Instant, seamless social interactions are the holy grail of onchain experiences. Yet, for years, the dream has been stymied by unpredictable fees and congested blockspace. Enter dynamic fee markets: a breakthrough economic mechanism that is transforming custom app-chains into high-speed, low-cost playgrounds for social dApps. By flexibly adjusting transaction costs in real time, dynamic fee structures unlock millisecond blockchain transactions and empower developers to build application-specific blockchains that feel as responsive as Web2 platforms.

Why Static Fees Break Social Onchain UX

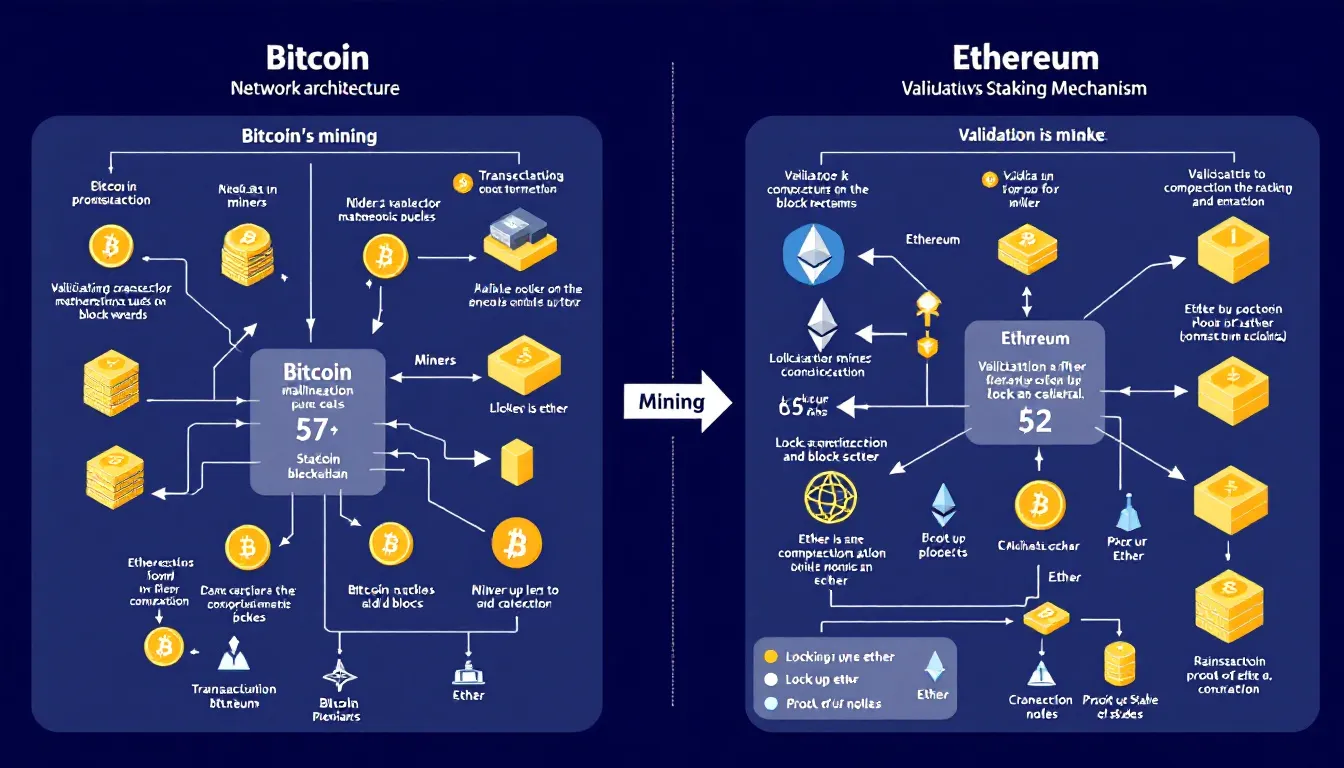

Traditional blockchains like Ethereum and Bitcoin rely on static or semi-static fee models where users must guess the right price to ensure their transaction is included quickly. In a fast-moving social context – think likes, comments, messages – this results in either overpaying or enduring frustrating delays. Worse still, during periods of network congestion, even basic interactions become prohibitively expensive or unreliable.

