In the evolving world of blockchain infrastructure, dynamic fee markets are rapidly becoming the engine behind scalable, user-centric custom app-chains. As application-specific blockchains (“app-chains”) move beyond the constraints of static fee schedules, dynamic pricing mechanisms are unlocking new dimensions of economic efficiency and network responsiveness. This technical guide explores how these adaptive fee structures are transforming rollup architectures, improving transaction prioritization, and reshaping the economics of decentralized applications.

Why Dynamic Fee Markets Matter for Custom App-Chains

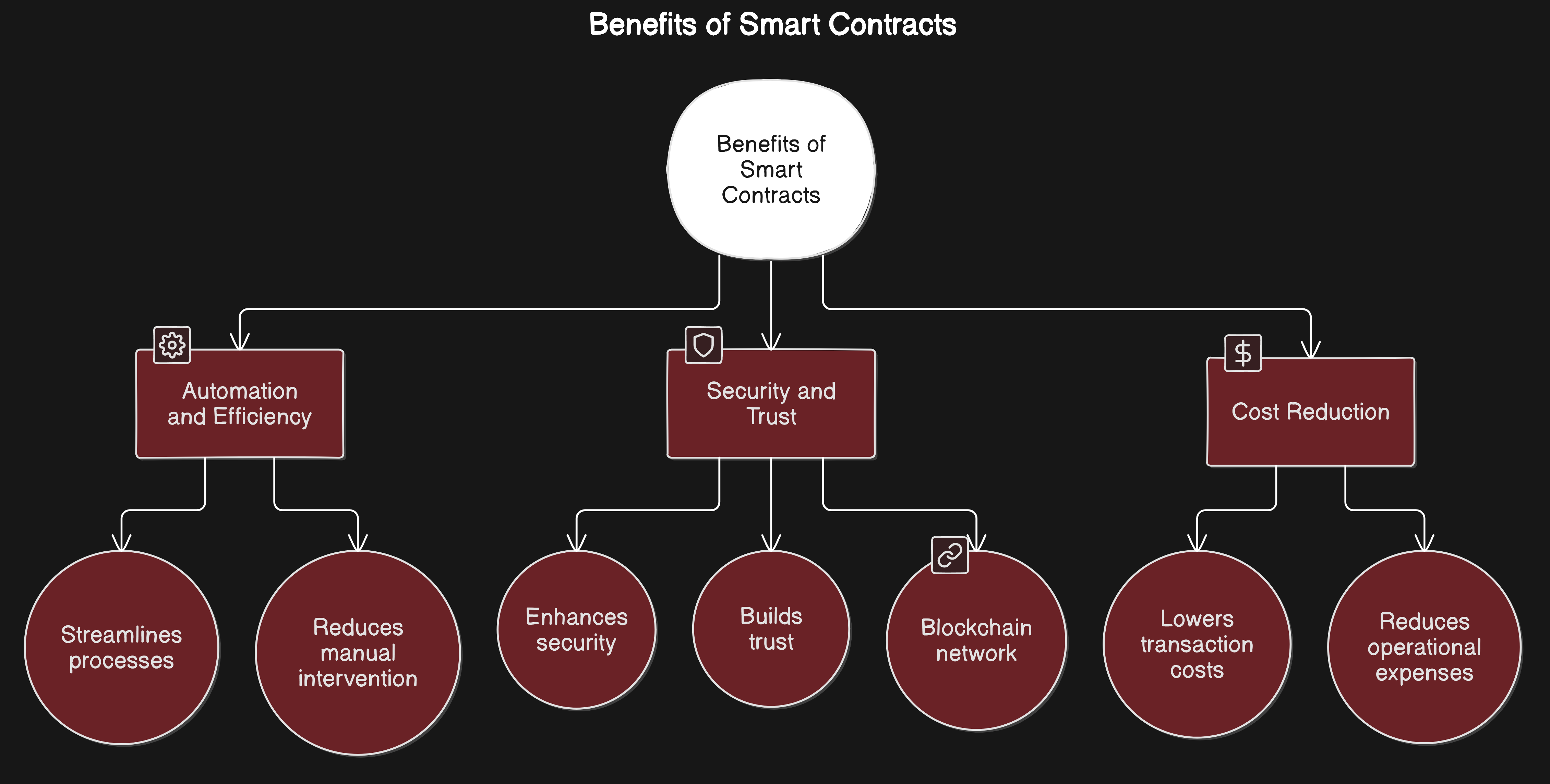

The “Everyone Gets a Chain” economy is not just a catchy phrase; it reflects a seismic shift in blockchain design philosophy. With modular frameworks like OP Stack and Cosmos SDK, developers can now tailor every layer of their chain, including the fee market. Traditional Layer 1s often suffer from congestion and unpredictable gas spikes. In contrast, dynamic fee markets empower custom app-chains to:

- Respond in real time to network congestion or quiet periods by adjusting transaction costs up or down.

