In the rapidly evolving world of decentralized finance, adaptive fee structures are emerging as a powerful lever for driving liquidity and trader engagement in custom app-chains. As blockchain applications become more specialized, the need for nuanced, context-aware economic models has never been more apparent. Static fee markets are giving way to dynamic mechanisms that flex in real time, responding to market conditions and aligning incentives across diverse participants.

Why Static Fee Models Fall Short in Modern Blockchain Markets

Traditional automated market makers (AMMs) typically rely on fixed transaction fees. While simple, these static models often fail to reflect the true cost of providing liquidity, especially during periods of heightened volatility or sudden drops in trading activity. This disconnect can lead to inefficient resource allocation, reduced liquidity, and missed opportunities for both traders and liquidity providers (LPs).

Recent research from the International Financial Cryptography Association and arXiv highlights how dynamic fee optimization can more effectively allocate scarce blockchain resources. By adapting fees based on network demand, volatility, or even transaction size, app-chains can create a more efficient and resilient trading environment. The result is not just a fairer system for LPs but also a smoother experience for traders who benefit from predictable and competitive pricing.

The Mechanics of Adaptive Fee Structures

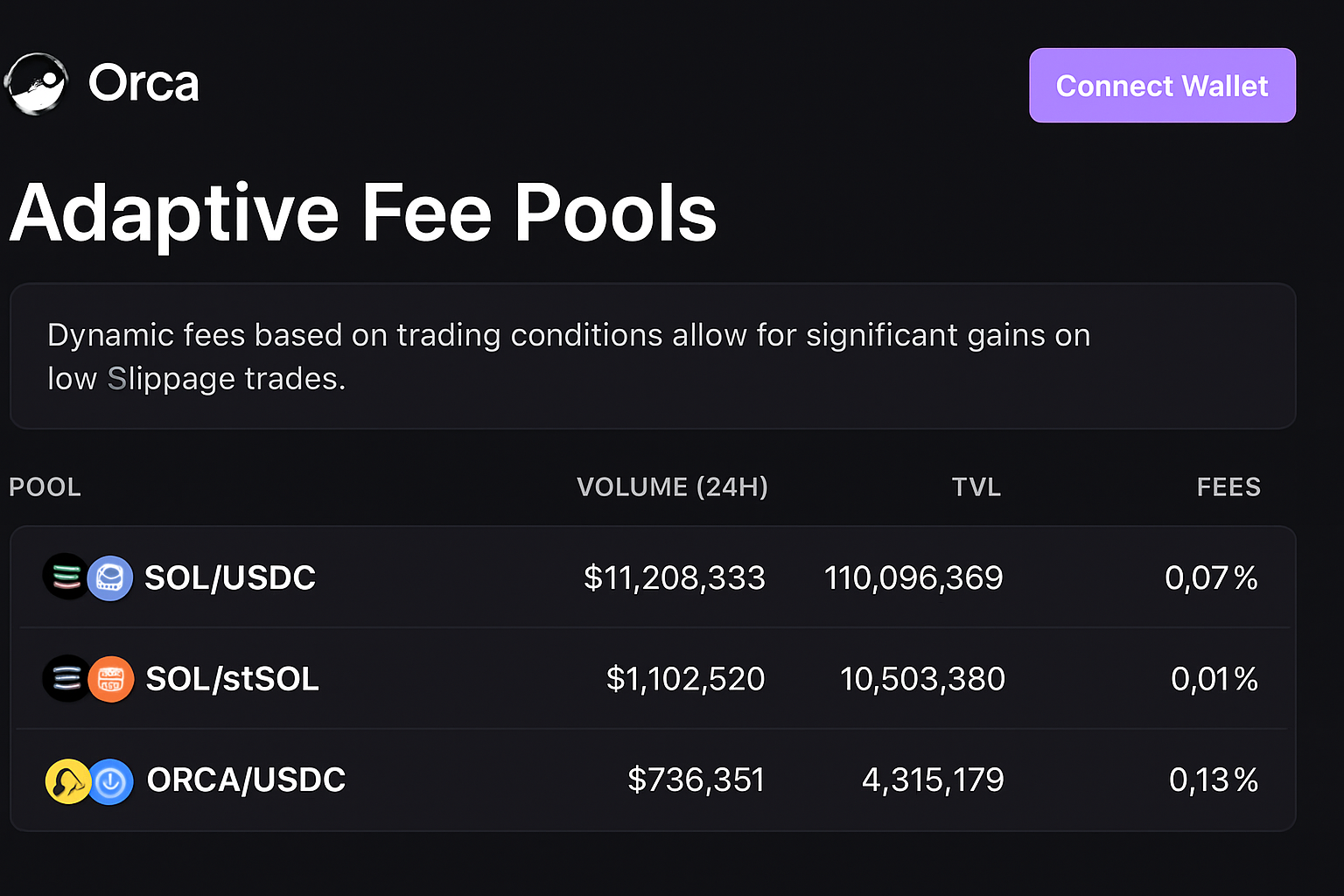

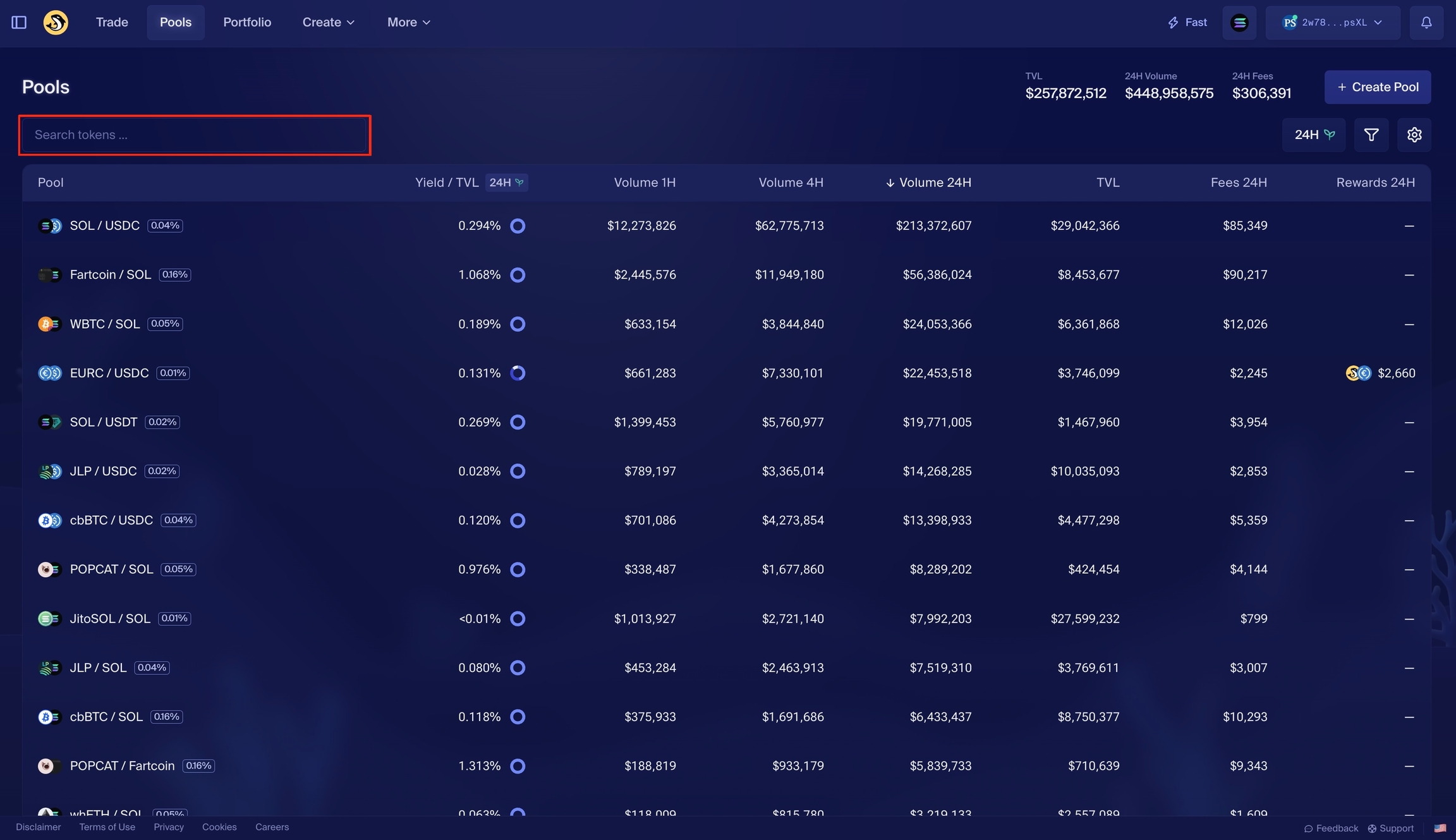

At the heart of these innovations are algorithms that adjust transaction fees in response to real-time market data. For example, protocols like Orca have pioneered adaptive fee pools, where a base fee is augmented by a dynamic component that rises as volatility increases. This ensures LPs are rewarded appropriately during turbulent conditions while lowering barriers for traders when markets stabilize.

Key Benefits of Adaptive Fee Structures for App-Chains

-

Enhanced Liquidity Through Dynamic Incentives: Adaptive fee structures adjust transaction fees in real-time, increasing during volatile periods to reward liquidity providers (LPs) for taking on greater risk and decreasing during stable periods to attract more trading activity. This dynamic approach helps maintain deep liquidity pools and active markets. Learn more about Orca’s Adaptive Fee Pools

