Developing decentralized applications that span multiple blockchains has long been a technical challenge, riddled with fragmented liquidity, inconsistent user experiences, and complicated developer workflows. Chain abstraction is rapidly emerging as the answer to these pain points, enabling multi-chain app-chains and custom rollups to operate with unprecedented simplicity and composability. By hiding the technical nuances of each underlying chain, chain abstraction lets developers focus on building seamless, scalable dApps, while users enjoy frictionless access to assets and services across networks.

What Is Chain Abstraction, and Why Does It Matter?

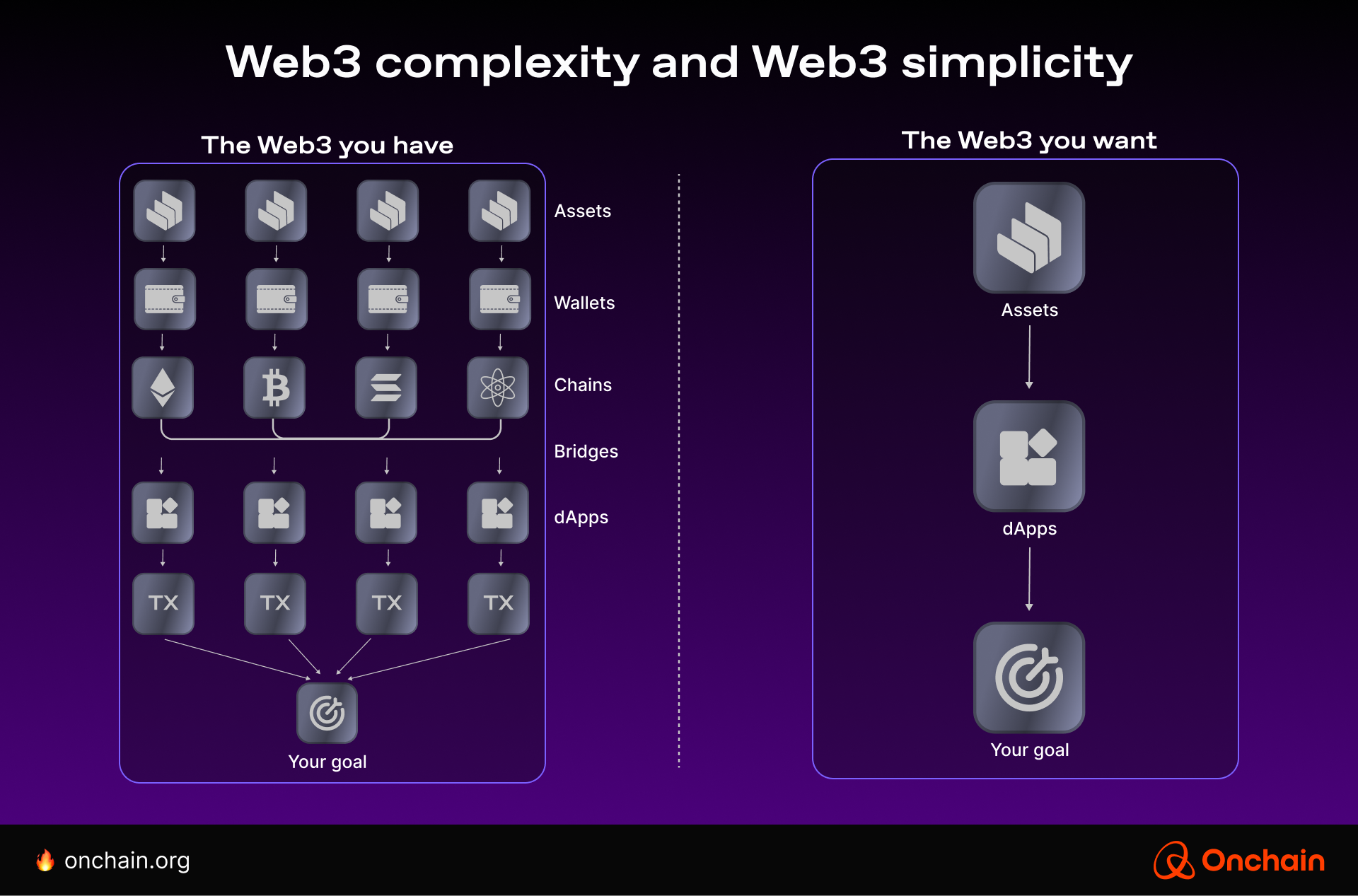

At its core, chain abstraction is a paradigm shift in blockchain development that makes the differences between chains invisible to both developers and end users. Instead of juggling separate wallets, gas tokens, or network configurations for Ethereum, Avalanche, or custom app-chains, users interact with a unified interface that abstracts away these complexities. This approach not only streamlines UX, but also unlocks new possibilities for cross-chain composability and capital efficiency.

The benefits extend far beyond user experience. By unifying development processes, allowing code to be written once and deployed everywhere, chain abstraction slashes maintenance overhead and accelerates innovation cycles. For developers targeting custom rollups, specialized fee markets, or complex DeFi protocols needing cross-chain liquidity, this means faster time-to-market and more robust applications.

