Decentralized sequencers are shaking up the landscape for custom app-chains in 2025, and the numbers speak for themselves. With on-chain fees projected to hit a staggering $19.8 billion this year, it’s clear that the way transactions are ordered and fees are determined is no longer just a technical detail – it’s the beating heart of blockchain’s economic engine. But what exactly is driving this transformation, and why are decentralized sequencers suddenly the talk of every serious protocol team?

![]()

The Scalability Revolution: Why Sequencers Matter More Than Ever

Let’s start with scalability, because that’s where decentralized sequencers have made their most visible mark. Since 2021, average blockchain transaction fees have dropped by an eye-watering 86%, thanks in large part to Ethereum’s scaling efforts and the proliferation of rollups. This isn’t just about cheaper transactions – it’s about unlocking entirely new use cases that were previously priced out of existence.

In early 2025 alone, daily blockchain transactions soared to 169 million, with monthly active wallets hitting 273 million. This surge is only possible because decentralized sequencers can process transactions in parallel across hundreds of app-chains, each with its own specialized fee market. The result? Congestion on one chain doesn’t spill over to others, keeping costs predictable and user experience smooth.

App-Specific Fee Markets: Control and Customization for Builders

The real game-changer is how decentralized sequencers empower applications to run their own isolated fee markets. No longer do devs have to worry about DeFi degens clogging up blockspace during NFT mints or L2 gaming surges causing unpredictable spikes in transaction costs for enterprise chains.

This shift enables apps not only to offer more stable pricing but also to capture a slice of execution revenue directly. It’s a win-win: users get reliability, while projects gain new revenue streams and tighter control over their platform economics. For a deep dive into programmable fee markets and how they work under the hood, check out our guide on programmable sequencer contracts.

