In 2025, the landscape for application-specific blockchains is being dramatically reshaped by a new breed of infrastructure: programmable onchain sequencers. If you’re building or optimizing custom app-chains, you’ve likely heard the buzz around Syndicate (SYND) and its Smart Sequencer architecture. But what’s really changed? The answer lies in how onchain sequencers are unlocking specialized fee markets, giving developers and communities unprecedented control over their blockchain’s economic engine.

From Centralized Bottlenecks to Onchain Programmability

Traditionally, the sequencing of transactions – the process that decides which transaction gets included next in a block – was handled by centralized, offchain services. This model worked, but it came with trade-offs: limited transparency, inflexible fee structures, and a lack of composability with other chains. In short, developers were stuck with one-size-fits-all fee models that rarely fit anyone perfectly.

The arrival of programmable onchain sequencers has flipped this script. Now, sequencing logic lives directly inside smart contracts on platforms like Syndicate. This means every rule about transaction ordering, inclusion criteria, and fee extraction is transparent and auditable. Developers can tweak these rules at the code level to fit their specific use case – whether that’s an NFT marketplace needing dynamic auctions or a DeFi protocol prioritizing low-latency trades.

Syndicate (SYND): The App-Chain Sequencing Token Fueling Innovation

Syndicate’s SYND token is at the heart of this shift. As an ERC-20 asset purpose-built for app-chain sequencing, SYND powers everything from gas payments to staking incentives within its network of Smart Rollups. But what makes Syndicate stand out is its focus on community-owned appchains with fully programmable sequencing logic. Developers aren’t just launching a blockchain; they’re designing an entire economic system tailored to their user base.

This flexibility has real-world impact. For example:

- Custom Fee Auctions: Want gas fees to be set by periodic auctions instead of fixed prices? Just code it into your sequencer contract.

- Tiered Pricing Models: Offer discounted fees to loyal users or stakers? The logic can be encoded directly onchain.

- MEV Management: Bake in rules for how Maximum Extractable Value (MEV) is captured and distributed – no more black-box profits leaking away from your community.

The result? A new era for blockchain fee models in 2025, where every app-chain can fine-tune its incentives without waiting for upstream protocol upgrades.

The Three Pillars: Customization, Transparency and Atomic Composability

The benefits of programmable onchain sequencers go beyond just flexible fees:

- Customization: Design dynamic pricing mechanisms that respond to network load or user behavior in real time.

- Transparency: Every transaction order and fee decision is visible onchain, making governance more accountable and giving users confidence in fair play.

- Atomic Composability: App-chains built with these sequencers can interact atomically across networks – enabling seamless cross-chain swaps or bundled transactions without clunky bridges or trust assumptions.