- Optimize resource allocation, ensuring bandwidth and computation are used efficiently without overcharging users.

- Enable innovative business models, such as fee-less transactions for select users or variable pricing based on transaction type.

This adaptability is particularly vital as more projects deploy rollups that batch transactions off-chain before settling on Ethereum or other base layers. By tuning fees dynamically, rollups can provide consistently low costs even during periods of high volatility, critical for dApps targeting mainstream adoption.

The Technical Anatomy of Dynamic Fee Markets

A robust dynamic fee market requires more than just an adjustable number in the protocol settings. Leading-edge implementations integrate several technical components:

Core Technical Components for Dynamic Fee Markets

-

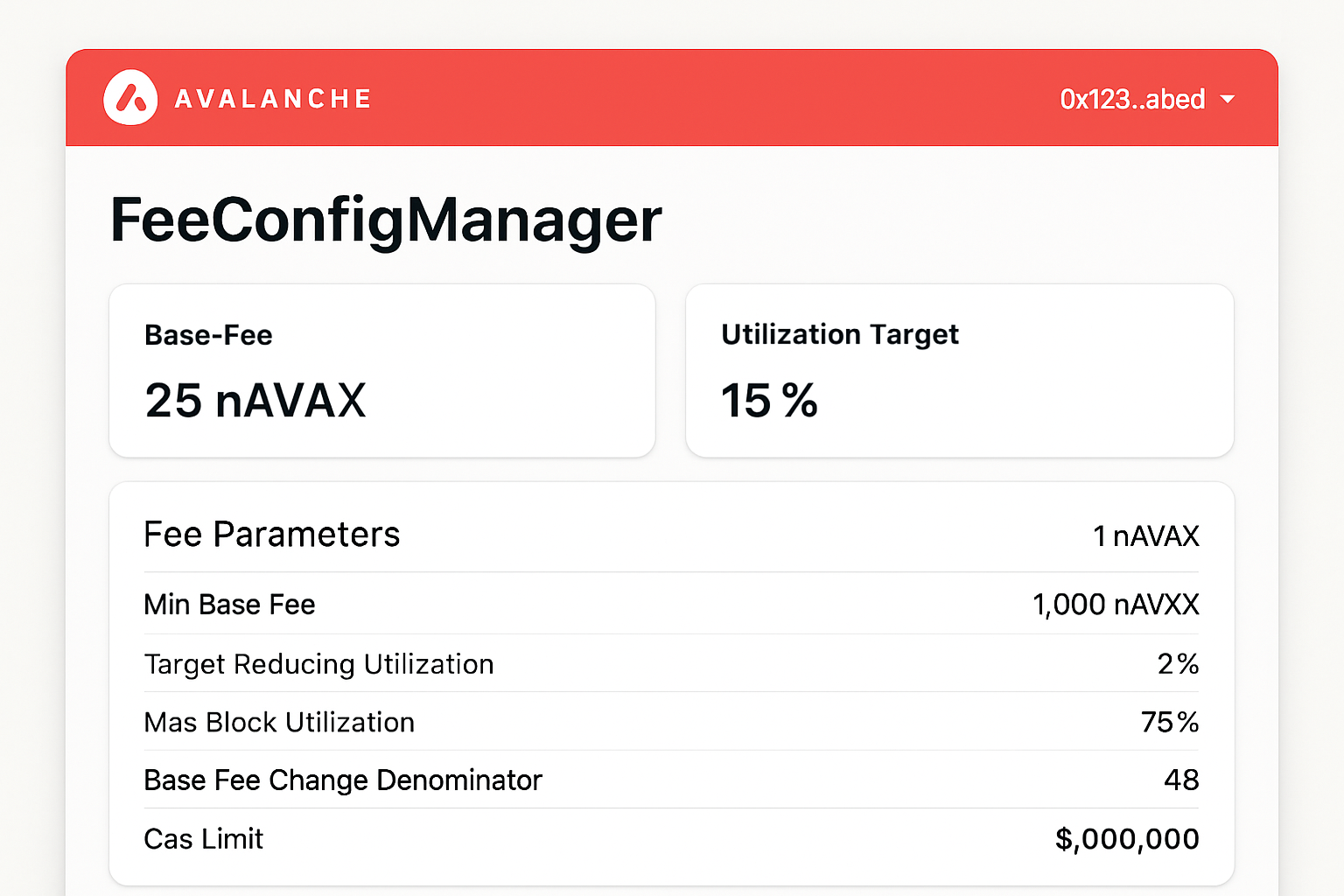

On-Chain Fee Configuration Management: Platforms like Avalanche FeeConfigManager enable real-time adjustment of transaction fee parameters directly on-chain, allowing app-chains to adapt fees to current network conditions.

