In the evolving landscape of blockchain scalability, Polkadot stands out as a robust platform for deploying custom app-chains equipped with specialized fee markets. With Binance-Peg Polkadot (DOT) trading at $1.55, down 0.0774% over the last 24 hours from a high of $1.69 and low of $1.46, developers are seizing this moment of market stability to experiment with rollup architectures. The recent launch of the Polkadot Deployment Portal (PDP) marks a pivotal shift, offering a no-code, one-click solution that abstracts away paraID reservations, genesis configurations, and core scheduling. This empowers builders to launch production-ready Polkadot custom rollups in minutes, complete with elastic coretime, shared security, and native XCM interoperability.

Traditional blockchains often grapple with congested fee markets that penalize niche applications, from DeFi protocols to gaming ecosystems. Polkadot’s architecture, however, enables application-specific blockchains where fees can be tailored precisely to use cases. Imagine a social media dApp charging micro-fees for content boosts or an NFT marketplace implementing dynamic pricing based on rarity tiers, all without spilling over into the relay chain’s economics. This isolation prevents demand spikes, ensuring predictable costs and optimal throughput.

Polkadot’s Native Rollups: Coretime and Shared Security Advantages

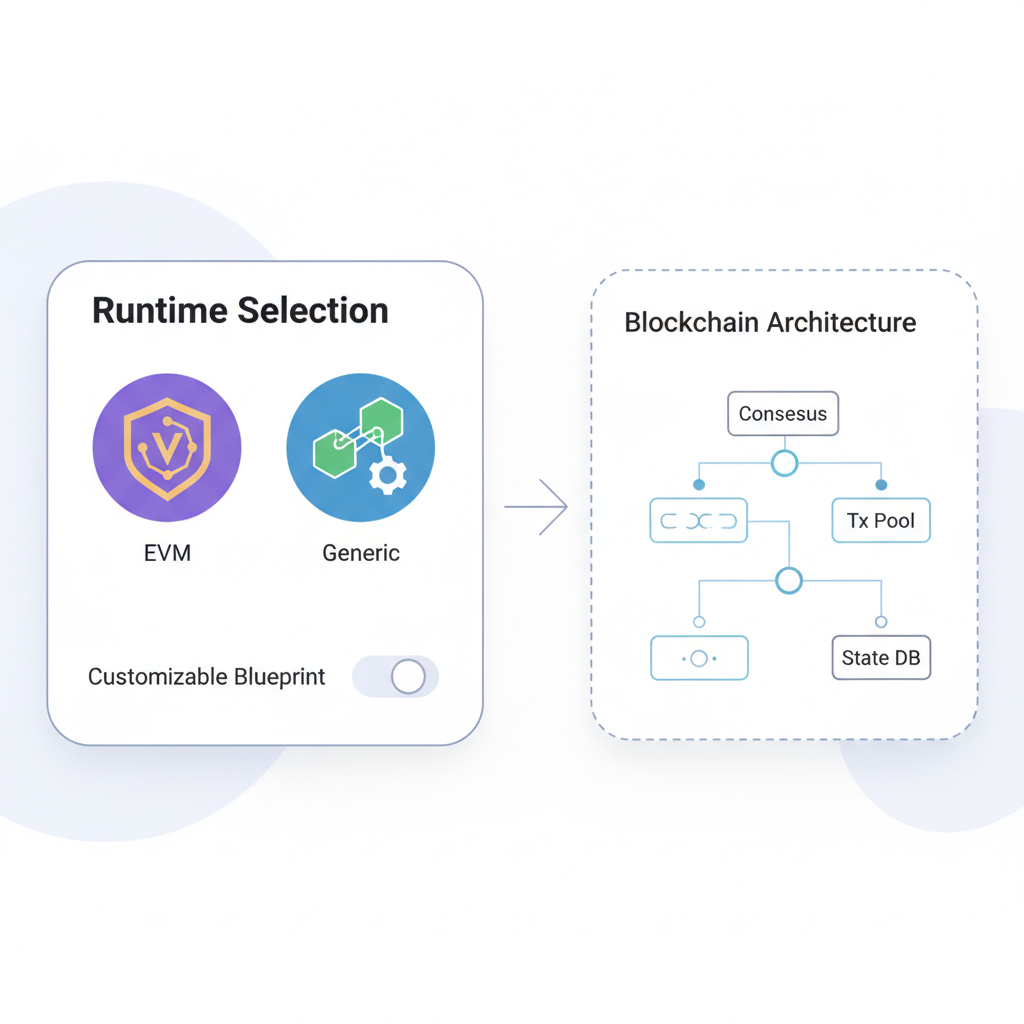

Polkadot’s evolution from parachains to native rollups via Asynchronous Backing and the Agile Coretime model redefines scalability. Developers can now procure fractional coretime units, scaling elastically without auctions. The PDP streamlines this, supporting both Generic and EVM runtimes while guaranteeing fast finality through a pure proxy security model. Asphere’s collaboration with the Web3 Foundation further amplifies this with no-code tools leveraging microservices and serverless computing, ideal for enterprises eyeing rapid iteration.

