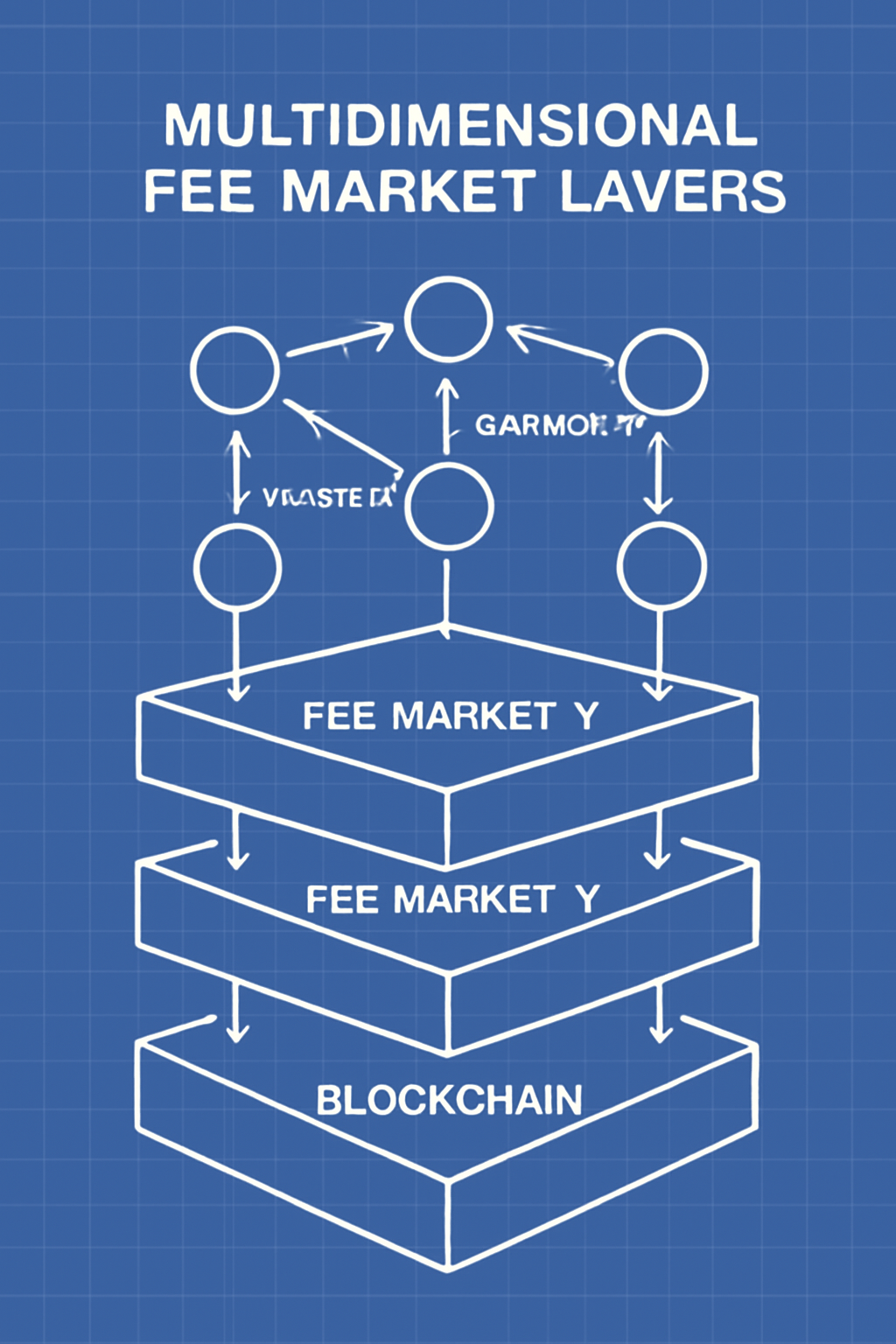

In the evolving landscape of blockchain scalability, custom app-chains stand out as a beacon for developers seeking to transcend the limitations of monolithic networks. Traditional unified fee structures, while simple, often falter under diverse workloads, leading to congestion and suboptimal resource use. Specialized fee markets, by contrast, offer a sophisticated alternative: they dissect transaction costs into granular components tailored to computation, storage, and bandwidth. This strategic segmentation not only optimizes throughput but also aligns economic incentives with real-world application demands, positioning custom app-chains as the backbone for next-generation decentralized ecosystems.

