Programmable sequencers are fundamentally reshaping the landscape of custom app-chains, giving developers granular control over transaction ordering, economic incentives, and network governance. As we move into late 2025, the demand for highly specialized fee markets and flexible sequencing logic is driving a new era of blockchain scalability and application-specific optimization.

Why Programmable Sequencers Matter for Custom App-Chains

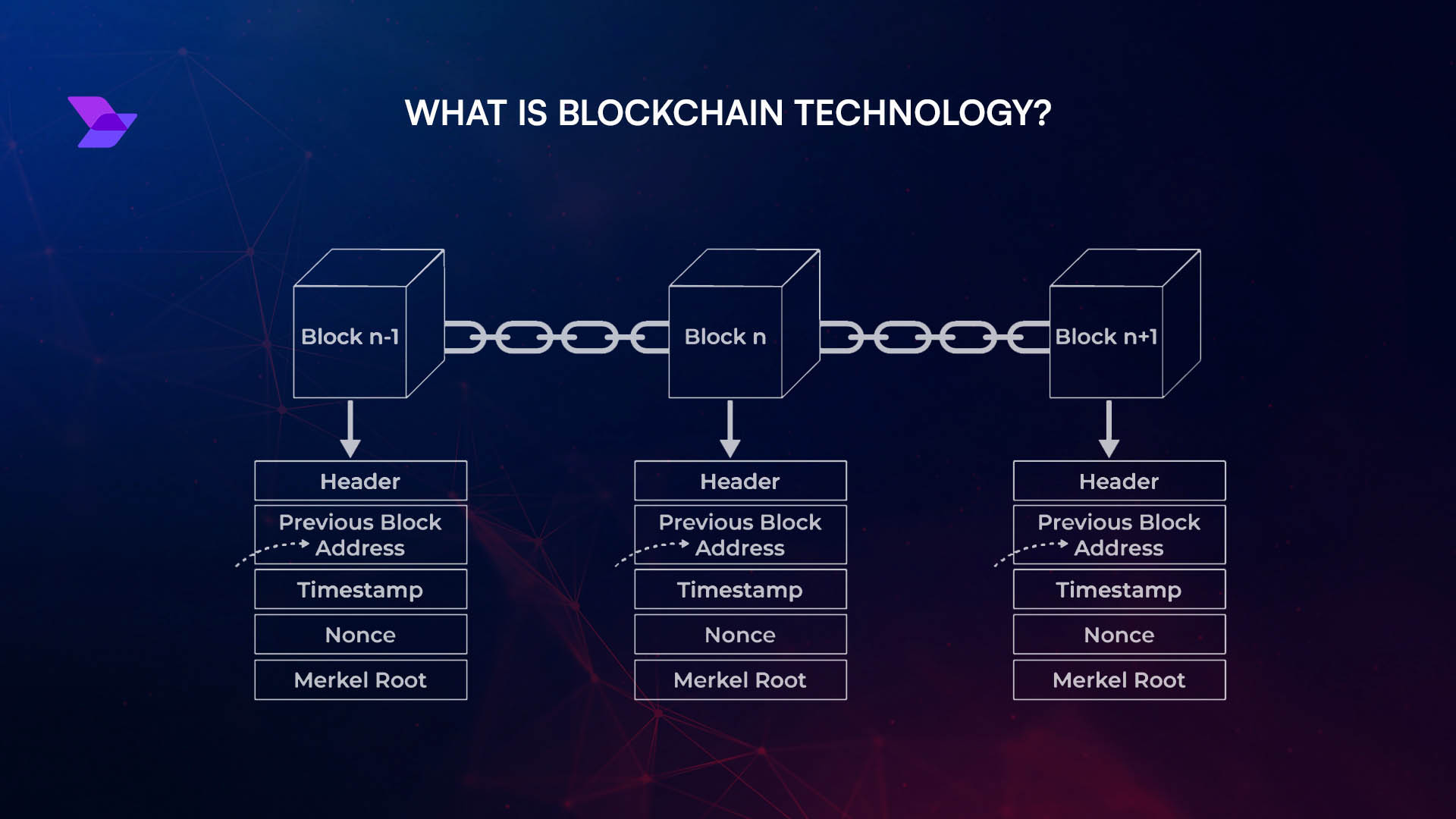

At the heart of every blockchain is a sequencer, a component responsible for determining the order in which transactions are processed. Traditionally, sequencers have operated as centralized or semi-centralized entities, introducing risks such as censorship, single points of failure, and fee monopolization. These limitations have become increasingly untenable for modern decentralized applications that require bespoke economic models and predictable performance.

