Decentralized finance (DeFi) is experiencing a paradigm shift, as the global market is projected to surge from $32.36 billion in 2025 to an astonishing $1,558.15 billion in the coming years. This exponential growth is fueling demand for scalable, efficient blockchain infrastructure that can handle high transaction volumes without bottlenecks or prohibitive costs. Enter dynamic fee markets, a breakthrough mechanism enabling custom app-chains to optimize transaction costs and resource allocation in real time, redefining what’s possible for DeFi scalability.

Why Static Fees Fail Modern DeFi

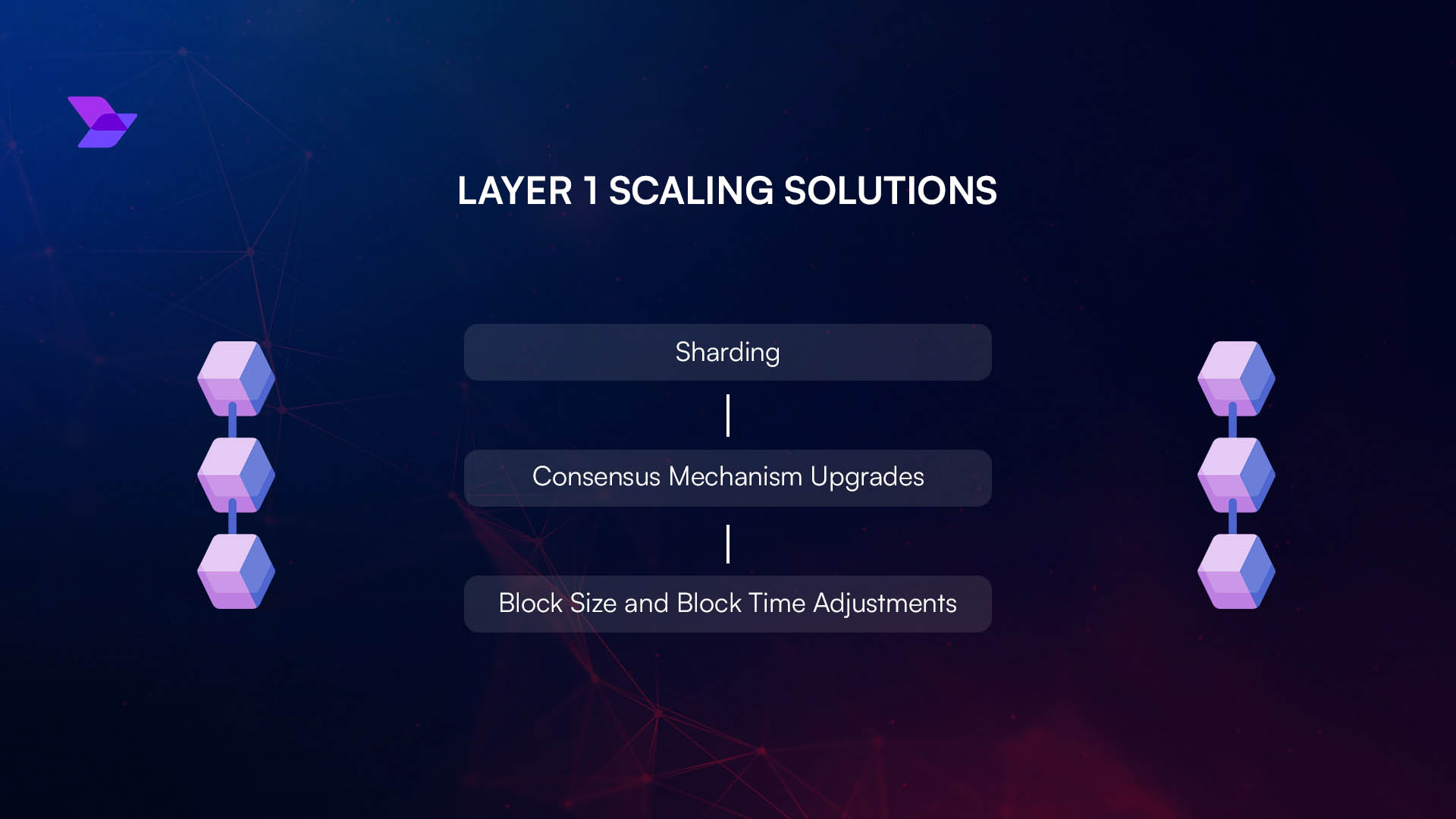

Traditional blockchains like Ethereum have historically relied on static or semi-static fee models, where users bid for block space and fees are largely determined by aggregate network demand. This approach leads to several inefficiencies:

- Congestion and Fee Spikes: During periods of high activity, fees can soar unpredictably, pricing out smaller transactions.

- Poor Capital Efficiency: Overpaying for block space or waiting for lower-fee periods results in wasted capital and user frustration.

- Lack of Flexibility: Static fees cannot adapt to specific dApp requirements or unique resource constraints.

For DeFi protocols, where cost efficiency and user experience are paramount, these limitations are unacceptable. That’s why development teams are increasingly turning to dynamic fee markets on custom app-chains.

The Mechanics of Dynamic Fee Markets

Dynamic fee markets employ algorithms that automatically adjust transaction fees based on real-time network conditions such as congestion, validator availability, or even dApp-specific priorities. Instead of a one-size-fits-all model, each app-chain can implement its own logic for fee calculation, enabling:

