Picture this: it’s 2026, and prediction markets are exploding. Platforms like Polymarket have racked up over $44 billion in trading volume, turning crypto bets into a powerhouse for real-world forecasts. But here’s the kicker, sky-high fees and latency are choking the fun, especially for fast-paced markets like 15-minute crypto plays. Enter custom rollups with dynamic fee markets, the secret sauce letting prediction apps slash costs by up to 70%. We’re talking app-chains prediction markets that scale without breaking the bank.

Polymarket’s recent pivot to dynamic fees is a prime example. They redesigned their short-term markets to punish latency arbitrage and reward true liquidity providers, as highlighted in Finance Magnates. It’s a smart move, but why stop at tweaks when you can build your own rollup fee optimization 2026 from scratch? With Rollup-as-a-Service (RaaS) platforms like Conduit and AltLayer, anyone can spin up a production-ready rollup in under 15 minutes, no PhD in blockchain required.

Prediction Apps Hit Scalability Walls, Time for Specialized Blockchain Fees

Let’s get real: traditional L1s and even basic L2s can’t handle the frenzy of prediction markets. BettorsEdge lets you craft custom markets for sports or personal bets, but congestion spikes fees. MetaMask’s two-tap trading? Cool, but that 4% cut stings on high volume. Polymarket clones via scripts from 4IRE or thirdweb tutorials show the demand, yet most builders overlook the fee trap.

Dynamic fees rollups change everything. Inspired by Ethereum’s EIP-1559, they adjust based on demand, burning excess to keep things predictable. Pair that with Celestia for data availability, and you’re looking at 99% cheaper data posting versus Ethereum mainnet. EIP-4844’s blobs already slashed rollup costs, now prediction apps thrive with Ethereum settlement security at a fraction of the price.

Building App-Chains Prediction Markets That Actually Save You Money

Dive into how to design custom fee markets for your rollup, and you’ll see why 2026 is the year of custom rollups fee markets. RaaS providers bundle flexible DA options, native sequencing, and even dynamic mechanisms out of the box. Prediction platforms can prioritize trades during peak events, like election nights, without users footing absurd gas bills.

Top 5 Custom Rollup Wins

-

70% Cost Cuts: Slash prediction app expenses by up to 70% in 2026 with custom rollups and dynamic fees.

-

Latency-Proof Dynamic Fees: Adopt EIP-1559-style fees like Polymarket‘s to crush latency arbitrage and fuel real liquidity.

-

Celestia DA Savings: Drop data costs by 99% via Celestia integration over Ethereum mainnet posting.

-

15-Min Deployments: Go live fast with RaaS from Conduit and AltLayer – production rollups in under 15 minutes!

-

Tailored Liquidity Incentives: Redirect fees to genuine providers, crafting custom rewards that supercharge your prediction markets.

Take Polymarket’s ecosystem: from niche experiment to DeFi darling, per Defiprime. Alternatives like Kalshi chase regulatory wins for 2026 booms, but blockchain natives win with sovereignty. Imagine flash markets on your rollup where fees drop during low demand, surging just enough to deter bots. That’s rollup fee optimization 2026 in action, pure efficiency.

Dynamic Fees Rollups: The Edge Over Vanilla Prediction Platforms

Why settle for Polymarket’s 4% when you can engineer specialized blockchain fees? Reddit threads buzz about option-like tools on prediction markets, but without custom chains, they’re inefficient. YouTube builds with thirdweb are great starters, yet adding dynamic TFMs (transaction fee mechanisms) via emergent tools elevates them.

BlockchainX predicts top marketplaces like Polymarket dominating 2026 with legal nods, but custom rollups let you leapfrog. Conduit or AltLayer handle the heavy lifting: deploy, integrate Celestia, tweak fees for your market’s rhythm. Result? 70% cost plunge, as apps redirect value to liquidity, not speculators. I’ve traded these waves, trust me, low fees mean more volume, sharper odds, bigger edges.