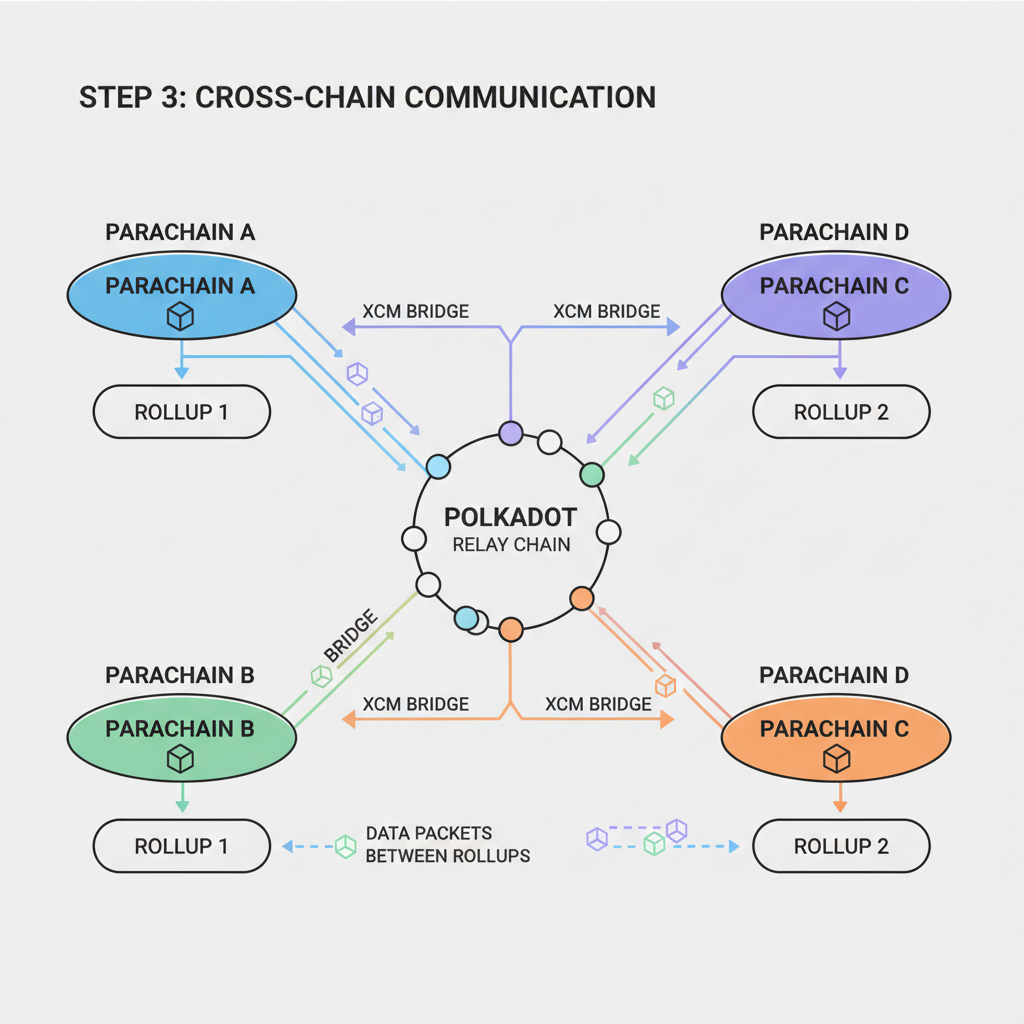

Consider the contrast with Ethereum: while Ethereum rollups rely on data availability layers, Polkadot rollups inherit sovereign security from the relay chain. This setup is particularly potent for rollup as a service Polkadot deployments, where services like Zeeve allow node launches in seconds on preferred clouds, and Ankr simplifies framework selection from OP Stack to zk alternatives.

Polkadot parachains scale through parallel specialized chains with shared security, XCM interoperability, forkless upgrades, and slot auctions.