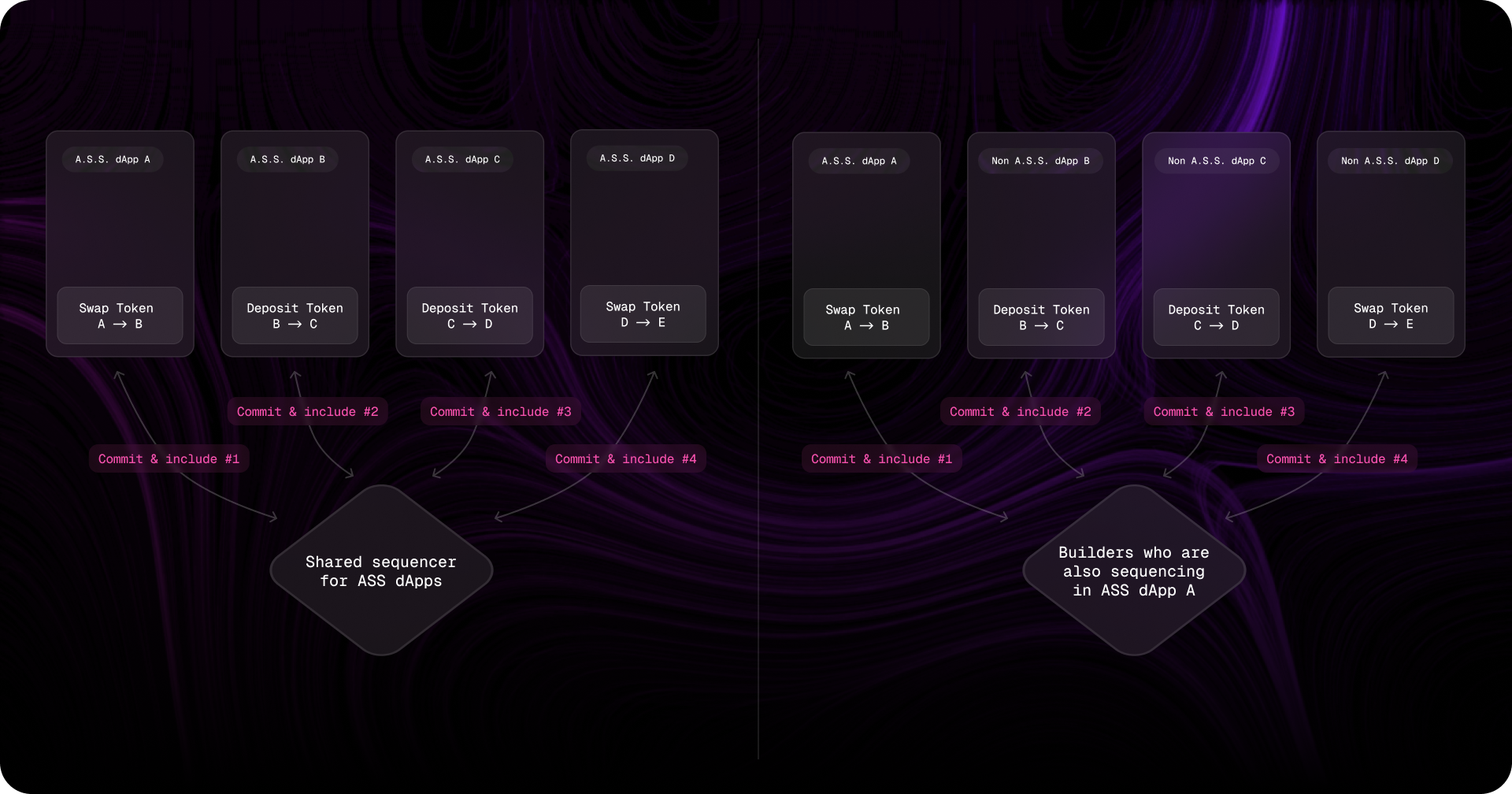

Programmable sequencers solve these issues by embedding transaction ordering logic directly into smart contracts. This on-chain programmability means developers can define exactly how transactions are included in blocks, who can participate in sequencing, and how fees are allocated, all without relying on opaque offchain services. The result is a transparent, auditable process that aligns with the ethos of decentralization while unlocking new possibilities for custom app-chain fee markets.

The Mechanics: How Programmable Sequencer Contracts Enable Flexible Fee Markets

With programmable sequencers now live via platforms like Syndicate (SYND), developers can build tailor-made fee markets optimized for their application’s unique needs. This flexibility manifests in several key ways:

- Isolated Fee Markets: By keeping each app-chain’s fee market separate, spikes in unrelated network activity no longer cause unpredictable gas fees or degrade user experience. This isolation is critical for DeFi protocols and gaming platforms where cost predictability is paramount.

- Customizable Inclusion Rules: Developers can write smart contract logic to prioritize certain transaction types, whitelist addresses, or implement fair ordering algorithms that reduce frontrunning and MEV extraction.

- Diverse Economic Models: Whether it’s implementing EIP-1559-style auctions or novel flat-fee systems, programmable sequencers allow teams to experiment with dynamic pricing mechanisms tailored to their users’ needs.

