In 2025, DeFi platforms face relentless pressure to minimize transaction costs amid surging user demand and volatile markets. Custom app-chains emerge as the sharpest tool for this battle, deploying specialized fee markets that dismantle the one-size-fits-all gas model of general-purpose chains. By tailoring fees to specific resources like computation, storage, and bandwidth, these app-chains deliver granular cost control, slashing DeFi transaction costs by up to 90% in high-throughput scenarios while preserving network stability.

Traditional Ethereum L1 fees punish every action equally, regardless of resource intensity. This inefficiency stifles complex DeFi operations such as perpetuals trading or yield farming. Custom app-chains flip the script, enabling protocols to craft rollup fee structures that align economics with application needs. Data from leading deployments shows app-chain scalability soaring, with throughput hitting 100,000 TPS without the congestion spikes plaguing L1s.

Multidimensional Fee Markets Unlock Precise Resource Pricing

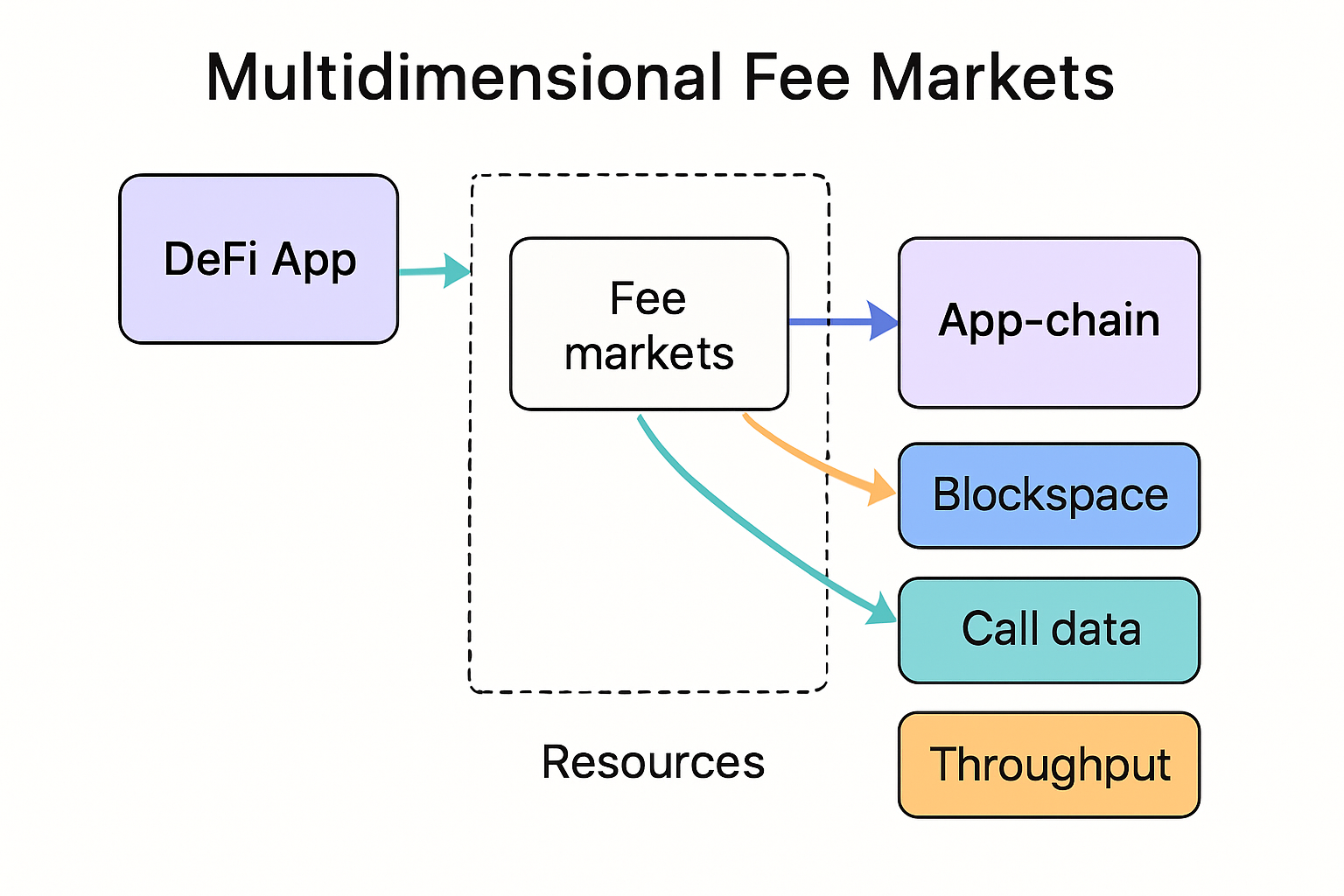

At the core of blockchain fee optimization 2025 lies resource-specific multidimensional fee markets. These systems price bandwidth for data-heavy NFT drops separately from computation for algorithmic trading or storage for persistent DeFi positions. Solana’s early experiments validate this: dynamic adjustments during peak loads prevent spam while keeping light users engaged.