Designing Specialized Fee Markets for Your Custom Rollup

Crafting specialized fee markets rollups begins with Substrate’s runtime configurability. Define fee tiers per pallet: fixed for oracle updates, auction-based for premium slots, or token-weighted for governance actions. This fundamentals-first approach, akin to macroeconomic policy tuning, mitigates MEV risks and aligns incentives with app-specific economics. For instance, a commerce chain might subsidize merchant transactions while premium users pay for priority finality.

Explore deeper strategies in our guide on implementing specialized fee markets in custom app-chains. Providers like PixelPlex and Ment Tech Labs emphasize dedicated consensus and token models, ensuring your rollup matches business imperatives. Blockchain App Factory’s RaaS tailors solutions for unique smart contracts and transaction types, underscoring Polkadot’s edge over monolithic chains.

Step-by-Step Rollup-as-a-Service Deployment on Polkadot

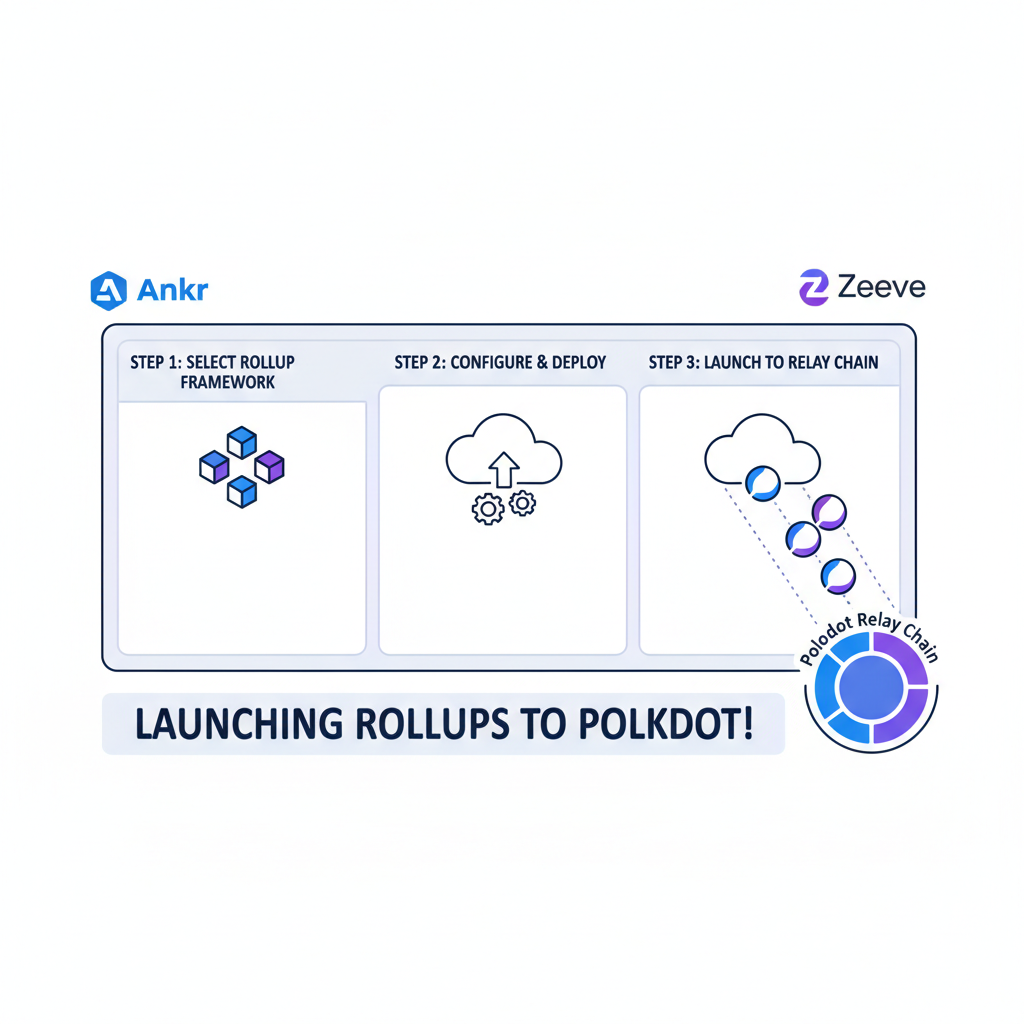

Embarking on deployment mirrors a disciplined investment strategy: assess needs, select tools, execute. Start with PDP for one-click magic or Ankr’s four-step process: account creation, framework choice (Substrate shines here), network selection, and data availability setup. Asphere’s enterprise arm signals native Polkadot support, blending RaaS with Polkadot’s growth playbook for coordinated ecosystem expansion.

Zeeve’s managed services handle validator nodes effortlessly, while Soranauts highlights XCM for cross-chain liquidity. As DOT holds at $1.55, timing favors experimentation before potential upswings.