-

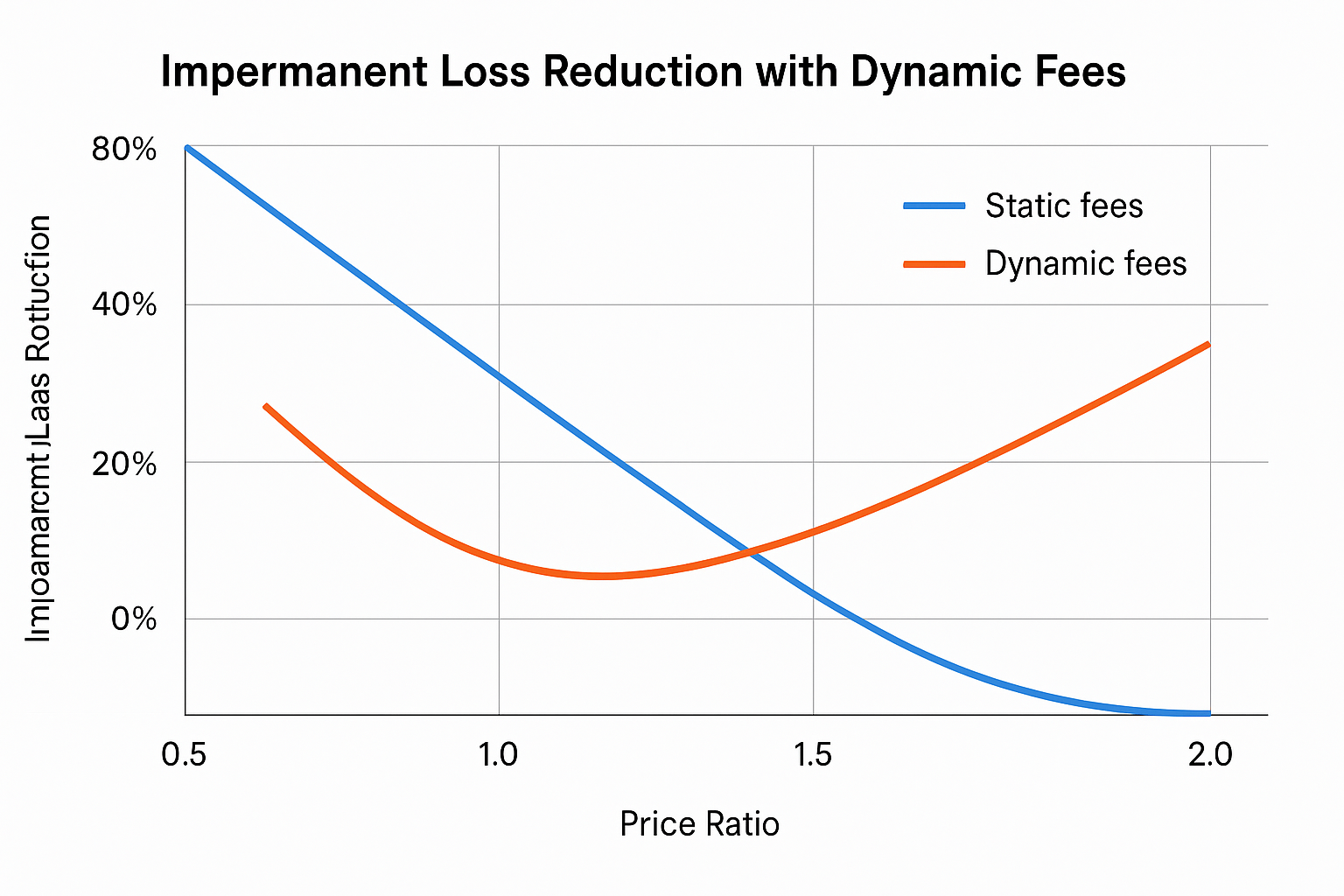

Reduced Impermanent Loss for Liquidity Providers: Research shows that dynamic fee mechanisms can reduce impermanent loss by up to 36% compared to static models, offering LPs better protection against market volatility and price fluctuations. See the research on dynamic fee mechanisms

-

Fair and Predictable Trading Costs: For traders, adaptive fees mean lower costs during stable markets and higher fees during volatility, leading to more predictable and fair pricing. This encourages higher trading volumes when markets are calm and discourages excessive speculation during turbulence.

