

Cosmos Hub (Cosmos SDK): Cosmos Hub employs an on-chain governance system where ATOM token holders can propose and vote on protocol upgrades, parameter changes, and community initiatives. This model emphasizes transparency and community-driven decision-making.

-

Osmosis: As a leading DeFi appchain in the Cosmos ecosystem, Osmosis features token-weighted voting for its OSMO holders. The platform allows users to submit and vote on proposals related to protocol upgrades, liquidity incentives, and fee structures, fostering active community engagement.

-

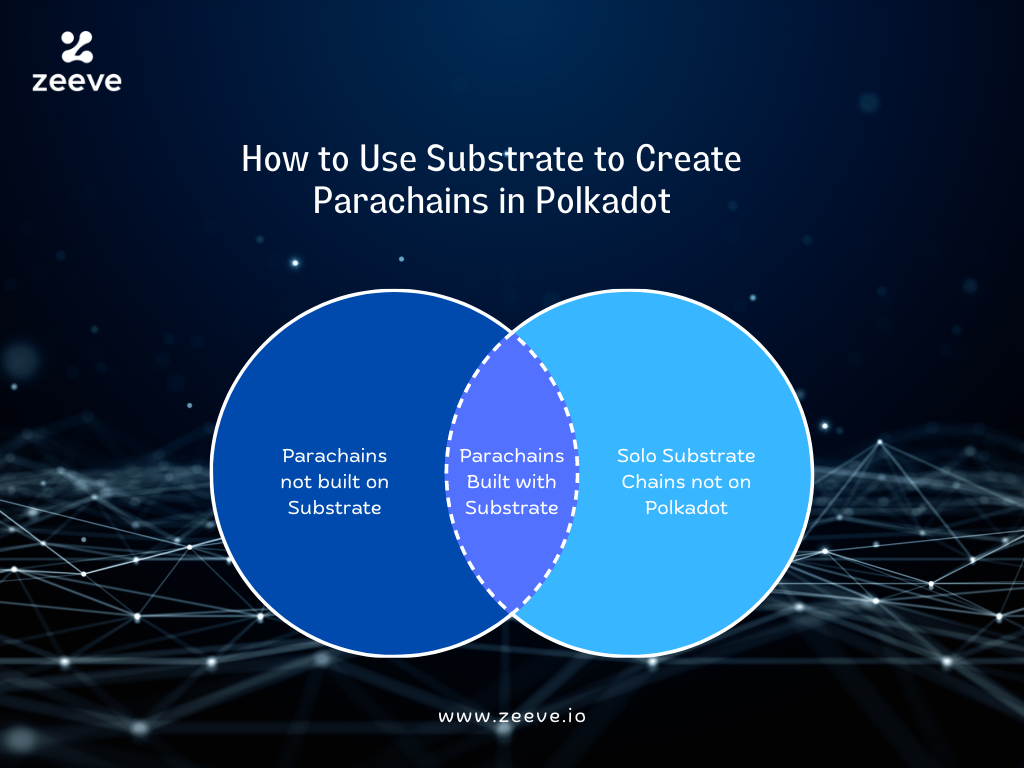

Polkadot Parachains: Many Polkadot parachains, such as Acala and Moonbeam, implement custom governance models leveraging on-chain referenda and council elections. Token holders participate directly or delegate votes, enabling flexible and adaptive governance.

-

MakerDAO (Dai Chain): MakerDAO, while originally on Ethereum, is transitioning toward an application-specific chain (Dai Chain) with a sophisticated governance framework. MKR token holders vote on risk parameters, collateral onboarding, and protocol upgrades, ensuring decentralized oversight.

-

Evmos: Built using Cosmos SDK, Evmos combines Ethereum-compatible smart contracts with appchain governance. EVMOS holders can propose and vote on network upgrades, validator sets, and economic parameters, blending Ethereum and Cosmos governance best practices.