-

Volatility-Adaptive Fee Algorithms: Implementing algorithms that adjust fees in response to market volatility—such as those described in adaptive fee research for DEXs—helps maintain trading activity and reduces impermanent loss during periods of high price fluctuation.

-

Multi-Dimensional Fee Markets: Utilizing frameworks that price multiple network resources (bandwidth, computation, storage) separately, as explored in dynamic pricing for non-fungible resources, improves scalability and resource allocation in custom app-chains.

-

Dynamic Exchange Fee Mechanisms: Protocols like Synthetix dynamically adjust trading fees based on market volatility, neutralizing front-running and ensuring fairness for users.

-

Custom Gas Token Support: Solutions such as ERC-20 Custom Gas Tokens allow users to pay transaction fees with tokens other than ETH, increasing flexibility for dApp ecosystems.

One widely adopted approach is EIP-1559-style base fees, which automatically adjust block-by-block according to demand. The OP Stack framework enables Layer 2 chains to leverage this model for granular control over their own blockspace economics. Meanwhile, Avalanche’s FeeConfigManager allows on-chain governance to fine-tune parameters such as base fees and elasticity multipliers, essential tools for rapidly iterating on fee policy.

An important innovation is the rise of multi-dimensional fee markets. Instead of charging a flat rate per transaction, these systems price different resources (CPU cycles, storage bytes, bandwidth) independently. This ensures that users pay precisely for what they consume, no more subsidizing expensive storage operations with simple token transfers. Research from arXiv demonstrates that such multi-dimensional pricing dramatically improves both network throughput and cost fairness.

Tuning Fees for Volatility and Fairness: Practical Examples

The real power of dynamic fees emerges during periods of extreme market volatility, a common occurrence in crypto ecosystems. Projects like Synthetix have pioneered algorithms that ramp up trading fees when price swings spike, deterring front-running bots and protecting liquidity providers from impermanent loss. Conversely, when markets stabilize, fees drop back down to encourage healthy trading volumes.

A compelling case comes from Siemens’ deployment of an Avalanche-based DEX for carbon credits and energy futures. Initially hampered by static fees that caused major slippage during energy crises, Siemens switched to a volatility-driven dynamic model, and saw slippage fall by 67% during peak stress events while also attracting deeper liquidity pools.

Developers building on frameworks like Cosmos SDK or OP Stack are now empowered to experiment with custom app-chain fee structures that go far beyond the one-size-fits-all gas model. For instance, Cosmos-based app-chains can implement custom gas tokens, enabling users to pay fees in the chain’s native token or even in ERC-20s, as detailed in recent Alchemy guides. This flexibility is not just a UX upgrade, it also creates new levers for protocol-level incentives and ecosystem growth.

Another major advantage of dynamic fee markets is their impact on transaction prioritization. By allowing fees to float according to real-time demand, app-chains can ensure that high-priority transactions are always included promptly, while less urgent activity can wait for lower-fee windows. This is especially important for rollups, where sequencers must efficiently allocate limited blockspace, often under volatile conditions.

Best Practices: Designing Dynamic Fee Markets for Scalability

To maximize the benefits of dynamic fee markets, custom app-chain architects should consider several best practices:

- Granular Resource Metering: Separate pricing for computation, storage, and bandwidth leads to fairer cost allocation and more predictable performance.

- Transparent Algorithms: Use well-documented adjustment formulas (such as EIP-1559) so users understand how fees are set and can plan accordingly.

- On-Chain Governance: Allow community stakeholders to tune key parameters, like base fee multipliers or volatility thresholds, via governance proposals for rapid adaptation.

- User Education: Provide clear interfaces and analytics so users can see how current network conditions impact their transaction costs.

The future will likely see even more nuanced models emerge. For example, mechanism design research for ZK-rollup prover markets suggests that auction-style or priority-based systems could further optimize both social welfare and network utilization. Meanwhile, protocols like GMI are experimenting with protocol-level fee rebates and cross-chain incentives to align user behavior with long-term network health.

Unlocking the Next Generation of Blockchain Scalability

The move toward dynamic fee markets marks a fundamental shift in how decentralized applications approach resource management and economic sustainability. By harnessing adaptive pricing mechanisms, custom app-chains can deliver a superior user experience, swift confirmations during busy periods, cost savings when demand drops, and transparent economics that attract both developers and liquidity providers.

If you’re designing your own rollup or exploring specialized fee strategies for your application-specific blockchain, now is the time to master these tools. The technical sophistication required is non-trivial, but the payoff is a resilient, scalable platform ready for mainstream adoption in an increasingly modular blockchain landscape.

Dive deeper into the mechanics of dynamic fee markets powering scalable custom app-chains at this detailed guide.