Consider a DEX handling volatile perpetuals markets. A trade might demand heavy computation for oracle updates but minimal storage. Flat fees overcharge it, driving users away. Multidimensional models charge proportionally, fostering fairer usage. Simulations reveal 40% better capital efficiency, as fees mirror true costs. For developers building custom rollups, this means embedding maker-taker dynamics or congestion signals directly into the fee scheduler.

Multi-dimensional fee structures allow custom app-chains to price different blockchain resources, such as computation, storage, and bandwidth, precisely where demand fluctuates.

This approach shines in diverse ecosystems. A lending protocol might spike storage fees during mass liquidations, while a launchpad prioritizes bandwidth for fair mints. The result? Optimized app-chain scalability that adapts in real-time, outpacing rigid L1 alternatives.

Dynamic Fees in DEXs Drive Liquidity and Efficiency Gains

Decentralized exchanges stand to gain most from dynamic fee structures in custom app-chains. Legacy constant-product AMMs suffer impermanent loss, eroding liquidity provider yields. Enter the Better Market Maker (BMM) model, wielding power-law invariants to cut losses by 36%. Paired with rebate systems that recycle fees to makers, these mechanisms bootstrap deep order books even in turbulent conditions.

Ethereum Technical Analysis Chart

Analysis by Tessa Crowley | Symbol: BINANCE:ETHUSDT | Interval: 4h | Drawings: 6

Technical Analysis Summary

To annotate this ETHUSDT chart in my style, start with a prominent downtrend line connecting the Dec 13, 2025 high at $4,300 to the recent low near $3,720 on Dec 7, 2025, using a thick red trend_line for bearish bias. Add horizontal_lines at key support $3,700 (strong) and resistance $4,100 (moderate), with text labels explaining confluence with prior lows/highs. Overlay a fib_retracement from the major swing low $3,850 (Dec 19) to high $4,150 (Dec 25), highlighting 61.8% retracement at $3,900 as potential entry zone. Use rectangle for consolidation range Dec 22-28 between $3,900-$4,100. Mark volume spikes with callout noting bearish divergence, and arrow_mark_down on recent MACD bearish crossover. Add long_position marker at $3,720 support with stop_loss below $3,650. Include callouts tying to 2025 DeFi rollup hype for long-term bullish context amid short-term caution.

Risk Assessment: medium

Analysis: Support test in downtrend amid positive DeFi catalysts (rollups, dynamic fees), but volume bias bearish; 2:1 R:R feasible with medium tolerance

Tessa Crowley’s Recommendation: Enter long on $3,720 confirmation candle with tight stop; scale out at resistance, hold core for 2025 app-chain rally

Key Support & Resistance Levels

📈 Support Levels:

-

$3,700 – Strong multi-touch low with volume shelf, aligns with 200-period MA

strong -

$3,850 – Moderate prior swing low, Fib 38.2% confluence

moderate

📉 Resistance Levels:

-

$4,100 – Moderate recent high, channel top resistance

moderate -

$4,300 – Strong monthly high, psychological barrier

strong

Trading Zones (medium risk tolerance)

🎯 Entry Zones:

-

$3,720 – Bounce off strong support with bullish divergence potential, medium risk aligns with tolerance

medium risk

🚪 Exit Zones:

-

$4,100 – Profit target at channel resistance/Fib extension

💰 profit target -

$3,650 – Stop loss below support invalidation

🛡️ stop loss

Technical Indicators Analysis

📊 Volume Analysis:

Pattern: bearish divergence – higher volume on downs, lower on ups

Confirms distribution, watch for spike reversal

📈 MACD Analysis:

Signal: bearish crossover

Momentum shift negative post recent high

Applied TradingView Drawing Utilities

This chart analysis utilizes the following professional drawing tools:

Disclaimer: This technical analysis by Tessa Crowley is for educational purposes only and should not be considered as financial advice.

Trading involves risk, and you should always do your own research before making investment decisions.

Past performance does not guarantee future results. The analysis reflects the author’s personal methodology and risk tolerance (medium).

ArXiv-backed research confirms: under high volatility, adaptive algorithms boost trader engagement 25% over static fees. Custom app-chains amplify this by isolating DEX compute from broader network load, ensuring sub-cent transaction costs. Imagine a perp DEX where taker fees fund maker rebates dynamically; liquidity surges as incentives align perfectly with market states.

Yet innovation demands nuance. Overly volatile fees risk alienating retail users. Savvy protocols layer in caps and floors, blending data-driven signals with user-friendly defaults. This balance propels DeFi transaction costs toward irrelevance, positioning app-chains as the infrastructure backbone for 2025’s liquidity wars.

