Custom app-chains have rapidly evolved from a niche experiment to a foundational layer in the modular blockchain stack. By empowering developers with granular control over execution environments, fee structures, and cross-chain interactions, these purpose-built blockchains are unlocking new frontiers in scalability and user experience. In 2025, the convergence of programmable fee markets and atomic composability is transforming how decentralized applications (dApps) operate across fragmented liquidity pools and diverse ecosystems.

Programmable Fee Markets: Tailoring Economics for Every App

The static, one-size-fits-all gas models of legacy blockchains are giving way to highly customizable fee markets. With custom app-chains, developers can now program transaction fees as first-class logic, enabling dynamic pricing based on network demand, user roles (such as maker-taker or pro-rata models), or even off-chain data feeds.

A leading example is Syndicate (SYND), which provides a decentralized protocol for launching programmable, atomically composable app-chains. Through on-chain governance modules and smart contract-based sorting mechanisms, Syndicate lets teams implement bespoke fee logic that aligns with their unique economic incentives. This flexibility not only optimizes network throughput but also enhances user fairness and reduces friction for both power users and newcomers.

The rise of dynamic fee markets has enabled dApp teams to experiment with innovative monetization strategies, ranging from zero-gas promotional periods to congestion pricing during peak events. As a result, projects deploying on custom app-chains can outpace general-purpose Layer 1s by offering lower costs and tailored experiences without sacrificing security or decentralization.

Atomic Composability: Seamless Multi-Contract Execution

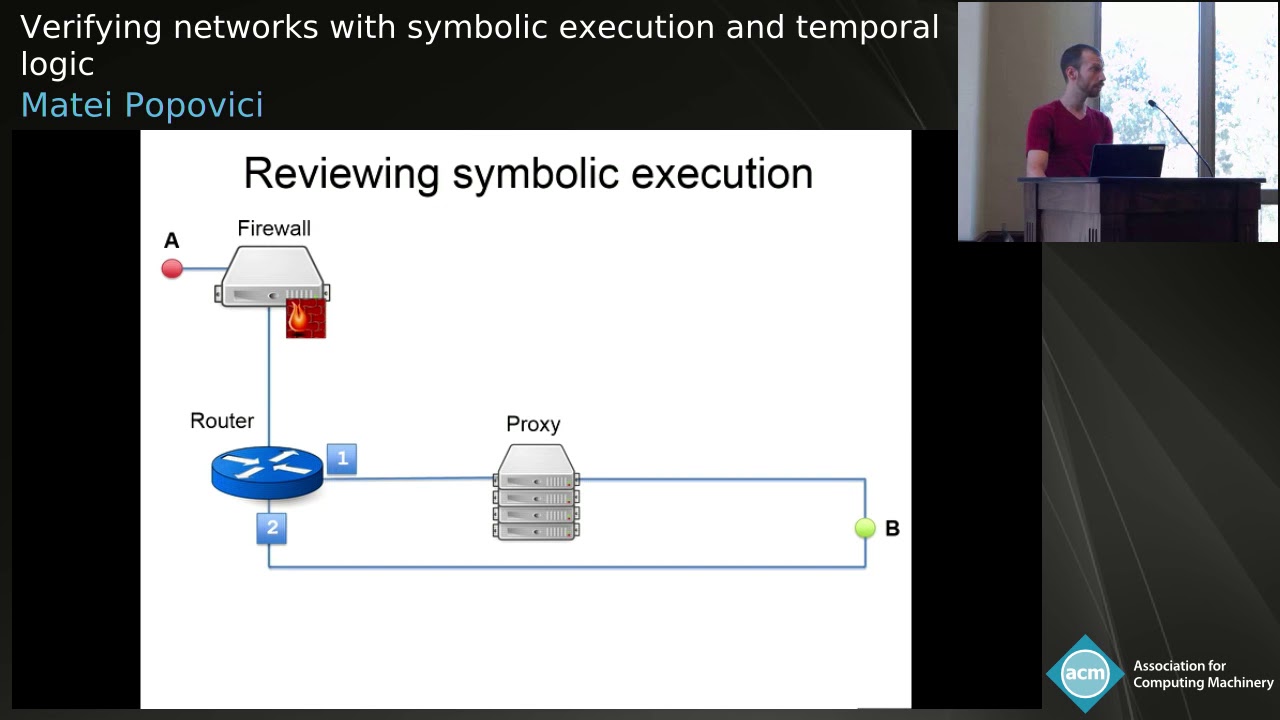

Atomic composability is the ability to execute complex transactions involving multiple contracts or protocols such that all operations succeed or fail together. This property is critical for DeFi primitives like flash loans, multi-step swaps, or cross-margin trading, where partial execution could lead to arbitrage exploits or systemic risk.

