The landscape for appchain development is undergoing a fundamental transformation. Historically, launching a new blockchain application meant bootstrapping your own validator set – a costly, time-consuming process that often limited innovation to well-funded teams. Today, thanks to advances in modular blockchain architecture and pooled staking protocols, developers can deploy secure appchains without assembling independent validator sets from day one. This evolution is exemplified by platforms like Tanssi Network and SymbioticFi, as well as infrastructure providers such as Ankr and Initia, which are rapidly lowering the barriers to entry for custom appchain deployment.

From Validator Bottlenecks to Instant Launch: The New Appchain Paradigm

Validator onboarding has long been a bottleneck in the expansion of application-specific blockchains. On networks like Ethereum or Cosmos, validators are responsible for proposing and attesting to new blocks, maintaining consensus, and securing the chain against attacks. Setting up a robust validator set typically requires significant technical expertise, economic incentives (such as high staking thresholds), and community trust. This complexity not only slows down innovation but also introduces risks of centralization during the early stages of an appchain’s life.

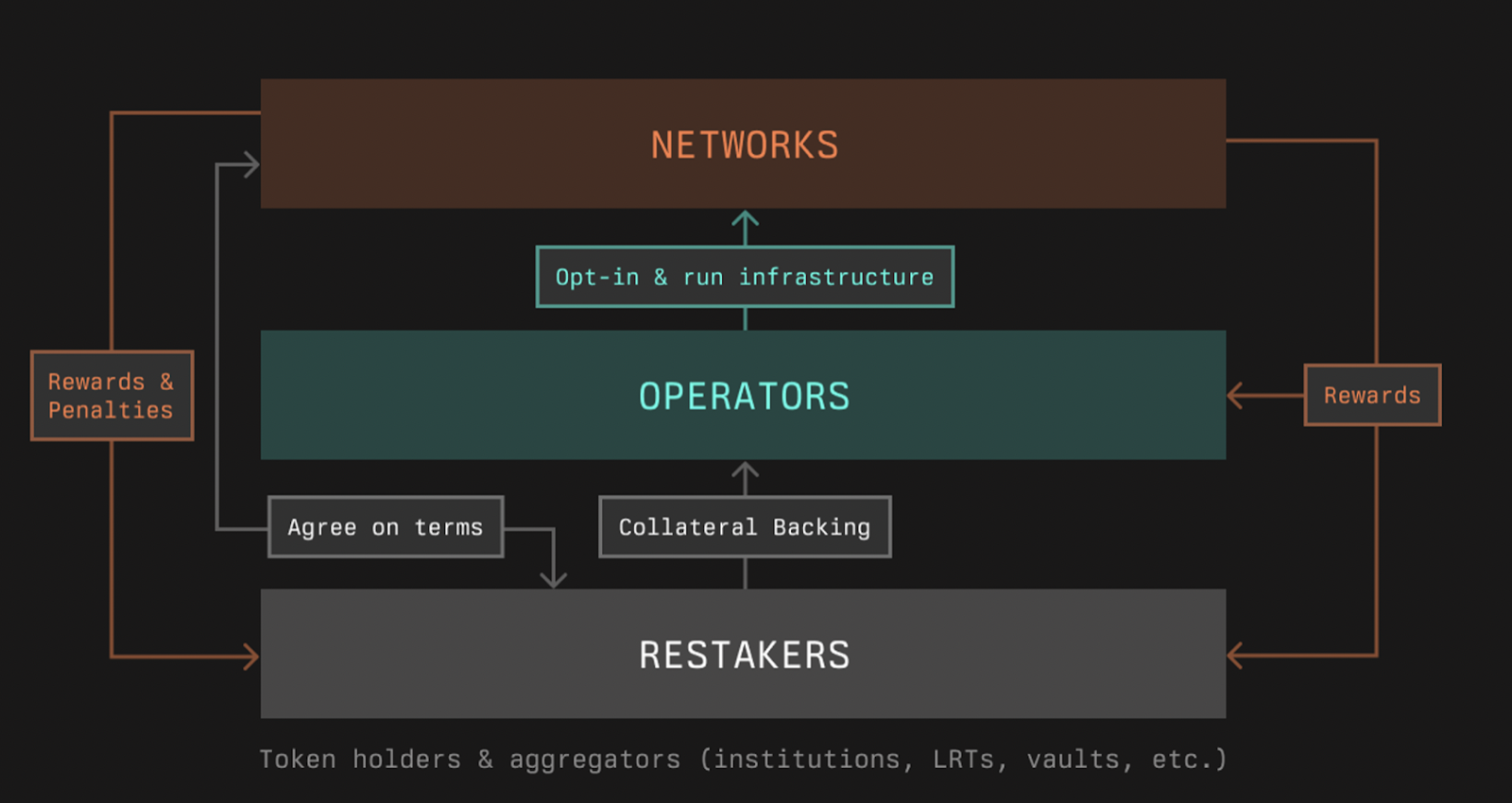

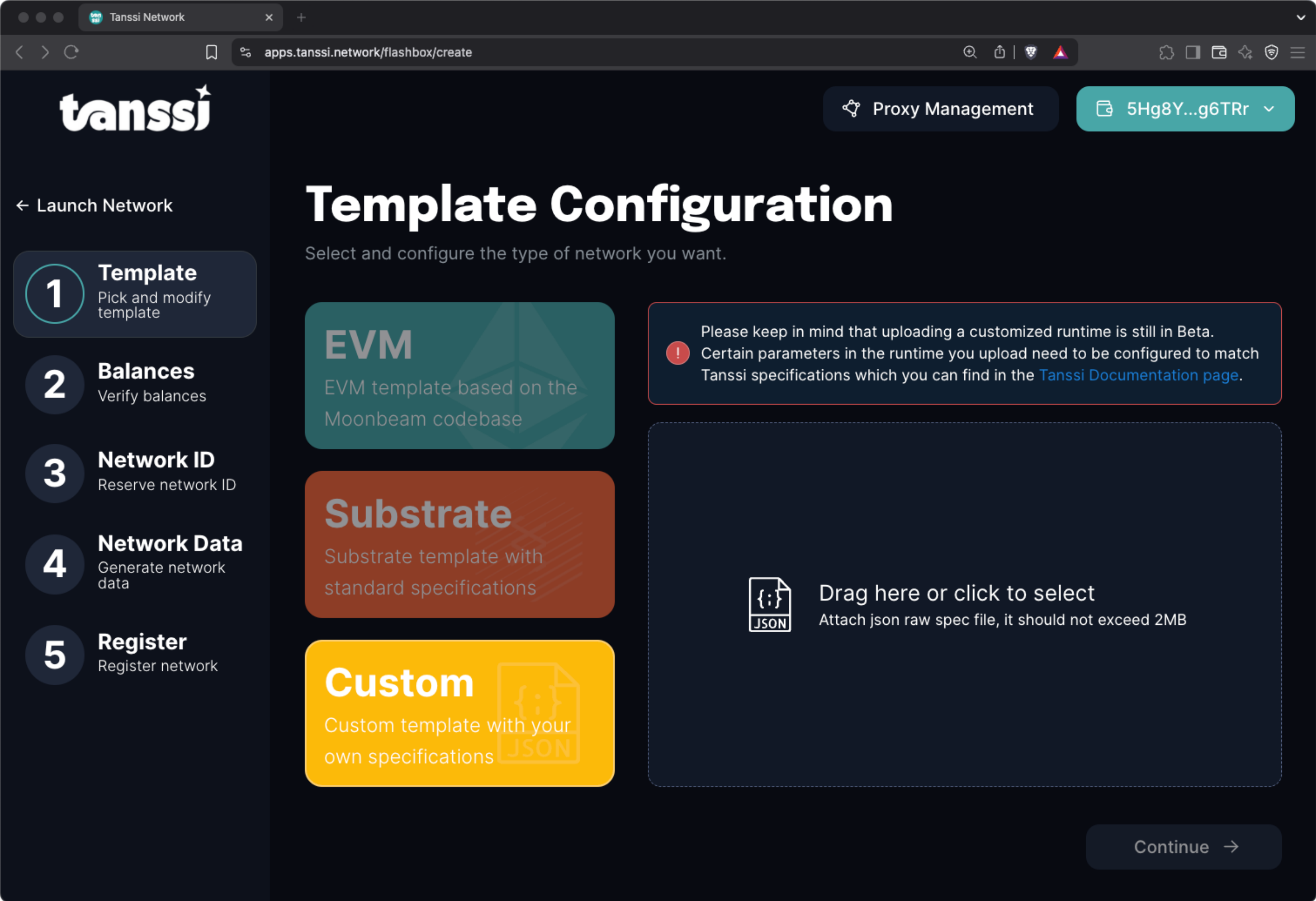

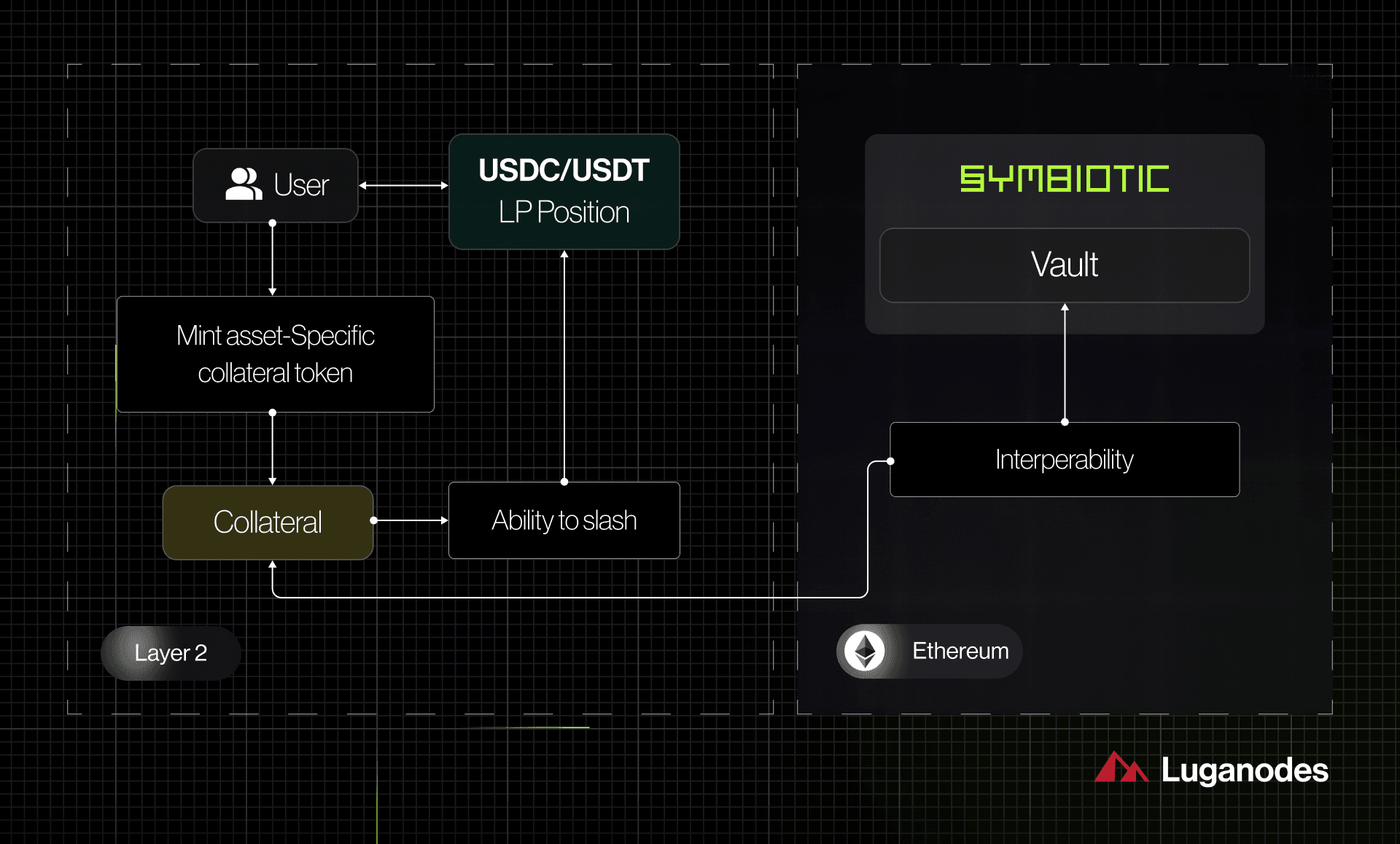

Recent advances flip this model on its head. Now, platforms like Tanssi Network and SymbioticFi allow developers to spin up secure appchains instantly by leveraging shared security pools – eliminating the need for bespoke validator sets at launch. As highlighted by @0xboomin on X: “you can now launch appchains without validator sets from day 1 discover how @TanssiNetwork and @symbioticfi lets builders spin up secure. . . ” This shift is more than just a convenience; it fundamentally changes how economic security is provisioned across the modular blockchain stack.

