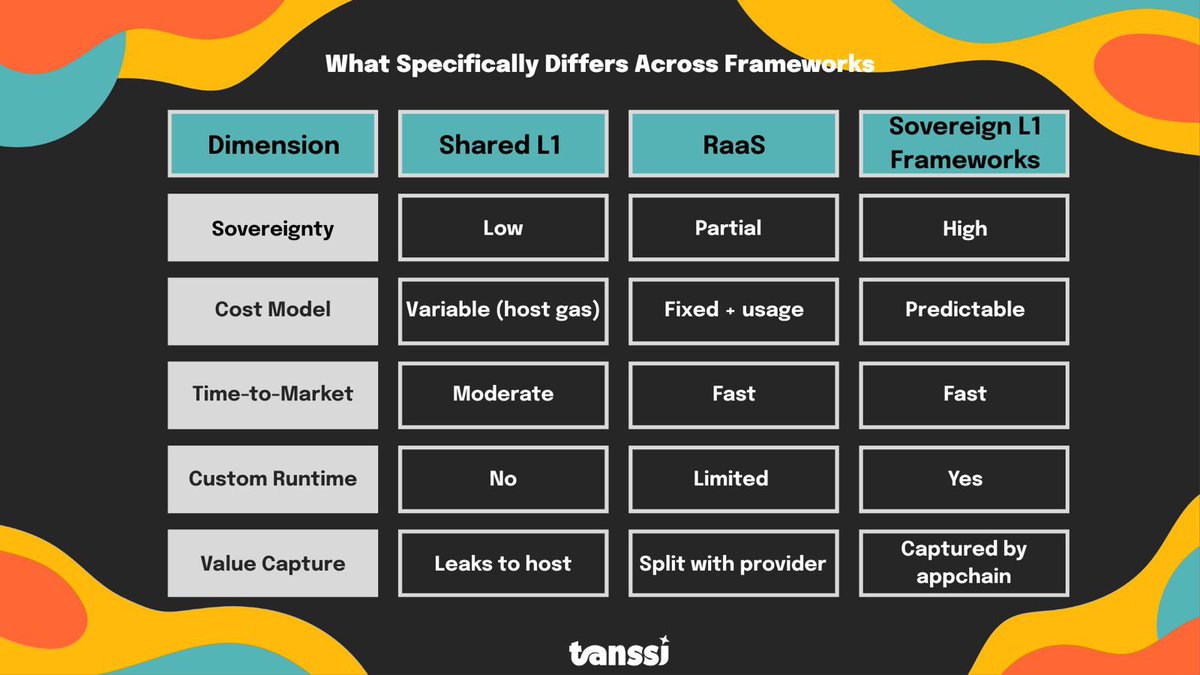

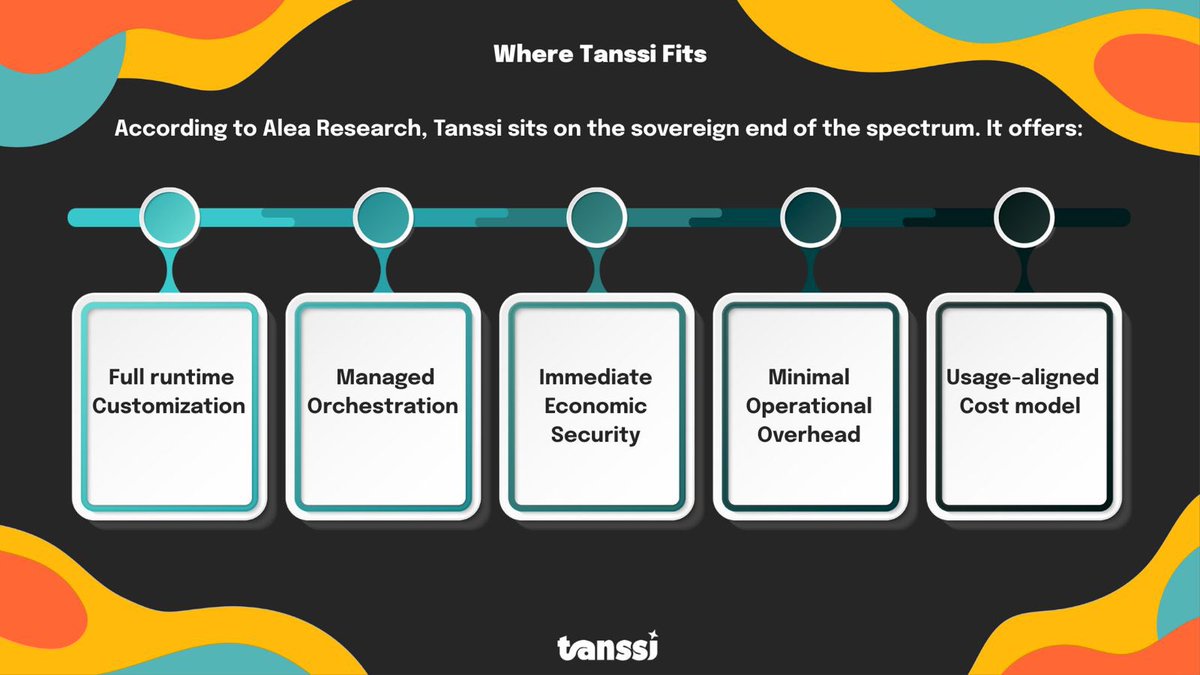

In the evolving blockchain landscape of 2026, developers building custom app-chains face a pivotal choice: lean into Rollup-as-a-Service (RaaS) platforms for speed and inherited security, or embrace sovereign frameworks for uncompromised control over execution environments and economics. This decision profoundly shapes the optimization of specialized fee markets, where precise resource allocation can make or break scalability and profitability. Drawing from recent analyses like Alea Research’s breakdown, the spectrum between RaaS and sovereign L1s reveals not just technical trade-offs, but strategic imperatives for value accrual in appchain ecosystems.

RaaS platforms have matured into powerhouse tools, exemplified by OP Stack, Arbitrum Orbit, and Polygon CDK. These services abstract away much of the infrastructure heavy lifting, allowing teams to spin up rollups that post transactions to Ethereum or other L1s. The appeal is immediate: deployment in weeks, not months. Security bootstraps effortlessly from the host chain’s validator network and economic finality. For applications demanding quick liquidity access, this integration with established ecosystems proves invaluable. Yet, as Alea Research notes, this convenience embeds dependencies that ripple through fee dynamics.