-

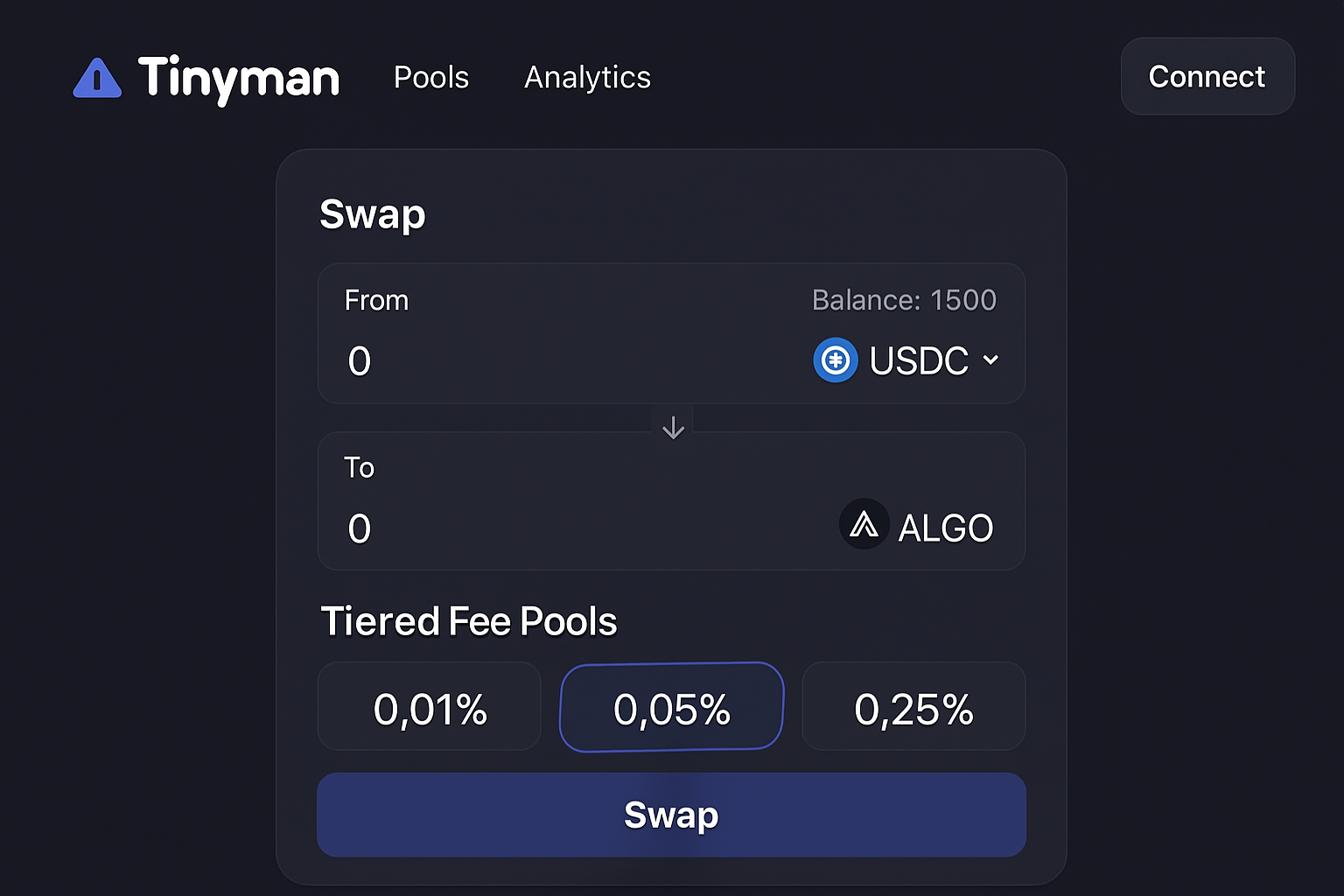

Customizable Fee Structures for Different Asset Types: Custom app-chains can implement tiered or asset-specific fee models. For example, Tinyman on Algorand proposes lower fees for stablecoin pairs and higher fees for exotic pairs, optimizing incentives for different market segments. Read about Tinyman’s tiered fee pools