Pooled Staking: How Shared Security Works in Practice

Pooled staking mechanisms are at the heart of this new paradigm. Instead of requiring each new chain to recruit its own validators and stakers, platforms aggregate stake from across their ecosystem into a common pool. This pool then underwrites the security of all participating chains according to protocol-defined rules.

The benefits are immediate and measurable:

Key Advantages of Pooled Staking for Appchain Launches

-

Eliminates the Need for Independent Validator Sets: Platforms like Tanssi Network and Ankr App Chains enable instant appchain deployment without requiring teams to recruit and manage their own validator sets from day one.

-

Lower Barrier to Entry for Developers: Pooled staking allows projects to access robust staking infrastructure without the technical and financial overhead of running solo validators, making appchain launches more accessible.

-

Rapid Deployment and Scalability: With modular solutions like Initia and Ankr App Chains, developers can quickly spin up scalable appchains that tap into existing staking pools for instant network participation.

-

Shared Rewards and Incentives: Pooled staking models distribute rewards among participants, incentivizing broader community involvement and enhancing network security from the outset.

Pooled staking is already familiar to many crypto users through services that let individuals combine their assets with others to meet minimum requirements for running validators (such as Ethereum’s 32 ETH threshold). The same logic applies here at a network level but with even greater efficiency gains: smaller projects can tap into robust security guarantees from day one without having to attract large capital inflows or manage complex validator operations independently.