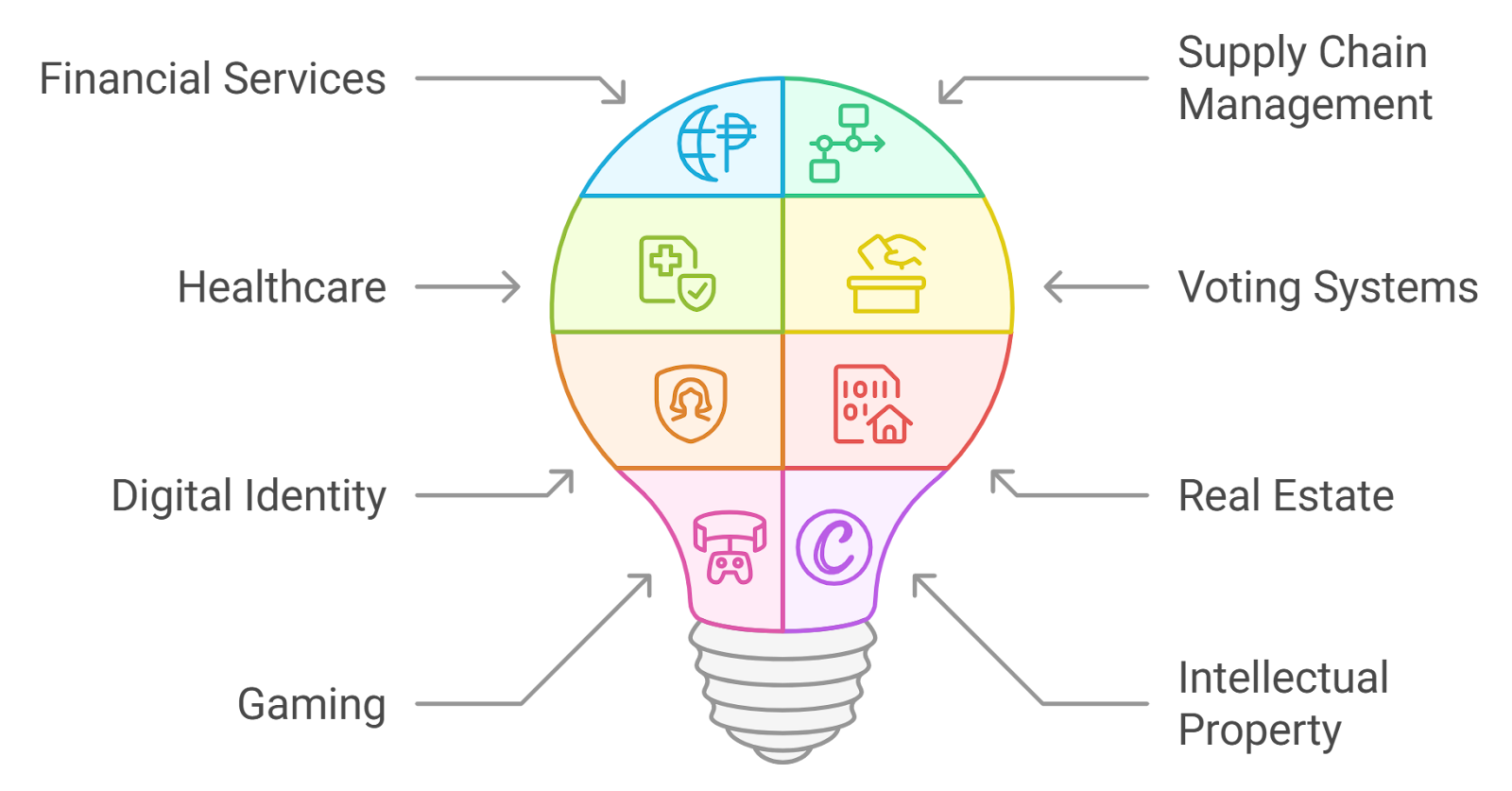

This trifecta means developers aren’t just building blockchains; they’re crafting unique marketplaces where value flows according to community-driven rules. For those exploring new territory in gaming, DeFi, or creator economies, this unlocks business models simply not possible before.

What’s especially exciting is how programmable onchain sequencers are democratizing access to advanced fee market engineering. You no longer need to be a core protocol developer at a major L1 to experiment with cutting-edge economic models. With tools like Syndicate, any team can spin up an app-chain, define their own fee logic, and even adjust parameters as the community grows or user behavior shifts. This agility is fueling a wave of experimentation in areas like:

- On-chain games that use variable gas pricing to manage congestion during high-traffic events.

- DeFi protocols that reward liquidity providers with reduced fees, all enforced by contract logic.

- NFT platforms that implement loyalty programs via tiered fee discounts for frequent traders.

The result? A Cambrian explosion of new fee market designs, each tailored to its audience and use case. We’re already seeing DAOs and project communities debate and upgrade their fee mechanisms in real time, something almost unimaginable just a few years ago.

Real-World Impact: Efficiency, Trust, and New Revenue Streams

The shift to programmable sequencers isn’t just technical provides it’s reshaping the economics of blockchain participation. By making sequencing rules transparent and auditable, users gain confidence that they aren’t being front-run or unfairly gouged by hidden MEV extraction. Builders can channel more value back into their communities via creative staking rewards or revenue-sharing models. And because everything runs on open smart contracts, anyone can fork or remix proven designs for their own project.

This also opens the door for entirely new business models. Imagine an app-chain where validators compete in real-time auctions to win sequencing rights, with proceeds flowing directly into ecosystem grants or user rebates. Or picture a game chain where transaction fees dynamically rise during tournaments but drop for regular players, automatically enforced by the sequencer’s logic.

If you want to dive deeper into these mechanics and see code examples in action, check out our guide on how programmable sequencers empower custom app-chains with flexible fee markets.

What’s Next? The Future of Custom App-Chains

The momentum behind decentralized sequencer technology is only accelerating. As more projects adopt programmable onchain sequencers, especially those powered by tokens like SYND, we’ll see even tighter integration between application logic and economic incentives. Expect rapid innovation in:

- User-centric governance: Communities voting directly on fee policy updates from their wallets.

- Composable cross-chain apps: Atomic swaps and bundled transactions across multiple app-chains without complex bridges.

- Diverse revenue models: From ad-supported chains to usage-based rebates, all enforceable via smart contract sequencing rules.

If you’re building in this space, now’s the time to experiment boldly. The tools are here, the only limit is your imagination (and maybe your gas budget).