-

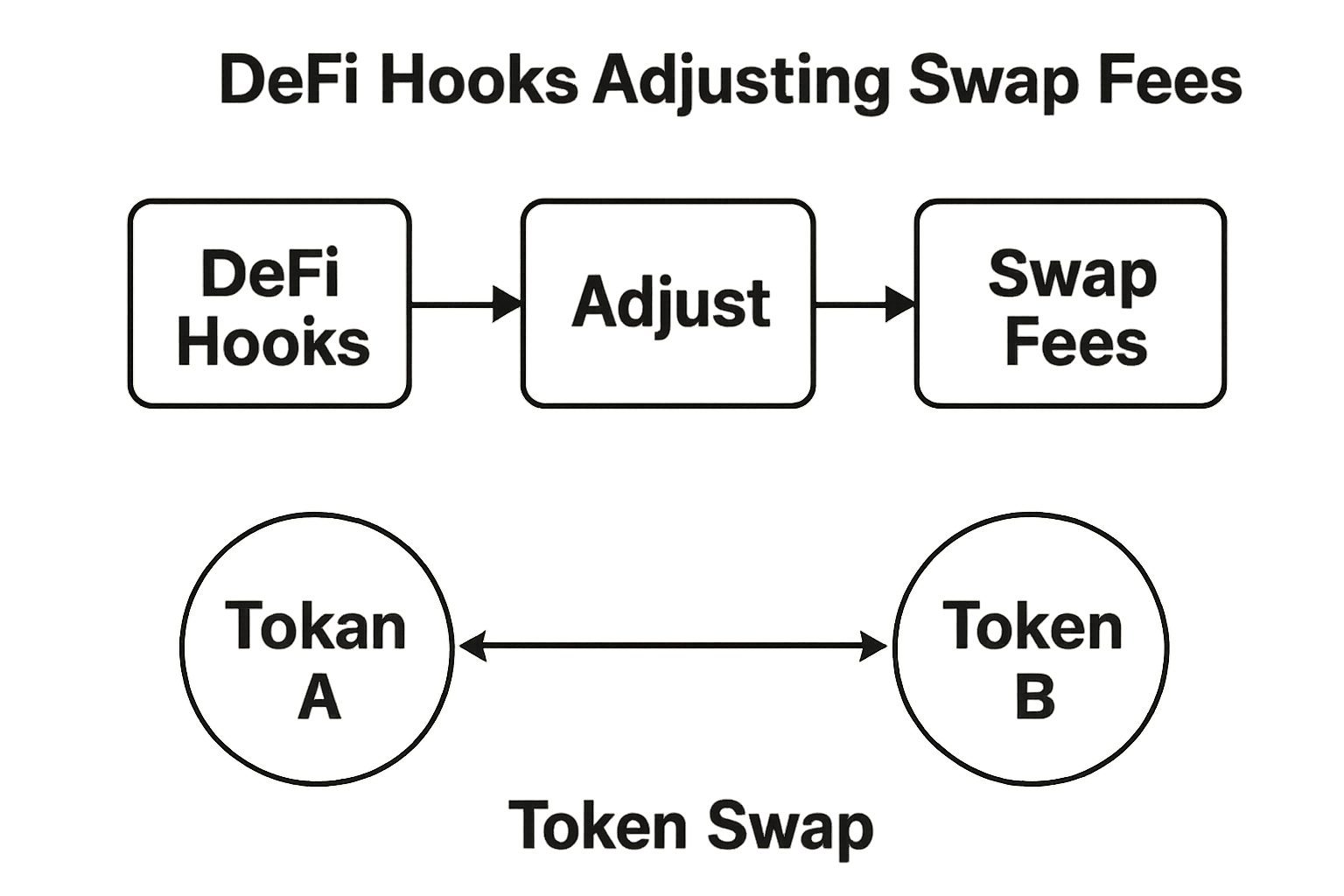

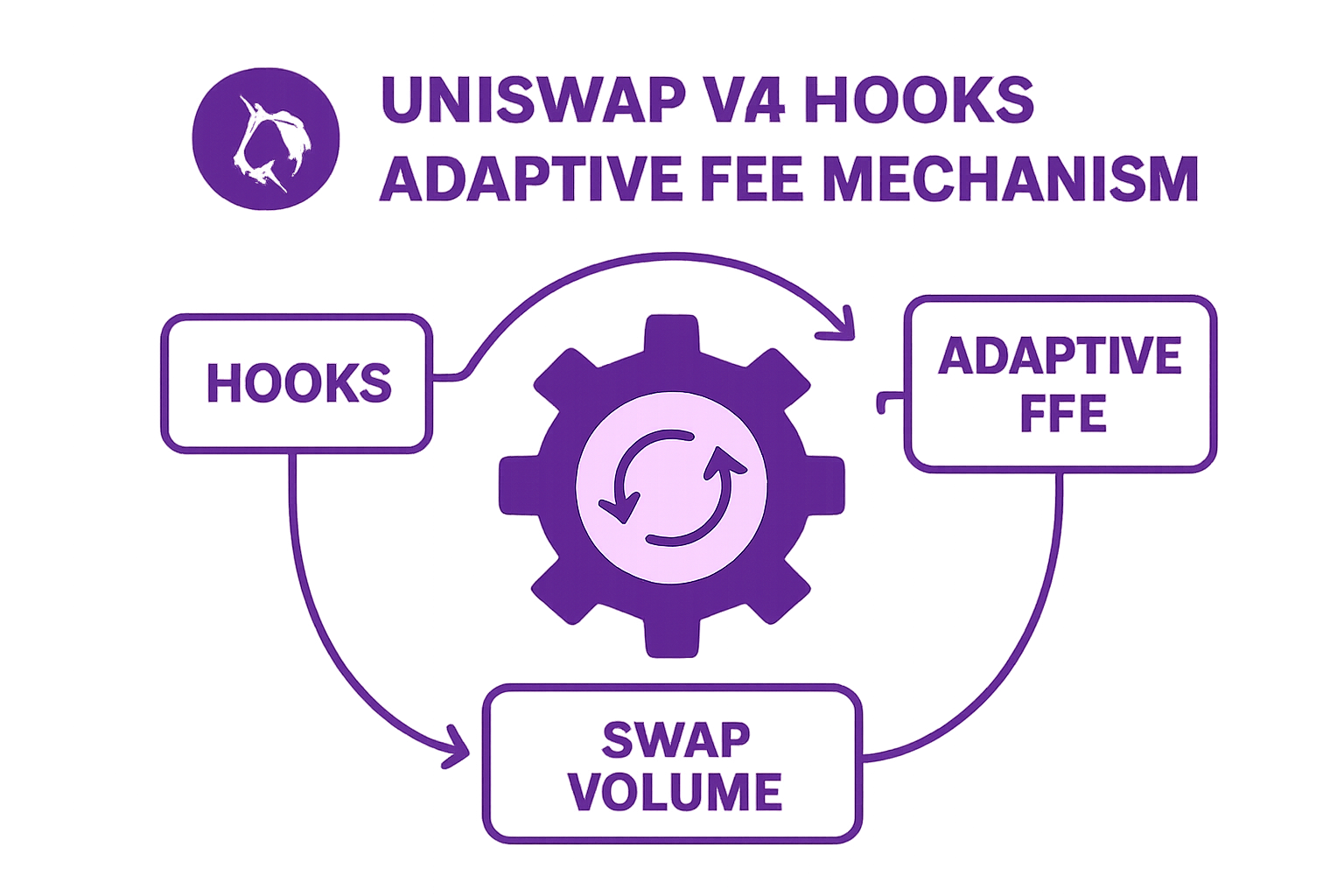

Programmable and Flexible Fee Logic via DeFi Hooks: Innovations like ‘hooks’—externally deployed contracts—enable app-chains to programmatically adjust fees based on factors like transaction size, user behavior, or market volatility, providing a flexible and future-proof approach to fee management. Explore how DeFi hooks work