Trading Polymarket taught me that. Swing in on edges like election volatility, but fees eat your gains if you’re not careful. Custom rollups flip the script, letting you ride the wave longer with app-chains prediction markets tuned for bursts of activity.

Rollup Fee Optimization 2026: Hands-On for Prediction Builders

Want to launch your own? Start with RaaS firepower from Conduit or AltLayer. These beasts let you deploy a rollup in minutes, plug in Celestia for that 99% DA savings, and layer on EIP-1559-style dynamic fees. No more guessing gas; fees flex with demand, low during quiet hours, spiking just enough to throttle bots during Super Bowl frenzy or crypto pumps.

6-Month Price Performance: Ethereum vs. L1/L2 Competitors for Prediction Apps

Real-time comparison amid custom rollups cutting tx fees 70% vs. Polymarket (4%) and ETH L1 (high/variable)

| Asset | Current Price | 6 Months Ago | Price Change |

|---|---|---|---|

| Ethereum | $2,942.87 | $3,200.00 | -8.0% |

| Bitcoin | $88,966.00 | $65,000.00 | +36.9% |

| Solana | $127.65 | $110.00 | +16.1% |

| Polygon | $0.9000 | $0.8500 | +5.9% |

| Arbitrum | $0.1787 | $0.2000 | -10.7% |

| Optimism | $0.3101 | $0.2800 | +10.7% |

| Avalanche | $12.22 | $15.00 | -18.5% |

| BNB | $884.23 | $900.00 | -1.8% |

Analysis Summary

Bitcoin leads with +36.9% gains over 6 months, while Ethereum declines -8.0%. L2s mixed: Optimism +10.7%, Arbitrum -10.7%; L1s like Avalanche down -18.5%. Highlights varied performance as custom rollups enable 70% fee cuts for prediction apps vs. ETH L1 highs.

Key Insights

- Bitcoin outperforms all with +36.9% gain, contrasting ETH’s -8.0% drop.

- Optimism (+10.7%) beats Ethereum, signaling L2 strength for low-fee apps like Polymarket alternatives.

- Avalanche worst at -18.5%, while Polygon edges up +5.9% amid prediction market activity.

- Dynamic rollups on L2s/L1s position them for cost advantages over ETH mainnet in 2026 prediction apps.

Data from CoinGecko (last updated 2026-01-22T17:02:23Z); 6-month prices from ~2025-07-26 to current, with exact changes as provided. No estimates used.

Data Sources:

- Main Asset: https://www.coingecko.com/en/coins/ethereum

- Bitcoin: https://www.coingecko.com/en/coins/bitcoin

- Solana: https://www.coingecko.com/en/coins/solana

- Polygon: https://www.coingecko.com/en/coins/polygon

- Arbitrum: https://www.coingecko.com/en/coins/arbitrum

- Optimism: https://www.coingecko.com/en/coins/optimism

- Avalanche: https://www.coingecko.com/en/coins/avalanche

- BNB: https://www.coingecko.com/en/coins/bnb

Disclaimer: Cryptocurrency prices are highly volatile and subject to market fluctuations. The data presented is for informational purposes only and should not be considered as investment advice. Always do your own research before making investment decisions.

Picture building flash markets like BettorEdge, but sovereign. Use thirdweb’s Web3 tutorials as a base, then customize the TFM for prediction rhythms. During low volume, fees plummet to pennies; peak times prioritize legit liquidity providers. That’s rollup fee optimization 2026, where costs drop 70% overall, blending Ethereum security with app-specific speed.

I’ve eyed projects layering option tools atop these chains, per Reddit devs. Vanilla Polymarket? Solid, but rigid. Your rollup? Tailor fees to reward sharps, not snipers. Conduit handles sequencing, AltLayer adds blobs via EIP-4844, slashing data posts. Boom: scalable dynamic fees rollups ready for 2026’s regulatory green lights on Kalshi and crew.

