In the high-stakes world of blockchain development, launching a custom rollup or app-chain often feels like footing a massive bill before the party even starts. Traditional deployments demand 6-9 months of intense engineering from 5-8 dedicated specialists, plus ongoing operational headaches that balloon costs far beyond initial projections. But what if you could flip the script with custom app-chains featuring trader-focused fee markets? These specialized setups prioritize low, predictable fees for high-volume traders while slashing deployer expenses through dynamic pricing that mirrors real demand. As Ethereum hovers at $1,991.88, developers are pivoting to these models to stay competitive.

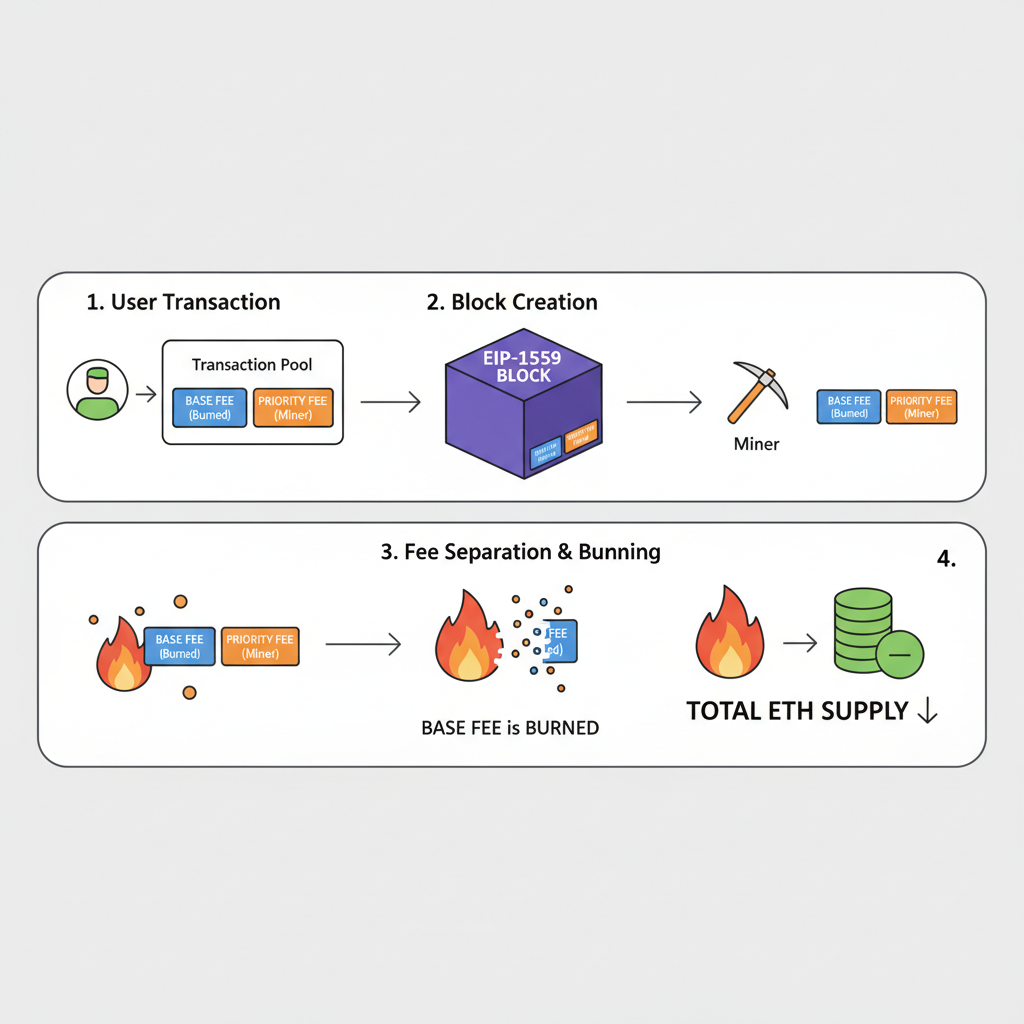

Trader-focused fee markets aren’t just a buzzword; they’re a pragmatic evolution. Picture this: instead of blanket fees that punish everyone during peaks, your app-chain isolates trading activity into dedicated markets. High-frequency orders pay a premium sliver, but retail traders and makers enjoy subsidized rates, fostering liquidity without the deployer spam costs that plague general-purpose chains. This approach draws from Ethereum’s EIP-1559, where base fees auto-adjust per block, but amps it up for app-specific needs like Solana’s local fee markets that let hot programs charge more while keeping the rest affordable.