The Problems Chain Abstraction Solves in Multi-Chain App-Chain Development

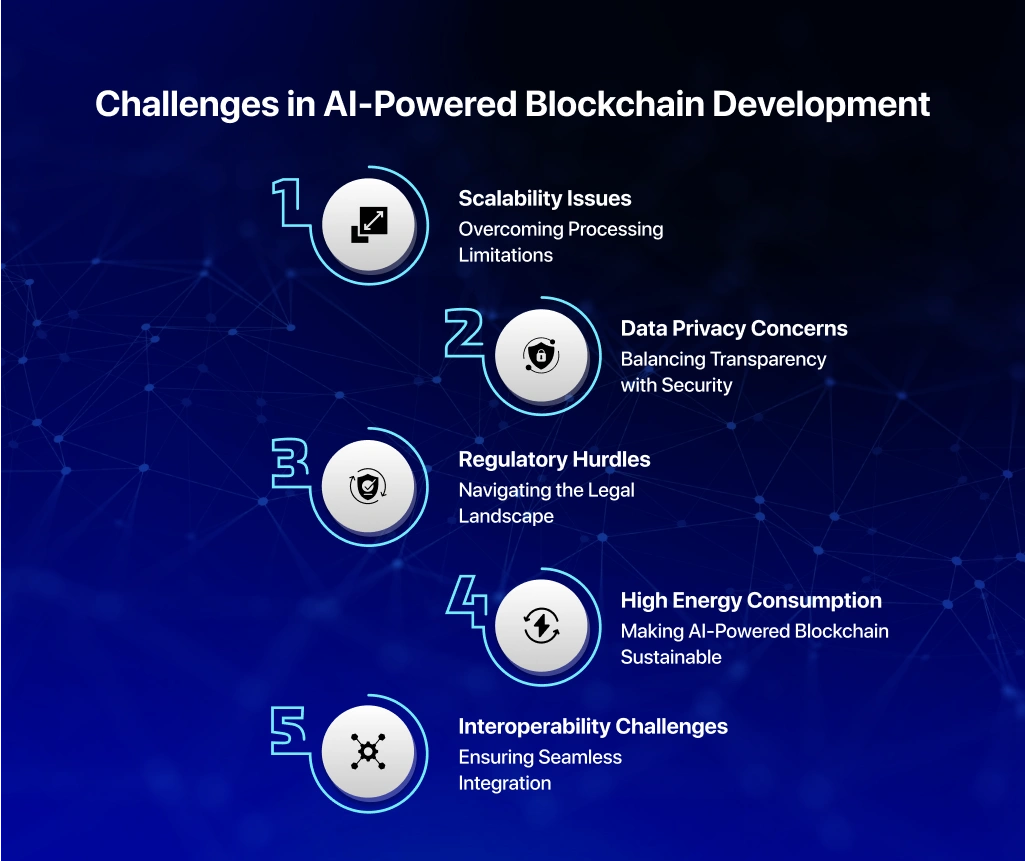

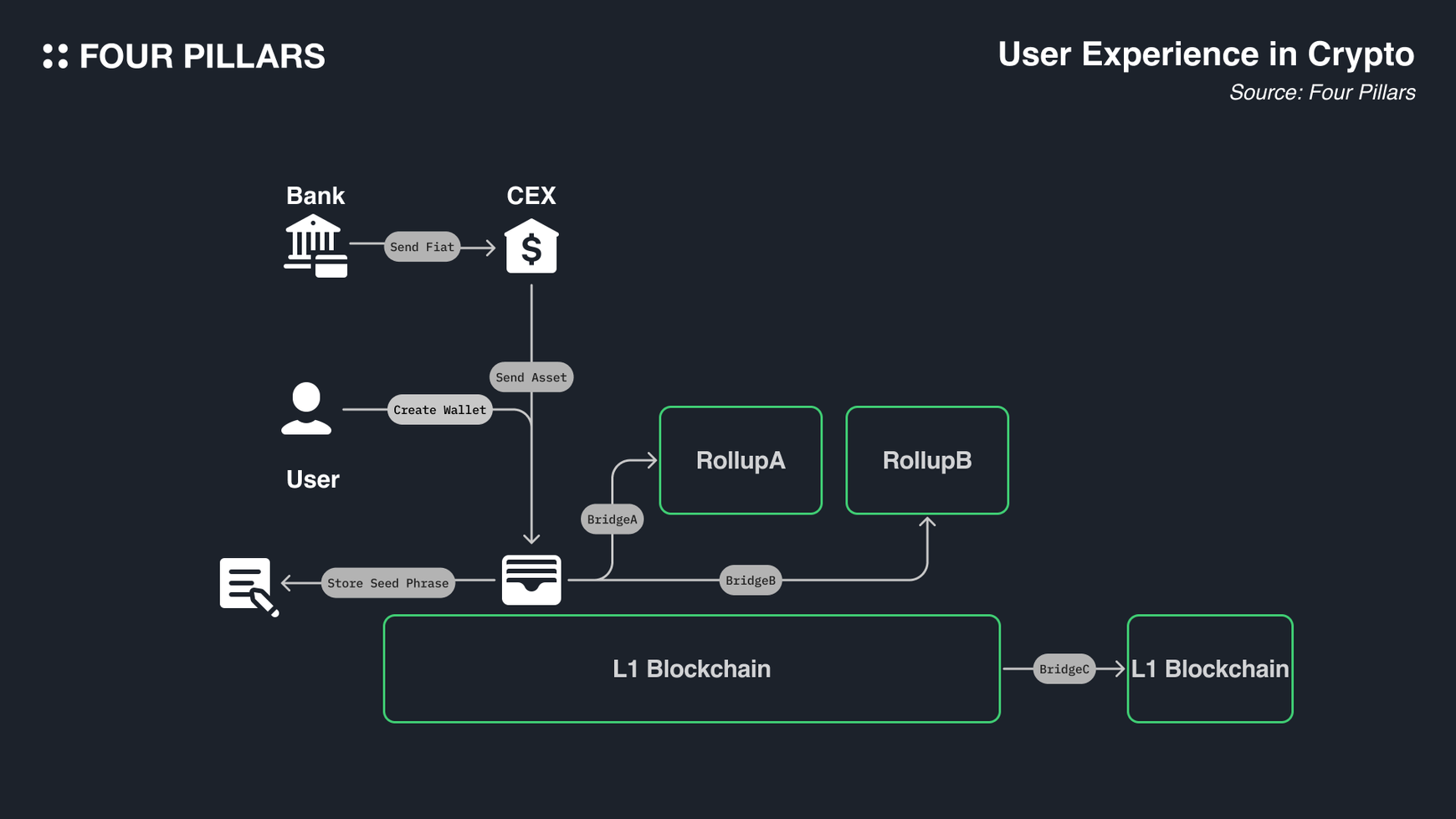

The traditional multi-chain environment is fragmented by design: each blockchain maintains its own consensus mechanism, wallet standard, gas token, and asset bridge. This fragmentation leads to several key challenges:

Top Pain Points in Multi-Chain App-Chain Development

-

Fragmented User Experience: Users must juggle multiple wallets, switch networks, and handle various gas tokens, leading to a confusing and cumbersome interface.