RaaS Platforms: Speed Meets Inherited Constraints

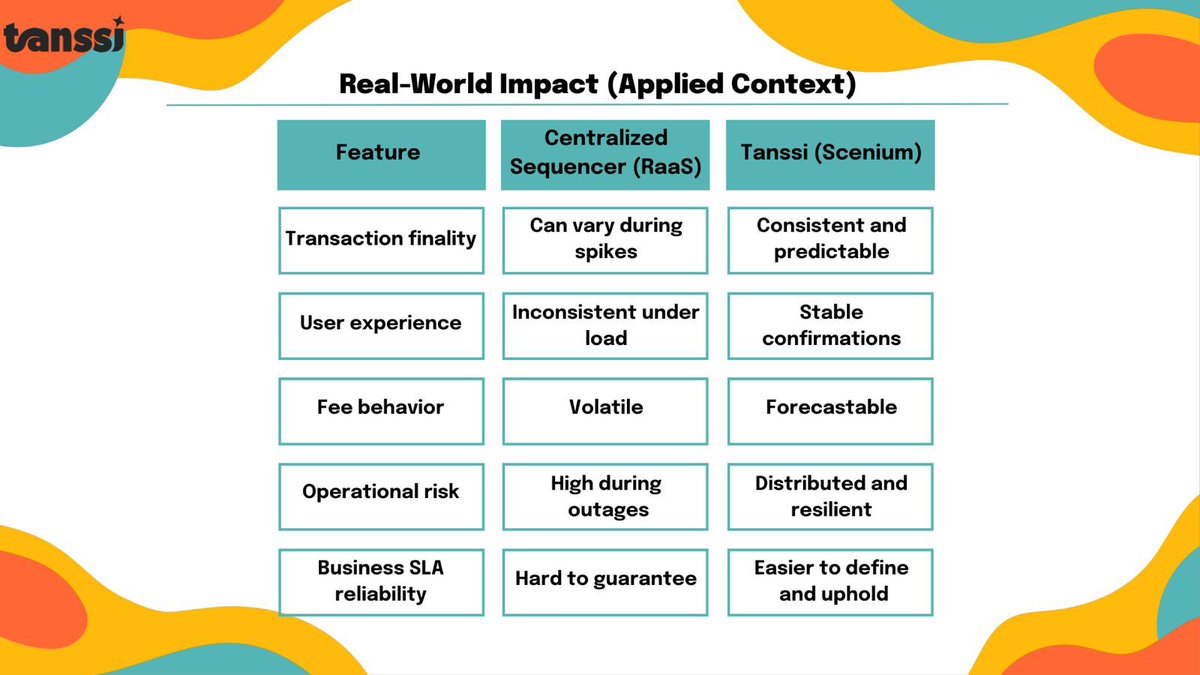

Consider the operational flow in RaaS. Developers configure sequencing, data availability, and settlement layers via modular stacks, but the underlying L1 dictates core parameters. During peak Ethereum congestion, say from NFT frenzies or DeFi surges, rollup fees spike unpredictably. This volatility undermines rollup fee optimization 2026 goals, as users grapple with costs tied to external demand rather than app-specific needs. Tanssi Network’s insights highlight how RaaS introduces platform fees and centralization risks, diluting sovereignty. While rapid go-to-market suits experimental projects, mature app-chains chasing tailored economics often outgrow these limitations.

Sovereign frameworks flip the script, granting builders full reign over the control plane. Platforms like Tanssi, Saga, Cosmos SDK zones, Substrate, and Avalanche subnets enable independent validator sets, bespoke consensus, and governance. Here, RaaS vs sovereign appchains diverges sharply: sovereign setups demand upfront investment in validator incentives and network bootstrapping, but yield enduring autonomy. Alea’s builder guide emphasizes this pole: teams design execution from scratch, capturing value directly rather than sharing with RaaS providers.

Sovereign L1s: Crafting Bespoke Economic Engines

At the heart of sovereign appeal lies the freedom to engineer sovereign L1 fee structures. Unlike RaaS’s EIP-1559 inheritance, which bundles gas into a one-dimensional auction, sovereign chains support multidimensional models. Imagine fees decoupling compute, storage, and bandwidth; high-throughput gaming apps bid aggressively on latency-critical resources while low-priority analytics pay premiums for persistence. Tanssi bridges this gap, offering L1 deployment in minutes without sacrificing sovereignty, countering RaaS’s centralization. For DeFi protocols or social apps, this precision prevents cross-demand congestion, as explored in isolated fee markets.

Yet sovereignty isn’t without friction. Bootstrapping demands rigorous tokenomics: validators must align incentives to rival Ethereum’s $trillions in stake. Operational demands escalate, from oracle integrations to slashing mechanisms. Still, for projects prioritizing long-term composability, the investment pays dividends. Saga’s protocol, for instance, streamlines this via elastic chain deployment, echoing Tanssi’s ethos of fast sovereignty.