A robust governance system should give stakeholders real influence over protocol upgrades, treasury management, and parameter changes. Liquid democracy – where voting power can be delegated fluidly – is gaining traction for its balance between expertise and broad participation. Meanwhile, token-weighted voting remains prevalent but can introduce plutocratic risks if not counterbalanced by quadratic or reputation-based systems.

A practical illustration is MakerDAO’s approach: each MKR token equals one vote on proposed changes. While simple to implement, such systems require vigilant monitoring of voter concentration to avoid centralization risks (GBA Global).

Adaptive Smart Contracts and Upgradability

No matter how carefully you design your initial ruleset, real-world conditions will change – sometimes rapidly. Appchain builders must prioritize upgradability in both smart contracts and governance processes from day one. Techniques like proxy contract patterns or modular libraries allow for bug fixes and feature enhancements without forcing disruptive migrations or new token launches.

Best practice: Pair upgradable contracts with transparent upgrade processes governed by community votes or multi-signature councils. This ensures both technical agility and stakeholder trust.

The Importance of Transparent Token Distribution

A fair launch is critical for building trust within your ecosystem. Clearly communicating how tokens are allocated across founding teams, investors, contributors, and the community helps prevent accusations of insider advantage or rug pulls. Mechanisms like airdrops or liquidity mining campaigns can broaden participation while rewarding early adopters.

Continuous transparency isn’t just a launch concern, it must be woven into the lifecycle of your application-specific blockchain. Public dashboards, regular reports, and open-source allocation contracts are essential for maintaining credibility in the eyes of both users and external observers. This is especially important as regulatory scrutiny intensifies across global jurisdictions.

Monitoring, Adapting, and Securing Your Appchain

The tokenomics and governance landscape is dynamic. Token velocity, inflation rates, and user engagement metrics can shift rapidly as your user base grows or market conditions evolve. The best teams treat tokenomics as a living system, one that requires regular measurement and iterative improvement.