-

Complex Development & Maintenance: Developers face the challenge of adapting code for each blockchain, increasing development time, maintenance overhead, and the risk of bugs.

-

Liquidity Fragmentation: Assets and liquidity are siloed across different chains, making cross-chain transfers difficult and reducing capital efficiency.

-

Poor Interoperability: Limited communication between blockchains hinders seamless data and asset movement, complicating the creation of interconnected dApps.

-

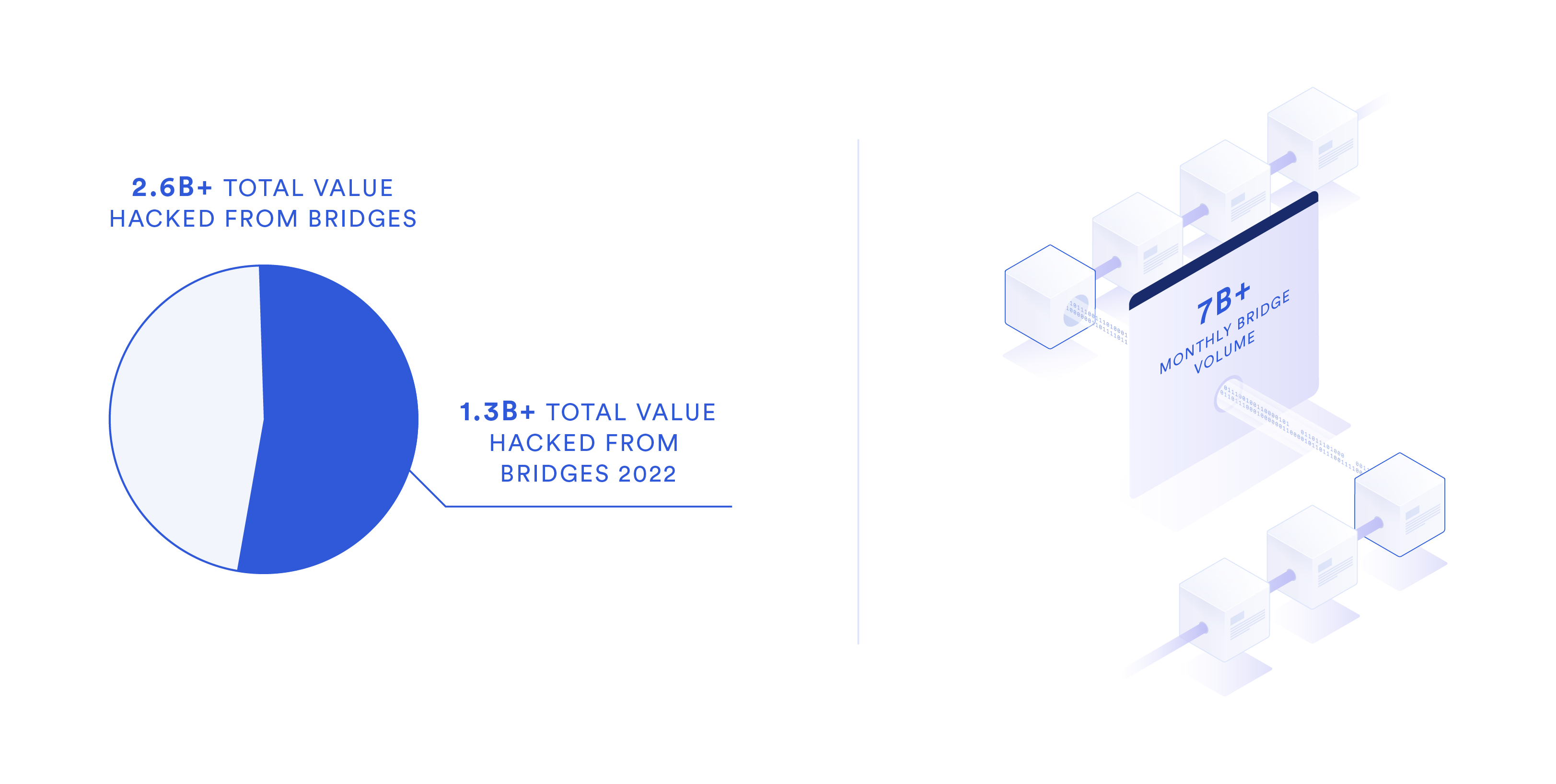

Security Risks in Bridging: Reliance on cross-chain bridges introduces additional attack vectors and vulnerabilities, putting user funds at risk.

