In the relentless pursuit of blockchain scalability, transaction costs remain a stubborn barrier to mass adoption. Ethereum’s Layer 1 fees have historically spiked during peak usage, pricing out everyday users and stifling DeFi innovation. Rollups promised relief by batching transactions and distributing L1 costs, yet as recent analyses reveal, they still grapple with mispricings and inefficient fee mechanisms. Enter custom app-chains: sovereign blockchains tailored for specific applications, armed with specialized fee markets that dynamically adjust to demand, slashing costs while preserving security and speed. This approach isn’t just incremental; it’s a fundamental redesign for sustainable growth.

Consider the rollup ecosystem today. Operators derive revenue by subtracting L1 posting costs and expenses from user fees, a model that incentivizes efficiency but exposes vulnerabilities. Research from arXiv highlights pricing attacks exploiting transaction fee mechanisms in rollups, where attackers manipulate bids to grief networks or extract undue value. Meanwhile, the mantra “rollups get cheaper with more users” holds true only when batch sizes grow, amortizing fixed L1 costs across more transactions. Yet general-purpose rollups, optimized for broad compatibility, can’t fully cater to niche demands like high-frequency trading or social interactions.

Why Custom App-Chains Outpace Generic Rollups

Custom app-chains flip the script by granting developers full control over execution environments and fee structures. Unlike shared Layer 2s, these chains implement app-specific blockchains fee structures, such as maker-taker models or usage-based tiers, directly aligned with application logic. dYdX’s migration to its own app-chain exemplifies this: a 100x throughput boost through custom precompiles for batch auctions and MEV capture, feats impossible on commoditized rollups. Dynamic fee markets adjust in real-time, ensuring blockspace allocation favors high-value txs while keeping latency sub-second for reactions or chats.

Recent advancements enable near-instant on-chain interactions, transforming user experiences in ways general L2s simply can’t match.

This vertical integration yields predictable costs. Layer 3 solutions built atop app-chains push fees to sub-cent levels for stablecoin transfers, democratizing remittances and payments. Zeeve’s tools make launching such chains straightforward, emphasizing reduce transaction costs blockchain via high-speed rollups without Ethereum’s baggage.

Unpacking the Mechanics of Specialized Fee Markets

At their core, specialized fee markets app-chains decouple fees from generic gas auctions. Traditional EIP-1559 burns base fees and tips validators, but app-chains can innovate: priority auctions for MEV-sensitive apps, flat fees for consumer dApps, or even negative fees subsidized by protocols. The key is expressivity; fees reflect true resource consumption, calibrated to the app’s economics.

Take ZK rollups: they slash costs by proving batches off-chain, distributing L1 gas across users. Custom variants extend this with app-tuned proofs, minimizing calldata overhead. Binance notes rollups charge less for compute but more for L1 posting; app-chains internalize this, optimizing the entire stack. Intel’s RaaS outlook predicts explosive growth in payment solutions leveraging these for cost parity with Web2.