Top Tools for Monitoring Tokenomics Health in Appchains

-

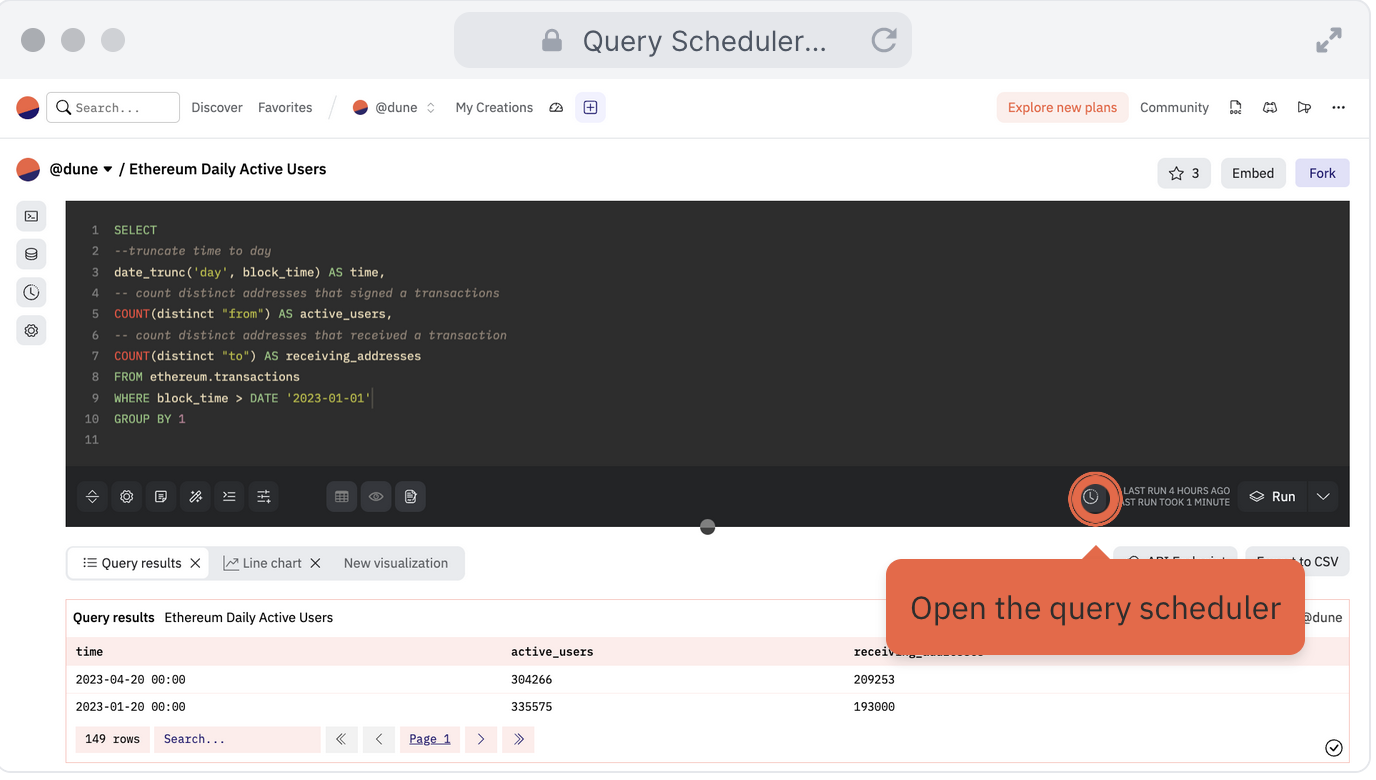

Dune Analytics: Provides customizable dashboards and real-time analytics for on-chain data, enabling appchain teams to track token distribution, velocity, and user engagement with SQL-based queries.

