Custom fee markets are emerging as the strategic backbone of application-specific blockchains, or app-chains. Unlike general-purpose blockchains that use one-size-fits-all fee models, app-chains can fine-tune their economic engines to match the unique demands of their underlying applications. This shift is not just a technical upgrade, it’s a fundamental change in how blockchain resources are allocated, user experiences are shaped, and network value is captured.

Why App-Chains Need Custom Fee Markets

Generalized blockchains like Ethereum rely on a single-dimensional fee metric, think of gas, as the arbiter of transaction costs. While effective for broad composability, this approach often leads to inefficiencies, especially as congestion spikes or resource needs diverge between applications. In contrast, application-specific blockchains can design specialized fee structures that directly reflect their operational priorities: computational throughput for DeFi protocols, bandwidth optimization for real-time games, or storage efficiency for decentralized file systems.

This ability to tailor fees at the app-chain level empowers developers to:

- Optimize resource allocation across computation, storage, and bandwidth

- Enhance user experience by minimizing unnecessary costs and volatility

- Create new economic models that align with the incentives of both users and validators

- Deter spam and manipulation with context-aware pricing and penalties

The result? More scalable networks and more sustainable ecosystems, a necessity as blockchain adoption enters its next macro cycle.

The Blueprint: Multidimensional Fee Structures

The heart of custom app-chain fee design lies in moving beyond flat pricing. Instead of charging a uniform rate per transaction, multidimensional fee markets assign distinct prices to different resources consumed. For example:

- Computation: Measured in CPU cycles or smart contract execution steps

- Storage: Priced per byte or data access frequency

- Bandwidth: Based on transaction size or message frequency across the network

- Custom constraints: Such as oracle calls or privacy operations unique to the application domain

This granular approach allows for dynamic rebalancing as network conditions evolve. Research from Diamandis et al. (2022) underscores that such frameworks not only improve efficiency but also create fairer marketplaces, where users pay for what they actually use rather than subsidizing unrelated activity.

If you want a deeper dive into design patterns behind these multidimensional structures, and real-world examples, explore our technical guide on dynamic fee markets powering custom app-chains.

Pillars of Dynamic Pricing Mechanisms in App-Chains

The static fee schedules of legacy chains are relics in an era where demand can spike unpredictably. Dynamic pricing mechanisms empower app-chains to set fees according to real-time resource usage and congestion levels. Here’s how this works in practice:

- Real-time adjustment: Fees rise during periods of high demand (preventing spam), then drop back during lulls (encouraging participation)

- User prioritization: Transactions can specify higher fees for faster inclusion or accept lower fees for delayed processing, enabling market-driven queueing without central intervention

- Ecosystem incentives: Validators/miners are rewarded proportionally to actual work performed across all dimensions, not just raw transaction count, aligning security with true resource consumption

This adaptive model is already being leveraged by sovereign rollups and modular chains seeking fine-grained control over their economics. It’s also a critical step toward unlocking new blockchain use cases that require predictable throughput and cost structures.

The next section will unpack how customization extends even further, from token selection to tiered pricing models, and examine best practices in ensuring fairness and security within these specialized markets.

Customization is where specialized fee markets truly differentiate application-specific blockchains from their monolithic predecessors. By giving developers the latitude to select transaction fee tokens, set up fee subsidies, or even design tiered pricing based on transaction urgency or user profiles, app-chains can closely align their economic models with community needs and business strategy. This is not just about technical optimization – it’s about shaping network culture, user acquisition, and long-term sustainability.

