Building a decentralized exchange (DEX) that stands out in 2025 requires more than just solid smart contracts and liquidity pools. The new frontier is custom app-chains equipped with dynamic fee markets: blockchains purpose-built for DEXs, where the fee structure itself becomes an engine of scalability, user engagement, and economic sustainability. If you’re aiming to create a next-generation DEX that not only competes but defines the standard, understanding how to build on application-specific rollups with specialized fee markets is essential.

Why Custom App-Chains Are Transforming DEX Architecture

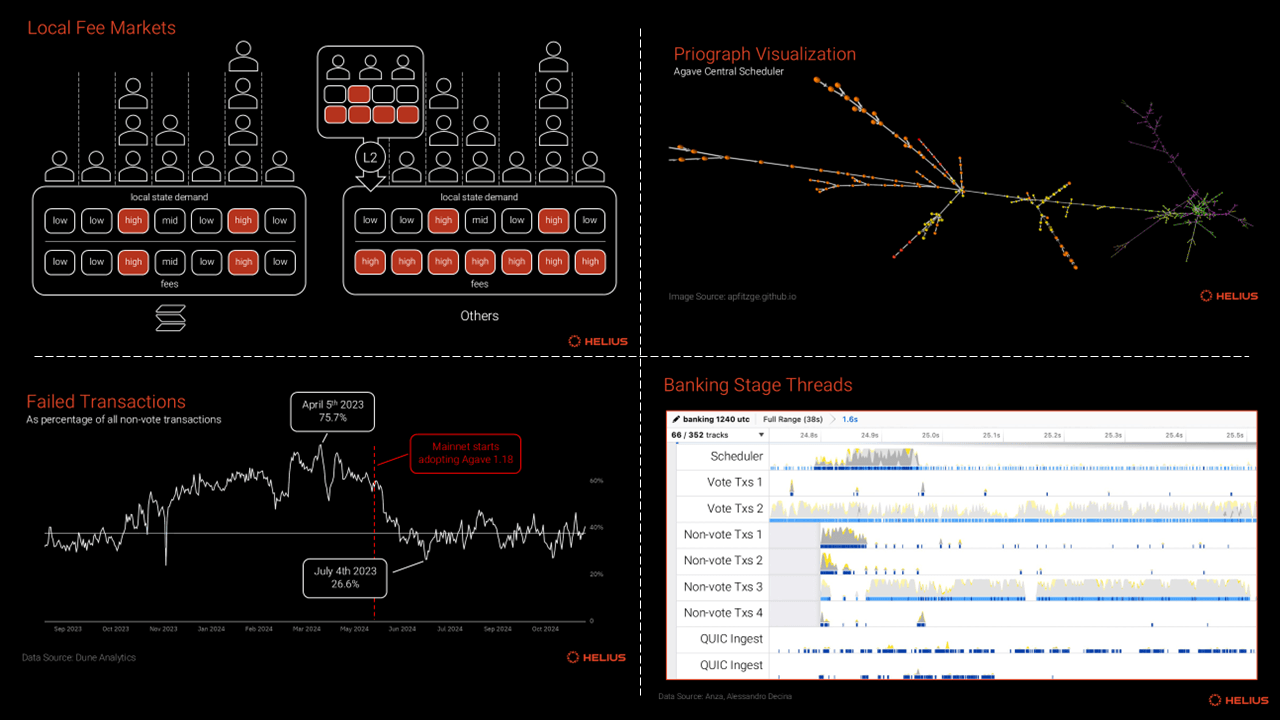

The move from general-purpose blockchains to application-specific chains (app-chains) is reshaping DeFi’s foundation. Unlike deploying on monolithic networks where generic fee models and congestion can throttle performance, app-chains allow you to design every layer, consensus, execution, interoperability, and especially the fee market, around your DEX’s needs.