Innovations in Sequencing Mechanisms: Beyond Simple Ordering

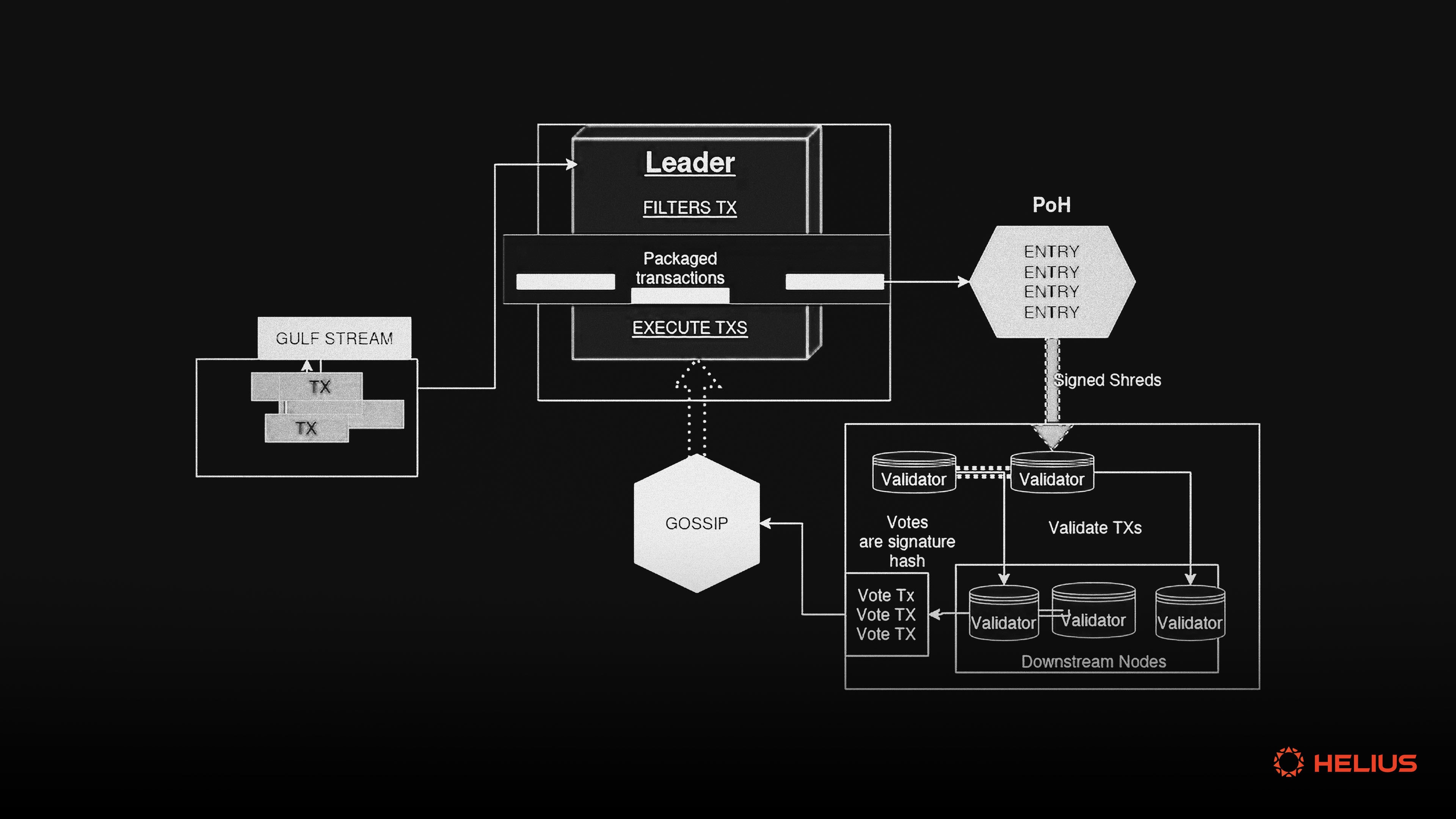

Forget everything you know about first-in-first-out ordering – 2025 is all about innovation at the sequencing layer. Take Solana’s latest approach: “Sequencer Driven Decoupled State Machine Replication. ” It addresses tricky issues like duplicate transactions and account fund exhaustion by pre-selling network capacity to out-of-protocol sequencers, then allocating specific accounts to those sequencers.

This architecture paves the way for multi-concurrent proposers without sacrificing censorship resistance or fair ordering. The upshot? Chains can scale horizontally while keeping MEV (maximal extractable value) in check – a crucial step for sustainable growth as application-layer fees skyrocket (up 126% year-over-year) even as base-layer fees decline.

If you’re building or investing in custom app-chains this year, understanding these sequencing innovations is non-negotiable. They don’t just shape network performance; they define who captures value within your ecosystem.

But the story doesn’t end with clever engineering. The rise of decentralized sequencers is also about redefining incentives and governance at every layer of the stack. By distributing sequencing power across multiple entities, networks can minimize single points of failure and reduce the risk of collusion or censorship. This is especially crucial as fee markets grow more lucrative, with $19.8 billion in on-chain fees up for grabs in 2025.

Protocols like Syndicate (SYND) are leading the charge here, letting communities own their sequencing infrastructure and even customize transaction ordering logic to fit their unique needs. Expect to see more projects experimenting with auction-based slots, dynamic fee curves (inspired by EIP-1559), and programmable revenue-sharing models that reward both validators and app teams.

Cross-Rollup Liquidity and Unified Fee Markets: Breaking Down Silos

One of the biggest pain points for users and developers alike has been liquidity fragmentation across rollups and app-chains. In 2025, shared sequencer networks are rapidly changing this by unifying fee markets and enabling smoother cross-chain UX. Instead of juggling multiple wallets or worrying about inconsistent gas prices, users interact with a seamless web of interoperable chains where value flows freely.

This isn’t just theoretical – we’re seeing real traction as protocols integrate shared sequencing layers that coordinate transaction ordering across ecosystems. The result? Lower friction for bridging assets, more efficient MEV capture at the network level, and a better deal for end-users who no longer pay a premium just to move between chains.

Top Decentralized Sequencer Networks Powering App-Chains in 2025

-

Syndicate (SYND) — A leading decentralized sequencer network, Syndicate empowers developers to launch custom app-chains with full control over transaction ordering, fee structures, and governance. Its modular architecture and the SYND token are central to driving adoption and innovation in the app-chain ecosystem.

-

OP Stack (Optimism) — The OP Stack is a popular rollup framework enabling Layer 2 and app-chain builders to deploy decentralized sequencers with dynamic fee mechanisms (EIP-1559 style). This flexibility helps projects create isolated fee markets and optimize transaction costs for their users.