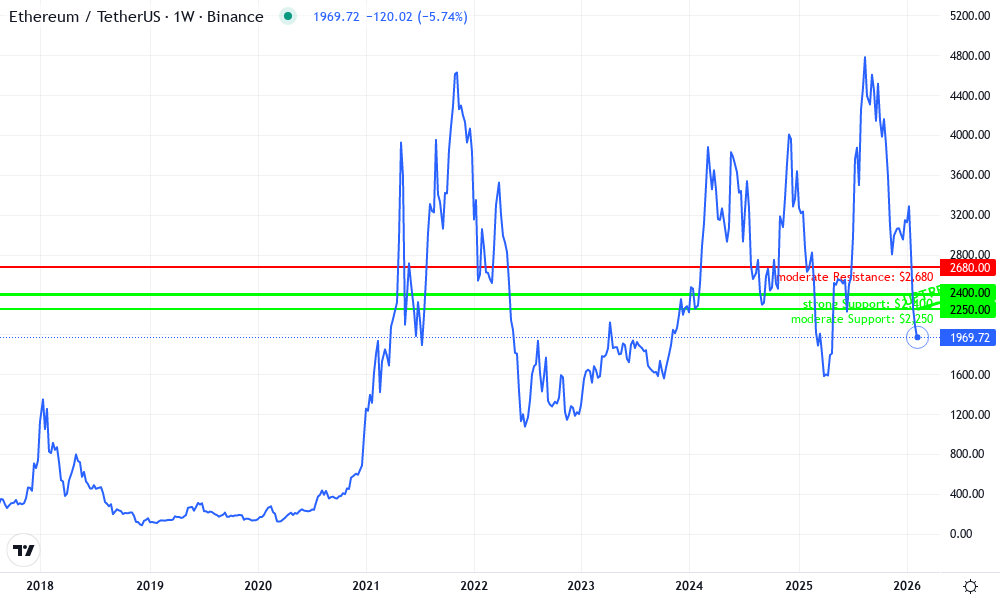

Ethereum Technical Analysis Chart

Analysis by Julia Reid | Symbol: BINANCE:ETHUSDT | Interval: 1W | Drawings: 5

Technical Analysis Summary

As Julia Reid, employing my conservative, fundamentals-driven approach, I recommend the following precise drawing instructions to annotate this ETHUSDT chart for clarity and alignment with sustainable growth themes. First, draw a prominent ‘trend_line’ connecting the major swing low on 2026-02-15 at 2250 to the recent higher low on 2026-10-20 at 2480, extending forward to project support into late 2026—label it ‘Long-term Uptrend: Patience in Rollup Era’. Add ‘horizontal_line’ at 2400 for strong support (‘Blockchain Fee Reductions Bolster Base’), 2600 for moderate resistance (‘Near-term Consolidation Ceiling’), and 3500 as a dashed ‘horizontal_line’ for aspirational resistance (‘Fundamental Target: App-Chain Adoption’). Use ‘rectangle’ to highlight the 2026-07-01 to 2026-09-30 consolidation zone between 2420 and 2680, annotating ‘Accumulation Amid L2 Advancements’. Place ‘callout’ on rising volume bars in Q3 2026 noting ‘Volume Confirmation of Base Building’. For MACD, add ‘arrow_mark_up’ at the bullish crossover in early October 2026. Include ‘text’ box in upper right: ‘CFA View: Low Risk Hold – Rollups Drive Efficiency’. Finally, ‘fib_retracement’ from 2026-05-01 high 2850 to 2026-07-15 low 2380, highlighting 61.8% retracement at 2520 as entry zone. These tools emphasize patience over speculation.

Risk Assessment: low

Analysis: Conservative setup with strong fundamentals (rollup scalability), clear support, and bullish indicator confirmation; aligns with low-risk tolerance

Julia Reid’s Recommendation: Accumulate on dips near 2520 for long-term portfolio allocation; hold patiently as Ethereum cements infrastructure leadership

Key Support & Resistance Levels

📈 Support Levels:

-

$2,400 – Strong multi-test support aligning with 2026 accumulation post-rollup news

strong -

$2,250 – Moderate prior swing low, fundamental floor

moderate

📉 Resistance Levels:

-

$2,680 – Moderate recent highs, consolidation resistance

moderate -

$3,500 – Weak psychological and fib extension target for H2 2026

weak

Trading Zones (low risk tolerance)

🎯 Entry Zones:

-

$2,520 – Fib 61.8% retracement in uptrend with volume support; low-risk dip buy for long-term hold

low risk

🚪 Exit Zones:

-

$3,500 – Conservative profit target based on channel projection and app-chain growth catalysts

💰 profit target -

$2,200 – Tight stop below key support to preserve capital

🛡️ stop loss

Technical Indicators Analysis

📊 Volume Analysis:

Pattern: Increasing on pullbacks, confirming accumulation

Volume profile shows higher lows in Q3-Q4 2026, bullish for fundamentals

📈 MACD Analysis:

Signal: Bullish crossover

MACD line crossing signal in Oct 2026, divergence from price supports reversal

Applied TradingView Drawing Utilities

This chart analysis utilizes the following professional drawing tools:

Disclaimer: This technical analysis by Julia Reid is for educational purposes only and should not be considered as financial advice.

Trading involves risk, and you should always do your own research before making investment decisions.