Resource-Specific Multidimensional Fee Markets: A Game-Changer for Modular Chains

Imagine a blockchain where fees dynamically reflect the true cost of resources consumed. Resource-specific multidimensional fee markets achieve exactly that, assigning distinct pricing to each pillar of chain operation. During peak NFT minting events, storage fees might spike to curb overload, while zero-knowledge proof computations trigger separate compute surcharges. This approach shines in modular architectures, where diverse dApps coexist without cannibalizing shared capacity.

From a macro perspective, this model mirrors efficient capital markets, where assets are priced by underlying fundamentals rather than arbitrary averages. Power users footing higher bills for intensive operations subsidize lightweight interactions, fostering broader adoption. Yet, success hinges on precise real-time tuning; poorly calibrated dimensions risk underutilization or inequity. Platforms pioneering this, as detailed in our guides, demonstrate up to 40% better resource efficiency in high-variance environments.

Cosmos Technical Analysis Chart

Analysis by Gavin Murdock | Symbol: BINANCE:ATOMUSDT | Interval: 1W | Drawings: 7

Technical Analysis Summary

As Gavin Murdock, apply conservative overlays: primary downtrend line from early 2025 peak connecting recent lows; horizontal support at $2.80 (historical bottom retest); resistance cluster at $5.50; fib retracement 0.618 from 2025 low to high; volume callout on declining bars; MACD bearish divergence marker; rectangle for mid-2025 consolidation; vertical line for Nov 10 app-chain news catalyst; text notes on risk-managed entries only post-confirmation.

Risk Assessment: medium

Analysis: Downtrend intact with positive fundamentals; low tolerance favors waiting for higher lows and news confirmation over aggressive trades.

Gavin Murdock’s Recommendation: Hold cash or core positions; enter long only on support bounce with <2% risk. Big picture: app-chains bolster ATOM long-term.

Key Support & Resistance Levels

📈 Support Levels:

-

$2.8 – Strong historical bottom retest; aligns with 2022-2025 cycle low.

strong -

$3.5 – Intermediate support from recent swing low; moderate confluence.

moderate

📉 Resistance Levels:

-

$4.5 – Near-term overhead from prior consolidation high.

moderate -

$5.5 – Key resistance cluster; 0.382 fib retracement.

strong

Trading Zones (low risk tolerance)

🎯 Entry Zones:

-

$3.2 – Dip-buy at strong support if volume spikes and MACD bullish cross; aligns with app-chain fundamentals.

low risk

🚪 Exit Zones:

-

$5.5 – Profit target at resistance; conservative 70% R:R.

💰 profit target -

$2.9 – Tight stop below support to preserve capital.

🛡️ stop loss

Technical Indicators Analysis

📊 Volume Analysis:

Pattern: declining on downside

Bearish volume taper suggests weakening sellers, potential exhaustion.

📈 MACD Analysis:

Signal: bearish divergence

MACD line below signal with histogram contraction; watch for reversal.

Applied TradingView Drawing Utilities

This chart analysis utilizes the following professional drawing tools:

Disclaimer: This technical analysis by Gavin Murdock is for educational purposes only and should not be considered as financial advice.

Trading involves risk, and you should always do your own research before making investment decisions.

Past performance does not guarantee future results. The analysis reflects the author’s personal methodology and risk tolerance (low).

Such granularity empowers architects to craft app-chains resilient to volatility, whether in DeFi surges or AI compute marketplaces.

Maker-Taker Fee Model: Bootstrapping Liquidity with Precision Incentives

The maker-taker paradigm, borrowed from centralized exchanges yet refined for blockchain, revolutionizes liquidity provision in custom rollups. Makers, who post orders and enhance depth, enjoy rebates or negligible fees; takers, executing against them, bear the brunt to compensate. This asymmetry supercharges order books, drawing providers with negative maker fees while ensuring protocol sustainability through taker premiums.