Why Deployer Costs Are Crushing Innovation

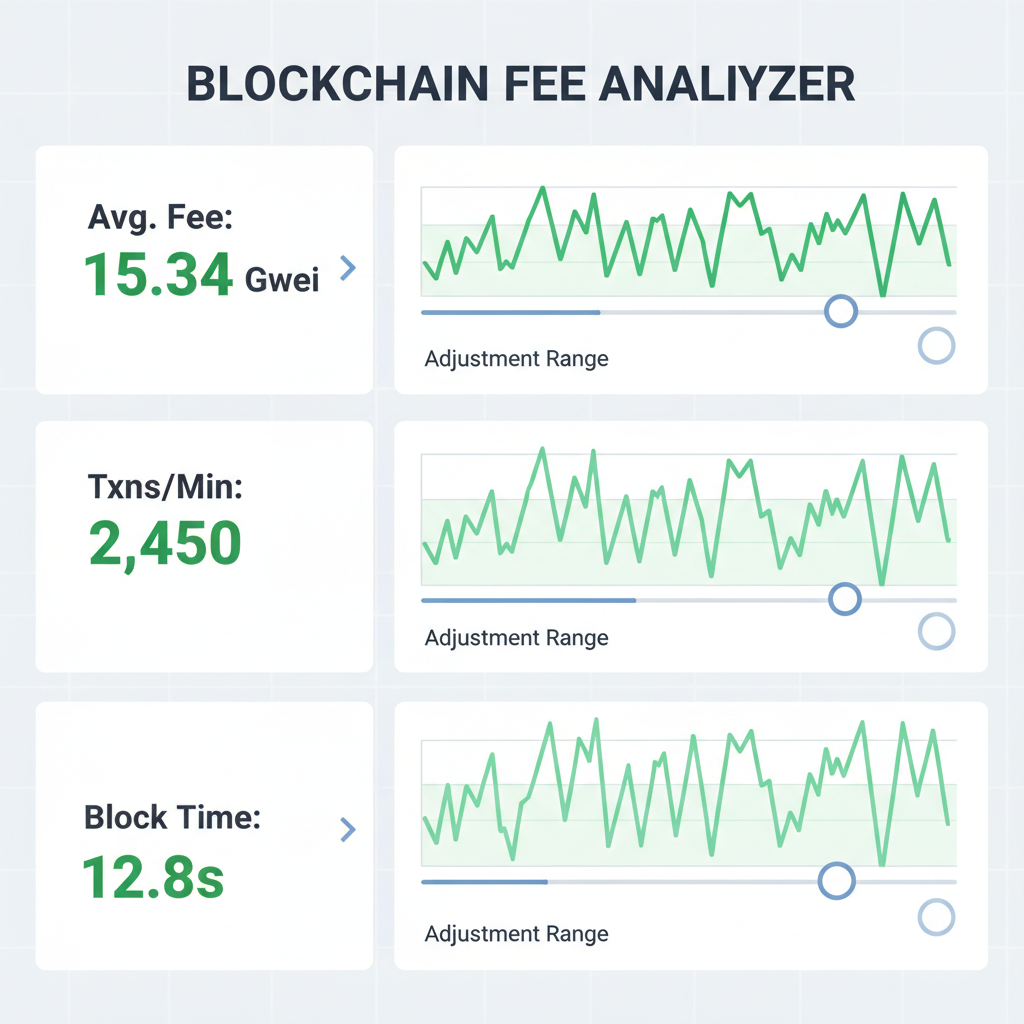

Let’s get real about the numbers. Rollup-as-a-Service (RaaS) providers like Zeeve and Caldera promise to spin up sovereign L1 app-chains or L2/L3 rollups in minutes, yet the upfront and recurring tabs remain steep without smart fee design. Analysis from Eco reveals RaaS can deliver up to 80% fee savings over mainnet ops by ditching in-house infra needs. Still, without specialized fee structures for rollups, deployers absorb the brunt: sequencer costs, data availability posts, and validator incentives eat into margins.

Consider the business model breakdown from Alchemy: rollups monetize via MEV tips, priority fees, and sequencer revenue, but in trader-heavy apps, undifferentiated fees lead to congestion and reduce deployer spam costs only if you rethink allocation. Hyperliquid’s HIP-3 nails this with permissionless onchain markets where deployers snag 50% of fees, balancing incentives without overcharging users. It’s a blueprint for beating those engineer-month marathons Instanodes flags as the norm.

Deployers earn 50% of market fees post-launch, proving trader-focused models can self-sustain amid Ethereum’s $1,991.88 stability.