Key Advantages of Dynamic Fee Markets in DeFi

-

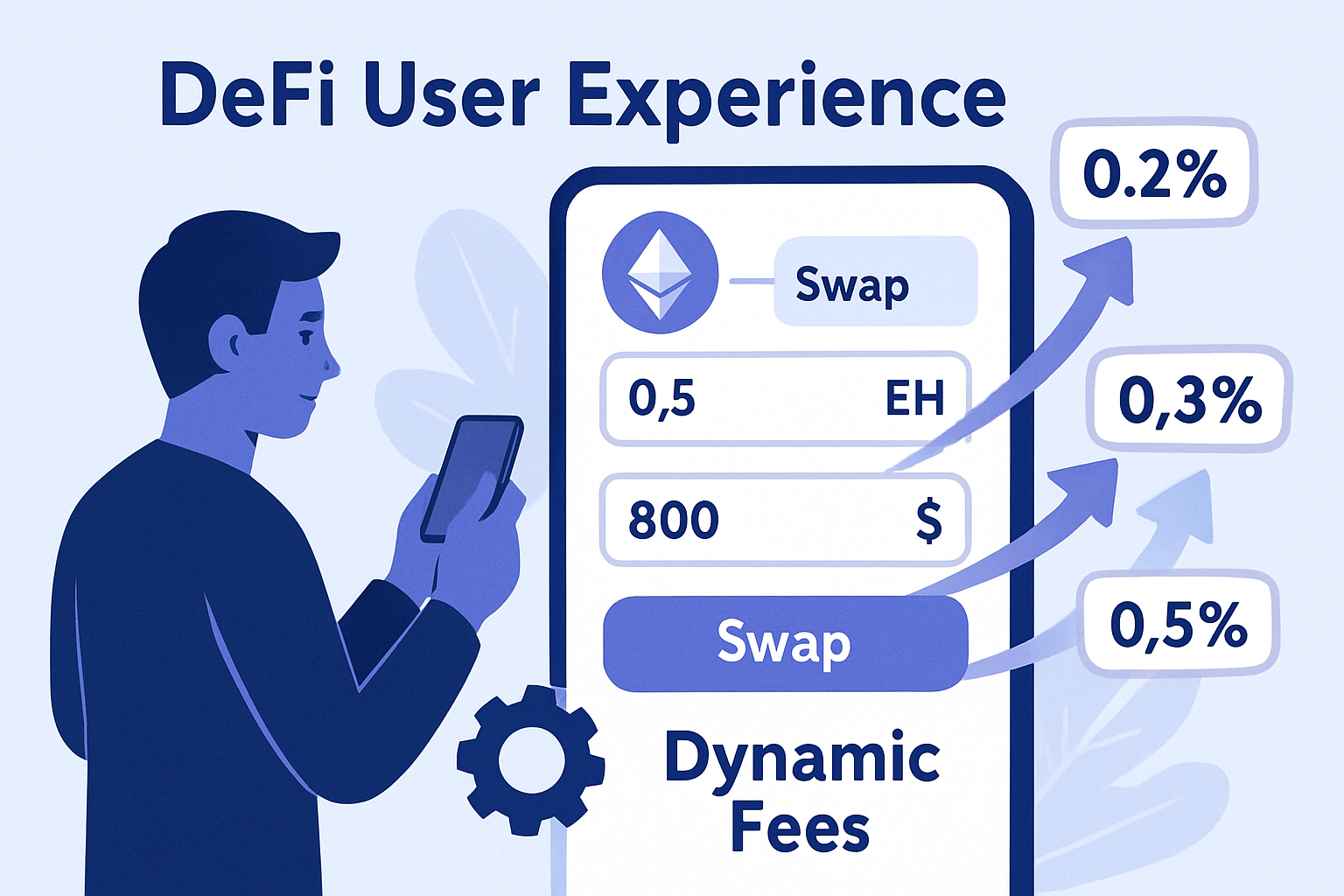

Optimized Transaction Costs: Dynamic fee markets adjust fees in real-time based on network demand, ensuring users pay fair and efficient prices for transactions. This reduces unnecessary costs during low activity and prevents excessive fees during congestion.

-

Enhanced Network Scalability: By responding to fluctuating demand, dynamic fees help prevent network congestion and maintain high throughput, supporting the rapid growth of DeFi platforms and app-chains.

-

Improved User Experience: Lower, predictable fees and faster transaction times make DeFi platforms more accessible and attractive to both new and experienced users.

-

Incentivized Ecosystem Growth: Flexible and transparent fee mechanisms attract more developers and users, fostering innovation and supporting the expansion of decentralized financial services.

This flexibility is exemplified by recent proposals in the Ethereum community that suggest using mathematical functions, such as square roots, to lower fees proportionally as project funding increases. Such models not only support smaller projects but also incentivize broader participation and ecosystem growth.

“Dynamic fees are a flexible pricing mechanism used in DeFi development to adjust transaction fees based on real-time conditions. ”: Nadcab Labs