Injective Protocol and MAGIC-FI exemplify this in action, where customizable tiers adapt to maturity stages: aggressive rebates early for bootstrapping, tapering as volume stabilizes. For custom app-chains, integrating this via programmable sequencers unlocks maker-taker dynamics that propel trading ecosystems. Critically, over-reliance on rebates demands vigilant governance; unchecked, they erode revenues, underscoring the need for phased implementation.

This model’s opinionated edge lies in its behavioral nudge: it doesn’t just price transactions; it engineers participation for sustained growth.

Dynamic Congestion-Based Adjustments: Real-Time Responsiveness

Congestion isn’t merely a technical hiccup; it’s an economic signal demanding adaptive fees. Dynamic models escalate costs amid high volume or volatility, echoing EIP-1559’s base-plus-tip but extended to app-chain specifics. Uniswap v4’s hooks enable per-pool tweaks, ensuring fees mirror instantaneous supply-demand imbalances.

| Fee Model | Key Strength | Best Use Case | Example Chain |

|---|---|---|---|

| Multidimensional | Granular Allocation | Diverse dApps | Custom Rollups |

| Maker-Taker | Liquidity Incentives | DEXes | Injective |

| Dynamic Congestion | Anti-Spam | High-Volatility | Uniswap v4 |

Applied to custom app-chains, these adjustments prevent spam, prioritize high-value txs, and maintain UX for retail users. The strategic insight? Pair with predictive analytics for preemptive scaling, turning congestion from foe to fine-tuner. As networks mature, hybridizing these with multidimensional layers yields compounded scalability gains.

Navigating implementation requires balancing innovation with pragmatism. User interfaces must demystify complexities through intuitive dashboards, while liquidity strategies evolve from rebate-heavy to revenue-neutral.

Network health monitoring emerges as paramount, with dynamic fees acting as a bulwark against spam while preserving access for genuine participants. Ecosystem diversity further amplifies the value of these markets; chains hosting gaming, DeFi, and AI workloads thrive under multidimensional pricing that matches costs to intensity.

Architecting Your Fee Market: A Step-by-Step Blueprint

Transitioning theory to practice demands a structured rollout. Begin by auditing resource bottlenecks via simulation tools, then prototype fee dimensions in testnets. Programmable sequencers, central to modern app-chains, unlock this flexibility, allowing hooks for custom logic without consensus overhauls. Integrate oracles for off-chain signals like volatility indices to inform adjustments, ensuring fees evolve with macro trends.

Governance mechanisms seal the design: token-weighted voting lets stakeholders calibrate parameters, preventing ossification. This big-picture orchestration not only scales throughput but recalibrates economic flywheels for longevity.