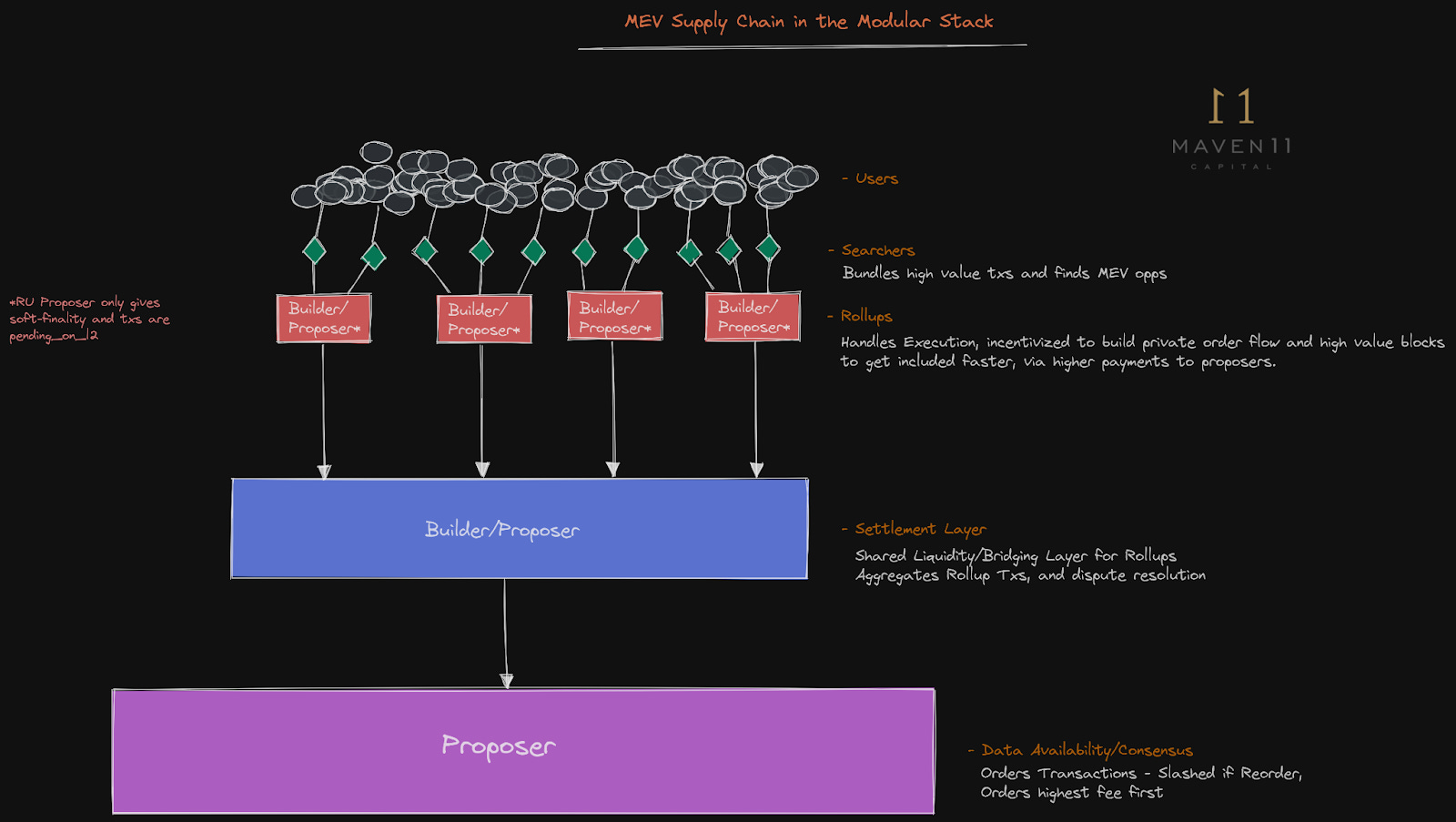

The challenge: As liquidity fragments across many rollups and specialized chains, ensuring atomicity becomes non-trivial. Enter shared sequencers, a breakthrough architecture that coordinates transaction ordering across multiple rollups in real time. By synchronizing mempools and settlement layers, shared sequencers enable unified liquidity pools while preserving atomic guarantees even in heterogeneous environments.