This is precisely why custom app-chains with specialized fee markets are gaining traction among builders of onchain social networks. These chains can be tuned for specific throughput and latency requirements while leveraging dynamic fees to ensure fair and efficient resource allocation. The result? A user experience that rivals centralized apps, but with all the transparency and composability of crypto infrastructure.

The Mechanics Behind Dynamic Fee Markets

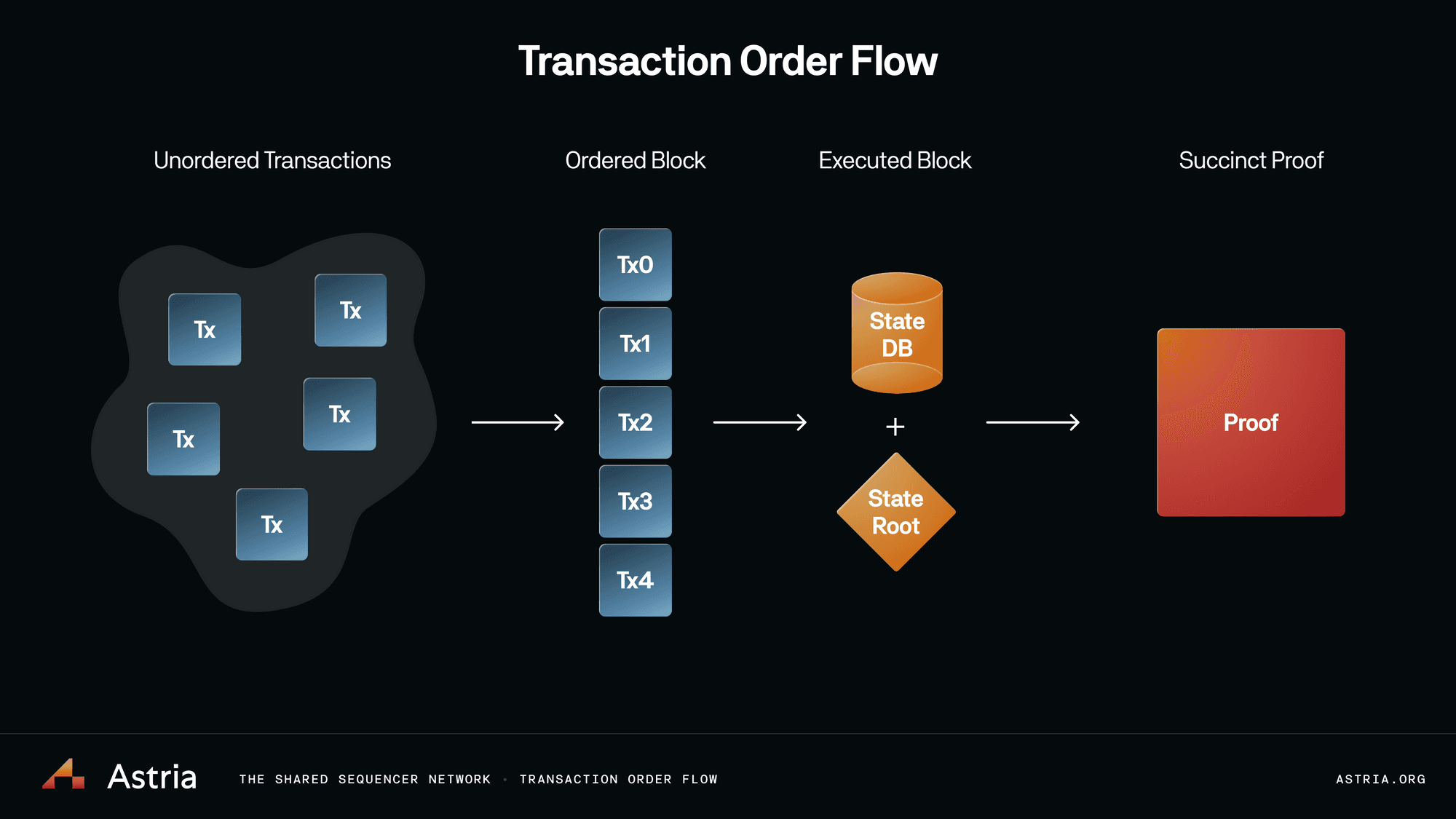

Dynamic fee markets operate by continuously adjusting transaction costs based on real-time demand for blockspace. When activity spikes – say during a viral moment or trending topic – fees rise just enough to prioritize the most urgent interactions without locking out everyday users. Conversely, when demand drops, fees fall back down so micro-interactions remain affordable.