This approach does more than just tweak numbers, it fundamentally reshapes incentive design within specialized fee markets. Liquidity providers see compensation that matches their risk exposure, potentially reducing impermanent loss by up to 36% compared to static models. Meanwhile, traders encounter lower fees during stable periods, encouraging higher volumes and deeper liquidity pools.

Custom App-Chains: Tailoring Fees to Unique Use Cases

Custom app-chains have an inherent advantage: they can tailor every aspect of their economic model, including fees, to their specific application domain. Take Tinyman on Algorand as an example; its proposed tiered pools assign lower fees to stablecoin pairs (promoting high volume) while applying higher rates to exotic assets where LP risk is greater.

This level of granularity opens the door for truly specialized liquidity incentives, allowing builders to craft environments that reward early trader engagement or encourage long-term capital commitments. The flexibility also supports experimentation with multidimensional fee markets, a trend explored in recent academic work, which could further optimize resource allocation across multiple axes like bandwidth, compute power, or storage.

Technological advances, such as programmable fee “hooks, ” are rapidly expanding what’s possible for custom app-chains. These smart contract extensions allow protocols to adjust fees dynamically based on factors like transaction size, user history, or sudden market swings. For builders, this means the ability to create highly responsive blockchain fee optimization strategies that go far beyond one-size-fits-all models.

As more projects adopt adaptive fee logic, a new generation of application-specific blockchains is emerging, each with its own finely tuned incentive design. This trend is particularly relevant for DeFi protocols seeking to balance early trader rewards with sustainable long-term liquidity. By calibrating fees according to real-time supply and demand, these chains can attract both sophisticated LPs and retail traders looking for fair execution and lower slippage.

Real-World Impacts: More Than Just Lower Fees

The implications of adaptive fee structures go well beyond cost savings. For liquidity providers, dynamic compensation can reduce the risk of impermanent loss and make it more attractive to provide capital during turbulent markets. For traders, the promise lies in better price discovery and reduced front-running, especially when paired with innovations like hooks that can detect and mitigate MEV (maximal extractable value) attacks in real time.

This virtuous cycle, where healthy liquidity attracts active trading, which in turn justifies deeper liquidity pools, is only possible when the underlying fee market is flexible enough to respond to evolving conditions. Adaptive models also pave the way for more inclusive participation by lowering barriers during calm periods while protecting LPs when volatility spikes.

“The future of DeFi will be defined by composable incentive design and specialized fee markets that adapt as quickly as their users do. ”

Looking Ahead: The Roadmap for Custom App-Chain Fee Markets

The next frontier is multidimensional fee markets where resource pricing isn’t limited to swaps alone but extends across compute, storage, and bandwidth, all dynamically priced according to network congestion or application-specific metrics. Early experiments in this direction are already underway on several leading app-chains.

Innovative Adaptive Fee Experiments on Custom App-Chains

-

Orca’s Adaptive Fee Pools on Solana dynamically adjust trading fees based on real-time market volatility. This mechanism increases fees during turbulent periods to better compensate liquidity providers and lowers them during stable times to attract traders, aligning incentives for both groups. Learn more

-

Tinyman’s Tiered Fee Pools on Algorand introduce different fee levels depending on the trading pair’s risk profile. Stablecoin pairs have lower fees to encourage volume, while more volatile or exotic pairs carry higher fees to reward LPs for risk. See Tinyman governance proposal

-

Uniswap v4 Hooks enable developers to deploy external contracts that modify pool behavior, including adaptive fee logic. These hooks can adjust fees in response to market conditions, transaction size, or user activity, offering a flexible approach to fee management on custom app-chains. Explore DeFi hooks on Uniswap v4