This approach unlocks several advantages:

- Scalability: Resources are dedicated to your protocol’s throughput rather than shared across thousands of unrelated apps.

- User Experience: Fees can be tailored dynamically to reduce friction during high-demand periods or incentivize liquidity when needed.

- Economic Flexibility: Fee structures can evolve as your user base grows or as new trading patterns emerge.

If you want to dive deeper into how dynamic fees supercharge scalability for custom app-chains, check out our technical overview at this guide.

The Blueprint: Designing Your DEX App-Chain With Dynamic Fees

The first step is architecting your blockchain’s core infrastructure. Unlike traditional deployments on Ethereum or other L1s, you’re free to optimize consensus mechanisms (such as Proof-of-Stake variants or hybrid models), block intervals, and state management for trading workloads. But the real differentiator comes in the fee market design.

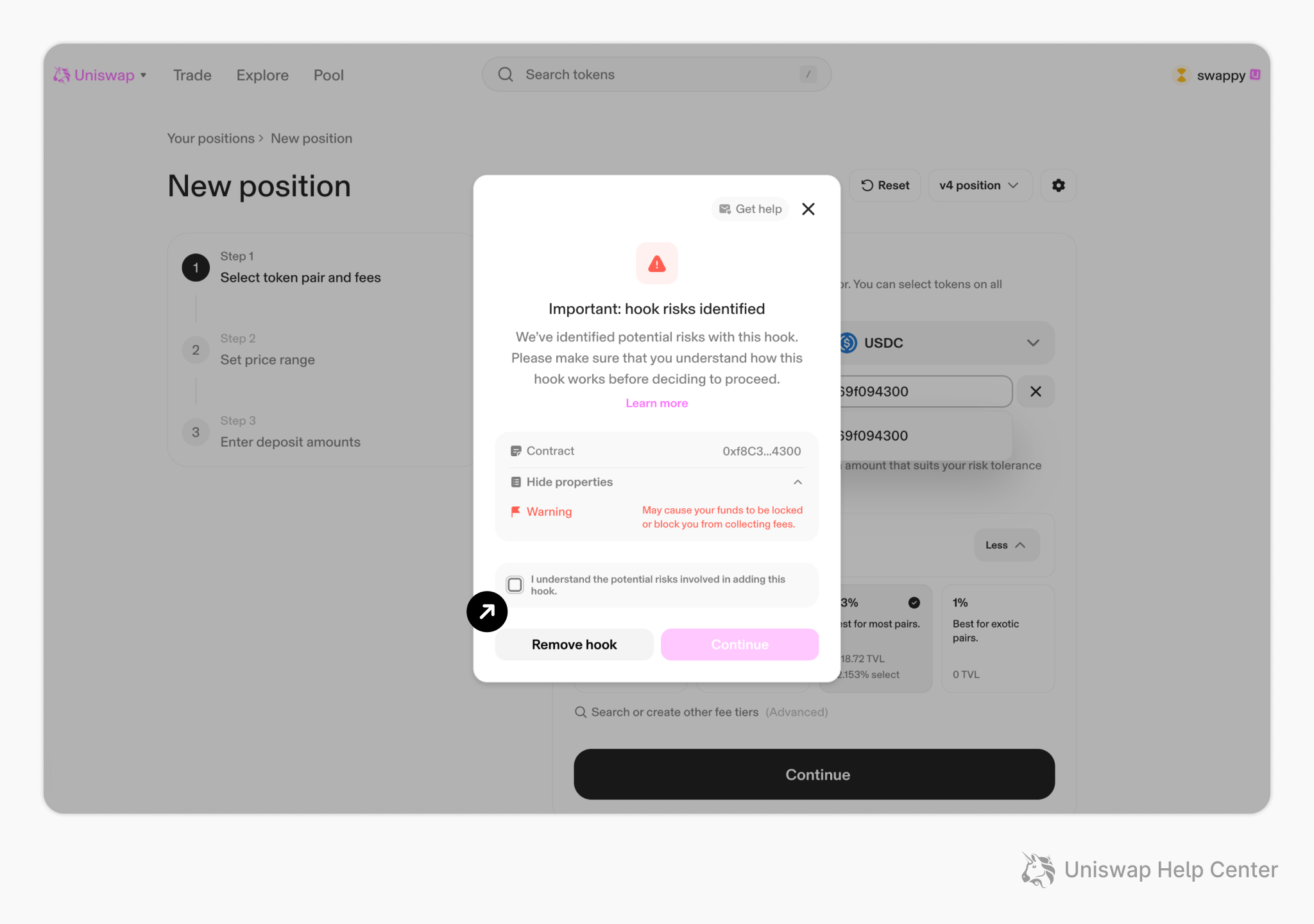

Dynamic Fee Markets automatically adjust transaction costs based on network conditions and real-time demand. For example, Uniswap v4 introduces customizable “hooks”: smart contract modules that let developers embed logic such as dynamic fees directly into liquidity pools. This means you can reward early liquidity providers with lower fees during bootstrapping phases or increase fees in periods of volatility to mitigate front-running risks.

Key Benefits of Dynamic Fee Markets for DEX App-Chains

-

Optimized Transaction Costs: Dynamic fee markets automatically adjust transaction fees based on real-time network demand, ensuring users pay fair prices during both high and low activity periods. This flexibility helps prevent network congestion and reduces unnecessary costs for traders.

-

Enhanced Liquidity Management: By leveraging advanced algorithms and features like Uniswap v4’s hooks, dynamic fee markets enable more efficient liquidity provisioning, reducing impermanent loss for liquidity providers and improving overall market depth.

-

Improved User Experience: Dynamic fees create a smoother trading environment by minimizing failed transactions and slippage, leading to more predictable and reliable trade execution for DEX users.

-

Greater Market Efficiency: Adjusting fees in response to market conditions incentivizes optimal trading behavior and helps maintain balanced supply and demand, resulting in tighter spreads and better price discovery.