Custom App-Chains: The Next Frontier for Scalable DeFi

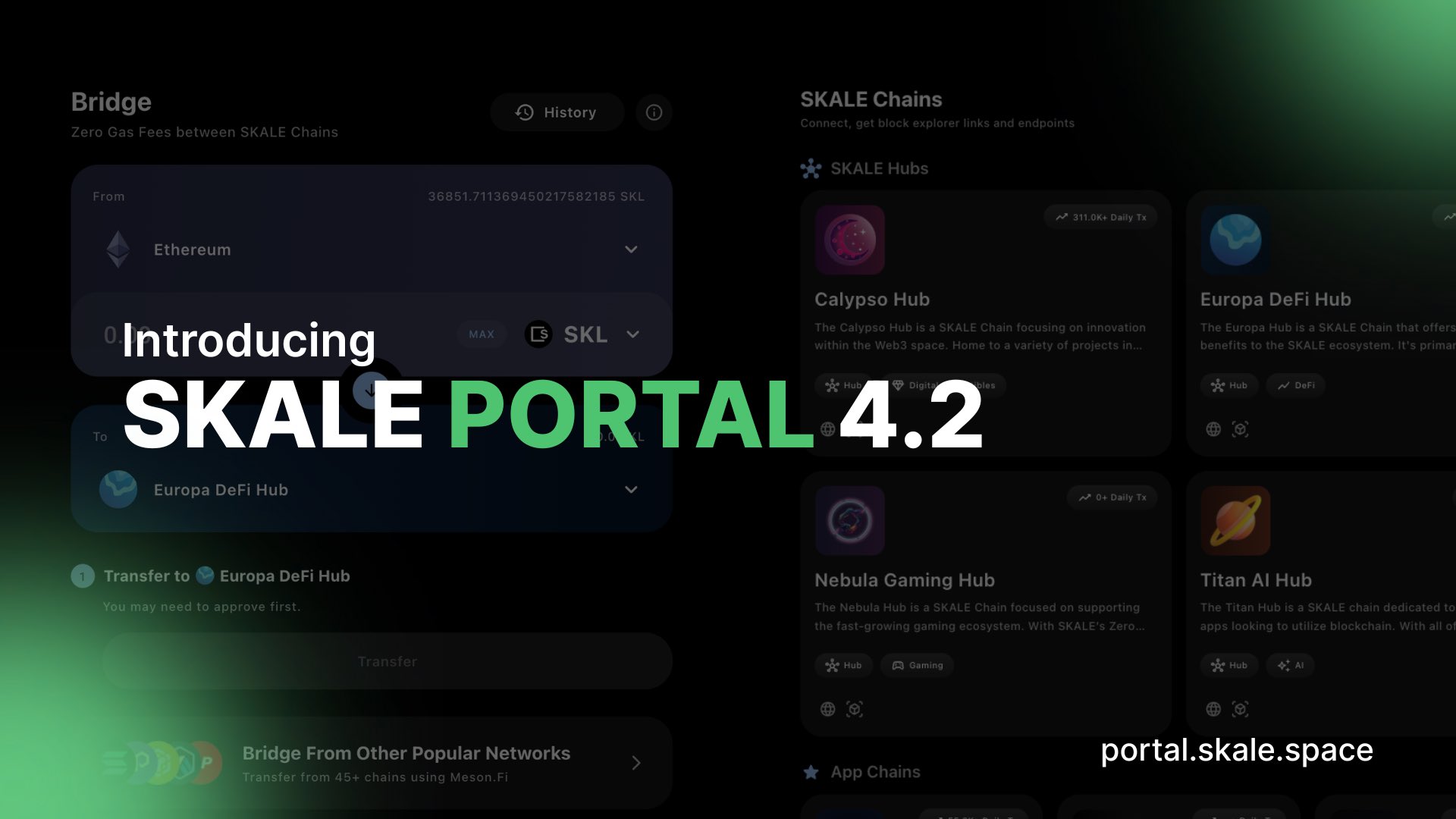

The rise of custom app-chains: dedicated blockchains tailored for individual dApps, has opened up new possibilities for specialized fee structures and resource management. Platforms like SKALE empower developers with granular control over consensus, governance, and most critically, fee logic. By integrating dynamic fee markets, these chains can:

- Optimize throughput by adjusting fees according to actual demand or resource usage (e. g. , execution, storage, bandwidth)

- Deliver instant finality and predictable costs, enhancing both user experience and protocol reliability

- Tailor validator incentives to align with unique economic models or community goals

This modular approach is rapidly gaining traction as DeFi protocols seek to escape the limitations of shared Layer 1 networks and build application-specific infrastructure. For a deep dive into technical implementation patterns, see our guide on supercharging custom app-chains with dynamic fee markets.

Dynamic Fees: Unlocking Capital Efficiency and Growth

The DeFi ecosystem thrives on innovation, but true scalability demands more than just faster consensus or higher throughput. It requires economic models that align incentives across users, developers, and validators, while keeping costs low and predictable. Dynamic fee markets are uniquely positioned to deliver on these requirements:

How Dynamic Fees Boost Capital Efficiency & Adoption in DeFi

-

Optimized Resource Allocation: Dynamic fee markets, as seen in SKALE and Solana, automatically adjust transaction costs based on real-time network demand. This ensures that resources are allocated efficiently, reducing wasted capacity and minimizing congestion during peak periods.