This approach isn’t just theoretical: Solana’s local fee markets and Ethereum’s EIP-1559 base-fee model both showcase how dynamic pricing can smooth out volatility and improve user fairness. According to recent research (Nadcab Labs, MDPI), decentralized exchanges already use similar mechanisms to optimize trading efficiency under varying market conditions.

Key Benefits of Dynamic Fee Markets for Custom App-Chains

-

Efficient Resource Allocation: Dynamic fee markets, as seen on Ethereum, allocate scarce blockspace to the highest-value transactions in real time, reducing network congestion and ensuring that critical social interactions are processed instantly.

-

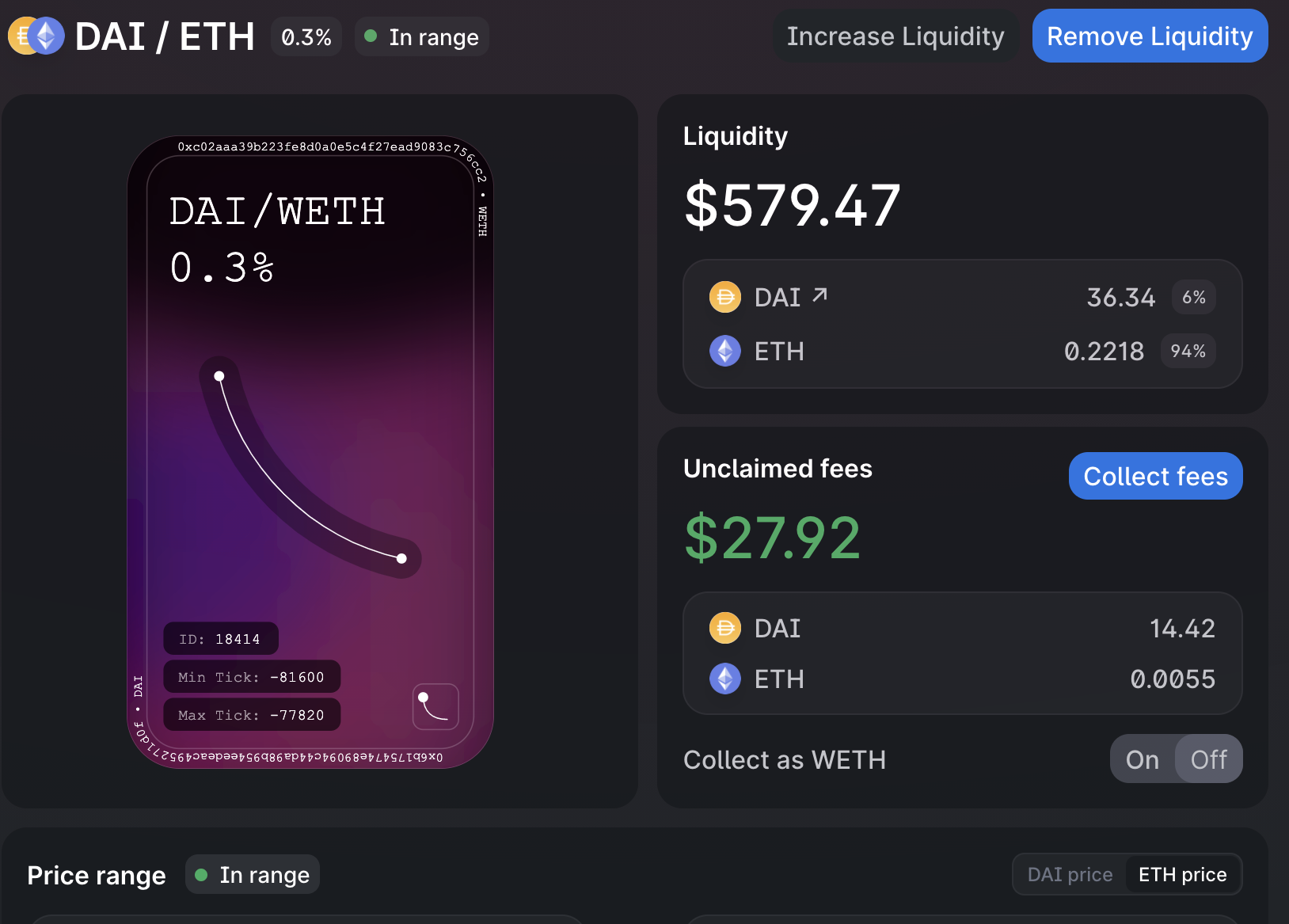

Lower and Flexible Transaction Costs: Platforms like Uniswap and Push Chain utilize dynamic fees to adjust transaction costs based on demand, making onchain interactions more affordable and accessible for users, especially during periods of low network activity.