Crafting Trader Low Fees App-Chains That Scale

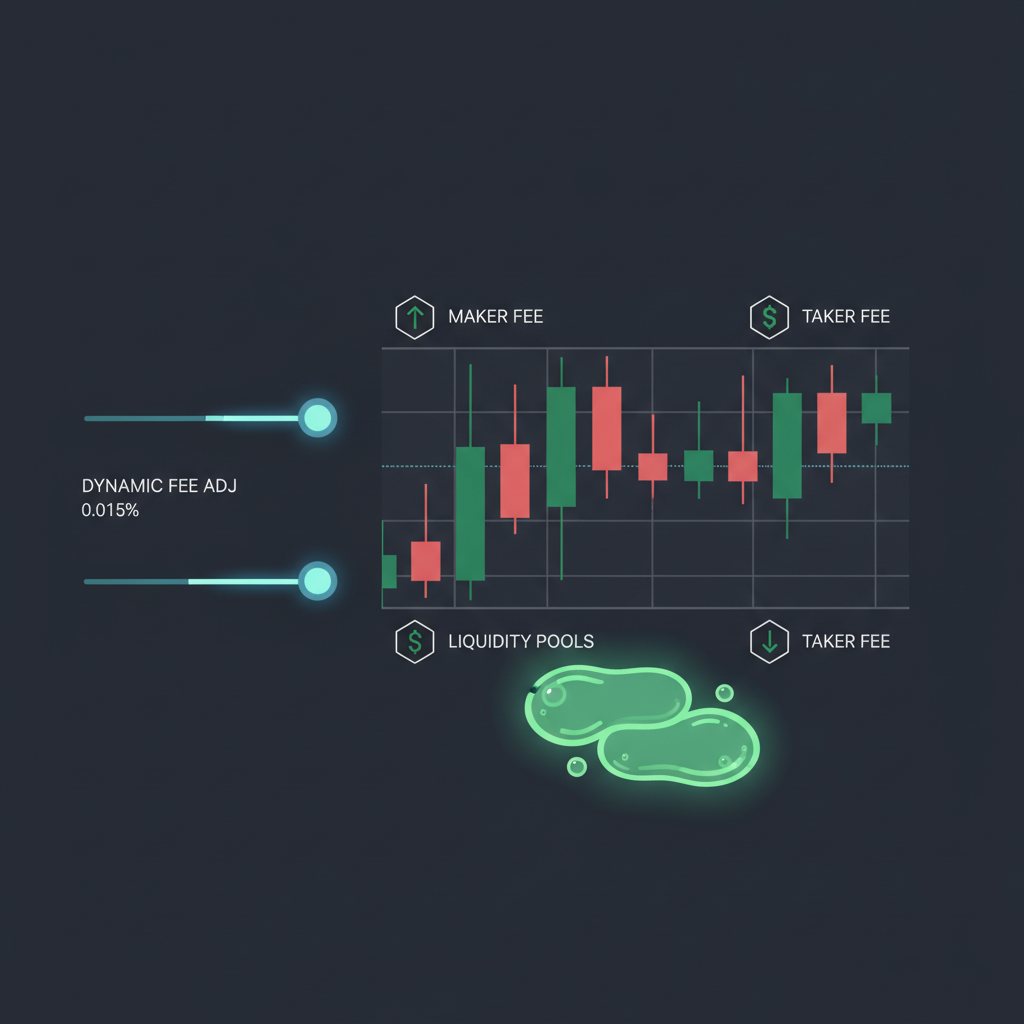

Building these chains starts with intentional fee architecture. Dive into maker-taker splits tailored for DeFi, where liquidity providers pay zero or rebates, pulling in volume that funds the chain. Optimistic rollups with dynamic fees shine here: validators process trades off-mainnet, posting minimal proofs, while fees spike only for compute-intensive bursts.

Caldera’s high-performance rollups exemplify this, deploying customizable stacks in minutes for gaming or perpetuals DEXes. Pair it with Coinbase Base’s dedicated blockspace and custom gas tokens, and you’ve got a recipe for trader low fees app-chains that undercut general L2s. Solana’s model informs the local twist: fees per account or program ensure a viral tweet or NFT mint doesn’t jack up swap costs.

Ethereum (ETH) Price Prediction 2027-2032: App-Chain Innovations Driving Scalability

Forecasts incorporating custom app-chains, rollups-as-a-service (RaaS), and trader-focused fee markets reducing deployment costs and boosting Ethereum ecosystem adoption amid 2026 baseline of $1,992.

| Year | Minimum Price | Average Price | Maximum Price | Avg YoY % Change |

|---|---|---|---|---|

| 2027 | $2,800 | $4,200 | $6,500 | +110% |

| 2028 | $4,000 | $7,500 | $12,000 | +79% |

| 2029 | $5,500 | $9,000 | $14,000 | +20% |

| 2030 | $7,000 | $12,500 | $20,000 | +39% |

| 2031 | $10,000 | $18,000 | $28,000 | +44% |

| 2032 | $14,000 | $25,000 | $40,000 | +39% |

Price Prediction Summary

Bullish long-term outlook for ETH with average prices projected to grow over 12x by 2032, fueled by app-chain fee innovations slashing costs by up to 80%, enhanced scalability via rollups, and rising adoption in DeFi/gaming. Min/max reflect bearish corrections and bull peaks tied to market cycles.