-

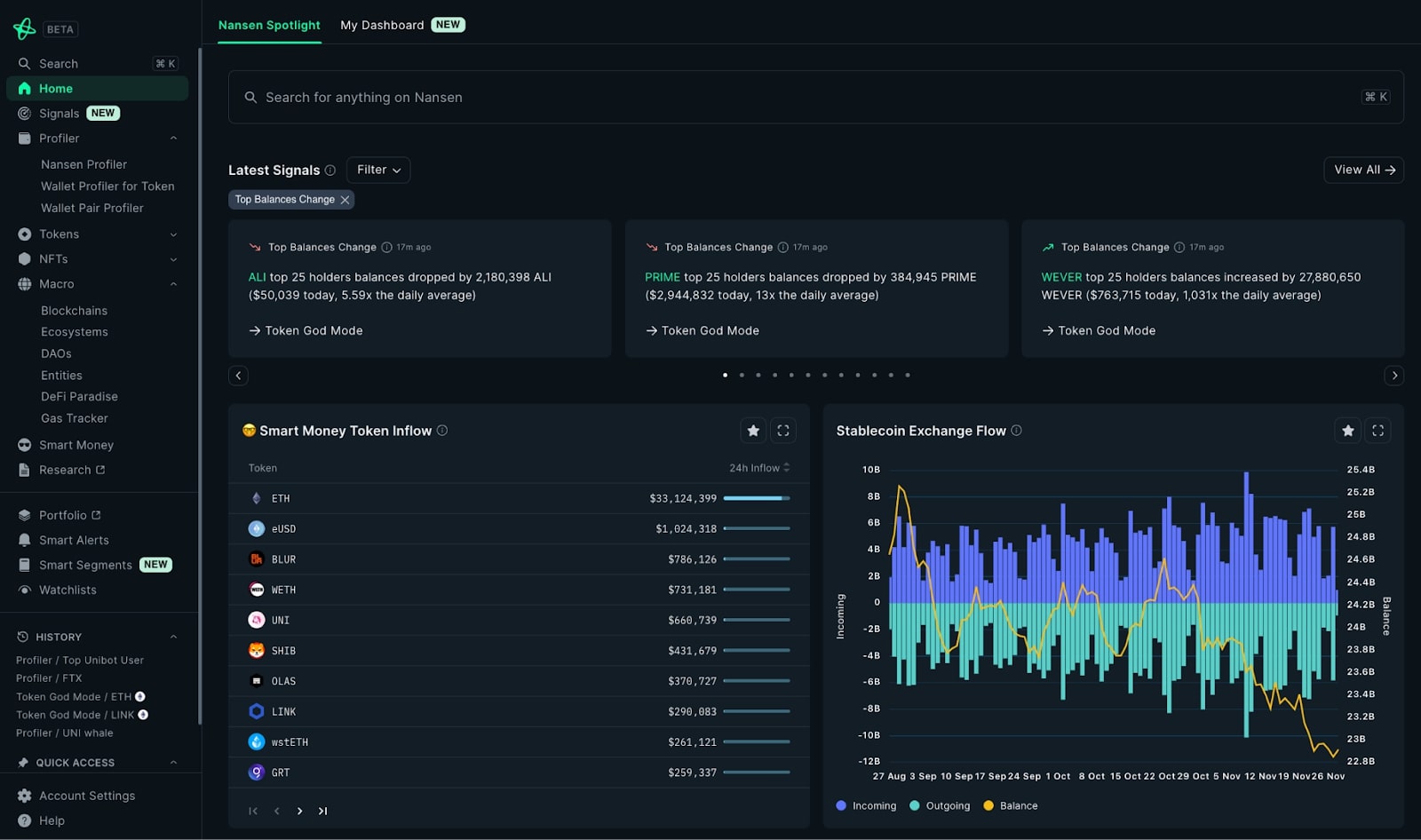

Nansen: Offers advanced on-chain analytics, wallet tracking, and token flow visualizations to monitor large holders, token movements, and community activity across appchains.

