Imagine slashing transaction fees by 96% overnight and watching daily transactions explode by nearly 500%. That’s the electrifying reality Avalanche delivered with its Avalanche9000 and Octane upgrades, turning the C-Chain into a powerhouse for custom app-chains. Right now, as AVAX trades at $11.61 amid a 24-hour dip of -3.09%, these moves aren’t just technical tweaks; they’re a blueprint for designing specialized fee markets app-chains that reward builders and users alike.

Avalanche’s C-Chain has always been the EVM-compatible heart of its ecosystem, but recent upgrades have supercharged it. The Avalanche9000 upgrade in December 2024 crushed the minimum base fee by 96%, making launches of sovereign L1s dirt cheap – down 99.9% in costs. Then came Octane in March 2025, activating ACP-176 for dynamic gas targets and smarter fee mechanisms. Result? C-Chain daily transactions surged 493.4%, active addresses jumped 57% quarter-over-quarter. This isn’t hype; it’s proof that usage-based blockchain fees can unlock explosive growth.

Avalanche9000 and Octane: The Fee-Slashing Duo Redefining Scalability

Let’s break it down. Pre-Avalanche9000, high base fees choked adoption on the C-Chain. Validators struggled with network congestion, and users paid premiums just to interact. Enter Avalanche9000: it permissionlessly lowered barriers, enabling devs to spin up app-chains without breaking the bank. Fees dropped 75-96% across reports, boosting daily txs by 38% initially and far more post-Octane.