Advanced Customization: Beyond One-Size-Fits-All

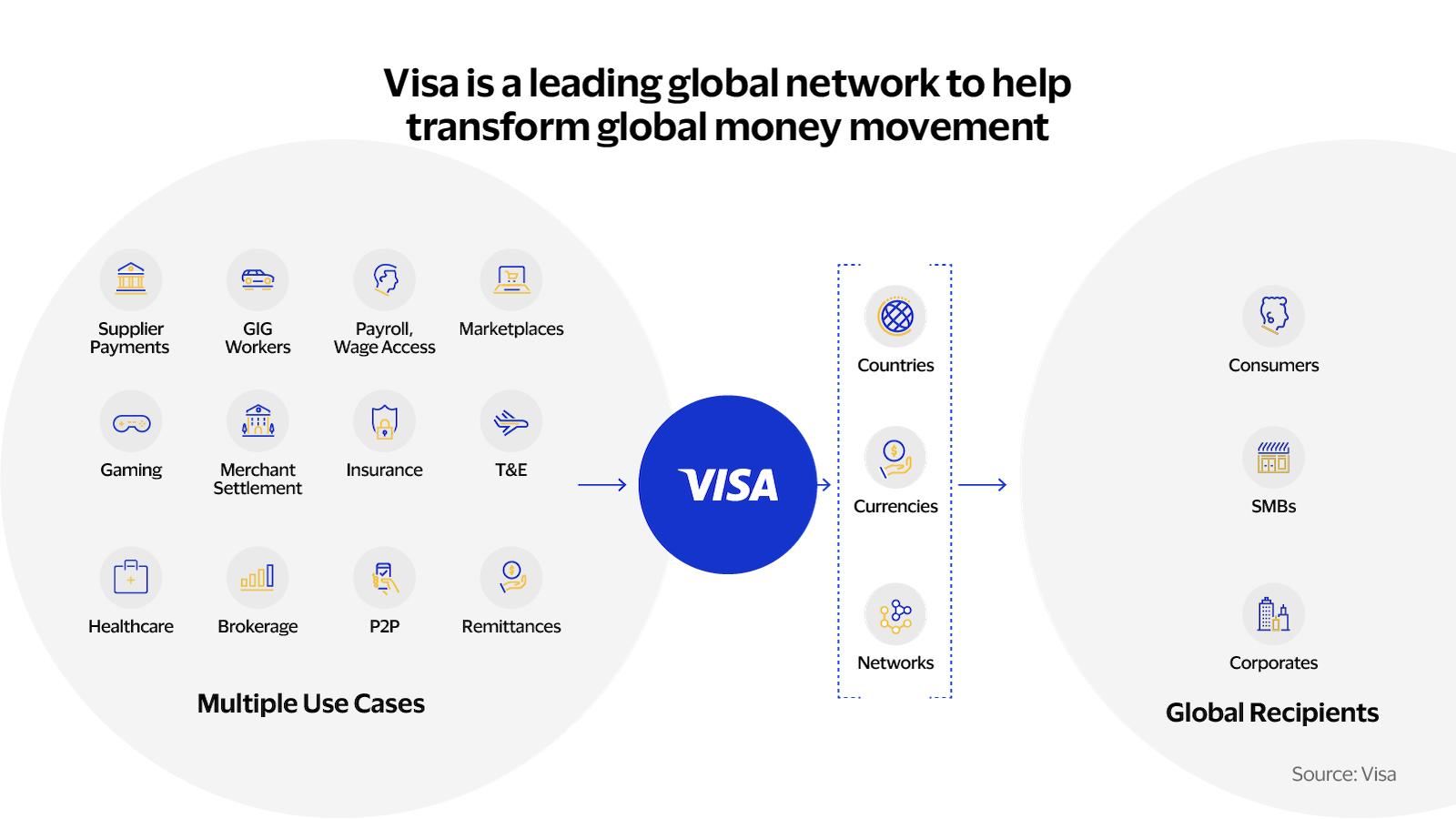

Consider an NFT marketplace chain that subsidizes minting fees for verified creators during off-peak hours, or a DeFi protocol that introduces a maker-taker model to encourage liquidity provision. These are not theoretical; they are live experiments in economic engineering now possible thanks to custom fee market tooling. The flexibility extends to:

- Token selection: Allowing users to pay fees in various assets, not just the native token

- Fee rebates and rewards: Incentivizing behaviors that benefit network health (such as batching transactions or providing liquidity)

- Tiered access: Offering premium throughput for mission-critical applications while keeping baseline access affordable for all

- Dynamic minimums: Setting adaptive floor prices to prevent spam without stifling genuine usage

This level of customization enables app-chains to break free from the constraints of legacy networks and build fee structures that support their core value proposition. For more on how adaptive fees drive engagement and liquidity, see our analysis on adaptive fee structures in custom app-chains.