-

Lower and Predictable Transaction Costs: By adjusting fees in response to network activity, platforms like Ethereum and Solana help users avoid unexpectedly high costs. This predictability encourages more frequent participation and supports smaller transactions, making DeFi more accessible to a broader audience.

-

Enhanced User Experience and Adoption: Custom app-chains with dynamic fees, such as those enabled by SKALE, offer near-zero or tailored transaction fees. This significantly improves transaction speed and cost-effectiveness, driving user adoption and retention in DeFi applications.

-

Incentivized Network Participation: Flexible fee structures can reward early adopters or active users with lower fees, as proposed in Ethereum’s dynamic fee models. This incentivizes both developers and users to engage with DeFi platforms, fostering innovation and ecosystem growth.

-

Scalability for Growing DeFi Markets: As the DeFi market is forecasted to reach around USD 1,558.15 billion, dynamic fee mechanisms help platforms scale efficiently to accommodate increasing transaction volumes without sacrificing performance or user experience.

As we move deeper into the era of modular blockchains and specialized app-chains, expect dynamic fee markets to become a core pillar of next-generation DeFi infrastructure.

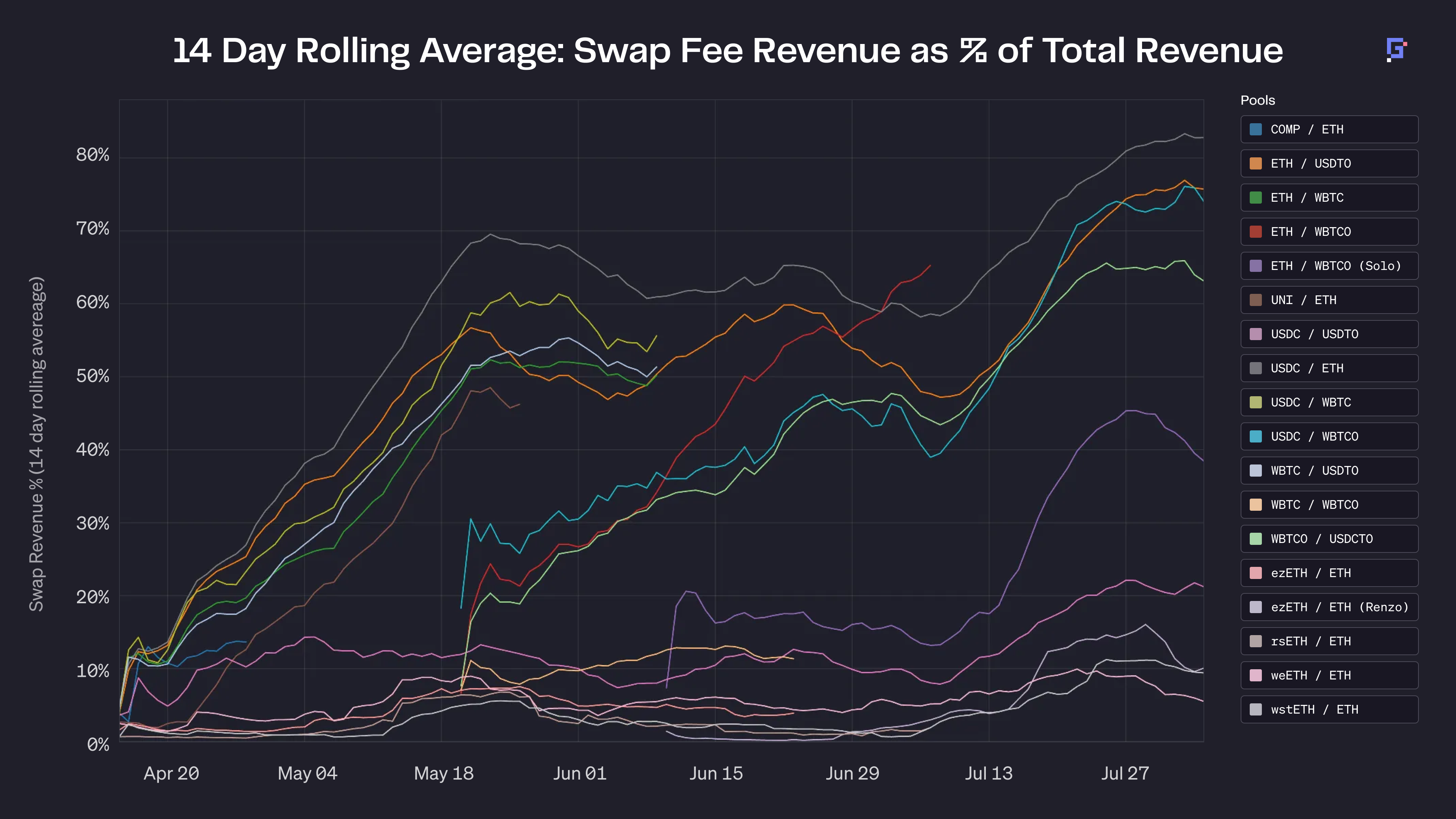

Leading DeFi projects are already leveraging dynamic fee markets to unlock new use cases and business models. For example, automated market makers (AMMs) can use real-time fee adjustments to maintain liquidity and optimize trading costs, while lending protocols dynamically tune fees to manage risk and incentivize stable utilization rates. This adaptability is especially crucial as the DeFi market, currently valued at $32.36 billion, is forecasted to skyrocket to $1,558.15 billion in the coming years, according to Precedence Research. Only blockchains that can efficiently scale both technically and economically will be able to capture this explosive growth.