-

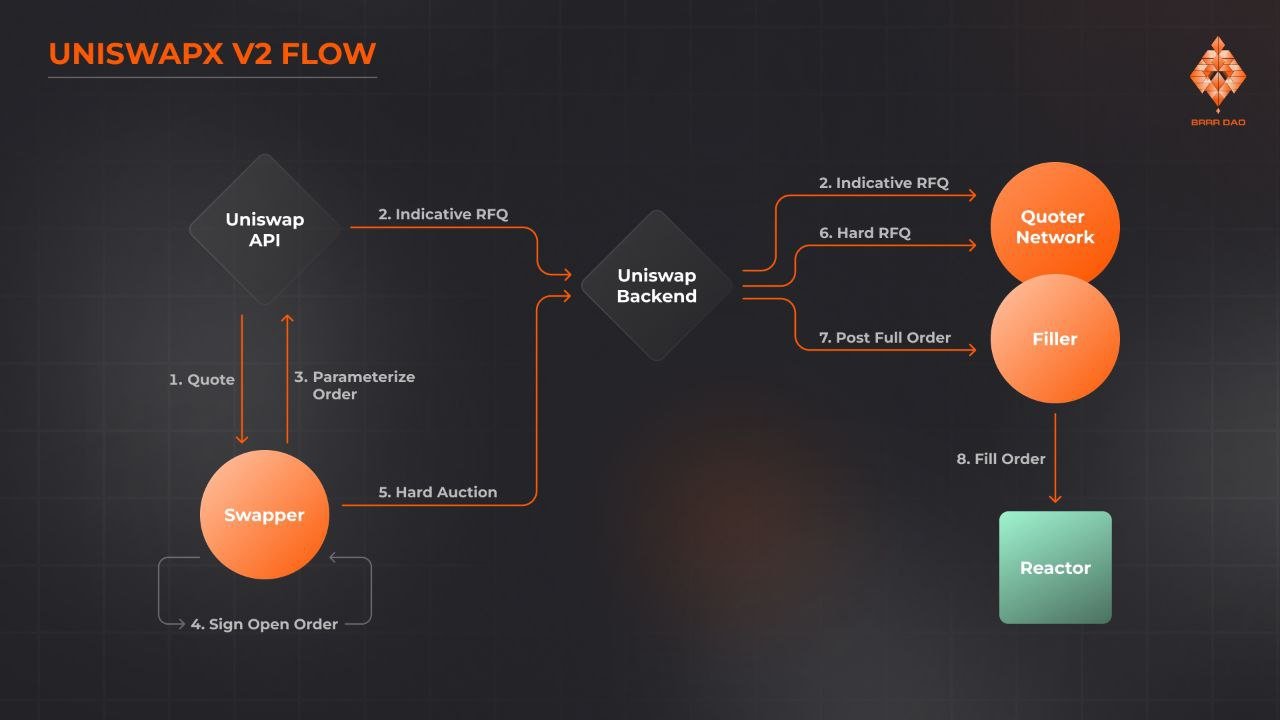

Customizable Fee Logic: Developers can implement custom fee strategies—such as intent-based trading or Dutch auctions (as seen in UniswapX)—to tailor the DEX’s fee structure to specific use cases, attracting a broader range of users and liquidity providers.