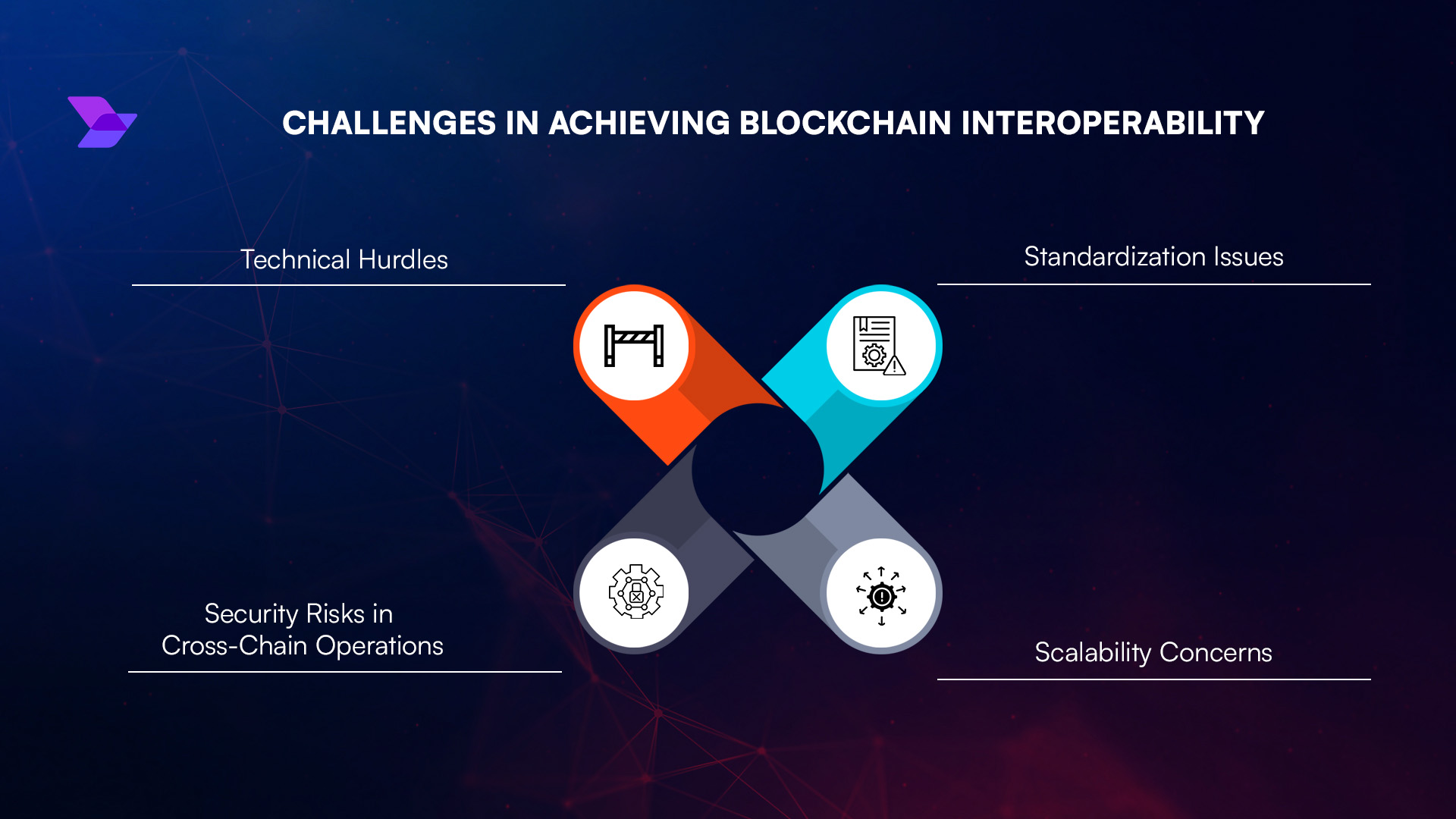

Safeguarding Security and Fairness

No matter how sophisticated the fee model, security and fairness must remain at the forefront. Specialized app-chain markets need robust anti-manipulation mechanisms: minimum base fees calibrated dynamically, penalties for resource abuse, and transparent pricing algorithms that can be audited by the community. This transparency is vital for user trust – if users can predict costs and understand how fees are set, they’re more likely to participate and contribute value.

The best designs also consider edge cases: How does the system respond under stress? Are there fallback mechanisms if one resource becomes bottlenecked? How do validators resolve disputes over resource accounting? These questions should be addressed upfront in any production-grade app-chain rollout.

Best Practices for Securing Custom Blockchain Fee Markets

-

1. Quantify Resource Usage Precisely: Begin by identifying and measuring how your appchain consumes resources—such as computation, storage, and bandwidth. This data-driven approach ensures fees are aligned with actual network demands, laying a secure foundation for your fee market.

-

2. Adopt Multidimensional Fee Structures: Implement separate fees for different resources (e.g., computation vs. storage), as recommended in Diamandis et al. (2022). This granular pricing model prevents resource abuse and enhances overall security.

-

3. Leverage Dynamic Pricing Mechanisms: Use real-time, demand-based fee adjustments to deter spam and denial-of-service attacks. Dynamic pricing helps maintain network performance and aligns incentives for honest participation.

-

4. Customize Fee Models to Fit Application Needs: Tailor your fee market—choose the transaction fee token, offer fee subsidies, or set tiered pricing. Customization ensures predictable, fair, and secure user experiences, boosting trust and adoption.

-

5. Implement Security and Fairness Mechanisms: Integrate minimum fees, penalties for abuse, and transparent rules to prevent manipulation. Fair access controls and clear policies are vital for a secure and robust fee market.

-

6. Continuously Monitor and Iterate: Regularly analyze fee market metrics—like throughput and resource utilization—to detect anomalies and optimize performance. Ongoing iteration keeps your fee market resilient to evolving threats.