Polkadot (DOT) Price Prediction 2027-2032

Professional forecasts based on rollup-as-a-service adoption, coretime demand, and Polkadot ecosystem growth from 2026 baseline ($1.55)

| Year | Minimum Price (USD) | Average Price (USD) | Maximum Price (USD) | Avg YoY % Change |

|---|---|---|---|---|

| 2027 | $2.00 | $4.00 | $8.00 | +158% |

| 2028 | $3.00 | $6.00 | $12.00 | +50% |

| 2029 | $4.50 | $10.00 | $20.00 | +67% |

| 2030 | $6.00 | $14.00 | $28.00 | +40% |

| 2031 | $8.00 | $18.00 | $35.00 | +29% |

| 2032 | $10.00 | $25.00 | $45.00 | +39% |

Price Prediction Summary

Polkadot (DOT) is positioned for robust growth from 2027-2032, fueled by no-code rollup deployments via PDP and Asphere, surging coretime demand from custom app-chains, and specialized fee markets. Starting from a 2026 low of ~$1.55 amid bearish conditions, base-case average prices climb to $25 by 2032, with bullish maxima reaching $45 on high adoption and market cycle upswings. Bearish minima reflect regulatory hurdles or competition, yet show progressive recovery.

Key Factors Affecting Polkadot Price

- Rapid rollup and app-chain adoption through Polkadot Deployment Portal (PDP) and Asphere no-code tools

- Growing coretime demand from scalable, interoperable specialized chains with XCM/XCMP

- Crypto market cycles with bull phases in 2028-2029 post-2026 bear market

- Favorable regulatory clarity for Web3 infrastructure and shared security models

- Competitive edge over Ethereum L2s via custom runtimes and fee markets

- Broader crypto market cap growth and institutional interest in Polkadot ecosystem

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Next, configure your runtime pallets for fee isolation. Use dynamic markets to adapt to load, preventing the congestion pitfalls seen in general-purpose chains. This tailored economics fosters sustainable dApps, from high-frequency trading bots to creator economies.

Pallets like TransactionPayment in Substrate serve as the backbone, allowing you to override base fees, tip calculations, and length fees with app-specific logic. For a gaming rollup, set negligible fees for routine moves but escalate for rare loot drops, ensuring economic viability without user friction. This precision turns potential bottlenecks into competitive moats, especially as Polkadot’s ecosystem coordinates growth through targeted strategies outlined in community forums.

Substrate Code Essentials: Configuring Fees in Your Runtime

To operationalize this, integrate a custom fee pallet into your runtime. Begin by declaring weights for extrinsics, then hook into the on_initialize phase for dynamic adjustments based on chain state. Here’s a practical snippet demonstrating fee tiering for an NFT marketplace app-chain, where rarity dictates multipliers.

Substrate Pallet for Dynamic Fee Multipliers by Tx Type and Asset Rarity

To implement a specialized fee market in your Polkadot app-chain or rollup, we develop a Substrate pallet that enables dynamic fee multipliers. These multipliers adjust transaction fees based on the **transaction class** (e.g., standard transfers vs. rare NFT operations) and the **asset rarity** (e.g., common tokens vs. legendary NFTs). This approach ensures high-value or congested operations pay more, optimizing resource allocation in your custom chain.