-

Enhanced User Experience: By enabling instant confirmations and low-latency transactions, dynamic fee markets power seamless social interactions on custom app-chains, which is crucial for real-time messaging and content sharing apps.

-

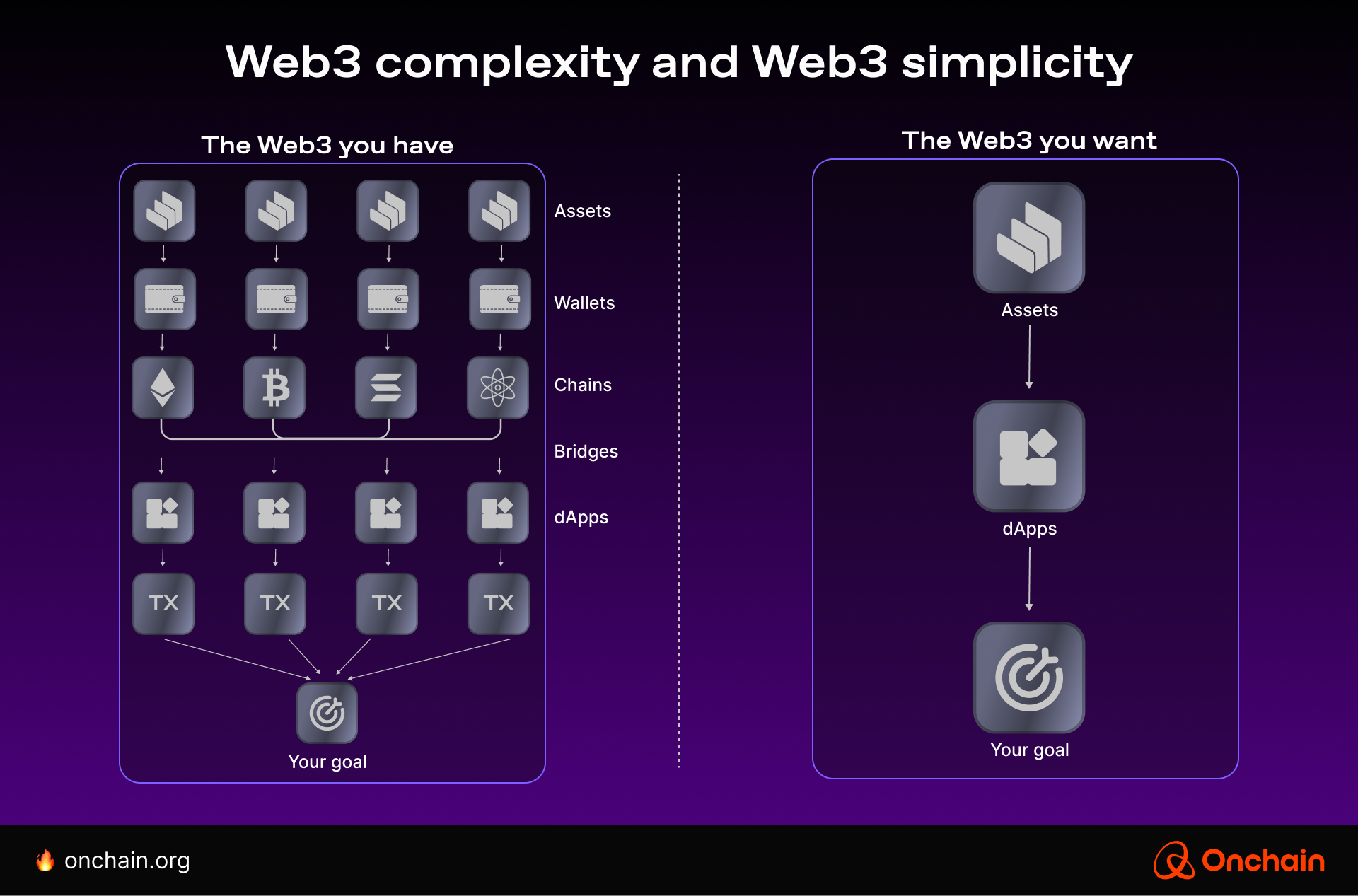

Universal Fee Abstraction: Solutions like Push Chain support cross-chain transactions and universal fee abstraction, allowing users to interact across multiple blockchains without worrying about different wallets or fee structures.

