As the blockchain ecosystem moves deeper into the modular era, app-specific rollups with dynamic fee markets are rapidly becoming the backbone of scalable, user-centric applications. The days of one-size-fits-all Layer 1 protocols are fading. Instead, developers now wield fine-grained control over transaction costs, throughput, and user experience by leveraging custom rollups with specialized fee structures. This shift is not just technical – it’s strategic, unlocking new economic models for DeFi, gaming, social apps, and beyond.

Why Dynamic Fee Markets Are Reshaping App-Specific Rollups

At its core, a dynamic fee market is a pricing system that adjusts transaction fees in real time according to network demand and resource availability. Unlike static gas models that often lead to congestion or inefficient resource allocation, dynamic markets create a responsive environment where costs reflect actual usage. This is particularly vital for app-chains targeting high-frequency DeFi trading or real-time gaming – domains where latency and cost can make or break user adoption.

The impact is already visible: leading DeFi platforms building on custom app-chains have slashed transaction costs while maintaining high throughput. By calibrating fees to match demand spikes or lulls, these rollups prevent bottlenecks and offer fair access to network resources. The result? A user experience that rivals centralized systems while preserving decentralization and composability.

Inside the Architecture: How Dynamic Fee Markets Work

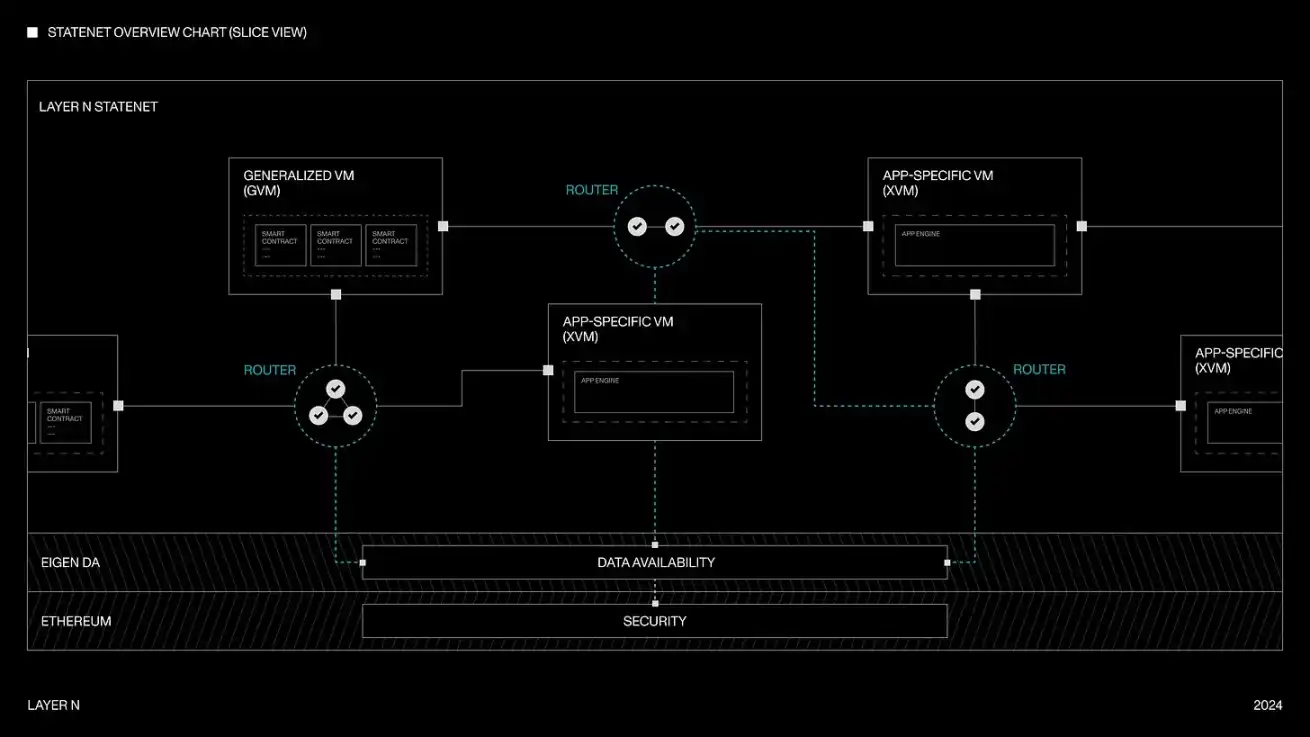

The architecture underpinning dynamic fee markets in app-specific rollups consists of several tightly integrated components:

- Resource Pricing: Fees are assigned dynamically based on current demand for computation, storage, or bandwidth. This ensures efficient allocation without overcharging during low-usage periods.