-

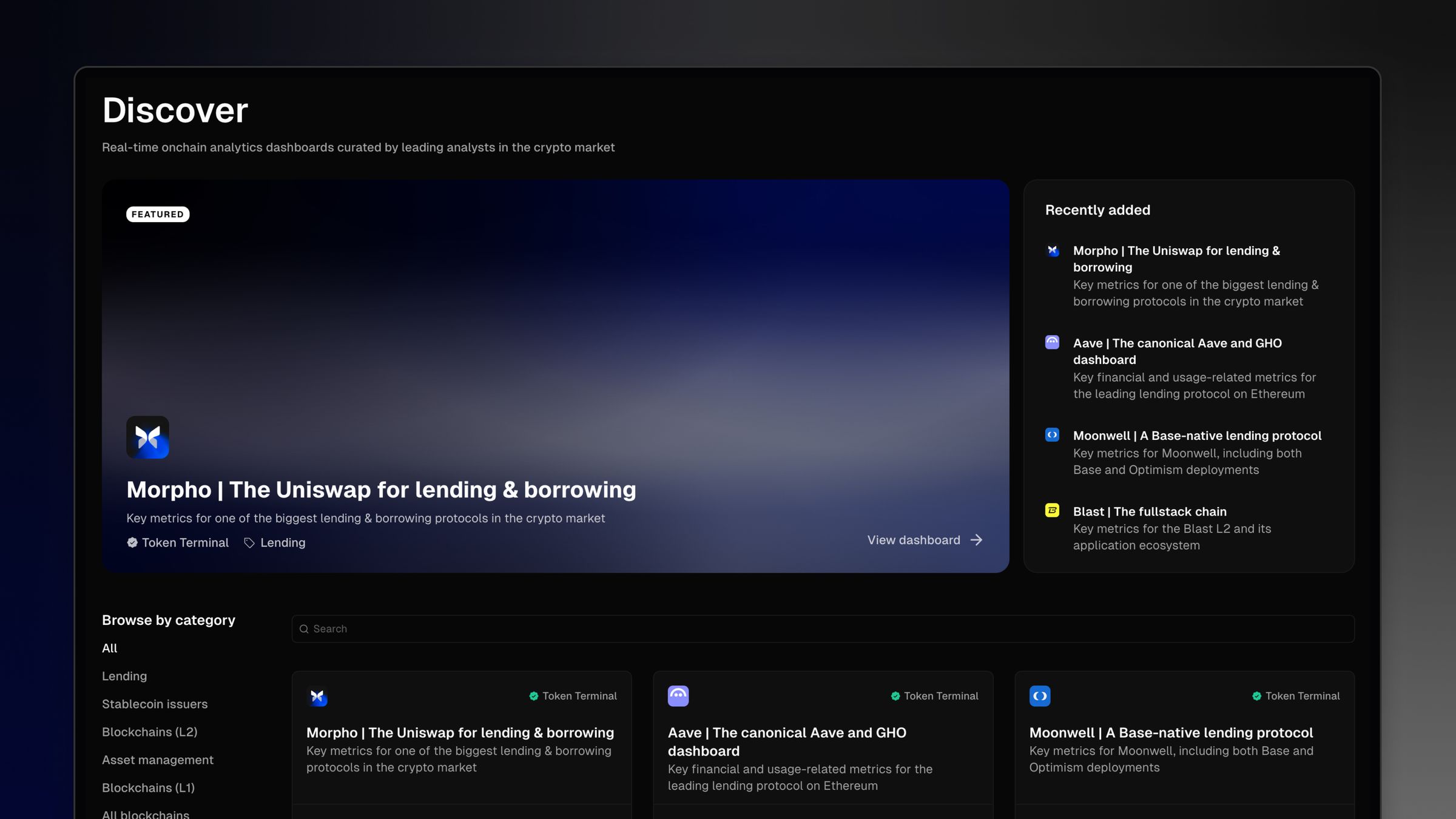

Token Terminal: Delivers financial and operational metrics for blockchains and dApps, including token supply, inflation rates, and protocol revenues—essential for assessing tokenomics health.

-

Flipside Crypto: Enables teams to build custom analytics dashboards and access community-driven tokenomics insights with robust data APIs for appchain monitoring.