-

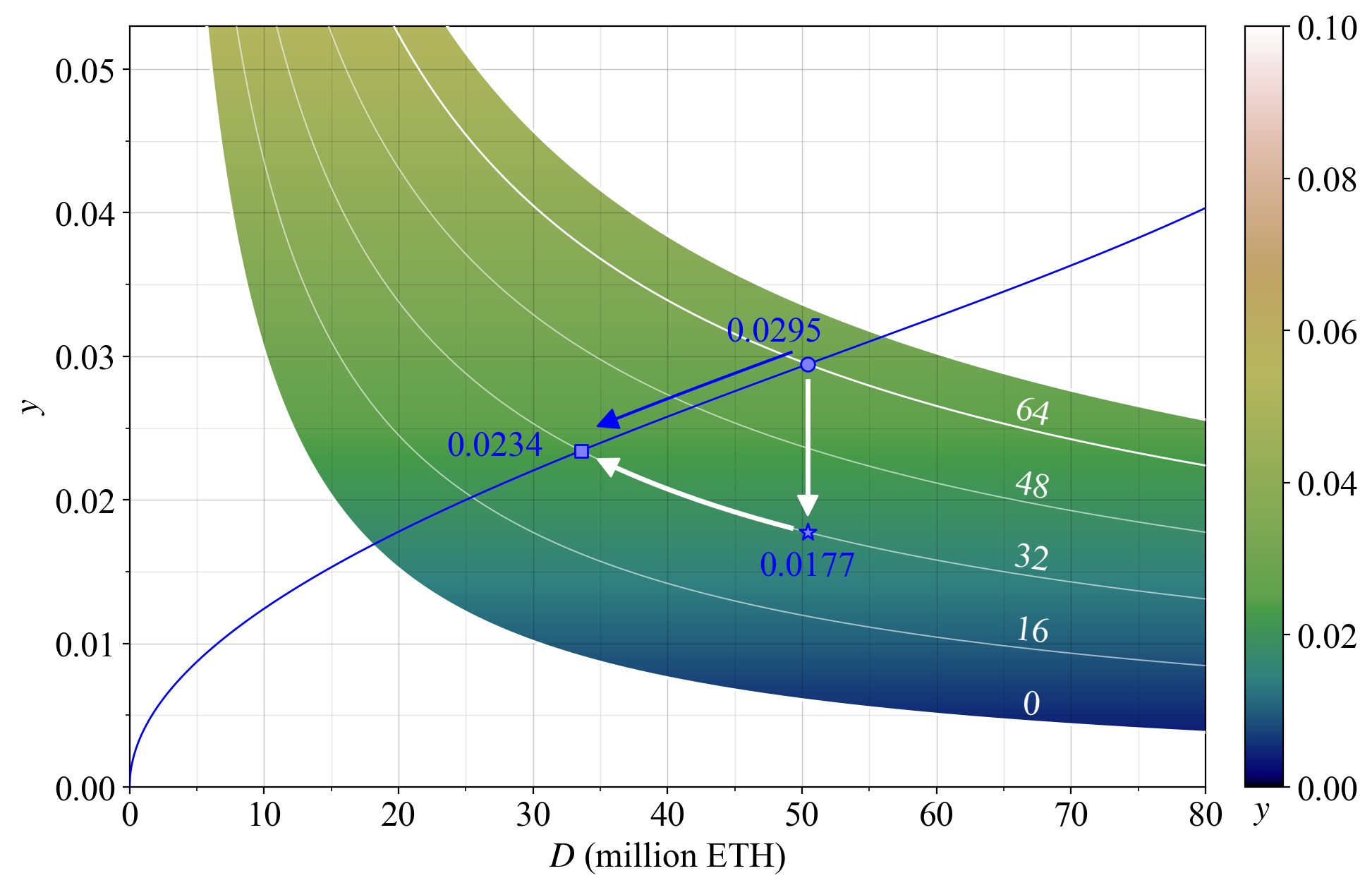

Developer Revenue Optimization: The Ethereum community’s proposed dynamic fee structure for the application layer balances developer incentives with user fairness, using mechanisms like the square root function to adjust fees proportionally and encourage ecosystem growth.