- Custom Execution Environments: Each rollup can tailor its execution logic to the needs of its application – whether that’s supporting ERC-20 tokens as gas (see Alchemy’s guide), or optimizing for ephemeral runtimes in gaming scenarios.

- Advanced Data Compression: By compressing transaction data before settlement on the main chain, rollups can boost throughput while keeping fees predictable and low.

- Specialized Consensus Mechanisms: Consensus algorithms are adapted for each use case – from fast-finality for trading apps to provable sessions for temporary NFT drops.

Together these components create a flexible economic engine that adapts to the unique demands of each application vertical. For a deeper dive into technical blueprints and implementation strategies, explore our in-depth guide on building custom rollups with dynamic fee markets.

Pioneering Use Cases: Where Dynamic Fee Markets Shine

The versatility of dynamic fee markets is best illustrated through their real-world impact across diverse verticals:

- On-Chain Gaming: Ephemeral rollups enable low-latency matches by spinning up temporary environments with tailored fee schedules – ensuring smooth gameplay even during peak activity.

- High-Frequency DeFi Trading: Platforms dynamically adjust fees based on order flow and liquidity needs, giving traders an experience comparable to top centralized exchanges but with full transparency.

- Real-Time Social Apps and Prediction Markets: Instant interactions and live odds updates are possible without prohibitive costs thanks to adaptive pricing models built directly into the chain’s architecture.

- NFT Drops and Event-Driven Applications: Dynamic fees help manage surges in demand during limited edition mints or live events, preventing network congestion and ensuring equitable access for all participants.

This strategic flexibility makes dynamic fee markets indispensable not just for reducing costs but also for aligning incentives among users, validators, and developers. For more practical examples and design patterns drawn from leading projects in this space, see our article on how dynamic fee markets power custom app-chains.

What sets dynamic fee markets apart is their ability to foster bespoke economic models for each application vertical. Consider a prediction market app: by leveraging real-time demand signals, the rollup can lower fees during off-peak hours to encourage liquidity provision, then ramp them up during high-stakes events to prevent spam and maintain performance. This elasticity is impossible on monolithic Layer 1s with rigid fee schedules.

For developers, the ability to fine-tune fee structures extends far beyond simple cost control. It enables innovative monetization strategies and even new forms of user engagement. For example, gaming rollups might subsidize player transactions with in-game rewards or ad revenue, while DeFi protocols could implement maker-taker models that dynamically adjust based on liquidity depth and volatility. These possibilities are explored in greater detail in our technical deep dive on designing custom fee markets for application-specific rollups.

The Strategic Edge: Custom App-Chains and Ecosystem Differentiation

The strategic advantage of app-specific rollups with dynamic fee markets lies in their capacity for differentiation. In a landscape where user experience is paramount, projects can no longer afford generic infrastructure. Instead, they must tailor every aspect of network economics to their specific audience, whether that means gasless transactions for social networks or burst capacity for NFT mints.

This customizability also empowers communities to participate directly in governance over fee parameters, incentivizing active stewardship and aligning all stakeholders around long-term sustainability. As more teams embrace this model, we’re witnessing the emergence of an “Everyone Gets a Chain” economy, where every major protocol or dApp can operate its own optimized environment with self-sovereign control over fees and incentives.

Ultimately, dynamic fee markets are not just about efficiency, they are about unlocking new forms of value creation at the application layer. By combining modular blockchain design with adaptive pricing mechanisms, developers can build systems that scale elastically while remaining fair and accessible.

Looking Ahead: The Future of Fee Market Architecture

The next frontier lies in further abstraction and automation of these markets. Expect to see more experimentation with multidimensional fee structures, where computation, storage, and bandwidth are priced independently based on real-time analytics. Integration with off-chain data sources (oracles) will enable even more nuanced adjustments, potentially linking transaction fees to external factors like market volatility or user segments.

As the modular blockchain thesis matures, specialized rollups powered by dynamic fee markets will set the standard for scalable Web3 infrastructure. The result? Lower barriers to entry for both users and developers, faster innovation cycles, and a competitive landscape driven by differentiated economics rather than brute-force scaling alone.

If you’re building in this space, or considering launching your own app-chain, now is the time to master these emerging architectures. Explore our comprehensive guide on implementing custom fee markets in application-specific rollups for actionable insights and code-level examples.

The rise of dynamic fee markets marks a pivotal shift not just in blockchain engineering but also in how we think about digital economies at scale. As always, those who move early, and strategically, will shape the future contours of decentralized applications.