Importantly, dynamic fee markets do not just benefit users. Validators and infrastructure providers also gain from more predictable and sustainable revenue streams. By decoupling fees from rigid blockspace auctions, custom app-chains can design incentive structures that reward validators for actual performance, uptime, and resource allocation, rather than simply maximizing short-term profits. This alignment of incentives reduces the risk of centralization and strengthens network security, a critical concern as DeFi protocols manage ever-larger pools of capital.

Designing Specialized Fee Structures

Implementing dynamic fee markets on custom app-chains requires careful design and ongoing calibration. Developers must consider:

- Resource Segmentation: Pricing execution, storage, and bandwidth independently to reflect true network costs

- Feedback Loops: Using real-time analytics to adjust fee formulas in response to shifting demand

- Governance Mechanisms: Allowing communities to vote on fee parameters, ensuring adaptability and transparency

For a detailed breakdown of how to implement these specialized fee models, see our technical guide on custom fee markets in application-specific rollups.

The Road Ahead: Toward a Hyper-Scalable DeFi Ecosystem

Dynamic fee markets are more than a technical upgrade, they represent a fundamental shift in how economic value flows through decentralized networks. As DeFi matures, users will demand not just lower fees but also fairness, transparency, and the ability to customize their experience. Custom app-chains, empowered by dynamic fee logic, are poised to deliver on all fronts: capital efficiency, validator incentives, and seamless user experiences.

Developers and protocol designers should view dynamic fee markets as a toolkit for experimentation and optimization. The most successful DeFi platforms will be those that continuously iterate on their fee logic, leveraging data and community feedback to refine their models. As the global DeFi market races toward $1,558.15 billion, the winners will be those who master the art and science of blockchain fee optimization.

For more real-world examples and advanced design patterns, explore our resource on dynamic fee markets in custom app-chains. The future of scalable DeFi will be built on chains that can adapt, optimize, and thrive in any market condition.