Case Study: Social Interactions at Web2 Speed

The latest generation of custom app-chains goes even further by integrating multidimensional fee structures at the application layer itself. For example, proposals within the Ethereum community suggest using a square root function to balance developer revenue with fairness in fee extraction – smaller projects get higher returns while larger ones face capped fees that encourage ecosystem growth (learn more here).

Meanwhile, platforms like Push Chain are pioneering shared-state Layer 1s that abstract away cross-chain complexity entirely. Users can send messages or react to posts across multiple chains in real time without worrying about juggling different wallets or inconsistent gas prices.

The Road Ahead: Universal Fee Abstraction and UX Innovation

The promise is clear: as dynamic fee markets become standard in application-specific blockchains and scalable rollups, we’re moving rapidly toward an era where onchain social interactions are not just possible but delightful. Developers gain fine-grained control over economics; users enjoy predictability and speed; communities thrive around new forms of digital expression.

What’s especially exciting is how these innovations are already reshaping the expectations for onchain engagement. Instead of clunky, delayed messaging or sticker shock from surprise gas spikes, users experience near-instant feedback, think sending a reaction or joining a group chat with sub-second finality. This is only possible because dynamic fee markets allow custom app-chains to recalibrate costs in real time, ensuring that blockspace is always allocated to those who value it most in the moment.

But the benefits go deeper than just speed and cost. Dynamic fee markets also open up new models for incentivizing community contributions and funding public goods within social protocols. By using multidimensional fee structures, projects can price different types of onchain actions, such as posting, voting, or tipping, according to their resource impact and social value. This means micro-interactions can remain virtually free during off-peak hours while still prioritizing urgent or high-value posts when demand surges.

Design Patterns Emerging in Application-Specific Blockchains

We’re seeing several architectural patterns emerge as builders experiment with dynamic fees:

Dynamic Fee Design Patterns in App-Specific Blockchains

-

Ethereum EIP-1559 Base Fee Model: Ethereum’s EIP-1559 introduces a dynamic base fee that adjusts automatically per block based on network congestion, ensuring efficient blockspace allocation and predictable transaction costs for users and dApps.