This approach is already being piloted by several next-gen protocols aiming to deliver seamless user experiences across different chains without compromising composability. For more technical deep dives on this topic, see our coverage of programmable on-chain sequencers.

Specialized Rollup Architectures: Building Blocks for Modular Blockchain Design

The toolkit for building custom app-chains has expanded dramatically in 2025. Platforms like Arbitrum Orbit offer developers the ability to spin up Layer 2 or Layer 3 chains with full control over sequencer selection, governance frameworks, and validation rules, supporting both optimistic and zk-rollup technologies. Meanwhile, Polygon’s Chain Development Kit (CDK) empowers teams to launch zk-powered app-chains with near-instant finality and ultra-low fees.

This proliferation of specialized rollup architectures is fueling a new wave of experimentation around modular blockchain design. Developers can now mix-and-match consensus engines, settlement layers, and cross-chain messaging protocols to craft application-specific blockchains optimized for their target use case, from high-frequency trading venues to privacy-preserving social networks.

One of the most significant advantages of this modularity is the ability to fine-tune every layer of the stack for optimal performance and cost efficiency. For example, a DeFi protocol requiring rapid order matching can prioritize ultra-fast sequencer logic and implement a tiered fee structure that rewards liquidity providers, while a gaming app-chain might subsidize user fees to encourage mass adoption. The result is an ecosystem where custom app-chains act as highly specialized engines, each calibrated for its own economic and technical context.

This flexibility extends beyond technical design into governance and community incentives. App-chain teams can introduce on-chain voting mechanisms for fee adjustments or protocol upgrades, ensuring that economic parameters evolve in lockstep with user demand and network growth. The programmable nature of these systems allows for continuous iteration, an essential feature in a rapidly changing market landscape.