Past performance does not guarantee future results. The analysis reflects the author’s personal methodology and risk tolerance (low).

Strategies for Designing Fee Markets That Scale

Crafting effective custom rollups fee optimization demands a nuanced blend of game theory and incentives. Start with congestion pricing: fees rise with demand, but app-chains cap them via reserved capacity for core functions. Implement minimum fees to deter spam, paired with refunds for valid txs. For DEXs, maker rebates funded by taker fees recapture value on-chain.

Guides on designing these markets stress simulation first: model attacks like those in arXiv papers to harden mechanisms. Patience pays here; iterate based on real usage, as Alex Beckett advises on batch economics. The result? Chains where costs plummet predictably, fostering loyalty over fleeting hype.

Game-theoretic robustness is paramount. Design fees to align incentives: validators earn from targeted tips, users from refunds on efficient batches. Tools like Zeeve simplify deployment, allowing rapid prototyping of these dynamic fees custom rollups.

Comparison of Fee Mechanisms: EIP-1559 vs Maker-Taker vs Dynamic Priority Auctions in App-Chains

| Fee Mechanism | Pros | Cons | Cost Reductions in App-Chains |

|---|---|---|---|

| EIP-1559 | • Predictable base fee that adjusts dynamically • Fee burning mechanism promotes deflation • Proven scalability on Ethereum and rollups |

• Vulnerable to congestion-induced fee spikes • Limited customization for app-specific needs |

• 10-100x reduction via rollup batching (distributes L1 costs) • Enhanced efficiency in app-chains for smoother DeFi trades |

| Maker-Taker | • Rewards makers (liquidity providers) with rebates • Charges takers, incentivizing genuine liquidity • Familiar model from CEXs and DEXs like Uniswap |

• Risk of wash trading and adverse selection • Taker fees can accumulate during high volume |

• Maker fees near-zero; 50-90% overall savings • Optimized for DEX app-chains with capital efficiency |

| Dynamic Priority Auctions | • Real-time bidding for transaction priority • Efficient blockspace allocation tailored to apps • Enables sub-second finality and custom precompiles |

• Implementation complexity • Potential for MEV-related issues if not managed |

• Sub-cent fees in L3 solutions • 100x throughput boost (e.g., dYdX app-chain migration) • Near-instant interactions slashing costs dramatically |

Real-world deployments underscore the transformative power. dYdX’s app-chain shift not only amplified throughput by 100x but also tailored fees for perpetuals trading, where high-frequency orders demand precision without congestion spikes. Social protocols leverage sub-second finality for reactions and chats, fees dynamically scaled to interaction volume, rendering on-chain social viable at fractions of a cent. Layer 3s atop these app-chains compress stablecoin transfers to negligible costs, outpacing legacy rails for remittances.

Mitigating Risks in Specialized Fee Designs

No fee market is impervious. The arXiv-identified pricing attacks on rollups – griefing via low bids or sandwich exploits – loom large, but app-chains fortify with custom validation rules. Minimum viable fees deter spam, while probabilistic refunds reward honest actors. Simulate relentlessly: model adversarial behaviors before mainnet, ensuring mechanisms withstand peak loads. Patience here reveals flaws early; rushed launches invite exploits that erode trust.

“The economics of rollups hinge on batch efficiency – app-chains extend this logic to bespoke economics, turning costs into competitive moats. “

Operators must balance revenue too. Subtract L1-equivalent posting from user fees, but internalize optimizations like compressed proofs or alternative data availability layers. RaaS platforms forecast this convergence, with payment apps leading adoption by mirroring Web2 affordability.

Measuring Success: Benchmarks and Tools

To validate app-specific blockchains fee structures, track metrics beyond raw TPS: cost per tx under load, MEV capture rates, user retention amid volatility. Tools from Rather Labs and Alex Beckett’s analyses provide baselines; Ethereum L1 fees, once prohibitive, now pale against app-chain sub-cent norms via batching mastery.