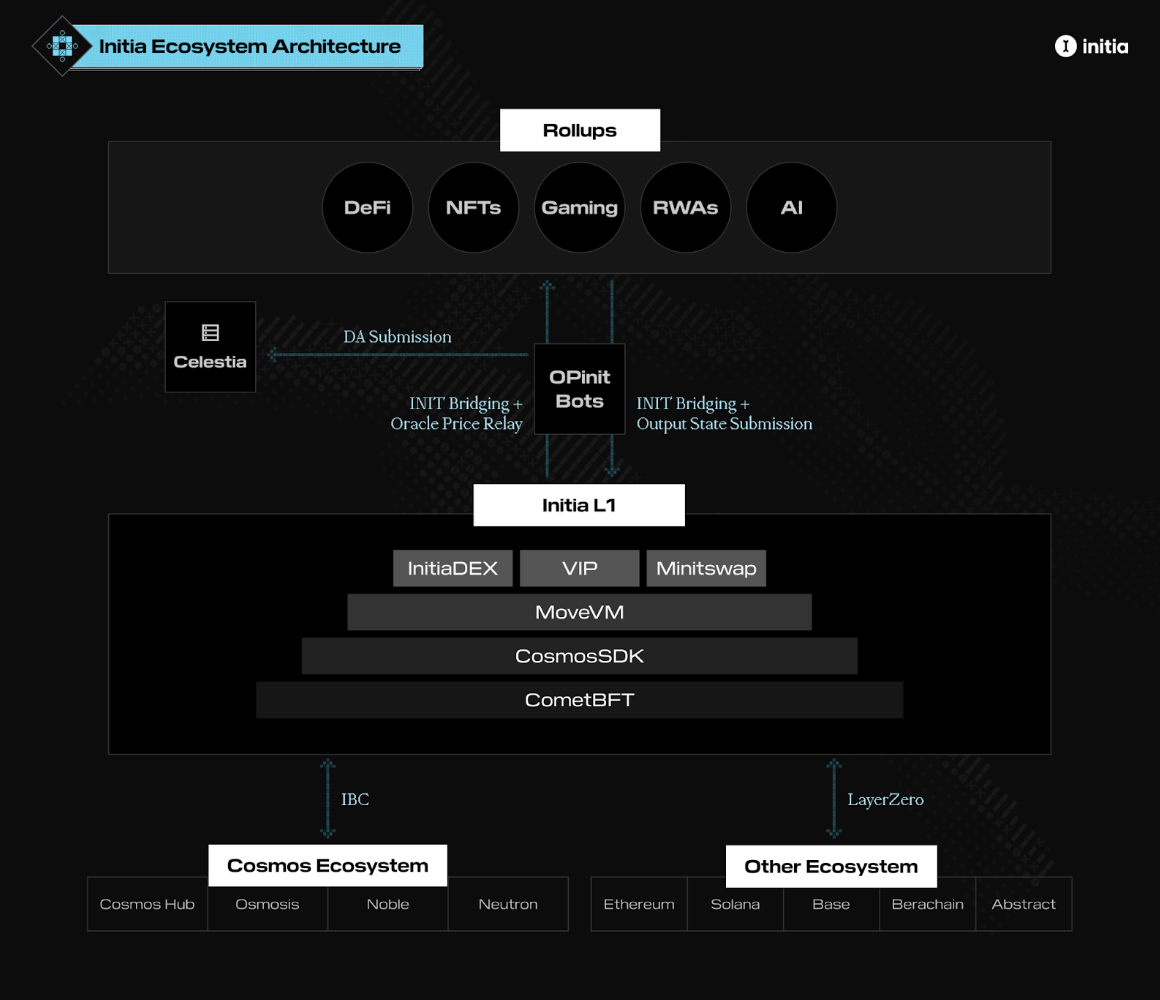

Case Studies: Initia’s Interwoven Stack and Ankr’s App Chains Suite

The April 2025 mainnet launch of Initia demonstrates how modularity and pooled security intersect in practice. Initia’s Interwoven Stack allows developers to deploy interconnected rollups that share security guarantees while maintaining composability across Layer-2 environments. By standardizing inter-chain communication and leveraging pooled resources, Initia reduces liquidity fragmentation – one of the persistent challenges facing multi-chain ecosystems.

Ankr’s App Chains suite takes this even further by offering everything needed for rapid deployment: pre-built validator binaries, load-balanced RPC endpoints, white-labeled explorers, and seamless integration with staking pools. According to their team (source), this approach lets builders focus on application logic while inheriting robust network-level security from day one – no independent validator recruiting required.

Security Without Compromise: Addressing Risks and Incentives

This model isn’t without trade-offs. Pooled staking protocols must be designed with careful attention to slashing conditions, incentive alignment among stakers, and mechanisms for preventing correlated failures across multiple chains sharing the same pool. However, when implemented correctly (as seen in emerging standards across Tanssi Network and SymbioticFi), these systems offer both strong economic guarantees and operational simplicity.

Appchain developers now have the freedom to launch specialized blockchains that inherit robust security from day one, but this convenience raises important questions about how pooled staking is governed and maintained over time. The key is striking a balance between ease of deployment and the ongoing integrity of network security.