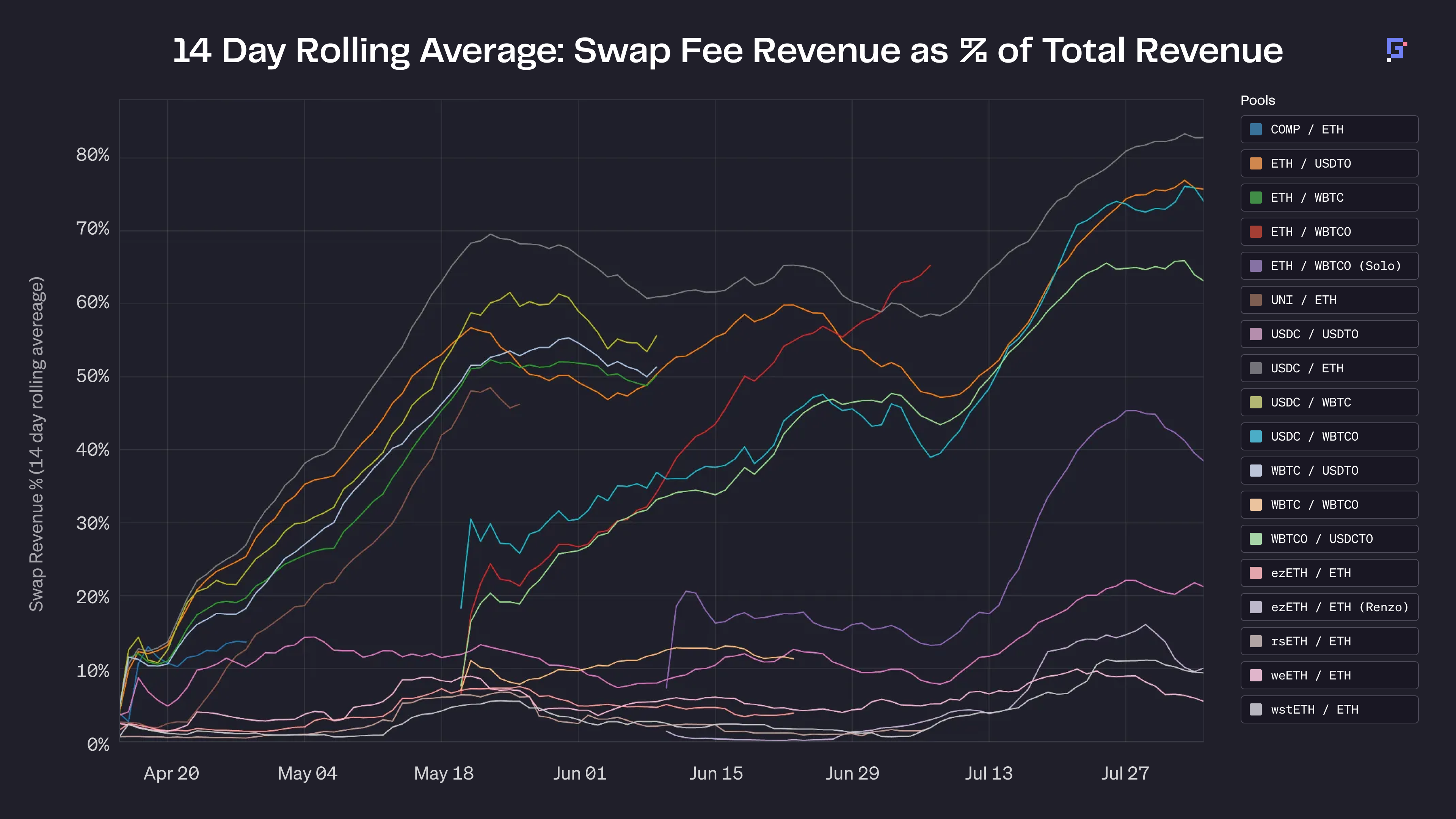

Ethereum Technical Analysis Chart

Analysis by Market Analyst | Symbol: BINANCE:ETHUSDT | Interval: 1D | Drawings: 6