This approach not only increases resilience but also enables new forms of value capture, such as directing a portion of execution revenue or MEV back to protocol stakeholders or DAOs. For an in-depth technical dive into these mechanisms, see our coverage on how programmable sequencer contracts enable custom fee markets on app-chains.

Syndicate (SYND) and the Rise of On-Chain Sequencing Tokens

The October 2025 launch of Syndicate (SYND) marks a pivotal moment for programmable sequencing infrastructure. SYND serves as both the native token powering sequencing operations and as an incentive mechanism within custom app-chains built atop its protocol. By moving sequencing logic from centralized operators into transparent smart contracts governed by SYND holders, Syndicate eliminates key trust assumptions while offering full composability with other DeFi primitives.

This model has already seen adoption across multiple verticals, from NFT marketplaces requiring rapid settlement finality to financial derivatives platforms demanding granular control over block inclusion rules. As more projects leverage SYND’s on-chain flexibility, expect further innovation around dynamic pricing strategies and permissionless participation models.

Evolving Market Dynamics: Real-World Use Cases

The impact of programmable sequencers extends beyond technical architecture, it fundamentally alters how fees are set, collected, and distributed across networks. For example:

- Tanssi’s global pool model assigns multiple sequencers per network to maximize uptime while preventing single-operator dominance over MEV flows.

- Starknet’s transition to decentralized sequencing brings EIP-1559-based fee markets directly onto L2s, enabling sub-second feedback loops and improving throughput without sacrificing neutrality.

This shift empowers developers to design networks where economic incentives align precisely with application goals, whether that means subsidizing user transactions during high-volume periods or introducing loyalty-based discounts for power users. For more about dynamic market design possibilities enabled by this technology stack, explore our guide on dynamic fee markets powering scalable custom app-chains.

As programmable sequencers become the new standard, the boundaries of what’s possible with custom app-chain fee markets are rapidly expanding. Developers are no longer constrained by monolithic, one-size-fits-all economic models. Instead, they can iterate on on-chain sequencer flexibility to achieve fine-grained control over network resources and user incentives.

Design Patterns for Specialized Fee Markets in 2025

In the current landscape, we’re seeing several design patterns emerge among top-performing custom app-chains:

- Dynamic Congestion Pricing: By leveraging real-time network analytics, programmable sequencers can adjust base fees or introduce surge pricing during periods of high demand. This ensures liveness while protecting core users from predatory fee spikes.

- MEV Redistribution Schemes: Instead of MEV being captured exclusively by sequencers or validators, smart contract logic enables redistribution to DAOs, liquidity providers, or even back to end-users as rebates.

- Access-Controlled Fee Tiers: Applications can implement tiered fee structures based on user reputation, staking participation, or NFT ownership, rewarding loyal contributors and deterring spam.

This level of configurability is only possible because sequencing rules are now defined at the protocol layer via smart contracts rather than dictated by offchain operators. For a deeper dive into these approaches and their technical implementation, see our resource on designing custom fee markets for application-specific blockchains.

The composability of programmable sequencers also opens doors for cross-chain collaboration and shared liquidity models. App-chains can coordinate fee policies or bundle transactions atomically across domains without sacrificing sovereignty over their own economic parameters.

Risks and Trade-Offs in Programmable Sequencer Architectures

No system is without trade-offs. While programmable sequencers offer unmatched flexibility and transparency, they also introduce new vectors for complexity and governance risk. Poorly designed sequencing logic can lead to unintended economic outcomes or open up new attack surfaces (for example, if inclusion rules are too permissive or MEV capture mechanisms lack proper checks).

This is why rigorous testing and ongoing auditing are essential when deploying novel sequencing algorithms. Protocol teams must carefully balance innovation with operational safety, especially as more value flows through these specialized fee markets.

What’s Next: The Roadmap for App-Chain Sequencing Innovation

The rise of tokens like Syndicate (SYND) signals a broader industry shift toward modular infrastructure where every aspect of transaction processing is upgradable and programmable. As standards mature and more middleware tools emerge for managing sequencing logic on-chain, we expect to see:

- Greater interoperability between app-chains via shared sequencing pools or cross-domain MEV auctions.

- User-facing fee customization, allowing individuals to select preferred inclusion guarantees or opt into specific pricing models at the wallet level.

- Ecosystem-wide experimentation with incentive schemes that blur the lines between users, validators, and protocol governors.

The combination of technical flexibility and economic expressiveness will ultimately define which platforms win developer mindshare in the next cycle.

If you’re building in this space or want to understand how your project could benefit from specialized sequencing infrastructure, check out our advanced technical guide on how dynamic fee markets supercharge custom app-chains.

The bottom line: Programmable sequencers give builders unprecedented power to define transaction flow, optimize user experience, and capture value in ways that simply weren’t possible with legacy blockchain architectures. As adoption accelerates through 2025 and beyond, expect specialized fee markets to become a defining feature of high-performance app-chains, and a catalyst for the next generation of decentralized applications.