Evolving Economics: Fee Markets and Staker Incentives

One of the most innovative aspects of pooled staking for appchain launch without validators is its impact on fee markets. With multiple appchains drawing from a shared security pool, protocol-level mechanisms are needed to allocate rewards fairly and maintain staker engagement. This often involves dynamic fee structures, where each appchain contributes a portion of transaction fees or inflationary rewards to the pool, ensuring that stakers remain incentivized to validate honestly across all chains.

For example, in models like those emerging on Tanssi Network or Initia’s Interwoven Stack, fee distribution algorithms are designed to reflect usage patterns and risk exposure. Chains that generate higher transaction volumes or present greater security challenges may pay proportionally more into the pool, creating a self-adjusting system that aligns economic incentives with actual workload and risk.

How Pooled Staking Transforms Fee Markets & Validator Incentives

-

Enables Appchain Launches Without Dedicated Validator Sets: Platforms like Tanssi Network and Ankr App Chains allow developers to launch appchains with pooled staking, eliminating the need for independent validator sets. This reduces entry barriers and operational costs while maintaining robust security.

-

Aggregates Staking Power to Secure Multiple Chains: With pooled staking, resources from many participants are combined, securing not just a single chain but potentially multiple appchains. This shared security model incentivizes validators to act honestly across all supported chains, as misbehavior could impact their aggregated rewards.

-

Reshapes Fee Distribution Mechanisms: Pooled staking introduces new fee market dynamics, where transaction fees from various appchains are aggregated and distributed among stakers. This creates a more predictable and attractive reward structure for validators and delegators compared to isolated, chain-specific fee markets.

-

Aligns Validator Incentives with Network Health: Validators in pooled staking systems are incentivized to maximize uptime and performance across all chains they help secure, as their rewards are tied to the overall activity and security of the pooled network rather than a single appchain.

-

Facilitates Seamless Scaling for New Appchains: By leveraging established staking pools, new appchains can quickly access security and validator participation, allowing for rapid scaling and experimentation without compromising on security or decentralization.

This approach also opens new possibilities for custom economic models. Developers can experiment with application-specific fee structures, such as dynamic gas pricing, MEV capture sharing, or cross-chain incentive programs, without compromising baseline security. The result is an ecosystem where both users and stakers benefit from greater flexibility and efficiency.

