When it comes to building scalable, high-performance application-specific rollups, the days of one-size-fits-all fee models are over. Today’s leading projects are pushing the boundaries with custom fee markets for rollups, unlocking new levels of efficiency and user engagement by tailoring economic incentives to their unique ecosystems. Let’s dive into three advanced fee market designs that are setting the pace for next-generation app-chains: the Maker-Taker Fee Model with Customizable Incentives, Dynamic Congestion-Based Fee Adjustment, and Resource-Specific Multidimensional Fee Markets.

Maker-Taker Fee Model with Customizable Incentives

If your rollup is focused on orderbook trading, AMMs, or any scenario where liquidity is king, the maker-taker fee model is a must-have. This structure splits users into two camps: makers, who provide liquidity by placing limit orders or posting liquidity to pools, and takers, who remove liquidity by executing against existing orders. The magic lies in customizing these incentives:

- Makers often pay lower fees, or even receive rebates, to encourage deeper liquidity books.

- Takers pay higher fees for instant execution, which helps fund maker rebates or protocol revenue.

- You can dial in these rates per market or user segment, creating targeted incentives for whales, retail traders, or partners.

- Some chains even experiment with negative maker fees (rebates) when taker demand is strong enough to offset them.

This approach isn’t just theory, it powers some of the most active crypto venues today. By letting you tweak maker/taker ratios and apply custom logic (like VIP tiers or seasonal promotions), your app-chain can attract sticky liquidity and keep order books healthy through all market cycles. For a deeper technical guide on implementing this model in your stack, check out our resource on Implementing Custom Fee Markets in Application-Specific Rollups.

Dynamic Congestion-Based Fee Adjustment

The era of static gas prices is fading fast, especially as blockspace becomes more valuable and user flows more unpredictable. Enter the world of dynamic congestion-based fee adjustment. Here’s how it works:

- Your rollup monitors real-time network activity, think mempool congestion, recent block utilization, or spikes in transaction demand.

- Fees automatically adjust up or down based on network load. When things get busy (NFT drops, liquidations), fees rise to prioritize urgent transactions and prevent spam.

- This keeps your chain responsive while smoothing out volatility, users aren’t left guessing what they’ll pay next block.

- You can layer additional logic: time-of-day discounts, surge pricing for specific dApps, or loyalty-based fee caps.

The result? Efficient allocation of blockspace during peak periods and fairer access for all users. Dynamic pricing also creates new opportunities for builders to design specialized economic models that reward long-term participation while keeping short-term speculators in check. For more real-world examples of dynamic fee markets powering custom app-chains, explore our article on How Dynamic Fee Markets Power Custom App-Chains: Real-World Examples and Design Patterns.

3 Advanced Fee Models for Custom Rollups

-

Maker-Taker Fee Model with Customizable Incentives: This model differentiates between makers (who add liquidity) and takers (who remove liquidity), offering lower fees or even rebates to makers. Leading platforms like MAGIC-FI and Injective implement customizable maker-taker structures, enabling flexible incentives to boost liquidity and trading activity.

-

Dynamic Congestion-Based Fee Adjustment: Fees automatically adjust in real time based on network congestion, trading volume, or volatility. Uniswap v4 and other advanced rollups use dynamic fee mechanisms to optimize for market conditions, ensuring fair pricing and efficient resource allocation.