-

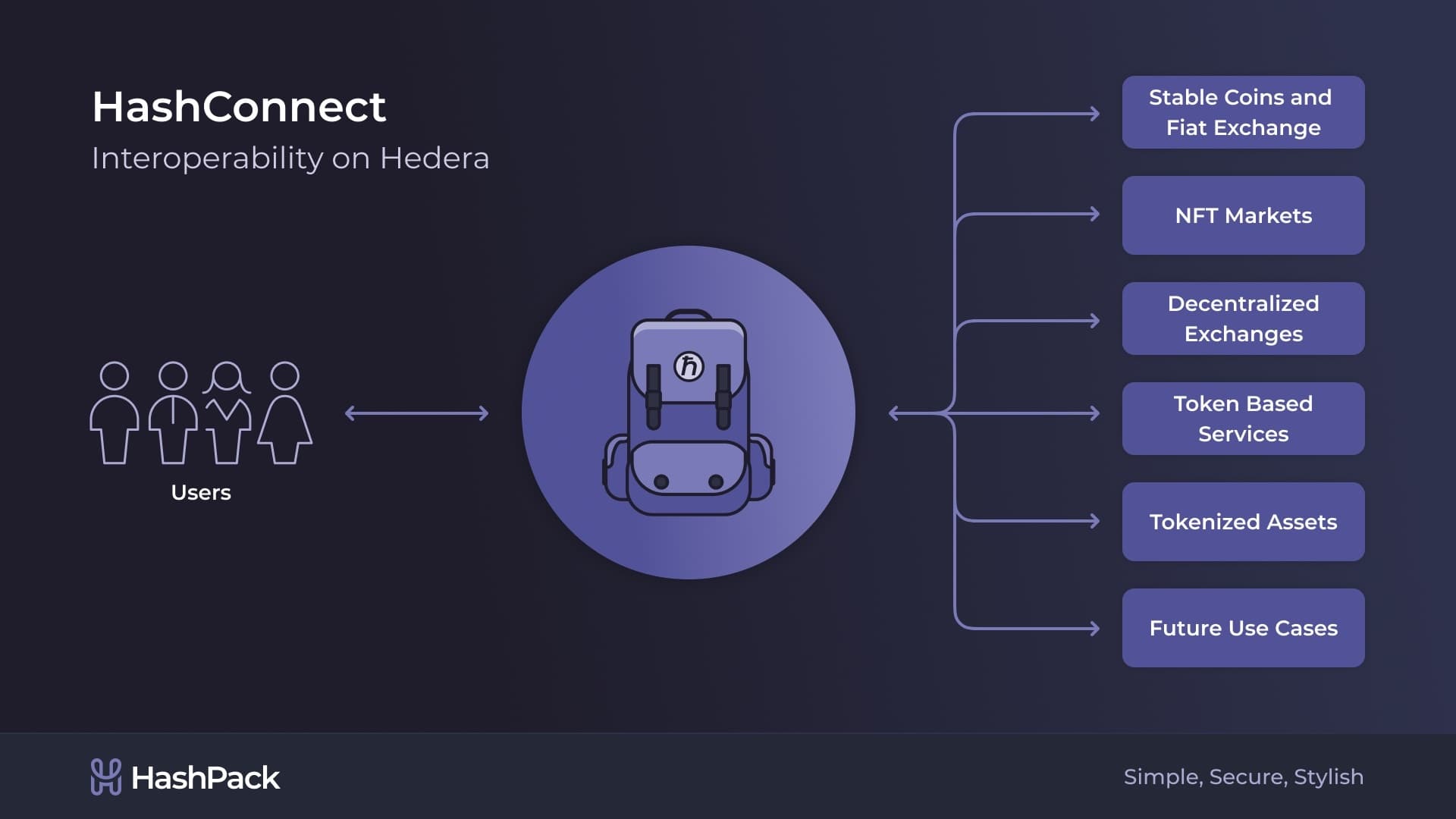

Scalability and Interoperability: Dynamic fee markets, when combined with cross-chain protocols like Chainlink’s CCIP, help DEX app-chains scale efficiently and facilitate seamless asset transfers across multiple blockchains.

Pillars of a Modern DEX App-Chain: Core Components Explained

A robust decentralized exchange blockchain with a specialized fee market typically includes these foundational elements:

- Custom Chain Architecture: Tailor consensus and execution layers for low-latency trading and fast settlement.

- Dynamic Fee Logic: Implement algorithms that respond to gas demand spikes or liquidity crunches by adjusting fees in real time.

- Advanced Liquidity Management: Integrate automated market maker (AMM) algorithms designed to minimize impermanent loss. Recent research shows certain approaches can reduce impermanent loss by up to 36% over legacy AMMs.