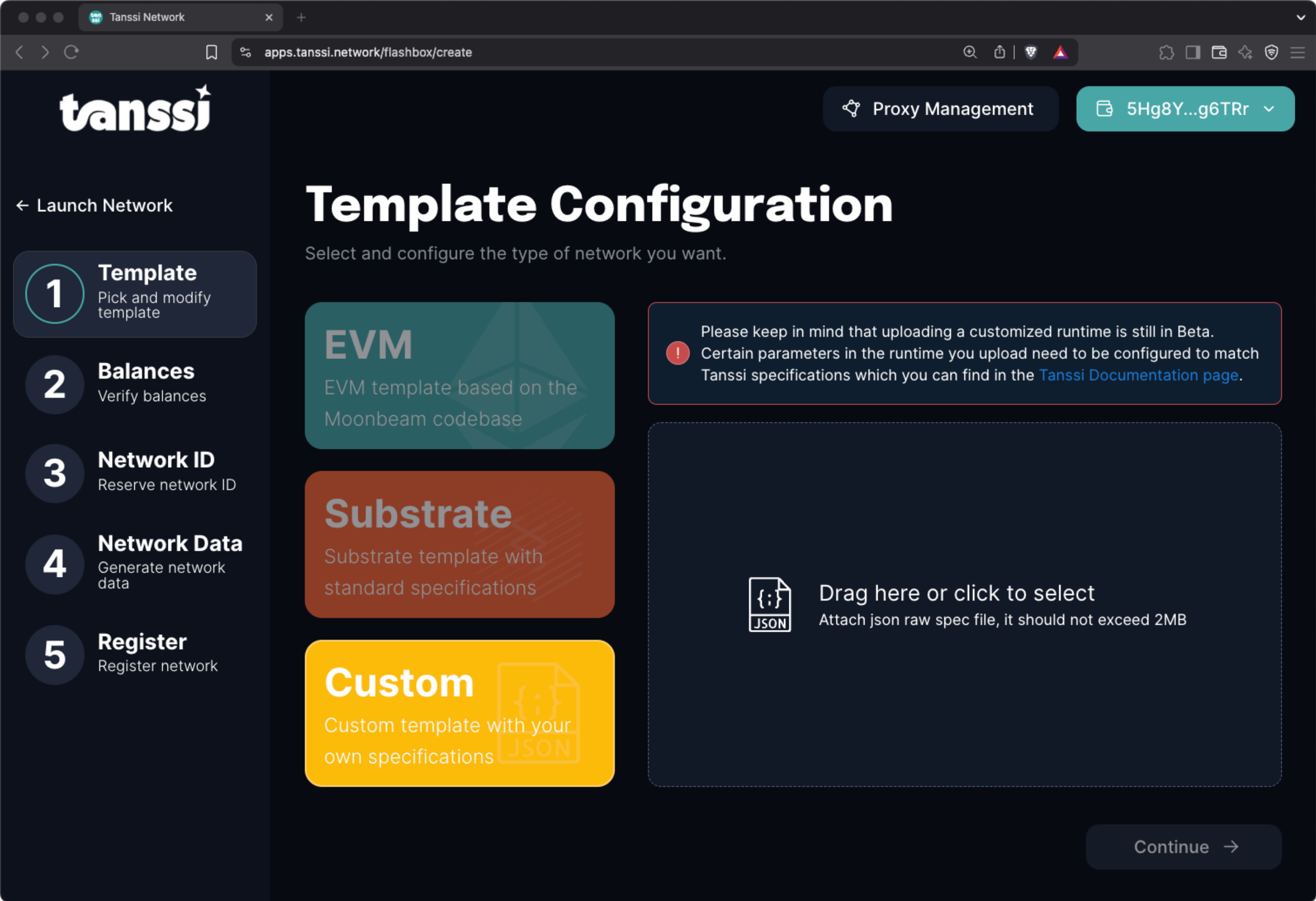

Developer Experience: From Idea to Mainnet in Days

The operational simplicity enabled by these platforms cannot be overstated. With pre-built infrastructure components, validator binaries, RPC endpoints, explorers, and seamless integration with staking pools, launching an appchain becomes a matter of deploying smart contracts rather than orchestrating a global validator recruitment campaign.

This democratizes blockchain innovation. Teams can iterate quickly on novel use cases (from DeFi primitives to gaming economies) without being bogged down by consensus logistics. Moreover, robust monitoring tools and automated slashing mechanisms ensure that even as chains proliferate, network health remains transparent and enforceable.

Community Governance and Future-Proofing

As the ecosystem matures, community governance will play a central role in evolving pooled staking protocols. Decisions around reward allocation, slashing parameters, and onboarding new chains increasingly involve token holders and DAO structures rather than centralized teams. This trend not only decentralizes power but also encourages broad participation in network stewardship, a critical factor for long-term resilience.

Looking ahead, we expect platforms like Initia and Ankr to further refine modular frameworks for onboarding new appchains securely while empowering communities to shape protocol evolution through open governance processes.

Key Takeaways: The Appchain Launch Revolution

- Pooled staking eliminates validator bottlenecks, letting builders focus on application logic instead of consensus bootstrapping.

- Shared security pools enable rapid scaling, supporting hundreds of interconnected appchains without sacrificing economic guarantees.

- Customizable fee markets enhance flexibility, allowing each chain to tailor its economics while contributing fairly to network-wide security.

- Open governance ensures adaptability, making pooled staking protocols responsive to community needs as technology evolves.

The ability to launch secure appchains instantly, without assembling bespoke validator sets, is reshaping what’s possible in decentralized application design. As platforms like Initia’s Interwoven Stack and Ankr’s App Chains suite continue pushing boundaries, expect even more innovation at the intersection of scalability, composability, and economic sovereignty.