The pallet stores configurable base multipliers per transaction class and fixed rarity factors. A utility function computes the final multiplier, which you can hook into your runtime’s fee calculation logic (e.g., via `pallet_transaction_payment`’s `WeightToFee` trait or a custom `SignedExtension`).

```rust

use frame_support::{

pallet_prelude::*,

traits::{tokens::fungibles, Currency},

};

use frame_system::pallet_prelude::*;

use sp_runtime::FixedPointNumber;

#[derive(Clone, Encode, Decode, PartialEq, Eq, RuntimeDebug, TypeInfo)]

pub enum TransactionClass {

/// Standard asset transfer

Transfer,

/// Rare NFT mint or trade

NftRare,

/// Common operations

Common,

}

#[derive(Clone, Encode, Decode, PartialEq, Eq, RuntimeDebug, TypeInfo)]

pub enum AssetRarity {

Common = 1,

Uncommon = 2,

Rare = 5,

Epic = 10,

Legendary = 20,

}

#[frame_support::pallet]

pub mod pallet {

use super::*;

#[pallet::pallet]

#[pallet::without_storage_info]

pub struct Pallet(_);

#[pallet::config]

pub trait Config: frame_system::Config {

type RuntimeEvent: From> + IsType<::RuntimeEvent>;

type AssetId: Parameter + Member + MaybeSerializeDeserialize;

type Balance: Parameter + Member + MaybeSerializeDeserialize + FixedPointOperand;

}

/// Base multiplier for each transaction class

#[pallet::storage]

#[pallet::getter(fn base_multiplier)]

pub type BaseMultiplier = StorageMap<

_,

Blake2_128Concat,

TransactionClass,

Permill,

ValueQuery,

>;

/// Rarity adjustment factors

#[pallet::storage]

pub type RarityFactor = StorageMap<

_,

Blake2_128Concat,

AssetRarity,

Permill,

ValueQuery,

>;

#[pallet::event]

#[pallet::generate_deposit(pub(super) fn deposit_event)]

pub enum Event {

FeeMultiplierUpdated(TransactionClass, Permill),

}

#[pallet::call]

impl Pallet {

/// Set base multiplier for a transaction class

#[pallet::weight(10_000)]

pub fn set_multiplier(

origin: OriginFor,

tx_class: TransactionClass,

multiplier: Permill,

) -> DispatchResult {

ensure_root(origin)?;

BaseMultiplier::::insert(tx_class, multiplier);

Self::deposit_event(Event::FeeMultiplierUpdated(tx_class, multiplier));

Ok(())

}

}

}

/// Computes dynamic fee multiplier

/// Call this in your runtime's `WeightToFee` implementation or custom pre-dispatch

pub fn compute_fee_multiplier(

tx_class: TransactionClass,

rarity: AssetRarity,

) -> Permill {

let base = pallet::BaseMultiplier::::get(tx_class);

let rarity_factor = pallet::RarityFactor::::get(rarity);

// Dynamic calculation: base * rarity_factor * network congestion factor (simplified)

base.saturating_mul(rarity_factor)

}

// Usage example in runtime: integrate with TransactionPayment pallet's `on_charge_transaction`

// by overriding or using SignedExtension for custom fee computation.

``` Deploy this pallet in your runtime by adding it to your `construct_runtime!` macro and configuring the necessary traits. Initialize default multipliers in the genesis config—e.g., 100% (Permill::one()) for common transfers, 500% for rare NFTs. For production rollups, benchmark weights accurately and consider integrating with Cumulus for parachain deployment. This setup provides thoughtful fee economics tailored to your app-chain’s needs, balancing accessibility and sustainability.

This code leverages frame_support: : dispatch: : Weight and pallet_transaction_payment, deployable via PDP’s Generic runtime. Test on a Zeeve-managed node first; their one-click setup on your cloud choice minimizes overhead. With DOT steady at $1.55 after dipping to a 24-hour low of $1.46, resource costs remain attractive for prototyping.

Layer in governance for fee parameter updates, using on-chain referenda to adapt markets without hard forks. PixelPlex’s dApp services exemplify this, protecting applications with tailored consensus while granting fee sovereignty. Such application specific blockchains fees shine in commerce chains, subsidizing volume trades to outpace Ethereum’s generalized markets.

Rollup-as-a-Service: From Prototype to Production

Scaling demands more than code; it requires orchestrated infrastructure. Ankr’s streamlined path, account setup, framework pick, network choice, data config, pairs seamlessly with Polkadot’s coretime flexibility. Asphere elevates this for enterprises, deploying via microservices for zero-downtime scaling, as highlighted in their Web3 Foundation partnership.

Post-deployment, monitor via Polkadot-JS Apps, tweaking core assignments for elasticity. Blockchain App Factory’s RaaS customizes for bespoke contracts, while Ment Tech Labs crafts tokenomics aligned to your model. XCM bridges unlock liquidity, letting your app-chain tap relay chain assets without security trade-offs.

Real-world traction builds: envision a DeFi hub with isolated lending fees, immune to relay chain volatility, or a social protocol monetizing interactions granularly. Polkadot’s forkless upgrades ensure evolution without disruption, a far cry from Ethereum’s sequencer risks. As 2026 approaches, Polkadot custom rollups 2026 adoption hinges on these tools, with PDP’s transparent pricing democratizing access.

Delve into isolated economics via our technical deep-dive on isolated fee markets for custom rollups, or blueprint your design with how-to-design-custom-fee-markets-for-application-specific-rollups. Services like Soranauts underscore shared security’s role in parallel chains, amplifying throughput.

With Binance-Peg DOT at $1.55, market stability underscores the strategic window for builders. Deploying now positions your project ahead of coretime demand surges, fostering dApps that thrive on predictable, specialized economics. Polkadot’s relay chain not only secures but elevates these sovereign worlds, paving scalable paths for decentralized innovation.