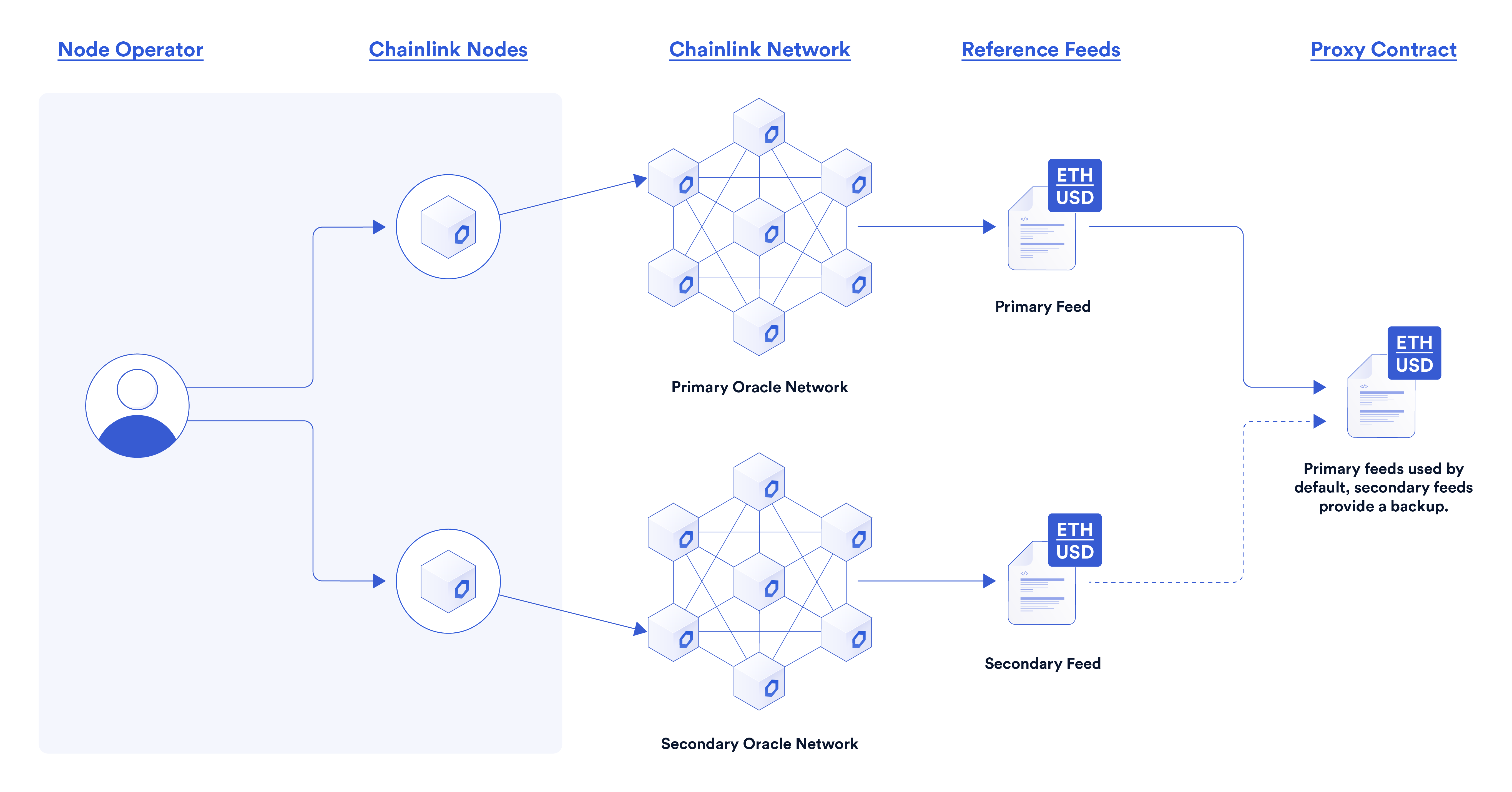

- Pegged Asset Pricing Oracles: Use reliable pricing feeds like Chainlink’s State Pricing for accurate asset valuation even when centralized exchange volume is thin.

- Cross-Chain Interoperability: Leverage protocols such as Chainlink CCIP so users can trade assets seamlessly across different blockchains from one unified interface.

- User-Centric Trading Intents: Enable features like intent-based orders (e. g. , UniswapX Dutch auctions), allowing traders to set preferences rather than micromanage transactions.

Diving Deeper: How Dynamic Fees Shape Liquidity and Trader Behavior

The heart of any thriving DEX is its liquidity, and this is where specialized blockchain fee structures shine. By making transaction costs responsive rather than fixed, you actively shape trader incentives and liquidity provider behavior. During times of high volatility or network congestion, dynamic fees can rise smoothly to prioritize urgent trades while still keeping costs predictable for everyday users. Conversely, during lulls in activity, lowering fees encourages more frequent trading and deeper pools.

This adaptive approach not only optimizes resource allocation but also creates a fairer environment for all participants, a stark contrast with the one-size-fits-all gas models found on legacy blockchains. To see concrete examples of how these designs play out in production environments, refer to our case study compilation at this link.

Designing and deploying decentralized exchange blockchains with dynamic fee markets isn’t just a technical exercise, it’s a strategic process that directly impacts liquidity, user retention, and long-term protocol sustainability. Let’s explore the operational nuances and best practices that set apart the most successful DEX app-chains in today’s landscape.