Strategic Deployment for DeFi Cost Mastery

Implementing specialized fee markets requires surgical precision. Start with user experience: intuitive dashboards demystify multidimensional pricing, turning complexity into a competitive edge. Next, calibrate incentives; maker-taker splits excel at genesis but evolve into performance-based rebates as TVL matures.

Network health hinges on anti-spam dynamics: congestion pricing clears blockspace efficiently, yet gentle ramps prevent fee shocks. For multi-dApp chains, resource silos prevent one app’s frenzy from starving others. Early adopters report 70% lower operational costs versus L1 deployments, with rollup fee structures scaling seamlessly to enterprise volumes.

Dynamic fee markets power these gains, enabling custom app-chains to thrive where L1s falter. Developers eyeing 2025 must prioritize modular stacks from top Rollup-as-a-Service providers, blending ZK proofs for security with fee innovation for speed.

Modular stacks lower barriers dramatically. Rollup-as-a-Service (RaaS) providers handle the heavy lifting of ZK proofs and sequencer deployment, letting teams focus on fee logic. Leading options deliver secure, high-speed solutions tailored for DeFi, with costs ranging from $200,000 for basic multi-chain setups to over $1 million for enterprise-grade custom blockchains packed with advanced security and scalability features.

Quantifying ROI: Cost Savings in Action

DeFi transaction costs plummet under specialized fee markets, but the real win lies in total ownership economics. A custom app-chain for a perp DEX might clock initial development at $500,000, yet recoup via 80% lower ongoing fees versus Ethereum L1. Data from 2025 deployments pegs average savings at 70% for high-volume protocols, factoring in reduced oracle calls and state bloat. Multidimensional pricing ensures compute-intensive trades pay their way without subsidizing idle storage, yielding predictable margins even as TVL balloons past $10 billion.

Take yield aggregators: traditional rollups choke on cross-protocol queries, inflating fees 5x during rebalances. App-chains with dynamic bandwidth allocation cut this to pennies, boosting APYs by 15-20% through efficiency. Opinionated take: ignore RaaS at your peril; providers like those topping 2025 lists streamline ZK rollup integration, slashing timelines from months to weeks while embedding fee optimization out of the box.

2025 Cost Comparison: Custom App-Chains vs Ethereum L1 for DeFi Apps

| Cost Category | Custom App-Chain (Range) | Ethereum L1 (Range) | Notes / ROI Projection |

|---|---|---|---|

| Initial Development Cost | $200,000 – $1M+ | $100,000 – $500,000 | Custom app-chains enable specialized fee markets; higher upfront but 2-3x ROI in 12 months via cost savings |

| RaaS Setup & Annual Fees | $50,000 – $250,000 | N/A | Rollup-as-a-Service (e.g., Instanodes); dynamic fees boost efficiency, projecting 300%+ ROI |

| Avg. Transaction Fee (Dynamic) | $0.001 – $0.05 | $0.50 – $5.00 | Multidimensional fees (bandwidth/compute/storage) reduce costs by 90%+ for high-volume DeFi |

| Annual Ops Cost (10M Tx) | $50,000 – $300,000 | $2M – $10M | Massive savings from app-chain scalability; ROI >400% in Year 1 for mid-size DEXs |

| Break-even Period | 3-9 months | 18-36 months | App-chains optimize for DeFi growth with resource-specific fees |

These figures underscore blockchain fee optimization 2025 as a no-brainer for serious builders. Protocols migrating to app-chains report 4x faster iterations on fee tweaks, unhindered by L1 governance delays.

Real-World Case Studies: App-Chains Crushing It

Solana-inspired designs proliferate, but DeFi pioneers push further. A leading perp platform on a custom rollup deploys maker-taker fees with volatility-adjusted rebates, sustaining 50,000 TPS amid 2025 bull runs. Liquidity providers see IL drop 36% via power-law curves, per simulations, while takers enjoy sub-second fills at fractional costs. Another standout: NFT launchpads using storage-surge pricing, where fees spike 3x during mints but revert instantly, curbing bots without user exodus.

ZK rollup projects eyeing 2026 dominance already bake in these mechanics, prioritizing app-chain scalability for multi-chain dApps. The multi-chain universe demands normalized data layers, yet custom fee markets add the economic edge, ensuring seamless composability without fee leakage.

Challenges persist, sure. Fee complexity risks UX friction, but polished interfaces and tooltips convert skeptics. Growth loops via subscription-tied fees for premium features further align incentives, as seen in emerging DeFi apps.

Developers nailing this checklist unlock atomic composability, where fees become programmable assets themselves. Picture rebates auto-compounding into yields or fees funding shared security pools. Such innovations cement custom app-chains as DeFi’s efficiency engine, rendering L1 relics obsolete. As 2025 unfolds, protocols wielding these tools won’t just optimize costs, they’ll redefine scalable, equitable finance on their terms.

Design your app-chain fees right to lead the charge.