- User Experience Complexity: Users must manage multiple wallets and switch networks manually.

- Liquidity Fragmentation: Assets are siloed on individual chains; bridging is slow and risky.

- Developer Overhead: Supporting multiple chains requires bespoke integrations for each network’s quirks.

- Inefficient Fee Markets: Each chain has its own fee market dynamics; optimizing costs across them is nontrivial.

This landscape stifles both adoption and innovation. As highlighted by the chainabstraction.dev documentation, true interoperability demands more than just token bridges, it requires a unified layer that lets assets flow freely while preserving security guarantees.

The Mechanics: How Chain Abstraction Works Under the Hood

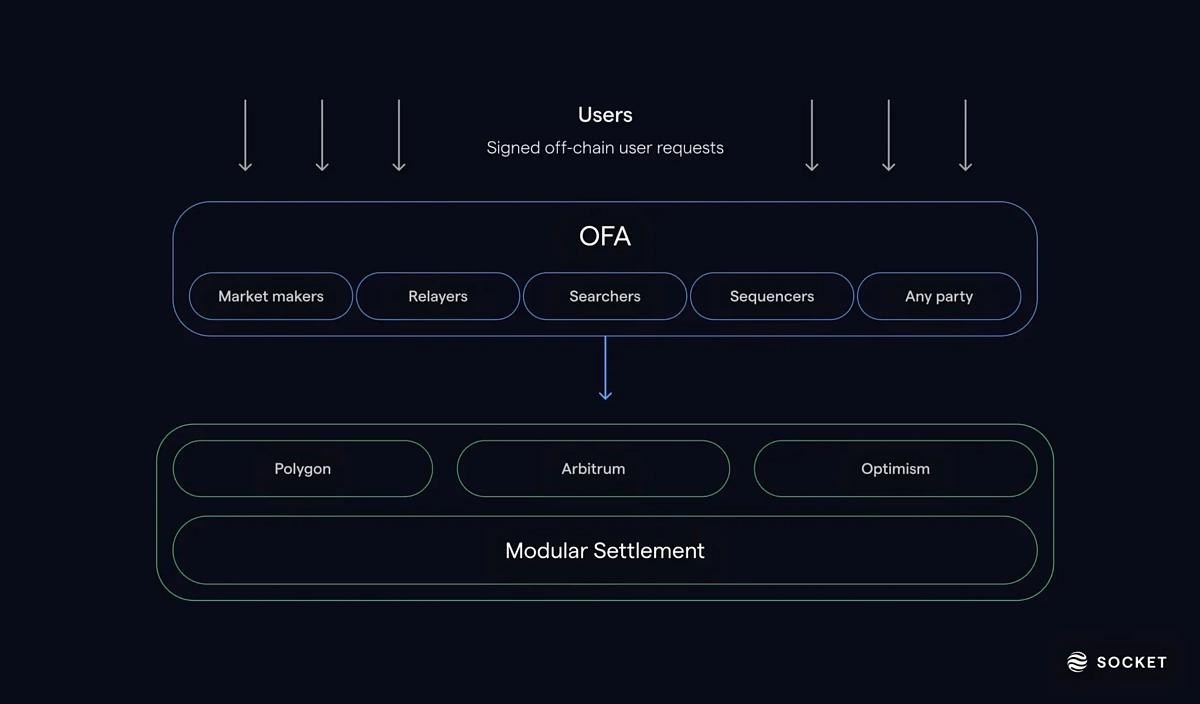

Modern implementations of chain abstraction leverage advanced blockchain development tools such as intent-based transaction routing, meta-transactions (where gas fees are sponsored or abstracted away), smart contract wallets with programmable logic, and cross-chain messaging protocols. These technologies combine to create an ecosystem where dApps can execute logic on any supported chain without exposing users, or developers, to underlying differences.