Operationalizing Dynamic Fee Markets: Best Practices

To fully harness the power of application-specific rollups with specialized fee structures, teams must move beyond theoretical design and focus on real-world execution. Here are several key considerations for builders:

Operational Tips for Launching a DEX App-Chain With Dynamic Fees

-

Design a Purpose-Built App-Chain Architecture: Develop a blockchain tailored to your DEX’s needs, prioritizing scalability, security, and interoperability to support high transaction volumes and seamless user experiences.

-

Implement Dynamic Fee Structures Using Hooks: Integrate mechanisms like Uniswap v4 hooks to enable transaction fees that adjust in real-time based on network activity and liquidity demand.

-

Optimize Liquidity Management With Advanced Algorithms: Adopt automated market maker (AMM) algorithms that minimize impermanent loss—recent research shows some models can reduce this loss by up to 36% compared to traditional approaches.

-

Ensure Accurate Asset Pricing With Reliable Oracles: Use trusted solutions like Chainlink State Pricing to provide precise and tamper-resistant price data, especially for assets with low trading volume.

-

Enable Cross-Chain Interoperability: Integrate protocols such as Chainlink CCIP to allow seamless asset and data transfers between your app-chain and other blockchains, expanding your DEX’s reach and liquidity.

-

Incorporate Intent-Based Trading Mechanisms: Enhance user experience by supporting features like UniswapX Dutch orders, which let traders specify their intentions and automate optimal trade execution.

1. Monitor Network Health Continuously: Implement robust analytics to track transaction throughput, average fees, and liquidity pool utilization. This data is essential for fine-tuning your dynamic fee algorithm over time.

2. Foster Community Input: Consider governance mechanisms that allow liquidity providers or traders to propose adjustments to fee logic, creating a feedback loop between users and protocol economics.

3. Prioritize Security Audits: Dynamic fee logic introduces new attack surfaces. Regular smart contract audits and simulation-based stress testing are non-negotiable before mainnet launch.

4. Optimize for Interoperability: As cross-chain trading becomes table stakes, ensure your app-chain integrates seamlessly with interoperability protocols like Chainlink CCIP or similar standards.

Case Study: Adaptive Fees in Action

The evolution of DEXs like Uniswap v4 demonstrates how hooks-enabled pools can drive granular control over fees while supporting innovative trading features such as limit orders or volatility-based pricing bands. Projects leveraging these capabilities have reported measurable improvements in liquidity depth and reduced slippage, outcomes that feed back into network effect growth.

This aligns with broader research showing that well-calibrated dynamic fee models can reduce impermanent loss by more than a third compared to static models, a critical differentiator as competition intensifies among decentralized trading venues.

Pushing the Boundaries: What’s Next for Custom App-Chains?

The next wave of innovation will come from blending intent-based trading (as seen in UniswapX) with programmable fee markets, allowing users to express complex trade preferences while the protocol automatically optimizes costs and execution paths behind the scenes. This paradigm shift not only streamlines UX but also unlocks new forms of market participation previously impossible on legacy chains.

If you’re interested in how adaptive fee structures directly drive liquidity growth and trader engagement, our deep dive at this resource offers actionable insights from leading projects.

Key Takeaways for DEX Builders

- Bespoke Fee Markets = Competitive Edge: The ability to tune transaction costs dynamically is now a baseline expectation among sophisticated DeFi users.

- User Experience Is Paramount: Lowering friction through adaptive fees keeps retail traders active even during high-volatility periods.

- Ecosystem Effects Matter: Interoperable custom app-chains attract diverse liquidity sources by removing barriers between networks.

The future belongs to protocols willing to rethink every layer, from consensus through economic incentives, to deliver seamless, fair, and scalable decentralized trading experiences. As custom app-chains mature, expect further convergence between advanced AMMs, oracle-powered pricing, intent-based UX flows, and ever-smarter specialized blockchain fee structures.