-

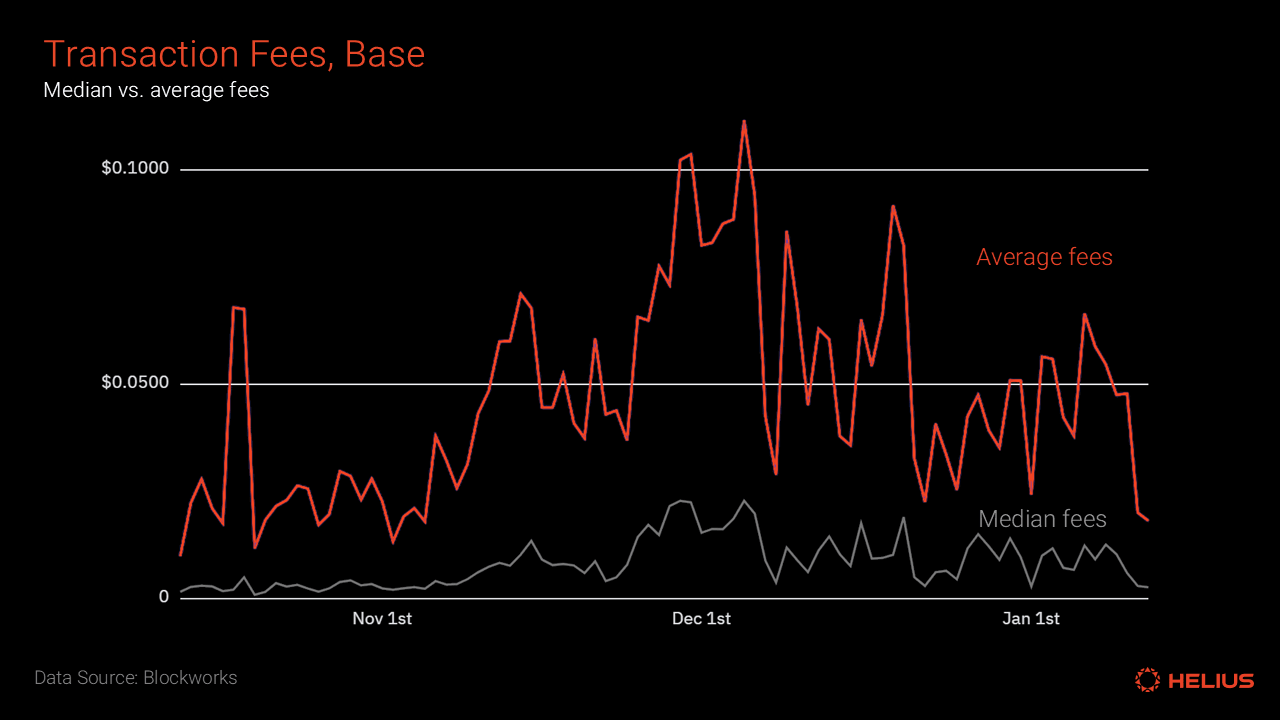

Resource-Specific Multidimensional Fee Markets: This model prices multiple non-fungible resources—like bandwidth, computation, and storage—individually. Solana and other high-performance blockchains are pioneering multidimensional fee markets, enabling granular, demand-driven pricing for each resource type.

Resource-Specific Multidimensional Fee Markets

The next frontier in application-specific blockchain fee structures? Pricing not just transactions, but every critical resource your chain consumes. That’s where resource-specific multidimensional fee markets come into play:

- Instead of charging a flat gas price per transaction, your rollup can assign separate fees for bandwidth (data), computation (CPU), storage (state), and even custom resources like oracle calls or privacy features.

- This granular approach enables ultra-efficient resource allocation, power users pay more when they push system limits while lightweight interactions stay cheap.

- You can dynamically tune each dimension based on real-time usage data, think surges in storage demand during NFT mints or extra compute required for ZK proofs.

- This model is especially powerful for modular chains serving diverse dApps with wildly different needs.

Pioneered by networks like Solana and inspired by cutting-edge research (see our technical guide here), multidimensional fee markets open up new possibilities for scaling without sacrificing fairness or composability. As application-specific rollups mature into full-featured ecosystems, expect this approach to become standard practice among top builders looking to maximize throughput and minimize user friction.

But how do you actually put these advanced models into practice? The secret sauce is in combining flexibility with transparency. Builders need to surface clear fee schedules, provide real-time analytics, and offer responsive support as user behaviors shift. This is where on-chain governance and data dashboards become essential tools for iterating on your fee market design.

Let’s break down the core benefits and trade-offs of each model so you can choose the right mix for your custom app-chain:

3 Advanced Fee Models Powering Modern Rollups

-

Maker-Taker Fee Model with Customizable IncentivesPopularized by platforms like MAGIC-FI and Injective Protocol, this model differentiates between ‘makers’ (who add liquidity) and ‘takers’ (who remove it). Makers often pay lower fees or even receive rebates, while takers pay higher fees for instant execution. Customizable incentives—like negative maker fees—help attract liquidity and optimize trading activity.

-

Dynamic Congestion-Based Fee AdjustmentPlatforms such as Uniswap v4 have pioneered dynamic fee structures that automatically adjust based on real-time network congestion, trading volume, or volatility. This ensures that fees remain fair and responsive, optimizing both liquidity provider returns and user experience as market conditions shift.

-

Resource-Specific Multidimensional Fee MarketsInspired by research and implemented on platforms like Solana, multidimensional fee markets allow rollups to price resources—such as bandwidth, computation, and storage—independently. This granular approach enables efficient scaling and the introduction of custom order types, tailoring costs to actual resource demand.

Key Considerations When Deploying Custom Fee Markets

- User Experience: Complex fee structures can be daunting. Use simple UI/UX cues and educational prompts to help users understand what they’re paying for and why.

- Liquidity and Growth: Maker-taker incentives are fantastic for bootstrapping liquidity but require careful calibration as your market matures. Watch out for scenarios where rebates outweigh protocol revenue.

- Network Health: Dynamic congestion-based fees help prevent spam and ensure blockspace is allocated efficiently, but overly aggressive surges may price out smaller users.

- Ecosystem Diversity: Multidimensional fee markets shine when your chain supports a wide variety of dApps or resource-heavy protocols, think gaming, DeFi, or AI compute marketplaces.

If you’re aiming to build a thriving ecosystem that attracts both power users and newcomers, it’s smart to blend these models. For example, you might combine maker-taker incentives with congestion-based adjustments during major token launches or NFT drops, while layering on resource-specific pricing for bandwidth-hungry apps. This hybrid approach keeps your chain adaptable without sacrificing predictability or fairness.

If there’s one lesson from the latest research and production chains, it’s this: custom app-chain economic models are not just about squeezing out more protocol revenue, they’re about building sustainable communities where everyone from whales to weekend traders has a seat at the table.

The future belongs to those who experiment boldly. Whether you’re optimizing liquidity with maker-taker tiers, smoothing out volatility with dynamic congestion pricing, or unlocking new business models via multidimensional fees, now is the time to stake your claim in the evolving landscape of application-specific blockchain fee structures.

Eager to get hands-on? Dive deeper into implementation strategies and technical walkthroughs in our guides on Implementing Custom Fee Markets in Application-Specific Rollups and How Dynamic Fee Markets Supercharge Custom App-Chains: A Technical Guide. And if you’re ready to push boundaries even further, check out our coverage on real-world deployments at How Dynamic Fee Markets Power Custom App-Chains: Real-World Examples and Design Patterns.