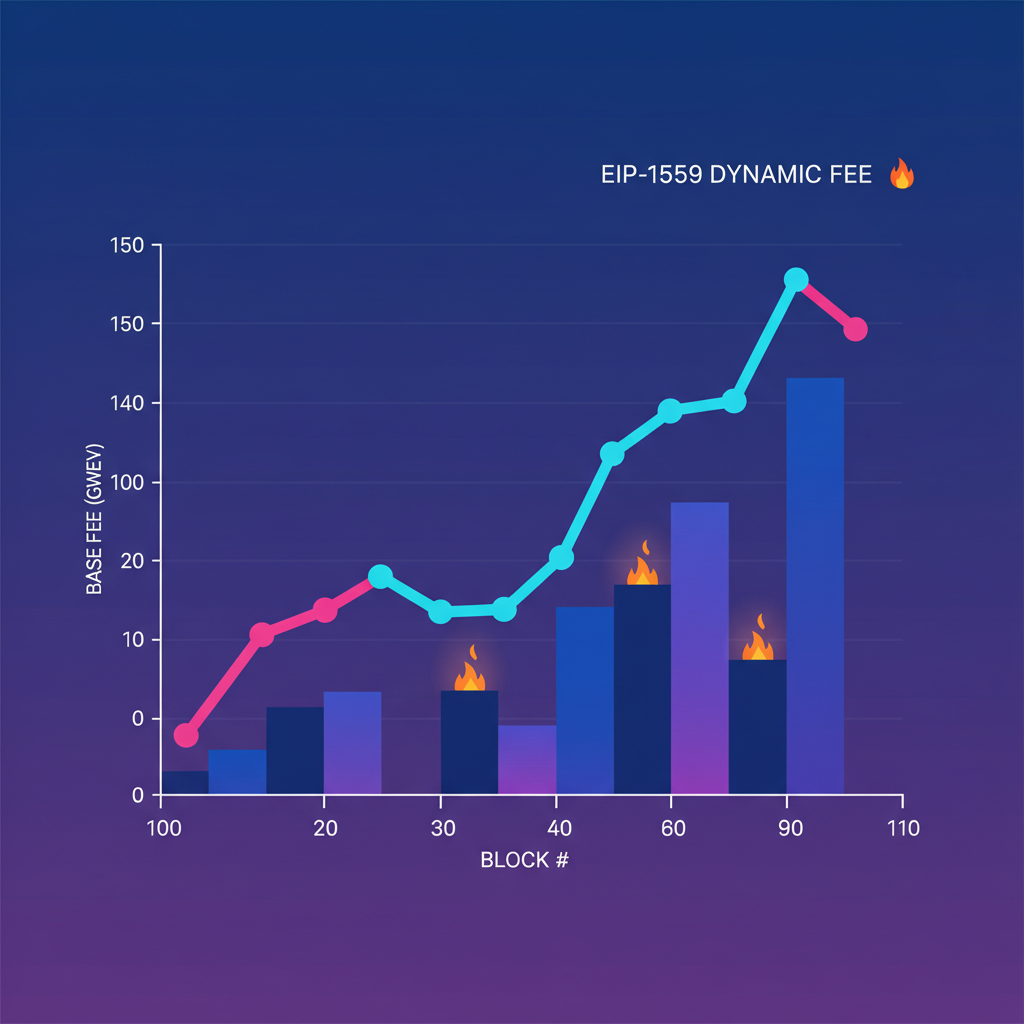

Octane took it further with dynamic adjustments. Gas targets flex based on utilization, base fees rise only when needed – think EIP-1559 on steroids, tailored for Avalanche’s subnet architecture. AVAX burns these fees, adding deflationary pressure while staking secures the network. At today’s $11.61 price, with a 24h high of $12.02 and low of $11.27, momentum feels primed for a rebound as these efficiencies draw more DeFi and gaming traffic.

Avalanche’s upgrades prove that specialized fee markets aren’t optional – they’re the tide custom app-chains must ride.

Retro9000 Grants: Supercharging C-Chain Rewards and Innovation

Timing couldn’t be better: on January 21, Avalanche launched the C-Chain round of Retro9000, a $40M retroactive grant program. Builders get rewarded for impact, not promises – pure meritocracy. This ties directly into Avalanche C-Chain rewards, where low fees meet real funding. Imagine deploying a custom rollup with custom rollups fee burning, then claiming grants based on your chain’s activity. It’s a flywheel: cheap txs drive usage, grants amplify it, fees fund sustainability.

AVAX’s role here is pivotal. As the gas token, it powers everything from tx fees to staking. Custom app-chains can mimic this: design app-specific rollup economics where fees accrue to creators or liquidity providers. Retro9000 exemplifies how grants and low fees = ecosystem boom. Post-upgrade, TVL rose nearly 40%, signaling confidence.