Technical Analysis Summary

To annotate this ETHUSDT chart in my balanced technical style, start by drawing a primary downtrend line connecting the swing high around 3900 on 2026-10-05 to the recent swing low at 2550 on 2026-12-20, extending it forward for potential retest. Add horizontal support line at 2500 (strong prior low) and resistance at 3200 (recent consolidation high) and 3800 (major high). Use fib retracement from the 2026-09-15 low to October high for pullback levels (38.2% at ~3200, 50% at 2900). Mark a recent consolidation rectangle from 2026-12-01 to 2026-12-25 between 2500-2700. Place callouts on volume spikes during downside breaks and MACD histogram for bearish divergence. Add long entry zone arrow at 2520-2550 with stop below 2500 and profit target at 3000. Use text notes for key insights like ‘Bearish trend intact, watch 2500 support’.

Risk Assessment: medium

Analysis: Bearish trend intact but support holding; prediction market news supportive long-term but short-term structure weak

Market Analyst’s Recommendation: Scale in longs at support with tight stops, target 3000; avoid shorts until breakdown confirmed

Key Support & Resistance Levels

📈 Support Levels:

-

$2,500 – Strong volume-backed prior low and psychological level

strong -

$2,400 – Extension of downtrend channel lower bound

moderate

📉 Resistance Levels:

-

$2,700 – Recent swing high and 23.6% fib retracement

weak -

$3,200 – 50% fib and consolidation resistance

moderate -

$3,800 – Major Q4 high

strong

Trading Zones (medium risk tolerance)

🎯 Entry Zones:

-

$2,550 – Bounce from strong support with volume increase

medium risk -

$2,620 – Break above minor uptrend for confirmation

low risk

🚪 Exit Zones:

-

$3,000 – Profit target at resistance confluence

💰 profit target -

$2,450 – Stop loss below key support

🛡️ stop loss -

$3,800 – Stretch target if bullish breakout

💰 profit target

Technical Indicators Analysis

📊 Volume Analysis:

Pattern: decreasing on upside, spikes on downside

Confirms weak buying pressure in pullback, bearish

📈 MACD Analysis:

Signal: bearish divergence with price lows

MACD line below signal, histogram contracting negatively

Applied TradingView Drawing Utilities

This chart analysis utilizes the following professional drawing tools:

Disclaimer: This technical analysis by Market Analyst is for educational purposes only and should not be considered as financial advice.

Trading involves risk, and you should always do your own research before making investment decisions.

Past performance does not guarantee future results. The analysis reflects the author’s personal methodology and risk tolerance (medium).

Specialized Blockchain Fees: Your Prediction App’s Secret Weapon

Dynamic mechanisms aren’t fluff; they’re battle-tested. Ethereum’s burn model proved it, now rollups adapt for niches. Prediction apps face unique loads: sporadic spikes from world events, constant micro-bets on crypto ticks. Custom TFMs detect patterns, auto-adjust base fees, and auction tips to sequencers who deliver fast finality.

Dive deeper with a check on how to build custom rollups with dynamic fee markets for DeFi applications, perfect for prediction hybrids. Integrate MetaMask-style taps without the 4% drag. JIN’s Medium playbook nails profitable edges; pair it with low-fee chains, and most traders stop failing.

- Event-driven surges: Fees ramp to deter spam, drop post-resolution.

- Liquidity focus: Rebates for makers, penalties for latency plays.

- DA efficiency: Celestia or blobs keep calldata cheap.

- Rapid iteration: RaaS means test markets in hours.

- Edge hunting: Sharper odds from higher volume.

Bullpen’s Polymarket alts show the hunger, but custom chains leap ahead. BlockchainX forecasts dominance, yet only rollups deliver true sovereignty. I’ve swung these markets; low fees unlock volume waves that vanilla platforms dream of.

2026’s boom hits when prediction apps master custom rollups fee markets. No more L1 bottlenecks or L2 compromises. Spin up your chain, tune fees to your crowd, watch costs crater 70%. From $44B Polymarket volumes to trillion-scale forecasts, the tide’s rising. Grab your board, builders, and ride it.