Cross-Chain Coordination in 2025: Unifying Fragmented Liquidity

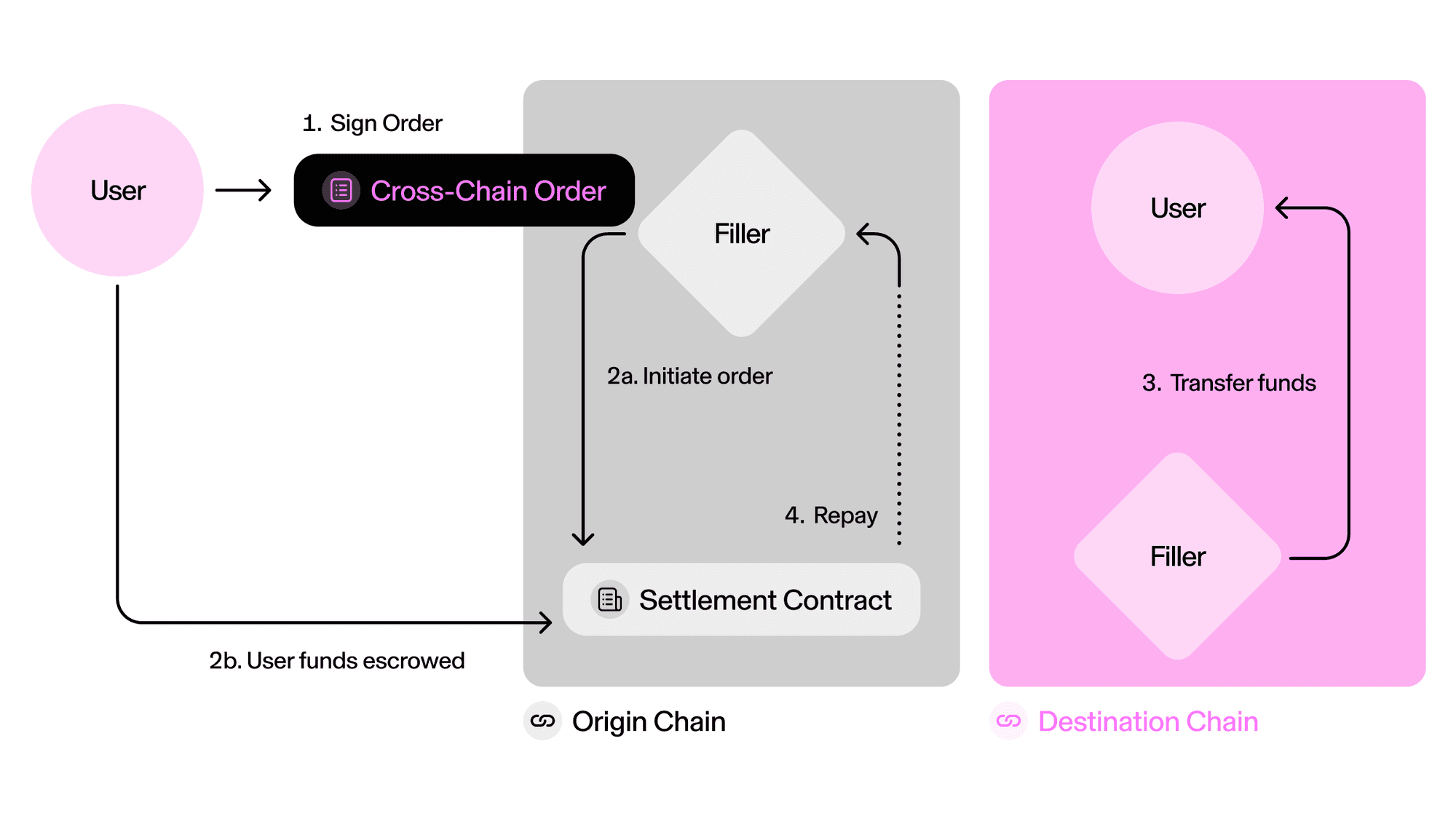

The rise of intent-based protocols and programmable cross-chain execution graphs is reshaping how liquidity moves across blockchains. Solutions like Router Protocol’s open architecture are enabling non-custodial, chain-agnostic execution flows that unify fragmented assets without relying on centralized bridges. By leveraging atomic composability modules and shared sequencers, developers can create unified user experiences that abstract away the complexity of underlying chains.

This trend is particularly evident in top DEXs and DeFi platforms experimenting with AI-driven routing engines, multi-agent coordination, and real-time settlement environments. As highlighted by industry research, the future of cross-chain coordination will depend on robust interoperability frameworks, and custom app-chains are at the forefront of this movement by providing programmable hooks for seamless integration.

Top Cross-Chain Coordination Protocols in 2025

-

Syndicate (SYND): A decentralized protocol enabling developers to launch programmable, atomically composable app-chains with customizable fee markets and governance. Syndicate is at the forefront of cross-chain coordination, powering seamless interoperability for next-gen dApps.

-

UniswapX: UniswapX is a leading cross-chain intents protocol, facilitating seamless multi-chain swaps and liquidity aggregation. It leverages off-chain order routing and on-chain settlement for efficient, atomic cross-chain transactions.

-

CoW Protocol: Renowned for its batch auction model, CoW Protocol offers intent-based, MEV-resistant cross-chain trading. It enables users to execute complex swaps across multiple blockchains atomically, optimizing for best execution and composability.

-

Eco: Eco provides a unified interface for cross-chain intents, allowing users to interact with multiple blockchains through a single, programmable layer. Its coordination logic simplifies complex DeFi operations and enhances liquidity sharing.

-

Router Protocol: Router Protocol introduces a non-custodial, chain-agnostic programmable execution graph, enabling arbitrary message passing and unified liquidity across diverse blockchains. Its architecture is designed for secure, atomic cross-chain coordination.

-

Chainlink CCIP: Chainlink’s Cross-Chain Interoperability Protocol (CCIP) delivers secure, programmable messaging and token transfers across blockchains. It underpins cross-chain composability for dApps, DeFi, and enterprise use cases.