-

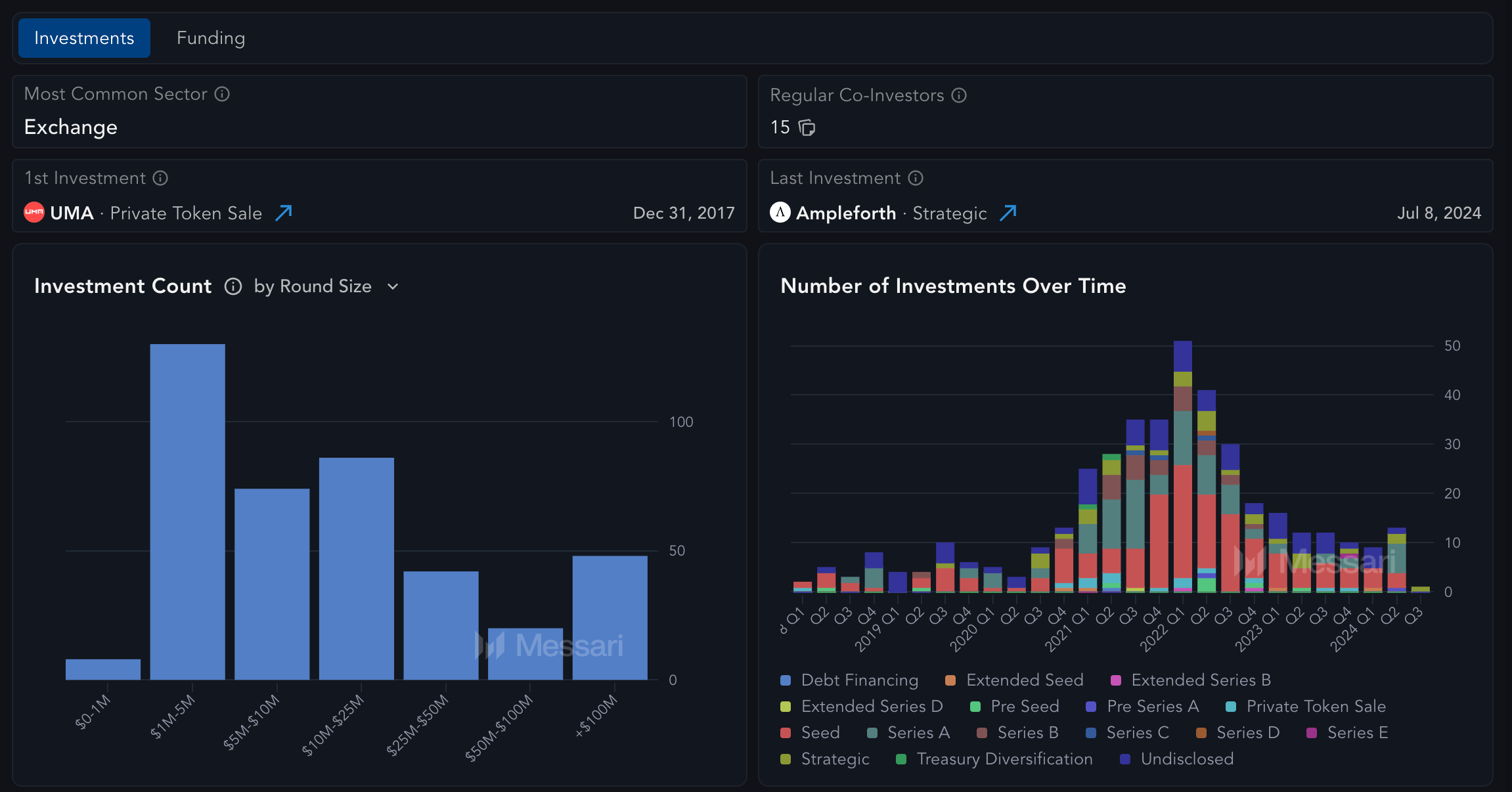

Messari: Provides in-depth research, token metrics, and governance tracking for major blockchains and appchains, supporting informed decision-making for tokenomics adjustments.

For example, monitoring on-chain analytics can help you spot early warning signs of governance capture or liquidity imbalances. Proactive adjustments, such as modifying reward rates or tweaking voting thresholds, can preempt systemic risks before they escalate. For more on continuous adaptation strategies, see the insights at ChainMonitor.

Security is non-negotiable in custom governance appchains. Formal verification, independent audits, and multi-signature wallets should be standard operating procedure. These measures not only protect against technical exploits but also signal a commitment to user safety, a critical factor in community growth. Compliance with evolving regulations should also be a priority from day one; failing to do so can jeopardize even the most innovative projects (Nasscom).

Key Takeaways for Custom Governance Appchains

- Align incentives: Build your token model around clear project goals.

- Embrace adaptable governance: Tailor voting systems to your community’s needs.

- Pursue upgradability: Use smart contract patterns that allow for safe evolution.

- Ensure distribution transparency: Communicate allocation clearly from launch onward.

- Monitor relentlessly: Track key metrics and adapt quickly to new data.

- Prioritize security and compliance: Make audits and regulatory checks routine.

The next generation of decentralized applications will be defined by their ability to combine technical flexibility with economic precision. By following these best practices for governance and tokenomics in application-specific blockchains, developers can create resilient ecosystems that thrive through both innovation cycles and market turbulence.