For example:

- Connext Network’s toolkit enables dApps to route transactions across chains automatically, so users never need to switch networks or juggle tokens manually.

- NEAR Protocol’s approach allows dApps to treat assets from different chains as if they were native, eliminating manual bridging steps entirely.

- Self Chain integrates AI-driven intents, letting users simply state what they want (“swap asset X for Y at best price”) while the backend handles all routing and execution across chains.

The result is a developer experience where cross-chain composability becomes the default, not an afterthought, and specialized fee markets can be designed at the application layer rather than dictated by underlying L1s or L2s.

Paving the Way for Unified Liquidity and Specialized Fee Markets

A major advantage of robust chain abstraction is liquidity unification. Instead of liquidity pools being isolated per chain (which leads to inefficient pricing), assets can move freely between app-chains without manual intervention. This not only improves capital efficiency but also opens doors for innovative fee models tailored specifically for custom rollups or application-specific blockchains, a topic we’ll explore further in part two of this article.

This evolution is already reshaping DeFi and NFT platforms, where fragmented liquidity and convoluted bridging once stifled growth. Developers can now build dApps that tap into a unified pool of assets, regardless of their origin chain, and deploy fee structures that incentivize usage based on real user activity rather than arbitrary network constraints. This is particularly impactful for custom app-chains with specialized fee markets, where flexibility in transaction cost design can be a game-changer for adoption.

Consider the impact on user onboarding: newcomers no longer need to learn about gas tokens or wallet management for each network. Instead, they interact through a single interface, abstracting away the blockchain’s technical layers. As NEAR Protocol’s documentation notes, this kind of abstraction preserves all the underlying benefits of decentralization while making blockchain “invisible” to end users, a critical step toward mainstream adoption.

Real-World Implementations: From Theory to Production

Several leading projects have already begun deploying chain abstraction frameworks in production environments:

Real-World Examples of Chain Abstraction

-

Connext Network: Provides a toolkit enabling dApps to execute transactions and logic across multiple blockchains, allowing users to interact seamlessly without switching networks or managing multiple wallets.

-

Self Chain: Utilizes AI-powered intents and keyless wallets to deliver a unified Web3 experience, letting users interact with various blockchains as if they were a single platform.

-

NEAR Protocol: Implements chain abstraction by allowing applications to interact with assets and services across multiple chains, effectively concealing blockchain complexity from end users.

These implementations are not just theoretical, projects like Connext Network and Self Chain are powering live applications today. Their toolkits handle everything from meta-transactions to cross-chain asset routing, letting developers focus on product innovation instead of infrastructure headaches.

The Developer’s Edge: Tooling and SDKs for Multi-Chain App-Chains

The rise of chain abstraction SDKs and composable blockchain development tools marks a turning point for teams building multi-chain app-chains. Instead of reinventing the wheel for each new deployment or integration, developers can leverage these SDKs to rapidly prototype and launch dApps that work across dozens of chains out-of-the-box. Features like intent-based execution, programmable wallets, and unified APIs dramatically reduce time-to-market while supporting advanced use cases such as dynamic fee markets or cross-chain governance.

This also has profound implications for security and upgradability. By centralizing logic at the application layer while distributing execution across multiple chains, developers can roll out upgrades faster and patch vulnerabilities without waiting for upstream protocol changes.

What’s Next? The Future of Cross-Chain Composability

The next frontier is deep cross-chain composability, where smart contracts on different app-chains interact as seamlessly as if they were on the same network. Chain abstraction lays the groundwork by providing unified messaging layers and intent-based routing mechanisms. This enables not just asset transfers but also complex workflows spanning lending protocols, NFT marketplaces, DAOs, and more, all without exposing users or developers to multi-chain friction.

As more projects adopt these paradigms, expect rapid innovation in areas like real-time arbitrage between fee markets, integrated compliance tooling across jurisdictions, and new business models driven by flexible economic designs unique to each app-chain ecosystem.