6-Month Price Performance: Ethereum vs. Rollups & App-Chains

Real-time cryptocurrency price comparison in the context of transaction fee optimizations for custom app-chains (Data as of 2026-02-12)

| Asset | Current Price | 6 Months Ago | Price Change |

|---|---|---|---|

| Ethereum | $1,968.21 | $2,500.00 | -21.3% |

| Bitcoin | $67,079.00 | $60,000.00 | +11.8% |

| Optimism | $0.1823 | $0.2000 | -8.8% |

| Arbitrum | $0.1111 | $0.1200 | -7.4% |

| dYdX | $0.1023 | $0.1100 | -7.0% |

| Polygon | $0.9000 | $1.00 | -10.0% |

| Solana | $80.40 | $85.00 | -5.4% |

| zkSync | $0.0226 | $0.0250 | -9.7% |

Analysis Summary

Over the past six months, the cryptocurrency market has declined for most assets except Bitcoin, which gained +11.8%. Ethereum saw the steepest drop at -21.3%, while rollup and app-chain tokens like Solana (-5.4%), dYdX (-7.0%), and Arbitrum (-7.4%) experienced milder losses amid discussions on slashing transaction costs via specialized fee markets.

Key Insights

- Bitcoin is the sole outperformer with +11.8% growth, contrasting the altcoin downturn.

- Ethereum’s -21.3% decline underscores L1 challenges compared to scaling solutions.

- L2 and app-chain assets show resilience: Solana at -5.4%, dYdX (app-chain) at -7.0%.

- Optimistic rollups like Optimism (-8.8%) and Arbitrum (-7.4%) perform better than ETH.

- Market context reflects broader declines of 5-21% for altcoins, per real-time data.

Real-time prices and 6-month changes sourced exclusively from provided CoinGecko data (last updated 2026-02-12T06:02:37Z). Historical prices approximate 6 months prior (e.g., 2025-08-16 for ETH). Changes formatted exactly as provided.

Data Sources:

- Main Asset: https://www.coingecko.com/en/coins/ethereum

- Bitcoin: https://www.coingecko.com/en/coins/bitcoin

- Optimism: https://www.coingecko.com/en/coins/optimism

- Arbitrum: https://www.coingecko.com/en/coins/arbitrum

- dYdX: https://www.coingecko.com/en/coins/dydx

- Polygon: https://www.coingecko.com/en/coins/polygon

- Solana: https://www.coingecko.com/en/coins/solana

- zkSync: https://www.coingecko.com/en/coins/zksync

Disclaimer: Cryptocurrency prices are highly volatile and subject to market fluctuations. The data presented is for informational purposes only and should not be considered as investment advice. Always do your own research before making investment decisions.

Visualize the divergence: where general rollups distribute L1 costs unevenly, custom stacks predict and preempt spikes. Changelly notes batch amortization slashes per-user fees; app-chains amplify this with app-tuned batches. CoinTracker’s advice – layer 2s for off-peak savings – evolves into sovereign control.