-

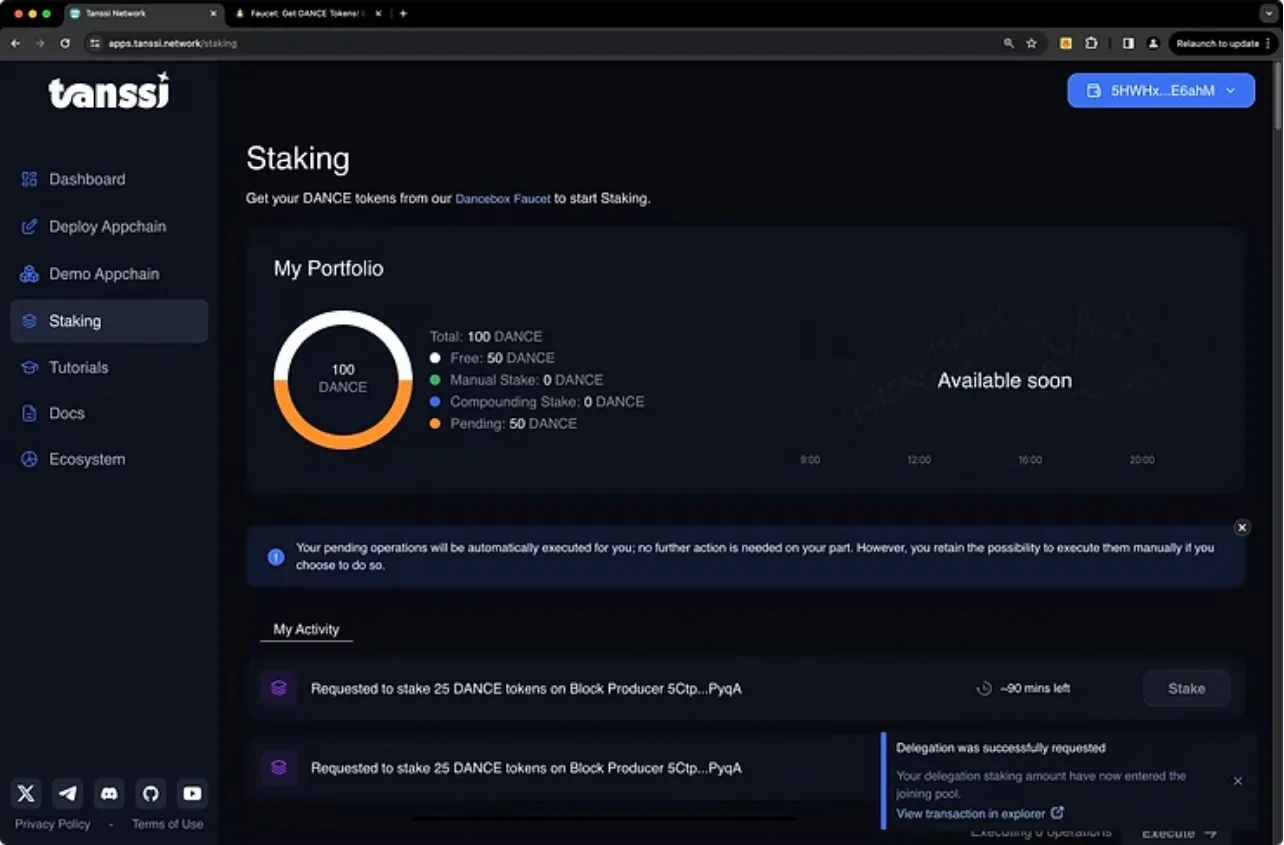

Tanssi Network — Tanssi streamlines app-chain deployment by providing a robust decentralized sequencer layer. Its architecture ensures rapid, secure, and censorship-resistant sequencing, making it a top choice for projects prioritizing decentralization and scalability.

-

Solana — With its innovative Sequencer Driven Decoupled State Machine Replication, Solana addresses challenges like duplicate transactions and fair ordering. Its approach to pre-selling network capacity to sequencers is reshaping high-throughput app-chain design.

-

Polygon CDK (Chain Development Kit) — Polygon CDK empowers developers to launch customizable app-chains with decentralized sequencing and shared liquidity. Its modular toolkit is widely adopted for building scalable, interoperable chains with predictable fee markets.

If you want to get into the technical weeds on how these unified fee markets work – from settlement guarantees to cross-domain arbitration – our deep dive on shared sequencers for interoperable app-chains is a must-read.

Risks and Future Outlook: What Builders Need To Watch

No technology is without trade-offs. While decentralized sequencers have unlocked new levels of scalability and flexibility, they also introduce fresh attack surfaces (think: sequencer bribery or liveness failures). The good news? Modular blockchain design means you can tailor your security assumptions to your use case – whether you need instant finality for gaming or maximum censorship resistance for DeFi.

The next frontier will be programmable sequencing contracts, letting teams define exactly how transactions are included, ordered, or excluded based on application logic or governance votes. We’re already seeing early experiments where apps can dynamically adjust fee parameters based on demand spikes or even share a portion of MEV revenue with loyal users.

If you’re serious about future-proofing your project’s economics, now’s the time to start prototyping these advanced mechanisms. For hands-on builders looking to implement dynamic fee markets today, our practical guide on dynamic fee markets for custom app-chains covers everything from initial setup to production deployment.

The Bottom Line: Decentralized Sequencers Are Defining Crypto’s Next Era

The numbers don’t lie: as application-layer fees surge by 126% year-over-year and total on-chain revenue targets $19.8 billion in 2025, it’s clear that decentralized sequencing isn’t a side-show – it’s center stage. Whether you’re an architect designing specialized rollup infrastructure or a founder seeking sustainable revenue streams, understanding how decentralized sequencers shape fee markets will determine who thrives in this new era of blockchain innovation.