Blueprints for Your Specialized Fee Markets in Custom App-Chains

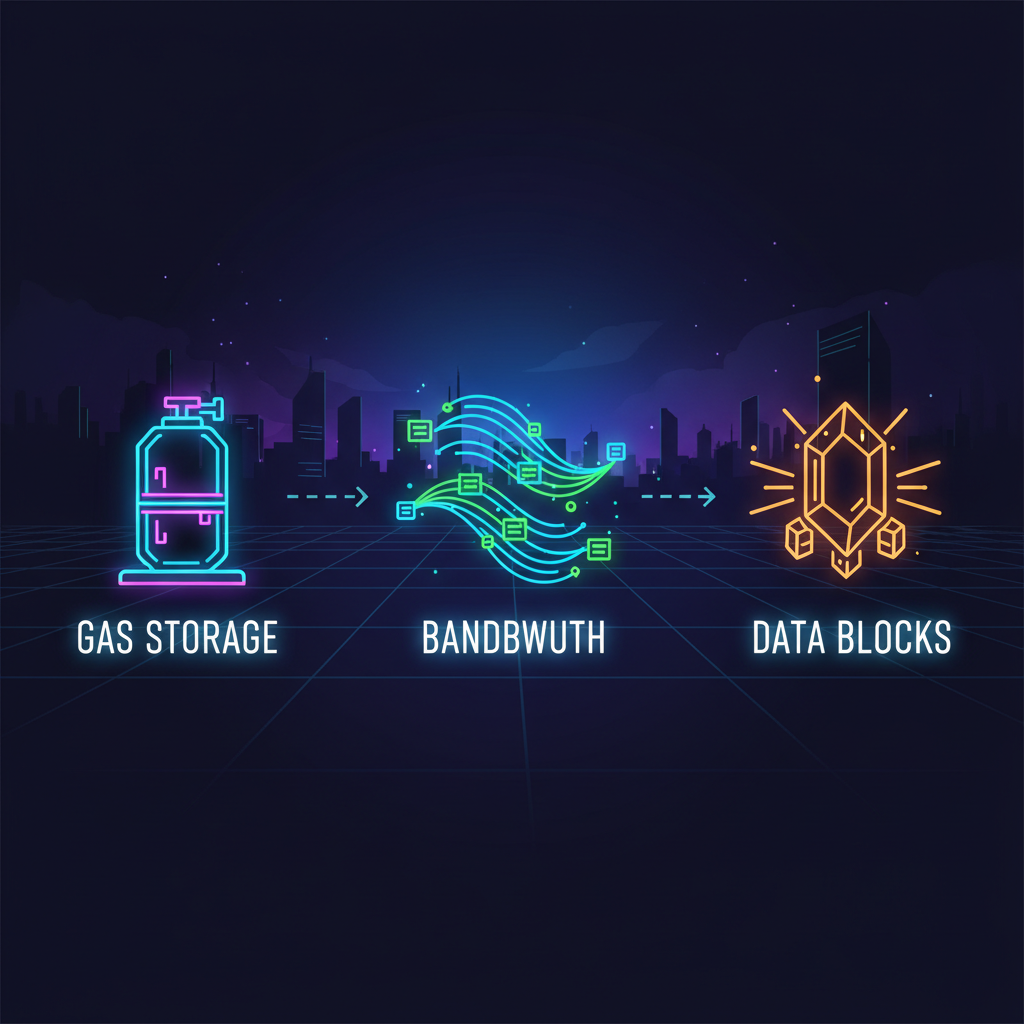

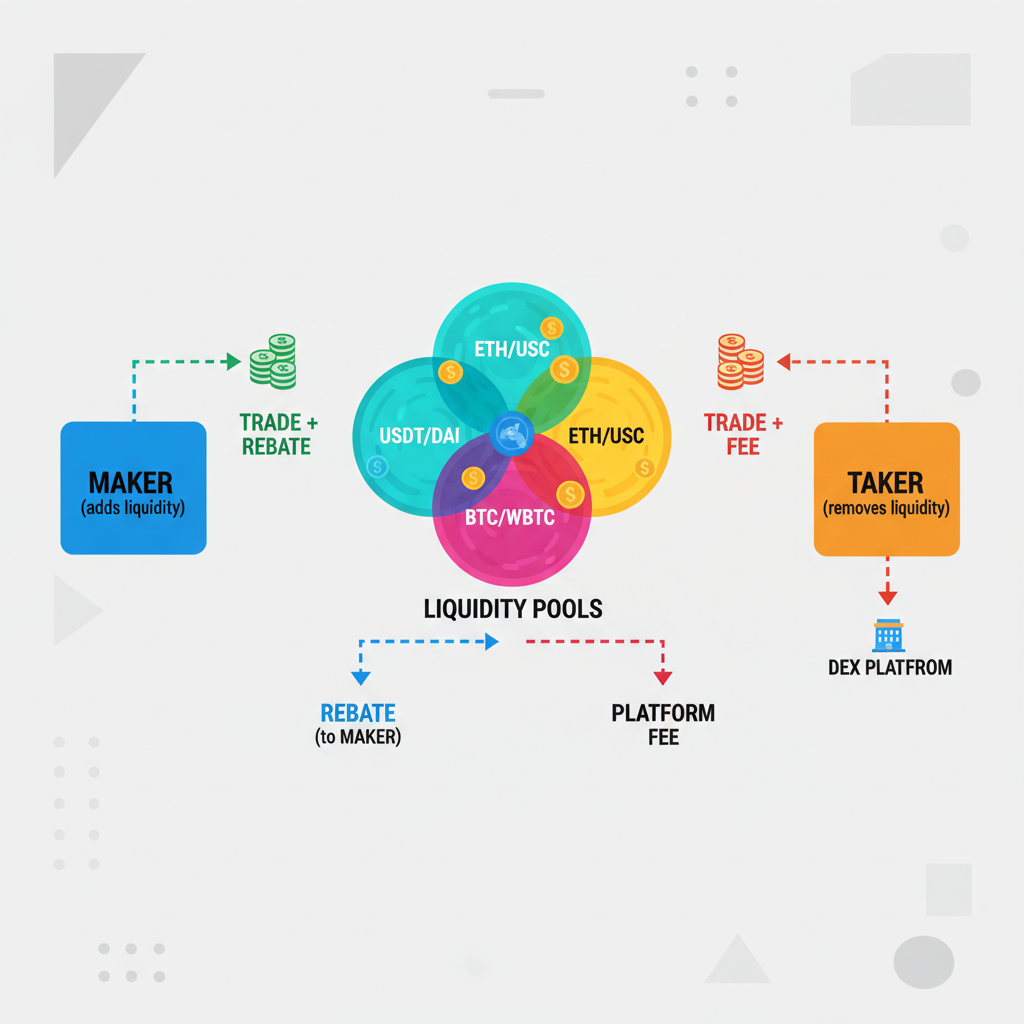

Ready to build your own? Start with multidimensional fees: price bandwidth, compute, and storage separately. Power users pay premiums during peaks; casual txs stay pennies. Avalanche’s algorithm dynamically sets base fees based on target utilization – adapt that for your app-chain. Implement maker-taker models for DEXes or burn mechanisms for deflation, just like AVAX.