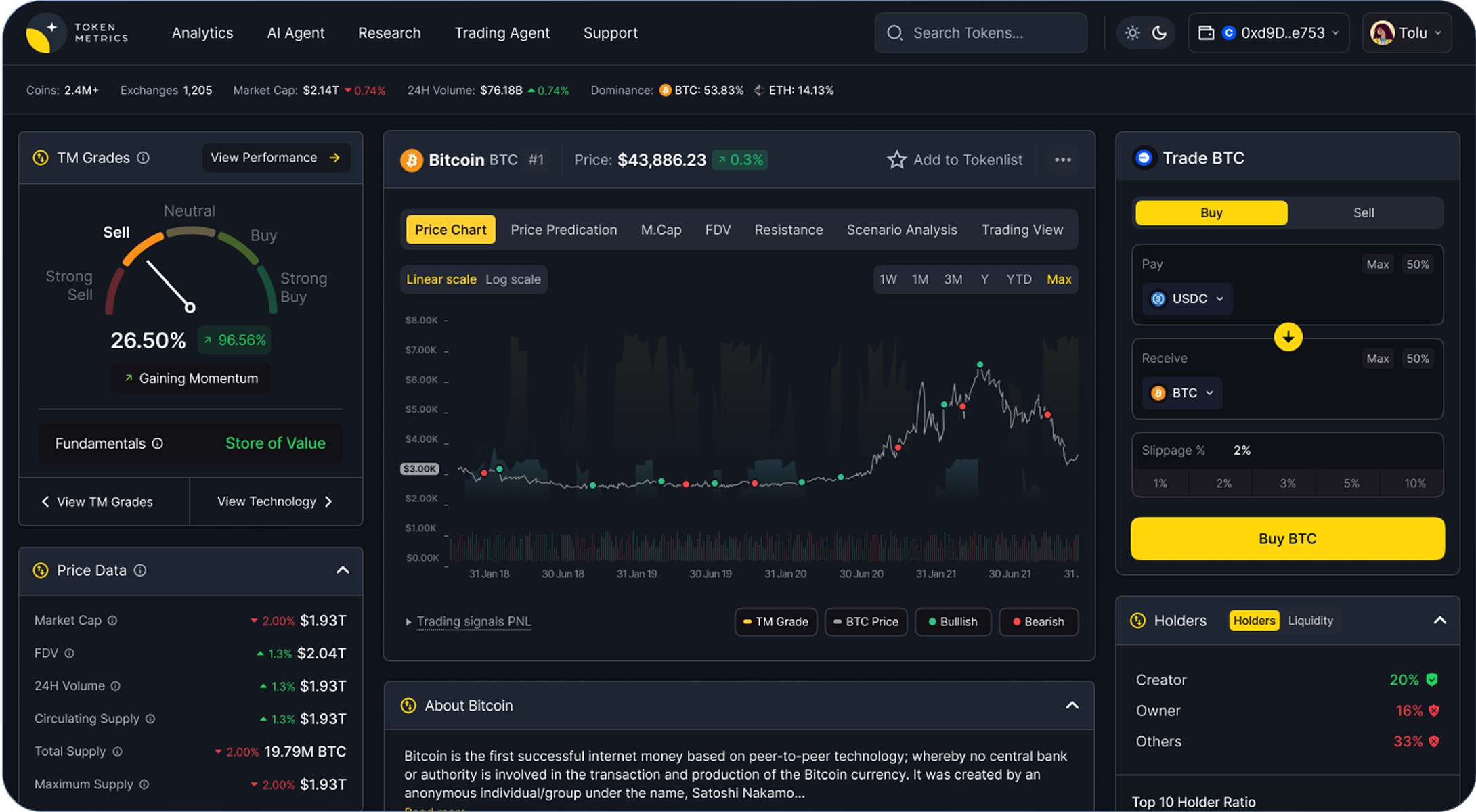

Continuous Monitoring and Iteration: The Feedback Loop

The most successful application-specific blockchains treat their fee markets as living systems. Continuous telemetry on transaction throughput, average fees across dimensions, resource utilization spikes – all this data feeds back into iterative upgrades. As user behavior shifts or new attack vectors emerge, developers must be ready to recalibrate pricing formulas or introduce new incentive levers.

This agile approach distinguishes modern app-chains from static Layer 1s. By embracing ongoing experimentation – guided by clear metrics and real-world feedback – teams can ensure their networks remain efficient, accessible, and secure as market conditions evolve.

If you’re building your own custom rollup or application chain, remember: your fee market isn’t just a technical detail. It’s your primary interface with users and validators alike – a lever for growth, resilience, and differentiated value creation in an increasingly modular blockchain landscape.

For a deeper dive into design methodologies and real-world examples of dynamic pricing in action, explore our technical guide on how dynamic fee markets supercharge custom app-chains.