-

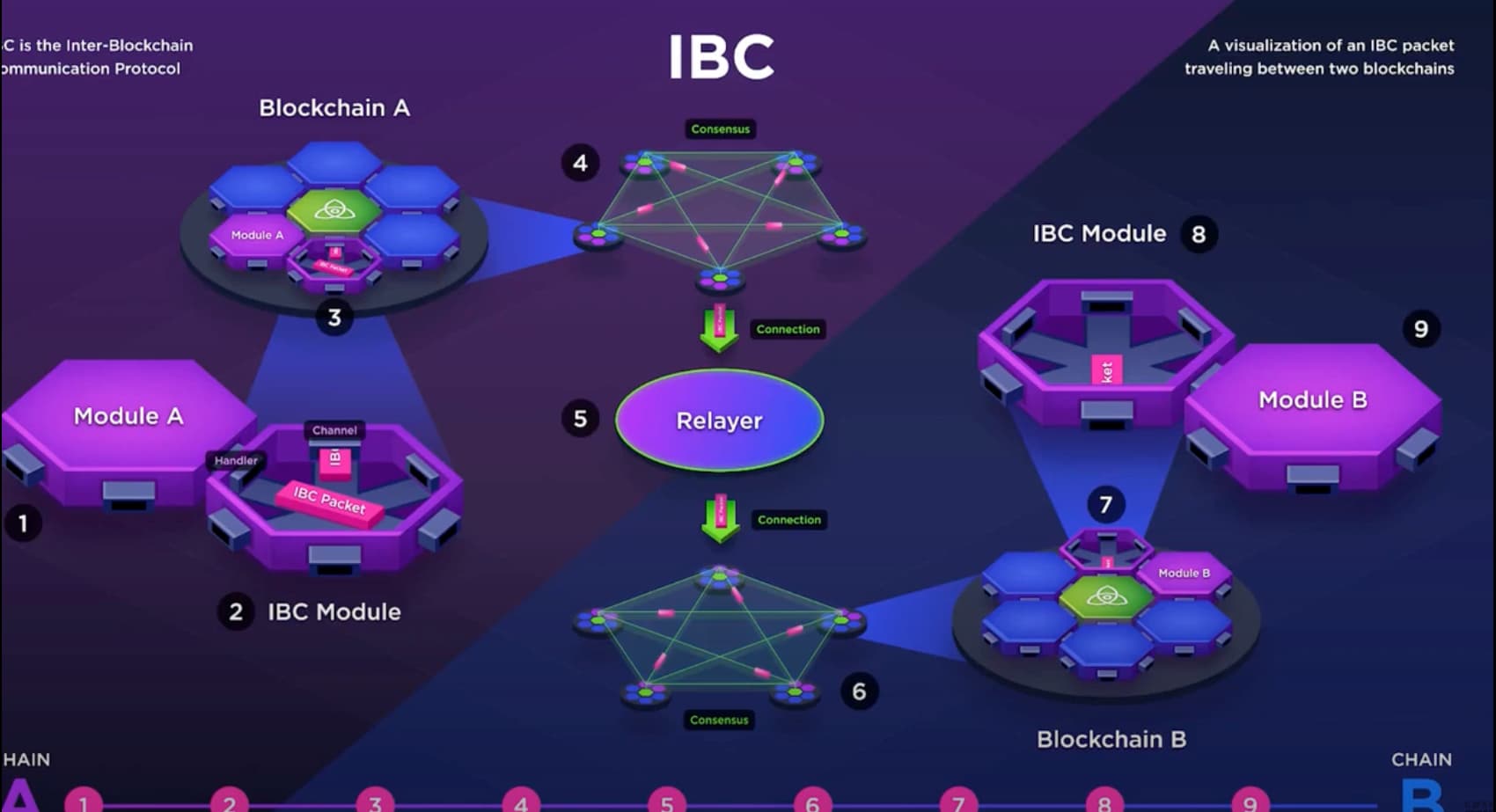

Cosmos IBC: The Inter-Blockchain Communication (IBC) protocol by Cosmos enables permissionless, trust-minimized data and asset transfer between independent blockchains, fostering a robust ecosystem of interconnected app-chains.

Key Takeaways: The Road Ahead for Custom App-Chains

The convergence of programmable fee markets, atomic composability, and modular blockchain design is setting the stage for an unprecedented era of innovation. Developers now have access to tools that allow them to:

- Design flexible economic models tailored to specific application needs

- Guarantee atomic execution across multiple contracts and chains

- Integrate seamlessly with emerging cross-chain protocols

- Evolve governance and incentives dynamically, responding to real-time network conditions

The next wave of decentralized applications will be defined by their ability to harness these capabilities, delivering lower costs, improved security, and superior user experience compared to monolithic Layer 1s. As more projects adopt custom app-chains with specialized fee markets, expect continued acceleration in DeFi innovation, NFT infrastructure, on-chain gaming economies, and beyond.

If you’re interested in diving deeper into how dynamic fee markets supercharge custom app-chains or exploring strategies for designing application-specific blockchains from the ground up, check out our guides on dynamic fee markets for app-chains or custom fee market design principles.