Check out this guide on custom fee markets for rollups. Layer in subnets for isolation, ensuring your chain scales without dragging the parent network. Prediction markets love this: low fees enable micro-bets at scale.

Avalanche (AVAX) Price Prediction 2027-2032

Projections based on fee market optimizations, Avalanche9000/Octane upgrades, and increased adoption amid market cycles

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg) |

|---|---|---|---|---|

| 2027 | $16.50 | $24.50 | $35.00 | +75% |

| 2028 | $22.00 | $32.00 | $48.00 | +31% |

| 2029 | $28.00 | $42.00 | $65.00 | +31% |

| 2030 | $36.00 | $55.00 | $85.00 | +31% |

| 2031 | $46.00 | $70.00 | $110.00 | +27% |

| 2022 | $58.00 | $90.00 | $140.00 | +29% |

Price Prediction Summary

AVAX is forecasted to experience robust growth from 2027-2032, with average prices climbing from $24.50 to $90.00, driven by slashed fees (up to 96% reduction), surging transaction volumes (493% post-upgrades), and $40M grants. Bullish maxima reflect adoption in custom app-chains; minima account for bearish cycles and competition.

Key Factors Affecting Avalanche Price

- Avalanche9000 (Dec 2024) and Octane (Mar 2025) upgrades slashing C-Chain fees by 75-96%, boosting daily txns 493% and active addresses 57%

- Retro9000 $40M grants incentivizing C-Chain innovation and app-chain development

- Dynamic fee mechanisms (ACP-176) enhancing scalability and cost-efficiency for DeFi/Web3 use cases

- Market cycles favoring L1s with low-cost, high-throughput networks post-regulatory clarity

- Competition from Ethereum L2s/Solana, staking yields, and broader crypto bull runs influencing volatility

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Dynamic fees prevent spam, allocate resources efficiently, and align incentives. Avalanche shows the path: from congested chain to tx machine. Your custom app-chain could do the same, especially with grants like Retro9000 inspiring the next wave.

But here’s where it gets really exciting for builders eyeing custom rollups fee burning and beyond. Avalanche’s C-Chain isn’t a one-off; it’s a living lab for app-specific rollup economics. Picture your gaming app-chain charging fees only on high-res asset renders, or a socialFi subnet billing per viral post compute. These aren’t pipe dreams – they’re deployable today with the right fee engine.

Multidimensional Fees: The Secret Sauce for App-Chain Efficiency

Traditional chains lump everything into gas; that’s amateur hour. Specialized fee markets break it down: bid on CPU cycles separately from calldata. Avalanche’s base fee algo already hints at this, ramping costs when utilization hits 50-70% targets. For your app-chain, go further – implement resource auctions where validators bid fees back to users during lulls. I love this because it flips scarcity into opportunity: heavy DeFi traders subsidize NFT minters without bloating the chain.

Take Retro9000 grants: $40M pool rewarding C-Chain activity retroactively. Deploy your app-chain, rack up txs at sub-cent fees, claim grants based on impact. At AVAX’s current $11.61 – down 3.09% in 24 hours from a high of $12.02 – staking yields look juicy, securing your chain while fees burn supply. This model’s a magnet for talent, as seen in the 57% active address spike post-Octane.

Opinion time: most L2s chase Ethereum’s shadow with uniform fees, but that’s fighting the tide. Custom app-chains thrive by owning their economics. Why settle for EVM gas when you can tailor fees to your killer app? Prediction markets exploded on low-fee chains; yours could house AI inference or RWAs with precision pricing.

Real-World Wins and Your Next Move

Gaming studios are flocking to Avalanche post-upgrades – think seamless on-chain leaderboards without fee friction. DeFi TVL jumped 40% after Octane, proving usage-based blockchain fees lure liquidity. Custom app-chains amplify this: launch sovereign L1s for 99.9% less, isolate traffic, monetize via fees. I’ve traded enough cycles to know – chains with adaptive economics print alpha.

Validators customize fees in Octane via ACP-176, flexing gas limits dynamically. Your app-chain? Mirror it with subnet configs: low base for reads, spikes for writes. Burn 100% of tips like AVAX for scarcity, or redistribute to DAOs. Check implementing specialized fee markets for the nuts-and-bolts. Pair with Retro9000-style grants, and you’re not just scaling – you’re owning the niche.

Low fees aren’t a feature; they’re rocket fuel for the app-chains that redefine Web3.

With AVAX holding $11.27-$12.02 range today, the network’s battle-tested. Builders, spin up that prediction market or social app-chain now – fees are negligible, grants await, growth is inevitable. Avalanche cracked the code; your turn to remix it.