Key Factors Affecting Ethereum Price

- Widespread RaaS adoption reducing deployment time/costs (6-9 months to minutes, 80% fee savings)

- Dynamic trader-focused fee markets (e.g., EIP-1559, Solana-style locals) ensuring efficient blockspace

- Ethereum L2/L3 rollup explosion creating ‘superchains’ with shared liquidity

- Halving cycles (2028) and regulatory tailwinds boosting institutional inflows

- Competition from ZK projects offset by ETH’s security/developer dominance

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Dynamic markets prevent cross-demand pileups, as explored in isolated fee markets. Traders get sub-cent swaps during lulls, scaling to millions TPS without fee explosions. This isn’t theory; it’s live in ZK superchains linking rollups for shared liquidity, per Rumble Fish insights on gaming use cases.

Real-World Wins: Hyperliquid and Beyond

Hyperliquid’s HIP-3 era spotlights the payoff. Permissionless market launches let anyone deploy, splitting fees 50/50 with the platform. Deployers offset costs via organic revenue, sidestepping the 6-9 month slog. Bankless coverage highlights how this fuels onchain perps without the gas wars of Ethereum at $1,991.88.

Meanwhile, Dysnix’s RaaS guide stresses posting processed TX data back to L1 efficiently, amplified by trader-centric fees. Delphi Digital’s rollup stacks deep-dive confirms: economics first means fee markets dictating viability. For optimistic rollups dynamic fees, integrate adaptive burns like EIP-1559 to deflate supply pressure, keeping ETH steady.

Foundational’s rollup archetypes offer another lens: from cashflow machines to anti-hero builds, all thrive when fees align with trader behavior rather than generic demand. Infinite liquidity loops emerge when optimistic rollups dynamic fees reward makers and punish only the noisiest spam, reducing deployer burdens that Instanodes pegs at engineer-heavy timelines.

Blueprints for Fee-Optimized Deployments

Shifting to action, the real edge lies in stacking these primitives. Platforms like Caldera let you fork OP Stack or ZK variants with trader-tuned params out of the box, slashing that 6-9 month dev cycle. But the magic happens in fee logic: implement local markets per program, as Solana does, so a perp DEX’s frenzy doesn’t hike NFT mint fees. This isolation, detailed in resources on preventing cross-demand congestion, keeps trader low fees app-chains humming at scale.

Ethereum’s stability at $1,991.88 underscores the timing: with L2 fees creeping up, app-chains with custom app-chains fee markets capture overflow. Zeeve’s sovereign L1s pair perfectly, offering enterprise infra without the ops tax. Developers report 80% savings via RaaS, per Eco, but only if fees self-fund via trader volume.

Opinion: Skip the hype around universal ZK stacks; for trading apps, optimistic rollups win with lighter proofs and adaptive pricing. Delphi Digital’s guide hammers this: economics precede tech. Bake in sequencer auctions where deployers bid for slots, then rebate to users, mirroring Hyperliquid’s split.

Deployment Checklist for Cost-Beating Chains

Run this checklist, and you’re not just deploying; you’re engineering sustainability. Dysnix outlines RaaS as TX offloading to L1 posts, but trader focus amplifies it: fees from high-volume perps cover DA costs, freeing deployers from Alchemy-noted pitfalls like thin margins.

ZK projects from Rumble Fish, like gaming superchains, extend this to shared security pools. Interconnected rollups share liquidity, with each node’s fees staying local, dodging Ethereum’s $1,991.88 gas spikes. Base Appchains add custom gas tokens, letting you peg fees to a stablecoin for ultimate predictability.

At $1,991.88, Ethereum’s poise signals maturity; app-chains now handle the trader grind. Providers like Instanodes rank top RaaS for reliability, but pair them with specialized fee markets, and costs plummet. Deployers reclaim margins, traders flock to sub-cent execution, and innovation escapes the engineer trap.

These models aren’t incremental; they’re the pivot point. As rollups evolve per Foundamental’s archetypes, trader-centric fees ensure your chain doesn’t just launch, but dominates blockspace economics. Dive in, tweak the splits, and watch deployment dread turn to revenue reality.