-

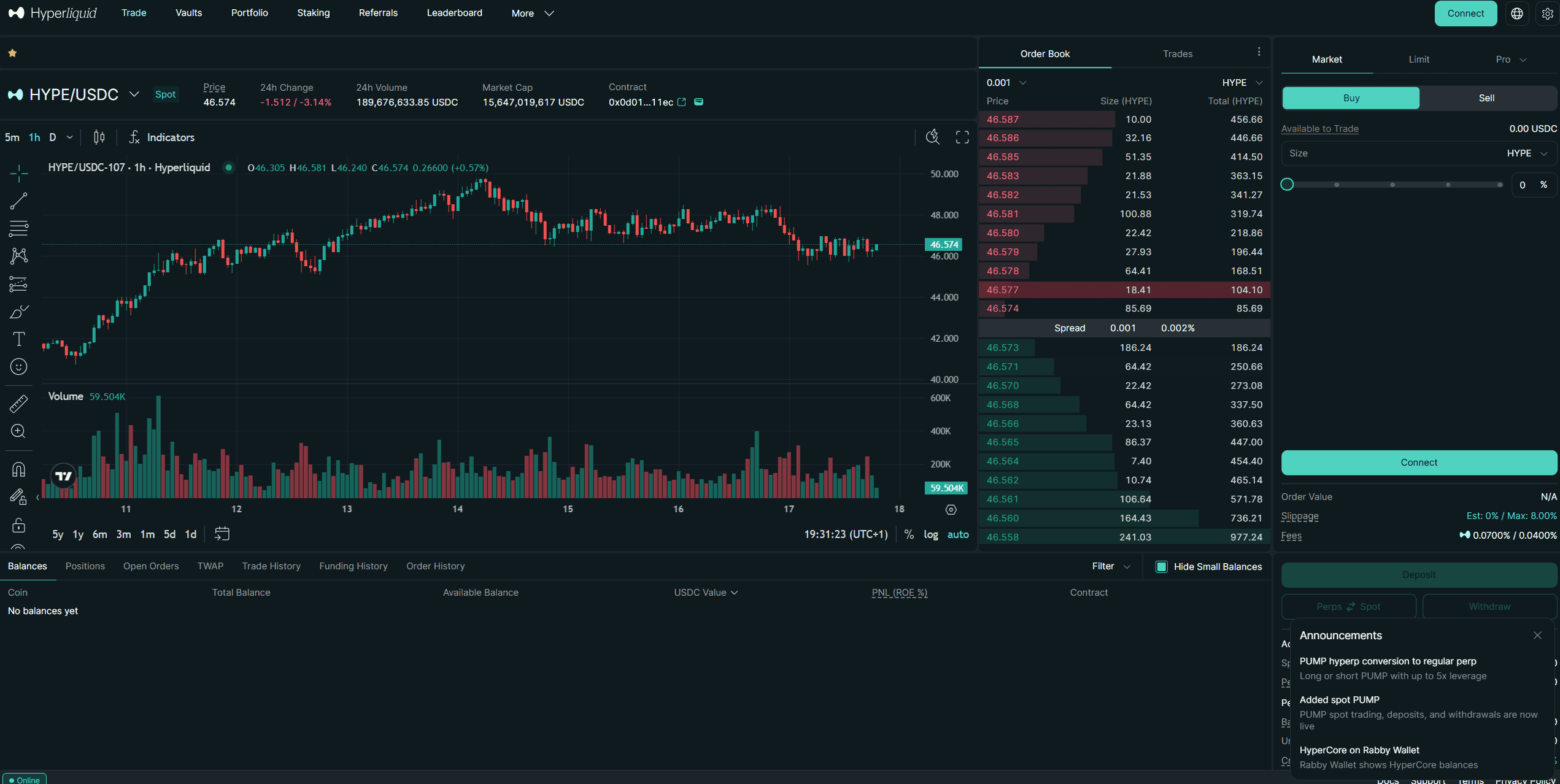

Solana Local Fee Markets: Solana implements local fee markets where fees are dynamically set for each account or program, allowing high-demand resources to price higher while keeping other interactions affordable. This supports instant, scalable social transactions.

-

Push Chain Universal Fee Abstraction: Push Chain pioneers universal fee abstraction, enabling users to pay fees in multiple tokens and dynamically routing transactions across chains. This design streamlines cross-chain social interactions and optimizes costs in real time.

-

Osmosis DEX Dynamic Fee Adjustments: Osmosis, a Cosmos-based DEX, employs dynamic swap fees that adjust based on liquidity pool volatility and trading volume, ensuring efficient pricing and mitigating front-running for social trading features.

-

Arbitrum Sequencer Fee Auctions: Arbitrum uses sequencer auctions where users can bid for transaction inclusion, dynamically adjusting fees based on demand and supporting fast, low-latency social app transactions on its optimistic rollup.

For instance, some chains implement local fee markets at the app level, letting each dApp set its own pricing logic based on user behavior and throughput needs. Others use auction-based mechanisms where users bid for priority access during network spikes, a model borrowed from DEXs but adapted for social context. The flexibility of these approaches is what enables true UX innovation.

These trends are accelerating with the rise of scalable rollups and modular blockchain frameworks. Developers can now launch chains purpose-built for social interaction, embedding specialized fee structures that balance affordability with sustainability from day one. The result isn’t just cheaper transactions, it’s a whole new paradigm for digital communities.

Practical Considerations: What Developers Should Know

If you’re building an onchain social app today, consider these practical tips:

- Tune your base fee logic to reflect actual usage patterns rather than a fixed schedule.

- Monitor demand spikes with real-time analytics so your app-chain can adjust fees proactively.

- Experiment with multidimensional pricing, such as charging differently for messages versus likes or reactions.

- Prioritize UX simplicity: abstract fees away from end-users wherever possible, universal fee abstraction is becoming table stakes.

The upshot? As dynamic fee markets mature across custom app-chains and scalable rollups, we’re not just solving old problems, we’re unlocking entirely new forms of programmable social capital. The next wave of onchain communities will be defined by their ability to move at Web2 speed without sacrificing decentralization or economic transparency.