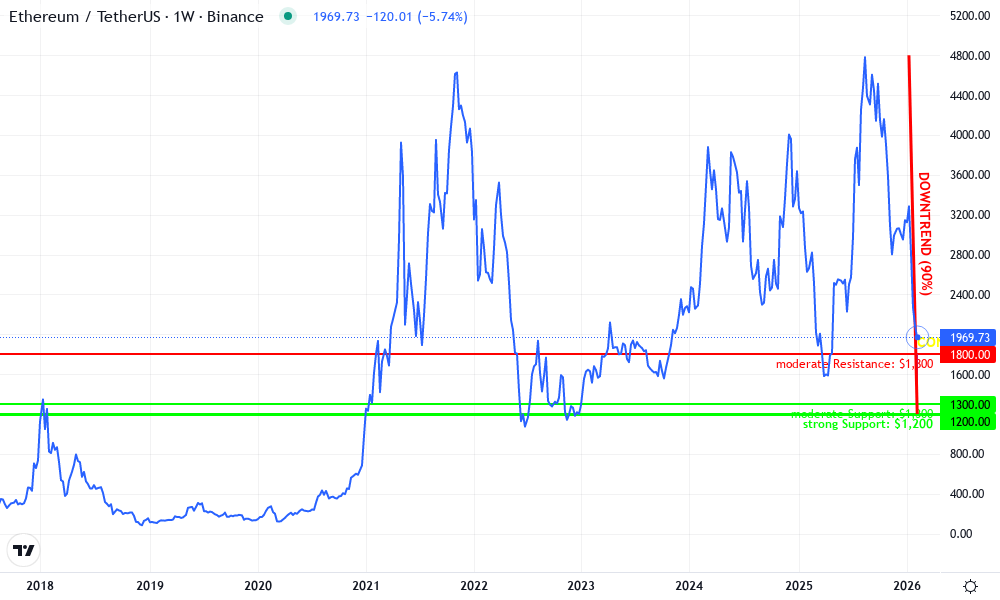

Ethereum Technical Analysis Chart

Analysis by Julia Reid | Symbol: BINANCE:ETHUSDT | Interval: 1W | Drawings: 5

Technical Analysis Summary

In my conservative style as a long-term fundamental investor, annotate the chart with a prominent downtrend line connecting the January 2026 high near $4,800 to the February low at $1,200 to highlight the ongoing correction. Add horizontal lines at key support $1,200 (strong) and resistance $1,800 (moderate), a rectangle for the recent consolidation zone from Feb 10-15 between $1,200-$1,800, callouts on declining volume during the drop, and an arrow_mark_down on the MACD bearish signal. Use text for ‘Patience: Wait for fundamental confirmation via rollup adoption’ near current price ~$1,400. Fib retracement from the drop for potential bounce levels.

Risk Assessment: medium

Analysis: High crypto volatility in correction phase, but ETH fundamentals bolstered by 2026 rollup/app-chain innovations reducing fees and enhancing scalability offset downside. Low tolerance favors waiting.

Julia Reid’s Recommendation: Hold core positions; scale in conservatively on support confirmation. Patience is the ultimate edge—fundamentals will prevail.

Key Support & Resistance Levels

📈 Support Levels:

-

$1,200 – Recent cycle low with volume spike, strong fundamental support amid rollup news.

strong -

$1,300 – Intermediate support from prior consolidation.

moderate

📉 Resistance Levels:

-

$1,800 – Immediate overhead resistance from early Feb highs.

moderate -

$2,500 – Deeper retracement level towards Jan consolidation.

weak

Trading Zones (low risk tolerance)

🎯 Entry Zones:

-

$1,350 – Conservative long entry on bounce from $1,200 support with volume confirmation, aligning low risk tolerance.

low risk

🚪 Exit Zones:

-

$1,800 – Initial profit target at resistance.

💰 profit target -

$1,150 – Tight stop below key support to preserve capital.

🛡️ stop loss

Technical Indicators Analysis

📊 Volume Analysis:

Pattern: Declining volume on downside move, suggesting weakening selling pressure.

Volume dries up during drop, bullish divergence for patient accumulators.

📈 MACD Analysis:

Signal: Bearish crossover with histogram contraction.

MACD confirms downtrend momentum but nearing oversold; watch for bullish divergence.

Applied TradingView Drawing Utilities

This chart analysis utilizes the following professional drawing tools:

Disclaimer: This technical analysis by Julia Reid is for educational purposes only and should not be considered as financial advice.

Trading involves risk, and you should always do your own research before making investment decisions.

Past performance does not guarantee future results. The analysis reflects the author’s personal methodology and risk tolerance (low).

Forward-thinking architects integrate feedback loops: on-chain oracles adjust parameters based on usage patterns, fostering adaptive markets. For DEXs, custom precompiles enable batch settlements that minimize slippage, fees rebated to liquidity providers. This isn’t mere optimization; it’s economic engineering for longevity.

Challenges persist – sequencer centralization risks, cross-chain composability – yet solutions emerge. Decentralized sequencers paired with app-specific bridges preserve sovereignty without isolation. As Vitalik reflects on Ethereum’s fee trajectory, app-chains accelerate the promise: scalable, affordable blockspace for all use cases. Developers eyeing implementation paths find in these markets the edge for enduring dApps. The path demands discipline, but rewards with ecosystems where costs fuel innovation, not friction.

Sustainable growth follows those who master these levers, turning blockchain’s promise into everyday reality.