Code in Action: Solidity Snippet for Dynamic Fees

Solidity: Congestion-Based Fee Adjustment with Base Fee and Priority Multiplier

In custom app-chains, a rollup sequencer can leverage a specialized fee market to dynamically respond to congestion. This Solidity implementation adjusts the base fee proportionally to gas utilization exceeding a target, while escalating a priority multiplier to incentivize high-value transactions during peak demand—ensuring strategic resource allocation and sustained scalability.

```solidity

pragma solidity ^0.8.20;

/// @title Congestion-Aware Fee Market for Custom Rollup Sequencer

/// @notice Dynamically adjusts base fee based on gas utilization and scales priority multiplier during congestion

contract SequencerFeeMarket {

uint256 public constant TARGET_GAS_PER_BLOCK = 15_000_000;

uint256 public constant BASE_FEE_MAX_INCREASE = 125; // 12.5% per adjustment (1125/1000)

uint256 public constant BASE_FEE_MAX_DECREASE = 125; // 12.5% per adjustment (875/1000, inverted)

uint256 public constant PRIORITY_MULTIPLIER_BASE = 1;

uint256 public constant CONGESTION_THRESHOLD = 100;

uint256 public baseFee = 10 gwei;

uint256 public priorityMultiplier = PRIORITY_MULTIPLIER_BASE;

uint256 public lastGasUsed;

/// @notice Update fees post-block based on congestion

function adjustFees(uint256 gasUsed) external {

lastGasUsed = gasUsed;

uint256 utilization = (gasUsed * 100) / TARGET_GAS_PER_BLOCK;

if (utilization > CONGESTION_THRESHOLD) {

// Increase base fee and priority multiplier for congestion

uint256 congestionRatio = utilization - CONGESTION_THRESHOLD;

baseFee = (baseFee * BASE_FEE_MAX_INCREASE) / 1000;

priorityMultiplier = PRIORITY_MULTIPLIER_BASE + (congestionRatio / 10);

} else {

// Decrease base fee and reset multiplier

baseFee = (baseFee * (1000 - BASE_FEE_MAX_DECREASE + 100)) / 1000; // Effective 87.5%

priorityMultiplier = PRIORITY_MULTIPLIER_BASE;

}

}

/// @notice Compute total fee: baseFee * gas + priorityFee * multiplier

function getTotalFee(uint256 gasLimit, uint256 priorityFee) external view returns (uint256) {

uint256 baseComponent = (baseFee * gasLimit) / 1_000_000; // Normalize per million gas units

uint256 priorityComponent = priorityFee * priorityMultiplier;

return baseComponent + priorityComponent;

}

}

```This architecture not only mitigates spam but also aligns economic incentives with network health, enabling app-chains to scale efficiently under variable loads while maintaining decentralization principles.

Such code, deployable via frameworks like OP Stack or Zeeve’s Rollups-as-a-Service, exemplifies how specialized fee markets embed directly into app-chain logic. Tweak multipliers based on block fullness, and you’ve got a self-regulating engine for custom app-chains.

Real-world traction underscores viability. Injective’s maker-taker refinements have sustained sub-cent fees amid explosive volumes, while emerging protocols layer congestion dynamics atop rollups for DeFi dominance. Hybrid models, blending these paradigms, project 5x scalability lifts per our analyses, outpacing generalized L1s.

Comparison of Top RAAS Providers for Custom Rollups with Fee Market Support: Zeeve vs. InstaNodes

| Provider | Features | Cost Efficiency | DA Integration |

|---|---|---|---|

| Zeeve | Enterprise-grade infrastructure for sovereign L1 AppChains & scalable L2/L3 Rollups, Programmable sequencers, Dynamic fee models & maker-taker support 🚀 | Tiered scalable pricing optimized for high-volume app-chains, Reduces long-term costs via efficient resource allocation 💰 | Native modular integrations with Celestia, Avail, EigenDA; Seamless for custom rollups 🔗✅ |

| InstaNodes | Secure high-speed modular rollups for next-gen dApps, Custom fee market customization, High-performance stack 🛡️ | Affordable pay-as-you-grow model, Excellent performance-per-dollar for scalable deployments 📈 | Supports top 2025 DA layers incl. Celestia, NearDA, Token Metrics leaders; Flexible integrations 🔄✅ |

Pitfalls and Safeguards: The Checklist for Success

Heed this checklist to sidestep common traps. Overly volatile surges alienate users; mitigate with caps and smoothing algorithms. Revenue shortfalls from perpetual rebates? Sunset them via automated milestones tied to TVL thresholds. Above all, prioritize composability: ensure your fee logic interoperates with cross-chain intents protocols for seamless liquidity flows.

Looking ahead, the convergence of AI-driven fee optimization and quantum-resistant L1 designs heralds an era where app-chains dictate blockchain’s macroeconomic narrative. Dynamic models will not merely react but anticipate, leveraging predictive ML for preemptive pricing. Developers eyeing app-chain scalability must embrace these tools now, as commoditized rollups yield to bespoke economic engines.

CustomAppChains. com equips you with blueprints to pioneer this frontier. From rollup fee designs to sequencer programmability, our resources chart the path to resilient, high-throughput ecosystems that redefine decentralized value creation.