-

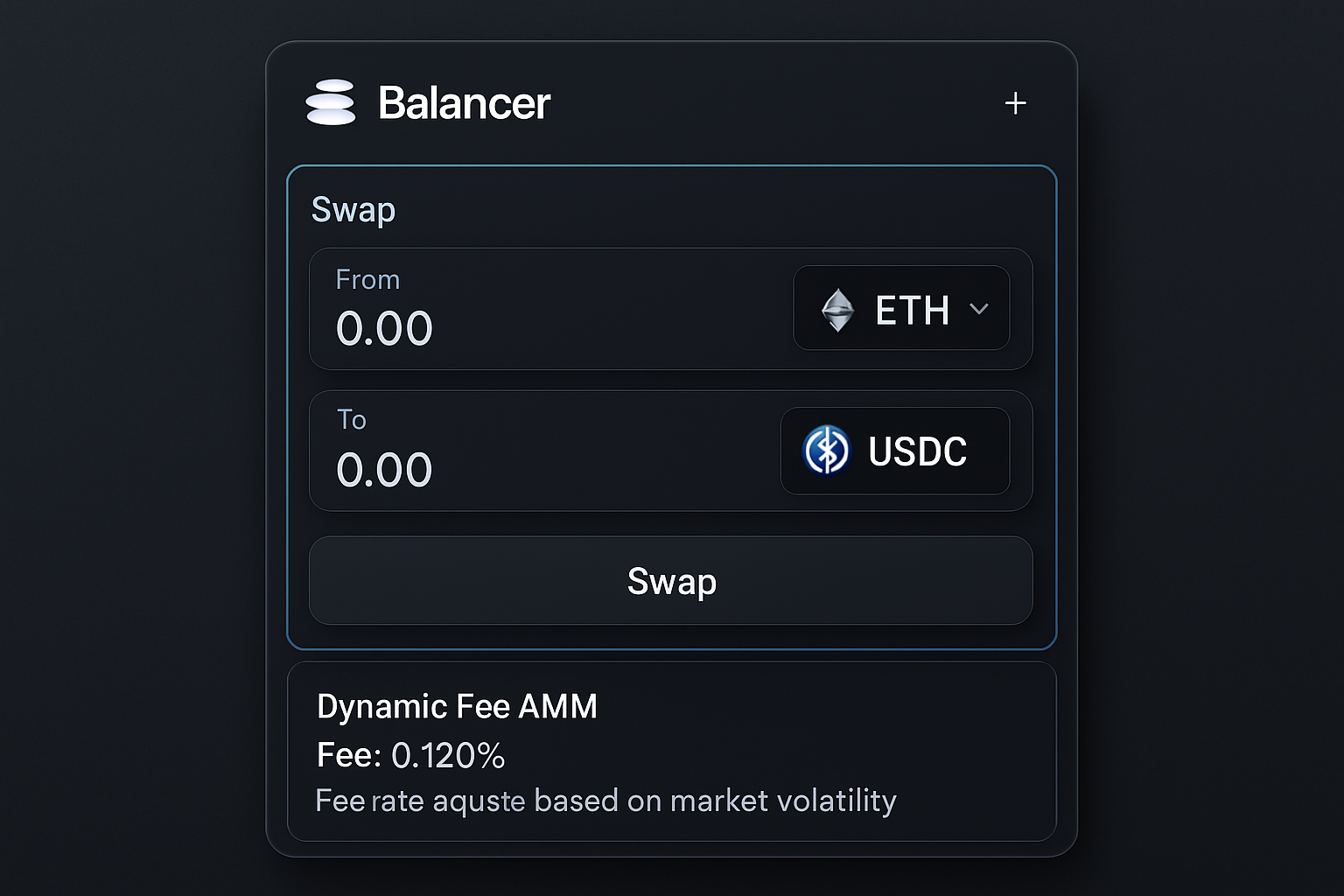

Balancer’s Dynamic Fee AMMs implement self-adjusting fees based on pool volatility and trading volume. Fees automatically rise during high volatility to protect LPs and decrease when markets are calm to encourage trading, optimizing liquidity provision. Read about Balancer dynamic fees

If you’re building or evaluating a new blockchain protocol, understanding how specialized fee markets work, and how they interact with your application’s core mechanics, is essential. These tools don’t just optimize costs; they shape user experience, capital flows, and ultimately the success of your ecosystem.

For a deeper dive into technical patterns and real-world results from adaptive fee markets across leading custom app-chains, explore our guide on how dynamic fee markets power custom app-chains.