Navigating the Control Spectrum for Fee Optimization

When optimizing Tanssi appchain framework or peers, builders weigh time-to-value against customization depth. RaaS excels in dependency-minimal launches, inheriting Ethereum’s liquidity moat, but caps fee innovation at stack boundaries. Sovereign paths, per Medium’s appchain guides, empower resource-specific auctions, vital for 2026’s bandwidth-hungry dApps. KuCoin insights frame this as a dependency calculus: rollups trade sovereignty for ops efficiency, while L1s reclaim it at complexity’s cost. A hybrid future looms, but today’s choice hinges on fee market ambitions. Dive deeper into RaaS evolution reveals scalability wins, yet sovereigns promise economic sovereignty.

The path to mastering custom app-chains fee markets requires dissecting real-world implications. For high-frequency trading DeFi apps, RaaS’s inherited EIP-1559 suffices initially, but as volumes scale, L1 congestion erodes margins. Sovereign frameworks shine here, permitting auctions that prioritize maker-taker dynamics or latency tiers. Tanssi’s template-based deployment accelerates this, blending RaaS speed with L1 autonomy, as Alea Research positions it squarely in the sovereign camp.

Fee Market Mechanics: Multidimensional Design in Sovereign Chains

Sovereign L1s unlock granular control absent in rollups. Developers implement resource-isolated fees: compute bids separately from calldata posting, mitigating the monolithic gas model. This prevents scenarios where a memecoin pump starves a stablecoin swap, a vulnerability RaaS inherits from Ethereum. Substrate’s pallet system or Cosmos SDK modules facilitate such innovations, enabling dynamic adjustments via on-chain governance. For gaming ecosystems, allocate bandwidth premiums to real-time actions, subsidizing archival queries. This precision, per Alea’s spectrum, drives value accrual to the app-chain itself, not diluted across a shared L1.

Quantitative edges emerge in simulations. A sovereign chain with decoupled fees can sustain 10x throughput under mixed loads versus RaaS equivalents, based on builder benchmarks from Medium analyses. Yet bootstrapping remains the hurdle: Saga’s chainlets distribute validator duties across a permissionless pool, easing entry. Cosmos IBC interoperability adds composability, letting sovereign chains tap liquidity without settlement dependencies.

Transitioning in 2026 demands pragmatic sequencing. Start with RaaS for MVP validation, migrate to sovereign as tokenomics mature. This hybrid mitigates risks, as KuCoin reports underscore: dependency audits precede sovereignty quests. Tanssi exemplifies the pivot point, slashing deployment from months to minutes while retaining economic levers. For bandwidth-intensive socialFi or AI inference chains, sovereign rollup fee optimization 2026 evolves into native multidimensionality, forecasting sub-cent transactions amid explosive adoption.

Strategic Roadmap: Aligning Frameworks with Ambitions

Builders prioritizing ops efficiency favor RaaS; those chasing protocol-owned liquidity lean sovereign. QuickNode’s RaaS breakdowns reveal pricing tiers favoring small teams, but scale exposes fixed fees as anchors. Sovereigns demand fundamentals: robust slashing, stake delegation, and MEV auctions to rival Ethereum’s maturity. As Vyacheslav’s X thread notes, rollups optimize operations sans sovereignty, forever tethered. Opinionated take: for enduring app-chains, invest in sovereignty early. Value accrues to native tokens via captured fees, fostering flywheels absent in rollup economics.

Examine Tanssi’s traction: post-Alea, integrations with EVM and ink! empower Rust devs to craft specialized fee markets rivaling custom rollups. Saga complements with infinite chains, each sovereign yet interoperable. By mid-2026, expect sovereign frameworks to dominate premium use cases, as RaaS commoditizes low-customization deployments. The spectrum isn’t binary; tools like AltLayer blur lines, but core trade-offs persist.

Ultimately, framework selection crystallizes around fee sovereignty. RaaS accelerates entry, sovereigns cement dominance. As app-chains proliferate, those wielding multidimensional fees will command ecosystems, turning infrastructure into moats. Developers, audit your use case against this control plane: rapid liquidity or bespoke economics? The choice defines 2026’s leaders in scalable, profitable chains.